Col Financial - Philippine Equity Research

Diunggah oleh

gwapongkabayoHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Col Financial - Philippine Equity Research

Diunggah oleh

gwapongkabayoHak Cipta:

Format Tersedia

TUESDAY, 23 FEBRUARY 2016

STOCKS IN FOCUS:

SMPH: FY15 income meets COL estimates

SMPHs revenue and income growth slowed to 4.7% and 10.3% respectively in 4Q15 from 9.2%

and 14.9% as of 9M15. This was due to a drop in real estate revenues in 4Q15. Nevertheless,

full-year net income was up 13.6% to Php20.90 Bil and this is equal to our estimate but missed

consensus estimate on lower than expected revenues. We maintain our HOLD rating on SMPH with

a fair value estimate of Php21.70. We like SMPH for being the biggest beneficiary, among property

companies, of the strong consumption in the Philippines. SMPH is the biggest mall operator in

the Philippines and continues to grow its portfolio at a good pace. However at the current price of

Php20.75, upside to our fair value estimate is limited to 4.5% therefore we maintain a HOLD rating

despite strong fundamentals of the company.

(As of February 22, 2016)

INDICES

INDICES

PSEi

All Shares

Financials

Holding Firms

Industrial

Mining & Oil

Property

Services

Close Points

%

6,783.08

-8.98 -0.13

3,911.89

-5.40 -0.14

1,525.61 -28.02 -1.80

6,405.08

8.93 0.14

11,089.67 133.40 1.22

10,599.03 -166.96 -1.55

2,701.16

2.31 0.09

1,539.88

-6.48 -0.42

Dow Jones

S&P 500

Nasdaq

16,620.66 228.67

1,945.50 27.72

4,570.61 66.18

AEV: Increasing estimates on lower income tax rate for AP

and cement business JV

Due to the lower than expected income tax rate of the Tiwi-Makban, we are raising APs 2016E

and 2017E net income forecast for the said years by 2.5% and 4.4% to Php19.4Bil and Php22.4Bil

respectively. We increased our FV estimate for AP by 3.1% to Php45.15/sh. Meanwhile, given

AEVs 74% stake in AP and its earnings accretive investment in Republic Cement, we are raising

our 2016E and 2017E earnings forecast for AEV by 3.2% and 4.9% to Php20.4Bil and Php24Bil

respectively. We are also raising our FV estimate on AEV by 5.7% to Php52/sh.

INDEX GAINERS

Ticker

URC

PCOR

ALI

Company

Universal Robina Corp

Petron Corporation

Ayala Land Inc

BLOOM Bloomberry Resorts

DMC DMCI Hldgs Inc

Index gainers led decliners 14 to 13 while 3 issues remained unchanged. Sector performance was

mixed with Financials (-1.80%) and Mining & Oil (-1.55%) leading decliners and Industrial (+1.22%)

making solid gains. Significant decliners were MBT (-3.29%), BPI (-3.10%), AGI (-1.92%), SMC

(-1.89%), and MPI (-1.86%). On the other hand, notable gainers were URC (+3.29%), PCOR

(+3.15%), and ALI (+1.75%).

Value turnover was thin, declining to Php4.4Bil from Php6.5Bil the previous session. Foreigners

were net sellers, liquidating Php82Mil worth of shares.

Price

194.40

9.49

31.90

4.33

12.46

%

3.29

3.15

1.75

1.41

1.30

INDEX LOSERS

INDEX LOSERS

PX: Releases inferred mineral resource estimates for Bumolo project

The PSEi took minimal losses on Monday as the release of unimpressive earnings results from

some companies did little to deter profit taking by investors. The index slipped 8.98 points or 0.13%

to close at 6,783.08.

