Merger of e Commerce

Diunggah oleh

WesleyJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Merger of e Commerce

Diunggah oleh

WesleyHak Cipta:

Format Tersedia

Tactful Management Research Journal

Vol. 2 | Issue. 8 | May 2014

ISSN :2319-7943

Impact Factor : 1.5326 (UIF)

ORIGINAL ARTICLE

MERGER AND ACQUISITION IN

E-COMMERCE SECTOR

Priyanka , Khushboo Sagar and Richa Verma

Assistant Professor , Ramjas College , Universtiy Of Delhi.

Assistant Professor , Shri Ram College Of Commerce , Universtiy Of Delhi.

Assistant Professor , Ramjas College, Universtiy Of Delhi.

Abstract:

The main objective of this research paper is to analyse the market growth of ecommerce which attracts the merger and acquisition in India. Through this paper we will

try to find out reasons of merger and acquisition from the experience of Indian ecommerce sector. Internet growth has led to a host of new developments, such as

decreased margins for companies as consumers turn more and more to the internet to

buy goods and demand the best prices .The industry is growing rapidly and there is still a

huge potential for growth. "Likewise, the industry has grown exponentially over the last

11 months and will continue to see growth the increased competition in the global market

has prompted the Indian companies to go for mergers and acquisitions as an important

strategic choice. The sector is witnessing a swathe of consolidation owing to various

mergers and acquisitions .However, industry experts believe this is just the start of the ecommerce wave in India. The growing penetration of technology facilitators such as

Internet connections, broadband and third generation (3G) services, laptops, smart

phones ,tablets and dongles, coupled with increasing acceptance of the idea of virtual

shopping, is set to drive the e-commerce eco-system. The e-commerce story in India

would surely witness a new world of digitalisation in the coming decade ,with a host of

start-ups emerging to compete with existing players in order to draw benefits from the

new and existing markets.

KEYWORDS:

MERGER And Acquisition , E-Commerce , acquisitions.

INTRODUCTION

In today's globalized scenario, competitiveness and competitive advantages have become the

buzzwords for corporate around the world. Merger and Acquisition in the e-commerce sector have been on

the rise in the recent past, both globally and in India. In this backdrop of emerging global and Indian trends

in e-commerce sector, this study illuminates the key issues surrounding M & A in Merger and Acquisition

with the focus on India. It also seeks to explain the motives behind some Merger and Acquisition that have

occurred in India

Mergers and Acquisitions is the only way for gaining competitive advantage domestically and

internationally and as such the whole range of industries are looking to strategic acquisitions within India

and abroad. In order to attain the economies of scale and also to combat the unhealthy competition within

the sector besides emerging as a competitive force to reckon with in the International economy.

Consolidation of Indian e-commerce sector through mergers and acquisitions on commercial

considerations and business strategies is the essential pre-requisite. Today, e-commerce sector is counted

among the rapidly growing industries in India .The business world is being gradually changed to an eeconomy by the ever-increasing global competition, increased information availability, knowledgeable

Priyanka , Khushboo Sagar and Richa Verma MERGER AND ACQUISITION IN E-COMMERCE SECTOR :

Tactful Management Research Journal (May ; 2014)

MERGER AND ACQUISITION IN E-COMMERCE SECTOR

consumers, changing relationships, rapid innovations, and increasingly complex products. In the last few

years, there have been paradigm shift in Indian e-commerce sector. The Indian e-commerce sector is

growing at an astonishing pace. A relatively new dimension in the Indian e-commerce sector is accelerated

through mergers and acquisitions

Mergers and acquisitions are a response to new technologies or market conditions that require a

strategic change in a company's direction or use of resources. Compared to current management, a new

owner is often better able to accomplish major change in the existing organizational structure.

The rapid growth of e-commerce in India is being driven by greater customer choice and improved

convenience. India has an internet user base of over 200million users as of 2013. 3rd largest internet

population compared to markets like the US and the UK but is growing at a much faster rate with a large

number of new entrants. The industry consensus is that growth is at an inflection point with key drivers of

Increasing computer educational level, Increased Usage of Internet, Rising standards of living and high

disposable incomes , Availability of a much wider product range (including online purchase from

international retailers and direct imports) compared to what is available at brick and mortar retailers ,Busy

lifestyles, easy to find product reviews, urban traffic congestion and lack of time for offline shopping ,

Lower prices compared to brick and mortar retail driven by disintermediation and reduced inventory and

real estate, user experience, payment gateways & logistics etc.

E-COMMERCE SECTOR HAVE BEEN CONSTANTLY INNOVATING

To capitalise on the benefits offered by the unique Indian consumer base, ecommerce Companies

have been innovating with policies traditionally not available in a brick-and-mortar store. Companies have

introduced return policies ranging from 730 days, free home delivery and the most recent cash on

delivery model. The last innovation has led to a lot of momentum in Internet sales and changed people's

perception towards online shopping as shoppers can now purchase without disclosing their credit/debit

card details. It is believed that more than 50.0 per cent of all online transactions in India are based on the

cash on delivery (COD) payment methodology.

