Abb India Ashok Leyland Berger Paints Cadila Healthcare

Diunggah oleh

Bharat JhamnaniJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Abb India Ashok Leyland Berger Paints Cadila Healthcare

Diunggah oleh

Bharat JhamnaniHak Cipta:

Format Tersedia

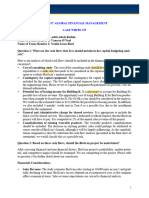

HIGH-GROWTH STOCKS

<

ASHOK LEYLAND

ABB INDIA

Market price (~)

Returns 1-year (%)

M-cap (~ cr)

Debt-equity ratio (x)

PE CY17E

1,163.3

4.2

24,650

0.2

58.6

| With a strong portfolio across power transmission and distribution

(T&D), and industrial equipment segments, the firm is well placed

to benefit from revival in the economy

| Order intake at ~2,290 crore, up 61 per cent year-on-year in the

September quarter, provides confidence

| Orders driven by the solar and T&D segments, where huge

investments are planned; annual market size for solar is ~20,000 crore

| The principal reasons for underperformance (losses in the rural

electrification business) have been addressed

Market price (~)

Returns 1-year (%)

M-cap (~ cr)

Debt-equity ratio(x)

PE FY17E

BERGER PAINTS

94.8

83.1

26,965

2.8

19.1

| Q2 volumes rose 47 per cent on

replacement demand and pre-buying

| Lower input costs, improved product mix

lead to better margins

| M&HCV market share to improve further

by 430 basis points to 31.5 per cent in FY16

| New launches (heavy trucks) and stronger

distribution will enhance portfolio

| Debt-equity ratio (excluding finance arm)

at 0.7 times to fall further on lower

working capital and asset sale

CUMMINS INDIA

CADILA HEALTHCARE

Market price (~)

Returns 1-year (%)

M-cap (~ cr)

Debt-equity ratio (x)

PE FY17E

221.3

24.4

15,347

0.5

33.9

| Berger has been increasing its market

share in domestic decorative paints,

cementing its number two position

| Capacity additions and premiumisation

of products will drive volumes and

margins

| Organised market for paints is expanding,

led by customer preferences, and is a big

positive for players like Berger

| Improving earnings growth could aid

longer-term stock performance

Market price (~)

Returns 1-year (%)

M-cap (~ cr)

Debt-equity ratio (x)

PE FY17E

412.9

33.1

42,265

0.7

22.4

| Strong top line growth and margin gains helped Cadila outperform

peers in recent years

| Increase in prices and authorised generics launches in the US have

led to higher growth in the past few quarters

| The US is expected to account for over half of its incremental sales

| Resolution of USFDA issues at its Moraiya plant will be a key trigger,

as a large chunk of ANDAs are filed from here

| Bio-similars, inhalers, transdermals and vaccines will be the

EICHER MOTORS

Market price (~)

Returns 1-year (%)

M-cap (~ cr)

Debt-equity ratio (x)

PE FY17E

1,006.8

15.0

27,907

27.9

MARUTI SUZUKI

NBCC

Market price (~)

4,640.5 | Outperformed peers

in FY16, with volume

Returns 1-year (%)

38.7

growth of 14 per cent

M-cap (~ cr)

1,40,179

vs industrys mere

nine per cent

Debt-equity ratio (x)

0.1

| Market share has

PE FY17E

21.4

risen 240 bps yearon-year to 47 per

cent in FY16

| Market share to rise

further on new

launches, broader

product portfolio and

wider reach

| Volume growth,

margin gains and pay

commission boost

have led analysts to

upgrade earnings

Market price (~)

Returns 1-year (%)

M-cap (~ cr)

Debt-equity ratio (x)

PE FY17E

Market price (~)

Returns 1-year (%)

M-cap (~ cr)

Debt-equity ratio (x)

PE CY17E

| Cummins has been

reporting a mixed show,

with strong domestic

growth but lower export

growth

| Led by favourable product

mix, it has, however,

sustained operating

margins at 16.8 per cent,

up 30 basis points in Q2

| Exports could see up to five

per cent growth in FY16,

but analysts see strong

potential

| Analysts remain bullish

due to the strong link

between the companys

growth with GDP growth,

export potential and

stricter emission norms

ULTRATECH CEMENT

995.5 | NBCC to gain from

huge opportunities in

31.3

the construction space

11,945 | Strong order book of

~30,000 crore is 5.8

times past 12 months

26.2

revenues

| Given the Smart Cities

initiative, Angel

Brokings analysts

estimate order book

to double by FY18

| Though NBCC gets

large orders on

nomination basis

and has a negative

working capital, it

remains a

competitive player

Data source: Bloomberg; E: Estimated; stock price and market capitalisation as on November 24; Debt-equity ratio for FY15

