Chapter7 Bay

Diunggah oleh

Joreleen Marie AyuyaoJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Chapter7 Bay

Diunggah oleh

Joreleen Marie AyuyaoHak Cipta:

Format Tersedia

CHAPTER 7

SUGGESTED ANSWERS

Exercise 7-1

1.

Contract price

Cost incurred to date

Est. cost to complete

2010

P50,000,000

P 7,500,000

30,000,000

2011

P50,000,000

P34,500,000

8,625,000

Total estimated cost

Total estimated gross profit

Percentage of completion

37,500,000

P12,500,000

20%

P43,125,000

P 6,875,000

80%

2012

P50,000,000

P40,800,000

__________

P40,800,000

P 9,200,000

100%

2010 - Recognized revenue

Cost of revenue

Gross profit

To Date

P10,000,000

7,500,000

P 2,500,000

Recognized in prior year/s

-

To be recognized this year

P10,000,000

7,500,000

P 2,500,000

2011 - Recognized revenue

Cost of revenue

Gross profit

P40,000,000

34,500,000

P 5,500,000

P10,000,000

7,500,000

P 2,500,000

P30,000,000

27,000,000

P 3,000,000

2012 - Recognized revenue

Cost of revenue

Gross profit

P50,000,000

40,800,000

P 9,200,000

P40,000,000

34,500,000

P 5,500,000

P10,000,000

6,300,000

P 3,700,000

2.

2010

a. Construction in progress

Cash, Materials, etc.

2011

7,500,000

b. Accounts Receivable

8,000,000

Progress Billings on Const. Contracts

2012

27,000,000

7,500,000

6,300,000

27,000,000

36,000,000

8,000,000

6,300,000

6,000,000

36,000,000

6,000,000

AA1 - Chapter 7 (2012 edition)

page

c. Cash

Accounts Receivable

5,500,000

d. Cost of LTCC

Construction in Progress

Revenue from LTCC

7,500,000

2,500,000

33,000,000

11,500,000

5,500,000

33,000,000

27,000,000

3,000,000

11,500,000

6,300,000

3,700,000

10,000,000

30,000,000

e. Progress Billings on

Construction Contracts

Construction In Progress

10,000,000

50,000,000

50,000,000

3.

Statement of Financial Position

Current Assets:

Accounts Receivable

P5,500,000

Current Liabilities:

Progress Billings on Construction Contracts

Less Construction in Progress

P44,000,000

40,000,000

P4,000,000

Exercise 7-2

2010

a. Construction in Progress

Cash, Materials, etc.

32,000,000

b. Accounts Receivable

Progress Billing on Const. Contract

33,000,000

c. Cash

Accounts Receivable

31,000,000

d. Cost of LTCC

Construction in Progress

Revenue from LTCC

144

2011

43,000,000

32,000,000

15,500,000

43,000,000

45,000,000

33,000,000

22,000,000

40,000,000

22,000,000

29,000,000

40,000,000

45,250,000

4,750,000

25,000,000

15,500,000

45,000,000

31,000,000

23,000,000

2,000,000

2012

29,000,000

22,250,000

2,750,000

50,000,000

25,000,000

AA1 - Chapter 7 (2012 edition)

page

e. Progress Billing on Const. Contracts

Construction in Progress

Contract price

Cost incurred to date

Estimated cost to complete

Total estimated cost

Total estimated gross profit

Percentage of completion

100,000,000

100,000,000

2010

P100,000,000

P 32,000,000

60,000,000

P 92,000,000

P 8,000,000

25%

2011

P100,000,000

P 75,000,000

16,000,000

P 91,000,000

P 9,000,000

75%

2012

P100,000,000

P 90,500,000

___________

P 90,500,000

P 9,500,000

100%

2010 - Recognized revenue

Cost of revenue

Gross profit

To date

P25,000,000

23,000,000

P 2,000,000

Recognized in prior year/s

-

To be recognized this year

P25,000,000

23,000,000

P 2,000,000

2011 - Recognized revenue

Cost of revenue

Gross profit

P75,000,000

68,250,000

P 6,750,000

P25,000,000

23,000,000

P 2,000,000

P50,000,000

45,250,000

P 4,750,000

2012 - Recognized revenue

Cost of revenue

Gross profit

P100,000,000

90,500,000

P 9,500,000

P75,000,000

68,250,000

P 6,750,000

P25,000,000

22,250,000

P 2,750,000

Exercise 7-3

1.