The trend in the e-commerce segment is that most of the e-tailers start with a single product and

later diversify their product portfolio with multiple offerings. Notably, the market leader Flipkart.com

broadened its offerings with various products such as mobile phones, computers, movies, music, baby

products and stationery from its initial set-up of selling books online Furthermore, Snapdeal.com, the

second largest e-commerce company that began operations as an online group discounting site in 2010, got

converted into a market place with thousands of products.

OBJECTIVES OF THE STUDY

To study the reasons for merger and acquisition in Indian e-commerce sector.

To analyse the mergers and acquisition in e-commerce sector.

To study the challenges faced by e-commerce sector in India.

RESEARCH METHODOLOGY

A comprehensive study has been undertaken for the e-commerce those have gone for M&A during

the post-reform period. Data require for the research paper is collected from secondary sources. Following

secondary sources have been used for data collection: digital-commerce IAMAI reports, books, websites,

newspaper, journals that are involved in consolidation

REASONS FOR MERGER AND ACQUISITION

To Limit competition: Markets developed and became more competitive and because of this market share

of all individual firms reduced so mergers and acquisition started.

Utilise under-utilised market power

The primary motivation for most mergers is to increase the value of the combined enterprise. Synergistic

effects can arise from four sources: (1) operating economies, which result from economies of scale in

management, marketing, production, or distribution; (2) financial economies , including lower transactions

costs and better coverage by security analysts;(3) differential efficiency, which implies that the

management of one firm is more efficient and that the weaker firm's assets will be more productive after the

merger; and (4) increased market power due to reduced competition. Operating and financial economies

are socially desirable, as are mergers that increase managerial efficiency ;but mergers that reduce

Tactful Management Research Journal | Volume 2 | Issue 8 | May 2014

MERGER AND ACQUISITION IN E-COMMERCE SECTOR

competition are socially undesirable and often illegal.

Utilise under-utilised resourceshuman and physical and managerial skills.

Displace existing management.

Create an image of aggressiveness and strategic opportunism, empire building and to amass vast economic

powers of the company.

Transfer of skill takes place between two organisation takes place which helps them to improve and

become more competitive.

Managers often cite diversification as a reason for mergers. They contend that diversification helps

stabilize a firm's earnings and thus benefits its owners ,to employees, suppliers, and customers.

Financial economists like to think that business decisions are based only on economic considerations,

especially maximization of firms' values. However, many business decisions are based more on managers'

personal motivations than on economic analyses. Business leaders like power, and more power is attached

to running a larger corporation than a smaller one. Obviously, no executive would admit that his or her ego

was the primary reason behind a merger, but egos do play a prominent role in many mergers.

Firm will be touted as an acquisition candidate because the cost of replacing its assets is considerably higher

than its market value.

Tax considerations have stimulated a number of mergers. For example, a profitable firm in the highest tax

bracket could acquire a firm with large accumulated tax losses. These losses could then be turned into

immediate tax savings rather than carried forward and used in the future.

RECENT MERGER AND ACQUISITION IN INDIA

1.Flipkart buys out Myntra for $300 Million. Flipkart is a leader in selling multiple product categories

online and Myntra is India's leading fashion retailer with strong brand recall.

Their combined might also places them in a better position to take on the likes of Amazon, which

has become increasingly aggressive in India's booming e-tailing market.

Flipkart is into a number of categories, Myntra is focused on fashion e-tailing. With Myntra's share

of 30% of online fashion sales, Flipkart now has a 50% share in a segment that's clocking nearly 100%

annualized growth. With this deal, Flipkart effectively has stolen the thunder from Gurgaon-based

Snapdeal, which was looking to be the first e-tailer in India to cross Rs 1,000 crore in fashion sales by the

end of this year.

As part of the acquisition, Myntra co-founder Mukesh Bansal will join Flipkart's board and will

also oversee Flipkart's fashion business. Flipkart and Myntra will remain as two separate entities, but

people holding stock options in Myntra will now hold the same in Flipkart. The current deal appears to be

win-win for both companies, and could be the making of a giant company, better positioned to address

India's growing demand for online retail - one that could put up strong competition against rivals .Flipkart

has announced it will invest $100 million in Myntra over the next 12 to 18 months, and it hopes to become

the country's largest fashion entity. That is a big advantage for Myntra, which has raised $125 million so far,

and will not have to worry about raising funds for further growth. The $130-million apparel e-retailing

industry is growing fast. However, fashion is highly fragmented and under-penetrated .While Flipkart will

bank on Myntra's fashion expertise and expanding its base of vendor brands (currently around 650), Myntra

will leverage Flipkart's logistics network. Flipkart ships books to almost all of India's 21,000 PIN codes,

and covers more than 100 cities for its entire product portfolio of 20 categories, including consumer

electronics, office supplies, and health and beauty products. Myntra reaches 30 cities with its own logistics

network, Myntra Logistics, and around 9,000 PIN codes via third-party logistics companies.

For Flipkart, setting up a huge fashion vertical means boosting margins, because fashion has the

highest margins - 35 to 40 per cent - among all products sold online. Myntra has big plans with its private

brands like Anouk, Dress berry and Roadster, which promise margins as high 60 per cent. Myntra will

continue to operate as a separate brand, and its founder Mukesh Bansal will occupy a seat on Flipkart's

board, heading all fashion at the new entity.

Flipkart will bring in its capabilities in customer service and technology. Both companies will also

net customers that have shopped on both portals - about 80 per cent of the country's online shoppers have

shopped on either Myntra or Flipkart.

