Boylston Shoe Shop

Diunggah oleh

Claire Marie ThomasHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Boylston Shoe Shop

Diunggah oleh

Claire Marie ThomasHak Cipta:

Format Tersedia

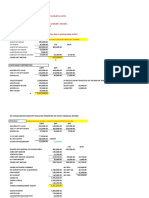

The Boylston Shoe company operates a chain of shoe stores that sells 10 different styles

of inexpensive mens shoes with identical unit cost and selling prices. A unit is defined

as a pair of shoes. Each store has a store manager who is paid a fix salary. Individual

sales people receives a fixed salary and sales commission. Boylston is considering

opening another store that is expected to have the revenue and costs relationships shown

here:

- Selling Price: $30,00

- Cost of shoes: $19,50

- Sales commission $1,50

- Annual Fixed costs: $360.000,00

1. What is the annual breakeven point in (a) units sold and (b)

revenues?

2. If 35.000 units are sold, What will be the stores operating

income?

3. If sales commissions are discontinued and fixed salaries are

raised by a total of $81.000,00. What would be the annual

breakeven point in (a) units sold and (b) revenues?

4. Refer to the original data. If, in addition to his fixed salary, the

store manager is paid a commission of $0,30 per unit sold,

What would be the annual breakeven point at (a) units sold and

(b) revenues?

5. Refer to the original data. If, in addition to his fixed salary, the

store manager is paid a commission of $0,30 per unit in excess

of the breakeven point, What would be the stores operating

income if 50.000 units were sold?

Refer to the requirement of previous exercise. In this problem asumme the role of the

owner of Boylston.

1. Calculate the number of units sold at which the owner of

Boylston would be indifferent between the original salary-pluscommissions plan for sales people and the higher fixed salaries

only plan.

2. As owner, Which sales compensation plan would you choose if

forecasted annual sales of the new store were at least 55.000

units? What do you think of the motivational aspect of your

chosen compensation plan?

3. Suppose the target operating income is $168.000,00 How many

units must be sold to reach the target operating income under

(a) the original salary-plus-commissions plan and (b) the higher

fixed salaries only plan?

4. You open the new store on January 1, 2008. With the original

salary plus commission compensation plan in place. Because

you expect the cost of the shoes to rise due to inflation, you

place a firm bulk order for 50.000 shoes and locked in the

$19,50 price per unit. But, towards the end of the year, only

48.000 shoes are sold and you authorise a mark-down of the

remaining inventory to $18,00 per unit. Finally all units are sold.

Sales people, as usual, get paid a commission of 5% of

revenues. What is the annual operating income for the store?

Anda mungkin juga menyukai

- AOL.com (Review and Analysis of Swisher's Book)Dari EverandAOL.com (Review and Analysis of Swisher's Book)Belum ada peringkat

- Corporate Financial Analysis with Microsoft ExcelDari EverandCorporate Financial Analysis with Microsoft ExcelPenilaian: 5 dari 5 bintang5/5 (1)

- Session 6-Enredamev5 PDFDokumen9 halamanSession 6-Enredamev5 PDFLaura GómezBelum ada peringkat

- Management Sheet 1 (Decision Making Assignment)Dokumen6 halamanManagement Sheet 1 (Decision Making Assignment)Dalia EhabBelum ada peringkat

- Baldwin Bicycle CompanyDokumen19 halamanBaldwin Bicycle CompanyMannu83Belum ada peringkat

- Siemens Electric Motor Works Process-Oriented CostingDokumen1 halamanSiemens Electric Motor Works Process-Oriented CostingEman TBelum ada peringkat

- Cadm Pre Mid Term 2016 - SolnDokumen5 halamanCadm Pre Mid Term 2016 - SolnngrckrBelum ada peringkat

- Anagene Case StudyDokumen1 halamanAnagene Case StudySam Man0% (3)

- The Quaker Oats Company and Subsidiaries Consolidated Statements of IncomeDokumen3 halamanThe Quaker Oats Company and Subsidiaries Consolidated Statements of IncomeNaseer AhmedBelum ada peringkat

