Lehman Brothers

Diunggah oleh

Nurul Artikah SariHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Lehman Brothers

Diunggah oleh

Nurul Artikah SariHak Cipta:

Format Tersedia

LEHMAN BROTHERS | ARTIKAH

CONTENT

INTRODUCTION

CAUSE OF LEHMAN BROTHER FAILURE:

CORPORATE GOVERNANCE

Corporate Risk Management Failure

Board of Director

Remuneration Scheme

Nomination Committees

TECHNICAL CAUSES

MISLEADING

CAUSES OF FINANCIAL CRISIS

CONCLUSION

REFERENCE

LEHMAN BROTHERS | ARTIKAH

INTRODUCTION

Lehman Brothers Holdings Inc. has filed for bankruptcy protection in the U.S.

The statement above is a current headline on the Lehman Brothers internet page - the fourth

largest investment bank in USA in 2007. It was surely a big surprise for a lot of company

stakeholders and shareholders, but when we look closer to this case, it was not unpredictable.

We will discuss in this work the reasons why Lehman Brothers had to file for Chapter 11, what

happened inside of the company, how corporate governance failed in this case and specifically

we will analyze their creative accounting issue REPO 105.

Lehman Brothers started in 1844 as a small grocery and dry goods store established by Henry

Lehman. Two decades later they traded cotton, moved to New York and established New York

Cotton Exchange. After this events Lehman continued on the road of success and became the

fourth-largest American investment bank. They survived the World wars and the Great

Depression, however, the collapse on the U.S. housing market brought Lehman Brothers to its

knees.

Objectively, there are many reasons why Lehman Brothers failed, but we could divide them to

two main groups technical issues and corporate governance failures. Lehman Brothers had

very weak corporate governance arrangements, no wonder when the turnover chief expressed

his opinion towards corporate governance as follows: Corporate governance is a joke. The

main areas of weakness were board of directors, corporate risk management, remuneration

scheme and nomination committees. In this work we will discuss mainly first two of them with

attention to REPO 105 operation what was the key creative accounting maneuver used by

Lehman Brothers.

LEHMAN BROTHERS | ARTIKAH

CAUSE OF LEHMAN BROTHER FAILURE: CORPORATE GOVERNANCE

Corporate Risk Management Failure

Since Lehman Brothers were a leading investment bank, it was inherent that risk is a part of

their day-today business. Financial markets are, by the principles, uncertain and face variety of

risks credit market, liquidity, legal, reputation and operational risk. Therefore, good risk

management is considered to be a base of all operations in the company, as well as risks

should be appropriately measured and analyzed.

In Lehman Brothers, overall risk limits and risk management policies were established by the

companys Executive Committee. Apart from that, the Risk Committee (which consisted of the

companys Executive Committee, the CRO and CFO) should meets weekly to discuss all

potential threats and risk taking activities. Sad is, that these facts are only pure statements in

Lehman Brothers policy manual of quantitative risk management. In reality, this committee met

only twice in the year 2006 and 2007. Besides that, Lehman started high- risk business years

before its bankruptcy. It was a period of aggressive growth strategy to overcome their problems.

During this period they developed exposures to risky subprime lending, structured products,

commercial real estate and high-risk lending for leveraged buyouts, but they have not

considered enough that these loans were less liquid that its usual investments and had more

vague prospects. Further, according to the Valukas report, they exceeded internal risk limits and

controls to pursuit higher earnings, what was the start of the end.

Valukas report (report composed by court-appointed investigator of bankruptcy of Lehman

Brothers, Anton Valukas) further stipulates that there is evidence that top officers of Lehman

Brothers Company (including the Chief Executive) violated their duties by exposing the

company to potential liability by filling misleading reports and financial statements. The specialty

of Lehman Brothers misleading transactions was Repo 105 through which company could

remove billions of liabilities off the balance sheet. The existence and misuse of the Repo 105

is very questionable and goes beyond corporate governance, concerning from accounting to

legal issues of its use. In following sections we will explore Repo transactions, their advantages,

disadvantages and ways of misuse.

Timothy Geithner (Secretary Of The Treasury), said in his report, Lehmans plunge into highrisk businesses in the years before its bankruptcy has become a familiar story. During this

period of aggressive growth, Lehman developed significant exposures to risky subprime

lending, commercial real estate, structured products, and high-risk lending for leveraged buyout.