However, the companies will not integrate the back end. The two teams will also function

separately.

Tactful Management Research Journal | Volume 2 | Issue 8 | May 2014

MERGER AND ACQUISITION IN E-COMMERCE SECTOR

Flipkart and Myntra are very different companies, so not merging all processes makes sense for

now. However, it could lead to challenges later.Flipkart is more of a multiple-category horizontal player,

aggressive on growth and market share, with a strong focus on customer experience. Content has never

been part of its core strategy.

But for Myntra, focused as it is on fashion, the business model revolves around merging the

customer experience of a fashion magazine with retail. The company has even roped in Bollywood

celebrities such as Hrithik Roshan for its private brand, HRX.

Tactful Management Research Journal | Volume 2 | Issue 8 | May 2014

MERGER AND ACQUISITION IN E-COMMERCE SECTOR

However, achieving cost efficiency is not yet a concern for Flipkart. As Sachin Bansal puts it:

"Cost synergies are not our priority for this acquisition. It was about scaling the two businesses in much

faster to expand market share in fashion."

Financial details of the deal, including Myntra's valuation, were not disclosed by the two

companies, but Mukesh Bansal said: "It is a fair valuation."

1.Acquisition targets include Sequoia Capital-backed Shopo.in, an online marketplace for Indian

handicraft products, which was bought by online marketplace Snapdeal. The transaction was motivated by

access to a network of sellers in a niche that would generate incremental value in terms of sales.

2.In another e-takeover, Flipkart acquired Letsbuy in order to deepen its catalogue of electronics products,

while online babycare company Babyoye merged with competitor Hoopos in a demand acquisition play, as

the companies targeted a similar customer base. Both were backed by Helion Venture Partners.

CHALLENGES OF E-COMMERCE IN INDIA

A.T. Kearney's 2012 E-Commerce Index examined the top 30 countries in the 2012 Global Retail

Development Index (GRDI). India is not ranked. India, the world?s second most populous country at 1.2

billion, does not make the Top 30, because of low internet penetration (11 percent) and poor financial and

logistical infrastructure compared to other countries.

Some of the infrastructural barriers responsible for slow growth of e Commerce in India are as

follows. Some of these even present new business opportunities.

A. Payment Collection: When get paid by net banking one has to end up giving a significant share of

revenue (4% or more) even with a business of thin margin. This effectively means parting away with almost

half of profits. Fraudulent charges, charge backs etc. all become merchant's responsibility and hence to be

accounted for in the business model.

B. Logistic: You have to deliver the product, safe and secure, in the hands of the right guy in right time

Tactful Management Research Journal | Volume 2 | Issue 8 | May 2014

MERGER AND ACQUISITION IN E-COMMERCE SECTOR

frame. Regular post doesn't offer an acceptable service level; couriers have high charges and limited reach.

Initially, you might have to take insurance for high value shipped articles increasing the cost.

C. Vendor Management: However advanced system maybe, vendor will have to come down and deal in

an inefficient system for inventory management. This will slow down drastically. Most of them won't carry

any digital data for their products. No nice looking photographs, no digital data sheet, no mechanism to

check for daily prices, availability to keep your site updated.

D. Taxation: Octroi, entry tax, VAT and lots of state specific forms which accompany them. These can be

confusing at times with lots of exceptions and special rules

E. Limited Internet access among customers and SMEs.

F. Poor telecom and infrastructure for reliable connectivity.

G. Multiple gaps in the current legal and regulatory framework

H. Multiple issues of trust and lack of payment gateways: privacy of personal and business data connected

over the Internet not assured; security and confidentiality of data not in place.

CURRENT STATUS OFE-COMMERCE SECTOR IN INDIA

As already mentioned above, growth of e-commerce industry has been phenomenally high.

However, its growth is dependent on a number of factors and most important of them is internet

connectivity. As per Forrester McKinsey report of 2013, India has 137 million internet users with

penetration of 11%. Total percentage of online buyers to internet users is 18%. Compared to India, China,

Brazil, Sri Lanka and Pakistan have internet population of 538 (40%), 79 (40%), 3.2 (15%) and 29 (15%)

millions respectively. Therefore, lower internet density continues to remain a challenge for e-commerce.

According to Report of DigitalCommerce, IAMAI-IMRB (2013), e-commerce is growing at the CAGR

of 34% and is expected to touch US$ 13 billion by end of 2013. However, travel segment constitutes nearly

71% of the transactions of consumer e-commerce industry, meaning thereby that e-tailing has not taken of

in India in any meaningful way. Share of e-tail has grown at the rate of 10% in 2011 to 16% in 2012.

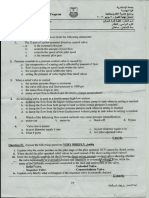

The figure, below, illustrates the growth in the market size since 2009

Tactful Management Research Journal | Volume 2 | Issue 8 | May 2014

MERGER AND ACQUISITION IN E-COMMERCE SECTOR

E-COMMERCE MARKET SIZE FROM 2009 TO 2013

(Figures in Crores. Percentages indicate share of the overall market size)

YEAR

Dec 2009

Dec 2010

Dec2011

Dec2012

Dec2013

(estimated)

Total market size

19,249

26,263

35,142

47,349

62,967

Online

Industry

Travel

14,953

(78%)

20,440

(78%)

2,6572

(76%)

34,544

(73%)

44,907

(71%)

Online

Industry

Non-Travel

4,296

(22%)

5,823

(22%)

8,570

(24%)

12,805

(27%)

18,060

(29%)

1,550

2372

3,872

6,454

10,004

1,540

1848

2,255

2,886

3,607

775

1085

1,682

2,354

3,061

431

518

792

1,110

1,388

? E-Tailing

? Financial Services

? Classifieds

?

