Case 1 1

Diunggah oleh

rohanfyaz00Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Case 1 1

Diunggah oleh

rohanfyaz00Hak Cipta:

Format Tersedia

Case #1.

1 - Waste Management Matching Principle

Case #1.1 Waste Management Matching Principle

I. Technical Audit Guidance

To maximize the knowledge acquired by students, this book has been designed to be read in

conjunction with the post-Sarbanes-Oxley technical audit guidance. All of the post-SarbanesOxley technical guidance is available for free at

http://www.pcaobus.org/Standards/index.aspx. In addition, a summary of the Sarbanes-Oxley

Act of 2002 is also available for free at

http://thecaq.aicpa.org/Resources/Sarbanes+Oxley/Sarbanes-Oxley++The+Basics.htm.

II. Recommended Technical Knowledge

PCAOB Auditing Standard No. 5

Paragraph #2

Paragraph #A5 (in Appendix A)

III. Classroom Hints Auditing Class

This case provides students with an opportunity to appreciate the difficulty that can be

associated with auditing the application of depreciation rules to different types of assets at an

audit client. Since the computation of depreciation expense requires management to estimate

the salvage value and the estimated useful life for each asset depreciated, an auditor is often

forced to evaluate a number of subjective factors when completing his/her procedures. To

properly do so, students are able to see that an auditor must first understand the true economic

substance of management's estimates for both salvage value and the estimated useful life.

After gaining this understanding, the auditor must then determine whether the client has

properly calculated and recorded depreciation expense in accordance with the economically

appropriate estimates. Of course, each of these judgments must be made based on sufficient

and competent evidence. In addition, the case provides a mechanism to illustrate the

importance of identifying relevant financial statement assertions and identifying the related

control activities that are designed to prevent and/or detect fraud in the post-Sarbanes audit

C1.1-1

Case #1.1 - Waste Management Matching Principle

environment. Finally, the case provides an opportunity for instructors to highlight the

responsibility of management and the board of directors for an effective internal control

system in the post-Sarbanes audit environment.

We believe it is essential for students to carefully read over the recommended

technical knowledge, along with this case reading. The educational psychology literature

suggests that the acquisition of technical/factual type knowledge increases dramatically when

such knowledge can be applied in a realistic context. Thus, we urge instructors to use this

case as a mechanism to impart the relevant post-Sarbanes technical audit knowledge, outlined

above.

This case assignment will work best if is used at the time when instructors cover the

purchasing process, the fixed asset process or the audit of depreciation expense.

Alternatively, the case can be used when instructors cover the audit evidence topic or when

instructors discuss the ways in which a management team can perpetrate a fraud. Indeed,

because of the subjectivity associated with the estimate of an assets useful life and salvage

value, the account can be used by management as a mechanism to help smooth earnings

and/or perpetrate fraudulent activity. As a result, we recommend that instructors spend time

in class reviewing the impact that an increase in salvage value and/or an increase in

depreciable life can have on reported earnings.

This discussion should help students

conceptualize how the application of depreciation rules can be used as a mechanism to

perpetrate fraudulent activity.

C1.1-2

Case #1.1 - Waste Management Matching Principle

Importantly, the goal of the previous discussion is not necessarily to make sure that

students are experts in auditing recorded depreciation expense at an audit client with

significant investments in fixed assets. Rather, we believe that it is important to point out to

students that they will encounter difficult financial statement accounts to audit in their role as

an auditor. So, when such an account is encountered, students must take the time to fully

understand the nature and economic substance of the account. The professional judgment that

is involved in auditing a difficult financial statement account also provides an opportunity for

instructors to remind students of the importance of being unbiased and objective when making

their audit judgments. Indeed, we believe that it is helpful to consistently remind students of

their responsibility to maintain an attitude of professional skepticism throughout the audit

process. Indeed, one of the primary goals of the Sarbanes-Oxley Act of 2002 was to take

steps to improve the independence and objectivity of the audit process (e.g., Section 201). As

such, we encourage instructors to take this opportunity to remind students of their

responsibility.

