Karvy Weekly Snippets 26 Mar 2016

Diunggah oleh

AdityaKumarDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Karvy Weekly Snippets 26 Mar 2016

Diunggah oleh

AdityaKumarHak Cipta:

Format Tersedia

Weekly Snippets

Research Desk Stock Broking

March 26, 2016

MARKET ROUNDUP

NIFTY (7716.50): Markets ended with a positive bias for the

fourth consecutive week on account consistent buying from

foreign institutional investors (FIIs) and increasing hopes of rate

cut by Central bank in the upcoming monetary policy slated on 05

Apr 2016. Nifty gained 112 points or 1.47% to close at 7716.50

and Sensex gained 384.82 points or 1.54% to close at 25337.56.

Overall breadth of market remained positive, where Banking, IT &

Commodity stocks outperformed the market, whereas Pharma

stocks remained underperformer during the week.

On the domestic front in truncated week market remained choppy

and ended at its highest note. Global market remained choppy

amid geopolitical concerns after militants targeted Brussels airport

and a city metro station on last Tuesday. Meanwhile, correction in

Crude oil prices kept risk appetite in check ahead of the long

Easter break.

Technically, Nifty is well placed above its 21 & 50-DEMA, approaching toward its major 200-DEMA which is currently placed near 7780

levels. The India VIX index a measure of volatility continued to dip to settle at 16.34 levels indicating the strength in the underlying move. In

the coming week with expiry of March contract, markets are likely to trade with positive bias and likely to head towards 7780 -7800 above

which next resistance is pegged around 7860-7900 levels. On the downside, supports are placed near 7600 levels followed by 7500-7540

area. Therefore, we recommend trade with positive bias in the range of 7600-7900 levels and any dip towards support levels can be utilized

as a buying opportunity.

Index Strategy

Report Highlights

Street Buzz, Corporate Actions, Economic events

Pg. 1-2

TECHNICAL PICK : NBCC

Pg. 5

HYBRID STRATEGIES

Pg. 5

DID YOU KNOW??- ?? NON CONVERTIBLE

DEBENTURES (NCDs)

Pg. 6

CALL RATIO SPREAD IN NIFTY

Buy one lot NIFTY March 7700 CE @ 68; Sell two lots of Nifty

March 7800 CE @ 20 | Max Gain: Rs 5400 | Max Loss: Rs. 2100

& Unlimited above UBEP | UPPER BREAK EVEN POINT

(UBEP): 7872 | LOWER BREAK EVEN POINT (LBEP): 7728 |

Time Frame: Expiry

STREET BUZZ...

The country's foreign exchange reserves surged by $2.539 billion to touch an all-time high of $355.947 billion in the week ended March 18,

on account of a rise in foreign currency assets (FCAs), the Reserve Bank has said.

The government said India will appeal against the World Trade Organizations (WTO) verdict over its policy relating to solar power

equipment. India had, as part of its National Solar Mission, imposed a stipulation that solar cells and solar modules be locally sourced. The

U.S. had filed a case against India at the WTO demanding a level-playing field for Indian and foreign solar component manufacturers. The

world body ruled in favour of the U.S.

Jewellery industry body AIBJSF on Friday decided to continue their strike for an indefinite period against imposition of 1% excise duty on

non-silver jewellery and announced plans to hand over keys of their shops to Finance Minister Arun Jaitley. AIBJSF and other local

associations, particularly those in Delhi- NCR, Rajasthan, Uttar Pradesh, Chhattisgarh and Madhya Pradesh, were against calling off the

strike.

Weekly Snippets

March 26, 2016

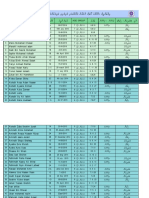

CORPORATE ACTIONS DURING THE WEEK

Company Code

Ex Date

Record Date

Purpose

TWL

28-03-2016

29-03-2016

Interim Dividend - Re 0.80/- Per Share (Purpose Revised)

CYIENT

28-03-2016

29-03-2016

Interim Dividend - Rs 4/- Per Share (Purpose Revised)

DLF

28-03-2016

29-03-2016

Interim Dividend - Rs 2/- Per Share (Purpose Revised)

HDFC

30-03-2016

31-03-2016

Interim Dividend

ECONOMIC EVENTS DURING THE WEEK

Event

Date

Prior

Survey

Foreign Reserves (MAR)

01/04//2016

$353.41B

Deposit Growth YoY (Q4 )

01/03/2016

10.60%

Japan Unemployment Rate (FEB)

29/03/2016

3.20%

3.20%

Germany Inflation Rate YoY

30/03/2016

0.20%

0.20%

NIFTY 50 V/S GLOBAL INDICES

SECTOR SNAPSHOT

2.00%

6.00%

1.00%

4.00%

0.00%

2.00%

-1.00%

0.00%

-2.00%

-3.00%

-4.00%

SECTORAL SNIPPETS

NIFTY BANK has closed the week with a positive gain of 1.49% and

outperformed the Nifty. The Index has bounced from the lower band

of Bollinger band and posted a V shape recovery on weekly charts.