Other

Services

Online

Industry surveys suggest that e-commerce industry is expected to contribute around 4 percent to the GDP

by 2020. In comparison, according to a NASSCOM report, by 2020, the IT-BPO industry is expected to

account for 10% of India's GDP, while the share of telecommunication services in India's GDP is expected

to increase to 15 percent by 2015. With enabling support,the e-commerce industry too can contribute much

more to the GDP.

. Major domestic e-commerce companies are Flipkart, Snapdeal, ebay, jabong, amazon, naaptol,

Homeshop18 etc.

As stated earlier, over 70% of all consumer e-commerce transactions in India are travel related, comprising

mainly of online booking of airline tickets, railway tickets and hotel bookings. The biggest players in the

travel category are Makemytrip.com, Yatra.com and the IRCTC website for railway bookings. Non-travel

related online commerce comprises 25-30 percent of the B2C e-Commerce market. The unfettered growth

Tactful Management Research Journal | Volume 2 | Issue 8 | May 2014

MERGER AND ACQUISITION IN E-COMMERCE SECTOR

of online travel category has been possible because the regulatory and infrastructure issues do not impede

its growth. Also, it does not face the infrastructure challenges since the goods need not be transferred

physically.B2B and B2C Classifieds (jobs, matrimony, car, real estate etc.) contribute to 5%, whereas other

online services such as online entertainment ticketing, online food delivery, buying

discounts/deals/vouchers etc. form 2 % of the overall market.

FUTURE OF E-COMMERCE IN INDIA

It is found that countries making in the top list of the table of e-commerce have required

technologies coupled with higher internet density, high class infrastructure and suitable regulatory

framework. India needs to work on these areas to realize true potential of e-commerce business in the

country

Size of the total e-commerce market in India is estimated to expand at a CAGR of About 40.0

percent during 201020 to USD200.0 billion5. Likewise, India is expected to record the highest growth in

the Asia Pacific region during 201216.The trend would shift with the online retail segment contributing

equally to the total market size, considering it is expected to grow significantly in the coming years. The

B2C segment would continue to lead the e-commerce market, thanks to the budding Indian Internet

population, supporting demographics, ease of payment modes and customer-centric innovative policies. In

the coming decade, we expect the sector to offer much more revolutionary practices such as Transacting

with the help of Mobile money, and having access to virtual trial rooms. Continue shopping online as the

sector is set to mature!!

Today, we are talking about e-commerce progress level of India, the seventh-largest by

geographical area, the second-most populous country, and the most populous democracy in the world.

Indian e-commerce space percentage is getting higher as more and more online retailers enter the market.

Although this level of entry in the e-commerce market is good from a long term perspective, the challenge is

that most entrepreneurs don't have the resources or capital to wait for years before they can get profits.

As foreign and domestic e-retail majors such as Amazon and Flipkart expand their businesses

aggressively, hiring activities are expected to grow by over 30 per cent in the sector and may help create up

to 50,000 jobs in the next 2-3 years. The e-commerce companies are also focusing on hiring lateral talent

from top IT companies and niche retail focused firms for their technology functions while they hire from

FMCG, consumer durables entities to fill in marketing and logistics positions. Besides, Growth industries

inevitably attract youth and that significant part of the hiring in e-commerce is at entry or junior levels

which accounts for a relatively younger profile of workforce. With global e-commerce giants entering

India, demand for talent will increase along with compensation for top executives

CONCLUSION

Internet economy will then become more meaningful in India. With the rapid expansion of

internet, e-commerce, is set to play a very important role in the 21stcentury, the new opportunities for M&A

Tactful Management Research Journal | Volume 2 | Issue 8 | May 2014

MERGER AND ACQUISITION IN E-COMMERCE SECTOR

that will be thrown open, will be accessible to both large corporations and small companies. The role of

government is to provide a legal framework for E-Commerce so that while domestic and international trade

are allowed to expand their horizons, basic rights such as privacy, intellectual property, prevention of fraud,

consumer protection etc. are all taken care of e-commerce players need to make a quick turnaround and

minimise fixed costs as much as possible .Accordingly, different companies are resorting to different

business models. Nevertheless, operating in a highly competitive environment with very low margins is not

an easy job.

Of the 193 e-commerce sites that were operational in India in October 2012, 89 have either shut

down or merged with other retailers, essentially wilting under pressure from high operating costs.