This case also provides an opportunity for instructors to highlight the increased

responsibility that management now has for effective internal controls under the SarbanesOxley Act of 2002 (SOX). Under Section 404 of SOX, management is responsible for

establishing and maintaining an effective internal control system that is designed to support

reliable financial statement reporting. In addition, management must undertake a process

whereby they assess the effectiveness of their own internal control system each year. Given

this increased responsibility, it is amazing for students to see that the management team and

Board of Directors at Waste Management actually ignored the recommendation made by

C1.1-3

Case #1.1 - Waste Management Matching Principle

Arthur Andersen to conduct a site by site analysis of their landfills. In the postSarbanes environment, this is clearly a process that would have to be in place to insure

reliable financial reporting. As such, the case provides an interesting point of discussion to

highlight an important change as a result of SOX.

Finally, this case provides an opportunity to highlight the importance of identifying the

relevant financial statement assertions about a significant financial statement account, a

critically important task in the post-Sarbanes environment. The discussion of student

responses to question #3 provides instructors with an opportunity to discuss this point. In

addition, the discussion of student responses to question #3 provides an opportunity for

instructors to highlight the importance of being able to identify an internal control activity that

is explicitly designed to support reliable financial statement reporting for a particular financial

statement assertion. Once again, the knowledge required to link an internal control activity to

the financial statement assertion is essential in the post-Sarbanes audit environment. Thus, we

encourage instructors to take the time to make this linkage explicit for students in the present

context.

Overall, a key premise of this book is to help simplify the relationship between a

companys internal control system and the financial statement account balances. Section 404

of SOX made clear that this relationship is paramount. However, the knowledge needed to

explicitly link a specific internal control activity to a relevant financial statement assertion is

not easy to impart. We therefore encourage instructors to allocate an appropriate amount of

time to this topic and to use multiple different cases to help illustrate your points. In our

experience, it is very difficult for audit students to make the connection between an internal

C1.1-4

Case #1.1 - Waste Management Matching Principle

control activity and a related financial statement assertion.

So, please consider

assigning at least 2 or 3 (and perhaps even 4 or 5) cases from Section 1 of this book to provide

the repetition that is needed for students to master this important topic. It is hoped that such

repeated task performance will help to better sensitize students to the importance of internal

control activities in helping to prevent and/or detect fraudulent financial reporting.

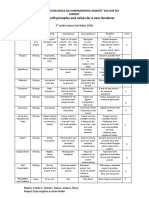

IV. Assignment Questions & Suggested Answers

1. Consider the principles, assumptions and constraints of Generally Accepted

Accounting Principles (GAAP). Define the matching principle and explain why it

is important to users of financial statements.

According to the matching principle, costs need to be matched to the revenues that they

helped to generate. A key point is that expenses should not necessarily be recognized when

the work is completed or a product is produced. Rather, the costs should be recognized when

the costs can be matched to revenue that has been recorded. If a connection cannot

reasonably be made between a cost and revenue that has been recognized, an accountant still

has a responsibility to try to determine whether there is some type of relationship between the

cost and revenue generated. The absolute goal is to try as hard as possible for an accountant

to provide the best measure of the profitability and performance of a company. As a result,

accountants should attempt to identify as best as possible, how much it cost to generate

revenue. This is the basis of the matching principle.

C1.1-5

Case #1.1 - Waste Management Matching Principle

2. Based on the case information provided, describe how Waste Management violated

the matching principle. Please be specific.

GAAP requires that depreciation expense be determined by allocating the historical cost of

assets over the useful life of the asset less the salvage value. When the management team at

Waste Management made changes to the estimated useful life and salvage value of several

assets, they effectively reduced the depreciation expense, ultimately resulting in overstated

income. The reduction of depreciation expense in the current year essential defers

depreciation expense to a future year. The Matching Principle requires the depreciation

expense of an asset to be recognized over its useful life so that the associated expense is

recorded in the year in which related income is earned. The arbitrary changes made to the

estimated useful lives and salvage values directly violated the matching principle because the

depreciation expense recognized in future years would now be unrelated to the production of

income in those related future years.

In essence, increases to the useful life of assets have the effect of writing up the value of an

asset and reducing expenses. This change can have a material impact on the financial

statements. These types of changes, that affect the way a user of financial statements values

Waste Management, must be properly disclosed as required by GAAP under the Full

Disclosure Principle. This principle requires management to disclose sufficient information to

allow the user to make a judgment about the financial position of Waste Management.

