Outa Legal Letter To SAA 7 Jul.

Diunggah oleh

Fadia Salie0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

171K tayangan6 halamanCivil rights body Outa has sent national carrier SAA a legal letter to suspend an R256m deal with 'dubious' contractor BnP Capital.

Judul Asli

Outa Legal Letter to SAA 7 Jul.

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniCivil rights body Outa has sent national carrier SAA a legal letter to suspend an R256m deal with 'dubious' contractor BnP Capital.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

171K tayangan6 halamanOuta Legal Letter To SAA 7 Jul.

Diunggah oleh

Fadia SalieCivil rights body Outa has sent national carrier SAA a legal letter to suspend an R256m deal with 'dubious' contractor BnP Capital.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

Anda di halaman 1dari 6

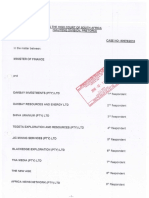

WEBBER WENTZEL

snameee wn > Linklaters

‘The South African Airways spre oe anton

cee [ohemerurg 207, Soc ea

Me Musa Zwane: Acting SAA Group CEO ees 26 oenresteg

Musezs a.com veobenantetcom

‘Ms Phumeza Nranisi Interim CFO: SAA

PhumezaNnentsi@iiveaa com

ce:

Mr Pravin Gorchan: Minster of Finance

minreg@leasur, gov 28

Me Kenneth Brown: Chiet Procurement Ofcer, Treasury

Lingo Mohiabi@trensury.aov.za

BNP Capital (Pty) Lid

Daniel@ionpeaptaLco 2a

‘Your rterence uerteronce Dato

bara Bona aay 2018

Dear Sirs / Mesdames

Unlawful conduct In respect of bid number RFP GSMO21/16: Appointment of a

‘Transaction Advisor to Provide Financial Advice to SAA and the Decision to

confine and award the contrac: for the sourcing of funds for the SAA Group to

BNP Capital (Pty) Led

11 We confirm that we have been instructed by the Organisation Undoing Tax Abuse

(OUTA"), a non-profit organisation aimed at serving the promotion, protection

and advancement of the Constiution of the Republic of South Africa in matters

WEBBER WENTZEL

estan Linklaters

44

az

43

44

45

Page 2

relating to policy, laws or conduct that offend the rights, values and principles

enshrined in the Constitution,

(On 14 March 2016, South African Airways ("SAA") publisted @ Request for

Proposals RFP GSMO21/16 entitled: Appointment of a Transaction Advisor to

Provide Financial Advice to SAA (‘the Traneaction Advieor Tender’). Tho RFP

sets out in Part 3 the Scope of Work for the Transaction Advisor Tender. The

‘Soope of Work for the Transaction Advisor Tender was limited to the provision of

analysis and advice on SAA's loan and lease agreements

During April 2016, SAA awarded BNP Capital (Pty) Ltd the Transaction Advisor

Tender and appointed BNP Capital (Pty) Ltd as the Transaction Advisor for SAA,

‘The process leading to the decision and the decision to award the Transaction

‘Advisor Tender to BNP Capital (Pty) Ltd was contrary to

‘The Evaluation Criteria for the Request for Proposals: 8NP Capital (Pty) Lta

4id not meet the threshold for the Phase 2, Functionality Criteria,

Clause 14 and clause 10.1 of the SAA Supply Chain Management Policy

(SCM Policy": SAA did not evaluate the bids based on the content of the

ocumentation and the evaluation criteria stipulated. SAA decided to do-

business with 2 supplier who did not meet the set evaluation itera

The objectives of the SAA SCM Policy: SAA failed to achieve value for

‘money in its Supply Chain Management ("SCM") activitios.

Dlause 11.1 of the SAA SCM Policy, SAA failed to satisfy self that the

Service requirements could be satisfied through existing contracts,

subsidiaries or employees,

Clause 11.2.1 of the SAA SCM Policy: SAA procured services in a manner

that was notin accordance with authorised policy,

‘WEBBER WENTZEL

46

47

48

49

on Lnklaters —

Clause 11.3.2 of the SAA SCM Policy: SAA restricted the Request for

Proposals to respondent suppliers to the Request for Information on

‘Transaction Advisory Services (RFI-GSM010/16) in ctcumstances where this

was not specified in the RFI document,

Clause 126.1 of the SAA SCM Policy: The Transaction Advisor Tender was

‘ot advertised for at least 14 days before closing time,

Clause 3.2 and 4.4.1. of the SAA SCM Policy read with section 217 of the

Constitution: SAA faled to contract for services in accordance with a system

that i fir, equitable, transparent, competitive and cost-effective.

