Glass-Steagall: Overview

Diunggah oleh

Niel BrianJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Glass-Steagall: Overview

Diunggah oleh

Niel BrianHak Cipta:

Format Tersedia

GlassSteagall Legislation

From Wikipedia, the free encyclopedia

This article is about four specific provisions of the Banking Act of 1933, which is also

called the GlassSteagall Act. For the earlier piece of economic legislation, see Glass

Steagall Act of 1932.

The GlassSteagall Act describes four provisions of the U.S. Banking Act of 1933 that

limited securities, activities, and affiliations within commercial banks and securities

firms.[1] Congressional efforts to "repeal the GlassSteagall Act" referred to those four

provisions (and then usually to only the two provisions that restricted affiliations

between commercial banks and securities firms[2]). Those efforts culminated in the 1999

GrammLeachBliley Act (GLBA), which repealed the two provisions restricting affiliations

between banks and securities firms.[3]

The GlassSteagall Act also is used to refer to the entire Banking Act of 1933, after its

Congressional sponsors, Senator Carter Glass (Democrat) of Virginia, and Representative

Henry B. Steagall (D) of Alabama.[4] This article deals with only the four provisions

separating commercial and investment banking. The article 1933 Banking Act describes the

entire law, including the legislative history of the GlassSteagall provisions separating

commercial and investment banking. A separate 1932 law also known as the GlassSteagall

Act is described in the article GlassSteagall Act of 1932.

Starting in the early 1960s, federal banking regulators interpreted provisions of the

GlassSteagall Act to permit commercial banks and especially commercial bank affiliates to

engage in an expanding list and volume of securities activities.[5] By the time the

affiliation restrictions in the GlassSteagall Act were repealed through the GLBA, many

commentators argued GlassSteagall was already "dead."[6] Most notably, Citibank's 1998

affiliation with Salomon Smith Barney, one of the largest US securities firms, was

permitted under the Federal Reserve Board's then existing interpretation of the Glass

Steagall Act.[7] President Bill Clinton publicly declared "the GlassSteagall law is no

longer appropriate."[8]

Many commentators have stated that the GLBA's repeal of the affiliation restrictions of

the GlassSteagall Act was an important cause of the financial crisis of 200708.[9][10]

[11] Some critics of that repeal argue it permitted Wall Street investment banking firms

to gamble with their depositors' money that was held in affiliated commercial banks.[12]

Others have argued that the activities linked to the financial crisis were not prohibited

(or, in most cases, even regulated) by the GlassSteagall Act.[13] Commentators, including

former President Clinton in 2008 and the American Bankers Association in January 2010,

have also argued that the ability of commercial banking firms to acquire securities firms

(and of securities firms to convert into bank holding companies) helped mitigate the

financial crisis.[14]

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- AP US History Study GuideDokumen12 halamanAP US History Study GuideKeasbey Nights100% (3)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Staar Social Studies 8 ReviewDokumen8 halamanStaar Social Studies 8 Reviewapi-2428702930% (1)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The FederalistDokumen656 halamanThe FederalistMLSBU11Belum ada peringkat

- 1987 DBQDokumen3 halaman1987 DBQKamaraman TVe100% (2)

- State Citizenship Case LawsDokumen2 halamanState Citizenship Case LawsJimmy BennettBelum ada peringkat

- Plessy v. Ferguson 1896Dokumen2 halamanPlessy v. Ferguson 1896Stephanie Dyson100% (1)

- Myth Moderate ObamaDokumen5 halamanMyth Moderate ObamaarielBelum ada peringkat

- T52 PDFDokumen30 halamanT52 PDFÁlvaro Sánchez AbadBelum ada peringkat

- Immanent EvaluationDokumen1 halamanImmanent EvaluationNiel BrianBelum ada peringkat

- DeWitt Clinton - CareerDokumen3 halamanDeWitt Clinton - CareerNiel BrianBelum ada peringkat