Although many factors support the growth of e-commerce in India, the fledgling industry is faced

with significant hurdles with respect to infrastructure, governance and regulation. Low internet penetration

of 11 percent impedes the growth of e-commerce by limiting the internet access to a broader segment of the

population. Poor last mile connectivity due to missing links in supply chain infrastructure is limiting the

access to far flung areas where a significant portion of the population resides. High dropout rates of 25-30

percent on payment gateways, consumer trust deficit and slow adoption of online payments are compelling

e-commerce companies to rely on costlier payment methods such as Cash on Delivery (COD) India needs

to work on these areas to realize true potential of e-commerce business in the country

REFERENCES

1.DIPP Discussion Paper on E-Commerce 2013-14

2.PANDEY I.M (2011) ,FINANCIAL MANAGEMENT Vikas publishing Housing P. Ltd. New Delhi,

PP. 674

3.Eugene F. Brigham, Joel F. Houston, 12th edition, Fundamentals of Financial

4.Management South-Western, a part of Cengagel earning, USA, PP.656-658

WEBSITES

1.http://www.iamai.in

2.http://en.wikipedia.org

3.http://economictimes.indiatimes.com/industry/jobs

4.http://www.ibef.org

5.http://m.economictimes.com/opinion/comments-analysis/flipkart-myntra-merger--the-imminentidentity-crisis/articleshow/msid-34735436,curpg-2.cms

6.http://www.thehindubusinessline.com/features/smartbuy/tech-news/ecommerce-hiring-to-grow-30on-amazon-local-players-push/article6046326.ece

7.http://www.thehindu.com/business/Industry/flipkart-buys-out-myntra-for-300-m/article6037600.ece

8.http://www.nextbigwhat.com/flipkart-myntra-acquisition-valuation-297/.

9.http://businesstoday.intoday.in/story/flipkart-buys-myntra-impact-on-fashion-e-retail-sector/

1/206484.html

10.http://www.scribd.com/doc/54549535

Priyanka

Assistant Professor , Ramjas College , Universtiy Of Delhi.

Khushboo Sagar

Assistant Professor , Shri Ram College Of Commerce , Universtiy Of Delhi.

Richa Verma

Assistant Professor , Ramjas College, Universtiy Of Delhi.

Tactful Management Research Journal | Volume 2 | Issue 8 | May 2014

Anda mungkin juga menyukai

- Flipkart Supply Chain ManagementDokumen22 halamanFlipkart Supply Chain Managementaparnaiyer88100% (15)

- Strategic Alliances: Three Ways to Make Them WorkDari EverandStrategic Alliances: Three Ways to Make Them WorkPenilaian: 3.5 dari 5 bintang3.5/5 (1)

- Flipkart Myntra Case Study Assignment 2 PDFDokumen13 halamanFlipkart Myntra Case Study Assignment 2 PDFJeetuSri100% (4)

- Consumer Buying Behaviour Towards E-commerce SitesDokumen57 halamanConsumer Buying Behaviour Towards E-commerce Sitesmanoj kumar Das67% (6)

- Indian e Commerce Industry PEST and Porter AnalysisDokumen5 halamanIndian e Commerce Industry PEST and Porter Analysisnidskhurana50% (4)

- Research Proposal E-RetailingDokumen10 halamanResearch Proposal E-RetailinghunnygoyalBelum ada peringkat

- Flipkart SCM Report Group 12Dokumen20 halamanFlipkart SCM Report Group 12Dhruv Shah80% (5)

- SDM AssignmentDokumen7 halamanSDM AssignmentWesley0% (3)

- Geneva IntrotoBankDebt172Dokumen66 halamanGeneva IntrotoBankDebt172satishlad1288Belum ada peringkat

- Ata 36 PDFDokumen149 halamanAta 36 PDFAyan Acharya100% (2)

- Chaman Lal Setia Exports Ltd fundamentals remain intactDokumen18 halamanChaman Lal Setia Exports Ltd fundamentals remain intactbharat005Belum ada peringkat

- Theme Meal ReportDokumen10 halamanTheme Meal Reportapi-434982019Belum ada peringkat

- Case Study On Flipkart-: Submitted To: DR - Richa AroraDokumen13 halamanCase Study On Flipkart-: Submitted To: DR - Richa AroraEven You, CanBelum ada peringkat

- A Project Report On: Merger and AcquisitionDokumen10 halamanA Project Report On: Merger and AcquisitionSamra IqbalBelum ada peringkat

- Flipkart-Myntra From A Merger To An Acquisition: Farhat FatimaDokumen14 halamanFlipkart-Myntra From A Merger To An Acquisition: Farhat FatimajadgugBelum ada peringkat

- Flipkart Myntra PDFDokumen14 halamanFlipkart Myntra PDFGuru Chowdhary0% (1)

- Inroduction: Merger and AcquisitionDokumen12 halamanInroduction: Merger and AcquisitionPraful Jain 1820566Belum ada peringkat

- Flipkart Myntra AcquisitionDokumen8 halamanFlipkart Myntra Acquisitionkirankang900% (1)

- Comparison Between Amazon and FlipkartDokumen45 halamanComparison Between Amazon and FlipkartAkshay chaudhary100% (1)

- Sheet #2: #1) Apple Pay and Master CardDokumen4 halamanSheet #2: #1) Apple Pay and Master CardAdam JaxBelum ada peringkat

- Impact of Flash Sales On E-Commerce Industry in IndiaDokumen9 halamanImpact of Flash Sales On E-Commerce Industry in IndiaIJRASETPublicationsBelum ada peringkat

- Scope of The StudyDokumen13 halamanScope of The StudyKather ShaBelum ada peringkat