- ExercisesDokumen19 halamanExercisesbajujuBelum ada peringkat

- Natureview FarmDokumen2 halamanNatureview FarmBen Hiran100% (1)

- Otago MuseumDokumen19 halamanOtago MuseumFoamdomeBelum ada peringkat

- Retail Analysis With Walmart DataDokumen2 halamanRetail Analysis With Walmart DatakPrasad8Belum ada peringkat

- Homework 4Dokumen3 halamanHomework 4amisha25625850% (1)

- MABE Reference Doc 1Dokumen7 halamanMABE Reference Doc 1roBinBelum ada peringkat

- Inventory ProblemsDokumen4 halamanInventory ProblemsPulkit AggarwalBelum ada peringkat

- Case Study 2.1 Meridian Water PumpsDokumen2 halamanCase Study 2.1 Meridian Water PumpsMammen VergisBelum ada peringkat

- FA - Abercrombie and Fitch Case StudyDokumen17 halamanFA - Abercrombie and Fitch Case Studyhaonanzhang100% (2)

- Inventory ManagementDokumen8 halamanInventory ManagementFareha Riaz100% (1)

- Bergerac Systems: THE Challenge OF Backward Integration: J J J J J JDokumen5 halamanBergerac Systems: THE Challenge OF Backward Integration: J J J J J JsrivatsavBelum ada peringkat

- SCM - Managing Uncertainty in DemandDokumen27 halamanSCM - Managing Uncertainty in DemandHari Madhavan Krishna KumarBelum ada peringkat

- Fajarina Ambarasari - 29118048 - Purity Steel Corporation 2012Dokumen7 halamanFajarina Ambarasari - 29118048 - Purity Steel Corporation 2012fajarina ambarasariBelum ada peringkat

- Quiz B Inventory Valuation Marks 05: Q: Choose The Best Answer For Each of The Following QuestionsDokumen2 halamanQuiz B Inventory Valuation Marks 05: Q: Choose The Best Answer For Each of The Following QuestionsArjun LalwaniBelum ada peringkat

- Home Depot Case Group 2Dokumen10 halamanHome Depot Case Group 2Rishabh TyagiBelum ada peringkat

- CP - Cma CaseDokumen5 halamanCP - Cma CaseYicong GuBelum ada peringkat

- Turnaround Plan For Linens N ThingsDokumen15 halamanTurnaround Plan For Linens N ThingsTinakhaladze100% (1)

- Chapter3-Product Mix ProblemDokumen8 halamanChapter3-Product Mix ProblemPradeep Hiremath100% (1)

- Otago's MuseumDokumen5 halamanOtago's Museumyecika50% (2)

- Boston Creamery Case AnalysisDokumen19 halamanBoston Creamery Case AnalysisTessa B. Dick100% (7)

- Econ7073 2021.S1Dokumen76 halamanEcon7073 2021.S1RebacaBelum ada peringkat

- Economic Impact of Oakland Athletics Ballpark at Howard TerminalDokumen13 halamanEconomic Impact of Oakland Athletics Ballpark at Howard TerminalZennie AbrahamBelum ada peringkat

- Presentation ITC EchoupalDokumen20 halamanPresentation ITC Echoupalsatabdi_123Belum ada peringkat

- Or PracticeProblems 2015Dokumen24 halamanOr PracticeProblems 2015Hi HuBelum ada peringkat

- Prestige Telephone Company SlidesDokumen13 halamanPrestige Telephone Company SlidesHarsh MaheshwariBelum ada peringkat

- Ccbe CASE Presentation: Group 2Dokumen13 halamanCcbe CASE Presentation: Group 2Rakesh SethyBelum ada peringkat

- Analysis of PolysarDokumen84 halamanAnalysis of PolysarParthMairBelum ada peringkat

- 101 Session FourDokumen45 halaman101 Session FourVinit PatelBelum ada peringkat

- Chapter 8 Long Lived Assets - SolutionsDokumen102 halamanChapter 8 Long Lived Assets - SolutionsKate SandersBelum ada peringkat

- Additional Questions - Competitive Advantage - Strategic ManagementDokumen6 halamanAdditional Questions - Competitive Advantage - Strategic ManagementkarimanrlfBelum ada peringkat

