G S B S U: Raduate Chool of Usiness Tanford Niversity

Diunggah oleh

claudioJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

G S B S U: Raduate Chool of Usiness Tanford Niversity

Diunggah oleh

claudioHak Cipta:

Format Tersedia

GRADUATE SCHOOL OF BUSINESS

STANFORD UNIVERSITY

CASE NUMBER: EC-15

FEBRUARY 2000

CISCO SYSTEMS: A NOVEL APPROACH TO

STRUCTURING ENTREPRENEURIAL VENTURES

Mike Volpi, vice president of business development at Cisco Systems, was in his office in

San Jose at Ciscos headquarters on June 27, 1997. He was considering strategic questions that

he had faced many times since joining Ciscos business development group in 1994. Volpis

colleagues had identified a new networking opportunity in optical routers, and Volpi wondered

whether Cisco should develop the product internally or pursue external talent that was more

familiar with the technology and market segment? If the external route was the best strategy to

get the right product to market on time, should Cisco build its own external venture or just

acquire someone outright?

NETWORKING OPPORTUNITY: PIPELINKS

For the previous two years, Cisco had been preaching about the promise of a multiservice network a single network that could transport data, voice, and video. Ciscos service

provider customers agreed that network convergence would ultimately improve cost

effectiveness and allow them to expand their service offerings. However, most service providers

were saddled with huge investments in circuit-based voice networks. This implied a market need

for optical (Sonet/SDH) routers that leveraged the existing infrastructure while enabling a

transition to multi-service networks: the market needed a product that could simultaneously

transport circuit-based traffic and route IP (Internet Protocol) traffic.1

Discussions with representatives from Ciscos Service Provider Line of Business

(SPLOB) indicated that developing optical routers internally was not a viable option. A brief

search had failed to identify attractive acquisition targets-no player had the people, products,

technological innovation, ownership concentration, and location that Cisco wanted. In a

Sonet/SDH (synchronous optical network/synchronous digital hierarchy) is a protocol for data transmission over

fiber optic lines.

Research Associates James McJunkin and Todd Reynders prepared this case under the supervision of Professor Garth Saloner

and Professor A. Michael Spence as the basis for class discussion rather than to illustrate either effective or ineffective handling

of an administrative situation. Margot Sutherland, Executive Director, Center for Electronic Business and Commerce, Stanford

Graduate School of Business managed the development of this case.

Copyright 2000 by the Board of Trustees of the Leland Stanford Junior University. All rights reserved. To order copies or

request permission to reproduce materials, email the Case Writing Office at: cwo@gsb.stanford.edu or write: Case Writing

Office, Graduate School of Business, Stanford University, Stanford, CA 94305-5015. No part of this publication may be

reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means - electronic,

mechanical, photocopying, recording, or otherwise - without the permission of the Stanford Graduate School of Business.

Version: (B 03/20/01

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 2

fortunate coincidence, however, entrepreneur Amit Shah had approached Cisco with an idea for a

Sonet/SDH router that was similar to the product that Cisco envisioned. Shahs company,

Pipelinks, was still in the idea stage so an outright acquisition was not yet appropriate. Volpi

realized that this situation exhibited similarities to one he had faced a year earlier. When Cisco

had created a custom, made-to-order company called Ardent Communications to fill a market

void. Plenty of mistakes had been made in structuring the venture, but much had been done

right. Volpi dug up the Ardent file and contemplated possible strategic and structural

improvements that could be made, in the hope that some incarnation of the spin-in model would

be an effective way to serve the current market need.

BACKGROUND ON CISCO SYSTEMS INC.2

Leonard Bosack and Sandy Lerner, husband and wife computer scientists at Stanford University

who invented a technology to link their disparate computer systems together founded Cisco

Systems in 1984.

They developed the first multi-protocol router a specialized

microcomputer that allowed two or more networks to talk to each other by deciphering,

translating, and funneling data between them. Ciscos technology opened up the potential to link

the worlds disparate computer networks together the way different telephone networks were

linked around the world.

Cisco began by offering high-end routers primarily in the LAN (local-area network) market. The

devices were the traffic cops of cyberspace they directed network traffic to its final destination

via the most efficient, least congested network path. As the global Internet and corporate

Intranets became more important, so too did Cisco. With an early foothold in this rapidly

growing industry, Cisco quickly became the leader in the data networking equipment market

the plumbing of the Internet. By 1997, Cisco made approximately 80% of the large-scale

routers that powered the Internet. Although routers, LAN switches, and wide-area network

(WAN) switches would remain Ciscos core products, the companys product line included other

networking solutions, including Web site management tools, dial-up and other remote access

solutions, Internet appliances, and network management software. Despite the breadth of its

product offerings, Cisco held the number one or two position in most markets in which it

competed. Ciscos Internetwork Operating System (IOS) software was also becoming the de

facto industry standard for delivering network services and enabling networked applications.3

Cisco received its initial funding from the venture capital firm Sequoia capital, who helped to

recruit John Morgridge as CEO in 1988. The company went public in February 1990 with a

$222 million market value and grew into a multinational corporation with over 10,000 employees

in 54 countries. By 1997, revenues had increased over ninety-fold since the IPO, from $69.8

million in fiscal 1990 to $6.4 billion in fiscal 1997. (Exhibit 1) In June 1997, Ciscos market

value totaled $46.3 billion.

Excerpts taken from Cisco Systems, Inc. Acquisition Integration for Manufacturing, Case # OIT-26, Graduate

School of Business Stanford University and Harvard Business School, revised January 1999.

3

Ciscos IOS Software was the industry leading internetworking software, like Microsoft Windows for networking.

IOS is a platform that delivers network services and enables networked applications. IOS enables interoperability

connections between otherwise disparate hardware, and accommodates network growth, change, and new

applications. It also contains security features, including access control, authentication, firewall, and encryption.

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 3

Two respected CEOs have led the company: John Morgridge and John Chambers. Morgridge

shaped the Cisco culture from day one, focusing on customer satisfaction, product quality, and

frugality. He once gave a legendary presentation on frugality to the Cisco sales force, after being

appalled by reports that salespeople were flying first class on business trips. Equipped with

slippers, earplugs, and eye covers, Morgridge displayed how to fly coach and make it seem like

first class. John Chambers, who joined Cisco in 1991 and succeeded Morgridge in January 1995,

was known for his fair but ultra-competitive nature. Chambers, a former IBM and Wang

Laboratories marketing and sales veteran, fostered Ciscos strong customer focus and was

credited with continuing Ciscos striking success in the networking industry.

Corporate Strategy

Throughout the 1990s, organizations of all sizes were beginning to recognize the value of their

information networks and the Internet as a source of business advantage. As a result, more of

Ciscos customers sought end-to-end networking solutions. Building on its expertise in routers,

Cisco strove to deliver a wide range of new products, expand its offerings through internal and

external efforts, enhance customer support, and increase its presence around the world.

The main element of Ciscos strategy during this expansion phase was to maintain a passionate

customer focus and consistently try to exceed customer expectations. To deliver on that goal,

Chambers reorganized Cisco to target three key markets: Enterprise, Service Providers, and

Small/Medium Business. The new organization enabled Cisco to provide market specific, endto-end solutions that included integrated software, hardware, and network management and to

customize its sales, support, and business programs to each market.

One of the keys to the companys success was the Cisco brand, which was recognized as a

leading name in networking. Customers associated the Cisco brand with a secure, reliable, highperformance network. Chambers wanted to enhance and expand the brand, and increased

Ciscos marketing to include television, Internet, and print advertising.

The ongoing deregulation of telecommunications and technology convergence were driving the

trend toward the integration of voice, video, and data networks. Historically, there had been

three separate types of networks: phone networks for transmitting voice, computer networks for

transmitting data, and broadcast networks for transmitting video but advances in digitization

allowed these forms of communication to be translated into binary computer language. This, in

turn, made it possible to transmit voice, data, and video over one network more efficiently and

economically than using three disparate networks. As a result, phone companies were beginning

to transform their archaic voice networks into unified, multi-service networks.

Chambers believed that this transition to the New World of communications would enable

Cisco to capture share in the $250 billion telecom equipment market that huge, well-capitalized

companies such as Lucent Technologies and Northern Telecom had dominated. These

competitors were so large that Chambers instilled a David vs. Goliath mentality within Cisco.