LEHMAN BROTHERS | ARTIKAH

Importantly, the Valukas Report indicates that Lehman repeatedly breached its own risk

concentration limits in pursuit of higher earnings.

Repo 105and the Lehman Brothers

According to the report, Lehman Brothers used repo operations purportedly for financing

reason, though they reported them as asset disposal in the financial statements. They removed

securities inventory from the balance sheet for seven to ten days and made misleading

appearance of the companys overall situation in 2007 and 2008. To be concrete, they

accounted for Repo 105 transactions as sales, by which they removed the inventory from the

balance sheet. The number of the Repo 105 transactions regularly raised before the closure of

the reporting period. That way Lehman Brothers borrowed billions of dollars and used them to

pay other liabilities. Few days later, they repaid the cash borrowings plus interest, repurchased

the securities and restored the assets on its financial statement. Main reasons for these

creative accounting procedures were mainly lowering the publicly reported net leverage and

balance sheet. Namely, the net leverage had become an important indicator for the rating

agencies and of bank risk. However, the Repo 105 operations were not completely legal under

the U.S. law, and therefore Lehman Brother had to do all of these transactions in the UK under

their London unit. In this situation, the most important question is who knew about these

operations and who is responsible for them. Mr. Fuld claims that he did not know about those

transactions, in spite of the fact that Bart McDade stated, that he had a discussion about the

Repo 105 with Dick Fuld in 2008. Valukas report also stipulates the evidence against three

Lehman Brothers CFOs. But, they defended their selves with statements, that almost all

financial firms practice the window-dressing to adjust their balance sheet at the end of the

accounting period.

LEHMAN BROTHERS | ARTIKAH

Board of directors in the Lehman Brothers

According to the OECD principles, the corporate governance should ensure the strategic

guidance of the company, the effective monitoring of management by the board, and the boards

accountability to the company and the shareholders. Based on these principles, board

members supposed to act on a fully informed basis, in best interest and fairly to the company

and shareholders. They should apply high ethical standards and should be able to exercise

objective independent judgment on corporate affairs. Moreover, they supposed to fulfill several

functions including reviewing and guiding corporate strategy, risk policy budgets and business

plans. Board should also monitor the effectiveness and manage potential conflicts of interest as

well as oversee the process of disclosure.

Lehman Brothers Board of Directors was composed of ten members. The Chairman and CEO

was Richard S. Fuld, Jr. and included eight independent directors according to NYSE. However,

behind all of that there was a fact, that nine out of 10 directors were retired. Moreover, their

average age were 68.4 years (four of them were over 75 years), only two of them have direct

experience in financial service industry and only one of them had current financial sector

knowledge. In addition, one was U.S. Navy officer, another theatrical producer. Pointless is also

the fact, that indeed board members should be independent and suppose to take care of the

corporation, they cannot do it very precisely. Especially not, when they are for instance director

of Weight Watchers International, as well as chairman of Lehmans governance and nominating

committee and a member of the compensation, finance and risk committee at the same time

(e.g. Marsha Johnsons Evans). At the end of this section, we also cannot forget to mention, that

Lehman Brothers board members were paid for their services extremely well, since the range

was from $325 000 to $397 000 plus very high every year bonuses. However, this hasnt been

enough to Mr. Fuld who rewarded his self with nearly half a billion dollars between 1993 and

2007.

LEHMAN BROTHERS | ARTIKAH

Remuneration scheme and Nomination

A study from researchers at Harvard University, The Wages of Failure: Executive

Compensation at Bear Stearns and Lehman 2000-2008, shows that the top executive

managers of Lehman Brothers received about $1 billion respectively from cash bonuses and

equity sales between 2000 and 2008.

The Board at Lehman Brothers awarded total remuneration of close to $500 million to Chairman

Fuld, just four days before its collapse and following an announcement that the firm lost almost

$4 billion in the third quarter, Fuld told the media that the Boards been wonderfully supportive.

CEO received nearly half a billion dollars in total compensation between 1993 and 2007.

The staff received a disproportionately high percentage of their pay in Lehman stock and option.

When the firm went public, employees owned 4 percent of the firm, worth $60m. By 2006, they

owned around 30 percent, equivalent to $11 billion, at least on paper.

In nomination cause of four of the ten member board at Lehman Brothers were over 75 years of

age and only one had current financial sector knowledge.