- Classic Ltd.Dokumen3 halamanClassic Ltd.Alexandra CaligiuriBelum ada peringkat

- Accounting in Action: Assignment Classification TableDokumen50 halamanAccounting in Action: Assignment Classification TableChi IuvianamoBelum ada peringkat

- Suraj T S (Me Cs 4)Dokumen4 halamanSuraj T S (Me Cs 4)Suraj TSBelum ada peringkat

- Accounting For The Intel Pentium Chip Flaw - QuestionsDokumen1 halamanAccounting For The Intel Pentium Chip Flaw - QuestionsShaheen MalikBelum ada peringkat

- IEOR 162 Group Project (Fall 2013)Dokumen4 halamanIEOR 162 Group Project (Fall 2013)DracoAndruw0% (2)

- AML Case 1 - Opticom Inc (Hana - Irma)Dokumen4 halamanAML Case 1 - Opticom Inc (Hana - Irma)Irma SuryaniBelum ada peringkat

- ABC QuestionsDokumen14 halamanABC QuestionsLara Lewis Achilles0% (1)

- Tesco GSCMDokumen6 halamanTesco GSCMadmbad2Belum ada peringkat

- Prestige Telephone CompanyDokumen2 halamanPrestige Telephone CompanyArbaz AbbasBelum ada peringkat

- Holly DazzleDokumen3 halamanHolly DazzleIqra Jawed100% (1)

- Merrimack Tractors and MowersDokumen10 halamanMerrimack Tractors and MowersAtul Bhatia0% (1)

- Amazon and ZapposDokumen4 halamanAmazon and ZapposNinadBelum ada peringkat

- Presentation (Cases in MA)Dokumen39 halamanPresentation (Cases in MA)kah凯Belum ada peringkat

- Beta Management QuestionsDokumen1 halamanBeta Management QuestionsbjhhjBelum ada peringkat

- Cost Management Accounting Assignment Bill French Case StudyDokumen5 halamanCost Management Accounting Assignment Bill French Case Studydeepak boraBelum ada peringkat

- Case Case:: Colorscope, Colorscope, Inc. IncDokumen4 halamanCase Case:: Colorscope, Colorscope, Inc. IncBalvinder SinghBelum ada peringkat

- Balakrishnan MGRL Solutions Ch12Dokumen30 halamanBalakrishnan MGRL Solutions Ch12iluvumiBelum ada peringkat

- Exercises On ILP FormulationsDokumen7 halamanExercises On ILP FormulationsSahil MakkarBelum ada peringkat

- Socio Economic Classification System in IndiaDokumen14 halamanSocio Economic Classification System in IndiaVignesh Lakshminarayanan0% (1)

- AIC Netbooks Optimizing Product AssemblyDokumen2 halamanAIC Netbooks Optimizing Product AssemblyPedro José ZapataBelum ada peringkat

- Boston Creamery Case StudyDokumen3 halamanBoston Creamery Case Studypathak2277Belum ada peringkat

- AMD Competitve StrategyDokumen30 halamanAMD Competitve StrategyClaire Marie ThomasBelum ada peringkat

- AES Session 6 Group D F2Dokumen13 halamanAES Session 6 Group D F2Claire Marie ThomasBelum ada peringkat

- Financial Theory and Corporate Policy - Copeland.449-493Dokumen45 halamanFinancial Theory and Corporate Policy - Copeland.449-493Claire Marie ThomasBelum ada peringkat

- Capital One - TemplateDokumen6 halamanCapital One - TemplateClaire Marie ThomasBelum ada peringkat

- AES Case PresentationDokumen13 halamanAES Case PresentationClaire Marie Thomas67% (3)

- Notes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)Dokumen10 halamanNotes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)ElaineJrV-IgotBelum ada peringkat

- IBCC Challan FormDokumen1 halamanIBCC Challan FormSalman Ul Moazzam33% (15)

- Important Points of Our Notes/Books:: TH THDokumen42 halamanImportant Points of Our Notes/Books:: TH THpuru sharmaBelum ada peringkat