While expanding into these new markets, Cisco also strove to maintain its product leadership in

each of the market segments it already served. The product leadership strategy involved the

innovation of Cisco's engineering teams, complemented by alliances, acquisitions, and minority

investments.

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 4

Building Shareholder Value through Acquisitions, Investments and Alliances

As the networking space became more competitive, and as minimizing time to market became

more important, Chambers realized that Cisco could not keep up with the changing market needs

solely through internal development. Acquisitions and alliances to gain access to world-class

technologies and people became a defining component of Ciscos strategy. This strategy was

relatively unique: most high-tech companies considered looking to the outside for technological

help a sign of weakness. Chambers commented on the acquisitions and alliances strategy:

They are a requirement, given how rapidly customer expectations change. The

companies who emerge as industry leaders will be those who understand how to

partner and those who understand how to acquire. Customers today are not just

looking for pinpoint products, but end-to-end solutions. A horizontal business

model always beats a vertical business model. So youve got to be able to provide

that horizontal capability in your product line, either through your own R&D, or

through acquisitions.4

Although Chambers and Ed Kozel, Ciscos chief technology officer, were a key driving force

behind Ciscos business development strategy, many in the industry regarded Mike Volpi as the

man responsible for shaping Ciscos legendary business development practice.5 When Volpi

joined Cisco in 1994 after graduating from the Stanford Graduate School of Business, Cisco had

completed only one acquisition, Crescendo Communications. Two more acquisitions closed

soon after Volpi arrived, but he was involved in all subsequent acquisitions.

Before pursuing a new market opportunity, Volpis group assessed the buy vs. build strategies.

If Cisco did not have the technological capability, engineering capacity, or time to develop the

product internally, the business development group would often opt to acquire or partner with an

external player. Although the acquisitions made headlines, licensing, partnering, and investing

were equally important to Ciscos strategy. Cisco was an active minority investor, which gave it

insight into new technologies without having to deploy internal development resources. Volpi

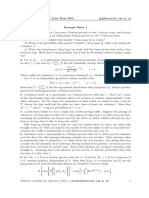

used a simple chart to assess companies (Figure 1).

Figure 1: Range of Ciscos Business Development Activities

Acquire

Invest

Joint R&D/ Marketing/Sales

Degree of

Strategic

Value

OEM/ License

Level of Commitment

The Art of the Deal, Business 2.0, October 1999.

Volpi initially reported to Charles Giancarlo, who joined Cisco through the Kalpana acquisition in 1994 and served

as VP of business development until March 1997, when Volpi assumed that title.

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 5

The public equity markets were the principal exit strategy for hot high-tech start-ups, but a Cisco

acquisition appealed to many networking companies. Cisco was the most effective tech company

at identifying, acquiring, and successfully integrating companies into its culture. By June 1997,

after the Ardent deal closed, Cisco had acquired 19 companies for an aggregate total of roughly

$7 billion (Exhibit 3). Why did Cisco do this better than the competition? We made every

mistake in the book, Volpi stated, but we learned from these mistakes, and they have helped us

in subsequent transactions.

Instead of acquiring large, established, public companies, Cisco typically acquired small

private companies, for $200 million or less.6 The smaller acquisitions made integration easier

large, established companies with strong corporate cultures were more difficult to integrate.

Chambers also asserted that Cisco did not acquire to gain short-term market share, but to find

technology and talent for the future:

When we acquire a company, we arent simply acquiring its current products,

were acquiring the next generation of products through its people. If you pay

between $500,000 and $3 million per employee, and all you are doing is buying

the current research and current market share, youre making a terrible

investment. In the average acquisition, 40 to 80 percent of the top management

and key engineers are gone in two years. By those metrics, most acquisitions

fail.7

Charles Giancarlo, Ciscos vice president of business development from 1994 to 1997, reiterated

the importance of acquiring and retaining key people:

When you are buying a company its obviously not for todays products. That

means keeping the people in place who can create that growth. We wont do a

deal if a company has golden parachutes accelerated vesting for employees

that kicks in once a company is sold. The minute you buy the company, they all

get rich. We prefer golden handcuffs, which are applied with two-year

noncompete agreements with key executives and technical personnel at the target

companies, and the provision of Cisco stock options that vest over time.8

LOOKING BACK TO 1996: THE MARKET OPPORTUNITY FOR A NEW ACCESS PRODUCT

In 1996, the evolution of network infrastructure was creating business opportunities in virtually

every sector of networking. Ciscos unique vantage point allowed it to rapidly identify these new

markets. By early 1996, Cisco believed that a need existed for an inexpensive product to carry

voice, data, and video traffic from a companys local-area network to the wide-area network.

Cisco identified two principal customer needs. The first was to simplify and improve

management of network access equipment. The conventional approach to public network access

required cabling disparate hardware components (such as leased line modems, channel banks,

6

The $4.6 billion acquisition in April 1996 of StrataCom, which filled Ciscos hole in WAN switching products,

stands out as an exception.

7

The Art of the Deal, Business 2.0, October 1999.

8

Ciscos Secret: Entrepreneurs Sell Out, Stay Put, Inc. Magazine, March 1997.

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 6

etc.) together, creating a complex hardware puzzle. Companies incurred high maintenance costs

and trouble-shooting nightmares because a different management system controlled each

component. The second was to optimize use of expensive WAN bandwidth. Despite the

industry buzz about high-speed ATM trunks,9 Cisco believed that these solutions would remain

expensive especially compared to LAN bandwidth where Ethernet technology10 dominated.

Cisco expected high-speed network access solutions, running at T3 (4.5Mbps) or OC-3

(155Mbps), to be confined to niche markets for the foreseeable future. Most customers would

choose the slower, more economical T1/E1 (1.5Mbps) link to the WAN.

These factors highlighted a market opportunity for an access solution that aggregated LAN-based

data, voice, and video traffic over the low cost T1/E1 ATM trunk. This solution would help

service providers:

Provide an integrated T1/E1 access solution that was cost-effective for wide

deployment

Contain costs by using a single product in multiple applications

Contain upgrade/conversion costs by using a remotely configurable product

Contain support costs by using a product with an interface familiar to both customers and

service providers.

This product concept was the genesis of Ardent Communications.

New Venture Strategy

In 1996, Volpi contemplated the traditional buy and build alternatives for the market that Ardent

Communications would serve. Building the product in-house had several advantages notably

not having to integrate two different organizations. The multi-service access business unit had

been doing similar things on a day-to-day basis, but lacked the human resources to devote to the

new project. Diverting resources away from current projects was not feasible. Building the

product in-house would take too long competition from 3Com, Ascend, US Robotics, and

Micom made time to market a priority. The business development team concluded that Cisco had

neither the time nor the resources to go after the new market on its own.

Buying a company whose products addressed this market was another option. However, Cisco

had a clear conception of the market need, but was unable to identify attractive companies that

were focused on this space. Volpis experience suggested that finding the right acquisition target

would be difficult in all cases Cisco would have to spend time and effort modifying the product

set and integrating the newly acquired company into the Cisco organization. Retaining key

employees post-acquisition was also always difficult.

Finding neither the buy or build alternatives satisfactory, Volpi mused, Why not custom make a

start-up to build exactly the product we want, and then buy them later if they succeed? This

solution would entail creating a new venture as a spin-in from day one build to buy. This

A trunk is an access line that connects remote offices or central sites to the service provider network. Asynchronous

Transfer Mode (ATM) is a data transfer technique where multiple service types, such as voice, video, or data, are

conveyed in small, fixed-size cells.

10

In 1996, Ethernet technology penetrated every corner of the Enterprise network with 10BaseT (10Mbps),

100BaseT (100Mbps), and the coming Gigabit Ethernet (1000Mbps).

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 7

spin-in model seemed to address three key issues: time-to-market, recruiting top talent, and

integration with the relevant Cisco business unit.

However, the Cisco business development team realized that the hybrid nature of the spin-in

solution raised difficult tradeoffs. What structure would allow the start-up to leverage Ciscos

strategic assets without quashing the entrepreneurial feel? How should Cisco structure the

venture to minimize the tradeoff between the virtues of independence and the need for smooth

ex-post integration? Could Cisco personnel coach the new team without stifling creativity?