144

Contract price

Total estimated cost:

Cost incurred to date

P 4,400,000

Estimated cost to complete

15,600,000

Total estimated gross profit

Percentage of completion ( P 4,400,000/20,000,000)

Gross profit to be recognized in 2012

P25,000,000

20,000,000

P 5,000,000

22%

P 1,100,000

AA1 - Chapter 7 (2012 edition)

2.

page

Accounts Receivable

Construction in Progress

Progress Billings on Construction Contracts

(P25,000,000 x 30% x 10%)

(P4,400,000 + P1,100,000)

(P25,000,000 x 30%)

145

P 750,000

P5,500,000

P7,500,000

Exercise 7-4

Contract price

Cost incurred to date

Estimated cost to complete

Total estimated cost

Total estimated gross profit

Percentage of completion

2010

P35,000,000

P17,500,000

10,500,000

P28,000,000

P 7,000,000

62.5%

2011

P35,000,000

P29,250,000

3,250,000

P32,500,000

P 2,500,000

90%

2012

P35,000,000

P31,000,000

P31,000,000

P 4,000,000

100%

2010 - Recognized revenue

Cost of revenue

Gross profit

To date

P21,875,000

17,500,000

P 4,375,000

Recognized in prior year/s

-

To be recognized this year

P21,875,000

17,500,000

P 4,375,000

2011 - Recognized revenue

Cost of revenue

Gross profit

P31,500,000

29,250,000

P 2,250,000

P21,875,000

17,500,000

P 4,375,000

P 9,625,000

11,750,000

P(2,125,000)

2012 - Recognized revenue

Cost of revenue

Gross profit

P35,000,000

31,000,000

P 4,000,000

P31,500,000

29,250,000

P 2,250,000

P 3,500,000

1,750,000

P 1,750,000

2. Journal entries

a. Construction in Progress

Cash, Materials, etc.

b. Accounts Receivable

Progress Billing on

Const. Contracts

c. Cash

Accounts Receivable

2010

17,500,000

2011

11,750,000

17,500,000

16,000,000

11,750,000

12,000,000

16,000,000

15,000,000

1,750,000

7,000,000

12,000,000

10,000,000

15,000,000

2012

1,750,000

7,000,000

10,000,000

10,000,000

10,000,000

AA1 - Chapter 7 (2012 edition)

d. Cost of LTCC

Construction in Progress

Construction in Progress

Revenue from LTCC

page

17,500,000

4,375,000

11,750,000

21,875,000

147

1,750,000

1,750,000

2,125,000

9,625,000

3,500,000

e. Progress Billing on Const. Contract

Construction in Progress

35,000,000

35,000,000

3.

2010 - Recognized revenue

Cost of revenue

Gross profit

To date

P17,500,000

17,500,000

==========

Recognized in prior year/s

============

To be recognized this year

P17,500,000

17,500,000

==========

2011 - Recognized revenue

Cost of revenue

Gross profit

P31,500,000

29,250,000

P 2,250,000

P17,500,000

17,500,000

----------------

P14,000,000

11,750,000

P 2,250,000

2012 - Recognized revenue

Cost of revenue

Gross profit

P35,000,000

31,000,000

P 4,000,000

P31,500,000

29,250,000

P 2,250,000

P3,500,000

1,750,000

P1,750,000

Exercise 7-5

Revenue recognized in 2012

Gross profit/income recognized in 2012

Cost incurred in 2012

(P26,000,000 x 40%)