Market price (~)

Returns 1-year (%)

M-cap (~ cr)

Debt-equity ratio (x)

PE FY17E

2,777.7 | UltraTech remains

best placed to benefit

10.3

from a revival in

76,225

cement demand

0.5 | It has added new

capacities across

19.0

regions to drive

volume growth

unlike its peers,

which are witnessing

capacity constraints

| In spite of weak

demand and prices

in the recent

quarters, has shown

relatively strong

operating

performance by

controlling costs

16,649.3

13.9

45,210

35.1

| Strong show, led by Royal

Enfield (RE), with volume

growth of 55 per cent and

28 per cent margins in Q2

| Margins expanded on

operating leverage and

lower commodity costs,

and should hold firm

| While waiting periods for

RE have come down,

growth for motorcycles

continues to be strong

| On a high base, volume

growth is pegged at 35 per

cent, led by bigger

network and portfolio

| M&HCVs to gain traction,

as customer preference

tilts towards Pro series

trucks

UNITED SPIRITS

Market price (~)

Returns 1-year (%)

M-cap (~ cr)

Debt-equity ratio (x)

PE FY17E

3,371.2 | Premiumisation of

products, soft input

25.9

costs and cost-cutting

48,994

will drive future

profitability

3.6

61.1 | Analysts expect

ebitda margin to

expand 400 bps a

year for both FY16

and FY17

| Continued focus on

reducing its debt of

~4,000 crore will

reduce interest costs

and aid profitability

| Increased revenue pie

of Diageo's high-value

brands will be a key

growth catalyst

Compiled by BS Research Bureau

Anda mungkin juga menyukai

- Idirect Bel Q4fy16Dokumen13 halamanIdirect Bel Q4fy16khaniyalalBelum ada peringkat

- Prabhudas Lilladher Apar Industries Q3DY24 Results ReviewDokumen7 halamanPrabhudas Lilladher Apar Industries Q3DY24 Results ReviewvenkyniyerBelum ada peringkat

- Investor Update (Company Update)Dokumen27 halamanInvestor Update (Company Update)Shyam SunderBelum ada peringkat

- 02budget Stocks PDFDokumen3 halaman02budget Stocks PDFoopsmeandyouBelum ada peringkat

- Motilal Oswal Sees 8% UPSIDE in Exide Lower Revenue Growth DentsDokumen10 halamanMotilal Oswal Sees 8% UPSIDE in Exide Lower Revenue Growth DentsDhaval MailBelum ada peringkat

- Voltas Q2FY21 revenue growth ahead of estimates; UCP segment margin up 223 bpsDokumen10 halamanVoltas Q2FY21 revenue growth ahead of estimates; UCP segment margin up 223 bpsVipul Braj BhartiaBelum ada peringkat

- Kpil 9 2 24 PLDokumen8 halamanKpil 9 2 24 PLrmishraBelum ada peringkat

- Stocks 2016 PDFDokumen1 halamanStocks 2016 PDFFakruddinBelum ada peringkat

- 2011 Annual Report EngDokumen143 halaman2011 Annual Report Engsabs1234561080Belum ada peringkat

- Apar IndustriesDokumen6 halamanApar IndustriesMONIL BARBHAYABelum ada peringkat

- Growth Startegy of CompaniesDokumen1 halamanGrowth Startegy of CompaniesRaj KodainBelum ada peringkat

- Aarti Industries - Q2FY22 Result Update - 02-11-2021 - 13Dokumen8 halamanAarti Industries - Q2FY22 Result Update - 02-11-2021 - 13darshanmaldeBelum ada peringkat

- 354466122018909bharat Forge LTD Q4FY18 Result Updates - SignedDokumen5 halaman354466122018909bharat Forge LTD Q4FY18 Result Updates - Signedakshara pradeepBelum ada peringkat