Going ahead the Index may find resistance around 16000 levels and

any bounce above the said levels will enhance the confidence

amongst the market participants and can take the Index to the

immediate high of 16250 levels. The Index is likely to face resistance

around 16250 levels and support is placed around 15700 levels.

Hence we are expecting positive momentum is likely to continue in

the Index in coming week.

NIFTY IT has posted the gap on 17 March before resuming its up

move on daily charts. The bounce in the stock has given the V shape

recovery and maintained its bullish bias last week with supportive

volume on daily charts. Going ahead the Index may find the support

around 10850 levels and resistance is paged around 11300 levels.

We are holding the view of sideways to positive on the Index for the

coming week.

NIFTY METAL has closed the week with the gain of 3.76% and

outperformed the Nifty. The Index has given the breakout above

1875 levels. Prior to that, the Index has bounced from the lower band

of Bollinger band after making low of 1450 levels with notable volume

which reflects the near term trend in the index is up and moment in

the Index will remain intact for near term. The Index may find support

around 1800 levels and above that resistance is placed around 2050

levels.

NIFTY FMCG has closed the week with flat to positive node with the

gain of 0.38% and underperformed the Nifty. Currently the Index is

trading near its mean on the Bollinger band and expected to

consolidate for coming week. Going ahead the Index may face

resistance around 19960 levels and support is placed around 19080

levels. On the other side the bounce above the 19960 will open the

room above around 20100 levels in near term.

Weekly Snippets

March 26, 2016

FII ACTIVITY IN DERIVATIVES

In the truncated week passed by FIIs continued to remain net buyers in Index future, while they remained sellers in stock futures and this

trend has been continuing since the beginning of this month. FIIs bought index future to the tune of 1190.83 crore, while they sold stock

futures to the tune of 2286.83 crore.

In the week they added 8458 long Index future contracts, and reduced their short position to the tune of 9592 contracts.

In the stock futures, long unwinding witnessed to the tune of 17922 contracts while 29187 short contracts were added during the week.

INDEX FUTURES

362

360

358

356

354

352

350

348

346

344

Index Fut. OI

STOCK FUTURES

Index Fut. Net Buy

800

700

600

500

400

300

200

100

0

Stock Fut. OI

1054

1053

1052

1051

1050

1049

1048

1047

1046

1045

1044

Stock Fut. Net Buy

0

-200

-400

-600

-800

-1000

-1200

INSTITUTIONAL ACTIVITY IN CASH

Foreign institutional players remained buyers for the fourth consecutive week and bought securities worth around Rs. 3469 Crore in cash

segment. The FIIs have bought securities worth Rs. 12677.35 crore during the month of march as compared to negative figure in February

of Rs.16146.03 Crore. In the year 2016 till date, the FIIs have been net sellers to the tune of Rs. 10723.10 Crore.

While on the flipside, our domestic institutions have sold securities worth Rs. 2571.72 Crore for the just concluded week and for the month

they have sold securities worth Rs. 8884.12 Crore. They were positive for the month of February where they were buyers of more than Rs.

10000 Crore worth stocks. In the year 2016 till date, the DIIs have been net buyers to the tune of Rs. 14482.39 Crore

Time Frame

FII/FPI

DII

1500

FII/FPI

1200

Month Till Date (Mar)

16,146.03

-8,884.12

Last Month (Feb)

-12,513.12

10,491.61

Year Till Date (01/01/1623/03/16)

-10,723.10

14,482.39

For the CY ended 2015

-17,512.09

67,412.64

DII

900

600

300

0

-300

-600

-900

-1200

21-Mar-16

22-Mar-16

23-Mar-16

Weekly Snippets

March 26, 2016

OI CHANGES DURING THE WEEK - STOCKS

Top OI Gainers with increase in Price

Top OI Closures with increase in Price

Long Accumulation

Short Closure

OI (in

lakhs)

OI Chg

(%)

PRICE

Chg (%)

TORNTPHARM

2.95

-22.23

6.49

2.04

AJANTPHARM

3.68

-10.60

4.63

18.93

1.34

IGL

11.48

-10.00

6.16

53.82

18.58

6.04

CONCOR

13.73

-9.80

6.39

8.34

17.95

3.39

BOSCHLTD

0.93

-9.08

7.69

Stock

OI (in

lakhs)

OI Chg

(%)

PRICE

Chg (%)

TVSMOTOR

43.48

42.37

7.67

PTC

88.32

20.66

UCOBANK

111.20

JETAIRWAYS

GRASIM

Stock

Top OI Gainers with decrease in Price

Top OI Closures with decrease in Price

Short Accumulation

Long Closure

Stock

OI (in

lakhs)

OI Chg

(%)

PRICE

Chg (%)

Stock

OI (in

lakhs)

OI Chg

(%)

PRICE

Chg (%)