(P3,120,000 - P1,300,000)

P10,400,000

1,820,000

P 8,580,000

Binondo Project

P12,000,000

12,400,000

P (400,000)

Pasig Project

P1,290,000

1,400,000

P( 110,000)

Exercise 7-6

Revenue (CP x % of work done in 2011)

Cost of revenue

Gross profit (loss)

AA1 - Chapter 7 (2012 edition)

page

Exercise 7-7

1. Contract revenue/price

Less Total profit

Total cost incurred

Less Cost incurred in 2010 and 2012

Cost incurred in 2011

P40,000,000

3,200,000

P36,800,000

23,600,000

P13,200,000

2. Gross profit to date, Dec.31, 2011

Cost incurred to date, Dec.31, 2011 (P7,200,000 + P13,200,000)

Revenue to date, Dec.31, 2011

Percentage-of-completion (24,000,000/40,000,000)

P 3,600,000

20,400,000

P24,000,000

60%

3. Gross profit to date, Dec.31, 2011

Percentage of completion

Total estimated gross profit

P3,600,000

60%

P6,000,000

4. Contract price

Less Total estimated gross profit

Total estimated cost

Less Cost incurred to date

Estimated cost to complete

P40,000,000

6,000,000

P34,000,000

20,400,000

P13,600,000

Exercise 7-8

Cash

Notes Receivable

Discount on Notes Receivable

Unearned Franchise Fees

Exercise 7-9

1. Cash

Notes Receivable

Discount on Notes Receivable

Unearned Franchise Fees

*P3,000,000 - (2.4868 x P1000,000)

500,000

1,000,000

207,540

1,292,460

4,000,000

3,000,000

513,200*

6,486,800

148

AA1 - Chapter 7 (2012 edition)

page

2. Cash

Notes Receivable

Discount on Notes Receivable

Revenue from Franchise Fees

4,000,000

3,000,000

3. Cash

4,000,000

513,200

6,486,800

Unearned Franchise Fees

4,000,000

4. Cash

4,000,000

Notes Receivable

3,000,000

Discount on Notes Receivable

Revenue from Franchise Fees

Unearned Franchise Fees (1,000,000 x 2.48685)

Exercise 7-10

2011

July 1 Cash

Notes Receivable

Discount on Notes Receivable

Unearned Franchise Fee

P800,000 x 3.1699 = P2,535,900

P3,200,000 - P2,535,900 = P664,100

513,200

4,000,000

2,486,800

1,200,000

3,200,000

644,100

3,735,900

Sept. 1 - Deferred Franchise Cost

Cash

100,000

Nov. 15 - Deferred Franchise Cost

Cash

60,000

Dec. 31 - Discount on Notes Receivable

Interest Revenue

P2,535,900 x 10% x 6/12 = P126,795

2012

Jan. 10 - Deferred Franchise Cost

Cash

100,000

60,000

126,795

126,795

100,000

100,000

149

AA1 - Chapter 7 (2012 edition)

page

15 - Unearned Franchise Fee

Franchise Fee Revenue

3,735,900

3,735,900

15 - Cost of Franchise Fee Revenue

Deferred Franchise Cost

260,000

260,000

July 1 Cash

Notes Receivable

800,000

800,000

1 - Discount on Notes Receivable

Interest Revenue

126,795

126,795

Problem 7-1

2011

a. Construction in Progress

Cash, Materials, etc.

