240 Assignment 1 For Posting

Diunggah oleh

pearlydawn0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

207 tayangan4 halamannotes

Judul Asli

240 Assignment 1 for Posting

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Ininotes

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

207 tayangan4 halaman240 Assignment 1 For Posting

Diunggah oleh

pearlydawnnotes

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 4

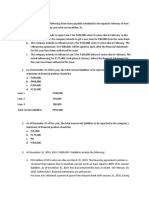

ASSIGNMENT 1: CURRENT LIABILITIES

Accounting 240: Financial Accounting, Part II

Problem 1: Current and noncurrent liabilities

You were able to obtain the following from the accountant for Florivel Corporation related to the

companys liabilities as of December 31, 2010.

Accounts payable

Notes payable trade

Notes payable bank

Wages and salaries payable

Interest payable

Mortgage notes payable 10%

Mortgage notes payable 12%

Bonds payable

P 650,000

190,000

800,000

15,000

?

600,000

1,500,000

2,000,000

The following additional information pertains to these liabilities:

All trade notes payable are due within six months from the end of the reporting period.

Bank notes payable include two separate notes payable to Allied Bank.

o A P300,000, 8% note issued March 1, 2008, payable on demand. Interest is payable

every six months.

o A 1-year, P500,000, 11% note issued January 2, 2010. On December 30, 2010, Florivel

negotiated a written agreement with Allied Bank to replace the note with a 2-year,

P500,000, 10% note to be issued January 2, 2011. The interest was paid on December

31, 2010.

The 10% mortgage note was issued October 1, 2007, with a term of 10 years. Terms of the note

give the holder the right to demand immediate payment if the company fails to make a monthly

interest payment within 10 days of the date the payment is due. As of December 31, 2010,

Agdangan is three months behind in paying its required interest payment.

The 12% mortgage note was issued May 1, 2004, with a term of 20 years. The current principal

amount due is P1,500,000. Principal and interest payable annually on April 30. A payment of

P220,000 is due April 30, 201. The payment includes interest of P180,000.

The bonds payable is 10-year, 8% bonds, issued June 30, 2001. Interest is payable semiannually every June 30 and December 31.

Based on the information above, answer the following:

1. What is the amount of the total current liabilities?

2. What is the amount of the total noncurrent liabilities?

Problem 2: Warranty and premium

Karlyzels Music Emporium carries a wide variety of music promotion techniques warranties and

premiums to attract customers.

Musical instrument and sound equipment are sold in a one-year warranty for replacement of parts and

labor. The estimated warranty cost, based on past experience, is 2% of sales.

The premium is offered on the recorded and sheet music. Customers receive a coupon for each peso

spent on recorded music or sheet music. Customers may exchange 200 coupons and P20 for an AM/FM

radio. Karlyzel pays P34 for each radio and estimates that 60% of the coupons given to customers will be

redeemed.

Karlyzels total sales for 2010 were P57,600,000. P43,200,000 of which were from musical instrument

and sound reproduction equipment, and P14,400,000 from recorded music and sheet music.

Replacement parts and labor for warranty work totalled P1,312,000 during 2010. A total of 52,000 AM/FM

radio used in the premium program were purchased during the year and there were 9,600,000 coupons

redeemed in 2010.

The accrual method is used by Karlyzel to account for the warranty and premium costs for financial

reporting purposes. The balance in the accounts related to warranties and premiums on January 1, 2010

were as shown below:

Inventory of Premium AM/FM radio

Estimated Premium Claims Outstanding

Estimated Liability from Warranties

P 319,600

358,400

1,088,000

Based on the information above:

1. Journalize all transactions involved; and

2. Determine the final amounts that will be shown on the 2010 financial statements for the following

accounts:

o Warranty expense

o Estimated liability from warranties

o Premiums expense

o Inventory of AM/FM radio

o Estimated liability for premiums

Problem 3: Provisions and contingent liabilities

The following information relates to Alabat Company as of December 31, 2010. Answer the following

questions relating to each of the independent situations as requested.

1. Beginning 2010, Alabat Company began marketing a new bear called Red Colt. To help

promote the product, the management is offering a special beer mug to each customer for every

20 specially marked bottle caps of Red Colt. Alabat estimates that out of the 300,000 bottles of

Red Colt sold during 2010, only 50% of the marked bottle caps will be redeemed. For the year

2010, 8,000 ugs were ordered by the company at a total cost of P360,000. A total of 4,500 mugs

were already distributed to customers.