LEHMAN BROTHERS | ARTIKAH

Technical causes of Lehman Brothers Failure

One of the main failure cases in Lehman Brothers was the misbehavior of top executives and

the inaction of both of the board and the auditing firm (Ernst & Young)

There are many similarities between the collapses of Enron in 2001 and Lehman Brothers in

2008, that they managed to reduce leverage on the right-hand side of balance sheet and at the

same time reduce assets on the left-hand side. In Lehman Brothers, Repo 105 transactions

double between late 2006 and May 2008, were known inside the corporation, exceeded the

firms self-imposed limits and typically happened at the end of each quarter, when financial

information had to be released.

Lehman in the last year was unable to retain the confident of its lenders and clients, because it

did not have sufficient liquidity to meet its current obligations and on two consecutive quarters

with huge reported losses, $2.8 billion in second quarter 2008 and $3.9 billion in third quarter

2008, without news of any definitive survival plan.

Misleading

The Wall Street equivalent of a coroners report, mention that Richard S.Fuld Jr, Lehmans

former chief executive, certified the misleading accounts, the report said. Mr. Valukas (one of

the examiner) wrote in the report Unbeknownst to the investing public, rating agencies,

government regulators, and Lehmans board of directors, Lehman reverse engineered the firms

net leverage ratio for public consumption, The report state that Mr. Fuld was at least grossly

negligent. Henry M. Paulson Jr., who was then the Treasury secretary, warned Mr. Fuld that

Lehman might fail unless it stabilized its finances or found a buyer.

LEHMAN BROTHERS | ARTIKAH

CAUSES OF FINANCIAL CRISIS

During much of the late 1990s and into the early 2000s many emerging-markets and

commodity-rich countries experienced large current account surpluses and sought safe assets

to invest in, traditionally sovereign and government agency debt. At the same time, there was

significant growth in institutional cash pools, such as pensions, money market funds, and hedge

funds, which also demanded these safe assets. As demand for these safe assets outstripped

supply, a global savings glut resulted. During the same period, booming U.S. housing prices and

low interest rates combined to create an exuberant mortgage market. Mortgage-backed

securities (MBS), whereby investors purchased the right to a stream of payments fuelled by a

pool of underlying mortgages, became very popular. As U.S. housing and mortgages had

traditionally been considered stable investments, and because at this time mostly lower risk

prime mortgages were used, many of these MBS received high investment-grade ratings. Prior

to 2003, the market in MBS had been dominated by the government-sponsored entities, the

Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage

Corporation (Freddie Mac), and also enjoyed an implied governmental guarantee.

In response to the savings glut, banks became more involved in producing MBS. As demand

continued, banks combined MBS with other types of asset-backed securities (ABS), such as

those based on credit card receivables, auto loans and student loans, to sell them as a new

type of bond-like security called collateralized debt obligations (CDOs). Payments under the

CDOs were to be made out of the flow of repayment from the underlying MBS and ABS making

up the CDO. Again, because of the mortgages underlying the CDOs, many received investmentgrade ratings.

CDOs proved very popular and were aggressively sold to investors in all the worlds major

markets. By 2007, CDOs had become a significant portion of the ABS market. To meet the

demand for MBS and CDOs, banks began pooling not just prime mortgages but also riskier

subprime loans and a greater portion of the securities underlying CDOs became MBS, and then

subprime MBS. Over time, lenders loosened underwriting standards in order to increase the

quantity of subprime mortgages that could be pooled. As they became common, CDOs and

other structured debt were routinely used as collateral for repo transactions.

CDOs were termed structured instruments because they were divided into different tranches

based on the timing of payments and the payment priority given the holder of a particular

LEHMAN BROTHERS | ARTIKAH

tranche (higher-rated tranches were guaranteed payment before lower rated tranches). Creating

tranches allowed investors to choose at what level of risk to invest and allowed investment firms

to create investment-grade tranches from even sub-prime mortgages. Lehmans troubles were

due in part to the fact that it retained some of the low-rated tranches of the CDOs it generated,

and these tranches were the first to get into trouble when the housing market cooled.

LEHMAN BROTHERS | ARTIKAH

CONCLUSION

The fact is that on September 15, 2008, Lehman Brothers filed for bankruptcy. And it wasnt the

first big international company (also not the last one) who ended under the Chapter 11. We can

for example point out the Enron bankruptcy from 2001, which is (maybe) accidently very similar

to Lehman Brothers case. But why we have the old pattern here again? My personal opinion is

that the reason is in the weak corporate governance arrangements in the company and in the

fact that corporate governance principles are not under the root of law. In the Lehman Brothers

weak corporate governance arrangements allowed officers to find the way how to accumulate

unearned profit and specifically increase their personal wealth.