LUPIN

56.96

56.86

-16.26

PETRONET

41.70

-16.01

-1.08

ANDHRABANK

124.32

47.86

-2.49

DIVISLAB

23.12

-10.14

-2.04

BIOCON

23.91

16.01

-5.36

EICHERMOT

1.72

-9.77

-7.95

CADILAHC

32.42

-8.97

-0.96

HDFC

97.68

-8.57

-2.69

NIFTY OPTIONS

PCR OI V/S NIFTY

x 100000

NIFTY OPTIONS OI

70

60

50

40

30

20

10

0

CALL

PUT

7400

7500

1.20

OPEN INTEREST

7600

7700

7800

1.15

7900

8000

On the options front, Nifty 7600 PE has highest OI standing at more than

53 lakh shares which may act as good support for the Index. On the other

hand, the upside has been capped around 7800 levels where highest Call

writing is witnessed. Therefore, the range would be 7600-7800 levels with

bias on the bullish side opening the doors for 7850-7900 levels as well.

7800.00

PCR OI

NIFTY 50

7700.00

1.10

7600.00

1.05

7500.00

1.00

7400.00

0.95

7300.00

The Put Call Ratio has been trading continuously above the psychological

mark of 1 throughout the last trading week. Currently, the PCR ratio

trading around 1.17 levels indicating the strength in the market with more

aggressive Put writing. On the other hand, till the PCR ratio is holding

above 1 level, one may remain bullish on the market taking a caution note

if it breaches 1.30-1.40 levels.

Weekly Snippets

March 26, 2016

PICK OF THE WEEK BUY NBCC | CMP: RS 941.60

ACT

BUY

ENTRY

940

SL

810

TGT

1100-1130

TIMEFRAME

4-6 months

The stock has given the breakout of downward sloping trend line drawn from the high of 1320 levels. Prior to that, the stock has seen sharp cut from

the high of 1320 levels and the selling pressure in the stock has placed the stock to the low of 852 levels. Thereafter, the stock spends

approximately six week in the consolidation range of 850-990 levels before giving breakout. The breakout has placed the stock above the all its

major moving averages which reflect the strength in the counter.

The move started from the low of 852 levels has placed the stock above the cluster of resistance placed in the range of 1005-1085 levels. The

recent development in the stock suggests inherent strength in the stock and the stock is well placed to test its all time high levels which are pegged

at 1320 levels in near term.

The parabolic SAR has triggered the fresh buy signal on the weekly charts and the price is trading well above the same. Which reflects the uptrend

in the stock will remain intact in the near term.

The stock is trading comfortably above the 50% of the retracement levels drawn from the high of 1320 to the low of 852 levels. The above discussed

price action suggests strength in the counter and the stock is well placed to take it up move for the immediate target of 1320 levels (all time high)

and above in near term. Hence, we suggest buy in the stock keeping stop loss of 890 levels for the target of 1400- 1450 levels in 4-5 months.

HYBRID STRATEGY

HYBRID STRATEGY

COVERED CALL IN LT

CALL LADDER IN BAJAJ-AUTO

LT has been trading with a bullish bias in the last trading week

and has breached the stiff rsistance zone of 1220-1225 levels.

The stock also has filled the gap area around 1235-1240 levels

and closed well above the same. We recommend one may build

covered call strategy with stop loss placed below 1230 levels

BAJAJ-AUTO has been trading with bullish bias in the last trading

week and has breached the stiff rsistance zone of 2350 levels.

Stock is in short-term up trend forming higher highs and higher

lows. On derivate front, the stock has seen a long addition in OI in

the previous week with increase in price. Hence, we

recommended a Call Ladder strategy.

Buy one lot of LT March Futures @ 1245 and sell one lot of

LT March 1260 CE at 10 | Maximum Profit: 7500 | Maximum

Loss: Unlimited | Break Even Point: 1235 | SL: Below 1230 |

Time Frame: Expiry.

20000

Buy one lot of BAJAJ-AUTO March 2350 CE @ 34 and Sell

one lot BAJAJ-AUTO March 2400 CE @ 13 & Sell one lot of

BAJAJ-AUTO March 2450 CE @ 4.50 | Max Gain: Rs 6700 |

Max Loss: Rs.3300 & Unlimited above UBEP | Upper Break

Even Point: 2483.50 | Lower Break Even Point: 2366.50 | SL:

2310 | Time Frame: Expiry

10000

0

-40000

-50000

-60000

-70000

Payoff at Expiry

-10000

-15000

-20000

-25000

2600

2550

2500

2450

2400

2350

2300

2250

2200

-5000

2150

-30000

2100

0

2050

-20000

2000

5000

1950

1440

1400

1360

1320

1280

1240

1200

1160

1120

1080

1040

-10000

10000

Weekly Snippets

March 26, 2016

Did You Know?? NON CONVERTIBLE DEBENTURES (NCDs)

CONCEPT

A mode of raising capital for the companies, Non Convertible Debentures allows an entity the option of borrowing money from the

public without having to dilute the stake in ownership as seen in equity. Non convertible debentures form the debt category of the

Balance Sheet of a company that can be secured or unsecured in nature. Depending upon the market scenario and liquidity

condition in the economy, the interest rates are arrived at which are offered by the NCDs. As a norm the interest rates offered

are slightly higher than fixed interest bearing instruments like fixed deposit. But as these are Tax Bearing instruments the interest

rate cannot be compared in absolute terms and must take into account the probable tax pay out by the participant. Interest on

NCDs is paid at different time period like quarterly, semi-annually or annually. They also have an option of cumulative interest in

which case interest is cumulated & paid on maturity.

