1 - 4 - 4. Evidence

Diunggah oleh

Diego Gonzáles0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

24 tayangan5 halaman...

Hak Cipta

© © All Rights Reserved

Format Tersedia

TXT, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Ini...

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai TXT, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

24 tayangan5 halaman1 - 4 - 4. Evidence

Diunggah oleh

Diego Gonzáles...

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai TXT, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 5

[MUSIC]

All right, so two things to keep in

mind and this are important things for

you to keep in mind and

you'll see in a minute why.

The first and remember if you actually

keep in mind the data that we've seen.

We highlighted already not

only that the arithmetic and

the geometric mean return

were different for

each of the countries that we're looking

at but also we looked at the pattern.

And the pattern was that

that arithmetic mean return

was higher than the geometric mean return.

Now, strictly speaking,

if you want to be mathematically correct,

what we can say for sure is the arithmetic

mean return is higher than or

equal to the geometric mean return.

Now, I am saying that's only

to be mathematically correct,

because strictly speaking

that is the case.

Now if you really think about it,

there's only one circumstance

in which the arithmetic and the geometric

mean are going to be the same number.

And that is when you get the same

return over and over and over again.

So for example, you buy an asset and

you get 10%, 10%, 10%, 10%, 10% for

all the periods that you're looking at.

Then when you calculate the arithmetic and

the geometric mean return

they're going to be the same.

And I'm saying that well, that's not very

interesting because none of the assets

that we work within finance

actually have that characteristic.

They typically fluctuate over time and

whenever you have fluctuation

in the value of an asset.

However in legal that implies

a difference between the arithmetic and

the geometric mean return.

Now, characteristic number two.

The difference between the arithmetic and

the geometric mean return,

which as we said before is

always a positive difference.

Is increasing in

the variability of the asset.

In fact it is increasing in

the volatility of the asset.

But since we haven't yet

defined volatility, I'm not going to

try to use that word just yet.

So think about, that depending on

how much assets fluctuate over time,

the higher that fluctuation,

the larger it's going to be the difference

between the arithmetic mean,

and the geometric mean.

And let me give you an example

that would actually highlight

why that is actually important.

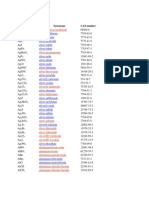

So, this is actually a very,

an asset with very little risk.

And that asset with very little risk,

as you see in there,

these are one year US Treasury Bills.

And basically, they have no risk.

They will not give you

a whole lot of returns, but

they will not actually

scare you along the way.

So as you see in those numbers that are in

front of you between 2004 and 2013, all

the numbers have been positive, sometimes

a little higher, sometimes a little lower.

But you haven't got any huge returns,

you haven't got any huge

disappointments either.

Now, If you add up all those returns and

divide it by ten,

which is the number of

returns that we have there,

then you're going to get

an arithmetic mean return of 1.95%.

If you calculated the geometric

mean return instead then what

you're going to get is 1.93%

a difference of two basis points.

Remember if you haven't ever heard

about the concept of basis points,

100 basis points is equal to 1%.

So that basically means that

two basis points is .02%.

And if all the differences between

arithmetic and geometric mean of return

were of that size, then we wouldn't worry

too much the difference between the two.

But, we do need to worry, and here is why.

Let's consider now the Russian market.

Now I should clarify that this

is a Russian equity market,

and as you see there, I don't need to tell

you much about the risk of this market.

In some periods, you actually

more than doubled your capital.

In some periods,

you lost about 80% of your capital,

in some other periods you lost

about one-third of your capital.

A market with huge variability,

with huge volatility,

with huge fluctuations in returns,

from very positive to a very negative.

Here comes the interesting thing.

Let's look, first,

the whole period that we have there in

terms of returns between 1995 and 2004.

If we were to calculate the arithmetic

mean return, we would get a huge number,

52.5%.

Now, let's suppose the following scenario.

Find someone who wants you

to buy Russian equities.

So here is a story that I tell you.

Look you should be investing

in Russian equities and

the reason is this between

the years 1995 and 2004 the mean

annual return of the Russian

equity market was over 52%.

I haven't lied to you.

I really haven't lied to you.

The problem is that I

gave you the incentive

to run the following calculation.

That is, I gave you the incentive to

think, well if I had started with a $100

at the beginning of 1995, and

my money had compounded at 52.5%.

Over ten years,

I would have ended with over $6,800.

So I started with $100.

I ended up with $6,800.

I multiplied my capital by

68 times in only ten years.

That's fantastic.

I do want to invest in

the Russian market now.

What's the problem with that?

