Sebelius Letter To Senators

Diunggah oleh

joshblackmanDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Sebelius Letter To Senators

Diunggah oleh

joshblackmanHak Cipta:

Format Tersedia

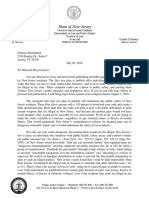

THE SECRETARY OF HEALTH AND HUMAN SERVICES

WASHINGTON, D.C. 20201

December 19, 2013

The Honorable Mark R. Warner

United States Senate

Washington, DC 20510

Dear Senator Warner:

Thank you for your thoughtful letter regarding the options that might be available to constituents

if their insurer has canceled their individual market plan. You have raised an important point,

and I want you to know how much I appreciate your constructive leadership on this issue.

As you know, one of the primary goals of the Affordable Care Act is to improve the quality and

affordability of health insurance. That's why the law requires health plans to cover preventive

services at no cost to consumers and prohibits plans from setting a lifetime or annual limit on

benefits, denying coverage, or raising premiums due to pre-existing conditions.

Historically the individual insurance market has been extremely volatile with consumers entering

and exiting plans frequently. The lack of defined consumer protections in this market has

accelerated the turn over in these plans. In fact, about 35 to 65 percent of health plans in today's

individual market are retained for just one year or less.

While some consumers are very satisfied with their policies and the benefits they receive, too

many have found their policies become unaffordable when they get sick and need coverage the

most. Moreover, in recent years annual premium increases have averaged about I 5 percent for

those who stay in their plan for more than one year.

Even though the Affordable Care Act will offer more coverage choices and protections for

millions of Americans, we are committed to ensuring the smoothest transition possible for those

who need to find a new health plan.

The President and I want to do everything we can to ensure that individuals with canceled plans

have as many options as possible. The policy that President Obama announced in November that

allows states and insurers to renew their 2013 health plans for 2014 is already helping many

consumers who faced loss of their coverage. Over half the states have accepted this option, and

many insurers have opted to renew plans so individuals can keep their coverage if they choose to

do so.

The Honorable Mark R. Warner

December 19, 2013

Page2

As a result of the President's renewal policy and early renewals offered by many insurers, the

population of individuals with canceled plans who do not have quality, affordable coverage for

2014 is clearly shrinking. Just as importantly, major insurance companies are aggressively

reaching out to consumers and working with them to find other acceptable options. These

companies are sending families multiple notices so that they will be aware of all their options.

And when it is not possible to help consumers stay in an existing plan, they are trying to help

them find plans that meet their needs.

Moreover, we continue to work on options to address transition issues, such as continuing access

for those with pre-existing conditions by extending the PCIP program by one month. I also want

to commend America's Health Insurance Plans (AHIP) and the companies they represent for

announcing yesterday that they will allow those who select coverage by December 23 to have

coverage effective January 1, while accepting premium payments until January 10.

The Department of Health and Human Services is also doing aggressive casework with these

individuals. To date, we have resolved nearly half of the cases we have received about canceled

plans and another one-third are in progress. Also, this week the Centers for Medicare &

Medicaid Services is setting up a separate hotline specifically targeted to help consumers who

have received cancellations (1-866-83 7-0677).

We understand, however, that despite all these efforts, there still may be a small number of

consumers who are not able to renew their existing plans and are having difficulty finding an

acceptable replacement in the Marketplace.

As you point out, the Affordable Care Act recognizes that individuals facing a hardship that

makes it difficult to afford a health plan with comprehensive benefits may qualify for an

exemption from the individual responsibility requirement. Individuals who qualify for this

"hardship exemption" are also able to purchase a catastrophic plan on the Marketplace. The

premium for these plans, which are otherwise only available to individuals under 30 years of age,

are on average about 20 percent lower than premiums for other plans available in the

Marketplace.

I very much appreciate your asking for a clarification on whether this exemption applies to those

with canceled plans who might be having difficulty paying for an existing bronze, silver, or gold

plan. I agree with you that these consumers should qualify for this temporary hardship

exemption, and I can assure you that the exemption will be available to them. As a result, in

addition to their existing options these individuals will also be able to buy a catastrophic plan to

smooth their transition to coverage through the Marketplace. To avoid any confusion on this

point and to make sure consumers can make decisions that are in their best interest, we will

supplement our existing call centers with a dedicated phone number and specialists to assist with

any questions in this area.