- RDA Matot11Dokumen4 halamanRDA Matot11Niel BrianBelum ada peringkat

- Biopunk - DescriptionDokumen2 halamanBiopunk - DescriptionNiel BrianBelum ada peringkat

- Electric Motor - HistoryDokumen5 halamanElectric Motor - HistoryNiel BrianBelum ada peringkat

- Barabara - DescriptionDokumen1 halamanBarabara - DescriptionNiel BrianBelum ada peringkat

- 3-2 Declaring Independence Notes UpdatedDokumen2 halaman3-2 Declaring Independence Notes UpdatedTilly milyBelum ada peringkat

- We The People 11th Edition Ginsberg Test BankDokumen25 halamanWe The People 11th Edition Ginsberg Test BankLaurenBateskqtre100% (16)

- Honors Us History Portfolio Narratives FinalDokumen25 halamanHonors Us History Portfolio Narratives Finalapi-305334314Belum ada peringkat

- Write T For True and F For False. Correct The False SentencesDokumen4 halamanWrite T For True and F For False. Correct The False SentencesMilton SalasBelum ada peringkat

- Monday Iowa Poll MethodologyDokumen4 halamanMonday Iowa Poll MethodologydmronlineBelum ada peringkat

- Unfinished Nation A Concise History of The American People 8th Edition Alan Brinkley Solutions Manual DownloadDokumen5 halamanUnfinished Nation A Concise History of The American People 8th Edition Alan Brinkley Solutions Manual DownloadKarl Telford100% (17)

- Federalism in AmericaDokumen13 halamanFederalism in Americaxxx3636Belum ada peringkat

- Constitution Scavenger HuntDokumen6 halamanConstitution Scavenger Hunttimothyjgraham1445Belum ada peringkat

- Civil Rights Act 1964Dokumen2 halamanCivil Rights Act 1964Hammad Khan LodhiBelum ada peringkat

- Who Is Joe Biden?: President TrumpDokumen3 halamanWho Is Joe Biden?: President TrumpSaripuddin saripBelum ada peringkat

- Gmail - Merrick Garland Could Change EVERYTHING...Dokumen3 halamanGmail - Merrick Garland Could Change EVERYTHING...L.A. ReidBelum ada peringkat

- Barack ObamaDokumen27 halamanBarack ObamapoojaBelum ada peringkat

- AP Style: Highlights of The Most Important Style RulesDokumen28 halamanAP Style: Highlights of The Most Important Style RulesKochi MacBelum ada peringkat

- Kami Export - 06 - Populist Party Notes PageDokumen2 halamanKami Export - 06 - Populist Party Notes PageTimothy MeadorBelum ada peringkat

- Introduction To The Federal Budget ProcessDokumen9 halamanIntroduction To The Federal Budget ProcessDulguun BaasandavaaBelum ada peringkat

- Chapter 9-10 Apush Study GuideDokumen15 halamanChapter 9-10 Apush Study Guideapi-237316331Belum ada peringkat

- Candidate List - Address: MonroeDokumen17 halamanCandidate List - Address: MonroeHolden AbshierBelum ada peringkat

- Abraham Lincoln Biography-1Dokumen2 halamanAbraham Lincoln Biography-1Khoulah HanifahBelum ada peringkat

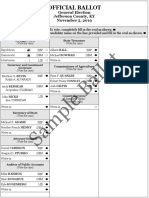

- Sample BallotsDokumen1 halamanSample BallotsCourier Journal50% (2)

- Kasper EmailDokumen2 halamanKasper EmailRob PortBelum ada peringkat

- Statement of The Chairman and Ranking Member of The Committee On Ethics Regarding Representative Tom ReedDokumen1 halamanStatement of The Chairman and Ranking Member of The Committee On Ethics Regarding Representative Tom ReedNews10NBCBelum ada peringkat

- Study Guide: Presidential TriviaDokumen8 halamanStudy Guide: Presidential Triviadocwatkins_eddBelum ada peringkat