In my opinion, there is no problem in the context of OECD principles since they arch over all

problems discussed in this work. OECD principles specifically say that the corporate

governance framework should ensure:

1. The strategic guidance of the company, the effective monitoring of management by the

board, and the boards accountability to the company and the shareholders

2. That timely and accurate disclosure is made on all material matters regarding the

corporation, including the financial situation, performance, ownership, and governance of

the company

3. That an annual audit is conducted by an independent, competent and qualified auditor in

order to provide an external and objective assurance to the board and shareholders that

the financial statements fairly represent the financial position and performance of the

company in all material respects.

As you can see above, if all of these points were fulfilled as is stated in the principles, the

Lehman Brothers company would probably not have to be under the Chapter 11. However,

there are several problems. First of all, Lehman Brothers had very weak corporate governance

arrangements and officers were not forced to fulfill the principles. Good instance is a situation in

their board of directors. Secondly, the most important issue is why companies should abide the

OECD principles, if there are no consequences of breaking them. I think that until the corporate

governance framework will not be under the law, these cases will arise. Moreover, problems are

also in the matter, that there are crucial differences between the law systems. As we could see,

LEHMAN BROTHERS | ARTIKAH

Lehman Brothers could not use Repo 105 in the U.S., but they were allowed to do it in UK and

manipulate their financial situation.

From nature, people are very inventive and they always look for means how to increase their

personal wealth. There will always be a group of people which goes beyond the principles as far

as the law permits and who will look for the opportunities to overpass the law. To conclude, I

would see the key issue in setting the system in the way, in which it will minimize opportunities

of these speculators and therefore minimize the failures of corporate governance.

LEHMAN BROTHERS | ARTIKAH

REFERENCE

1. http://www.investopedia.com/articles/economics/09/lehman-brother2.

3.

4.

5.

6.

collapse.asp#ixzz1fMgLOtOn

http://www.reuters.com/article/2008/09/us

www.gsb.stanford.edu/cgrp/documents/cgrp03

Lehman brothers, quantitative risk management policy manual, September 2007,p3

http://www.limkediii.com/answers/financial-market/equity

http://journalistsresource.ore/studies/economics/corporation/executive-compensationat-

bear-stearns-and-lehman/

7. http://ccsenet.org/journal/index.php/ijef/article/download

8. http://www.oecd.org/dataoecd/32/18/31557724.pdf

9. http://ftalphaville.ft.com/blog/2010/03/12/173241/repo-105/

10. http://www.oecd.org/dataoecd/32/1/42229620.pdf

11. http://www.jenner.com/lehman/docs/debtors/LBEX-DOCID%20384020.pdf

12. http://www.imd.org/research/challenges/TC039-10.cfm

13. http://rmi.nus.edu.sg/aboutus/enewsletterrmi/issue3/MarketReviewRepo105(edited).htm

14. http://globalinvestmentwatch.com/americas-most-wanted-the-lehman-brothers-boardofdirectors/

Anda mungkin juga menyukai

- Lehman BrothersDokumen25 halamanLehman BrothersKiran J50% (2)

- Lessons From Lehman BrothersDokumen3 halamanLessons From Lehman BrothersJanjeremy2885100% (3)

- Collapse of Lehman BrothersDokumen8 halamanCollapse of Lehman BrothersDerick John PalapagBelum ada peringkat

- Casestudy - Lehman Brothers and The Subprime Crisis Week 2Dokumen2 halamanCasestudy - Lehman Brothers and The Subprime Crisis Week 2Rachita ArikrishnanBelum ada peringkat

- Lehman Brothers Case StudyDokumen12 halamanLehman Brothers Case StudyRohit Prajapati100% (1)

- Lehman Brothers - Analysis of FailureDokumen25 halamanLehman Brothers - Analysis of FailureArif AhmedBelum ada peringkat

- Lehman Brothers DownfallDokumen17 halamanLehman Brothers DownfallAli ImranBelum ada peringkat

- Becg Assingment On "Lehman Bankruptcy"Dokumen12 halamanBecg Assingment On "Lehman Bankruptcy"Sachin BabbiBelum ada peringkat