-4.62

-4.82

-8.72

INDEX GAINERS

TOP STORY:

MARKET SUMMARY:

1.40

1.45

1.47

YTD%

-2.43

-1.97

-1.62

-2.97

0.53

1.65

-7.35

0.63

Ticker

MBT

BPI

AGI

SMC

MPI

Company

Metrobank

Bank of the Phil Islan

Alliance Global Inc

San Miguel Corporation

Metro Pacific Inv Corp

Price

76.45

87.60

14.32

70.00

5.79

%

-3.29

-3.10

-1.92

-1.89

-1.86

TOP 5 MOST ACTIVE STOCKS

TOP 5 MOST ACTIVE STOCKS

Ticker

URC

SMPH

JFC

ALI

MPI

Company

Universal Robina Corp

SM Prime Hldgs Inc

Jollibee Foods Corp

Ayala Land Inc

Metro Pacific Inv Corp

Turnover

332,642,800

283,820,900

281,746,900

273,916,500

214,966,800

PHILIPPINE EQUITY RESEARCH

STOCKS IN FOCUS:

SMPH: FY15 income meets COL estimates

4Q15 earnings up 10.3% to Php5.44 Bil. SMPHs revenue and income growth slowed to 4.7% and

10.3% respectively in 4Q15 from 9.2% and 14.9% as of 9M15. This was due to a drop in real estate

revenues in 4Q15. Nevertheless, full-year net income was up 13.6% to Php20.90 Bil and this is equal

to our estimate but missed consensus estimate on lower than expected revenues.

Richard Laeda, CFA

Ticker: SMPH

Rating: HOLD

Target Price: Php21.70

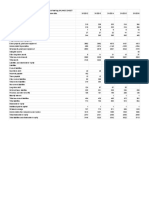

Exhibit 1: Results summary

in Php Mil

Revenues

Core Net income

4Q14

4Q15

% change

FY14

FY15

% change

18,441

4,934

19,301

5,444

4.7%

10.3%

66,240

18,391

71,500

20,900

7.9%

13.6%

% of estimate

COL

Consensus

100.0%

95.3%

100.0%

91.6%

source: SMPH, COL estimates, Bloomberg

Residential revenues drop in 4Q15 while rentals remain strong. Total revenue growth dropped

to 4.6% in 4Q15 due to a 9.8% decline in real estate revenues. This was due to lower revenue

recognition from the almost-completed projects that were launched in 2011 and 2012. Because of

the drop in 4Q15, real estate revenues were flat compared to 2014. Despite this, SMPH remains

optimistic this year as they expect to see an acceleration in booking of revenues from projects

launched in tha past three years. Projects of SMDC continued to enjoy strong sales which boosted

its reservation sales in 2015 by 15% to Php39.8 Bil from Php34.6 Bil.

On the other hand, other core businesses maintained their strong performance during the quarter

with revenues from rental and cinema and event ticket sales respectively growing 12.2% and 37.5%

respectively. Growth in rental revenus came from the 12.65% y/y expansion in Philippine mall GFA

from 6.5 Mil sqm as of end FY14 to 7.3 Mil sqm as of end last year. Excluding new malls and

expansion, same-store rentals grew 7% y/y.

Exhibit 2: FY15 Revenue breakdown

4Q14

4Q15

% change

FY14

FY15

% change

Rental revenues

Real estate

10,055

6,183

11,285

5,576

12.2%

-9.8%

36,497

22,152

40,700

22,200

11.5%

0.2%

Cinema and event ticket sales

1,004

1,380

37.5%

4,269

4,781

12.0%

Other revenues

Total

1,203

18,445

1,059

19,301

-11.9%

4.6%

3,323

66,240

3,819

71,500

14.9%

7.9%

in Php Mil

source: SMPH

Maintain HOLD and FV estimate of Php21.70. We maintain our HOLD rating on SMPH with a

fair value estimate of Php21.70. We like SMPH for being the biggest beneficiary, among property

companies, of the strong consumption in the Philippines. SMPH is the biggest mall operator in

the Philippines and continues to grow its portfolio at a good pace. However at the current price of

Php20.75, upside to our fair value estimate is limited to 4.5% therefore we maintain a HOLD rating

despite strong fundamentals of the company.

TUESDAY, 23 FEBRUARY 2016

page 2

PHILIPPINE EQUITY RESEARCH

AEV: Increasing estimates on lower income tax rate for AP and cement business JV

Due to the lower than expected income tax rate of the Tiwi-Makban, we are raising APs 2016E

and 2017E net income forecast for the said years by 2.5% and 4.4% to Php19.4Bil and Php22.4Bil

respectively. We increased our FV estimate for AP by 3.1% to Php45.15/sh. Meanwhile, given AEVs

74% stake in AP and its earnings accretive investment in Republic Cement, we are raising our 2016E

and 2017E earnings forecast for AEV by 3.2% and 4.9% to Php20.4Bil and Php24Bil respectively.