The Honorable Mark R. Warner

December 19, 2013

Page 3

Thank you again for raising this issue and for all your efforts to make sure that every American

has an opportunity to both know all their options in the free market and to find the policies that

are best for them.

Sincerely,

~us

cc:

Senator Angus King

Senator Jeanne Shaheen

Senator Mary L. Landrieu

Senator Heidi Heitkamp

Senator Tim Kaine

Anda mungkin juga menyukai

- Obamacare: What's in It for Me?: What Everyone Needs to Know About the Affordable Care ActDari EverandObamacare: What's in It for Me?: What Everyone Needs to Know About the Affordable Care ActPenilaian: 4 dari 5 bintang4/5 (1)

- The Insider’s Guide to Obamacare’s Open Enrollment (2015-2016)Dari EverandThe Insider’s Guide to Obamacare’s Open Enrollment (2015-2016)Belum ada peringkat

- Comunicado Del Senado de EEUUDokumen2 halamanComunicado Del Senado de EEUUTodo NoticiasBelum ada peringkat

- Uaranteed Hoices TO Trengthen Edicare and Ealth Ecurity FOR LLDokumen13 halamanUaranteed Hoices TO Trengthen Edicare and Ealth Ecurity FOR LLDave WeigelBelum ada peringkat

- Affordable Care Act ThesisDokumen5 halamanAffordable Care Act Thesisgbtrjrap100% (1)

- The Case For The Public Option Over Medicare For AllDokumen4 halamanThe Case For The Public Option Over Medicare For AllAnthony Sanglay, Jr.Belum ada peringkat

- Discussion 1Dokumen2 halamanDiscussion 1robinBelum ada peringkat

- MPA LLC Jour NAL MPA LLC: JournaDokumen10 halamanMPA LLC Jour NAL MPA LLC: JournaMARY GLASSBelum ada peringkat

- New Solvency Advocate Walker 17Dokumen4 halamanNew Solvency Advocate Walker 17saifbajwa9038Belum ada peringkat

- Connecting With CoverageDokumen3 halamanConnecting With CoverageiggybauBelum ada peringkat

- How Much Will Americans Sacrifice For Good Health Care?: All-Time Health Care Is A Human RightDokumen4 halamanHow Much Will Americans Sacrifice For Good Health Care?: All-Time Health Care Is A Human RightVaishali MakkarBelum ada peringkat

- Research Paper Topics On Health InsuranceDokumen5 halamanResearch Paper Topics On Health Insurancevguneqrhf100% (1)

- Research Paper On MedicaidDokumen7 halamanResearch Paper On Medicaidafnkhujzxbfnls100% (1)

- Affordable Care ActDokumen23 halamanAffordable Care ActPanktiBelum ada peringkat

- Faq For t4p - Fall 2013Dokumen4 halamanFaq For t4p - Fall 2013api-240744329Belum ada peringkat

- 5 Big Effects ObamacareDokumen7 halaman5 Big Effects ObamacarenlprofitsBelum ada peringkat

- Senator Casey - Health Care Sabotage OnlineDokumen13 halamanSenator Casey - Health Care Sabotage Onlinefox43wpmtBelum ada peringkat

- The Shifting Landscape of The US Healthcare System Through The ACA and Specific InitiativesDokumen3 halamanThe Shifting Landscape of The US Healthcare System Through The ACA and Specific InitiativesPhoebe MwendiaBelum ada peringkat

- 2010-04-02 - Health Care Reform ArticleDokumen4 halaman2010-04-02 - Health Care Reform ArticleTerry PetersonBelum ada peringkat

- #6 The Democratic Voter, February 1, 2012 #6 Small SizeDokumen8 halaman#6 The Democratic Voter, February 1, 2012 #6 Small Sizedisaacson1Belum ada peringkat

- TCYH WomenDokumen11 halamanTCYH WomenlocalonBelum ada peringkat

- White Paper - Short Term MedicalDokumen1 halamanWhite Paper - Short Term Medicalapi-282947512Belum ada peringkat

- Thesis On Health InsuranceDokumen8 halamanThesis On Health Insurancekimberlyjonesnaperville100% (2)

- It's Time For A Single-Payer Healthcare System: Philip Kotler March 25, 2017Dokumen10 halamanIt's Time For A Single-Payer Healthcare System: Philip Kotler March 25, 2017pedronuno20Belum ada peringkat

- Governing Health The Politics of Health Policy 5th Edition Ebook PDFDokumen61 halamanGoverning Health The Politics of Health Policy 5th Edition Ebook PDFevelyn.enos817100% (44)

