European Engine Oils: Heavy Duty Diesel Market Overview

Diunggah oleh

Rivas Arellano PatricioDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

European Engine Oils: Heavy Duty Diesel Market Overview

Diunggah oleh

Rivas Arellano PatricioHak Cipta:

Format Tersedia

European Engine Oils

Heavy Duty Diesel Market Overview

Market Drivers

Market Structure

The Western European on-road heavy duty diesel engine

oil market continues to undergo a period of dramatic

change as the result of three factors:

The Western European on-road heavy duty diesel engine

oil market may be segmented by many factors including

performance, specifications, viscosity grade, base oils,

elemental limits and aftertreatment system compatibility.

Figure 1 illustrates Lubrizols segmentation of this market

into three broad market tiers, each with distinct

performance and value characteristics.

Emissions

Changing European Union (EU) emissions legislation,

designed to reduce potentially harmful vehicle exhaust

emissions, is resulting in new engine designs and

aftertreatment systems being introduced by OEMs. Euro

IV resulted in the use of selective catalytic reduction

(SCR) and exhaust gas recirculation (EGR) to reduce

oxides of nitrogen (NOx) emissions. Particulate emissions

were reduced by the use of diesel particulate filters (DPF),

leading to lower SAPS engine oils being developed.

Moving through Euro V and looking forward to Euro VI

there is likely to be greater use of DPFs, SCR and EGR.

Figure 1 Heavy Duty Diesel Engine Oil Market Structure

Fuel Economy

Ultra High Performance Diesel (UHPD)

The drive to increase the fuel efficiency of heavy duty

vehicles is to lower the cost of operating a vehicle. This is

leading to a shift in the viscosity grades, from 15W-40

and higher to 10W-40 and 5W-30. However, there is no

standard test for the evaluation of heavy duty diesel

engine oil fuel economy improvement. Therefore, it is

essential that any claims of fuel economy improvement

are carefully evaluated to ensure that they will be

measurable in the field. Although current legislation does

not consider the reduction of carbon dioxide (CO2)

emissions it is likely that this will be a future requirement.

This premium market tier represents the highest levels of

engine oil performance seen in the European heavy duty

diesel market. Predominantly 10W-40, formulated with

API Group III base oils, the UHPD tier is split into two

distinct segments by the differing requirements of ACEA

E6-08 and ACEA E4-08. Both provide the highest levels of

engine oil durability and are intended for use under

severe operating conditions. However, ACEA E6-08

engine oils are formulated to a lower SAPS level in order

to be suitable for use in vehicles fitted with advanced

aftertreatment systems, particularly DPFs. Demand for

ACEA E6-08 engine oils is expected to grow with the

increased use of DPFs to meet the expected Euro VI

emissions standards.

Durability

The introduction of new engine designs, aftertreatment

systems and fuels are making the environment in which

the engine oil operates increasingly severe. As a result,

engine oil durability must be increased to ensure that

engine oils continue to perform as required.

These three factors continue to result in the need for new

engine oil technology, designed to operate in vehicles

with the latest aftertreatment systems, while delivering

ever greater durability and fuel economy improvement.

Super High Performance Diesel (SHPD)

A premium performance market tier that represents the

main oil quality levels required for use in medium severity

applications. This tier is also split into two distinct

segments by the differing performance and SAPS

requirements of ACEA E7-08 and ACEA E9-08. Engine

oils meeting ACEA E7-08 are typically 15W-40s

formulated with API Group I base oils. Since ACEA E2-08

is no longer in the 2008 Oil Sequences the minimum

ACEA performance level for heavy duty diesel

applications has become ACEA E7-08 resulting in a

growing demand for this tier.

ACEA E9-08 is a new mid SAPS requirement and

contains many elements of API CJ-4 and is intended for

use in vehicles fitted with DPFs together with EGR and/or

SCR. ACEA E9-08 oils are expected to be 15W-40s

based on API Group II base oils and demand for them is

forecast to grow as the use of DPFs increases. ACEA E908 is also likely to become the minimum performance

level for heavy duty diesel applications for Euro VI.

grades (10W-40 and 5W-30) will continue to increase at

the expense of the heavier grades (20W-50 and

monogrades).