C1.1-6

Case #1.1 - Waste Management Matching Principle

3. Consult Paragraph #2 and Paragraph A5 (in Appendix A) of PCAOB Auditing

Standard No. 5. Do you believe that Waste Management had established an

effective system of internal control over financial reporting related to the

depreciation expense recorded in its financial statements? Why or why not?

According to paragraph #2 of Auditing Standard #5, effective internal control over

financial reporting provides reasonable assurance regarding the reliability of financial

reporting and the preparation of financial statement for external purposes. If one or more

material weaknesses exist, the company's internal control over financial reporting cannot be

considered effective. In the Appendix of Auditing Standard #5, paragraph #A5 provides

more specifics about the definition of an internal control system.

According to that paragraph, such a system is a process designed by, or under the

supervision of, the company's principal executive and principal financial officers, or persons

performing similar functions, and effected by the company's board of directors, management,

and other personnel, to provide reasonable assurance regarding the reliability of financial

reporting and the preparation of financial statements for external purposes in accordance with

GAAP and includes those policies and procedures that (1) Pertain to the maintenance of

records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions

of the assets of the company; (2) Provide reasonable assurance that transactions are recorded

as necessary to permit preparation of financial statements in accordance with generally

accepted accounting principles, and that receipts and expenditures of the company are being

made only in accordance with authorizations of management and directors of the company;

and (3) Provide reasonable assurance regarding prevention or timely detection of

unauthorized acquisition, use, or disposition of the company's assets that could have a

material effect on the financial statements.

C1.1-7

Case #1.1 - Waste Management Matching Principle

Waste Management did not have an effective system of internal control over financial

reporting related to the depreciation expense recorded in its financial statements. Stated

simply, Waste Managements internal control system did not provide reasonable assurance

that the transactions are recorded fairly, accurately, and in accordance with GAAP.

4. Under what circumstances is a company allowed to change the useful life and

salvage value of its fixed assets under GAAP? As an auditor, what type of evidence

would you want to examine to determine whether Waste Managements decision to

change the useful life and salvage value of its assets was appropriate under GAAP?

A company is allowed to change the useful life and/or the salvage value of its fixed

assets under GAAP if events or circumstances reveal additional information that indicates that

a change to the useful life and/or salvage value will more accurately depict the current market

situation. Stated simply, there should be a legitimate basis to make any changes to these

variables. In addition, according to the SEC, changes to the variables used in estimating

depreciation and the resulting impact to investors should be disclosed in the financial

statements to be in accordance with GAAP.1

U.S. Securities and Exchange Commission. (26 March 2002). SECURITIES AND EXCHANGE

COMMISSION vs. DEAN L. BUNTROCK, PHILLIP B. ROONEY, JAMES E. KOENIG, THOMAS C. HAU,

HERBERT A. GETZ, and BRUCE D. TOBECKSEN.

http://www.sec.gov/litigation/litreleases/complr17435.htm.

C1.1-8

Case #1.1 - Waste Management Matching Principle

For evidence, an auditor should examine relevant information about comparable useful

lives used in the industry and monitor the companys actual experience for similar assets in

the past to determine if the firms decision to change the useful life and salvage value of its

assets was appropriate under GAAP. Overall, the rationale for changes must be well

supported and reasonable. In making this determination, interviews with managers and other

relevant personnel would be essential, as each of these estimates are subjective. Ultimately,

the events or circumstances resulting in the need for the changes would need to be critically

evaluated and corroborated with sufficient and competent evidence by the auditors. After

considering all of the available evidence, if the auditors are still unsure about the decision,

they could use an independent third party to evaluate the changes to the useful life and/or

salvage value that are proposed.