- Brief Brief: IssueDokumen20 halamanBrief Brief: Issuenitin.firkeBelum ada peringkat

- An Alternative Approach To Providing Universal CareDokumen5 halamanAn Alternative Approach To Providing Universal CareAnonymous yFIsD9kTCA100% (4)

- Affordable Care Act Term PaperDokumen8 halamanAffordable Care Act Term Paperd1jim0pynan2100% (1)

- Peer Reviewed Second DraftDokumen8 halamanPeer Reviewed Second DraftZnaLeGrandBelum ada peringkat

- Second Draft, The Poor's Medicaid, The Government's RuleDokumen8 halamanSecond Draft, The Poor's Medicaid, The Government's RuleZnaLeGrandBelum ada peringkat

- Health Insurance ThesisDokumen5 halamanHealth Insurance Thesisginabuckboston100% (2)

- Policy Memo 1 1Dokumen6 halamanPolicy Memo 1 1api-488942224Belum ada peringkat

- Medicare Part D DissertationDokumen7 halamanMedicare Part D DissertationPayToWritePaperSingapore100% (1)

- Moderate Senate Democrats Letter To McConnell, Alexander, and Hatch On Fast-Track Repeal of The Affordable Care ActDokumen2 halamanModerate Senate Democrats Letter To McConnell, Alexander, and Hatch On Fast-Track Repeal of The Affordable Care ActU.S. Senator Tim KaineBelum ada peringkat

- VRRFDokumen18 halamanVRRFDan NgugiBelum ada peringkat

- This Time Get It Right: Good-Bye ObamaCare: Health Savings Accounts Open the Door to Universal Coverage and Lower CostsDari EverandThis Time Get It Right: Good-Bye ObamaCare: Health Savings Accounts Open the Door to Universal Coverage and Lower CostsBelum ada peringkat

- Running Head: OBAMACARE 1Dokumen7 halamanRunning Head: OBAMACARE 1omondistepBelum ada peringkat

- Final, The Poor's Medicaid, The Government's Rule.Dokumen8 halamanFinal, The Poor's Medicaid, The Government's Rule.ZnaLeGrandBelum ada peringkat

- Sebelius TestimonyDokumen8 halamanSebelius TestimonyAmerican Health LineBelum ada peringkat

- HealthPolicyConsensusGroup ReportDokumen7 halamanHealthPolicyConsensusGroup ReportPeter Sullivan0% (2)

- How Is The Transition To An Exchange-Based Environment Affecting Health Insurers, Providers, and Consumers?Dokumen5 halamanHow Is The Transition To An Exchange-Based Environment Affecting Health Insurers, Providers, and Consumers?api-227433089Belum ada peringkat

- The Establishment Strikes Back: Medical Savings Accounts and Adverse Selection, Cato Briefing PaperDokumen7 halamanThe Establishment Strikes Back: Medical Savings Accounts and Adverse Selection, Cato Briefing PaperCato InstituteBelum ada peringkat

- Kathleen Sebelius Testimony 10-30-2013Dokumen8 halamanKathleen Sebelius Testimony 10-30-2013margafretBelum ada peringkat

- Sebelius TestimonyDokumen7 halamanSebelius TestimonyabbyrogersBelum ada peringkat

- Final BillDokumen3 halamanFinal Billapi-336446760Belum ada peringkat

- Affordable Care Act Research PaperDokumen4 halamanAffordable Care Act Research Papereffbd7j4100% (1)

- Medicare Plan Finder Identified ChangesDokumen2 halamanMedicare Plan Finder Identified ChangesArnold VenturesBelum ada peringkat

- OnepageleavebehindDokumen2 halamanOnepageleavebehindapi-544117547Belum ada peringkat

- Medicaid Term PaperDokumen8 halamanMedicaid Term Paperc5qz47sm100% (1)

- Final Report For Colorado Public Option - Includes Appendices I - IVDokumen101 halamanFinal Report For Colorado Public Option - Includes Appendices I - IVapi-491077033Belum ada peringkat

- Privatizing Medicaid in ColoradoDokumen7 halamanPrivatizing Medicaid in ColoradoIndependence InstituteBelum ada peringkat

- Shutting Out The Progressive Agenda - FrontlineDokumen2 halamanShutting Out The Progressive Agenda - FrontlineMahesh BabuBelum ada peringkat