Should Cisco invite other investors to participate in the financing? How large an initial

ownership stake should Cisco take in the venture? Incentives would also be a major issue: How

could Cisco provide the right incentives for the new ventures management and employees,

without upsetting the current Cisco employees who would help integrate the new venture?

Eventually, the new venture would have to live within an existing Cisco business unit and rely on

Cisco employees for success.

Structuring the Ardent Communications Venture

To develop a potential model for the new venture approach in 1996, Volpi and Kozel had

reflected on an earlier deal that Cisco had considered. In the spring of 1996, Wu Fu Chen, a

networking entrepreneur, was working with Sequoia Capital and two Cisco employees to launch

a new networking company. The idea for this company came from the Cisco employees, who

intended to leave their jobs at Cisco to build a solution that they hoped Cisco would want to

acquire. The product concept had potential, and the founding team was flush with engineering

talent. Wu Fu Chen had co-founded four companies since 1986, including Cascade

Communications and Arris Networks. Yet the Cisco business development team declined to

invest: Chambers believed that funding Cisco employees to go out and build new networking

companies would set a dangerous precedent.

Mike Volpi and Ed Kozel believed that Wu Fu would be an excellent person to recruit as

President and CEO of the proposed spin-in venture, which they would call Ardent

Communications. Kozel contacted Wu Fu and outlined the Ardent business idea and Ciscos

spin-in concept. Volpi later characterized the initial message to Wu Fu as simply, Make this

product and well give you lots of money. After a series of discussions, Wu Fu agreed to head

up the Ardent venture.

Defining the Ardent 101 Product

In June 1996, Kozel, Volpi, and Wu Fu outlined the basic functional specification for the first

Ardent product, tentatively called Ardent 101. For Cisco to buy the new company, Wu Fu and

his team needed to develop a traffic aggregation device for data, voice, and video with certain

functional requirements (Figure 2). The group also developed milestones that would set

expectations for the product timeline (Figure 3).

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 8

Figure 2: Ardent 101 Functional Requirements

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Ability to accept data, voice, and video traffic

Aggregate up to 2Mbps traffic on the WAN side

Support ATM, Frame Relay, and TDM trunks

Support standard office environments

Support Bridging, IP Routing for LAN data traffic

Support Circuit Emulation for Voice and Video Applications

Support voice and data compression

The target list price for the base configuration is about $5,000; Cost of

goods target is $800 or lower

Will consider support of data encryption

Support European requirements (E1)

Figure 3: Ardent 101 Milestones

1.

2.

3.

4.

Six months after the Effective Date of the Agreement, the Company shall have

completed the specifications for function, architecture, and design for the

Product

Twelve months after the Effective Date of the Agreement, the Company shall

have begun integration of the Product

Fifteen months after Effective Date of the Agreement, the Company shall have

begun the beta program for the Product

Eighteen months after the Effective Date of the Agreement, First Customer

Shipment shall have occurred

Capital Structure

By June 14, 1996, Cisco and Wu Fus team had agreed on a preliminary term sheet for the new

venture (Exhibit 4). Kozel and Volpi invited Sequoia Capital to participate in the financing to

create a more start-up feel. To foster an entrepreneurial environment with strong employee

incentives, Cisco gave the founding team and employees a large ownership position over 55%

on a fully diluted basis. Cisco sought an equity stake of only 32% for itself. This was a major

departure from the large equity shares other parent companies were requesting in their spin-ins

and spin-outs (arguing that their intellectual property, brand name, and other resources entitled

them to free equity). Sequoia Capital also took a relatively small equity position of 11%. All

parties agreed that a balanced board of directors would deliver the right control over the

companys direction. Initially, the board would consist of Wu Fu, Ed Kozel, and Sequoias Mike

Goguen.

Unlike most venture deals, the Series A and Series B rounds were negotiated simultaneously,

with closing dates less than two months apart. In the A round (July 11 closing) Wu Fu and the

other members of the founding team would purchase 3 million shares of Series A Preferred Stock

at $0.333 per share. The low share price was analogous to cheap founders stock in an

entrepreneurial venture. Neither Cisco nor Sequoia would participate in the A round. The

implied post-money valuation as of July 11 was $2.4 million.

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 9

For the B round, the new company decided to issue 11 million shares. On August 30, Ardent

received the first cash infusion of the B round, in which Sequoia Capital purchased

approximately 2.5 million shares at $1.00 per share. Cisco also made its investment at $1.00 per

share, purchasing 7.535 million shares of Series B Preferred Stock on September 20. Seven days

later, the founders purchased another one million shares. The remaining equity capitalization

consisted of 9.25 million shares of common stock, of which approximately 3 million shares

would go to the engineering team as option grants. The implied post-money valuation as of

August 30 was $23.3 million. Exhibit 5 describes the rough capitalization table Cisco used.

Retaining Key Employees

Volpi knew that even though Cisco was creating Ardent to produce a specific product, it was the

people, not the product, that represented much of Ardents value. Cisco therefore laid out a fouryear vesting period for the options granted to employees 25 percent would vest after the first

year, with the remainder vesting monthly over the next three years. Upon a change in control,

like the planned acquisition by Cisco, only Wu Fu Chens vesting would accelerate (at most one

year of vesting would remain, but he was subject to a one-year lock up agreement which kept

him from leaving Ardent upon acquisition).

Facilitating the Spin-in: The Put/Call Feature

Cisco needed a legal mechanism that would allow Ardent to cleanly spin-in at some point in

the future. The founding team proposed a simple put/call structure that would give Cisco the

option to purchase the company at a pre-specified price, but would also obligate Cisco to

purchase the company if the new team succeeded in building the product. This was the first time

that Cisco had integrated a put/call feature into a strategic investment. John Chambers and Ed

Kozel viewed it as an innovative mechanism for developing a made-to-order company. The

Option section of the term sheet explained the call option:

Until the earlier of fifteen (15) months from the closing or one (1) month after the first

customer shipment, Cisco shall have the right to acquire either all of the outstanding

equity securities of the Company, or all of the Companys assets, in Ciscos discretion,

for a purchase price of $232,500,000, payable either in cash or equity securities of

Cisco.11

Since Cisco would also write a put option, the shareholders in the new venture could force it to

purchase the company at the pre-specified price, as long as the ten specific functional

requirements were met. To keep matters simple, the put and call would have the same strike

price. The put option read:

if First Customer Shipment occurs within (15) months after the functional

requirements for the Product are first defined, and in Ciscos reasonable judgment, the

product meets the specifications set forth, each of the security holders shall sell its

Securities to Cisco, and Cisco shall be obliged to and will purchase such Securities, in

accordance with the purchase price and other terms of purchase12

11

Excerpt from Memorandum of Terms for Private Placement of Series A and B Preferred Stock of Ardent

Corporation, June 1996.

12

Ibid.

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 10

Cisco believed that although the put/call structure truncated the upside for investors and

employees, it mitigated enough risk to make the investment or employment decision attractive

from a risk/reward standpoint. The option agreement turned out to be a very effective recruiting

instrument. If the product requirements and milestones were met, the 15-20 person engineering

team would share a $30 million payout in less than 15 months. The five person founding team

would do even better: delivering on the product would allow them to share more than $100

million.

Leveraging Ciscos Assets

IOS

The Ardent product would complement Ciscos existing multi-service access products (called the

3800 product family). To facilitate interoperability, Volpi decided to license Ciscos IOS

software to Ardent free of charge until Ciscos option to buy the company expired. IOS was to

be the architectural foundation for Ardent 101. Ardent would focus on adding the technologies

of ATM and Frame Relay over a T1/E1 connection, circuit emulation for digitized voice over

ATM or Frame Relay, voice compression, and telephony capabilities. These changes were not on

the official evolutionary path of IOS, though they were similar to development work being done

within Cisco. Many Cisco employees had also created and modified IOS for use in the various

products Cisco sold, but not to be sold as a shrink-wrapped software product. The procedures to

use and adapt IOS were not well documented, which would present a challenge to the Ardent

employees. Under the terms of the licensing deal, Cisco would retain all ownership of IOS,

including software Ardent developed to interact directly with IOS.