MODE OF INVESTMENT

NCDs can be accessed by investors in similar fashion as is done for equities.

Public Issue: During the public issue of the bonds, you can invest in them by submitting a physical form furnishing the

details as requested.

Exchange: NCDs bonds are listed on NSE or BSE or at times on both after the Public Issue. You can invest in these

bonds through your trading account like the way you invest in shares. However, NCDs have liquidity risk. Even if NCD

get listed, low volumes can deprive investors of any opportunity in exiting prematurely.

BENEFITS OF NCDs

Credit Rating: It is mandatory for companies seeking to raise money through NCDs to get their issue rated by agencies

such as CRISIL, ICRA, CARE and Fitch Ratings. Ratings by a third party assess the quality of the issue in terms credit

performance providing the potential NCD holder with valuable insight. NCDs with higher ratings are safer but carry lower

interest rate as this means the issuer has the ability to service its debt on time and carries lower default risk and vice

versa.

Liquidity: Listing of NCDs on exchanges like NSE & BSE provides liquidity to your investments

Tenure: The tenure on NCDs can be between 2 years to 20 years making for excellent long term investment plan.

TDS: Tax Deducted at Source is not applicable on listed debentures.

Easy Monitoring: As NCDs can be purchased and sold like shares in Demat Form they provide easy monitoring.

TAXATION

Tax treatment is exactly similar to any other interest income such as interest income from FDs. Interest income from NCDs will be

subjected to tax at normal rates by including it in Income from other sources. The principal amount received on maturity is not

taxed at all. But if you decide to sell NCDs on stock exchange where it is traded, then capital gains arises.

Short Term Capital Gains Tax is applicable depending on the tax slab you fall into if the instrument is sold before a year.

Long Term Capital Gains Tax is applicable at 20% with indexation & 10% without indexation

CURRENT TREND

As per the provisional data with Securities and Exchange Board of India (Sebi), Indian firms have raked in a mammoth total of Rs

58,533 crore through NCDs in the current fiscal (2015-16) as on march 14 which is much higher compared to Rs. Rs 9,713 crore

garnered in the entire last fiscal. Experts believe that due to the volatile market conditions have forced many companies to opt for

NCD route to garner fresh capital. Most of the funds have been mobilised for expansion, to support working capital requirements

and for other general corporate purposes.

Weekly Snippets

March 26, 2016

KARVY RESEARCH DESK

QUERIES & FEEDBACK

JK Jain

Toll-Free: 1800 425 8283

Head Research

Email ID: service@karvy.com

KARVY STOCK BROKING LTD

KARVY STOCK BROKING LTD| Karvy Millenium | Plot No : 31| Financial District |Gachibowli | Hyderabad - 500 032

Analyst Certification

The following analyst(s), JK Jain, who is (are) primarily responsible for this report and whose name(s) is/ are mentioned therein, certify (ies) that the views

expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is

or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer

Karvy Stock Broking Limited [KSBL] is a SEBI registered Stock Broker, Depository Participant, and Portfolio Manager and also distributes financial products.

The subsidiaries and group companies including associates of KSBL provide services as Registrars and Share Transfer Agents, Commodity Broker, Currency

and forex broker, merchant banker and underwriter, Investment Advisory services, insurance repository services, financial consultancy and advisory services,

realty services, data management, data analytics, market research, solar power, film distribution and production profiling and related services. Therefore

associates of KSBL are likely to have business relations with most of the companies whose securities are traded on the exchange platform. The information

and views presented in this report are prepared by Karvy Stock Broking Limited and are subject to change without any notice. This report is based on

information obtained from public sources, the respective corporate under coverage and sources believed to be reliable, but no independent verification has

been made nor is its accuracy or completeness guaranteed. The report and information contained herein is strictly confidential and meant solely for the

selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or

reproduced in any form, without prior written consent of KSBL. While we would endeavor to update the information herein on a reasonable basis, KSBL is

under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent KSBL from doing

so. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. This report and information

herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for

securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time.

KSBL will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice

or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. This material is for personal information and we

are not responsible for any loss incurred based upon it. The investments discussed or recommended in this report may not be suitable for all investors.

Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advice,

as they believe necessary. While acting upon any information or analysis mentioned in this report, investors may please note that neither KSBL nor any

associate companies of KSBL accepts any liability arising from the use of information and views mentioned in this report. Investors are advised to see Risk

Disclosure Document to understand the risks associated before investing in the securities markets. Past performance is not necessarily a guide to future

performance. Forward-looking statements are not predictions and may be subject to change without notice. Actual results may differ materially from those set

forth in projections.