This change in demand will impact the types of base oil

required as illustrated in figure 3. Increased usage of

10W-40 and 5W-30 will result in greater demand for API

Mainline

Mainly used in older vehicles this lower performance tier

includes basic quality engine oils meeting older ACEA Oil

Sequences or API categories.

Market Demand

The change in engine oil demand by market tier, viscosity

grade and base oil type has changed considerably in the

last few years. The introduction of new engine oil

requirements for aftertreatment compatibility, greater

durability and fuel economy improvement have resulted in

a change in the types of engine oil used in Europe.

Figure 3 Change in demand by API Base Oil Group

Group III base oils. Demand for ACEA E9-08 15W-40s is

likely to result in a growth in demand for API Group II

base oils. The obsolescence of E2, E3 and E5, combined

with the changes in vehicle parc, will result in a fall in

demand for older 15W-40, 20W-50 and monograde

engine oils; reducing demand for API Group I base oils.

Market Outlook

The heavy duty diesel engine oil market will continue to

change over the next 4 years. Emissions, durability & fuel

economy requirements will continue to drive demand for

higher value engine oils with lighter viscosity grades,

higher quality base oils and new innovative additive

chemistry.

Figure 2 Change in demand by viscosity grade

Figure 2 illustrates the relative change in demand by

viscosity grade that Lubrizol expects to see over the next

5 year period from 2008 to 2012. As demand for lower

SAPS engine oils continues to increase in both the UHPD

and SHPD market tiers, demand for the lighter viscosity

In the short term, as DPF usage increases in heavy duty

applications the demand for lower SAPS engine oils

meeting ACEA E6-08 and ACEA E9-08 will continue to

increase rapidly and is forecast to represent over a third

of all engine oil demand by 2013.

For further information on changes in heavy duty diesel

engine oils see www.lubrizol.com\ACEA2008

Anda mungkin juga menyukai

- Spesifikasi Oli MesinDokumen6 halamanSpesifikasi Oli MesinRichard FebrinoBelum ada peringkat

- API-SAE Engine Oil Service BoletinDokumen2 halamanAPI-SAE Engine Oil Service BoletinElmer PatpaulBelum ada peringkat

- Fact Sheet - API ClassificationsDokumen7 halamanFact Sheet - API ClassificationsArif SuhartoBelum ada peringkat

- ACEA Engine Oil in ShortDokumen2 halamanACEA Engine Oil in ShortRajiv SrivastavaBelum ada peringkat

- Ecf 3Dokumen2 halamanEcf 3ZERO-HBelum ada peringkat

- Base Oil Product TrendsDokumen18 halamanBase Oil Product Trendsrvsingh100% (2)

- API Oil Guide 2011Dokumen4 halamanAPI Oil Guide 2011Daniel Shimomoto de AraujoBelum ada peringkat

- Designations 111Dokumen5 halamanDesignations 111Oumarba KamandaBelum ada peringkat

- Sales Engineering Information: 4.04. Fuel Specification For DAF Diesel EnginesDokumen6 halamanSales Engineering Information: 4.04. Fuel Specification For DAF Diesel EnginesBartek GrzybowskiBelum ada peringkat

- API Oil Guide 2010Dokumen4 halamanAPI Oil Guide 2010Tudor RatiuBelum ada peringkat

- Cat Engine Crankcase FluidsDokumen8 halamanCat Engine Crankcase FluidsTiago RodriguesBelum ada peringkat

- Shell Lubricants CK4 and FA4 Technical Brochure LoDokumen20 halamanShell Lubricants CK4 and FA4 Technical Brochure LoiosalcidoBelum ada peringkat

- Service Bulletin: Engine OilDokumen16 halamanService Bulletin: Engine OilDan LiamBelum ada peringkat

- Volvo Next Generation RequirementsDokumen4 halamanVolvo Next Generation RequirementsJako MishyBelum ada peringkat

