Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)

Diunggah oleh

Shyam SunderJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)

Diunggah oleh

Shyam SunderHak Cipta:

Format Tersedia

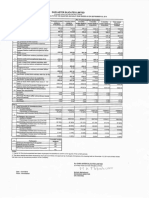

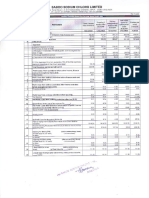

AUTC P|NS (rNDrA)

LTMTTED

REGD" OFFICE:2776,PYA?ELAL BUILDING, MOTOR MARKET, KASHMERE GATE, DEIHI.II0006

CIN:

E MAlt lD] autopins@vsnt.gpm

[34300DI1975P1C007994

(fig. in

PART I

[ocs)

Slqlemenl of Slondolone Un-oudlled Resulk lor lhe Quorler Ended 3l .03.20'

3 Monlhs

ended

(3r.03.20r

s)

Proceedin Correspondi

g 3 Monlhr ng 3 Monlhs

Yeqr lo

Yeor lo

Previous

dote figures

dole

figures lor

yeqr

ended

previous

30.06.20r4

ended

for curenl

ended

(3r.r2.20r (3r.03.20r 4) yeor ended

previous

4)

Rs.

31.03.2015

yeqr

yeqr

ended

31.03.2014

ncome from operolions

o)Net Soles/lncome from Operotions

Net of excise dutv)

(blOther Operoting lncome

Un

Audiled

Un

Audited

Audited

Un

Audited

296.52

385.56

| 145.72

t395.91

284.55

296.s2

385.56

1145.72

t395.91

1402.00

o) Cost of moteriolconsumed

201.26

210.53

269.89

809.42

977 .t 4

19 t .03

b) Purchose of Stock -in-trode

-24.54

-28.30

1.26

128.29

-105.87

27.67

34.02

32.44

36.62

127.78

r30.5r

r32.70

25.00

25.00

25.00

100.00

100.00

107.04

45.23

54.70

49.67

225.83

279.06

440.77

280.97

294.37

382.44

| 134.74

l3B0.B4

I499.21

3.58

2.15

3.12

10.98

15.07

-97.21

730.8r

2.15

3.12

10.98

15.07

633.60

0

3.12

0

10.98

r.93

15.07

631 .67

402.00

Expenses

c) Chonge in inventories of finished

qoods, work in proqress ond stock in trode

d) Employees benefits expense

Un

Audited

284.55

Tolollncome from operolions (nel)

2

Un

Audited

e) Deprecioiion ond omoriisotion

expense

f) Other Expense (ony item exceeding

10% of the totol expenses reloting to

coniinuing operotions lo be shown

seoorotelv)

Tolol expenses

3

Prolil from Operolions before Other

lncome, finonce cosls & Exceplionol llems

fl-2)

4

Other lncome

Profil/ (Loss) from ordinory oclivilies

before finonce cosl & exceplionol ilems

0

3.58

(3+4)

6

a

Fincnce costs

Profit/ (Loss) lrom ordinory oclivities ofler

finonce cosls bul before exceptionol

3.58

2.15

tl

3.58

2.15

3.12

r0.98

t5.02

0

3.58

0

3.12

,'l

t0.98

15.07

2.15

3.12

10.98

15.07

631 .67

ilems(5+6)

9

Exceptionol iiems

Profil/ (Loss) from Ordinory Aclivilies

before Tox (7+8)

l0

Tox Expense

lt

r3

Net Profit/ {Loss) from Ordinory Aclivilies

ofler tox (9+10)

Exlroordinorv ilem (nel of lox exoense)

Nel Profil (+)/Loss (-) for the period (l ltl2)

t4

Shore of Profil/ (loss) of ossocioles*

12

0

e (o

\J

0

0. |Eerr

f, (1"u{,<

\\

. 'r_hl

ti?

l'.' "" $,[tr/

\i" * #'

631.67

631 .67

Net Profil /Loss otler loxes, mlnorily

inleresl qnd shore of profit / (loss) of

ossocioles (13+14+l

Poid up Equiiy Shore Copitol

l0/- eoch

Foce Volue of Rs.