We are also raising our FV estimate on AEV by 5.7% to Php52/sh.

George Ching

Ticker: AEV

Rating: HOLD

Target Price: Php52.00

Raising AP earnings estimates on Tiwi-Makbans lower than expected income tax rate. The

income tax holiday of the Tiwi-Makban geothermal plant will end in June 2016. However, given that

the plant already obtained the Certificate of Endorsement (COE) from the ERC as a renewable

energy (RE) producer, it will only need to pay 10% income tax (vs the 30% income tax of traditional

power producers) once its income tax holiday expires. This is a positive development as we assumed

a 30% income tax rate for the Tiwi-Makban.

Republic Cement acquisition to be earnings accretive. In September 2015, AEV CRH Holdings

Inc, the cement business joint venture of AEV and Irish building materials company CRH PLC,

completed the acquisition of a 99.09% stake of Republic Cement (formerly Lafarge Republic Inc.

or LRI). Net of finance cost, the acquisition of Republic Cement should boost AEVs earnings by

Php303Mil for 2016E (1.5% of earnings), and by Php406Mil for 2017E (1.7% of earnings).

TOP STORY:

PX: Releases inferred mineral resource estimates for Bumolo project

Releases inferred mineral resource estimates for Bumolo project . Philex Mining Corp. disclosed

the release of a maiden inferred mineral resource estimate (MRE) as a result of its on-going drilling at

the Bumolo porphyry copper-gold project. The MRE resulted to 21.7Mil tonnes of ore at 0.2% copper

and 0.3g/ton of gold, at a 0.274% copper equivalent cut-off grade. The project is part of PXs on-going

resource definition drilling program, which is aimed to provide additional ore to the Padcal Mine. The

Bumolo deposit is located in the Baguio Mineral District and is 1.5km to the east of the Sto. Tomas II

deposit of the Padcal Mine. PX is continuing the program to increase the inferred resources and to

upgrade it to measured and indicated resource estimates.

Angelo Lecaros

Ticker: PX

Rating: HOLD

Target Price: Php4.85

Results positive but still needs to be confirmed. The potential addition of resources bodes well

for PXs Padcal Mine given that it is currently estimated to last only until 2022, with an estimated

remaining reserve of 66.8Mil tons of ore as of end-2015. Assuming that the inferred 21.7Mil tonnes

are proven to be mineable, it will extend the Padcal Mines life by around two more years (or until

2024). This translates to an estimated additional Php22.0Bil in metals revenues. However, the

disclosed figure is still an inferred estimate and further tests will need to be done to classify these

resources as confirmed.

Maintain HOLD rating. Though the potential extension of the Padcal Mines life is positive for PX,

we remain cautious over its profitability because of the persistent decline in metal prices. We are

maintaining our HOLD rating on PX with a FV estimate of Php4.85/sh.

TUESDAY, 23 FEBRUARY 2016

page 3

PHILIPPINE EQUITY RESEARCH

Calendar of Key Events

FEBRUARY

MON

TUES

WED

THURS

FRI

SAT

2

VMC: Annual

Shareholders Meeting

3

UBP: Ex-date Php1.50

Cash Dividend

4

LOTO: Ex-date Php0.60

Cash Dividend

9

TECH: Ex-date Php0.005

Cash Dividend

10

11

HOUSE: Ex-date

Php0.25 Cash Dividend

12

TFC: Annual

Shareholders Meeting

13

15

PF: Ex-date Php1.20

Cash Dividend

16

WEB: Ex-date Php0.20

Cash Dividend

17

GLO: Ex-date Php22.00

Cash Dividend

18

IMI: Ex-date Php0.2204

Cash Dividend

19

MFC: Ex-date Php0.185

Cash Dividend

20

22

23

URC: Ex-date Php3.15

Cash Dividend

24

25

26

SLF: Ex-date Php0.39

Cash Dividend

27

29

TUESDAY, 23 FEBRUARY 2016

page 4

PHILIPPINE EQUITY RESEARCH

Investment Rating Definitions

BUY

HOLD

SELL

Stocks that have a BUY rating have attractive

fundamentals and valuations, based on

our analysis. We expect the share price

to outperform the market in the next six to

twelve months.

Stocks that have a HOLD rating have either

1.) attractive fundamentals but expensive

valuations; 2.) attractive valuations but

near term earnings outlook might be poor

or vulnerable to numerous risks. Given the

said factors, the share price of the stock may

perform merely inline or underperform the

market in the next six to twelve months.