- Lehman Brothers Holdings IncDokumen17 halamanLehman Brothers Holdings Incrachit1993Belum ada peringkat

- Lehman Brothers Case StudyDokumen13 halamanLehman Brothers Case StudyIshita BansalBelum ada peringkat

- Cast Study - GM MotorsDokumen9 halamanCast Study - GM MotorsAbdullahIsmailBelum ada peringkat

- Watawala Plantation 2018Dokumen184 halamanWatawala Plantation 2018ThilinaAbhayarathneBelum ada peringkat

- Assignemnt 1 - Baring and Lehman Brother's BankDokumen7 halamanAssignemnt 1 - Baring and Lehman Brother's BankBrow SimonBelum ada peringkat

- Ethical Dilemmas in Product DevelopmentDokumen44 halamanEthical Dilemmas in Product Developmentfrndjohn88% (8)

- Case Study of Lehman Brothers CollapseDokumen4 halamanCase Study of Lehman Brothers Collapsemukesh chhotala100% (1)

- LTCMDokumen6 halamanLTCMAditya MaheshwariBelum ada peringkat

- WorldcomDokumen12 halamanWorldcomvarunatorBelum ada peringkat

- A Case Study of Hampton Machine ToolDokumen3 halamanA Case Study of Hampton Machine Toolsevillejo199033% (3)

- Case Session18Dokumen3 halamanCase Session18Raju SharmaBelum ada peringkat

- Case AnalysisDokumen7 halamanCase AnalysisMK RKBelum ada peringkat

- The Last Days of Lehman BrothersDokumen19 halamanThe Last Days of Lehman BrothersSalman Mohammed ShirasBelum ada peringkat

- Amazon Financial Statement AnalysisDokumen4 halamanAmazon Financial Statement Analysisapi-270738730Belum ada peringkat

- Case Study Analysis - Krispy Kreme DonutsDokumen5 halamanCase Study Analysis - Krispy Kreme DonutsAlefyah Shabbir100% (2)

- Case Analysis - Dot ComDokumen3 halamanCase Analysis - Dot Comapi-382295150% (2)

- Questions For Case AnalysisDokumen3 halamanQuestions For Case AnalysisDwinanda SeptiadhiBelum ada peringkat

- Theranos JOMDokumen7 halamanTheranos JOMInderpal MehtaBelum ada peringkat

- Assignment of BRAC Bank 3Dokumen17 halamanAssignment of BRAC Bank 3Syed M IslamBelum ada peringkat

- Lehman BrothersDokumen16 halamanLehman Brotherstimezit100% (1)

- Sabmiller Marketing Plan - Group 1Dokumen20 halamanSabmiller Marketing Plan - Group 1Glory100% (1)

- World ComDokumen3 halamanWorld ComneammaBelum ada peringkat

- Marriott CorporationDokumen8 halamanMarriott CorporationtarunBelum ada peringkat

- Presentation On Hindustan Unilever LTDDokumen9 halamanPresentation On Hindustan Unilever LTDSatyajit MallBelum ada peringkat

- Report Banking RiabkovDokumen6 halamanReport Banking RiabkovKostia RiabkovBelum ada peringkat

- Morgan StanleyDokumen9 halamanMorgan StanleyNikita MaskaraBelum ada peringkat

- Marriott Corporation (Project Chariot) : Case AnalysisDokumen5 halamanMarriott Corporation (Project Chariot) : Case AnalysisChe hareBelum ada peringkat

- LTCM Case - Study PDFDokumen7 halamanLTCM Case - Study PDFEdward Fernand50% (2)

- The Tread Way Tire CompanyDokumen22 halamanThe Tread Way Tire CompanyKuzhanthaivel M G BBelum ada peringkat

- EnglishnizationDokumen10 halamanEnglishnizationdrcoolzBelum ada peringkat

- Avon Calls On Foreign Markets APA 3 PagesDokumen6 halamanAvon Calls On Foreign Markets APA 3 PagesSabika NaqviBelum ada peringkat

- LACE Group3 Meredith HPHDokumen20 halamanLACE Group3 Meredith HPHRaviSinghBelum ada peringkat

- The Goldman Sachs IPO (A) - ATSCDokumen9 halamanThe Goldman Sachs IPO (A) - ATSCANKIT PUNIABelum ada peringkat