Associates of KSBL might have managed or co-managed public offering of securities for the subject company or might have been mandated by the

subject company for any other assignment in the past twelve months.

Associates of KSBL might have received compensation from the subject company mentioned in the report during the period preceding twelve

months from the date of this report for investment banking or merchant banking or brokerage services from the subject company in the past twelve

months or for services rendered as Registrar and Share Transfer Agent, Commodity Broker, Currency and forex broker, merchant banker and

underwriter, Investment Advisory services, insurance repository services, consultancy and advisory services, realty services, data processing,

profiling and related services or in any other capacity.

KSBL encourages independence in research report preparation and strives to minimize conflict in preparation of research report.

Compensation of KSBLs Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

KSBL generally prohibits its analysts, persons reporting to analysts and their relatives from maintaining a financial interest in the securities or

derivatives of any companies that the analysts cover.

KSBL or its associates collectively or Research Analysts do not own 1% or more of the equity securities of the Company mentioned in the report as

of the last day of the month preceding the publication of the research report.

KSBL or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with

preparation of the research report and have no financial interest in the subject company mentioned in this report.

Accordingly, neither KSBL nor Research Analysts have any material conflict of interest at the time of publication of this report.

It is confirmed that KSBL and Research Analysts primarily responsible for this report and whose name(s) is/ are mentioned therein of this report

have not received any compensation from the subject company mentioned in the report in the preceding twelve months.

It is confirmed that JK Jain, Research Analyst did not serve as an officer, director or employee of the companies mentioned in the report.

KSBL may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor KSBL have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on KSBL by any Regulatory Authority impacting Equity Research Analyst activities.

Anda mungkin juga menyukai

- Weekly Snippets - Karvy 12 Mar 2016Dokumen7 halamanWeekly Snippets - Karvy 12 Mar 2016AdityaKumarBelum ada peringkat

- Premarket MorningReport Dynamic 18.11.16Dokumen6 halamanPremarket MorningReport Dynamic 18.11.16Rajasekhar Reddy AnekalluBelum ada peringkat

- T I M E S: Market Yearns For Fresh TriggersDokumen22 halamanT I M E S: Market Yearns For Fresh TriggersDhawan SandeepBelum ada peringkat

- Markets Await Rate Cut: T I M E SDokumen20 halamanMarkets Await Rate Cut: T I M E SRushank ShuklaBelum ada peringkat

- Premarket MorningReport Dynamic 24.11.16Dokumen7 halamanPremarket MorningReport Dynamic 24.11.16Rajasekhar Reddy AnekalluBelum ada peringkat

- Premarket MorningReport Dynamic 20.12.16Dokumen7 halamanPremarket MorningReport Dynamic 20.12.16Rajasekhar Reddy AnekalluBelum ada peringkat

- MOStQuantitativeOutlookMonthly November2022Dokumen9 halamanMOStQuantitativeOutlookMonthly November2022M DanishBelum ada peringkat

- Quity Research AB: Erivative Report ST Arch: E L D 1 MDokumen9 halamanQuity Research AB: Erivative Report ST Arch: E L D 1 MAru MehraBelum ada peringkat

- MOSt Market Outlook 12 TH February 2024Dokumen10 halamanMOSt Market Outlook 12 TH February 2024Sandeep JaiswalBelum ada peringkat

- Weekly View:: Nifty Likely To Trade in Range of 6600-6800Dokumen14 halamanWeekly View:: Nifty Likely To Trade in Range of 6600-6800Raya DuraiBelum ada peringkat

- Weekly Market UpdateDokumen1 halamanWeekly Market UpdateNeeta ShindeyBelum ada peringkat

- ICICIdirect MonthlyTrendDokumen10 halamanICICIdirect MonthlyTrendRamesh KrishnamoorthyBelum ada peringkat

- T I M E S: Markets Witness Pre-Budget RallyDokumen20 halamanT I M E S: Markets Witness Pre-Budget Rallyswapnilsalunkhe2000Belum ada peringkat

- Equity TipsDokumen9 halamanEquity TipsAru MehraBelum ada peringkat

- Weekly Mutual Fund and Debt Report: Retail ResearchDokumen14 halamanWeekly Mutual Fund and Debt Report: Retail ResearchGauriGanBelum ada peringkat

- Premarket MorningReport Dynamic 03.11.16Dokumen6 halamanPremarket MorningReport Dynamic 03.11.16Rajasekhar Reddy AnekalluBelum ada peringkat

- Money Times MagazineDokumen18 halamanMoney Times MagazineAkshay Dujodwala0% (1)

- Monthly Report - Sep 2016: Retail ResearchDokumen10 halamanMonthly Report - Sep 2016: Retail ResearchshobhaBelum ada peringkat

- MOSt Market Outlook 26 TH March 2024Dokumen10 halamanMOSt Market Outlook 26 TH March 2024Sandeep JaiswalBelum ada peringkat