We dislike both the valuations and

fundamentals of stocks with a SELL rating.

We expect the share price to underperform in

the next six to twelve months.

Important Disclaimers

Securities recommended, offered or sold by COL Financial Group, Inc.are subject to investment risks, including the possible loss of the principal amount

invested. Although information has been obtained from and is based upon sources we believe to be reliable, we do not guarantee its accuracy and it may

be incomplete or condensed. All opinions and estimates constitute the judgment of COLs Equity Research Department as of the date of the report and are

subject to change without notice. This report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a

security. COL Financial ans/or its employees not involved in the preparation of this report may have investments in securities or derivatives of securities of

securities of the companies mentioned in this report, and may trade them in ways different from those discussed in this report.

2401-B East Tower, Philippine Stock Exchange Centre, Exchange Road, Ortigas Center, Pasig City 1605 Philippines

Tel: +632 636-5411

TUESDAY, 23 FEBRUARY 2016

Fax: +632 635-4632

Website: http://www.colfinancial.com

page 5

Anda mungkin juga menyukai

- D&L Industries Still Growing StrongDokumen6 halamanD&L Industries Still Growing Strongανατολή και πετύχετεBelum ada peringkat

- Philippine Stocks in Focus: MBT Profits Up 25% to Php4.2Bil in 2Q15, MEG 1H15 Income Outperforms EstimatesDokumen8 halamanPhilippine Stocks in Focus: MBT Profits Up 25% to Php4.2Bil in 2Q15, MEG 1H15 Income Outperforms Estimatesippon_osotoBelum ada peringkat

- 9M15 Earnings Beat Estimates On EDC and Hydro Plant's Better Than Expected ResultsDokumen4 halaman9M15 Earnings Beat Estimates On EDC and Hydro Plant's Better Than Expected ResultsTeddy AcedoBelum ada peringkat

- Stocks in Focus:: Infected Count Death Toll Total RecoveredDokumen4 halamanStocks in Focus:: Infected Count Death Toll Total RecoveredJBelum ada peringkat

- Gujarat Pipavav Port LTD (GPPL) Gujarat Pipavav Port LTD (GPPL)Dokumen11 halamanGujarat Pipavav Port LTD (GPPL) Gujarat Pipavav Port LTD (GPPL)Rajiv BharatiBelum ada peringkat

- Fertilizer Sector: FFBL Result PreviewDokumen1 halamanFertilizer Sector: FFBL Result PreviewMuhammad Sarfraz AbbasiBelum ada peringkat

- 2016 Nov 7 DailyDokumen3 halaman2016 Nov 7 DailyshadapaaakBelum ada peringkat

- FY14 Earnings of Php3.3Bil Exceeds Guidance But Lags Consensus EstimatesDokumen3 halamanFY14 Earnings of Php3.3Bil Exceeds Guidance But Lags Consensus EstimatesJanMarkAbrahamBelum ada peringkat

- Pilipinas Shell Petroleum Corporation Engages in The Refining and MarketingDokumen4 halamanPilipinas Shell Petroleum Corporation Engages in The Refining and MarketingClemenia Rea FeBelum ada peringkat

- 9M15 Income Outperforms Estimates: Megaworld CorporationDokumen3 halaman9M15 Income Outperforms Estimates: Megaworld CorporationTeddy AcedoBelum ada peringkat

- Indices DNL: Slight Underperformance in 1Q15 On Lingering Effects of Port CongestionDokumen10 halamanIndices DNL: Slight Underperformance in 1Q15 On Lingering Effects of Port CongestionAsh CampiaoBelum ada peringkat

- JG Summit Holdings Inc Annual Report 2016Dokumen256 halamanJG Summit Holdings Inc Annual Report 2016Ji YuBelum ada peringkat

- HSIE Results Daily - 12 Nov 22-202211120745240401459Dokumen18 halamanHSIE Results Daily - 12 Nov 22-202211120745240401459N KhanBelum ada peringkat

- RHB Equity 360°: (Parkson, KLK, AirAsia, Tan Chong, APM, Carlsberg, Hunza Technical: KLK, AFG) - 19/08/2010Dokumen5 halamanRHB Equity 360°: (Parkson, KLK, AirAsia, Tan Chong, APM, Carlsberg, Hunza Technical: KLK, AFG) - 19/08/2010Rhb InvestBelum ada peringkat