- IL&FS Crisis Impact On Indian EconomyDokumen4 halamanIL&FS Crisis Impact On Indian EconomyBhavesh Rockers GargBelum ada peringkat

- List of Case Questions: Case #1 Oracle Systems Corporation Questions For Case PreparationDokumen2 halamanList of Case Questions: Case #1 Oracle Systems Corporation Questions For Case PreparationArnold TampubolonBelum ada peringkat

- ASSIGNMENT 1 Case Study-United Sugar CompanyDokumen4 halamanASSIGNMENT 1 Case Study-United Sugar CompanyMehereen AubdoollahBelum ada peringkat

- FIN300 Homework 4Dokumen4 halamanFIN300 Homework 4John0% (2)

- A Zero Wage Increase Again - Situational AnalysisDokumen1 halamanA Zero Wage Increase Again - Situational AnalysisRahul Kashyap100% (1)

- Kmart and SearsDokumen19 halamanKmart and Searsshibanibordia100% (1)

- The Rise and Fall of Enron - A Case StudyDokumen11 halamanThe Rise and Fall of Enron - A Case StudyAYUSH GUPTABelum ada peringkat

- Krispy Kreme Doughnuts-Suggested QuestionsDokumen1 halamanKrispy Kreme Doughnuts-Suggested QuestionsMohammed AlmusaiBelum ada peringkat

- Quiz 1Dokumen3 halamanQuiz 1Yong RenBelum ada peringkat

- Kentucky Fried Chicken in JapanDokumen3 halamanKentucky Fried Chicken in Japanezeasor arinzeBelum ada peringkat

- Regtech at HSBC': Institute of Management, Nirma UniversityDokumen8 halamanRegtech at HSBC': Institute of Management, Nirma UniversitySoumiya BishtBelum ada peringkat

- Corporate Governance Failure in The Lehman Brothers CaseDokumen6 halamanCorporate Governance Failure in The Lehman Brothers Caseranasanjeev0007Belum ada peringkat

- Lehman Bro Corporate Governance FailureDokumen18 halamanLehman Bro Corporate Governance FailureAzhar AkhtarBelum ada peringkat

- Case Application 1aDokumen3 halamanCase Application 1akikiBelum ada peringkat

- Lehman AssignmentDokumen6 halamanLehman AssignmentDuaa’s CreativityBelum ada peringkat

- Lehman Brother Ethical DilemmaDokumen3 halamanLehman Brother Ethical DilemmaVenkatesh KamathBelum ada peringkat

- Assignment 1 Final Paper (Edited)Dokumen8 halamanAssignment 1 Final Paper (Edited)paterneBelum ada peringkat

- THE LEHMAN BROTHERS CASE A Corporate Governance Failure, Not A Failure of Financial Markets - Finance - BankingDokumen4 halamanTHE LEHMAN BROTHERS CASE A Corporate Governance Failure, Not A Failure of Financial Markets - Finance - BankingKumar AnandBelum ada peringkat

- Case Study On Lehman Brothers by Nadine SebaiDokumen5 halamanCase Study On Lehman Brothers by Nadine Sebainadine448867% (3)

- Scanned DocumentsDokumen2 halamanScanned DocumentsNurul Artikah SariBelum ada peringkat

- Chapter 2 - Conceptual Framework and Standard Setting Process (Part 2)Dokumen13 halamanChapter 2 - Conceptual Framework and Standard Setting Process (Part 2)Nurul Artikah SariBelum ada peringkat

- CHAPTER 1 Historical Development of AccountingDokumen28 halamanCHAPTER 1 Historical Development of AccountingNurul Artikah SariBelum ada peringkat

- EPF Contribution:: LiableDokumen2 halamanEPF Contribution:: LiableNurul Artikah SariBelum ada peringkat

- X3 45Dokumen20 halamanX3 45Philippine Bus Enthusiasts Society100% (1)

- Public Provident Fund Card Ijariie17073Dokumen5 halamanPublic Provident Fund Card Ijariie17073JISHAN ALAMBelum ada peringkat

- IndGlobal Digital Company ProfileDokumen30 halamanIndGlobal Digital Company ProfilerakeshdadhichiBelum ada peringkat

- People Vs MaganaDokumen3 halamanPeople Vs MaganacheBelum ada peringkat

- Romanian Architectural Wooden Cultural Heritage - TheDokumen6 halamanRomanian Architectural Wooden Cultural Heritage - ThewoodcultherBelum ada peringkat