- Ultratech Cement: Cost Optimisation Drive To Scale Up ProfitabilityDokumen10 halamanUltratech Cement: Cost Optimisation Drive To Scale Up ProfitabilityRohan AgrawalBelum ada peringkat

- Technical Analysis ReportDokumen8 halamanTechnical Analysis ReportManikantaBelum ada peringkat

- Press 25jul23 ResultsDokumen5 halamanPress 25jul23 ResultsNagendranBelum ada peringkat

- Autos: 2QFY17E Results PreviewDokumen11 halamanAutos: 2QFY17E Results Previewarun_algoBelum ada peringkat

- Exide Industries: Performance HighlightsDokumen12 halamanExide Industries: Performance HighlightsAngel BrokingBelum ada peringkat

- Exide Industries (EXIIND) : Earning Surprises! Exide Back On TrackDokumen9 halamanExide Industries (EXIIND) : Earning Surprises! Exide Back On TrackRahul RegeBelum ada peringkat

- Tata Motors Company 1QFY23 Under Review 28 July 2022Dokumen9 halamanTata Motors Company 1QFY23 Under Review 28 July 2022Rojalin SwainBelum ada peringkat

- 7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Dokumen5 halaman7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Nicholas ChehBelum ada peringkat

- Asian Paints 18012024 MotiDokumen12 halamanAsian Paints 18012024 Motigaurav24021990Belum ada peringkat

- IDirect MarutiSuzuki Q2FY19Dokumen12 halamanIDirect MarutiSuzuki Q2FY19Rajani KantBelum ada peringkat

- Company Profile - POWER: Key DataDokumen1 halamanCompany Profile - POWER: Key DataAnas AdnanBelum ada peringkat

- Inox Wind: Bottom Made, Reiterate BUYDokumen9 halamanInox Wind: Bottom Made, Reiterate BUYDinesh ChoudharyBelum ada peringkat

- Unaudited Financial Results Half-Year Ended September 30, 2016Dokumen15 halamanUnaudited Financial Results Half-Year Ended September 30, 2016Puja BhallaBelum ada peringkat

- Unaudited Financial Results Half-Year Ended September 30, 2016Dokumen15 halamanUnaudited Financial Results Half-Year Ended September 30, 2016Puja BhallaBelum ada peringkat

- SharekhanTopPicks 31082016Dokumen7 halamanSharekhanTopPicks 31082016Jigar ShahBelum ada peringkat

- Bharat Forge Geojit Research May 17Dokumen5 halamanBharat Forge Geojit Research May 17veguruprasadBelum ada peringkat

- Tata Motors (TELCO) : Domestic Business Reports Positive Margins!Dokumen12 halamanTata Motors (TELCO) : Domestic Business Reports Positive Margins!pgp28289Belum ada peringkat

- HMCL-20240211-MOSL-RU-PG012Dokumen12 halamanHMCL-20240211-MOSL-RU-PG012Realm PhangchoBelum ada peringkat

- Star Ferro & Cement (STAFER) : Volume Growth To Drive RevenuesDokumen14 halamanStar Ferro & Cement (STAFER) : Volume Growth To Drive RevenuesKirtikumar ShindeBelum ada peringkat

- Bharti Airtel (BHATE) : All Eyes On How Data Market UnfoldsDokumen13 halamanBharti Airtel (BHATE) : All Eyes On How Data Market Unfoldsarun_algoBelum ada peringkat

- Prabhudas Lilladher Sees 7% UPSIDE in Pidilite Industries StrongDokumen8 halamanPrabhudas Lilladher Sees 7% UPSIDE in Pidilite Industries StrongDhaval MailBelum ada peringkat

- Industrial Goods Sector - Mid-Year Outlook 2023Dokumen17 halamanIndustrial Goods Sector - Mid-Year Outlook 2023Carl MacaulayBelum ada peringkat

- TTK Prestige 16082019 PDFDokumen7 halamanTTK Prestige 16082019 PDFSujith VichuBelum ada peringkat

- AvalonDokumen10 halamanAvalonRaghu NayakBelum ada peringkat

- Strong volume growth and product launches to drive Kansai Nerolac PaintsDokumen5 halamanStrong volume growth and product launches to drive Kansai Nerolac Paintssaran21Belum ada peringkat

- Neutral Sector Outlook for Transmission & Distribution in FY13Dokumen12 halamanNeutral Sector Outlook for Transmission & Distribution in FY13Santhosh Kumar GBelum ada peringkat