11,000,000

b. Accounts Receivable

Progress Billing on Const. Contract

10,800,000

c. Cash

Accounts Receivable

10,000,000

d. Cost of LTCC

Construction in Progress

Revenue from LTCC

11,000,000

2,750,000

11,000,000

4,800,000

9,200,000

10,800,000

9,200,000

10,000,000

10,000,000

10,000,000

4,800,000

1,450,000

13,750,000

e. Progress Billing on Construction Contracts

Construction in Progress

Problem 7-2

Income Statement

Revenue from LTCC: 2011

2012

2012

4,800,000

6,250,000

20,000,000

20,000,000

P2,750,000

1,450,000

150

AA1 - Chapter 7 (2012 edition)

page

Statement of Financial Position

Receivables: 2011

P 800,000

2012

Inventory - CIP, net of billings

2011 (13,750,000 - 10,800,000)

P2,950,000

2012

Problem 7-3

Year

Income (loss) Recognized

Recl ending balance

2010

10,000,000

3,800,000

2011

10,000,000

9,400,000

2012

10,000,000

Contract price

Cost incurred to date

Estimated cost to complete

Total estimated cost

Total estimated gross profit

Percentage of completion

Gross profit to date

Less Gross profit recognized in prior year/s

Gross profit to be recognized this year

Problem 7-4

Contract price

Cost incurred to date

Estimated cost to complete

Total estimated cost

Total estimated gross profit (loss)

Percentage of completion

Gross profit (loss) to date

Less gross profit recognized in prior year

Gross profit - current year

2010

P150,000,000

P 40,000,000

80,000,000

P120,000,000

P 30,000,000

33 1/3%

P 10,000,000

_____-______

P 10,000,000

PROJECT A

2011

2012

P29,000,000

P29,000,000

P16,800,000

P26,400,000

11,200,000

------------P28,000,000

P26,400,000

P 1,000,000

P 2,600,000

60%

100%

P 600,000

P 2,600,000

------600,000

P 600,000

P 1,000,000

CIP Invty. ending balance

50,000,000

120,000,000

2011

P150,000,000

P100,000,000

25,000,000

P125,000,000

P 25,000,000

80%

P 20,000,000

10,000,000

P 10,000,000

PROJECT B

2011

2012

P34,000,000 P34,000,000

P14,400,000 P21,200,000

17,600,000

13,000,000

P32,000,000 P34,200,000

P 2,000,000 P( 200,000)

45%

P 900,000 P( 200,000)*

-----900,000

P 900,000 P(1,100,000)

* The entire loss should be recognized immediately

151

Cost in excess of billings

12,000,000

26,000,000

2012

P150,000,000

P120,000,000

---------------P120,000,000

P 30,000,000

100%

P 30,000,000

20,000,000

P 10,000,000

PROJECT C

2011

2012

P17,000,000

P17,000,000

P 3,200,000

P11,830,000

9,600,000

1,170,000

P12,800,000

P13,000,000

P 4,200,000

P 4,000,000

25%

91%

P 1,050,000

P 3,640,000

---1,050,000

P 1,050,000

P 2,590,000

PROJECT D

2012

P2,000,000

P 5,600,000

10,400,000

P16,000,000

P 4,000,000

35%

P 1,400,000

----P 1,400,000

AA1 - Chapter 7 (2012 edition)

page

(1) Percentage of completion method

Gross profit

Operating expenses

Net income

2011

P2,550,000

1,200,000

P1,350,000

2012

P3,890,000

1,200,000

P2,690,000

Problem 7-5

1. (a)