- RHB Equity 360: Top StoryDokumen5 halamanRHB Equity 360: Top StoryRhb InvestBelum ada peringkat

- COL Financial - Company UpdateDokumen2 halamanCOL Financial - Company UpdategwapongkabayoBelum ada peringkat

- Buy P 2.70: RecommendationDokumen6 halamanBuy P 2.70: RecommendationPaul Michael AngeloBelum ada peringkat

- Top Stories:: WED 10 APR 2019Dokumen3 halamanTop Stories:: WED 10 APR 2019Rodriguez ElizaBelum ada peringkat

- RHB Equity 360 20100824Dokumen5 halamanRHB Equity 360 20100824Rhb InvestBelum ada peringkat

- Broker Rader - Sugar Industry - Petronet LNG - Saregama Jan 23 2023 JMDokumen2 halamanBroker Rader - Sugar Industry - Petronet LNG - Saregama Jan 23 2023 JMPranavPillaiBelum ada peringkat

- Ogdcl WorkDokumen7 halamanOgdcl WorkNeeraj KumarBelum ada peringkat

- Oil & Gas Dev. Company: EquitiesDokumen3 halamanOil & Gas Dev. Company: EquitiesVishal Kumar NankaniBelum ada peringkat

- RHB Equity 360° - 23 September 2010 (Media, Sunway REIT, Tan Chong, KPJ Technical: Sunrise)Dokumen4 halamanRHB Equity 360° - 23 September 2010 (Media, Sunway REIT, Tan Chong, KPJ Technical: Sunrise)Rhb InvestBelum ada peringkat

- Trup SL 2015Dokumen29 halamanTrup SL 2015maikha pBelum ada peringkat

- FMCG Sector 1Dokumen8 halamanFMCG Sector 1Devina D'souzaBelum ada peringkat

- Lucky Cement Ltd. Detail Report WE Financial Services Ltd. August 2014Dokumen11 halamanLucky Cement Ltd. Detail Report WE Financial Services Ltd. August 2014Muhammad ZubairBelum ada peringkat

- Best Performing Stock Advice For Today - Neutral Rating On GAIL Stock With A Target Price of Rs.346Dokumen22 halamanBest Performing Stock Advice For Today - Neutral Rating On GAIL Stock With A Target Price of Rs.346Narnolia Securities LimitedBelum ada peringkat

- COL Financial - ICT Earnings AnalysisDokumen4 halamanCOL Financial - ICT Earnings AnalysisgwapongkabayoBelum ada peringkat

- Havells India - PrintingDokumen19 halamanHavells India - PrintingTushar DasBelum ada peringkat

- 3Q14 Press Release 326aDokumen18 halaman3Q14 Press Release 326aeconomics6969Belum ada peringkat

- Finance EeeeeDokumen11 halamanFinance EeeeeJendeukkieBelum ada peringkat

- RHB Equity 360° - 22/02/2010 (Market, Genting Spore, EON Cap, Proton, Sime Darby, ILB Technical: Latexx, AFG)Dokumen4 halamanRHB Equity 360° - 22/02/2010 (Market, Genting Spore, EON Cap, Proton, Sime Darby, ILB Technical: Latexx, AFG)Rhb InvestBelum ada peringkat

- Top Recommendation - 140911Dokumen51 halamanTop Recommendation - 140911chaltrikBelum ada peringkat

- JPM Ayala LandDokumen6 halamanJPM Ayala LandJT GalBelum ada peringkat

- Earnings Top Estimates: Filinvest Land, IncDokumen2 halamanEarnings Top Estimates: Filinvest Land, IncJanMarkAbrahamBelum ada peringkat

- Fertilizer Sector: FFC Result PreviewDokumen1 halamanFertilizer Sector: FFC Result PreviewMuhammad Sarfraz AbbasiBelum ada peringkat

- Fauji Fertilizer Bin Qasim Ltd. - Valuation Report: Industry OverviewDokumen7 halamanFauji Fertilizer Bin Qasim Ltd. - Valuation Report: Industry OverviewValeed ChBelum ada peringkat

- Analysis PsoDokumen3 halamanAnalysis PsoTrend SetterBelum ada peringkat

- Marico Result UpdatedDokumen10 halamanMarico Result UpdatedAngel BrokingBelum ada peringkat

