Q3 2015 Dec

Diunggah oleh

jamesJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Q3 2015 Dec

Diunggah oleh

jamesHak Cipta:

Format Tersedia

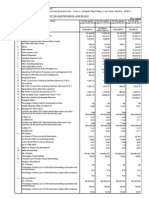

HERITAGE FOODS LIMITED

(Formerly known as HERITAGE FOODS (INDIA) LIMITED)

Regd. Office: 6 - 3 - 541/c, Adj. to NIMS, Punjagutta, Hyderabad - 500 082.

CIN: L15209TG1992PLC014332 - www.heritagefoods.in - Tel: 040 - 23391221/23391222 Fax: 30685458, Email- hfl@heritagefoods.in

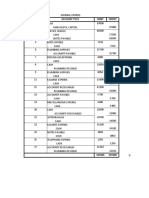

PART I : STATEMENT OF STANDALONE AND CONSOLIDATED UNAUDITED FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED DECEMBER 31, 2015

STANDALONE

Quarter Ended

Nine Months Ended

Particulars

(RS.in lakhs)

Year Ended

31.12.2015 30.09.2015 31.12.2014 31.12.2015 31.12.2014

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited)

Quarter Ended

CONSOLIDATED

Nine Months Ended

Year Ended

31.03.2015 31.12.2015 30.09.2015 31.12.2014 31.12.2015 31.12.2014

(Audited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited)

31.03.2015

(Audited)

1. Income from operations

57167.74

1091.20

58258.94

57602.95

1080.29

58683.24

50260.90

818.92

51079.82

171567.27

3220.38

174787.65

150335.38

2559.43

152894.81

203348.14

3948.51

207296.65

57167.74

1091.20

58258.94

57602.95

1080.29

58683.24

50260.90

818.92

51079.82

171567.27

3220.38

174787.65

150335.38

2559.43

152894.81

203348.14

3948.51

207296.65

37562.84

12650.25

(4082.94)

31869.22

11938.69

2062.36

33984.38

10289.55

(2656.27)

104511.32

35714.74

(1922.34)

97032.19

31127.22

(3141.30)

131393.51

42184.17

(5079.25)

37562.84

12650.25

(4082.94)

31869.22

11938.69

2062.36

33984.38

10289.55

(2656.27)

104511.32

35714.74

(1922.34)

97032.19

31127.22

(3141.30)

131393.51

42184.17

(5079.25)

3455.26

856.08

5677.03

56118.53

2140.41

3501.50

863.71

5791.08

56026.56

2656.68

2764.34

863.52

4861.28

50106.80

973.02

10133.52

2553.96

17025.30

168016.50

6771.15

8129.97

2516.44

14352.29

150016.80

2878.01

11072.42

3399.03

19522.51

202492.39

4804.26

3455.26

856.08

5677.03

56118.53

2140.41

3501.50

863.71

5791.08

56026.56

2656.68

2764.34

863.52

4861.75

50107.27

972.55

10133.52

2553.96

17025.30

168016.50

6771.15

8129.97

2516.44

14352.76

150017.27

2877.54

11072.42

3399.03

19522.66

202492.54

4804.11

4. Other Income

5. Profit / (Loss) from ordinary activities before finance costs and exceptional items (3+4)

117.09

2257.50

124.06

2780.74

74.74

1047.76

391.83

7162.98

236.70

3114.70

702.66

5506.92

117.09

2257.50

124.06

2780.74

74.74

1047.29

391.83

7162.98

236.70

3114.24

717.83

5521.94

6. Finance costs

7. Profit /(Loss) from ordinary activities after finance costs but before exceptional items (5-6)

327.41

1930.09

400.79

2379.95

347.29

700.47

1164.71

5998.27

1152.94

1961.77

1593.01

3913.91

327.41

1930.09

400.79

2379.95

347.29

700.00

1164.71

5998.27

1152.94

1961.30

1593.01

3928.92

8. Exceptional Items

136.95

1793.14

0.00

2379.95

0.00

700.47

136.95

5861.32

0.00

1961.77

0.00

3913.91

136.95

1793.14

0.00

2379.95

0.00

700.00

136.95

5861.32

0.00

1961.30

0.00

3928.92

652.00

4.02

1137.12

1137.12

905.00

(19.14)