- ACEA Oil SequencesDokumen14 halamanACEA Oil Sequencesctiiin100% (1)

- Engine Oil: Operation and Maintenance ManualDokumen5 halamanEngine Oil: Operation and Maintenance ManualАлександр БудзинскийBelum ada peringkat

- Lubricants CATEGORIESDokumen6 halamanLubricants CATEGORIEShassantaufik.iqiBelum ada peringkat

- ACEA Oil Sequences FinalDokumen15 halamanACEA Oil Sequences Finalbluesys100% (1)

- Vw-Audi Oil Spec ArticleDokumen5 halamanVw-Audi Oil Spec ArticleLindsay MooreBelum ada peringkat

- Advanced Fuel Inj Technology Future Diesel PowertrainDokumen17 halamanAdvanced Fuel Inj Technology Future Diesel PowertrainDan SerbBelum ada peringkat

- Guide To Engine Oil Claims and Specs Top TechDokumen1 halamanGuide To Engine Oil Claims and Specs Top Techd_ansari26Belum ada peringkat

- API Oil Guide 2010Dokumen4 halamanAPI Oil Guide 2010amsoilromaniaBelum ada peringkat

- LZ LUBEMagFeb2010 EORoleFuelEconomyDokumen2 halamanLZ LUBEMagFeb2010 EORoleFuelEconomyMukul AzadBelum ada peringkat

- Capacidades de Recarga e RecomendaçõesDokumen9 halamanCapacidades de Recarga e RecomendaçõesislanmateusfrBelum ada peringkat

- ACEA Oil Sequences: General RequirementsDokumen6 halamanACEA Oil Sequences: General RequirementswurtukukBelum ada peringkat

- 2012 ACEA Oil SequencesDokumen14 halaman2012 ACEA Oil SequencesmichaelovitchBelum ada peringkat

- Fuel and OilDokumen15 halamanFuel and OilNur AzizahBelum ada peringkat

- Oil Spec AceaDokumen4 halamanOil Spec Aceaeoinreynolds94Belum ada peringkat

- Acea 2002Dokumen13 halamanAcea 2002alghifari27Belum ada peringkat

- Lubricant SpecificationsDokumen6 halamanLubricant SpecificationsAbdellatif BaKrBelum ada peringkat

- ACEA European Oil Sequences 2016Dokumen15 halamanACEA European Oil Sequences 2016David PomaBelum ada peringkat

- SEBU 6251 Oil - Engine Crankcase Fluid RecommendationsDokumen6 halamanSEBU 6251 Oil - Engine Crankcase Fluid RecommendationsAndri Konyoa Konyoa0% (1)

- 2009 Engine Oil Guide PDFDokumen3 halaman2009 Engine Oil Guide PDFahmetBelum ada peringkat

- Oil w4015Dokumen4 halamanOil w4015Ripai AhmadBelum ada peringkat

- Essential Guide To Motor Oil Brochure FINAL PDFDokumen16 halamanEssential Guide To Motor Oil Brochure FINAL PDFMauris BelmonteBelum ada peringkat

- BMW Oil Specs and RecsDokumen5 halamanBMW Oil Specs and RecsSami Mlijy100% (1)

- Driving Heavy Duty Engine Oil Towards API CI-4Dokumen18 halamanDriving Heavy Duty Engine Oil Towards API CI-4robertoalfaro492023100% (1)

- Engine OilDokumen3 halamanEngine Oiladzli khaizuranBelum ada peringkat

- ACEA Oil Sequences 2021Dokumen6 halamanACEA Oil Sequences 2021anibal_rios_rivasBelum ada peringkat

- Lubricating Oil in EGR Diesel EnginesDokumen4 halamanLubricating Oil in EGR Diesel Enginesman_iphBelum ada peringkat

- Which Oil Is Right For You?Dokumen4 halamanWhich Oil Is Right For You?Cherille DBelum ada peringkat

- BP On Off Highway Product Range LeafletDokumen4 halamanBP On Off Highway Product Range Leafletmedidas012Belum ada peringkat