C1.1-9

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Case 1.4 Sunbeam The Revenue Recognition PrincipleDokumen4 halamanCase 1.4 Sunbeam The Revenue Recognition Principlerohanfyaz0075% (4)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- MCOM - Ac - Paper - IDokumen542 halamanMCOM - Ac - Paper - IKaran BindraBelum ada peringkat

- Process Flow Chart of Textile ManufacturingDokumen7 halamanProcess Flow Chart of Textile Manufacturingrohanfyaz00Belum ada peringkat

- Textile Manufacturing Process Flow ChartsDokumen5 halamanTextile Manufacturing Process Flow ChartsTanbir Rahman100% (1)

- Chapter 111Dokumen35 halamanChapter 111rohanfyaz00Belum ada peringkat

- 012182005Dokumen1 halaman012182005FarukIslamBelum ada peringkat

- A Project On Online Food Delivery SystemDokumen30 halamanA Project On Online Food Delivery Systemrohanfyaz00Belum ada peringkat

- Comprehensive Guide to Accountancy SolutionsDokumen141 halamanComprehensive Guide to Accountancy SolutionsAlakesh PhukanBelum ada peringkat

- Subject: Application For Trimester Drop Fall 2018Dokumen1 halamanSubject: Application For Trimester Drop Fall 2018FarukIslamBelum ada peringkat

- Statistics Assignment FinalDokumen9 halamanStatistics Assignment Finalrohanfyaz00Belum ada peringkat

- CV OF RohanDokumen2 halamanCV OF Rohanrohanfyaz00Belum ada peringkat

- Middle Ages Lecture Handout 12-12-14Dokumen6 halamanMiddle Ages Lecture Handout 12-12-14rohanfyaz00Belum ada peringkat

- Middle AgesDokumen7 halamanMiddle Agesrohanfyaz00Belum ada peringkat

- All PresidentsDokumen62 halamanAll Presidentsrohanfyaz00Belum ada peringkat

- Coestudy 02Dokumen1 halamanCoestudy 02rohanfyaz00Belum ada peringkat

- Chapter 19: Business Research MethodsDokumen7 halamanChapter 19: Business Research Methodsrohanfyaz00Belum ada peringkat

- CV of Ariful IslamDokumen2 halamanCV of Ariful Islamrohanfyaz00Belum ada peringkat

- Quotation-Northern Fashion Ltd.Dokumen3 halamanQuotation-Northern Fashion Ltd.rohanfyaz00Belum ada peringkat

- 2canddfunctionalist 140116102247 Phpapp02Dokumen27 halaman2canddfunctionalist 140116102247 Phpapp02rohanfyaz00Belum ada peringkat

- 04-08 Addendum ObyrneDokumen53 halaman04-08 Addendum Obyrnerohanfyaz00Belum ada peringkat

- Organo GrumDokumen1 halamanOrgano Grumrohanfyaz00Belum ada peringkat

- Masters InstructionsDokumen23 halamanMasters InstructionsgitanodefeBelum ada peringkat

- Grameenphone Financial Analysis ReportDokumen52 halamanGrameenphone Financial Analysis Reportrohanfyaz00Belum ada peringkat

- Letter of Transmission: Sabrina Haque Chowdhury United International UniversityDokumen1 halamanLetter of Transmission: Sabrina Haque Chowdhury United International Universityrohanfyaz00Belum ada peringkat

- 5Dokumen1 halaman5rohanfyaz00Belum ada peringkat

- AzizulDokumen8 halamanAzizulrohanfyaz00Belum ada peringkat

- Business Case of Self Care ServiceDokumen18 halamanBusiness Case of Self Care Servicerohanfyaz00Belum ada peringkat

- Wnmve: Ò T Ó QK (MBVZB C×WZ)Dokumen4 halamanWnmve: Ò T Ó QK (MBVZB C×WZ)rohanfyaz00Belum ada peringkat

- Forecasting techniques and demand dataDokumen29 halamanForecasting techniques and demand dataBryan Seow0% (1)

- G Qrdwïb GVNV ' Rvwki NV MB Mnkvix Aa VCK Wnmveweávb WefvmDokumen9 halamanG Qrdwïb GVNV ' Rvwki NV MB Mnkvix Aa VCK Wnmveweávb Wefvmrohanfyaz00Belum ada peringkat

- Level 10 Halfling For DCCDokumen1 halamanLevel 10 Halfling For DCCQunariBelum ada peringkat

- British Universal Steel Columns and Beams PropertiesDokumen6 halamanBritish Universal Steel Columns and Beams PropertiesjagvishaBelum ada peringkat