Contract price

Cost incurred to date

Estimated cost to complete

Total estimated cost

Total estimated gross profit

2010

P1,200,000,000

P 240,000,000

760,000,000

P1,000,000,000

P 200,000,000

2011

P1,200,000,000

P605,000,000

495,000,000

P1,100,000,000

P 100,000,000

Percentage of completion

24%

55%

2012

P1,200,000,000

P900,000,000

100,000,000

P1,000,000,000

P 200,000,000

90%

2010-Revenue

Cost of revenue

Gross profit

To date

P288,000,000

240,000,000

P 48,000,000

Recognized in

prior year

----------------

To be recognized

in current year

P288,000,000

240,000,000

P 48,000,000

2011-Revenue

Cost of revenue

Gross profit

To date

P660,000,000

605,000,000

P 55,000,000

Recognized in

prior year

P288,000,000

240,000,000

P 48,000,000

To be recognized

in current year

P372,000,000

365,000,000

P 7,000,000

To date

P1,080,000,000

900,000,000

P 180,000,000

Recognized in

prior year

P660,000,000

605,000,000

P 55,000,000

To be recognized

in current year

P420,000,000

295,000,000

P125,000,000

2012-Revenue

Cost of revenue

Gross profit

2013

P1,200,000,000

P1,050,000,000

-------P1,050,000,000

P 150,000,000

100%

152

AA1 - Chapter 7 (2012 edition)

2013-Revenue

Cost of revenue

Gross profit

2.

a

b.

c.

d.

e.

Construction in Progress

Cash, Materials, etc.

page

To date

P1,200,000,000

1,050,000,000

P 150,000,000

Recognized in

prior year

P1,080,000,000

900,000,000

P 180,000,000

2010

240,000,000

Accounts Receivable

Progress Billings on Const. Contract

260,000,000

Cash

Accounts Receivable

240,000,000

Cost of LTCC

Construction in Progress

Construction in Progress

Revenue from LTCC

240,000,000

48,000,000

To be recognized

in current year

P 120,000,000

150,000,000

P( 30,000,000)

2011

365,000,000

240,000,000

365,000,000

310,000,000

260,000,000

2012

295,000,000

295,000,000

2013

150,000,000

150,000,000

340,000,000

290,000,000

310,000,000

270,000,000

240,000,000

340,000,000

300,000,000

270,000,000

365,000,000

7,000,000

288,000,000

290,000,000

300,000,000

300,000,000

295,000,000

125,000,000

372,000,000

Progress Billings on Const. Contracts

Construction in Progress

300,000,000

150,000,000

30,000,000

120,000,000

420,000,000

1,200,000,000

1,200,000,000

Problem 7-6

Contract price

Cost incurred to date

Estimated cost to complete

Total estimated cost

Total estimated gross profit

Percentage of completion

Gross profit to date

Less Gross profit recognized in prior year

Gross profit - current year

153

2010

P14,000,000

P 5,000,000

7,500,000

P12,500,000

P 1,500,000

40%

P 600,000

-----P 600,000

2011

P14,000,000

P11,475,000

1,275,000

P12,750,000

P 1,250,000

90%

P 1,125,000

600,000

P 525,000

2012

P13,000.000

P12,295,000

------P12,295,000

P 705,000

100%

P 705,000

1,125,000

P (420,000)

AA1 - Chapter 7 (2012 edition)

page

154

Problem 7-7

1. Recognized revenue

Cost of revenue

Gross Profit (loss)

2010

P 11,000,000

10,000,000

P 1,000,000 (1)

2. Contract-price

Cost incurred to date

Estimated cost to complete

Total estimated cost

Total estimated gross profit

Percentage of completion

Gross profit to date

Less GP recognized in prior year/s

GP to be recognized this year

2011

P13,000,000 (2)

12,500,000

P 500,000

2012

P11,000,000 (3)

11,500,000 (4)

P (500,000)

2010

P35,000,000

P10,000,000

22,500,000

P32,500,000

P 2,500,000

30.77%

P 769,250

P 769,250

2011

P35,000,000

P22,500,000

9,500,000

P32,000,000

P 3,000,000

70.3125%

P 2,109,375

769,250

P 1,340,125

Problem 7-8

Franchise A:

The circumstances imply that the full accrual method could be used.

Franchise revenue

P3,578,000*

Franchise cost

1,400,000

Interest revenue (P2,178,000 x 4%)

Income from Franchise A

*Initial deposit

PV of four payments [4% for 4 periods

(P600,000 x 3.6299)]

Total

P35,000,000

34,000,000 (5)

P 1,000,000

P2,178,000

87,200

P2,265,200

P 1,400,000

2,178,000

P 3,578,000

Franchise B:

Because of the doubtful collection and only partial completion, the deposit method should be used. No revenue or income would be

recognized in 2012 from the franchise fee. However, because the first payment of P600,000 was made, interest revenue of P87,200 would

be recognized.