- Acea European Oil Sequences 2021Dokumen7 halamanAcea European Oil Sequences 2021alghifari27Belum ada peringkat

- Castrol Canada Gps 2019 PDFDokumen173 halamanCastrol Canada Gps 2019 PDFJeremias UtreraBelum ada peringkat

- 2021 ACEA Oil Sequences Light-Duty EnginesDokumen7 halaman2021 ACEA Oil Sequences Light-Duty EnginesSupriyadiBelum ada peringkat

- Bosch Fuel LubricityDokumen4 halamanBosch Fuel LubricityvictorpoedeBelum ada peringkat

- 26 - 27 - 206 Dad Ed01 2002Dokumen2 halaman26 - 27 - 206 Dad Ed01 2002Pussyclit LickerBelum ada peringkat

- Section 5 - Fuel, Lubricating Oil, and CoolantDokumen11 halamanSection 5 - Fuel, Lubricating Oil, and CoolantRamon100% (1)

- Gear Oil ClassificationDokumen27 halamanGear Oil ClassificationSiva ReddyBelum ada peringkat

- Maintenance Intervals: Operation and Maintenance Manual ExcerptDokumen65 halamanMaintenance Intervals: Operation and Maintenance Manual ExcerptmedescalanteBelum ada peringkat

- Gas Engines Oils TechPaperDokumen15 halamanGas Engines Oils TechPaperZamani Mahdi100% (1)

- Surface Vehicle Recommended PracticeDokumen7 halamanSurface Vehicle Recommended Practicewilian_coelho3309Belum ada peringkat

- 1 FT1536 c6 - E4ab0101p0 - Recommend Lubricants 2010Dokumen13 halaman1 FT1536 c6 - E4ab0101p0 - Recommend Lubricants 2010Yuri HovadickBelum ada peringkat

- ACEADokumen14 halamanACEAChristopher KelleyBelum ada peringkat

- Cat DEODokumen4 halamanCat DEOahmed_eng_1500Belum ada peringkat

- BMW 5 & 6 Series E12 - E24 - E28 -E34 Restoration Tips and TechniquesDari EverandBMW 5 & 6 Series E12 - E24 - E28 -E34 Restoration Tips and TechniquesBelum ada peringkat

- LS Swaps: How to Swap GM LS Engines into Almost AnythingDari EverandLS Swaps: How to Swap GM LS Engines into Almost AnythingPenilaian: 3.5 dari 5 bintang3.5/5 (2)

- Mercedes Benz & Dodge Sprinter CDI 2000-2006 Owners Workshop ManualDari EverandMercedes Benz & Dodge Sprinter CDI 2000-2006 Owners Workshop ManualPenilaian: 2.5 dari 5 bintang2.5/5 (2)

- Mercedes Benz & Dodge Sprinter CDI 2000-2006 Owners Workshop ManualDari EverandMercedes Benz & Dodge Sprinter CDI 2000-2006 Owners Workshop ManualBelum ada peringkat

- Author's Accepted Manuscript: Physica B: Physics of Condensed MatterDokumen29 halamanAuthor's Accepted Manuscript: Physica B: Physics of Condensed MatteryassinebouazziBelum ada peringkat

- TSO C72cDokumen6 halamanTSO C72cRobert FlorezBelum ada peringkat

- 4 BrickDokumen31 halaman4 BrickNardos GebruBelum ada peringkat

- Chills General RulesDokumen36 halamanChills General RulesMuthu KumarBelum ada peringkat

- Hey 4-N/i'ethylenedio Yphenyl Sopropyl E.: 4-MethylenedioxyphenylisopropylamineDokumen2 halamanHey 4-N/i'ethylenedio Yphenyl Sopropyl E.: 4-MethylenedioxyphenylisopropylamineAnonymous FigYuONxuuBelum ada peringkat

- Effect of Particle Size On Rotary Drum CompostingDokumen21 halamanEffect of Particle Size On Rotary Drum CompostingNaztovenBelum ada peringkat