Well, remember,

[COUGH] the arithmetic mean return

number doesn't tell you at which

rate your money evolved over time.

What tells you that is

the geometric mean return.

And guess what?

When we calculate the geometric

mean return is 18.4.

Now, 18.4 is a great number.

I mean, we would like to get many assets

in our portfolios in which we get 18.4%

per year over ten years and we probably

will not be able to find all those many.

But the thing is that 18.4 is far,

far lower than 52.5% per year.

And as a matter of fact, when you

compound 18.4 over ten years had you

started with $100 at the beginning of 1995

at the end of 2004 you would have $542.

Now $542 is still a great return but

of course its far far lower than $6,800.

So that means that what really happened to

your money is that it evolved at 18.4% per

year over ten years, and

your capital went from $100 to $542.

Again, that may be a very good rate

of return for those ten years, but

it's far, far lower than the $6,800

that I led you to believe.

Now this is why the difference

between the arithmetic mean and

the geometric mean is important.

If I don't tell you, if I'm a little

wishy-washy, if I'm not very specific

about what I mean by mean return, then I

maybe actually lying to you without lying

to you because I haven't lied when I say

that the mean annual return was 52.5%.

I was just a little wishy-washy.

So, to give you the incentive,

to run a calculation that is

actually not the correct one.

Now, it actually gets worse than that and

the reason it gets worse

than that is the following.

Let's focus now on that period,

that shorter period between 1995 and 1998.

Now let's look at the period

between 1995 and 1998.

What we see there, is that if we

calculate the arithmetic return of

those four numbers

are 38.7% just under 39%.

And again lets suppose and lets go back

to our hypothetical story that, for

whatever reason, I want you to invest

in Russian equites, and I tell you look

between 95 and 98, the mean annual

return on this market was almost 39%.

And I'm not lying to you.

The numbers would back up that

the mean annual return is 38.7%.

But at the same time that I'm not lying

to you, I'm not being very specific, and

I give you the incentive

to run that calculation.

That had you started with a $100

at the beginning of 1995 and

obtain those four returns between 95 and

98 at the end of that period you would

of ended with $371 in your pocket.

What's the problem with that?

Well, that if you calculate

the geometric mean return,

that number was actually minus 9.7%.

That means that you almost lost 10%

per year on an compounded basis.

And I'm not lying to you there, either.

You can actually calculate

those two numbers and remember,

the relationship between

the arithmetic and

the geometric mean is such that

the first is higher than the second.

But being higher than the second does not

prevent the situation in which the first

is positive and the second is negative.

As it is the case here with

the Russian market between 95 and 98.

So we have a very large and

positive arithmetic mean return and

an awful and

negative geometric mean return.

So your money actually lost at the mean

annual rate of almost 10% per year,

which means that you started

the year 1995 with $100 and

you ended the year 1998

with $67 in your pocket.

And that happened with

an arithmetic mean return of 38.7%.

So I sort of rest my case in

terms of trying to impress on you

the importance of the difference

between these two types of return.

They're very different because

they answer different questions,

they're numerically different, and one can

tell you that you're actually making money

over time, but the other may show you

that you're losing money over time, or

you're making a lot less money than you

thought you were making to begin with.

[MUSIC]

Anda mungkin juga menyukai

- Cascading Your Strategy - IntrafocusDokumen10 halamanCascading Your Strategy - IntrafocusDiego GonzálesBelum ada peringkat

- 1 - 5 - 5. VolatilityDokumen6 halaman1 - 5 - 5. VolatilityDiego GonzálesBelum ada peringkat

- CF2 DayDokumen247 halamanCF2 DayDiego GonzálesBelum ada peringkat

- 1 - 2 - 2. Periodic ReturnsDokumen5 halaman1 - 2 - 2. Periodic ReturnsDiego GonzálesBelum ada peringkat

- Mixer - Yamaha Emx5016cf ManualDokumen40 halamanMixer - Yamaha Emx5016cf ManualjekulBelum ada peringkat

- Day Count ConventionDokumen7 halamanDay Count ConventionDiego GonzálesBelum ada peringkat

- HW F94Dokumen60 halamanHW F94Diego GonzálesBelum ada peringkat

- Read MeDokumen6 halamanRead MeDiego GonzálesBelum ada peringkat

- 1.1 Marketing 101 Building Strong BrandsDokumen6 halaman1.1 Marketing 101 Building Strong Brandsdriscoll42Belum ada peringkat

- HWs Soln F01 PDFDokumen69 halamanHWs Soln F01 PDFDiego GonzálesBelum ada peringkat