Licensing IOS software to Ardent for free was contentious it upset Cisco personnel who felt that

the company was giving away the crown jewels, the real value-add in Ciscos solutions, and then

paying to buy it back.

Engineering talent

Ardent would also need engineering help to integrate IOS into its new product. To address this

issue, a few Cisco employees were selected to work with the Ardent team throughout the

development process. This was not unusual, because Cisco had provided consulting services in

the past. Ardent paid the standard fee for these engineering resources, $250,000 per engineer per

year. Since this was regarded as a temporary assignment, these people remained employees of

Cisco under the same terms as they had before Ardent surfaced.

Testing and certification facilities

Cisco also provided testing and certification facilities. Cisco allowed Ardent to use its testing

and certification facilities free of charge until the option period expired, after which Ardent

would pay a nominal fee.

Business unit expertise

A key issue was the extent to which the multi-service access business unit should coach Ardent

through the development process and stay informed about what progress had been made. Cisco

had similar products in the pipeline, but none overlapped significantly with Ardent 101 as

defined in the product requirements document. Volpi and Kozel decided not to involve the

business units until after the Ardent product was completed. This approach seemed appropriate

because the product specification had already been narrowly defined, minimizing the degrees of

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

freedom and therefore the need for frequent coaching or updates.

stealth mode through early 1997.

p. 11

Hence, Ardent operated in

Cisco form factor

Both Cisco and Ardent wanted the new product to have the look and feel of the Cisco product

line, although the product specification did not require it. Instead of designing a tailored box for

Ardent 101, Wu Fu decided to adhere to the existing Cisco product line and required his

engineers to adopt the form factor for the Cisco 2500 series. This solution was compact and

familiar to Ciscos carrier customers. Squeezing Ardent 101 into the 2500 box would be

engineering and manufacturing challenge, but the Ardent engineers felt confident it could be

done.

Accounting issues

The Ardent spin-in model had implications on the accounting methods Cisco could employ to

account for the venture and complete the spin-in. Many of Ciscos acquisitions had used the

pooling-of-interests method. For acquisitions when Cisco paid far more than the assets book

value, the pooling method was preferable.13 Pooling-of-interests accounting required, among

other things, that the acquisition occur in a single transaction where over 90% of the company

was acquired, and that no prior control be exerted on the company. Since Cisco took an initial

32% stake in Ardent, and the call option translated into significant control, pooling was never a

possibility but the ventures strategic value outweighed the accounting effects. Volpi

commented, We certainly look at the accounting impact in our decision process, but I dont

think that accounting issues should ever dominate the strategic issues in making decisions.

The accounting for Ciscos investment in Ardent was relatively straightforward. Since Cisco

owned more than 20% but less than 50% of the company, GAAP required that Cisco use the

equity method of accounting. Hence, the Ardent investment was recorded on Ciscos books at

acquisition cost plus its pro-rata share of Ardents earnings (or losses).

The Ardent Acquisition

In June 1997, Volpi and Kozel discussed whether Cisco should exercise its option to purchase

the outstanding shares of Ardent. In many ways, the decision was immaterial, because Wu Fu

and his team were likely to meet the acceptance criteria and exercise their put option, obligating

Cisco to purchase Ardent. Hence, the key consideration was timing: Should Cisco wait until the

end of the option period to spin-in Ardent or do it now? Volpi and Kozel determined that doing

the deal sooner rather than later would deliver two principal benefits. First, Cisco could begin to

integrate Ardent into the Cisco family, speeding time to market for the Cisco branded solution.

Second, purchasing early would avoid confusing the marketplace. Ardents marketing people

had begun to put their own spin on the product, now called Integress. However, Cisco might

want to use a different marketing approach. If Ardent educated the marketplace, Cisco would

either have to continue the same marketing program or re-educate potential customers.

Historically, re-education had not worked well. In fact, competitors were highlighting Ciscos

inconsistent messages in their white papers and marketing materials.

13

Net income is generally lower under the purchase method because significant goodwill, an intangible asset which

represents the excess of the purchase price over the assets book value, must be amortized over a defined period.

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 12

On June 24, Cisco announced its intention to acquire Ardent. The press release stated: Under

the terms of the acquisition agreement, shares of Cisco common stock worth approximately $156

million will be exchanged for the outstanding shares and options of Ardent (Exhibit 6). This

was consistent with the agreed upon total acquisition price of $232.5 million because Cisco

already owned 32% of the company.

Cisco paid approximately $10.00 per share. The founders received approximately $102.3 million

more than 100 times their initial investment. Sequoia Capital received $24.6 million, a

relatively small sum but still 10 times money invested in less than 12 months.

Although the Ardent deal had several flaws, Cisco had learned a lot about how to structure future

deals from the acquisition. Volpi turned his attention away from the Ardent acquisition and back

to the Pipelinks opportunity.

JUNE 1997: VOLPI CONSIDERS THE PIPELINKS OPPORTUNITY

Several of Volpis colleagues at Cisco had identified the market opportunity for a Sonet/SDH

router capable of simultaneously transporting circuit-based traffic and routing IP (Internet

Protocol). Cisco would target the product at many of its service provider customers who were

struggling to bring their networks into the New World of unified networks, but wanted to make

the transition without scrapping their existing circuit-based TDM infrastructure.

One factor was Cisco's expertise in optical routing. In 1997, it was limited. High-speed

Sonet/SDH networking solutions were much larger and more expensive (with price points in the

hundred thousand to multi-million dollar range) than Ciscos traditional products. Because this

was an unfamiliar market for Cisco, Volpi and his team looked externally to pursue the market

opportunity, but none of the existing players met Cisco's criteria.

Volpi's team believed, however, that Amit Shahs idea might address this market need. Shah,

who had sold his first networking company to Cabletron Systems, a Cisco competitor, realized

the increasing need for bandwidth on the access points of the Internet infrastructure the metro

space near large population areas. Shah conceived a Sonet/SDH router product similar to the one

Cisco envisioned. He called the idea Pipelinks. After a series of discussions, Volpi and Kozel

determined that Cisco would like to bring Shahs product to market using the Ardent spin-in

model. Shah was intrigued by the idea it seemed like an effective way to: (1) raise funds, (2)

recruit the right people, and (3) execute with customers. Once Shah had agreed in principle to

structure Pipelinks as a spin-in, Volpi sat down to outline the terms of the deal. As he dug

through the license agreements, term sheets, and product requirements in the old Ardent file,

Volpi identified several potential improvements and modifications that he would make.

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 13

Exhibit 1

Cisco Systems Historical Financials

BALANCE SHEET

FISCAL YEAR ENDING JULY 31,

ANNUAL ASSETS (000s)

CASH

MARKETABLE SECURITIES

RECEIVABLES

INVENTORIES

OTHER CURRENT ASSETS

TOTAL CURRENT ASSETS

NET PROP, PLANT & EQUIP

INVEST & ADV TO SUBS

DEPOSITS & OTHER ASSET

TOTAL ASSETS

1990

ANNUAL LIABILITIES (000S)