- Research Paper On Ecommerce in India PDFDokumen4 halamanResearch Paper On Ecommerce in India PDFafnhemzabfueaa100% (1)

- Flipkart Walmart AcquisitionDokumen21 halamanFlipkart Walmart Acquisitionoreo oreoBelum ada peringkat

- Adapting Marketing Practices To New Liberalized Economy: Prof. Sunita Musafir, Prof. Anu MoomDokumen11 halamanAdapting Marketing Practices To New Liberalized Economy: Prof. Sunita Musafir, Prof. Anu MoomChinmoy SenBelum ada peringkat

- Research Papers On E-Retailing in IndiaDokumen5 halamanResearch Papers On E-Retailing in Indiaafnhgewvmftbsm100% (1)

- An Article On E-Commerce By: Syed Sadham Hussain R (2014Pgp394)Dokumen6 halamanAn Article On E-Commerce By: Syed Sadham Hussain R (2014Pgp394)Sadham TrichyBelum ada peringkat

- Case Study Answers Increase Lululemon's Brand ValueDokumen10 halamanCase Study Answers Increase Lululemon's Brand ValueDaniel MutisoBelum ada peringkat

- Strategy Formulation: Group Project (Section D)Dokumen9 halamanStrategy Formulation: Group Project (Section D)Aurva BhardwajBelum ada peringkat

- Impact of E-Commerce On Emerging Start-UpsDokumen7 halamanImpact of E-Commerce On Emerging Start-UpsIJAR JOURNALBelum ada peringkat

- E-commerce impact on Indian SME growthDokumen5 halamanE-commerce impact on Indian SME growthSudheera LingamaneniBelum ada peringkat

- Index: NO Chapter Name NODokumen53 halamanIndex: NO Chapter Name NOSiddharth JainBelum ada peringkat

- A Studay On Ecommerce WilsonkumarDokumen5 halamanA Studay On Ecommerce WilsonkumarThala WilsonBelum ada peringkat

- Human Resource Management Project Report: By: Pavan Kumar Divi HRLP-026Dokumen8 halamanHuman Resource Management Project Report: By: Pavan Kumar Divi HRLP-026Shweta RameshBelum ada peringkat

- A Case Study of Acquisition of Spice Communications by Isaasdaddea Cellular LimitedDokumen13 halamanA Case Study of Acquisition of Spice Communications by Isaasdaddea Cellular Limitedsarge1986Belum ada peringkat

- Ecommerce in IndiaDokumen8 halamanEcommerce in IndiaSrinivas GotetyBelum ada peringkat

- Research Paper On e Business in IndiaDokumen5 halamanResearch Paper On e Business in Indiaijsgpibkf100% (1)

- Summer Internship Project Report On: Benchmarking-Working Capital of Specific Indian IndustriesDokumen12 halamanSummer Internship Project Report On: Benchmarking-Working Capital of Specific Indian Industriesanjali shilpa kajalBelum ada peringkat

- Supply Chain Management Role of Management AccountantDokumen7 halamanSupply Chain Management Role of Management Accountantvb_krishnaBelum ada peringkat

- Consumer Perception Towards Online Grocery StoresDokumen60 halamanConsumer Perception Towards Online Grocery StoresTanveer Singh Rainu83% (12)

- Flipkart Acquires Myntra to Gain Fashion Edge and Beat RivalsDokumen6 halamanFlipkart Acquires Myntra to Gain Fashion Edge and Beat Rivalscarl vonBelum ada peringkat

- Impact of Customers (Retailers) Towards E-Commerce''Dokumen15 halamanImpact of Customers (Retailers) Towards E-Commerce''salmanBelum ada peringkat

- Literature Review On Indian Retail IndustryDokumen8 halamanLiterature Review On Indian Retail Industryafdttricd100% (1)

- Effectiveness of CRM practices in DecathlonDokumen57 halamanEffectiveness of CRM practices in DecathlonMOHIT VIGBelum ada peringkat

- 10 - Chapter 1Dokumen14 halaman10 - Chapter 1merarib342Belum ada peringkat

- Aditi SynoooDokumen19 halamanAditi SynoooRavinder KumarBelum ada peringkat

- International Journal of Business and Management Invention (IJBMI)Dokumen4 halamanInternational Journal of Business and Management Invention (IJBMI)inventionjournalsBelum ada peringkat

- Foreign Direct Investment in eDokumen3 halamanForeign Direct Investment in eAmritambu SatyarthiBelum ada peringkat

- Research Paper On Ecommerce in IndiaDokumen5 halamanResearch Paper On Ecommerce in Indiawonopwwgf100% (1)

- SEO Flipkart Supply ChainDokumen22 halamanSEO Flipkart Supply ChainKarishma MehtaBelum ada peringkat

- Week 1 Chapter 1: Strategic Management and Strategic CompetitivenessDokumen7 halamanWeek 1 Chapter 1: Strategic Management and Strategic CompetitivenessRosalie Colarte LangbayBelum ada peringkat

- Impact of Flash Sales On Consumers &E-Commerce Industry in IndiaDokumen10 halamanImpact of Flash Sales On Consumers &E-Commerce Industry in Indiaeca 1104Belum ada peringkat