What is the amount of the liability that Alabat Company should report on its December 31, 2010

statement of financial position? Journalize.

2. On January 2, 2008, Alabat Company introduced a new line of products that carry a three-year

warranty against factory defects. Estimated warranty costs related to peso sales are as follows:

1% of sales in the year of sale, 2% in the year after sales and 3% in the second year after sale.

Sales and actual warranty expenditures for the period 2008 to 2010 were as follows:

2008

2009

2010

Sales

P100,000

250,000

350,000

Actual Warranty Expense

P

750

3,750

11,250

What amount should Alabat report as warranty expense in 2010? Journalize.

3. During 2010, Alabat Company guaranteed a suppliers P500,000 loan from a bank. On October 1,

2010, Alabat was notified that the supplier had defaulted on the loan and filed for bankruptcy

protection. Counsel believes Alabat will probably have to pay between P250,000 and P450,000

under its guarantee. As a result of the suppliers bankruptcy, Alabat entered into a contract in

December 2010 to retool its machines so that Alabat could accept parts from other suppliers.

Retooling costs are estimated to be P300,000.

What amount should Manfred report as a liability in its December 31, 2010, statement of financial

position? Journalize.

4. A court case decided on December 21, 2010 awarded damages against Alabat. The judge has

announced that the amount of damages will be set at a future date, expected to be in March

2011. Alabat has received advice from its lawyers that the amount of the damages could be

anything between P20,000 and P7,000,000.

As of December 31, 2010, how much should be recognized in the statement of financial position

regarding this court case? Journalize.

5. Alabats directors decided on November 3, 2010 to restructure the companys operations as

follows:

Factory T would be closed down and put on the market for sale.

100 employes working in Factory T would be retrenched effective November 30, 2010 and

would be paid their accumulated entitlements plus 3 months wages.

The remaining 20 employees working in Factory T would be transferred to Factory X, which

would continue operating.

5 head-office staff would be retrenched effective December 31, 2010 and would be paid

their accumulated entitlements plus 3 months wages.

As at December 31, 2010, the following transactions and events had occurred:

Factory T was shut down on November 30, 2010. An offer of P80 million had been received

for Factory T, however there was no binding sales agreement.

The 100 employees that had been retrenched, had left and their accumulated entitlements

had been paid, however, an amount of P1,520,000, representing a portion of the 3 months

wages for the retrenched employees, had still not been paid.

Costs of P460,000 were expected to be incurred in transferring the 20 employees to their

new work in Factory X. the transfer will occur on January 15, 2011.

Four of the five head office staff had been retrenched, had left, and their accumulated

entitlements, including the 3 months wages, had been paid. However, one employee, D.

Terminator, remained on to complete administrative tasks relating to the closure of Factory

T and the transfer of staff to Factory X. D. Terminator was expected to stay until January

31, 2011. D. Terminators salary for January would be P80,000 and his retrenchment

package would be P260,000, all of which would be paid on the day he left. He estimated

that he would spend 60% of his time administering the closure of Factory T, 30% of his time

administering the transfer of staff to Factory X and the remaining 10% on general

administration.

Calculate the amount of the restructuring provision to be recognized in Alabats financial

statements as at December 31, 2010. Journalize.

Anda mungkin juga menyukai

- DepEd Form 137-ADokumen2 halamanDepEd Form 137-Akianmiguel84% (116)

- Chapter 9 - Audit of Liabilities RoqueDokumen77 halamanChapter 9 - Audit of Liabilities RoqueCristina Ramirez90% (10)

- Project Finance in Theory and Practice: Designing, Structuring, and Financing Private and Public ProjectsDari EverandProject Finance in Theory and Practice: Designing, Structuring, and Financing Private and Public ProjectsPenilaian: 4.5 dari 5 bintang4.5/5 (4)

- 17Mb221 Industrial Relations and Labour LawsDokumen2 halaman17Mb221 Industrial Relations and Labour LawsshubhamBelum ada peringkat

- 5.AUDITING ProblemDokumen111 halaman5.AUDITING ProblemAngelu Amper68% (22)

- Internship Confidentiality AgreementDokumen5 halamanInternship Confidentiality AgreementMonique AcostaBelum ada peringkat

- Financial Accounting FundamentalsDokumen11 halamanFinancial Accounting FundamentalsCarl Angelo100% (1)