- MOSt Market Outlook 20 TH March 2024Dokumen10 halamanMOSt Market Outlook 20 TH March 2024Sandeep JaiswalBelum ada peringkat

- MARKET OUTLOOK FOR 11 July - CAUTIOUSLY OPTIMISTICDokumen5 halamanMARKET OUTLOOK FOR 11 July - CAUTIOUSLY OPTIMISTICMansukh Investment & Trading SolutionsBelum ada peringkat

- Daily Equity ReportDokumen5 halamanDaily Equity ReportJijoy PillaiBelum ada peringkat

- Money MT1 - 061117Dokumen23 halamanMoney MT1 - 061117ramshere2003165Belum ada peringkat

- Weekly Mutual Fund and Debt Report: Retail ResearchDokumen16 halamanWeekly Mutual Fund and Debt Report: Retail ResearchGauriGanBelum ada peringkat

- JSTREET Volume 319Dokumen10 halamanJSTREET Volume 319JhaveritradeBelum ada peringkat

- T I M E S: Modinomics Ahoy!Dokumen19 halamanT I M E S: Modinomics Ahoy!abdul87sBelum ada peringkat

- JSTREET Volume 325Dokumen10 halamanJSTREET Volume 325JhaveritradeBelum ada peringkat

- MOSt Market Outlook 16 TH May 2023Dokumen10 halamanMOSt Market Outlook 16 TH May 2023Smit ParekhBelum ada peringkat

- Premarket Technical&Derivative Angel 24.11.16Dokumen5 halamanPremarket Technical&Derivative Angel 24.11.16Rajasekhar Reddy AnekalluBelum ada peringkat

- MOStMarketOutlook3rdMay2023 PDFDokumen10 halamanMOStMarketOutlook3rdMay2023 PDFLakhan SharmaBelum ada peringkat

- T I M E S: Follow-Up Buying Support Needed at Higher LevelsDokumen19 halamanT I M E S: Follow-Up Buying Support Needed at Higher LevelsSudarsan PBelum ada peringkat

- 11.12morning NewsDokumen2 halaman11.12morning NewsrajavenkateshsundaraneediBelum ada peringkat

- T I M E S: Markets Overbought Correction LikelyDokumen22 halamanT I M E S: Markets Overbought Correction LikelyShivaBelum ada peringkat

- MoneytimesDokumen19 halamanMoneytimesArijitNathBelum ada peringkat

- India Infoline Weekly WrapDokumen8 halamanIndia Infoline Weekly WrappasamvBelum ada peringkat

- MOSt Market Outlook 21 ST March 2024Dokumen10 halamanMOSt Market Outlook 21 ST March 2024Sandeep JaiswalBelum ada peringkat

- Tech Derivatives DailyReport 210416Dokumen5 halamanTech Derivatives DailyReport 210416xytiseBelum ada peringkat

- MOSt Market Outlook 13 TH February 2024Dokumen10 halamanMOSt Market Outlook 13 TH February 2024Sandeep JaiswalBelum ada peringkat

- E L D 20 A: Quity Research AB: Erivative TH PrilDokumen9 halamanE L D 20 A: Quity Research AB: Erivative TH PrilAru MehraBelum ada peringkat

- JSTREET Volume 322Dokumen10 halamanJSTREET Volume 322JhaveritradeBelum ada peringkat

- Market Outlook: Dealer's DiaryDokumen24 halamanMarket Outlook: Dealer's DiaryAngel BrokingBelum ada peringkat

- MOSt Market Outlook 15 TH February 2024Dokumen10 halamanMOSt Market Outlook 15 TH February 2024Sandeep JaiswalBelum ada peringkat

- MOSt Market Outlook 27 TH March 2024Dokumen10 halamanMOSt Market Outlook 27 TH March 2024Sandeep JaiswalBelum ada peringkat

- J STREET Volume 317Dokumen10 halamanJ STREET Volume 317JhaveritradeBelum ada peringkat

- Weekly Stock Market Research ReportDokumen6 halamanWeekly Stock Market Research ReportRahul SolankiBelum ada peringkat

- Monthly Report - August 2016: Retail ResearchDokumen10 halamanMonthly Report - August 2016: Retail ResearchshobhaBelum ada peringkat

- Premarket Technical&Derivatives Angel 16.11.16Dokumen5 halamanPremarket Technical&Derivatives Angel 16.11.16Rajasekhar Reddy AnekalluBelum ada peringkat

- Premarket Technical&Derivative Angel 21.12.16Dokumen5 halamanPremarket Technical&Derivative Angel 21.12.16Rajasekhar Reddy AnekalluBelum ada peringkat

- Opening Bell: Market Outlook Today's HighlightsDokumen7 halamanOpening Bell: Market Outlook Today's HighlightsxytiseBelum ada peringkat

- T I M E S: Markets To Struggle at Higher LevelsDokumen23 halamanT I M E S: Markets To Struggle at Higher LevelsMAJNU BhaiBelum ada peringkat

- Market Diary - 23.12.2016Dokumen5 halamanMarket Diary - 23.12.2016narnoliaBelum ada peringkat