- Term PaperDokumen16 halamanTerm PaperAnu MoudgilBelum ada peringkat

- Myntra's acquisition by Flipkart to compete against Amazon in Indian e-commerceDokumen4 halamanMyntra's acquisition by Flipkart to compete against Amazon in Indian e-commerceLovEly LOoksBelum ada peringkat

- Ecommerce-In India-project-SunilBrid-2022-2023-Sem IV-Sales and MarketingDokumen57 halamanEcommerce-In India-project-SunilBrid-2022-2023-Sem IV-Sales and MarketingJagdishBelum ada peringkat

- Gaurav Rathore PR FinalDokumen73 halamanGaurav Rathore PR Finalgauravrathore8797Belum ada peringkat

- E - Retailing in India: Emerging Trends and Opportunities AheadDokumen10 halamanE - Retailing in India: Emerging Trends and Opportunities AheadYashit SonkarBelum ada peringkat

- Akshat NTCC Sem5 For PlagiarismDokumen23 halamanAkshat NTCC Sem5 For PlagiarismAkshat SrivastavaBelum ada peringkat

- Market Research Online GroceryDokumen32 halamanMarket Research Online Groceryswapnil chonkar50% (2)

- Blueprint to the Digital Economy (Review and Analysis of Tapscott, Lowy and Ticoll's Book)Dari EverandBlueprint to the Digital Economy (Review and Analysis of Tapscott, Lowy and Ticoll's Book)Penilaian: 5 dari 5 bintang5/5 (1)

- Net Profit (Review and Analysis of Cohan's Book)Dari EverandNet Profit (Review and Analysis of Cohan's Book)Belum ada peringkat

- Opening Digital Markets (Review and Analysis of Mougayar's Book)Dari EverandOpening Digital Markets (Review and Analysis of Mougayar's Book)Belum ada peringkat

- Net Ready (Review and Analysis of Hartman and Sifonis' Book)Dari EverandNet Ready (Review and Analysis of Hartman and Sifonis' Book)Belum ada peringkat

- Summary: Creating Value in the Network Economy: Review and Analysis of Tapscott's BookDari EverandSummary: Creating Value in the Network Economy: Review and Analysis of Tapscott's BookBelum ada peringkat

- Evolving With Inclusive Business in Emerging Markets: Managing the New Bottom LineDari EverandEvolving With Inclusive Business in Emerging Markets: Managing the New Bottom LineBelum ada peringkat

- LavalleeRobillard ICSE2015 WhyGoodDevelopersWriteBadCodeDokumen11 halamanLavalleeRobillard ICSE2015 WhyGoodDevelopersWriteBadCodeStupinean CiprianBelum ada peringkat

- KTNP TwentyninePalmsDokumen12 halamanKTNP TwentyninePalmsWesleyBelum ada peringkat

- Mutants & Masterminds 1st Ed Character Generater (Xls Spreadsheet)Dokumen89 halamanMutants & Masterminds 1st Ed Character Generater (Xls Spreadsheet)WesleyBelum ada peringkat

- HiDokumen1 halamanHiWesleyBelum ada peringkat

- HBP Sodium Resident Education Module 508Dokumen67 halamanHBP Sodium Resident Education Module 508WesleyBelum ada peringkat

- Linear Algebra Done WrongDokumen284 halamanLinear Algebra Done WrongJamieP89100% (2)

- Memoirs of The Secret Societies of The South of ItalyDokumen269 halamanMemoirs of The Secret Societies of The South of ItalyWesley100% (1)

- Calc Prep 1Dokumen43 halamanCalc Prep 1WesleyBelum ada peringkat

- Hypertension GuidelinesDokumen30 halamanHypertension GuidelinesLucky PermanaBelum ada peringkat

- 2010 Nuclear Posture Review ReportDokumen72 halaman2010 Nuclear Posture Review ReportantoniocaraffaBelum ada peringkat

- HiDokumen1 halamanHiWesleyBelum ada peringkat

- A Global Look at The Protection of Intellectual PropertyDokumen83 halamanA Global Look at The Protection of Intellectual PropertypdgcssBelum ada peringkat

- Update 2015 Fall Catalog CAN Final LRDokumen64 halamanUpdate 2015 Fall Catalog CAN Final LRWesleyBelum ada peringkat

- World Economic Forum - The Global Risks Report 2016 11th EditionDokumen103 halamanWorld Economic Forum - The Global Risks Report 2016 11th EditionSeni NabouBelum ada peringkat

- Final 2012Dokumen4 halamanFinal 2012WesleyBelum ada peringkat

- Gerd TreatmentDokumen11 halamanGerd TreatmentArri KurniawanBelum ada peringkat

- JNC 7 Report Guidelines for High Blood PressureDokumen52 halamanJNC 7 Report Guidelines for High Blood PressurepatriciajesikaBelum ada peringkat

- GerdDokumen12 halamanGerdcrystalastBelum ada peringkat

- GerdDokumen18 halamanGerdMeliana OctaviaBelum ada peringkat

- Data Protection ActDokumen51 halamanData Protection ActWesleyBelum ada peringkat

- Incourse Question IPELIDokumen2 halamanIncourse Question IPELIWesleyBelum ada peringkat

- Internal Lab ReportDokumen6 halamanInternal Lab ReportWesleyBelum ada peringkat

- Basic D&D Character CardDokumen2 halamanBasic D&D Character CardGlen HallstromBelum ada peringkat