- US Health Policy and Market Reforms: An IntroductionDari EverandUS Health Policy and Market Reforms: An IntroductionBelum ada peringkat

- How Is Health Care Reform Affecting U.S. Health Insurers' Market Opportunities and Risks?Dokumen6 halamanHow Is Health Care Reform Affecting U.S. Health Insurers' Market Opportunities and Risks?api-227433089Belum ada peringkat

- Social Security / Medicare Handbook for Federal Employees and Retirees: All-New 4th EditionDari EverandSocial Security / Medicare Handbook for Federal Employees and Retirees: All-New 4th EditionBelum ada peringkat

- Communicating The Real Costs of Accidents and Illnesses: Broker World MagazineDokumen2 halamanCommunicating The Real Costs of Accidents and Illnesses: Broker World MagazineHelene Tripodi CurtoBelum ada peringkat

- 2018 12 30 FInal JudgmentDokumen1 halaman2018 12 30 FInal JudgmentjoshblackmanBelum ada peringkat

- District of Columbia Et Al v. Trump OpinionDokumen52 halamanDistrict of Columbia Et Al v. Trump OpinionDoug MataconisBelum ada peringkat

- No. 19-10011 United States Court of Appeals For The Fifth CircuitDokumen33 halamanNo. 19-10011 United States Court of Appeals For The Fifth CircuitjoshblackmanBelum ada peringkat

- District of Columbia Et Al v. Trump OpinionDokumen52 halamanDistrict of Columbia Et Al v. Trump OpinionDoug MataconisBelum ada peringkat

- 3-D Printed Gun Restraining OrderDokumen7 halaman3-D Printed Gun Restraining Orderjonathan_skillingsBelum ada peringkat

- Grewel Et Al V Defense Distributed Et Al ComplaintDokumen101 halamanGrewel Et Al V Defense Distributed Et Al ComplaintDoug MataconisBelum ada peringkat

- United States District Court Western District of Washington at SeattleDokumen29 halamanUnited States District Court Western District of Washington at SeattlejoshblackmanBelum ada peringkat

- Defense Distributed v. State - Dismissal With PrejudiceDokumen1 halamanDefense Distributed v. State - Dismissal With PrejudicejoshblackmanBelum ada peringkat

- S/ Paul S. DiamondDokumen1 halamanS/ Paul S. DiamondjoshblackmanBelum ada peringkat

- United States District Court For The Eastern District of PennsylvaniaDokumen18 halamanUnited States District Court For The Eastern District of PennsylvaniajoshblackmanBelum ada peringkat

- NJ Cease and Desist LetterDokumen2 halamanNJ Cease and Desist LetterjoshblackmanBelum ada peringkat

- Motion For A Temporary Restraining Order (7/25/18)Dokumen23 halamanMotion For A Temporary Restraining Order (7/25/18)joshblackmanBelum ada peringkat

- Washington v. Defense Distributed - Response To Temporary Restraining OrderDokumen71 halamanWashington v. Defense Distributed - Response To Temporary Restraining OrderjoshblackmanBelum ada peringkat

- Letter: Washington v. Defense Distributed (7/31/18)Dokumen47 halamanLetter: Washington v. Defense Distributed (7/31/18)joshblackman100% (1)

- Grewal v. Defense Distributed - Letter BriefDokumen19 halamanGrewal v. Defense Distributed - Letter BriefjoshblackmanBelum ada peringkat

- Washington v. Defense Distributed - Response To Temporary Restraining OrderDokumen71 halamanWashington v. Defense Distributed - Response To Temporary Restraining OrderjoshblackmanBelum ada peringkat

- Complaint - Defense Distributed v. Grewal and FeuerDokumen16 halamanComplaint - Defense Distributed v. Grewal and Feuerjoshblackman100% (3)

- Letter From The Brady Campaign (7/24/18)Dokumen35 halamanLetter From The Brady Campaign (7/24/18)joshblackmanBelum ada peringkat

- Supplemental Motion (7/27/18)Dokumen9 halamanSupplemental Motion (7/27/18)joshblackmanBelum ada peringkat

- Charles County Code Home Rule ReportDokumen32 halamanCharles County Code Home Rule ReportMarc Nelson Jr.Belum ada peringkat

- Republic Flour Mills Inc vs. Comm. of Cutoms (39 SCRA 509) Case DigestDokumen3 halamanRepublic Flour Mills Inc vs. Comm. of Cutoms (39 SCRA 509) Case DigestCamelle EscaroBelum ada peringkat

