All About UK Accountancy

Diunggah oleh

audreywii0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

66 tayangan1 halamanAll About UK Accountancy

Hak Cipta

© © All Rights Reserved

Format Tersedia

TXT, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniAll About UK Accountancy

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai TXT, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

66 tayangan1 halamanAll About UK Accountancy

Diunggah oleh

audreywiiAll About UK Accountancy

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai TXT, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

All About UK Accountancy

UK accountancy is somewhat different from American accountancy, in that there ar

e more regulatory standards for accounting in the UK than in America. In Americ

a, companies must follow the Generally Accepted Accounting Principles (GAAP) set

down by the Financial Accounting Standards Board. The UK uses the generally ac

cepted accounting principles as a standard for accounting in UK companies. Howe

ver, there are other guidelines accountants in the UK must consider.

UK accountants must also consider the International Financial Reporting Standard

s (IFRS) set forth by the European Union (EU). These international financial re

porting standards were developed in an attempt to streamline the financial repor

ts from UK companies as well as companies in other European nations. This makes

financial reporting easier to understand by everyone. The international financ

ial reporting standards also allow UK businesses to more easily compare their fi

nancial statements to those of companies in other nations for the purpose of det

ermining competition and industry standards.

In addition to the generally accepted accounting principles (GAAP) and the inter

national financial reporting standards (IFRS), UK businesses must also adhere to

UK law, such as the Companies Act 1985, as amended by the Companies Act 1989.

These UK laws incorporate both the GAAP and the IFRS, as well as other European

law. The UK Companies Act 1985 also requires UK companies to file their accoun

ts with the Registrar of Companies, which makes the financial reports available

to the UK and worldwide public.

The Companies Act 1985 will soon be superseded by the Companies Act 2006, which

is not yet in effect in the UK. This UK Companies Act 2006 will restate in vary

ing fashions the provisions laid down in the Companies Act 1985, and the amendme

nts of the Companies Act 1989. However, changes are being made to incorporate t

he European Union's takeover of financial standards, and the laws regarding inte

rnational trade and financial reporting that are now necessary for UK companies

to follow. It will also put into codified law the UK common law that was previo

usly used in regards to UK companies and accountancy.

Any UK accountancy issues that require immediate attention but are not covered b

y the generally accepted accounting principles (GAAP), international financial r

eporting standards (IFRS), or Companies Act 1989 are brought before the Urgent I

ssues Task Force. This group determines solutions to issues of UK accountancy,

and publish Abstracts which are binding immediately for UK companies. These add

itional standards must also be followed by UK companies.

As you can see, accountancy in the UK is much more complex than that of the Unit

ed States of America. There are many UK laws, European Laws, and accounting sta

ndards to follow for UK companies. While Americans must only adhere to the gene

rally accepted accounting principles (GAAP) set down by the Financial Accounting

Standards Board (FASB), UK companies must adhere also to the International Fina

ncial Reporting Standards (IFRS) set down by the European Union. If you have an

y question about standard accounting practices for UK companies, you should cont

act an accountant to help you with your UK accountancy as soon as possible.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Red Zuma ProjectDokumen6 halamanRed Zuma Projectazamat13% (8)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Mini Case AnalysisDokumen2 halamanMini Case AnalysisErlene LinsanganBelum ada peringkat

- Signed Off Entrepreneurship12q1 Mod2 Recognize A Potential Market v3Dokumen23 halamanSigned Off Entrepreneurship12q1 Mod2 Recognize A Potential Market v3Marrian Alamag50% (2)

- Week 6 Financial Accoutning Homework HWDokumen7 halamanWeek 6 Financial Accoutning Homework HWDoyouknow MEBelum ada peringkat

- Ap Macroeconomics Syllabus - MillsDokumen6 halamanAp Macroeconomics Syllabus - Millsapi-311407406Belum ada peringkat

- Iride: Bike & Scooty Rental ServicesDokumen21 halamanIride: Bike & Scooty Rental ServicesSidharth ChowdhuryBelum ada peringkat

- The Importance of MoneyDokumen9 halamanThe Importance of MoneyLinda FeiBelum ada peringkat

- BCOM (Hons) - Sem - II-IV-VI-08-03-2022Dokumen2 halamanBCOM (Hons) - Sem - II-IV-VI-08-03-2022anshul yadavBelum ada peringkat