- Hi-Tech Gaskets Catalogue PDFDokumen60 halamanHi-Tech Gaskets Catalogue PDFVivek AnandBelum ada peringkat

- Factors Influencing ToxicityDokumen7 halamanFactors Influencing ToxicityderrickBelum ada peringkat

- Experiment 15.2 Temperature and Le Chatalier's Principle I. PurposeDokumen3 halamanExperiment 15.2 Temperature and Le Chatalier's Principle I. PurposeDingBelum ada peringkat

- Heat Treat System Assessment CQI-9Dokumen48 halamanHeat Treat System Assessment CQI-9shashi kant kumarBelum ada peringkat

- Cold Black FXDokumen3 halamanCold Black FXpankaj chaudharyBelum ada peringkat

- Environmental Chemistry and Microbiology - Unit 3 - Week 1Dokumen6 halamanEnvironmental Chemistry and Microbiology - Unit 3 - Week 1Abhijit NathBelum ada peringkat

- PH - Wikipedia, The Free EncyclopediaDokumen11 halamanPH - Wikipedia, The Free EncyclopediaShikhar MahajanBelum ada peringkat

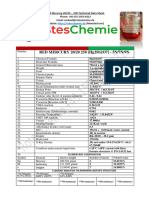

- Red Mercury 2020 Technical Data SheetDokumen2 halamanRed Mercury 2020 Technical Data SheetThe UniversBelum ada peringkat

- State Wise Distribution of Units Registered Under Factories Act, 1948Dokumen6 halamanState Wise Distribution of Units Registered Under Factories Act, 1948api-19850688Belum ada peringkat

- Magpro BrochureDokumen20 halamanMagpro BrochuresabiuBelum ada peringkat

- RioBooster SDSDokumen10 halamanRioBooster SDSpepeBelum ada peringkat

- Acyclic HydrocarbonsDokumen14 halamanAcyclic Hydrocarbonsvishal_kalraBelum ada peringkat

- Compounding PracticeDokumen19 halamanCompounding PracticeBrix GallardoBelum ada peringkat

- Experiment 6: Determination of Ascorbic Acid Using Iodometric Titration MethodDokumen7 halamanExperiment 6: Determination of Ascorbic Acid Using Iodometric Titration MethodNurul AdBelum ada peringkat

- Shell MFO 500 (Non ISO Grade) : Test Property Unit MethodDokumen1 halamanShell MFO 500 (Non ISO Grade) : Test Property Unit MethodVilius BukysBelum ada peringkat

- H2SDokumen21 halamanH2SBeatrizCamposBelum ada peringkat

- Fuel Cells Article in ISOFT by Inderraj GulatiDokumen6 halamanFuel Cells Article in ISOFT by Inderraj GulatiInderraj_Gulati100% (1)

- Flange Sealing Guide - EN PDFDokumen64 halamanFlange Sealing Guide - EN PDFAli AlizadehBelum ada peringkat

- Herbert Brown and Edward N. Peters' : Abstract: 80% or (503 000)Dokumen5 halamanHerbert Brown and Edward N. Peters' : Abstract: 80% or (503 000)Liz HansBelum ada peringkat

- Sci3 Q1mod5 Changes in Materials Brenda Quilladas Bgo v1Dokumen25 halamanSci3 Q1mod5 Changes in Materials Brenda Quilladas Bgo v1MArkBelum ada peringkat

- ISSN:2157-7048: Executive EditorsDokumen10 halamanISSN:2157-7048: Executive EditorsElaziouti AbdelkaderBelum ada peringkat

- CHM 3104 Chemical Thermodynamics: 1) Pn. HayatiDokumen8 halamanCHM 3104 Chemical Thermodynamics: 1) Pn. HayatiFatimah zafirahBelum ada peringkat

- Antimicrobial FinishesDokumen32 halamanAntimicrobial Finisheschahat anejaBelum ada peringkat

- The Frenkel-Kontorova Model - IntroductionDokumen5 halamanThe Frenkel-Kontorova Model - Introductionreal thinkerBelum ada peringkat