- France Winckler Final Rev 1Dokumen14 halamanFrance Winckler Final Rev 1Luciano Junior100% (1)

- EN 12449 CuNi Pipe-2012Dokumen47 halamanEN 12449 CuNi Pipe-2012DARYONO sudaryonoBelum ada peringkat

- Condition Based Monitoring System Using IoTDokumen5 halamanCondition Based Monitoring System Using IoTKaranMuvvalaRaoBelum ada peringkat

- Easa Management System Assessment ToolDokumen40 halamanEasa Management System Assessment ToolAdam Tudor-danielBelum ada peringkat

- Money Laundering in Online Trading RegulationDokumen8 halamanMoney Laundering in Online Trading RegulationSiti Rabiah MagfirohBelum ada peringkat

- Prac Res Q2 Module 1Dokumen14 halamanPrac Res Q2 Module 1oea aoueoBelum ada peringkat

- Process Financial Transactions and Extract Interim Reports - 025735Dokumen37 halamanProcess Financial Transactions and Extract Interim Reports - 025735l2557206Belum ada peringkat

- Rubric 5th GradeDokumen2 halamanRubric 5th GradeAlbert SantosBelum ada peringkat

- Pipeline Welding SpecificationDokumen15 halamanPipeline Welding Specificationaslam.ambBelum ada peringkat

- Open Far CasesDokumen8 halamanOpen Far CasesGDoony8553Belum ada peringkat

- Srimanta Sankaradeva Universityof Health SciencesDokumen3 halamanSrimanta Sankaradeva Universityof Health SciencesTemple RunBelum ada peringkat

- LEARNING ACTIVITY Sheet Math 7 q3 M 1Dokumen4 halamanLEARNING ACTIVITY Sheet Math 7 q3 M 1Mariel PastoleroBelum ada peringkat

- IELTS Speaking Q&ADokumen17 halamanIELTS Speaking Q&ABDApp Star100% (1)

- Excess AirDokumen10 halamanExcess AirjkaunoBelum ada peringkat

- Week 15 - Rams vs. VikingsDokumen175 halamanWeek 15 - Rams vs. VikingsJMOTTUTNBelum ada peringkat

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDokumen2 halamanBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledCesar ValeraBelum ada peringkat

- UD150L-40E Ope M501-E053GDokumen164 halamanUD150L-40E Ope M501-E053GMahmoud Mady100% (3)

- Corporate Governance, Corporate Profitability Toward Corporate Social Responsibility Disclosure and Corporate Value (Comparative Study in Indonesia, China and India Stock Exchange in 2013-2016) .Dokumen18 halamanCorporate Governance, Corporate Profitability Toward Corporate Social Responsibility Disclosure and Corporate Value (Comparative Study in Indonesia, China and India Stock Exchange in 2013-2016) .Lia asnamBelum ada peringkat

- CENG 5503 Intro to Steel & Timber StructuresDokumen37 halamanCENG 5503 Intro to Steel & Timber StructuresBern Moses DuachBelum ada peringkat

- eHMI tool download and install guideDokumen19 halamaneHMI tool download and install guideNam Vũ0% (1)

- Grading System The Inconvenient Use of The Computing Grades in PortalDokumen5 halamanGrading System The Inconvenient Use of The Computing Grades in PortalJm WhoooBelum ada peringkat

- Service Manual: Precision SeriesDokumen32 halamanService Manual: Precision SeriesMoises ShenteBelum ada peringkat

- PEDs and InterferenceDokumen28 halamanPEDs and Interferencezakool21Belum ada peringkat

- Objective Mech II - IES 2009 Question PaperDokumen28 halamanObjective Mech II - IES 2009 Question Paperaditya_kumar_meBelum ada peringkat

- Managerial EconomicsDokumen3 halamanManagerial EconomicsGuruKPOBelum ada peringkat

- Breaking NewsDokumen149 halamanBreaking NewstigerlightBelum ada peringkat

- Indian Journal of Natural Products and Resources Vol 1 No 4 Phytochemical pharmacological profile Cassia tora overviewDokumen8 halamanIndian Journal of Natural Products and Resources Vol 1 No 4 Phytochemical pharmacological profile Cassia tora overviewPRINCIPAL BHILWARABelum ada peringkat