ACCOUNTS PAYABLE

$

ACCRUED EXPENSES

INCOME TAXES

TOTAL CURRENT LIAB

OTHER LONG TERM LIAB

TOTAL LIABILITIES

MINORITY INTEREST

SHAREHOLDER EQUITY

TOT LIAB & NET WORTH

INCOME STATEMENT

FISCAL YEAR ENDING JULY 31,

NET SALES

COST OF GOODS

GROSS PROFIT

R & D EXPENDITURES

SELL GEN & ADMIN EXP

OPERATING INCOME

NON-OPERATING INC

INTEREST EXPENSE

INCOME BEFORE TAX

TAXES

NET INCOME

Source: Cisco Systems

1992

1993

1994

1995

1996

1997

35,842 $

21,102

15,874

3,701

1,673

78,192

4,114

367

82,673 $

40,323 $

51,104

34,659

6,078

8,797

140,961

12,665

519

154,145 $

39,955 $

116,477

61,258

9,142

20,244

247,076

28,017

46,866

1,974

323,933 $

27,247 $

53,567 $

284,388 $

279,695 $

61,738

129,219

279,754

758,489

129,109

237,570

421,747

622,859

23,500

27,896

81,805

301,188

26,702

59,425

116,466

197,409

268,296

507,677

1,184,160

2,159,640

48,672

77,449

172,561

331,315

274,260

457,394

583,871

1,060,758

3,985

11,174

51,357

78,519

595,213 $ 1,053,694 $ 1,991,949 $ 3,630,232 $

269,608

1,005,977

1,170,401

254,677

400,603

3,101,266

466,352

1,630,390

253,976

5,451,984

4,973 $

6,290

1,976

13,239

123

13,469

69,204

82,673 $

7,743 $

17,965

542

26,250

436

26,686

127,459

154,145 $

16,262 $

46,953

15,108

78,323

78,323

245,610

323,933 $

24,744 $

31,708 $

59,812 $

153,683 $

77,492

130,846

257,099

445,776

17,796

42,958

71,970

169,894

120,032

205,512

388,881

769,353

120,032

205,512

388,881

769,353

40,792

41,257

475,181

848,182

1,562,276

2,819,622

595,213 $ 1,053,694 $ 1,991,949 $ 3,630,232 $

207,178

656,707

256,224

1,120,109

1,120,109

42,253

4,289,622

5,451,984

1990

$

1991

69,776 $

23,957

45,819

6,168

18,260

21,391

2,088

23,479

9,575

13,904 $

1991

183,184 $

62,499

120,685

12,687

41,809

66,189

4,567

70,756

27,567

43,189 $

1992

339,623 $

111,243

228,380

26,745

72,248

129,387

6,719

136,106

51,720

84,386 $

1993

1994

1995

649,035 $ 1,334,436 $ 2,232,652 $

210,528

450,591

742,860

438,507

883,845

1,489,792

44,254

106,680

306,575

130,682

276,995

485,254

263,571

500,170

697,963

11,557

22,330

40,014

275,128

522,500

737,977

103,173

199,519

281,488

171,955 $

322,981 $

456,489 $

1996

1997

4,096,007 $ 6,452,000

1,409,862

2,243,000

2,686,145

4,209,000

399,291

1,210,000

886,048

1,370,000

1,400,806

1,629,000

64,019

262,000

1,464,825

1,891,000

551,501

840,000

913,324 $ 1,051,000

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 14

Exhibit 2

Cisco Systems Monthly Stock Price Chart: February 1990- June 199714

$18.00

$16.00

$14.00

$12.00

$10.00

$8.00

$6.00

$4.00

$2.00

Source: Cisco Systems

14

Prices adjusted for all splits since IPO, based on January 25, 2000 stock price.

Feb-97

Aug-96

Feb-96

Aug-95

Feb-95

Aug-94

Feb-94

Aug-93

Feb-93

Aug-92

Feb-92

Aug-91

Feb-91

Aug-90

Feb-90

$-

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

Company

p. 15

Exhibit 3

Summary of Ciscos Acquisitions as of June 1997

Date

Purchase Price

Description

Crescendo

Communications, Inc.

Newport Systems

Solutions, Inc.

September 1993

$95 million

July 1994

$93 million

Kalpana, Inc.

October 1994

$240 million

LightStream Corp.

October 1994

$120 million

Combinet, Inc.

August 1995

$132 million

Internet Junction, Inc.

September 1995

not public

Grand Junction, Inc.

September 1995

$400 million

Network Translation,

Inc.

October 1995

not public

TGV Software, Inc.

January 1996

$138 million

StrataCom, Inc.

April 1996

$4.666 million

Telebit Corps MICA

Technologies

July 1996

$200 million

High-performance work group CDDI

and FDDI switching solutions.

Software-based routers for remote

network sites of small/medium sized

networks.

Manufacturer of modular and stackable

LAN switching products extend the

usability and data capacity of existing

Ethernet LANs.

Jointly held company formed in 1993

by Bolt Beranek and Newman and UB

Networks offers enterprise ATM

switching, workgroup ATM switching,

LAN switching and routing.

Supplier of ISDN (Integrated Services

Digital Network) remote-access

networking products useful for

telecommuting and other networked

applications.

Developer of Internet gateway software

connecting central and remote office

desktop users with the Internet.

Inventor and leading supplier of Fast

Ethernet (100BaseT) and Ethernet

desktop switching products.

Manufacturer of cost-effective, low

maintenance network address

translation and enterprise Internet

firewall hardware and software.

Internet software products for

connecting disparate computer systems

over local area, enterprise-wide and

global computing networks including

the Internet.

Leading supplier of Asynchronous

Transfer Mode (ATM) and Frame Relay

high-speed wide areas network

switching equipment transporting a

wide variety of information, including

voice, data and video.

Modem ISDN Channel Aggregation

(MICA) technologies will deliver highdensity digital modem technology with

Ciscos dial-up and access product

lines.

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 16

Exhibit 3 (contd)

Summary of Ciscos Acquisitions as of June 1997

Company

Date

Purchase Price

Nashoba Networks, Inc.

August 1996

$100 million

Granite Systems

September 1996

$220 million

Netsys Technologies

October 1996

$79 million

Metaplex, Inc.

December 1996

not public

Telesend

March 1997

not public

Skystone Systems Corp.

June 1997

$102 million

Global Internet Software

Group

June 1997

$40 million

Ardent Communications

Corp.

June 1997

$156 million

Source: Cisco Systems

Description

Token ring switching technologies

for providing users with a wide

choice of employing highperformance switched workgroup

and backbone Token Ring

environments.

Standards-based multilayer Gigabit

Ethernet switching technologies

for developing a wide choice of

backbone network technologies.

Network modeling and design

software intended to help common

customers base design and plan for

networks ideally suited to their

unique business requirements.

Specialist in network product

development in the enterprise

marketplace, gives customers the

ability to migrate from SNA to IP.

Specialist in wide area network

access products, gives

telecommunications carriers a

more cost-effective way to deliver

high-speed data services for

Internet and intranet access

applications.

Innovator of high-speed

Synchronous Optical

Networking/Synchronous Digital

Hierarch technology to carry

information to high-capacity

backbone networks, such as those

operated by telecommunications

carriers and ISPs.

GISG is a pioneer in the Windows

NT network security marketplace

with its Windows NT Centri

Firewall for small/medium

businesses.

Pioneer in designing combined

communications support for

compressed voice, LAN, data and

video traffic across Frame Relay

and ATM networks.

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 17

Exhibit 4

Preliminary Ardent Term Sheet, June 1996

______________________________________________________________________________

Memorandum of Terms

For Private Placement of

Series A and Series B Preferred Stock of

Ardent Communications Corporation

June 14, 1996

______________________________________________________________________________

This memorandum summarizes the principal terms of the Series A and Series B Preferred Stock

financing of Ardent Communications Corporation.

Offering Terms

Issuer:

Securities to be Issued:

Price:

Ardent Communications Corporation, a California

corporation

(the "company")

3,000,000 shares of Series A Preferred Stock and

11,000,000 shares of Series B Preferred Stock

$.333 per share of Series A and

$1.00 per share of Series B

Terms of Series A and Series B

Preferred Stock

Dividends:

Annual $.03 and $.08 per share dividend,

respectively, payable when and if declared by

Board; dividends are not cumulative. For any other

dividends or distributions, Preferred Stock

participates with Common Stock on an as-converted

basis.

Liquidation Preference:

First pay cost plus accrued dividends on each share

of Preferred Stock. Thereafter Preferred and

Common share on as converted basis, until such

time as the Preferred Stock has received an

aggregate of two times cost, thereafter all proceeds

shall go to the Common Stock.

A merger, reorganization or other transaction in

which control of the company is transferred will be

treated as if a liquidation.

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 18

Exhibit 4 (contd)

Preliminary Ardent Term Sheet, June 1996

Conversion:

Convertible into one share of Common Stock (subject to

antidilution adjustment) at any time at the option of the

holder.

Automatically converts into Common Stock upon

consummation of underwritten public offering with a

price of $5.00 and aggregate proceeds in excess of

$7,500,000.

Antidilution Adjustments:

Conversion ratio adjusted on narrow weighted average

basis in the event of a dilutive issuance. Proportional

adjustments for stock splits and stock dividends.

Voting Rights:

Votes on an as-converted basis, but also has series vote

as provided by law and on (i) the creation of any senior

or pari passu security, (ii) repurchase of Common Stock

except upon termination of employment, (iii) any

transaction in which control of the Company is

transferred, and (iv) any adverse change to the rights,

preferences and privileges of the Series A or Series B

Preferred.