- Dangote Cement's financial charges and tax cut into profit as sales revenue grows slowlyDokumen16 halamanDangote Cement's financial charges and tax cut into profit as sales revenue grows slowlygregBelum ada peringkat

- Rosete, Gherlen Clare A. Manacct Prof. Lopez Comparative AnalysisDokumen8 halamanRosete, Gherlen Clare A. Manacct Prof. Lopez Comparative AnalysisGlare RoseteBelum ada peringkat

- Mafin QuizDokumen2 halamanMafin QuizNesgie MiclatBelum ada peringkat

- RHB Equity 360° - (Axiata, UMW, Gent Msia, AMMB, MAHB, MBM, Star, Hunza Technical: Gent Msia, Gamuda) - 18/08/2010Dokumen4 halamanRHB Equity 360° - (Axiata, UMW, Gent Msia, AMMB, MAHB, MBM, Star, Hunza Technical: Gent Msia, Gamuda) - 18/08/2010Rhb InvestBelum ada peringkat

- CORDLIFE ANALYSISDokumen21 halamanCORDLIFE ANALYSISKelvin FuBelum ada peringkat

- Petron Corporation: Challenging Outlook Amid COVID-19Dokumen3 halamanPetron Corporation: Challenging Outlook Amid COVID-19Kimberly Anne CaballesBelum ada peringkat

- Simplex Infra, 1Q FY 2014Dokumen10 halamanSimplex Infra, 1Q FY 2014Angel BrokingBelum ada peringkat

- Chevron Lubricants Lanka PLC (LLUB) - Q1 FY 16 - HOLDDokumen11 halamanChevron Lubricants Lanka PLC (LLUB) - Q1 FY 16 - HOLDSudheera IndrajithBelum ada peringkat

- FINC3015 Cash Flows 70%Dokumen10 halamanFINC3015 Cash Flows 70%Matthew RobinsonBelum ada peringkat

- Hansson Private Label Expansion Risk Case StudyDokumen3 halamanHansson Private Label Expansion Risk Case StudyRodrigo Montechiari33% (6)

- Pets at Home Fy24 Interims Rns Vfinal CombinedDokumen43 halamanPets at Home Fy24 Interims Rns Vfinal Combinedrichard87bBelum ada peringkat

- Globe Equity Investment AnalysisDokumen16 halamanGlobe Equity Investment AnalysisNicole TorresBelum ada peringkat

- CardinalStone Research - Forte Oil PLC - Higher Fuel Margins, Geregu Upgrade, A Plus For 2016 EarningsDokumen10 halamanCardinalStone Research - Forte Oil PLC - Higher Fuel Margins, Geregu Upgrade, A Plus For 2016 EarningsDhameloolah LawalBelum ada peringkat

- SSI Daily Call On Factory and FPT and NTP - BMP 4Q13Dokumen8 halamanSSI Daily Call On Factory and FPT and NTP - BMP 4Q13Cương TiếnBelum ada peringkat

- Stocks in Focus:: Infected Count Death Toll Total RecoveredDokumen3 halamanStocks in Focus:: Infected Count Death Toll Total RecoveredJBelum ada peringkat

- MID-CAP CORNER: Automotive recovery to aid Amtek Auto; Firstsource turns around; Indiabulls Power to gain from plantsDokumen1 halamanMID-CAP CORNER: Automotive recovery to aid Amtek Auto; Firstsource turns around; Indiabulls Power to gain from plantspuneetdubeyBelum ada peringkat

- Power Grid Corporation of India LTD (Pgcil) (Pgcil) : AnalystDokumen14 halamanPower Grid Corporation of India LTD (Pgcil) (Pgcil) : AnalystRajiv BharatiBelum ada peringkat

- Bangladesh Quarterly Economic Update: June 2014Dari EverandBangladesh Quarterly Economic Update: June 2014Belum ada peringkat

- Philippines: Energy Sector Assessment, Strategy, and Road MapDari EverandPhilippines: Energy Sector Assessment, Strategy, and Road MapBelum ada peringkat

- Bangladesh Quarterly Economic Update: September 2014Dari EverandBangladesh Quarterly Economic Update: September 2014Belum ada peringkat

- INPAG Exposure DraftDokumen188 halamanINPAG Exposure DraftgwapongkabayoBelum ada peringkat