Reserves (excl. Revoluotion Reserve) os

per bolonce sheet of previous occounting

yeor

Eorning Per Shore (before exlroordinory

(o) Bosic

(b) Diluted

Eorning Per Shore (ofter exlroordinory

PARTICULARS OF SHAREHOLDING

- Number of Shores

-% of

17t0724

1710724

\710724

Shoreholding

- Number of Shores

-% of Shores (os o % of the iotol

shoreholding of promoter ond promoter

o % of the totolshore

copitol of the com

b) Non-encumbered

Number of Shores

-% of Shores (os

o % of the totol

shoreholding of promoier ond promoler

-% of Shores (os

-% of Shores (os

of the totol shore

copitolof the

3 monlhs ende

31 /03/20]| 5

INVESTOR COMPLAINTS

Pending ot the beginning of the quorier

Received during the quorter

Disposed of during ihe quorier

Remoining unresolved of the end of the

t7 10724

\710724

1710724

AUTO PrNS (rNDlA) L|M|TED

REGD. OFFICE: 2776, PY ARELAT BUItDING, MOIOR MARKEI, KASHMERE GATE, DELHI.l10006

CIN:

E MAIL lDi autqoins@vsnt.com

t34300Dt1975PtC007994

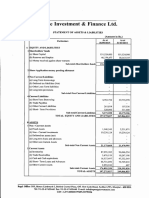

Statement of Assets and Liabilities as per Clause 41 of the Listing Agreement

s. In

ln lacs

Rs.

Standalone Statement of Assets & Liabilities

Particulars

As at current year

ended 31.03.2015

As at previous year

ended 31.03.2014

(Unaudited)

(Unaudited)

570.7-l

570.71

"10.49

0.00

6.02

0.00

581.20

576.73

101.53

101.53

0.00

0.00

0.00

0.00

EOUITY AND LIABILITIES

Shareholders' Funds:

(i)

Share Capital

(ii) Reserves & Surplus

2

J

iii) Monev received aeainst share warrants

Sub-total- Shareholders'funds

Share Application monev pendins allotment

Non-current liabilities

il Lons-term borrowines

) Deferred tax liabilities (net)

iii) Other lons term liabilities

(iv) Lone-term nrovisions

Sub-total - Non-current liabilities

Current liabilities

0.00

101.53

Short-term borrowins

121.74

86.31

ii) Trade pavables

(iii) Other current liabilities

(iv) Short-term provisions

172."19

100.00

104.20

238.59

0.00

0.00

Sub-total - Current liabilities

TOTAL - EOUITY AND LIABILITIES

398.1.3

424.90

1080.86

1103.16

351.93

457.93

2.75

0.00

2.75

Assets

Non-current assets

0.00

101.53

i) Fixed assets

i) Non-current investments

(iii) Deffered tax assets (net)

v) Lonq-term loans and advances

(v) Other non-current assets

Sub-total - Non-current assets

Current Assets

(i) Current investments

i) lnventories

i) Trade receivables

v) Cash & cash equivalents

(v) Short-ternr loans and advances

i) Other current assets

Sub-total - Current assets

TOTAL ASSETS'

Note:

1.

2.

3.

4.

5.

7.62

0.00

7.62

0.00

362.30

462.30

0.00

0.00

0.00

568.10

98.74

5.91

5-10.47

1,5.20

33.72

30.51

0.16

37.76

58.75

7't8.56

640.86

1080.86

1103.15

The Results were taken on record at the meeting of the Board of Directors held on 30.04.2015.

The figures in respect of previous period's have been re-grouped wherever necessary

There is no change in accounting policies/practices as compared to previous accounting year.

During the current quarter, no investor complaints were received. No complaints were pending

in the beginning and at the end of the quarter ended on 31st March, 2015. Provision for taxation, if anv, shall be made at the close of the Financial Year

Place: New Delhi

Date : 30.04.2015

For

*

DIITECTOR

DIN:00176574

CK

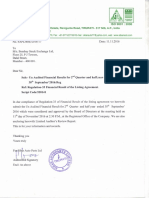

SANJAY RAWAL AND CO.

CHARTERED ACCOVNTANTS

A-146,6.F., DAyANAND COLONy, LAJPAT NA6AR-rV, NEW DELHr-11cr/24

Phone :'91-1 t-264218?2, ?6282518, Telefox : *91-1 l-26?26319

Emoil : cosonjoyrowol@gmoil.com

AUDITORS LIMITED REVIEW REPORT FOR THE QUARTER ENDED

3Lsr MARCH,aqL' OF M/S. AUTO PINS (TNDIA) LTD.