- Econ 221 Chapter 7. Utility MaximizationDokumen9 halamanEcon 221 Chapter 7. Utility MaximizationGrace CumamaoBelum ada peringkat

- Midterm Task - Units 1,2,3-Be IDokumen9 halamanMidterm Task - Units 1,2,3-Be IALBERT D BlanchBelum ada peringkat

- Financial Accounting: Accounting For Merchandise OperationsDokumen84 halamanFinancial Accounting: Accounting For Merchandise OperationsAnnie DuolingoBelum ada peringkat

- Contemporary-World-GE3-Module-4 ANSDokumen10 halamanContemporary-World-GE3-Module-4 ANSIman SimbulanBelum ada peringkat

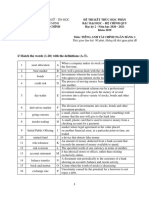

- Đề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Dokumen4 halamanĐề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Hoang TrieuBelum ada peringkat

- Anik Nayak (KP)Dokumen54 halamanAnik Nayak (KP)Meet gayakvadBelum ada peringkat

- Option One 2006-1 Jul07Dokumen72 halamanOption One 2006-1 Jul07janisnagobadsBelum ada peringkat

- 01 Activity 1 Strategic MGTDokumen1 halaman01 Activity 1 Strategic MGTAlvarez JafBelum ada peringkat

- House PerksDokumen2 halamanHouse PerkssushmasrBelum ada peringkat

- 5d6d01005f325curriculum MPSM LatestDokumen51 halaman5d6d01005f325curriculum MPSM LatestMostafa ShaheenBelum ada peringkat

- Victoria Girls' High School Grade 8 EMS Accounting Source Documents Term 2 Assignment Total: 40 MarksDokumen3 halamanVictoria Girls' High School Grade 8 EMS Accounting Source Documents Term 2 Assignment Total: 40 Marksmongiwethu ndhlovuBelum ada peringkat

- Lect 12 EOQ SCMDokumen38 halamanLect 12 EOQ SCMApporva MalikBelum ada peringkat

- Session 3 Unit 3 Analysis On Inventory ManagementDokumen18 halamanSession 3 Unit 3 Analysis On Inventory ManagementAyesha RachhBelum ada peringkat

- Multi-Dimensions of Unit Linked Insurance Plan Among Various Investment AvenuesDokumen8 halamanMulti-Dimensions of Unit Linked Insurance Plan Among Various Investment AvenuesRahul TangadiBelum ada peringkat

- Independent University of Bangladesh: An Assignment OnDokumen18 halamanIndependent University of Bangladesh: An Assignment OnArman Hoque SunnyBelum ada peringkat

- School of Business and Economics Submitted To: Dr. AbebawDokumen5 halamanSchool of Business and Economics Submitted To: Dr. AbebawMarcBelum ada peringkat

- Heritage Tourism: Submitted By, Krishna Dev A.JDokumen5 halamanHeritage Tourism: Submitted By, Krishna Dev A.JkdboygeniusBelum ada peringkat

- Morong Executive Summary 2016Dokumen6 halamanMorong Executive Summary 2016Ed Drexel LizardoBelum ada peringkat

- Money Banking and Financial Markets 3Rd Edition Cecchetti Solutions Manual Full Chapter PDFDokumen41 halamanMoney Banking and Financial Markets 3Rd Edition Cecchetti Solutions Manual Full Chapter PDFKatherineJohnsonDVMinwp100% (8)

- Analisa Biaya & Metode Penilaian Investasi Pada Kebakaran - OkDokumen22 halamanAnalisa Biaya & Metode Penilaian Investasi Pada Kebakaran - OkCarter GansBelum ada peringkat

- A STUDY ON THE ADMINISTRATION DEPARTMENT OF VADAMALAYAN HOSPITAL (Recovered) NewDokumen41 halamanA STUDY ON THE ADMINISTRATION DEPARTMENT OF VADAMALAYAN HOSPITAL (Recovered) NewP.DEVIPRIYABelum ada peringkat

- Chapter 2 ReviseDokumen4 halamanChapter 2 ReviseFroy Joe Laroga Barrera IIBelum ada peringkat