- Formulario de Teoria de Colas y SimulacionDokumen2 halamanFormulario de Teoria de Colas y SimulacionJeRsonTCBelum ada peringkat

- Slides 21Dokumen20 halamanSlides 21Diego GonzálesBelum ada peringkat

- Module 1 Practice Questions UPLOADEDDokumen2 halamanModule 1 Practice Questions UPLOADEDshallabh_kheraBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Chemical Formulas at A GlanceDokumen47 halamanChemical Formulas at A GlanceSubho BhattacharyaBelum ada peringkat

- MyDokumen33 halamanMyAnubhav GuptaBelum ada peringkat

- Income Taxation SchemesDokumen2 halamanIncome Taxation SchemesLeonard Cañamo100% (4)

- Unilever Case StudyDokumen17 halamanUnilever Case StudyRosas ErmitañoBelum ada peringkat

- Build, Operate and TransferDokumen11 halamanBuild, Operate and TransferChloe OberlinBelum ada peringkat

- 1 .Operating Ratio: Year HUL Nestle Britannia MaricoDokumen17 halaman1 .Operating Ratio: Year HUL Nestle Britannia MaricoSumith ThomasBelum ada peringkat

- Front PageDokumen8 halamanFront PageSiddanth SidBelum ada peringkat

- FGH60N60SFD: 600V, 60A Field Stop IGBTDokumen9 halamanFGH60N60SFD: 600V, 60A Field Stop IGBTManuel Sierra100% (1)

- BenihanaDokumen6 halamanBenihanaaBloomingTreeBelum ada peringkat

- Resumo BTG Pactual PDFDokumen206 halamanResumo BTG Pactual PDFJulio Cesar Gusmão CarvalhoBelum ada peringkat

- Sybcom PpiDokumen6 halamanSybcom PpiMaxson Miranda100% (2)

- Key Drivers For Modern Procurement 1Dokumen22 halamanKey Drivers For Modern Procurement 1setushroffBelum ada peringkat

- Status Report of The Pan European Corridor XDokumen52 halamanStatus Report of The Pan European Corridor XWeb BirdyBelum ada peringkat

- Major Recessionary Trends in India and Ways To Overcome It: Presented byDokumen34 halamanMajor Recessionary Trends in India and Ways To Overcome It: Presented byYogesh KendeBelum ada peringkat

- Economics Course OutlineDokumen15 halamanEconomics Course OutlineDavidHuBelum ada peringkat

- Our Friends at The Bank PDFDokumen1 halamanOur Friends at The Bank PDFAnnelise HermanBelum ada peringkat

- FICO Configuration Transaction CodesDokumen3 halamanFICO Configuration Transaction CodesSoumitra MondalBelum ada peringkat

- Faasos 140326132649 Phpapp01Dokumen15 halamanFaasos 140326132649 Phpapp01Arun100% (1)

- For: Jyg Travel and Tours 2D1N Bohol Tour Itinerary MAY 23 - 25, 2018 Good For 3 Pax PHP 2,900/PAXDokumen2 halamanFor: Jyg Travel and Tours 2D1N Bohol Tour Itinerary MAY 23 - 25, 2018 Good For 3 Pax PHP 2,900/PAXLiza L. PadriquezBelum ada peringkat

- Demand LetterDokumen45 halamanDemand LetterBilly JoeBelum ada peringkat

- Atlantic Computer: A Bundle of Pricing Options Group 4Dokumen16 halamanAtlantic Computer: A Bundle of Pricing Options Group 4Rohan Aggarwal100% (1)

- Toilet SoapDokumen15 halamanToilet SoapMarjorie Jean Andal100% (1)

- 10000026382Dokumen489 halaman10000026382Chapter 11 DocketsBelum ada peringkat

- Monmouth Student Template UpdatedDokumen14 halamanMonmouth Student Template Updatedhao pengBelum ada peringkat

- CH 03Dokumen33 halamanCH 03Akshay GoelBelum ada peringkat

- Wells Fargo Preferred CheckingDokumen3 halamanWells Fargo Preferred CheckingAarón CantúBelum ada peringkat

- ICICIdirect HDFCBank ReportDokumen21 halamanICICIdirect HDFCBank Reportishan_mBelum ada peringkat

- Accounting Changes and Error AnalysisDokumen39 halamanAccounting Changes and Error AnalysisIrwan Januar100% (1)

- 2016 ICPA Question PaperDokumen65 halaman2016 ICPA Question Paper22funnyhrBelum ada peringkat

- Hul Marketing Starategies Over The YearsDokumen11 halamanHul Marketing Starategies Over The YearsJay Karan Singh ChadhaBelum ada peringkat