(35.24)

1529.33

1529.33

201.36

0.00

(49.09)

548.20

548.20

2,208.00

(18.06)

(66.84)

3738.23

3738.23

565.36

(0.45)

(164.61)

1561.47

1561.47

1169.36

(0.45)

(76.02)

2821.02

2821.02

652.00

(0.00)

4.02

1137.12

0.00

1137.12

905.00

(19.15)

(35.24)

1529.33

0.00

1529.33

201.36

0.00

(49.10)

547.74

547.74

2,208.00

(18.06)

(66.84)

3738.23

0.00

3738.23

565.36

(0.45)

(164.61)

1561.00

0.00

1561.00

1169.36

(0.45)

(76.02)

2836.04

0.00

2836.04

1137.12

1529.33

548.20

3738.23

1561.47

2821.02

(0.04)

1137.08

(0.02)

1529.32

(0.13)

0.06

547.56

(0.06)

3738.16

(0.24)

0.06

1560.70

(0.28)

0.16

2835.60

2319.90

10.00

----

2319.90

10.00

----

2319.90

10.00

----

2319.90

10.00

----

2319.90

10.00

----

2319.90

10.00

16981.26

2319.90

10.00

----

2319.90

10.00

----

2319.90

10.00

----

2319.90

10.00

----

2319.90

10.00

----

2319.90

10.00

16972.70

4.90

4.90

6.59

6.59

2.36

2.36

16.11

16.11

6.73

6.73

12.16

12.16

4.90

4.90

6.59

6.59

2.36

2.36

16.11

16.11

6.73

6.73

12.22

12.22

4.90

4.90

6.59

6.59

2.36

2.36

16.11

16.11

6.73

6.73

12.16

12.16

4.90

4.90

6.59

6.59

2.36

2.36

16.11

16.11

6.73

6.73

12.22

12.22

(a) Net Sales / Income from Operations (Net of excise duty)

(b) Other Operating Income

Total income from operations (a+b)

2. Expenditure

(a) Cost of materials consumed

(b) Purchase of stock-in-trade

(c) Changes in inventories of finished goods,work-in-progress

and stock-in-trade

(d) Employees benefits expense

(e) Depreciation and amortisation expense

(f ) Other expenses

Total expenditure (a+b+c+d+e+f)

3. Profit / (Loss) from operations before other income, finance costs & exceptional items (1-2)

9. Profit / (Loss) from ordinary activities before tax (7-8)

10. Tax expense

Current Tax /MAT

Prior period tax

Deferred Tax Charge / (Credit)

11.Net Profit/ (Loss) from ordinary activities after tax ( 9 -10)

12.Extraordinary Items (net of tax expense)

13.Net Profit/(Loss) for the period before share of profit /(loss) of associates and minority

interest (11-12)

14.Share of profit / (loss) of associates

15. Minority interest

16. Net Profit/ (Loss) after taxes, minority interest and share of profit / (loss) of associates

(13+14+15)

17. Paid-up equity share capital

Face value per share (Rs.)