"We have reviewed the accompanying statement of Unaudited Financial Results of M/s. Auto

Pins (India) Ltd. having its registered office at 2776, Pyarelal Building, Motor Market,

Kashmere Gate, Delhi - 110006 fot the quarter endrng 31" March, 2015. This statement is the

responsibilitl' of the Companv's Management and has been appror.'ed by the Board of Directors

of the Company. Our responsibiliW is to issue a report on these financial statements based on

our tevierv.

rWe conducted our review

in accotdance with the Standard on Review Engagement (SRE) 2400,

Engagements to Revierv Financial Statemerrts issued bl the Inslitute of Chartered Accountants

of Indra. This statement requires that rve plan and perform the teview to obtain moderate

assurance as to whether the financial statements are ftee or material misstatement. A review is

limited primarily to incluiries of companv personnel and anah,tical procedures applted to frnancial

data and thus providc lcss assutance than an audit. We have not performed an audit and

rccorclinglr. we clo irol ('\pl'r'Ss 261 opinion.

Based on out teview conducted as above, nothing has comc to our notice that causes us t.)

believe that the accompanyng statement of unaudited financial results prepared in accordance

with applicable accounting standards and other recognized accounting policies has nor disclosed

the information tequired to be disclosed in terms of Clause 41 of the Listrng Agreement

rncluding the manner in which rt rs to be dtsclosed, or that it contains any material misstatement.

For Sanjay Rawal & Co.

Membership No. 088156

Dare: 30-04-2015

Place: New Delhi

Anda mungkin juga menyukai

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Dari EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Belum ada peringkat

- Fast-Track Tax Reform: Lessons from the MaldivesDari EverandFast-Track Tax Reform: Lessons from the MaldivesBelum ada peringkat

- Financial Analysis of Reliance Industries Limited MAKSUDDokumen93 halamanFinancial Analysis of Reliance Industries Limited MAKSUDAsif KhanBelum ada peringkat

- TOPIC 4 Leases IFRS 16 PDFDokumen13 halamanTOPIC 4 Leases IFRS 16 PDFAnonymous ns1HpZKAf100% (1)

- Debit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Dokumen6 halamanDebit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Jeane Mae BooBelum ada peringkat

- Reviewer FinalsDokumen16 halamanReviewer FinalsAngela Ricaplaza Reveral100% (2)

- Mutual Fund Holdings in DHFLDokumen7 halamanMutual Fund Holdings in DHFLShyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen3 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokumen5 halamanFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen5 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokumen2 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen3 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen8 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokumen3 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2015 (Result)Dokumen8 halamanStandalone Financial Results, Limited Review Report For September 30, 2015 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen9 halamanStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Pdfnews PDFDokumen5 halamanPdfnews PDFMurthy KarumuriBelum ada peringkat

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen7 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokumen6 halamanFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Announces Q1 (Standalone) Results, Limited Review Report (Standalone) & Results Press Release For The Quarter Ended June 30, 2016 (Result)Dokumen4 halamanAnnounces Q1 (Standalone) Results, Limited Review Report (Standalone) & Results Press Release For The Quarter Ended June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen9 halamanStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen6 halamanStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokumen2 halamanFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen3 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Financial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen5 halamanFinancial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- CAT: Annual ReportDokumen131 halamanCAT: Annual ReportBusinessWorldBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokumen2 halamanFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionDari EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionBelum ada peringkat

- Order of Hon'ble Supreme Court in The Matter of The SaharasDokumen6 halamanOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderBelum ada peringkat

- JUSTDIAL Mutual Fund HoldingsDokumen2 halamanJUSTDIAL Mutual Fund HoldingsShyam SunderBelum ada peringkat

- HINDUNILVR: Hindustan Unilever LimitedDokumen1 halamanHINDUNILVR: Hindustan Unilever LimitedShyam SunderBelum ada peringkat

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDokumen2 halamanSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderBelum ada peringkat

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDokumen5 halamanExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderBelum ada peringkat

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Dokumen1 halamanPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderBelum ada peringkat

- Financial Results For Mar 31, 2014 (Result)Dokumen2 halamanFinancial Results For Mar 31, 2014 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For March 31, 2016 (Result)Dokumen11 halamanStandalone Financial Results For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen4 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Settlement Order in Respect of R.R. Corporate Securities LimitedDokumen2 halamanSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderBelum ada peringkat