Clause 34 of the SAA SCM Policy read with the principles of the Treasury

Regulations issued in terms of the Public Finance Management Act) The

head of Global Supply Management and Board of Directors falled in their

‘duty and obligation to avoid abuse of the SCM system.

(On 11 May 2016 SAA’s Global Supply Management Unit made a request to the:

Bid Adjudication Committee ("BAC") to increase the scope of the contract under

the Transaction Advisor Tender by confining and awarding to BNP Capital (Pty)

Lid @ second contract for the sourcing of funds for SAA to settle certain of SAA's

loans that were due to mature at the end of June 2016,

We are instucted that the BAC approved the recommendation of the Global

‘Supply Management Unit on 13 May 2016. The recommendation was approved

by the SAA Eoard of Directors by way of round robin vote on 26 May 2016,

BNP Capital (Pty) Ltd was arcoringly anpnintad to source funding of R15 bilion

for SAA, at a success fee of 1.5% which equates to an amount of R225 milion

(exclusive of VAT) (the funding services")

WEBBER WENTZEL

roars Linklaters

an

82

83

84

85

86

a7

Page +

‘The process and decision to appoint BNP Capital (Pty) Ltd to provide the funding

services ~ elther as a new and self-standing contract through a confined process,

(oF a8 an extension andior variation of the contract under the Transaction Advisor

‘Tender - was contrary to:

Clause 11.10 and 12 of the SAA SCM Policy: SAA was required to use @

competitive tender with an open bidding process for contrac's above the

R500 000 threshold

Clause 11.19 of the SAA SCM Policy: SAA undertook a process of limited /

‘confined bidding when there were no exceptional circumstances justifying

‘such a process.

Clause 11.°8 of the SAA SCM Policy: SAA approved the extension of the:

contract awarded under tender RFP GSM 021/16 without the necessary

approval, and without justification.

Clause 11." of the SAA SCM Policy: SAA falled to satisfy iself that the

service requirements could be satisfied through existing contracts,

‘subsidiaries or employees.

Clause 11.2.1 of the SAA SCM Policy: SAA procured services in a manner

that was nol in accordance with authorised policy.

Clause 9.2 and 4.4.1 of the SAA SCM Policy read with section 217 of the:

Constitution: SAA failed to contract for services in accordance vith a system

that i far, equitable, transparent, competitive and cost-effective,

Clause 34 of the SAA SCM Policy read with the principles of the Treasury

Regulations issued in terms of the Public Finance Management Act: The

head of Glebal Supply Management and Board of Directors failed in their

duty and obligation to evuid abuse ofthe SCM system

WEBBER WENTZEL

estan Linklaters

Pages

9 The award of the Transaction Advisor Tender, and the decision to appoint BNP

Capital (Pty) Ltd to provide funding services, constitute administrative action in

terms ofthe Promotion of Administrative Justice Act 3 of 2000 (“PAJA™).

410 OUTA\s therfore ofthe view that the process leading to both decisions, and the

‘decisions themselves, were unlawful in that they were contrary to:

10.1 The terms of the Request for Proposals;

102 The SAA SCM Policy;

10.3 Sections 3 and 6 of PAJA;

10.4 The Public Finance Management Act

105 The Preferential Procurement Policy Framework Act § of 2000;

10.6 Sections 93 and 217 of the Constitution; and

10.7 Section 54(2)(d) andlor section 54(2)(e) of the PFMA.

114 Inthe circumstances. OUTA requests an undertaking fram SAA’

14.4 To suspend the performance of its payment obligations under any contract

arising from the Transaction Advisor Tender and the funding services

decision; and

11.2 To suspend the conclusion of any contracts arising from the Transaction

‘Advisor Tender and the tunciing services decision, pending a lawful and J or

‘competitive procurement process for the relevant services.