- SEM DiarrheaDokumen3 halamanSEM DiarrheaWesleyBelum ada peringkat

- Hello WorldDokumen1 halamanHello WorldWesleyBelum ada peringkat

- Teaching Sheet: Patient/Family - Brat Diet What Is A BRAT Diet?Dokumen1 halamanTeaching Sheet: Patient/Family - Brat Diet What Is A BRAT Diet?WesleyBelum ada peringkat

- Hello Everyone This Is A Document Form LondonDokumen1 halamanHello Everyone This Is A Document Form LondonWesleyBelum ada peringkat

- Elevators SpecifecsDokumen6 halamanElevators SpecifecsWesleyBelum ada peringkat

- Igc3 Nebosh Guidance 2014 v.2Dokumen21 halamanIgc3 Nebosh Guidance 2014 v.2Cezar DumitriuBelum ada peringkat

- CCS PDFDokumen2 halamanCCS PDFАндрей НадточийBelum ada peringkat

- Ieee Research Papers On Software Testing PDFDokumen5 halamanIeee Research Papers On Software Testing PDFfvgjcq6a100% (1)

- Fundamentals of Corporate Finance Canadian Canadian 8th Edition Ross Test Bank 1Dokumen36 halamanFundamentals of Corporate Finance Canadian Canadian 8th Edition Ross Test Bank 1jillhernandezqortfpmndz100% (22)

- Royalty-Free License AgreementDokumen4 halamanRoyalty-Free License AgreementListia TriasBelum ada peringkat

- Week 3 SEED in Role ActivityDokumen2 halamanWeek 3 SEED in Role ActivityPrince DenhaagBelum ada peringkat

- For Mail Purpose Performa For Reg of SupplierDokumen4 halamanFor Mail Purpose Performa For Reg of SupplierAkshya ShreeBelum ada peringkat

- Notes On Lesson: Faculty Name Code Subject Name CodeDokumen108 halamanNotes On Lesson: Faculty Name Code Subject Name CodeJeba ChristoBelum ada peringkat

- 2020-05-14 County Times NewspaperDokumen32 halaman2020-05-14 County Times NewspaperSouthern Maryland OnlineBelum ada peringkat

- Assignment-2: MCA204 Financial Accounting and ManagementDokumen6 halamanAssignment-2: MCA204 Financial Accounting and ManagementrashBelum ada peringkat

- Proposal Semister ProjectDokumen7 halamanProposal Semister ProjectMuket AgmasBelum ada peringkat

- 7458-PM Putting The Pieces TogetherDokumen11 halaman7458-PM Putting The Pieces Togethermello06Belum ada peringkat

- Biggest Lessons of 20 Years InvestingDokumen227 halamanBiggest Lessons of 20 Years InvestingRohi Shetty100% (5)

- ABS Rules for Steel Vessels Under 90mDokumen91 halamanABS Rules for Steel Vessels Under 90mGean Antonny Gamarra DamianBelum ada peringkat

- Miniature Circuit Breaker - Acti9 Ic60 - A9F54110Dokumen2 halamanMiniature Circuit Breaker - Acti9 Ic60 - A9F54110Gokul VenugopalBelum ada peringkat

- Engine Controls (Powertrain Management) - ALLDATA RepairDokumen4 halamanEngine Controls (Powertrain Management) - ALLDATA Repairmemo velascoBelum ada peringkat

- Aptio ™ Text Setup Environment (TSE) User ManualDokumen42 halamanAptio ™ Text Setup Environment (TSE) User Manualdhirender karkiBelum ada peringkat

- Trinath Chigurupati, A095 576 649 (BIA Oct. 26, 2011)Dokumen13 halamanTrinath Chigurupati, A095 576 649 (BIA Oct. 26, 2011)Immigrant & Refugee Appellate Center, LLCBelum ada peringkat

- Rebranding Brief TemplateDokumen8 halamanRebranding Brief TemplateRushiraj Patel100% (1)

- Bob Duffy's 27 Years in Database Sector and Expertise in SQL Server, SSAS, and Data Platform ConsultingDokumen26 halamanBob Duffy's 27 Years in Database Sector and Expertise in SQL Server, SSAS, and Data Platform ConsultingbrusselarBelum ada peringkat

- Queries With AND and OR OperatorsDokumen29 halamanQueries With AND and OR OperatorstrivaBelum ada peringkat

- Customer Satisfaction and Brand Loyalty in Big BasketDokumen73 halamanCustomer Satisfaction and Brand Loyalty in Big BasketUpadhayayAnkurBelum ada peringkat

- Benchmarking Guide OracleDokumen53 halamanBenchmarking Guide OracleTsion YehualaBelum ada peringkat

- Social EnterpriseDokumen9 halamanSocial EnterpriseCarloBelum ada peringkat

- PS300-TM-330 Owners Manual PDFDokumen55 halamanPS300-TM-330 Owners Manual PDFLester LouisBelum ada peringkat

- Developing a Positive HR ClimateDokumen15 halamanDeveloping a Positive HR ClimateDrPurnima SharmaBelum ada peringkat

- E2 PTAct 9 7 1 DirectionsDokumen4 halamanE2 PTAct 9 7 1 DirectionsEmzy SorianoBelum ada peringkat