- Earnings Analysis - Bloomberry Resorts CorporationDokumen8 halamanEarnings Analysis - Bloomberry Resorts CorporationgwapongkabayoBelum ada peringkat

- Techspotlight 8 27 2021Dokumen3 halamanTechspotlight 8 27 2021gwapongkabayoBelum ada peringkat

- Credit Card Fees and ChargesDokumen2 halamanCredit Card Fees and ChargesgwapongkabayoBelum ada peringkat

- COL Financial - Company Update EWDokumen7 halamanCOL Financial - Company Update EWgwapongkabayoBelum ada peringkat

- Whitepaper Automating Fraud Detection GuideDokumen8 halamanWhitepaper Automating Fraud Detection GuideJongBelum ada peringkat

- HSBC Advance TOCDokumen42 halamanHSBC Advance TOCgwapongkabayoBelum ada peringkat

- Earnings Analysis - PIZZADokumen7 halamanEarnings Analysis - PIZZAgwapongkabayoBelum ada peringkat

- COL Financial PCG ScreenPlay - Sept 15 2016Dokumen6 halamanCOL Financial PCG ScreenPlay - Sept 15 2016gwapongkabayoBelum ada peringkat

- Earnings Analysis - MWCDokumen7 halamanEarnings Analysis - MWCgwapongkabayoBelum ada peringkat

- COL Financial - Weekly Notes 20180413Dokumen4 halamanCOL Financial - Weekly Notes 20180413gwapongkabayoBelum ada peringkat

- MedTech PRC Board Exam Topnotcher 2017Dokumen1 halamanMedTech PRC Board Exam Topnotcher 2017gwapongkabayoBelum ada peringkat

- Earnings Analysis - MBTDokumen7 halamanEarnings Analysis - MBTgwapongkabayoBelum ada peringkat

- Earnings Analysis - PXDokumen7 halamanEarnings Analysis - PXgwapongkabayoBelum ada peringkat

- Philippine Equity Research FocusDokumen6 halamanPhilippine Equity Research FocusgwapongkabayoBelum ada peringkat

- Focus Items: Philippine Equity ResearchDokumen7 halamanFocus Items: Philippine Equity ResearchgwapongkabayoBelum ada peringkat

- COL Financial - Philippine Daily Notes 20170905Dokumen4 halamanCOL Financial - Philippine Daily Notes 20170905gwapongkabayoBelum ada peringkat

- AP: Postponement of Davao Coal Plant Expansion To Have Minimal Impact On FVDokumen4 halamanAP: Postponement of Davao Coal Plant Expansion To Have Minimal Impact On FVgwapongkabayoBelum ada peringkat

- COL Financial - Tech Spotlight March 8 2016Dokumen7 halamanCOL Financial - Tech Spotlight March 8 2016gwapongkabayoBelum ada peringkat

- COL Financial - Company UpdateDokumen2 halamanCOL Financial - Company UpdategwapongkabayoBelum ada peringkat

- COL Financial - Bull's Eye July 11, 2016Dokumen7 halamanCOL Financial - Bull's Eye July 11, 2016gwapongkabayoBelum ada peringkat

- COLing The Shots 2016-02-16Dokumen6 halamanCOLing The Shots 2016-02-16gwapongkabayoBelum ada peringkat

- PhilEquity Corner - March 21, 2016Dokumen3 halamanPhilEquity Corner - March 21, 2016gwapongkabayoBelum ada peringkat

- PhilEquity Corner - April 25, 2016Dokumen3 halamanPhilEquity Corner - April 25, 2016gwapongkabayoBelum ada peringkat

- PhilEquity Corner - March 14, 2016Dokumen4 halamanPhilEquity Corner - March 14, 2016gwapongkabayoBelum ada peringkat

- Vantage Point - March 22, 2016Dokumen1 halamanVantage Point - March 22, 2016gwapongkabayoBelum ada peringkat

- Security Bank - UITF Investment ReportDokumen2 halamanSecurity Bank - UITF Investment ReportgwapongkabayoBelum ada peringkat

- 2015 URC Earnings ReportDokumen4 halaman2015 URC Earnings ReportgwapongkabayoBelum ada peringkat

- COL Financial - BPIDokumen3 halamanCOL Financial - BPIgwapongkabayoBelum ada peringkat