- MT 26th JuneDokumen22 halamanMT 26th JuneSatya PrasadBelum ada peringkat

- Expiry Preview: Futures & OptionsDokumen8 halamanExpiry Preview: Futures & OptionsBala Nand RahulBelum ada peringkat

- Most Market Out Look 27 TH February 24Dokumen12 halamanMost Market Out Look 27 TH February 24Realm PhangchoBelum ada peringkat

- GS Sales Trading - Good Morning Mail 27.03.2024Dokumen6 halamanGS Sales Trading - Good Morning Mail 27.03.2024Franco CaraballoBelum ada peringkat

- Q2 Results To Set The Pace: A Time Communications PublicationDokumen18 halamanQ2 Results To Set The Pace: A Time Communications Publicationswapnilsalunkhe2000Belum ada peringkat

- T I M E S: Overbought Conditions Could Trigger CorrectionDokumen20 halamanT I M E S: Overbought Conditions Could Trigger CorrectionAmey TiwariBelum ada peringkat

- MOSt Market Outlook 4 TH April 2024Dokumen10 halamanMOSt Market Outlook 4 TH April 2024Sandeep JaiswalBelum ada peringkat

- Master Circular On General Conditions of Service Rules of DMRCDokumen54 halamanMaster Circular On General Conditions of Service Rules of DMRCAdityaKumarBelum ada peringkat

- Master Circular On Pay and Allowances-Office Order No PP - 1716 - 2013Dokumen94 halamanMaster Circular On Pay and Allowances-Office Order No PP - 1716 - 2013AdityaKumarBelum ada peringkat

- Master Circular On LTC Rules in DMRCDokumen17 halamanMaster Circular On LTC Rules in DMRCAdityaKumarBelum ada peringkat

- Compendium of CVC Circulars 2017Dokumen202 halamanCompendium of CVC Circulars 2017AdityaKumarBelum ada peringkat

- Master Circular On Medical Attendance Rules in DMRC.Dokumen31 halamanMaster Circular On Medical Attendance Rules in DMRC.AdityaKumarBelum ada peringkat

- DMRC Employees Own Your House Advance Rules: Master CircularDokumen18 halamanDMRC Employees Own Your House Advance Rules: Master CircularAdityaKumar100% (1)

- Consolidated List of Empanelled HospitalsDokumen37 halamanConsolidated List of Empanelled HospitalsAdityaKumarBelum ada peringkat

- REP-2019 - 02 - CSAB - Special Round - BTech (First Year) - Instructions For Institute Reporting - A - Y - 2019-20Dokumen2 halamanREP-2019 - 02 - CSAB - Special Round - BTech (First Year) - Instructions For Institute Reporting - A - Y - 2019-20AdityaKumarBelum ada peringkat

- Compendium of CVC Circulars 2017Dokumen202 halamanCompendium of CVC Circulars 2017AdityaKumarBelum ada peringkat

- Compendium of CVC Circulars 2018Dokumen102 halamanCompendium of CVC Circulars 2018AdityaKumar100% (1)

- First Source Solutions LTD - Karvy Recommendation 11 Mar 2016Dokumen5 halamanFirst Source Solutions LTD - Karvy Recommendation 11 Mar 2016AdityaKumarBelum ada peringkat

- HBA Master Circular Bilingual NewDokumen33 halamanHBA Master Circular Bilingual NewAdityaKumarBelum ada peringkat

- Aadhaar Enrolment and Updation FacilityDokumen4 halamanAadhaar Enrolment and Updation FacilityAdityaKumarBelum ada peringkat

- Karvy Morning Moves 28 Mar 2016Dokumen4 halamanKarvy Morning Moves 28 Mar 2016AdityaKumarBelum ada peringkat

- Aebc Grievance Redressal PolicyDokumen2 halamanAebc Grievance Redressal PolicyAdityaKumarBelum ada peringkat

- Neral Allowances: (I) House Rent AllowanceDokumen16 halamanNeral Allowances: (I) House Rent AllowanceAdityaKumarBelum ada peringkat

- Global Boards LTD 041110Dokumen32 halamanGlobal Boards LTD 041110AdityaKumarBelum ada peringkat

- Body Rulership in AstrologyDokumen3 halamanBody Rulership in AstrologyAdityaKumarBelum ada peringkat

- Benazir Bhutto The Bloody HomecomingDokumen3 halamanBenazir Bhutto The Bloody HomecomingAdityaKumarBelum ada peringkat

- Harivanshrai BachchanDokumen7 halamanHarivanshrai BachchanAdityaKumarBelum ada peringkat

- Analysis of PLANETS in 12 HousesDokumen4 halamanAnalysis of PLANETS in 12 HousesAdityaKumarBelum ada peringkat

- Pre-Qualification Document - Addendum 04Dokumen4 halamanPre-Qualification Document - Addendum 04REHAZBelum ada peringkat

- NF79178240335624 ETicketDokumen2 halamanNF79178240335624 ETicketridam aroraBelum ada peringkat