AA1 - Chapter 7 (2012 edition)

page

155

Franchise C:

Because of the doubtful collection but substantial completion, either the installment sales or cost recovery method could be used. If the

installment sales method is used, gross profit of P843,600* would be recognized in 2012 plus interest revenue of P87,200.

*Franchise revenue

Franchise cost

Franchise gross profit

P3,578,000

2,000,000

P1,578,000

Gross profit percentage: P1,578,000 P3,578,000

Collections in 2012:

Initial fee

First payment:

Interest

Principal

Total

44.1%

P1,400,000

87,200

512,800

P 600,000

512,800

P1,912,800

Gross profit recognized in 2012: P1,912,800 x 44.1% = P843,600

If the cost recovery method is used, no revenue or income would be recognized, because the P2,000,000 collections are exactly offset by

the P2,000,000 costs.

Problem 7-9

2012

July

1

Cash

Notes Receivable

Unearned Franchise Fee

Aug. 15

Sept. 15

Dec. 31

7,000,000

8,000,000

15,000,000

Deferred Franchise Cost

Cash

800,000

Deferred Franchise Cost

Cash

500,000

Interest Receivable

Interest Revenue

400,000

800,000

500,000

400,000

AA1 - Chapter 7 (2012 edition)

2013

Jan. 1

15

31

July

Dec.

31

page

Cash

Notes Receivable

Interest Receivable

2,400,000

Deferred Franchise Cost

Cash

1,000,000

2,000,000

400,000

1,000,000

Unearned Franchise Fee

Cost of Franchise Revenue

Franchise Fee Revenue

Deferred Franchise Cost

15,000,000

2,300,000

15,000,000

2,300,000

Cash

Notes Receivable

Interest Revenue

P6,000,000 x 10% x 6/12

2,300,000

2,000,000

300,000

Interest Receivable

Interest Revenue

200,000

200,000

Problem 7-10

1. Downpayment made on Jan 1, 2012

Present value of an ordinary annuity (P240,000 x 3.69590)

Total revenue recorded by Triple Eight

P 800,000.00

887,016.00

P1,687.016.00

2. Cost of acquisition

P 1,687,016

3. Cash

Notes Receivable

Discount on Notes Receivable

Unearned Franchise Fees

800,000.00

1,200,000.00

312,984.00

1,687,016.00

156

AA1 - Chapter 7 (2012 edition)

4.

page

a. P800,000 cash received from downpayment. (P887,016.00 is recorded as unearned revenue from franchise fees).

b. P800,000 cash received from downpayment

c. None. (P 800,000 is recorded as unearned revenue from Franchise fees).

MULTIPLE CHOICE

1.

2.

3.

4.

5.

C

B

D

A

C

6.

7.

8.

9.

10.

11.

P20,000,000 x (3,000,000/15,000,000) =

12.

Contract price

Less Total estimated cost:

Cost incurred to date

Est. cost to complete

Total estimated income

% of completion (3150/9450)

Income to be recognized in 2012

B

D

D

D

C

13.

Contract price

Total estimated cost

Total estimated income

Percentage-of-completion (27/81)

Income recognized last year

14.