- July 22, 2016 Strathmore TimesDokumen24 halamanJuly 22, 2016 Strathmore TimesStrathmore TimesBelum ada peringkat

- Military Laws in India - A Critical Analysis of The Enforcement Mechanism - IPleadersDokumen13 halamanMilitary Laws in India - A Critical Analysis of The Enforcement Mechanism - IPleadersEswar StarkBelum ada peringkat

- Computer Engineering Project TopicsDokumen5 halamanComputer Engineering Project Topicskelvin carterBelum ada peringkat

- Level 2 TocDokumen5 halamanLevel 2 TocStephanie FonsecaBelum ada peringkat

- Contemporary Worl Module 1-Act.1 (EAC) Bea Adeline O. ManlangitDokumen1 halamanContemporary Worl Module 1-Act.1 (EAC) Bea Adeline O. ManlangitGab RabagoBelum ada peringkat

- Nestle Corporate Social Responsibility in Latin AmericaDokumen68 halamanNestle Corporate Social Responsibility in Latin AmericaLilly SivapirakhasamBelum ada peringkat

- Ati - Atihan Term PlanDokumen9 halamanAti - Atihan Term PlanKay VirreyBelum ada peringkat

- Channarapayttana LandDokumen8 halamanChannarapayttana Landnagaraja.raj.1189Belum ada peringkat

- Posh TTTDokumen17 halamanPosh TTTKannanBelum ada peringkat

- PoetryDokumen5 halamanPoetryKhalika JaspiBelum ada peringkat

- Dewi Handariatul Mahmudah 20231125 122603 0000Dokumen2 halamanDewi Handariatul Mahmudah 20231125 122603 0000Dewi Handariatul MahmudahBelum ada peringkat

- RAN16.0 Optional Feature DescriptionDokumen520 halamanRAN16.0 Optional Feature DescriptionNargiz JolBelum ada peringkat

- Louis I Kahn Trophy 2021-22 BriefDokumen7 halamanLouis I Kahn Trophy 2021-22 BriefMadhav D NairBelum ada peringkat

- Facilitators of Globalization PresentationDokumen3 halamanFacilitators of Globalization PresentationCleon Roxann WebbeBelum ada peringkat

- ConsignmentDokumen2 halamanConsignmentKanniha SuryavanshiBelum ada peringkat

- Theodore L. Sendak, Etc. v. Clyde Nihiser, Dba Movieland Drive-In Theater, 423 U.S. 976 (1975)Dokumen4 halamanTheodore L. Sendak, Etc. v. Clyde Nihiser, Dba Movieland Drive-In Theater, 423 U.S. 976 (1975)Scribd Government DocsBelum ada peringkat

- Options TraderDokumen2 halamanOptions TraderSoumava PaulBelum ada peringkat

- Daftar Ebook-Ebook Manajemen Bisnis MantapDokumen3 halamanDaftar Ebook-Ebook Manajemen Bisnis MantapMohamad Zaenudin Zanno AkilBelum ada peringkat

- Case Presentation and Analysis - Operations JollibeeDokumen7 halamanCase Presentation and Analysis - Operations JollibeeDonnabie Pearl Pacaba-CantaBelum ada peringkat

- Authors & Abstract Guideline V-ASMIUA 2020Dokumen8 halamanAuthors & Abstract Guideline V-ASMIUA 2020tiopanBelum ada peringkat

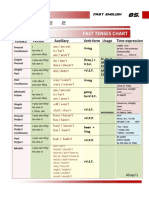

- Table 2: Fast Tenses ChartDokumen5 halamanTable 2: Fast Tenses ChartAngel Julian HernandezBelum ada peringkat

- Principles of Natural JusticeDokumen20 halamanPrinciples of Natural JusticeHeracles PegasusBelum ada peringkat

- People Vs Gonzales-Flores - 138535-38 - April 19, 2001 - JDokumen10 halamanPeople Vs Gonzales-Flores - 138535-38 - April 19, 2001 - JTrexPutiBelum ada peringkat

- Farhat Ziadeh - Winds Blow Where Ships Do Not Wish To GoDokumen32 halamanFarhat Ziadeh - Winds Blow Where Ships Do Not Wish To GoabshlimonBelum ada peringkat

- Us and China Trade WarDokumen2 halamanUs and China Trade WarMifta Dian Pratiwi100% (1)