- The Bank Credit Analysis Handbook: A Guide for Analysts, Bankers and InvestorsDari EverandThe Bank Credit Analysis Handbook: A Guide for Analysts, Bankers and InvestorsPenilaian: 4 dari 5 bintang4/5 (1)

- Saneamiento Comarca TraducidoDokumen22 halamanSaneamiento Comarca TraducidoVictor Agredo EchavarriaBelum ada peringkat

- Judy Carter - George Irani - Vamık D. Volkan - Regional and Ethnic Conflicts - Perspectives From The Front Lines, Coursesmart Etextbook-Routledge (2008)Dokumen564 halamanJudy Carter - George Irani - Vamık D. Volkan - Regional and Ethnic Conflicts - Perspectives From The Front Lines, Coursesmart Etextbook-Routledge (2008)abdurakhimovamaftuna672Belum ada peringkat

- CPAR - Auditing ProblemDokumen12 halamanCPAR - Auditing ProblemAlbert Macapagal83% (6)

- La Consolacion College - Manila Auditing Problem Final Quiz # 1Dokumen6 halamanLa Consolacion College - Manila Auditing Problem Final Quiz # 1NJ SyBelum ada peringkat

- FAR 1 Reviewer AnswerDokumen27 halamanFAR 1 Reviewer AnswerZace Hayo100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDari EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionBelum ada peringkat

- Disbursement VoucherDokumen5 halamanDisbursement VoucherFonzy RoneBelum ada peringkat

- City of Columbus Reaches Settlement Agreement With Plaintiffs in Alsaada v. ColumbusDokumen2 halamanCity of Columbus Reaches Settlement Agreement With Plaintiffs in Alsaada v. ColumbusABC6/FOX28Belum ada peringkat

- PrE3 Final ExamDokumen16 halamanPrE3 Final ExamLyca MaeBelum ada peringkat

- Moss Co. bonds and warrants analysisDokumen65 halamanMoss Co. bonds and warrants analysisJoy Montalla Sangil80% (5)

- 2011 NATIONAL CPA MOCK BOARD EXAMINATION PRACTICAL ACCOUNTINGDokumen12 halaman2011 NATIONAL CPA MOCK BOARD EXAMINATION PRACTICAL ACCOUNTINGRhea SamsonBelum ada peringkat

- Quiz Audit of LiabilitiesDokumen3 halamanQuiz Audit of LiabilitiesCattleyaBelum ada peringkat

- Audit of LiabilitiesDokumen36 halamanAudit of Liabilitiesjaymark canaya0% (1)

- UntitledDokumen12 halamanUntitledMaykel BolañosBelum ada peringkat

- Practical Accounting 1 2011Dokumen17 halamanPractical Accounting 1 2011abbey89100% (2)

- Quiz BowlDokumen3 halamanQuiz BowljayrjoshuavillapandoBelum ada peringkat

- Financial Accounting Day 1Dokumen12 halamanFinancial Accounting Day 1looter198100% (1)

- Audit of Liabiities and She-1Dokumen9 halamanAudit of Liabiities and She-1Yaj CruzadaBelum ada peringkat

- Practical AccountingDokumen13 halamanPractical AccountingDecereen Pineda RodriguezaBelum ada peringkat

- AP Pakyo CompanyDokumen8 halamanAP Pakyo CompanyKristin Zoe Newtonxii PaezBelum ada peringkat

- Eos CupFinal RoundDokumen7 halamanEos CupFinal RoundMJ YaconBelum ada peringkat

- NFJPIA Mockboard 2011 P1Dokumen7 halamanNFJPIA Mockboard 2011 P1jhefster_81Belum ada peringkat

- Jpia Cup p1Dokumen65 halamanJpia Cup p1RonieOlarte100% (1)

- Financial Quali - ADokumen9 halamanFinancial Quali - ACarl AngeloBelum ada peringkat

- Review Questions Liabilities and Current LiabilitiesDokumen21 halamanReview Questions Liabilities and Current LiabilitiesAbigail Valencia MañalacBelum ada peringkat

- Audit Liabilities to Evaluate Financial ReportingDokumen2 halamanAudit Liabilities to Evaluate Financial ReportingJessicaBelum ada peringkat