- Exide Industries: Running On Low ChargeDokumen9 halamanExide Industries: Running On Low ChargeAnonymous y3hYf50mTBelum ada peringkat

- Amara Raja Batteries - Initiating Coverage ICICIdirectDokumen25 halamanAmara Raja Batteries - Initiating Coverage ICICIdirectanandvisBelum ada peringkat

- EdgeReport TATAELXSI ConcallAnalysis 14-10-2022 333Dokumen3 halamanEdgeReport TATAELXSI ConcallAnalysis 14-10-2022 333RajatBelum ada peringkat

- MAC group projectDokumen14 halamanMAC group projectHimanshu GuptaBelum ada peringkat

- About Syngene InternationalDokumen15 halamanAbout Syngene Internationalalkanm750Belum ada peringkat

- Nagarjuna Construction (NAGCON) : Rising Debt Level To Restrict Earnings GrowthDokumen6 halamanNagarjuna Construction (NAGCON) : Rising Debt Level To Restrict Earnings GrowthEquity DynamicsBelum ada peringkat

- Sterlite Technologies (STETEC) : Export Demand Drives GrowthDokumen10 halamanSterlite Technologies (STETEC) : Export Demand Drives Growthsaran21Belum ada peringkat

- Shree Cement (SHRCEM) : Realisation, Power Cost Drives MarginsDokumen13 halamanShree Cement (SHRCEM) : Realisation, Power Cost Drives Marginsarun_algoBelum ada peringkat

- Power Grid Corporation of India LTD (Pgcil) (Pgcil) : AnalystDokumen14 halamanPower Grid Corporation of India LTD (Pgcil) (Pgcil) : AnalystRajiv BharatiBelum ada peringkat

- Diwali Dhanotsav Portfolio 2023Dokumen22 halamanDiwali Dhanotsav Portfolio 2023pramodkgowda3Belum ada peringkat

- APL Apollo Tubes Motilal Oswal PDFDokumen4 halamanAPL Apollo Tubes Motilal Oswal PDFsameerBelum ada peringkat

- Cables Wires Industry Report April 19Dokumen41 halamanCables Wires Industry Report April 19atishsatamBelum ada peringkat

- Paint - Sector Update, Initiating Coverage On AsianPaints Buy, Berger Paints Hold, Kansai Nerolac BUY PDFDokumen92 halamanPaint - Sector Update, Initiating Coverage On AsianPaints Buy, Berger Paints Hold, Kansai Nerolac BUY PDFSahil GargBelum ada peringkat

- Wires & Cables Sector - YES SecuritiesDokumen41 halamanWires & Cables Sector - YES SecuritiesVickyBelum ada peringkat

- Microsoft Word - IDirect - SolarInds - Q1FY17Dokumen12 halamanMicrosoft Word - IDirect - SolarInds - Q1FY17anjugaduBelum ada peringkat

- Polycab India's Strong Export Orders Drive FY20 Earnings GrowthDokumen10 halamanPolycab India's Strong Export Orders Drive FY20 Earnings Growthkishore13Belum ada peringkat

- Havells Equity ResearchDokumen9 halamanHavells Equity ResearchRicha P SinghalBelum ada peringkat

- Zee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingDokumen13 halamanZee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingAshokBelum ada peringkat

- LT Tech - 4qfy19 - HDFC SecDokumen12 halamanLT Tech - 4qfy19 - HDFC SecdarshanmadeBelum ada peringkat

- CMP: INR3,210: FY23 AR Analysis - Re-Energising The Core in A Tough TimeDokumen14 halamanCMP: INR3,210: FY23 AR Analysis - Re-Energising The Core in A Tough TimeSameer MaradiaBelum ada peringkat

- Economic Indicators for East Asia: Input–Output TablesDari EverandEconomic Indicators for East Asia: Input–Output TablesBelum ada peringkat

- The Future of MoneyDokumen104 halamanThe Future of MoneyKhiêm TrầnBelum ada peringkat

- Bank Loan Application DetailsDokumen8 halamanBank Loan Application Detailsbalamurali sankaranarayananBelum ada peringkat

- Morning Session Q&ADokumen50 halamanMorning Session Q&AGANESH MENONBelum ada peringkat

- Manage Cash & EquivalentsDokumen39 halamanManage Cash & EquivalentsAiki VillorenteBelum ada peringkat