18. Reserves excluding revaluation reserves as per Balance Sheet of previous Accounting

year

19. Earnings per share (Rs.)

a) EPS before Extraordinary items for the period, for the year

to date and for the previous year (not annualized) :

i. Basic

ii. Diluted

b) EPS after Extraordinary items for the period, for the year

to date and for the previous year (not annualized):

i. Basic

ii. Diluted

HERITAGE FOODS LIMITED

SEGMENT REPORTING FOR THE QUARTER AND NINE MONTHS ENDED DECEMBER 31, 2015

Particulars

(Rs. In lakhs)

Quarter Ended

STANDALONE

Nine Months Ended

31.12.2015 30.09.2015 31.12.2014 31.12.2015 31.12.2014

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited)

Year Ended

31.03.2015

(Audited)

Quarter Ended

31.12.2015

(Unaudited)

CONSOLIDATED

Nine Months Ended

30.09.2015 31.12.2014 31.12.2015 31.12.2014

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

Year Ended

31.03.2015

(Audited)

1. Segment Revenue

a. Dairy

b. Retail

c. Agri

d. Bakery

e. Renewable Energy

f. Heritage Foods Retail Limited

g. Heritage Conpro Ltd

Total Segment Revenue

Less: Inter Segment Revenue

Net Sales / Income from Operations

43035.00

14444.40

2406.30

215.03

78.54

60179.27

1920.33

58258.94

44191.58

13862.69

2201.08

193.90

63.12

60512.37

1829.13

58683.24

38604.01

11883.10

2119.53

161.12

64.80

52832.57

1752.75

51079.82

130903.67

41700.57

6945.58

614.07

207.46

180371.35

5583.70

174787.65

115182.90

35924.50

6378.19

409.31

178.90

158073.80

5178.99

152894.81

155585.71

49397.00

8400.16

588.92

257.03

214228.82

6932.18

207296.65

43035.00

14444.40

2406.30

215.03

78.54

60179.27

1920.33

58258.94

44191.58

13862.69

2201.08

193.90

63.12

60512.37

1829.13

58683.24

38604.01

11883.10

2119.53

161.12

64.80

52832.57

1752.75

51079.82

130903.67

41700.57

6945.58

614.07

207.46

180371.35

5583.70

174787.65

115182.90

35924.50

6378.19

409.31

178.90

158073.80

5178.99

152894.81

155585.71

49397.00

8400.16

588.92

257.03

214228.82

6932.18

207296.65

2565.01

(442.57)

(37.84)

(6.29)

35.83

2114.14

327.41

0.00

6.41

0.00

1793.14

3410.32

(574.14)

(63.79)

(19.14)

20.46

2773.71

400.79

0.00

3.97

3.06

2379.95

1459.30

(370.67)

(49.15)

(16.02)

20.22

1043.68

347.29

4.09

700.47

8598.09

(1536.38)

(123.53)

(31.65)

74.26

6980.81

1164.71

42.16

3.06

5861.32

4410.64

(1187.58)

(90.29)

(72.76)

41.34

3101.35

1152.94

13.32

0.04

1961.77

6717.47

(1107.36)

(125.47)

(84.46)

70.53

5470.70

1593.01

1.24

37.42

0.04

3913.91

2565.01

(442.57)

(37.84)

(6.29)

35.83

2114.14

327.41

0.00

6.41

0.00

1793.14

3410.32

(574.14)

(63.79)

(19.14)

20.46

2773.71

400.79

0.00

3.97

3.06

2379.95

1459.30

(370.67)

(49.15)

(16.02)

20.22

(0.24)

(0.23)

1043.21

347.29

4.09

700.00

8598.09

(1536.38)

(123.53)

(31.65)

74.26

6980.81

1164.71

42.16

3.06

5861.32

4410.64

(1187.58)

(90.29)

(72.76)

41.34

(0.24)

(0.23)

3100.88

1152.94

13.33

0.04

1961.30

6717.47

(1107.36)

(125.47)

(84.46)

70.53

(0.76)

(0.63)

5469.31

1593.01

(15.17)

37.42

0.04

3928.92

19660.80

7742.53

3074.62

1023.07

1273.20

(102.92)

32671.30

16018.67

7059.11

3173.43

1054.41

1310.72

(154.85)

28461.50

15127.37

7925.69

3291.48

1067.36

1,617.15

16.72

29045.78

19660.80

7742.53

3074.62

1023.07

1273.20

(102.92)