- Portfolio NestleDokumen26 halamanPortfolio NestleSivapradha PalaniswamiBelum ada peringkat

- Closing America's Infrastructure Gap:: The Role of Public-Private PartnershDokumen42 halamanClosing America's Infrastructure Gap:: The Role of Public-Private PartnershrodrigobmmBelum ada peringkat

- Job Description - BFSI CandidatesDokumen1 halamanJob Description - BFSI CandidatesAman DagaBelum ada peringkat

- Accounting PretestDokumen4 halamanAccounting PretestseymourwardBelum ada peringkat

- MERS Southeast Legal Seminar (11.10.04) FinalDokumen26 halamanMERS Southeast Legal Seminar (11.10.04) FinalgregmanuelBelum ada peringkat

- 52patterns - 7 Chart PatternsDokumen64 halaman52patterns - 7 Chart PatternspravinyBelum ada peringkat

- ATC List 2017 Updated 5517Dokumen47 halamanATC List 2017 Updated 5517Varinder AnandBelum ada peringkat

- Malaysian Government Budgeting MalaysianDokumen31 halamanMalaysian Government Budgeting MalaysianHanisah AbdulRahmanBelum ada peringkat

- Problem 1Dokumen4 halamanProblem 1Live LoveBelum ada peringkat

- Bank Baroda Project.Dokumen106 halamanBank Baroda Project.Ketul SahuBelum ada peringkat

- Export 09 - 07 - 2020 00 - 39Dokumen59 halamanExport 09 - 07 - 2020 00 - 39Kalle AhiBelum ada peringkat

- CHAPTER 6 - Handouts For StudentsDokumen4 halamanCHAPTER 6 - Handouts For StudentsErmiasBelum ada peringkat

- BA 421-Feasibility StudyDokumen14 halamanBA 421-Feasibility StudyMary Ann Jacolbe BaguioBelum ada peringkat

- Assignment On MoneybhaiDokumen7 halamanAssignment On MoneybhaiKritibandhu SwainBelum ada peringkat

- PRMG 6010 - Risk Management For Project Managers Uwi Exam Past Paper 2012Dokumen4 halamanPRMG 6010 - Risk Management For Project Managers Uwi Exam Past Paper 2012tilshilohBelum ada peringkat

- Agricultural Business Farm and Ranch Management PDFDokumen2 halamanAgricultural Business Farm and Ranch Management PDFRajesh VernekarBelum ada peringkat

- Quantitative Problems Chapter 5Dokumen5 halamanQuantitative Problems Chapter 5Fatima Sabir Masood Sabir ChaudhryBelum ada peringkat

- Financial Accounting Steel SectorDokumen36 halamanFinancial Accounting Steel SectorashishBelum ada peringkat

- Accounting For Manufacturing FirmDokumen13 halamanAccounting For Manufacturing Firmnadwa dariahBelum ada peringkat

- Accounting PrinciplesDokumen4 halamanAccounting PrinciplesManjulaBelum ada peringkat

- The Safe Mortgage Loan Originator National Exam Study Guide Second Edition 2nd Edition Ebook PDFDokumen62 halamanThe Safe Mortgage Loan Originator National Exam Study Guide Second Edition 2nd Edition Ebook PDFalec.black13997% (33)

- CA51024 - Quiz 2 (Solutions)Dokumen6 halamanCA51024 - Quiz 2 (Solutions)The Brain Dump PHBelum ada peringkat

- BSE SME Exchange - BusinessDokumen53 halamanBSE SME Exchange - BusinessDeepak GajareBelum ada peringkat

- Strategy 10: Long StraddleDokumen9 halamanStrategy 10: Long StraddlenemchandBelum ada peringkat

- Idec 8301381772Dokumen1 halamanIdec 8301381772denny palimbungaBelum ada peringkat

- Lesson 29 - General AnnuitiesDokumen67 halamanLesson 29 - General AnnuitiesAlfredo LabadorBelum ada peringkat

- Company Name: Starting Date Cash Balance Alert MinimumDokumen3 halamanCompany Name: Starting Date Cash Balance Alert MinimumdantevariasBelum ada peringkat