Terms of Preferred Stock

Purchase Agreement

Representations and Warranties:

Standard representations and warranties by the Company.

Assignment of Inventions and

Confidentiality Agreement:

All employees and consultants shall enter into companys

standard form inventions and proprietary information

agreement.

Terms of Investor Rights

Agreement

Registration Rights:

(a) Beginning earlier of June 28, 2000 or six months

after initial registration, two demand registrations upon

initiation by holders of at least 30% of outstanding

Preferred Stock for aggregate proceeds in excess of

$10,000,000. Expenses paid by Company.

(b) Unlimited piggyback registration rights subject to pro

rata cutback at the underwriters discretion. Full cutback

upon IPO; 30% minimum inclusion thereafter. Expenses

paid by Company.

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 19

Exhibit 4 (contd)

Preliminary Ardent Term Sheet, June 1996

(c) Unlimited S-3 Registrations of at least

$1,000,000 each upon initiation by holders of 20%

of the Preferred. Expenses paid by Company.

Registration rights terminate (i) five years after

initial public offering or (ii) when all shares can be

sold under Rule 144, whichever occurs first.

No future registration rights may be granted without

consent of a majority of Investors unless

subordinate to Investors rights.

Right of First Refusal:

Cisco Systems shall have the right to purchase all

securities issued in subsequent equity financings of

the Company, provided the Option, as defined

below, has not expired.

Financial Information:

The Investors shall receive standard information

rights including audited financial reports, quarterly

unaudited financial reports, monthly unaudited

financial reports and annual budget and business

plan, as well as standard inspection rights.

Board of Directors:

Board shall consist of four members. Board

composition at Closing shall be Wu Fu Chen, Ed

Kozel, and Mike Goguen. One other representative

will be designated by a majority vote of the Series B

Preferred Stock.

Post-Closing Capitalization

Series A Preferred Stock Outstanding

Series B Preferred Stock Outstanding

Common Stock held by Founders

Common Stock Reserved for Employees

(however, an additional 3,750,000 shares

shall be available for grant after expiration

of Option, held by Cisco):

TOTAL :

3,000,000

9,000,000

6,250,000

3,000,000

shares

shares

shares

shares

12.9%

47.3%

26.9%

12.9%

23,250,000

shares

100.0%

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 20

Exhibit 4 (contd)

Preliminary Ardent Term Sheet, June 1996

Other Matters

Common Stock Vesting:

Restrictions on Common Stock Transfers:

Common Stock shall vest as follows: After twelve

months of employment, 25% will vest; the

remainder will vest monthly over the following 36

months. Repurchase option on unvested shares at

cost. No acceleration in the event of a Change of

Control, except for Mr. Chen, whose vesting shall

accelerate in the event of a Change of Control such

that at most one year of vesting shall remain.

(a) No transfers allowed prior to vesting.

(b) Right of first refusal on vested shares until

initial public offering.

(c) No transfers or sales permitted during lockup period of up to 180 days required by

underwriters in connection with stock

offerings by the Company.

Option:

Until the earlier of fifteen (15) months from the

Closing or three (3) months after First Customer

Shipment, Cisco shall have the right to acquire

either all of the outstanding equity securities of the

Company, or all of the Companys assets, in Ciscos

discretion, for a purchase price of $232,500,000

payable either in cash or equity securities of Cisco.

Closing Conditions:

Closing subject to negotiation of definitive legal

documents and completion of legal and financial

due diligence by Investors.

Source: Cisco Systems

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 21

Exhibit 5

Ardent Capitalization Table

Preferred A

Cisco

Sequioa Capital

Founders

Engineering Team

Total

Valuation ($/shr)

Valuation ($)

Cash Inflow

Preferred B

3,000,000

3,000,000

$

$

$

0.33

2,400,000

999,000

Acquisition Price

232,500,000

Return

Cisco

Venture Capital

Founders (5 employees)

Engineering Team (20 employees)

$

$

$

$

Cash Out

75,350,000

24,650,000

102,500,000

30,000,000

Return (Cash in - cash out) Per Employee

Founders

$

Engineering Team

$

20,299,550

1,499,850

Common

7,535,000

2,465,000

1,000,000

11,000,000

$

$

$

1.00

23,250,000

11,000,000

$

$

$

$

Cash In

7,535,000

2,465,000

1,002,250

3,000

6,250,000

3,000,000

9,250,000

$

$

$

0.001

23,250,000

9,250

Option to Acquire

Cisco Cost/Head

Cisco Cost

$

$

6,286,000

157,150,000

Conditions

- No accelerated vesting for employees or founders, except for Wu Fu Chen

- Commitment from Wu Fu to stay one year post acquisition

- Right to future offerings in the company or direction of those offerings

Source: Cisco Systems

Multiple

10.0

10.0

102.3

9,978

Total

7,535,000

2,465,000

10,250,000

3,000,000

23,250,000

Ownership

32%

11%

44%

13%

100%

Cisco Systems: A Novel Approach to Structuring Entrepreneurial Ventures EC-15

p. 22

Exhibit 6

Press Release for the Ardent Communications Acquisition

CISCO SYSTEMS TO ACQUIRE ARDENT COMMUNICATIONS CORP.

Further investment in Data, Voice and Video Integration For Public and Private Networks

SAN JOSE, Calif. June 24, 1997 Cisco Systems, Inc. today announced it has signed a

definitive agreement to acquire privately-held Ardent Communications Corp. Previously, Cisco

and Sequoia Capital held minority equity stakes in Ardent. San Jose-based Ardent is a pioneer in

designing combined communications support for compressed voice, LAN, data and video traffic

across public and private Frame Relay and ATM networks.

Under the terms of the acquisition agreement, shares of Cisco common stock worth

approximately $156 million will be exchanged for the outstanding shares and options of Ardent.

In connection with the acquisition, Cisco expects a one-time charge against after-tax earnings of

23 cents per share in the fourth fiscal quarter of 1997. The acquisition is expected to be

completed by late-July 1997 subject to various closing conditions, including clearance under the

Hart-Scott-Rodino Antitrust Improvements Act and Ardent shareholder approval.

CISCO STEPS UP INTEGRATION OVER FRAME RELAY AND ATM NETWORKS

With the continued pace of deregulation of the telecommunications service industry, carriers are

increasingly offering services which integrate communication channels of voice, video, and data.

As a result, the demand for low cost, easy to use, multiservice access products for new carrier

services is rapidly expanding. The acquisition of Ardent will complement Ciscos 3800 series

within carrier service offerings for branch offices and remote sites by extending leadership in

integration of voice, video and data. Based on Cisco IOS software, Ardents low cost platforms

will natively support multiservice traffic and implement voice compression using high

performance Digital Signal Processor (DSP) technology. Ardents early affiliation with Cisco has

resulted in a complementary product platform offering superior interoperability with existing

Cisco multiservice access and switching product lines.

ABOUT ARDENT COMMUNICATIONS

Ardent Communications was founded in 1996 by CEO Wu Fu Chen. Mr. Chen has co-founded

four other companies since 1986 including Cascade Communications and Arris Networks.

Ardents approximately 40 employees will remain in San Jose and become part of the

Multiservice Access Business Unit led by Vice President and General Manager Alex Mendez

within Ciscos Service Provider line of business.

Ardent Communications is on the leading edge of integrated access equipment design. Founded

in 1996, Ardent designs, manufacturers and distributes advanced access products for integrating

voice, video and data on public or private Frame Relay or ATM networks.