12 We request such an undertaking in writing by the authorised official by close of

business on 13 July 2016, fling which we will aunch appropriate proceedings in

the High Court

‘WEBBER WENTZEL

seni Linklaters

Yours sincerely

thar,

WEBBER WENTZEL

Moray Hathom

Partner

Dra t 92158906509

Enal: moray habemgecberarzl om

Page 6

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Brics 2018: The Johannesburg DeclarationDokumen23 halamanBrics 2018: The Johannesburg DeclarationFadia Salie100% (1)

- Tom Moyane Letter To President RamaphosaDokumen4 halamanTom Moyane Letter To President RamaphosaFadia Salie100% (1)

- Annexures To Rule 7 Condonation PDFDokumen81 halamanAnnexures To Rule 7 Condonation PDFFadia SalieBelum ada peringkat

- Deputy Finance Minister Mcebisi Jonas Hits Back at Ajay GuptaDokumen25 halamanDeputy Finance Minister Mcebisi Jonas Hits Back at Ajay GuptaFadia Salie50% (2)

- Budlender Report - Trillian Capital PartnersDokumen106 halamanBudlender Report - Trillian Capital PartnersSundayTimesZA100% (23)

- Standard Bank Moves To Block Jacob Zuma From Intervening in Gupta CaseDokumen104 halamanStandard Bank Moves To Block Jacob Zuma From Intervening in Gupta CaseFadia Salie100% (1)

- Nuclear Deal: Earthlife Africa JHB V Minister of EnergyDokumen73 halamanNuclear Deal: Earthlife Africa JHB V Minister of EnergySundayTimesZA100% (8)

- Memo To Deputy President From Eskom 19012018Dokumen17 halamanMemo To Deputy President From Eskom 19012018Fadia Salie100% (6)

- Finance Minister Pravin Gordhan's 2017 Budget SpeechDokumen32 halamanFinance Minister Pravin Gordhan's 2017 Budget SpeechFadia Salie92% (13)

- Absa's Answering Affidavit in Gupta Bank Accounts CaseDokumen109 halamanAbsa's Answering Affidavit in Gupta Bank Accounts CaseFadia Salie100% (2)

- Gordhan Vs Oakbay Affidavit Oct 2016Dokumen96 halamanGordhan Vs Oakbay Affidavit Oct 2016Fadia SalieBelum ada peringkat

- Finance Minister Pravin Gordhan's Mini Budget SpeechDokumen23 halamanFinance Minister Pravin Gordhan's Mini Budget SpeechFadia Salie0% (1)

- Regulations On Exemption From and Rebates On The Payment of TollsDokumen24 halamanRegulations On Exemption From and Rebates On The Payment of TollsFadia SalieBelum ada peringkat

- South Africa Crime Stats 2015/16Dokumen5 halamanSouth Africa Crime Stats 2015/16Fadia SalieBelum ada peringkat

- Statement of The Monetary Policy CommitteeDokumen10 halamanStatement of The Monetary Policy CommitteeFadia SalieBelum ada peringkat

- Executive Summary of The Myburgh Report On The Rapid Decline of The Fortunes of Abil and African BankDokumen47 halamanExecutive Summary of The Myburgh Report On The Rapid Decline of The Fortunes of Abil and African BankFadia SalieBelum ada peringkat

- Full S&P Rating StatementDokumen13 halamanFull S&P Rating StatementFadia SalieBelum ada peringkat

- SAA Leaked MemorandumDokumen13 halamanSAA Leaked MemorandumFadia Salie50% (2)

- HooggeregshofDokumen34 halamanHooggeregshofLerouxPDFBelum ada peringkat

- MILLWARD BROWN Best Liked Ads Q3 & Q4 2014 With Title Hyperlinks For Bizcoms-1Dokumen23 halamanMILLWARD BROWN Best Liked Ads Q3 & Q4 2014 With Title Hyperlinks For Bizcoms-1Fadia SalieBelum ada peringkat

- The Rise and Fall of Eskom - and How To Fi X It NowDokumen22 halamanThe Rise and Fall of Eskom - and How To Fi X It NowFadia Salie100% (2)