- Comparison Table of Luxembourg Investment VehiclesDokumen11 halamanComparison Table of Luxembourg Investment Vehiclesoliviersciales100% (1)

- Ambit Capital Mr. KN Sivasubramanian AddressDokumen19 halamanAmbit Capital Mr. KN Sivasubramanian AddressbrijsingBelum ada peringkat

- Franklin India Bluechip FundDokumen5 halamanFranklin India Bluechip Fundbanerjee_rocksBelum ada peringkat

- Americanhomeproductscorporation Copy 120509004239 Phpapp02Dokumen6 halamanAmericanhomeproductscorporation Copy 120509004239 Phpapp02Tanmay Mehta100% (1)

- Financial Management II Chapter SummaryDokumen83 halamanFinancial Management II Chapter SummaryMANUEL GONZÁLEZBelum ada peringkat

- Polytechnic University of the Philippines Special Qualifying ExamDokumen21 halamanPolytechnic University of the Philippines Special Qualifying ExamKristine SanchezBelum ada peringkat

- Assurance SP Reviewer PremidDokumen14 halamanAssurance SP Reviewer PremidMica Bengson TolentinoBelum ada peringkat

- Developments in Corporate GovernanceDokumen46 halamanDevelopments in Corporate GovernanceSameed ShakeelBelum ada peringkat

- Allergan Full2014Dokumen112 halamanAllergan Full2014Pando DailyBelum ada peringkat

- Preliminary computations and consolidation of Piero SAADokumen3 halamanPreliminary computations and consolidation of Piero SAAMuhammad SyukurBelum ada peringkat

- Module 2 CVR Notes PDFDokumen8 halamanModule 2 CVR Notes PDFDr. Shalini H SBelum ada peringkat

- NYSF Practice TemplateDokumen22 halamanNYSF Practice TemplaterapsjadeBelum ada peringkat

- Soal 1Dokumen3 halamanSoal 1feronica utomoBelum ada peringkat

- Acctg 1Dokumen39 halamanAcctg 1Clarize R. MabiogBelum ada peringkat

- ALL Solved Data of FIN622 Corporate FinanceDokumen69 halamanALL Solved Data of FIN622 Corporate Financesajidhussain557100% (1)

- Book ListDokumen10 halamanBook Listdj1284Belum ada peringkat

- Valuation Concepts Module 8 PDFDokumen8 halamanValuation Concepts Module 8 PDFJisselle Marie CustodioBelum ada peringkat

- Stakeholders and Sustainable Corporate Governance in NigeriaDokumen154 halamanStakeholders and Sustainable Corporate Governance in NigeriabastuswitaBelum ada peringkat

- Ashok Leyland-Aug13 15Dokumen4 halamanAshok Leyland-Aug13 15ajd.nanthakumarBelum ada peringkat

- Value Investing SpreadsheetDokumen6 halamanValue Investing SpreadsheetfbxurumelaBelum ada peringkat

- Problems Using ROE as the Sole Measure of PerformanceDokumen2 halamanProblems Using ROE as the Sole Measure of Performancewahab_pakistanBelum ada peringkat

- ABN-Amro CGDokumen13 halamanABN-Amro CGYin MingBelum ada peringkat

- Mergers & AqcusitionDokumen34 halamanMergers & AqcusitionDeepaBelum ada peringkat

- The Case Analysis of L'Oreal Corp. As Market LeaderDokumen18 halamanThe Case Analysis of L'Oreal Corp. As Market LeaderDaniel Pandapotan MarpaungBelum ada peringkat

- German RemediesDokumen2 halamanGerman RemediesbhuvaneshkmrsBelum ada peringkat

- FIN3CSF Case Studies in FinanceDokumen5 halamanFIN3CSF Case Studies in FinanceDuy Bui100% (2)

- COCOFED vs. RepublicDokumen50 halamanCOCOFED vs. RepublicJay Kent RoilesBelum ada peringkat

- CEU Balance SheetDokumen1 halamanCEU Balance SheetmadhuBelum ada peringkat

- Mannesmann AG Case Study: Group 2: Riddhi, Payal, Parnil, Sanjana and HarshilDokumen18 halamanMannesmann AG Case Study: Group 2: Riddhi, Payal, Parnil, Sanjana and HarshilParnil SinghBelum ada peringkat

- WiproDokumen4 halamanWiproabeerBelum ada peringkat