32671.30

15127.37

7925.69

3291.48

1067.36

1617.15

16.72

29045.78

18687.41

8877.40

3135.92

1075.13

1588.95

222.41

33587.22

19660.80

7742.53

3074.62

1023.07

1273.20

(0.30)

(0.28)

(102.92)

32670.71

16018.67

7059.11

3173.43

1054.41

1310.72

(0.38)

(0.32)

(154.85)

28460.79

15127.36

7925.69

3291.48

1067.36

1617.15

(0.08)

(0.02)

16.72

29045.67

19660.80

7742.53

3074.62

1023.07

1273.20

(0.30)

(0.28)

(102.92)

32670.71

15127.36

7925.69

3291.48

1067.36

1617.15

(0.08)

(0.02)

16.72

29045.67

18687.41

8877.40

3135.92

1075.13

1588.95

(0.52)

(0.41)

222.41

33586.28

2. Segment Results

(Profit (+) / (Loss) (-) before finance costs and tax)

a. Dairy

b. Retail

c. Agri

d. Bakery

e. Renewable Energy

f. Heritage Foods Retail Limited

g. Heritage Conpro Ltd

Total Segment Results

Less: I. Finance costs

ii. Other un-allocable expenses net off

Add: i. Interest income

ii. Other un-allocable income

Total Profit before Tax

3. Capital Employed

(Segment Assets - Segment Liabilities)

a. Dairy

b. Retail

c. Agri

d. Bakery

e. Renewable Energy

f. Heritage Foods Retail Limited

g. Heritage Conpro Ltd

h. Unallocated

Total

Notes:

1.The above results for the quarter and nine months ended December 31,2015 have been reviewed by the Audit Committee and approved by the Board of Directors in their meeting held on January 21,2016.

2. The Statutory Auditors have conducted a limited review of accounts for the aforesaid period.

3.As per the Accounting Standard (AS- 17), the Company has identified Dairy, Retail, Agri, Bakery and Renewable Energy segments as reportable segments. The segment wise results are given above.

4 Exceptional item is related to additional provision for bonus for the year 2014-15 as per the Payment of Bonus(Amendment) Act,2015.

5.The Consolidated Financial results are prepared as per applicable accounting standards notified under Companies (Accounts) Rules, 2014.

6. Figures of previous period(s)/ year(s) have been regrouped/rearranged wherever necessary.

For and on behalf of the Board

Sd/-

N Bhuvaneswari

Date: January 21, 2016

Place: Hyderabad

Vice Chairperson & Managing Director

DIN -00003741

Anda mungkin juga menyukai

- Temporary Shelters Revenues World Summary: Market Values & Financials by CountryDari EverandTemporary Shelters Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Sebi MillionsDokumen3 halamanSebi MillionsShubham TrivediBelum ada peringkat

- Sebi MillionsDokumen2 halamanSebi MillionsNitish GargBelum ada peringkat

- Fin440 ApexFoods and GHAILDokumen22 halamanFin440 ApexFoods and GHAILAbid KhanBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen7 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- New Listing For PublicationDokumen2 halamanNew Listing For PublicationAathira VenadBelum ada peringkat

- Q2 Fy2011-12 PDFDokumen2 halamanQ2 Fy2011-12 PDFTushar PatelBelum ada peringkat

- Standalone Financial Results For March 31, 2015 (Result)Dokumen3 halamanStandalone Financial Results For March 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For June 30, 2015 (Company Update)Dokumen7 halamanFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderBelum ada peringkat

- Chapter 2 (20-34)Dokumen15 halamanChapter 2 (20-34)Selva KumarBelum ada peringkat

- Segment Reporting (Rs. in Crore)Dokumen8 halamanSegment Reporting (Rs. in Crore)Tushar PanhaleBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Dokumen16 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderBelum ada peringkat

- HDFC Life and IciciDokumen5 halamanHDFC Life and IciciSubhashBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen8 halamanStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results For Sept 30, 2015 (Standalone) (Result)Dokumen3 halamanFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Auditors Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Consolidated Balance Sheet: As at 31st December, 2011Dokumen21 halamanConsolidated Balance Sheet: As at 31st December, 2011salehin1969Belum ada peringkat