- IMO Publications Catalogue 2005 - 2006Dokumen94 halamanIMO Publications Catalogue 2005 - 2006Sven VillacorteBelum ada peringkat

- Suntay Vs SuntayDokumen5 halamanSuntay Vs SuntayNikki Joanne Armecin LimBelum ada peringkat

- Deputy RangerDokumen3 halamanDeputy Rangerkami007Belum ada peringkat

- Making of The ConstitutionDokumen3 halamanMaking of The ConstitutionSureshBelum ada peringkat

- Valmores v. AchacosoDokumen16 halamanValmores v. AchacosoRah-rah Tabotabo ÜBelum ada peringkat

- Modern Indian History 1939 Onwards Towards Freedom: Compiled By-Pratik NayakDokumen34 halamanModern Indian History 1939 Onwards Towards Freedom: Compiled By-Pratik NayakvinnyBelum ada peringkat

- Prabhunath Singh - WikipediaDokumen3 halamanPrabhunath Singh - WikipediaVaibhav SharmaBelum ada peringkat

- Moot Court Memorial On Behalf of RespondentsDokumen19 halamanMoot Court Memorial On Behalf of RespondentsMAYUKH PARIALBelum ada peringkat

- Simulasi Cat HitungDokumen2 halamanSimulasi Cat HitungSir cokieBelum ada peringkat

- Topic of Assignment-The Role of Judicial Activism in Implementation and Promotion of Constitutional LawsDokumen11 halamanTopic of Assignment-The Role of Judicial Activism in Implementation and Promotion of Constitutional LawsR. U. Singh100% (1)

- Consti II Case ListDokumen44 halamanConsti II Case ListGeron Gabriell SisonBelum ada peringkat

- EssayDokumen10 halamanEssayalessia_riposiBelum ada peringkat

- Burma (Myanmar)Dokumen4 halamanBurma (Myanmar)khenoenrileBelum ada peringkat

- Essay - Power Struggle Between Stalin and TrotskyDokumen4 halamanEssay - Power Struggle Between Stalin and TrotskyMatteyko1996Belum ada peringkat

- Deeds of The Ever GloriousDokumen123 halamanDeeds of The Ever GloriousTselin NyaiBelum ada peringkat

- Sem3 SocioDokumen15 halamanSem3 SocioTannya BrahmeBelum ada peringkat

- Articles of Confederation SimulationDokumen7 halamanArticles of Confederation Simulationapi-368121935100% (1)

- Press Release - Disqualification of Rahul GandhiDokumen32 halamanPress Release - Disqualification of Rahul GandhiNavjivan IndiaBelum ada peringkat

- May Coup (Poland)Dokumen3 halamanMay Coup (Poland)nico-rod1Belum ada peringkat

- Casay NHS K12 Grading TemplateDokumen4 halamanCasay NHS K12 Grading TemplatePrince Yahwe RodriguezBelum ada peringkat

- Abe vs. Foster Wheeler Corp, 1 SCRA 579, Feb 27, 1961Dokumen1 halamanAbe vs. Foster Wheeler Corp, 1 SCRA 579, Feb 27, 1961BrunxAlabastroBelum ada peringkat

- CCAL's Lex Populi: Centre For Constitutional and Administrative LawDokumen33 halamanCCAL's Lex Populi: Centre For Constitutional and Administrative LawAnkit ChauhanBelum ada peringkat

- "The German New Order in Poland" by The Polish Ministry of Information, 1941Dokumen97 halaman"The German New Order in Poland" by The Polish Ministry of Information, 1941Richard TylmanBelum ada peringkat

- Eco PracticeQuizDokumen12 halamanEco PracticeQuizAbinash AgrawalBelum ada peringkat

- Khyber Pakhtunkhwa Public Service CommissionDokumen2 halamanKhyber Pakhtunkhwa Public Service CommissionazmatBelum ada peringkat

- Rothbard's Wall Street Banks and American Foreign PolicyDokumen5 halamanRothbard's Wall Street Banks and American Foreign PolicyGold Silver WorldsBelum ada peringkat

- Brexit Case FinalDokumen9 halamanBrexit Case FinalderinsavasanBelum ada peringkat

- 0241JICA (2006) Pakistan Transport Plan Study in The Islamic Republic of PakistanDokumen330 halaman0241JICA (2006) Pakistan Transport Plan Study in The Islamic Republic of Pakistankwazir70100% (1)