- Chapter 1-4 QuizDokumen11 halamanChapter 1-4 Quizspur iousBelum ada peringkat

- Soal Kuis Uas - AklDokumen3 halamanSoal Kuis Uas - AklBastian Nugraha SiraitBelum ada peringkat

- Examination About Investment 18Dokumen3 halamanExamination About Investment 18BLACKPINKLisaRoseJisooJennieBelum ada peringkat

- PPL Cup AverageDokumen7 halamanPPL Cup AverageRukia KuchikiBelum ada peringkat

- Ifrint 2012 Dec Q PDFDokumen6 halamanIfrint 2012 Dec Q PDFPiyal HossainBelum ada peringkat

- 2011 NATIONAL CPA MOCK BOARD EXAMINATIONDokumen7 halaman2011 NATIONAL CPA MOCK BOARD EXAMINATIONkonyatanBelum ada peringkat

- Liabilities from trial balance problemsDokumen3 halamanLiabilities from trial balance problemsJohn Mark PalapuzBelum ada peringkat

- Accounts ReceivablesDokumen10 halamanAccounts ReceivablesYenelyn Apistar Cambarijan0% (1)

- Paulita Company financial reporting questionsDokumen7 halamanPaulita Company financial reporting questionsArvin John Masuela100% (1)

- Financial Statement AnalysisDokumen3 halamanFinancial Statement Analysiselsana philipBelum ada peringkat

- FINAL For Students Premium and Warranry Liability and LiabilitiesDokumen8 halamanFINAL For Students Premium and Warranry Liability and LiabilitiesHardly Dare GonzalesBelum ada peringkat

- FAR 1 Reviewer AnswerDokumen27 halamanFAR 1 Reviewer AnswerMary Joy CabilBelum ada peringkat

- 03 Accounting For Receivables StudentDokumen4 halaman03 Accounting For Receivables StudentFaith BariasBelum ada peringkat

- Audit of Liabs 1Dokumen2 halamanAudit of Liabs 1Raz MahariBelum ada peringkat

- Auditing Problems, CRC-ACEDokumen9 halamanAuditing Problems, CRC-ACESannyboy Paculio Datumanong100% (1)

- AC - IntAcctg1 Quiz 04 With AnswersDokumen2 halamanAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- SEO-optimized title for fitness health spa membership fees documentDokumen5 halamanSEO-optimized title for fitness health spa membership fees documentDarwin LopezBelum ada peringkat

- Discussion Questions:: Auditing Practice II Third Term, AY 2015-2016 Workbook Page 1-1Dokumen4 halamanDiscussion Questions:: Auditing Practice II Third Term, AY 2015-2016 Workbook Page 1-1mimi96Belum ada peringkat

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsDari EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsBelum ada peringkat

- Private Client Practice: An Expert Guide, 2nd editionDari EverandPrivate Client Practice: An Expert Guide, 2nd editionBelum ada peringkat

- International Relations: A Simple IntroductionDari EverandInternational Relations: A Simple IntroductionPenilaian: 5 dari 5 bintang5/5 (9)

- International Economic Indicators and Central BanksDari EverandInternational Economic Indicators and Central BanksBelum ada peringkat

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryDari EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- How to Restore the Greek Economy: Win 10 Million Dollar to Prove It WrongDari EverandHow to Restore the Greek Economy: Win 10 Million Dollar to Prove It WrongBelum ada peringkat

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryDari EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingDari EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingBelum ada peringkat

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryDari EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryBelum ada peringkat

- How To Buy A House For 1 Euro in Italy?: Practical bookDari EverandHow To Buy A House For 1 Euro in Italy?: Practical bookBelum ada peringkat

- BenedictsDokumen12 halamanBenedictsEros CuestaBelum ada peringkat

- My Answers or Opinions Sa Given Sample of Financial Statement:3 Sorry Ate If Late and Medyo Di Ko Alam Pano Maganalyze NG FS Hahaha I Tried @@Dokumen2 halamanMy Answers or Opinions Sa Given Sample of Financial Statement:3 Sorry Ate If Late and Medyo Di Ko Alam Pano Maganalyze NG FS Hahaha I Tried @@pearlydawnBelum ada peringkat

- Significance of The StudyDokumen2 halamanSignificance of The StudypearlydawnBelum ada peringkat

- 2MGT220 PaperDokumen31 halaman2MGT220 PaperpearlydawnBelum ada peringkat

- Movie Ethics ReviewDokumen4 halamanMovie Ethics ReviewpearlydawnBelum ada peringkat