- Top 100 Volume Robocallers April 2021-CombinedDokumen6 halamanTop 100 Volume Robocallers April 2021-CombinedAnonymous Pb39klJ0% (1)

- Deccan Cements - Rating Rationale PDFDokumen6 halamanDeccan Cements - Rating Rationale PDFAkashBelum ada peringkat

- Parking Yard Lease AgreementDokumen2 halamanParking Yard Lease AgreementmasafrBelum ada peringkat

- Accounting Voucher 60Dokumen1 halamanAccounting Voucher 60Pavan BhandareBelum ada peringkat

- Review of The Literature: Ajit and BangerDokumen18 halamanReview of The Literature: Ajit and BangertejasparekhBelum ada peringkat

- Intermediate Accounting Test Bank With SolManDokumen40 halamanIntermediate Accounting Test Bank With SolManbpadz04Belum ada peringkat

- HDFC Bank provides nationwide banking services with 2000+ branchesDokumen16 halamanHDFC Bank provides nationwide banking services with 2000+ branchesVenkateshwar Dasari NethaBelum ada peringkat

- 1.2.2 - For-Profit Types of BusinessesDokumen35 halaman1.2.2 - For-Profit Types of BusinessesKenny HsuBelum ada peringkat

- Tire City Inc.Dokumen6 halamanTire City Inc.Samta Singh YadavBelum ada peringkat

- Research On Corporate Social Risponsibility and Access To FinanceDokumen35 halamanResearch On Corporate Social Risponsibility and Access To FinanceAlene AmsaluBelum ada peringkat

- Math WorksheetDokumen2 halamanMath WorksheetasdfghBelum ada peringkat

- Evaluating Properties with Positive Cash FlowDokumen23 halamanEvaluating Properties with Positive Cash FlowChadBelum ada peringkat

- Farmer Producer OrganisationsDokumen158 halamanFarmer Producer OrganisationsAbhishek ToppoBelum ada peringkat

- Bibek Pashu Tatha Machha PalanDokumen44 halamanBibek Pashu Tatha Machha PalanBIBUTSAL BHATTARAIBelum ada peringkat

- Bioscan Group 2 11062023Dokumen4 halamanBioscan Group 2 11062023Aditi KathinBelum ada peringkat

- YES Premia Soc - Savings Account - A5 Dec 2019 - 01Dokumen4 halamanYES Premia Soc - Savings Account - A5 Dec 2019 - 01Rasmiranjan PradhanBelum ada peringkat

- Corporate Governance in Terms With SEC GuidelinesDokumen13 halamanCorporate Governance in Terms With SEC Guidelinesasif29mBelum ada peringkat

- Portfolio With A Single Index ModelDokumen43 halamanPortfolio With A Single Index ModelDicky IrawanBelum ada peringkat

- Notice Tata Elxsi 34th AGMDokumen15 halamanNotice Tata Elxsi 34th AGMNaresh JainBelum ada peringkat

- BSBCOM603 - Task 3Dokumen5 halamanBSBCOM603 - Task 3Ali Butt0% (1)

- Project Report Table of Content: 1004 Financial Planning For Salaried Employee and Strategies For Tax SavingsDokumen2 halamanProject Report Table of Content: 1004 Financial Planning For Salaried Employee and Strategies For Tax SavingsSai VarunBelum ada peringkat

- The Unofficial Guide To Real Estate InvestingDokumen507 halamanThe Unofficial Guide To Real Estate InvestingAlessandro Costa100% (11)

- Audit Engagement LetterDokumen3 halamanAudit Engagement LetterMakeup Viral StudiosBelum ada peringkat

- Case Study II: Sleeping Beauty Bonds: Name Imitation Affiliated Instructor Course DateDokumen6 halamanCase Study II: Sleeping Beauty Bonds: Name Imitation Affiliated Instructor Course DateCollins GathimbaBelum ada peringkat

- FINTECH REGULATIONS AND REGTECH: A COMPARISON OF INDIA AND GERMANYDokumen10 halamanFINTECH REGULATIONS AND REGTECH: A COMPARISON OF INDIA AND GERMANYYash KhandelwalBelum ada peringkat

- Financial Inclusion DeclarationDokumen58 halamanFinancial Inclusion DeclarationAarti KatochBelum ada peringkat