- Consolidation Physical Fitness Test FormDokumen5 halamanConsolidation Physical Fitness Test Formvenus velonza100% (1)

- Prince Baruri Offer Letter-1Dokumen3 halamanPrince Baruri Offer Letter-1Sukharanjan RoyBelum ada peringkat

- Form Audit QAV 1&2 Supplier 2020 PDFDokumen1 halamanForm Audit QAV 1&2 Supplier 2020 PDFovanBelum ada peringkat

- Adobe Scan 03-May-2021Dokumen22 halamanAdobe Scan 03-May-2021Mohit RanaBelum ada peringkat

- HumanitiesprojDokumen7 halamanHumanitiesprojapi-216896471Belum ada peringkat

- The Future of Freedom: Illiberal Democracy at Home and AbroadDokumen2 halamanThe Future of Freedom: Illiberal Democracy at Home and AbroadRidho Shidqi MujahidiBelum ada peringkat

- CHAPTER - 3 - Creating Responsive Supply ChainDokumen23 halamanCHAPTER - 3 - Creating Responsive Supply Chainsyazwani aliahBelum ada peringkat

- UFC 3-270-01 Asphalt Maintenance and Repair (03!15!2001)Dokumen51 halamanUFC 3-270-01 Asphalt Maintenance and Repair (03!15!2001)Bob VinesBelum ada peringkat

- Test Bank For We The People 10th Essentials Edition Benjamin Ginsberg Theodore J Lowi Margaret Weir Caroline J Tolbert Robert J SpitzerDokumen15 halamanTest Bank For We The People 10th Essentials Edition Benjamin Ginsberg Theodore J Lowi Margaret Weir Caroline J Tolbert Robert J Spitzeramberleemakegnwjbd100% (14)

- Correctional Case StudyDokumen36 halamanCorrectional Case StudyRaachel Anne CastroBelum ada peringkat

- 1-Introduction - Defender (ISFJ) Personality - 16personalitiesDokumen6 halaman1-Introduction - Defender (ISFJ) Personality - 16personalitiesTiamat Nurvin100% (1)

- Open Quruan 2023 ListDokumen6 halamanOpen Quruan 2023 ListMohamed LaamirBelum ada peringkat

- Financial Amendment Form: 1 General InformationDokumen3 halamanFinancial Amendment Form: 1 General InformationRandolph QuilingBelum ada peringkat

- Analysis of Business EnvironmentDokumen6 halamanAnalysis of Business EnvironmentLapi Boy MicsBelum ada peringkat

- Hunting the Chimera–the end of O'Reilly v Mackman_ -- Alder, John -- Legal Studies, #2, 13, pages 183-20...hn Wiley and Sons; Cambridge -- 10_1111_j_1748-121x_1993_tb00480_x -- 130f73b26a9d16510be20781ea4d81eb -- Anna’s ArchiveDokumen21 halamanHunting the Chimera–the end of O'Reilly v Mackman_ -- Alder, John -- Legal Studies, #2, 13, pages 183-20...hn Wiley and Sons; Cambridge -- 10_1111_j_1748-121x_1993_tb00480_x -- 130f73b26a9d16510be20781ea4d81eb -- Anna’s ArchivePrince KatheweraBelum ada peringkat

- Pulse of The Profession 2013Dokumen14 halamanPulse of The Profession 2013Andy UgohBelum ada peringkat

- EthicsDokumen11 halamanEthicsFaizanul HaqBelum ada peringkat

- A Study On Cross Cultural PracticesDokumen56 halamanA Study On Cross Cultural PracticesBravehearttBelum ada peringkat

- Budo Hard Style WushuDokumen29 halamanBudo Hard Style Wushusabaraceifador0% (1)

- RwservletDokumen2 halamanRwservletsallyBelum ada peringkat

- CMAT Score CardDokumen1 halamanCMAT Score CardRaksha RudraBelum ada peringkat

- Core Values Behavioral Statements Quarter 1 2 3 4Dokumen1 halamanCore Values Behavioral Statements Quarter 1 2 3 4Michael Fernandez ArevaloBelum ada peringkat

- 4-Cortina-Conill - 2016-Ethics of VulnerabilityDokumen21 halaman4-Cortina-Conill - 2016-Ethics of VulnerabilityJuan ApcarianBelum ada peringkat

- rp200 Article Mbembe Society of Enmity PDFDokumen14 halamanrp200 Article Mbembe Society of Enmity PDFIdrilBelum ada peringkat

- Glossary of Important Islamic Terms-For CourseDokumen6 halamanGlossary of Important Islamic Terms-For CourseibrahimBelum ada peringkat

- 2016 GMC Individuals Round 1 ResultsDokumen2 halaman2016 GMC Individuals Round 1 Resultsjmjr30Belum ada peringkat

- Ifm 8 & 9Dokumen2 halamanIfm 8 & 9Ranan AlaghaBelum ada peringkat

- PAPER 2 RevisedDokumen36 halamanPAPER 2 RevisedMâyúř PäťîĺBelum ada peringkat