- Research - JournalDokumen14 halamanResearch - JournalpearlydawnBelum ada peringkat

- Philo Paper 2Dokumen2 halamanPhilo Paper 2pearlydawnBelum ada peringkat

- Cao Dai ReligionDokumen12 halamanCao Dai ReligionpearlydawnBelum ada peringkat

- Cao Dai ReligionDokumen12 halamanCao Dai ReligionpearlydawnBelum ada peringkat

- Chowtime CuisineDokumen7 halamanChowtime CuisinepearlydawnBelum ada peringkat

- Assignment - Take Home Short Exam - January 2016 - Finance 203 ADokumen2 halamanAssignment - Take Home Short Exam - January 2016 - Finance 203 ApearlydawnBelum ada peringkat

- Mrktg201 2nd Case StudyDokumen6 halamanMrktg201 2nd Case StudypearlydawnBelum ada peringkat

- Nature of Muslim MarriageDokumen18 halamanNature of Muslim MarriagejaishreeBelum ada peringkat

- Abner PDSDokumen7 halamanAbner PDSKEICHIE QUIMCOBelum ada peringkat

- Avr42783: Using Usart To Wake Up Atmega328Pb From Sleep ModeDokumen12 halamanAvr42783: Using Usart To Wake Up Atmega328Pb From Sleep ModeMartin Alonso Cifuentes DazaBelum ada peringkat

- LabReport2 Group6Dokumen7 halamanLabReport2 Group6RusselBelum ada peringkat

- Doe V Doe Trevi LawsuitDokumen30 halamanDoe V Doe Trevi LawsuitSaintBelum ada peringkat

- Exposition TextDokumen5 halamanExposition TextImam YusaBelum ada peringkat

- TIL 1897 Controller Connectivity and Stalled Io Live ValuesStandard - TIL 1897Dokumen13 halamanTIL 1897 Controller Connectivity and Stalled Io Live ValuesStandard - TIL 1897bali abdelazizBelum ada peringkat

- Key provisions of the Philippine Civil Code on laws and jurisprudenceDokumen7 halamanKey provisions of the Philippine Civil Code on laws and jurisprudenceIzay NunagBelum ada peringkat

- Derbes, Program of Giotto's ArenaDokumen19 halamanDerbes, Program of Giotto's ArenaMarka Tomic DjuricBelum ada peringkat

- 01 PartnershipDokumen6 halaman01 Partnershipdom baldemorBelum ada peringkat

- Bank and Types of BanksDokumen9 halamanBank and Types of Banksanju skariaBelum ada peringkat

- Itlp Question BankDokumen4 halamanItlp Question BankHimanshu SethiBelum ada peringkat

- Wrongful Detention Claim Over Missing Cows DismissedDokumen12 halamanWrongful Detention Claim Over Missing Cows DismissedA random humanBelum ada peringkat

- Ad Intelligence BDokumen67 halamanAd Intelligence BSyed IqbalBelum ada peringkat

- TOR Custom Clearance in Ethiopia SCIDokumen12 halamanTOR Custom Clearance in Ethiopia SCIDaniel GemechuBelum ada peringkat

- High Treason and TreasonDokumen6 halamanHigh Treason and Treasonapi-272053603Belum ada peringkat

- Legal Due Diligence Report for PT Olam IndonesiaDokumen65 halamanLegal Due Diligence Report for PT Olam IndonesiaHubertus SetiawanBelum ada peringkat

- Online Dog RegistrationDokumen2 halamanOnline Dog RegistrationtonyBelum ada peringkat

- Quit Claim Deed for Condo Unit in Bay County FLDokumen2 halamanQuit Claim Deed for Condo Unit in Bay County FLMalcolm Walker100% (4)

- Meaning PerquisiteDokumen2 halamanMeaning PerquisiteModassir Husain KhanBelum ada peringkat

- The Following Information Is Available For Bott Company Additional Information ForDokumen1 halamanThe Following Information Is Available For Bott Company Additional Information ForTaimur TechnologistBelum ada peringkat

- PFR CompiledDokumen91 halamanPFR CompiledLyn Dela Cruz DumoBelum ada peringkat

- Flores Cruz Vs Goli-Cruz DigestDokumen2 halamanFlores Cruz Vs Goli-Cruz DigestRyan SuaverdezBelum ada peringkat