Source: Cisco Systems

Anda mungkin juga menyukai

- Cisco SystemsDokumen18 halamanCisco SystemsGaurav SaxenaBelum ada peringkat

- Cisco Systems Architecture: ERP and Web Enabled ITDokumen33 halamanCisco Systems Architecture: ERP and Web Enabled ITTanuj Bansal100% (1)

- Cisco AbridgedDokumen16 halamanCisco AbridgedEconomiks PanviewsBelum ada peringkat

- Cisco Systems-Documentation AutosavedDokumen36 halamanCisco Systems-Documentation Autosavedcrabrajesh007Belum ada peringkat

- CiscoDokumen6 halamanCiscoNatalia Kogan0% (2)

- Cisco Iron PortDokumen28 halamanCisco Iron PortElizaPopescuBelum ada peringkat

- Cisco's Networked Supply Chain Drove SuccessDokumen7 halamanCisco's Networked Supply Chain Drove SuccessSri NilayaBelum ada peringkat

- CISCO Case SummaryDokumen2 halamanCISCO Case SummaryAhmed Elghannam100% (4)

- Cisco's Networked Supply Chain Enabled Rapid Growth But Also Contributed to the 2000-2001 DownturnDokumen7 halamanCisco's Networked Supply Chain Enabled Rapid Growth But Also Contributed to the 2000-2001 DownturnIiebm PuneBelum ada peringkat

- Cisco's E-Business Transformation SuccessDokumen5 halamanCisco's E-Business Transformation SuccessSonya PurnamaBelum ada peringkat

- Case - Business Strategy Cisco SystemsDokumen2 halamanCase - Business Strategy Cisco SystemsAishwarya DeshpandeBelum ada peringkat

- IT & Systems Case Study - Cisco Systems The Supply Chain StoDokumen11 halamanIT & Systems Case Study - Cisco Systems The Supply Chain Stox01001932Belum ada peringkat

- CASE: Cisco SystemsDokumen6 halamanCASE: Cisco SystemsNIHAL KUMARBelum ada peringkat

- IT & Systems Case Study - Cisco Systems The Supply Chain StoDokumen0 halamanIT & Systems Case Study - Cisco Systems The Supply Chain StoDipesh JainBelum ada peringkat

- CISCO SYSTEMS - Supply Chain StoryDokumen7 halamanCISCO SYSTEMS - Supply Chain StorykristokunsBelum ada peringkat

- Prof. A. R. Mishra Vivek Jaiswal Pgdm-Iii "B": Presented To: - Presented ByDokumen14 halamanProf. A. R. Mishra Vivek Jaiswal Pgdm-Iii "B": Presented To: - Presented ByVIVEK JAISWALBelum ada peringkat

- Makalah CiscoDokumen9 halamanMakalah CiscoRahman IqbalBelum ada peringkat

- Cisco Systems: - GuardiansDokumen17 halamanCisco Systems: - GuardiansIvy Marie P. LumangcasBelum ada peringkat

- ATIKA SALEEM SCM Assignment.Dokumen5 halamanATIKA SALEEM SCM Assignment.Atika SaleemBelum ada peringkat

- Cisco System: Cisco Systems, Inc. Is An American-Based Multinational Corporation That Designs andDokumen4 halamanCisco System: Cisco Systems, Inc. Is An American-Based Multinational Corporation That Designs andjudith matienzoBelum ada peringkat

- CISCO Systems The Suply Chain StoryDokumen7 halamanCISCO Systems The Suply Chain StoryNikhil GunaBelum ada peringkat

- Cisco Case StudyDokumen2 halamanCisco Case StudyCarbon_AdilBelum ada peringkat

- Cisco Systems Architecture - Group2Dokumen31 halamanCisco Systems Architecture - Group2Abhishek Neha100% (1)

- CcnaDokumen6 halamanCcnaMahmoud SalahBelum ada peringkat

- Cisco IT Case Study SONADokumen6 halamanCisco IT Case Study SONAArtwo DetwoBelum ada peringkat

- 3119Dokumen26 halaman3119Demelash AsegeBelum ada peringkat

- Cisco: Control TechniquesDokumen6 halamanCisco: Control TechniquesRonak SinghBelum ada peringkat

- Cisco and GE HistoryDokumen5 halamanCisco and GE HistoryJeneth OrtuaBelum ada peringkat

- Cisco Ansoff Analysis Market PenetrationDokumen4 halamanCisco Ansoff Analysis Market PenetrationPranave NellikattilBelum ada peringkat

- Cisco SystemsDokumen2 halamanCisco SystemsCode FrikkyBelum ada peringkat

- Guinan CiscoDokumen22 halamanGuinan CiscoSameer PatelBelum ada peringkat

- Cisco Vs SiemensDokumen31 halamanCisco Vs SiemensDavid HicksBelum ada peringkat

- IMS Application Developer's Handbook: Creating and Deploying Innovative IMS ApplicationsDari EverandIMS Application Developer's Handbook: Creating and Deploying Innovative IMS ApplicationsPenilaian: 5 dari 5 bintang5/5 (1)

- Cloud Networking: Understanding Cloud-based Data Center NetworksDari EverandCloud Networking: Understanding Cloud-based Data Center NetworksPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- Week 03 - Cisco Systems, Solving Business Problems Through CollaborationDokumen4 halamanWeek 03 - Cisco Systems, Solving Business Problems Through CollaborationOctaviani SantosoBelum ada peringkat

- Introduction to Python Network Automation: The First JourneyDari EverandIntroduction to Python Network Automation: The First JourneyBelum ada peringkat

- Routing The Path To End-To-End CommunicationDokumen28 halamanRouting The Path To End-To-End CommunicationSerkanBelum ada peringkat

- Cisco System Case StudyDokumen2 halamanCisco System Case Studyaman KumarBelum ada peringkat

- Packet Magazine Aug 04Dokumen82 halamanPacket Magazine Aug 04nsaliBelum ada peringkat

- Cisco HistoryDokumen49 halamanCisco HistoryLuis JimenezBelum ada peringkat

- Cisco Bring Your Own Device: Device Freedom Without Compromising The IT NetworkDokumen23 halamanCisco Bring Your Own Device: Device Freedom Without Compromising The IT Networknick99Belum ada peringkat

- Introduction InglesDokumen10 halamanIntroduction InglesJose Guillermo Valeriano LeañoBelum ada peringkat

- Cisco SystemsDokumen3 halamanCisco Systemsdian ratnasariBelum ada peringkat

- Cisco Systems Architecture Class 3: IT and Internal OrganizationDokumen4 halamanCisco Systems Architecture Class 3: IT and Internal OrganizationPriya DarshiniBelum ada peringkat

- Deploying Cisco Voice Over IP SolutionsDokumen519 halamanDeploying Cisco Voice Over IP SolutionsAFS AssociatesBelum ada peringkat

- The Evolution of Cloud Computing: How to plan for changeDari EverandThe Evolution of Cloud Computing: How to plan for changeBelum ada peringkat

- Chief Information Security Officer in Dallas FT Worth TX Resume Dean TrumbullDokumen3 halamanChief Information Security Officer in Dallas FT Worth TX Resume Dean TrumbullDeanTrumbellBelum ada peringkat

- Cisco Annual Report 2019Dokumen134 halamanCisco Annual Report 2019solejBelum ada peringkat

- BMDE Report Group 9Dokumen15 halamanBMDE Report Group 9Jyotsana KumariBelum ada peringkat

- Swot CiscoDokumen2 halamanSwot CiscoVarun yashuBelum ada peringkat

- Cisco Systems, Inc.: Some Facts and FiguresDokumen3 halamanCisco Systems, Inc.: Some Facts and Figuresintercultural_c2593Belum ada peringkat

- Developing IP-Based Services: Solutions for Service Providers and VendorsDari EverandDeveloping IP-Based Services: Solutions for Service Providers and VendorsBelum ada peringkat

- The Future of Network Security - Cisco SecureX ArchitectureDokumen4 halamanThe Future of Network Security - Cisco SecureX ArchitectureRodrigo AyalaBelum ada peringkat

- Cisco Press - Deploying Cisco VOIPDokumen519 halamanCisco Press - Deploying Cisco VOIPAl BingawyBelum ada peringkat

- Cisco CaseDokumen13 halamanCisco CasesheialcoBelum ada peringkat

- SD Wan Blog How Prepared Is Your Network For The Digital EraDokumen2 halamanSD Wan Blog How Prepared Is Your Network For The Digital EraFernando Jorge RuffoBelum ada peringkat

- IoE AAGDokumen3 halamanIoE AAGrajekriBelum ada peringkat

- U01a1-Lan Infrastructure Deployment Scope-HagoodDokumen10 halamanU01a1-Lan Infrastructure Deployment Scope-HagoodHalHagoodBelum ada peringkat