Contract price

Total estimated cost (P4,650,000 + P10,850,000)

Total estimated loss to be recognized in full

P4,000,000

P10,500,000

P3,150,000

6,300,000

9,450,000

P 1,050,000

33 1/3%

P 350,000

P9,000,000

8,100,000

P 900,000

33 1/3%

P 300,000

P15,000,000

15,500,000

P 500,000

157

AA1 - Chapter 7 (2012 edition)

15

page

Contract price

Total estimated cost (P4M + P4M + P2M)

Total estimated gross profit

Percentage-of-completion (8M/10M)

Gross profit to date

Less Gross profit recognized in 2011

(P14M P8M = P6M x 4/8)

Gross profit to be recognized in 2012

P14,000,000

10,000,000

P 4,000,000

80%

P 3,200,000

P

3,000,000

200,000

16

Contract price

Total estimated cost

Total estimated gross profit

Percentage-of-completion (600/1,800)

Gross profit to be recognized in 2012

P3,000,000

1,800,000

P1,200,000

33 1/3%

P 400,000

17.

Contract price

Total cost incurred

Gross profit

Gross profit percentage (1,200/12,000)

P12,000,000

10,800,000

P 1,200,000

10%

18

A

Contract price

Total estimated cost

Total est. gross profit

Percentage-of-completion

Gross profit to date

Less GP recognized in 2011

GP to be recognized In 2012

Cubao

P16,200,000

14,400,000

P 1,800,000

83 1/3%

P 1,500,000

750,000*

P 750,000

Total GP = P750,000 + P228,000

Marikina

P25,200,000

23,100,000

P 2,100,000

100%

P 2,100,000

1,872,000**

P 228,000

P

978,000

*P16,200,000 P14,400,000 = P1,800,000 x 60/144 = P750,000

**P25,200,000 P22,500,000 = P2,700,000 x 156/225 = P1,872,000

19.

20,000,000/24,000,000

83.33%

158

AA1 - Chapter 7 (2012 edition)

20.

21.

Contract price

Total estimated cost

Total estimated gross profit

Percentage-of-completion

GP to date

GP recognized in prior years

(P30M - P22M = P8M x 50%)

GP to be recognized in 2012

Total amount billed

Less Balance of accounts receivable

Total collections

Amount deposited

Cash collected not yet deposited

22. D

P150,000 937,500/9,000,000

23. D

Mobilization fee (P1.2B x 1%)

Collections on billings (1.2B x 10% x 90%)

Total fee received by NNO

24. C

Contract price

Gross profit rate

Total estimated gross profit

Percentage-of-completion

Realized gross profit

25.

26.

27.

28.

29.

D

D

A

C

D

P200,000 + P1,000,000 P900,000 = P300,000

page

P30,000,000

24,000,000

P 6,000,000

83.33%

P 5,000,000

4,000,000

P 1,000,000

P843,750

300,000

P543,750

500,000

P 43,750

P1,440,000

P 1.2M

10.8M

P12.0M

P100.00M

25%

P25.00M

50%

P12.50M

159

AA1 - Chapter 7 (2012 edition)

page

30. C

Downpayment

First installment payment

Addl fee (P1,000,000 x 3%)

Earned Franchise Fees

P 50,000

50,000

30,000

P130,000

31. C

P1,000,000 x 1/5 = P200,000 + 1% of P5,000,000

P 250,000

32. D

P 1,000,000 + 5% of P8,000,000 =

33. C

Downpayment

PV of installment payment

Additional fee ( P 9,000,000 x 5% )

Earned franchise fee

P1,400,000

P 100,000

199,650

450,000

P 749,650

160

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- 2012-06 CFA L2 100 ForecastDokumen236 halaman2012-06 CFA L2 100 ForecastAfaque Mehmood Memon100% (3)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Tax Answers 2Dokumen280 halamanTax Answers 2Don83% (6)

- Midterm 3 AnswersDokumen7 halamanMidterm 3 AnswersDuc TranBelum ada peringkat

- Factsheet ANTM 2023 01Dokumen4 halamanFactsheet ANTM 2023 01arsyil1453Belum ada peringkat

- FM09-CH 09Dokumen12 halamanFM09-CH 09Mukul KadyanBelum ada peringkat

- Maintaining Price Stability Ensuring Adequate Flow of Credit To The Productive Sectors of The Economy To Support Economic Growth Financial StabilityDokumen54 halamanMaintaining Price Stability Ensuring Adequate Flow of Credit To The Productive Sectors of The Economy To Support Economic Growth Financial Stabilityfrancis reddyBelum ada peringkat