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Dokumen5 halamanFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Karnataka Bank Results Sep12Dokumen6 halamanKarnataka Bank Results Sep12Naveen SkBelum ada peringkat

- Financial Results For The Quarter Ended 30 June 2012Dokumen2 halamanFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaBelum ada peringkat

- Result Q-1-11 For PrintDokumen1 halamanResult Q-1-11 For PrintSagar KadamBelum ada peringkat

- Ref: Code No. 530427: Encl: As AboveDokumen3 halamanRef: Code No. 530427: Encl: As AboveShyam SunderBelum ada peringkat

- Financial Reports of Devi Sea LTD: Profit & Loss Account For The Year Ended 31St March, 2009Dokumen11 halamanFinancial Reports of Devi Sea LTD: Profit & Loss Account For The Year Ended 31St March, 2009Sakhamuri Ram'sBelum ada peringkat

- PDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Dokumen1 halamanPDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Rakesh BalboaBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokumen2 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- CTC - Corporate Update - 10.02.2014Dokumen6 halamanCTC - Corporate Update - 10.02.2014Randora LkBelum ada peringkat

- Pidilite Caselet DataDokumen3 halamanPidilite Caselet DataTejaswi KancherlaBelum ada peringkat

- GodrejDokumen21 halamanGodrejVishal V. ShahBelum ada peringkat

- MSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012Dokumen4 halamanMSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012kpatil.kp3750Belum ada peringkat

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen2 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokumen3 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen5 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Keerthika Case StudiesDokumen9 halamanKeerthika Case StudiesAarti SaxenaBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen3 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Avt Naturals (Qtly 2011 06 30) PDFDokumen1 halamanAvt Naturals (Qtly 2011 06 30) PDFKarl_23Belum ada peringkat

- Reliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003Dokumen3 halamanReliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003ak47ichiBelum ada peringkat

- Avt Naturals (Qtly 2012 12 31)Dokumen1 halamanAvt Naturals (Qtly 2012 12 31)Karl_23Belum ada peringkat

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Dokumen6 halamanAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Updates On Financial Results For March 31, 2015 (Result)Dokumen3 halamanUpdates On Financial Results For March 31, 2015 (Result)Shyam SunderBelum ada peringkat

- ITC LimitedDokumen7 halamanITC LimitedlovemethewayiamBelum ada peringkat

- Announces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Dokumen3 halamanAnnounces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderBelum ada peringkat

- IT Return IT1 WithAnnexure 8432374Dokumen9 halamanIT Return IT1 WithAnnexure 8432374just_urs207Belum ada peringkat

- Balance Sheet AnalysisDokumen8 halamanBalance Sheet Analysisramyashraddha18Belum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen4 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Central Release of Last Year But Received During The Current Year Actual O.B. As On 1st April of The YearDokumen6 halamanCentral Release of Last Year But Received During The Current Year Actual O.B. As On 1st April of The YearmridanishjBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Fine Foods Limited: FU Wang Food LimitedDokumen8 halamanFine Foods Limited: FU Wang Food LimitedS. M. Zamirul IslamBelum ada peringkat

- Standalone Financial Results, Auditors Report For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Auditors Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Sesi 1 Receivables War22e - Ch09 Bagian 1Dokumen51 halamanSesi 1 Receivables War22e - Ch09 Bagian 1rina.asmara asmaraBelum ada peringkat

- Adjustments For Final AccountsDokumen48 halamanAdjustments For Final AccountsArsalan QaziBelum ada peringkat

- Financial Plan TemplateDokumen4 halamanFinancial Plan TemplateHalyna NguyenBelum ada peringkat

- Chapter 2 Problems - IADokumen8 halamanChapter 2 Problems - IAKimochi SenpaiiBelum ada peringkat