- Cisco Live Emea Umbrella Press Release Final 1.27Dokumen3 halamanCisco Live Emea Umbrella Press Release Final 1.27trbvmsBelum ada peringkat

- Written Activity Unit 7Dokumen6 halamanWritten Activity Unit 7Francis Desoliviers Winner-BluheartBelum ada peringkat

- Ex 1Dokumen75 halamanEx 1claudioBelum ada peringkat

- ENVE 100-Introduction To Environmental EngineeringDokumen6 halamanENVE 100-Introduction To Environmental EngineeringclaudioBelum ada peringkat

- App Prob2018 4Dokumen2 halamanApp Prob2018 4claudioBelum ada peringkat

- Financial RatiosDokumen1 halamanFinancial RatiosclaudioBelum ada peringkat

- Ex 1Dokumen3 halamanEx 1claudioBelum ada peringkat

- 1 2 n n i =1 i n n−1 −λxDokumen2 halaman1 2 n n i =1 i n n−1 −λxclaudioBelum ada peringkat

- App Prob2018 3Dokumen2 halamanApp Prob2018 3claudioBelum ada peringkat

- App Prob2018 2Dokumen2 halamanApp Prob2018 2claudioBelum ada peringkat

- 437 F13 Exam1 v1.0 SolDokumen11 halaman437 F13 Exam1 v1.0 SolKhoa PhamBelum ada peringkat

- 1 2 n n i =1 i n n−1 −λxDokumen2 halaman1 2 n n i =1 i n n−1 −λxclaudioBelum ada peringkat

- Ex 1Dokumen3 halamanEx 1claudioBelum ada peringkat

- App Prob2018 4Dokumen2 halamanApp Prob2018 4claudioBelum ada peringkat

- Exam Part 1 With Solutions PDFDokumen12 halamanExam Part 1 With Solutions PDFKoukou AmkoukouBelum ada peringkat

- Ex 1Dokumen3 halamanEx 1claudioBelum ada peringkat

- Mathematical StatisticsDokumen84 halamanMathematical Statisticsmiss_bnmBelum ada peringkat

- Midterm So LNDokumen8 halamanMidterm So LNclaudioBelum ada peringkat

- 05 EE394J 2 Spring11 Phasor Time Domain PlotsDokumen1 halaman05 EE394J 2 Spring11 Phasor Time Domain PlotsclaudioBelum ada peringkat

- ExamenDokumen7 halamanExamenclaudioBelum ada peringkat

- 3phphasr PDFDokumen3 halaman3phphasr PDFclaudioBelum ada peringkat

- 1 2 n n i =1 i n n−1 −λxDokumen2 halaman1 2 n n i =1 i n n−1 −λxclaudioBelum ada peringkat

- Ex 1Dokumen3 halamanEx 1claudioBelum ada peringkat

- Understanding Power System Harmonics Grady April 2012Dokumen181 halamanUnderstanding Power System Harmonics Grady April 2012Pablo FloresBelum ada peringkat

- F Day1Dokumen18 halamanF Day1claudioBelum ada peringkat

- 3 PH PhasrDokumen132 halaman3 PH PhasrclaudioBelum ada peringkat

- Study Guide For Prerequisite TestDokumen5 halamanStudy Guide For Prerequisite TestclaudioBelum ada peringkat

- 01 EE394J 2 Spring12 Power PresentationDokumen57 halaman01 EE394J 2 Spring12 Power PresentationclaudioBelum ada peringkat

- 03 EE394J 2 Spring11 Refresher ProblemsDokumen13 halaman03 EE394J 2 Spring11 Refresher ProblemsclaudioBelum ada peringkat

- F Day1Dokumen18 halamanF Day1claudioBelum ada peringkat

- Practice 1Dokumen9 halamanPractice 1claudioBelum ada peringkat

- Practice 1Dokumen9 halamanPractice 1claudioBelum ada peringkat

- LAUSD Procure to Pay Process BlueprintDokumen217 halamanLAUSD Procure to Pay Process Blueprintrtmathew12Belum ada peringkat

- E-Commerce Srs DocumentDokumen30 halamanE-Commerce Srs DocumentK. J kartik JainBelum ada peringkat

- Areca Leaf Plate Making MachineDokumen21 halamanAreca Leaf Plate Making MachineKumar DiwakarBelum ada peringkat

- Brisbane River Ferry Terminal Rebuild Design CompetitionDokumen5 halamanBrisbane River Ferry Terminal Rebuild Design CompetitionEmilia PavelBelum ada peringkat

- Ship Design SoftwareDokumen2 halamanShip Design Softwarepramod100% (1)

- Alw AE1F OoptiflowwDokumen12 halamanAlw AE1F OoptiflowwCarlos LópezBelum ada peringkat

- Design and Frabrication of Pneumatic Bore Well Child Rescue SystemDokumen7 halamanDesign and Frabrication of Pneumatic Bore Well Child Rescue SystemAnonymous kw8Yrp0R5rBelum ada peringkat

- OceanSaver AS - Kashif Javaid PDFDokumen28 halamanOceanSaver AS - Kashif Javaid PDFvangeliskyriakos8998Belum ada peringkat

- Measurement With A Focus: Goal-Driven Software MeasurementDokumen4 halamanMeasurement With A Focus: Goal-Driven Software MeasurementLydia LeeBelum ada peringkat

- Content For Auto Electrical WebsiteDokumen3 halamanContent For Auto Electrical WebsiteshermanBelum ada peringkat

- Ideas On How To Start A BusinessDokumen5 halamanIdeas On How To Start A Businesskevin cosnerBelum ada peringkat

- AEDK0627 CAT Truck Body Operation and Maitenance Guide PDFDokumen9 halamanAEDK0627 CAT Truck Body Operation and Maitenance Guide PDFCarlos Lobo100% (2)

- BC670 PDFDokumen225 halamanBC670 PDFMailin1981Belum ada peringkat

- The Concept and Evolution of MRP-Type SystemsDokumen51 halamanThe Concept and Evolution of MRP-Type SystemsDr. Mahmoud Abbas Mahmoud Al-Naimi100% (1)

- NR467 - Rules For Steel Ships - PartAVol01Dokumen262 halamanNR467 - Rules For Steel Ships - PartAVol01Meleti Meleti MeletiouBelum ada peringkat

- Basic Log - CoinpubDokumen17 halamanBasic Log - CoinpubMitraBelum ada peringkat

- PP MFG End UserDokumen92 halamanPP MFG End Userprasadpandit123Belum ada peringkat

- Specification For Bonding Fresh Concrete To Hardened Concrete With A Multi-Component Epoxy AdhesiveDokumen10 halamanSpecification For Bonding Fresh Concrete To Hardened Concrete With A Multi-Component Epoxy AdhesiveRandolph CamaclangBelum ada peringkat

- RNAV Training For ATC - Japan - 3Dokumen156 halamanRNAV Training For ATC - Japan - 3Rizwan Noor H100% (1)

- Nasm1312-13 Double Shear Test PDFDokumen7 halamanNasm1312-13 Double Shear Test PDFMichelle Camacho Heredia100% (1)

- Jalanidhi IIMKDokumen3 halamanJalanidhi IIMKsajigopinathanBelum ada peringkat

- JAWA MotokovDokumen4 halamanJAWA MotokovNamaku WahyuBelum ada peringkat

- Life Cycle AssessmentDokumen12 halamanLife Cycle AssessmentaliBelum ada peringkat

- Test 3 ReadingDokumen29 halamanTest 3 ReadingThinh LeBelum ada peringkat

- FrameworkDokumen8 halamanFrameworkAmr Abu AlamBelum ada peringkat

- Granolithic FlooringDokumen16 halamanGranolithic FlooringDinesh Perumal50% (2)

- Define Pricing Procedure StepsDokumen3 halamanDefine Pricing Procedure Stepsashokkumar1979Belum ada peringkat

- Critical-Analysis-ISU-APC-ANTONY 2019Dokumen20 halamanCritical-Analysis-ISU-APC-ANTONY 2019Ainobushoborozi Antony100% (2)

- CERC Dell BestDokumen35 halamanCERC Dell BestDan FilibiuBelum ada peringkat

- What Is The Proper Torque To Use On A Given BoltDokumen2 halamanWhat Is The Proper Torque To Use On A Given Boltes_kikeBelum ada peringkat