- The Balance Sheet Items For CIBDokumen1 halamanThe Balance Sheet Items For CIBKhalid Al SanabaniBelum ada peringkat

- Private Placement Trade Programs ExplainedDokumen18 halamanPrivate Placement Trade Programs ExplainedMike Weiner100% (6)

- Laporan Cash Flow ANTAM KomengDokumen2 halamanLaporan Cash Flow ANTAM KomengNiky SuryadiBelum ada peringkat

- Barclays SELLDokumen16 halamanBarclays SELLbrucepackard3948Belum ada peringkat

- Human Resources 3Dokumen104 halamanHuman Resources 3Harsh 21COM1555Belum ada peringkat

- Globalinvestmentfunds Annualreport 706Dokumen368 halamanGlobalinvestmentfunds Annualreport 706xuhaibimBelum ada peringkat

- Time Lines and NotationDokumen7 halamanTime Lines and NotationShreya Ramaswamy100% (1)

- Factsheet Ton How Do Inflation and The Rise in Interest Rates Affect My MoneyDokumen8 halamanFactsheet Ton How Do Inflation and The Rise in Interest Rates Affect My Moneyimhidayat2021Belum ada peringkat

- AtmDokumen16 halamanAtmFRANCIS JOSEPHBelum ada peringkat

- Statement Ending 11/30/2022: Summary of AccountsDokumen4 halamanStatement Ending 11/30/2022: Summary of AccountsGrégoire TSHIBUYI KATINABelum ada peringkat

- Synopsis Axis and Icici BankDokumen11 halamanSynopsis Axis and Icici Banksauravv7Belum ada peringkat

- Services Quality Analysis in SBI BankDokumen110 halamanServices Quality Analysis in SBI Bankvinodksrini007100% (4)

- Company Accounting Australia New Zealand 5th Edition Jubb Solutions ManualDokumen35 halamanCompany Accounting Australia New Zealand 5th Edition Jubb Solutions Manualunworth.apnoeawldza100% (23)

- ch#5 of CFDokumen2 halamanch#5 of CFAzeem KhalidBelum ada peringkat

- Gen Math Q2 W1 2 QADokumen34 halamanGen Math Q2 W1 2 QAarneahagacoscos090Belum ada peringkat

- 03 - Literature Review PDFDokumen12 halaman03 - Literature Review PDFPreet kaurBelum ada peringkat

- Mahusay Bsa-315major-Output-1Dokumen3 halamanMahusay Bsa-315major-Output-1Jeth MahusayBelum ada peringkat

- Sub: Bank Account Details.: Date: 17-08-2019Dokumen1 halamanSub: Bank Account Details.: Date: 17-08-2019ABDUL FAHEEMBelum ada peringkat

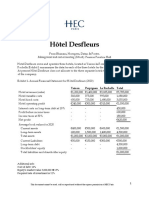

- S07 Desfelurs V3Dokumen2 halamanS07 Desfelurs V3Khushi singhalBelum ada peringkat

- Bridge Course in EconomicsDokumen17 halamanBridge Course in EconomicsProfessor Tarun DasBelum ada peringkat

- Bonds Market in PakistanDokumen26 halamanBonds Market in PakistanSumanSohailBelum ada peringkat

- 5.1.2 Ordinary AnnuityDokumen19 halaman5.1.2 Ordinary AnnuityTin LauguicoBelum ada peringkat

- 2023 10 02 11 04 28jul 23 - 605009Dokumen3 halaman2023 10 02 11 04 28jul 23 - 605009prasannapharaohBelum ada peringkat

- Ifrs 17 Reinsurance Contract Held ExampleDokumen24 halamanIfrs 17 Reinsurance Contract Held ExampleHesham AlabaniBelum ada peringkat