- Wright Investors Service Comprehensive Report For MGC Pharmaceuticals LTDDokumen67 halamanWright Investors Service Comprehensive Report For MGC Pharmaceuticals LTDAnonymous mg0c9hqXCBelum ada peringkat

- CH 02Dokumen24 halamanCH 02Dima100% (2)

- Advance Chapter 2 4 - 6005941748281382493Dokumen114 halamanAdvance Chapter 2 4 - 6005941748281382493NatnaelBelum ada peringkat

- Accountancy Model Paper-2-1Dokumen9 halamanAccountancy Model Paper-2-1Hashim SethBelum ada peringkat

- Financial Modelling FundamentalsDokumen44 halamanFinancial Modelling FundamentalsNguyen Binh MinhBelum ada peringkat

- Detailed Lesson Plan - Fabm 1 (Second)Dokumen12 halamanDetailed Lesson Plan - Fabm 1 (Second)Maria Benna Mendiola100% (5)

- Excell 1 ShannanDokumen7 halamanExcell 1 Shannansrhaythorn0% (1)

- Accounting Equation & Accounting CDokumen134 halamanAccounting Equation & Accounting Ckulife100% (1)

- Financials GlossaryDokumen248 halamanFinancials GlossarySaif Al MutairiBelum ada peringkat

- AfarDokumen53 halamanAfarrodell pabloBelum ada peringkat

- Responsibility Acctg Transfer Pricing GP AnalysisDokumen21 halamanResponsibility Acctg Transfer Pricing GP AnalysisMoon LightBelum ada peringkat

- Ans Mini Case 2 - A171 - LecturerDokumen14 halamanAns Mini Case 2 - A171 - LecturerXue Yin Lew100% (1)

- Answers - Module 5 For TeamsDokumen4 halamanAnswers - Module 5 For Teamsbhettyna noayBelum ada peringkat

- Problem Mr. Lindbergh Lendl S. Soriano Practice Set MerchandisingDokumen5 halamanProblem Mr. Lindbergh Lendl S. Soriano Practice Set MerchandisingRayna AbrenicaBelum ada peringkat

- Definition of 'Ratio Analysis'Dokumen3 halamanDefinition of 'Ratio Analysis'Hemalatha AroorBelum ada peringkat

- Fin Mid Quiz FinalDokumen44 halamanFin Mid Quiz FinalAtik MahbubBelum ada peringkat

- Cost Goods Manufactured Schedule V13Dokumen12 halamanCost Goods Manufactured Schedule V13Osman AffanBelum ada peringkat

- One Shot Revision - Cash Flow StatementsDokumen39 halamanOne Shot Revision - Cash Flow Statementssoumithansda286Belum ada peringkat

- Yanaprima Hastapersada TBK.: Company Report: July 2018 As of 31 July 2018Dokumen3 halamanYanaprima Hastapersada TBK.: Company Report: July 2018 As of 31 July 2018roxasBelum ada peringkat

- Monica Cement Company Journal Entries Account Titles Dr. CRDokumen6 halamanMonica Cement Company Journal Entries Account Titles Dr. CRclarice_anneBelum ada peringkat

- Bus Com 12Dokumen3 halamanBus Com 12Chabelita MijaresBelum ada peringkat

- Chapter # 17: Valuation of Accounts ReceivableDokumen24 halamanChapter # 17: Valuation of Accounts ReceivableHakim JanBelum ada peringkat

- Departmental AccountsDokumen12 halamanDepartmental AccountsHarsh KumarBelum ada peringkat

- Topic 7 - Receivables - Rev (Students)Dokumen48 halamanTopic 7 - Receivables - Rev (Students)RomziBelum ada peringkat

- Question CSOFP - TUNADokumen1 halamanQuestion CSOFP - TUNAAyunieazahaBelum ada peringkat

- Problem 2 12 AccountingDokumen4 halamanProblem 2 12 AccountingSofia Gwen VenturaBelum ada peringkat