- Financial Results For June 30, 2014 (Audited) (Result)Dokumen3 halamanFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results For September 30, 2013 (Result)Dokumen2 halamanFinancial Results For September 30, 2013 (Result)Shyam SunderBelum ada peringkat

- Financial Results For Dec 31, 2013 (Result)Dokumen4 halamanFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results For June 30, 2013 (Audited) (Result)Dokumen2 halamanFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For June 30, 2016 (Result)Dokumen2 halamanStandalone Financial Results For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- PDF Processed With Cutepdf Evaluation EditionDokumen3 halamanPDF Processed With Cutepdf Evaluation EditionShyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Transcript of The Investors / Analysts Con Call (Company Update)Dokumen15 halamanTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderBelum ada peringkat

- Investor Presentation For December 31, 2016 (Company Update)Dokumen27 halamanInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Ca Ipcc Accounts Suggested Answers May 2016 PDFDokumen16 halamanCa Ipcc Accounts Suggested Answers May 2016 PDFMahavir ShahBelum ada peringkat

- M. GordonDokumen27 halamanM. GordonRosevie ZantuaBelum ada peringkat

- IAS 1 Preparation of FS PDFDokumen12 halamanIAS 1 Preparation of FS PDFJohn Carlo SantianoBelum ada peringkat

- Cmpo-Hvkm N Cizn N Kvioan/V - P - N Nc-A-Ip-Dn V: S ( - P-HCN 2017 HneDokumen52 halamanCmpo-Hvkm N Cizn N Kvioan/V - P - N Nc-A-Ip-Dn V: S ( - P-HCN 2017 HneshabeervmkBelum ada peringkat

- Mock Test of Jaiib Principles & Practices of Banking.: AnswerDokumen12 halamanMock Test of Jaiib Principles & Practices of Banking.: Answeraao wacBelum ada peringkat

- Solution FAR270 APRIL 2022Dokumen6 halamanSolution FAR270 APRIL 2022Nur Fatin Amirah100% (1)

- ADJUSTING Activities With AnswersDokumen5 halamanADJUSTING Activities With AnswersRenz RaphBelum ada peringkat

- Cai Acc. Imp Questions (Part 1)Dokumen100 halamanCai Acc. Imp Questions (Part 1)SheenaBelum ada peringkat

- Unit Iii Learning ActivityDokumen10 halamanUnit Iii Learning ActivityChin FiguraBelum ada peringkat

- Fulbari - 6 Kavre: Cash Flow StatementDokumen21 halamanFulbari - 6 Kavre: Cash Flow StatementSudeep RegmiBelum ada peringkat

- 2012 ArDokumen83 halaman2012 ArtheredcornerBelum ada peringkat

- Balance Sheet As at December 31, 2009Dokumen19 halamanBalance Sheet As at December 31, 2009pradeepkallurBelum ada peringkat

- FABM2 Module 06 (Q1-W7)Dokumen8 halamanFABM2 Module 06 (Q1-W7)Christian Zebua75% (4)

- Partnership-WPS OfficeDokumen3 halamanPartnership-WPS OfficeRanelene CutamoraBelum ada peringkat

- Financial Statements, Cash Flow, and Taxes: Multiple Choice: ConceptualDokumen2 halamanFinancial Statements, Cash Flow, and Taxes: Multiple Choice: ConceptualKristel SumabatBelum ada peringkat

- Chap 004Dokumen24 halamanChap 004Hiep LuuBelum ada peringkat

- Canterbury Institute of Management (CIM) : ACCT101 Foundations of AccountingDokumen10 halamanCanterbury Institute of Management (CIM) : ACCT101 Foundations of AccountingSuman GautamBelum ada peringkat

- Horizontal AnalysisDokumen3 halamanHorizontal AnalysisTeofel John Alvizo Pantaleon0% (1)

- Jurnal 07 YoyonSupriadi PDFDokumen7 halamanJurnal 07 YoyonSupriadi PDFAnnisa oktaviaBelum ada peringkat

- Mr. Nirmal Jain: The UnbeatablesDokumen7 halamanMr. Nirmal Jain: The Unbeatablesshashi singhBelum ada peringkat

- Credit Creation by Commercial BanksDokumen19 halamanCredit Creation by Commercial BanksSaumitra RaneBelum ada peringkat

- On August 1 2014 Delanie Tugut Began A Tour CompanyDokumen1 halamanOn August 1 2014 Delanie Tugut Began A Tour CompanyTaimour HassanBelum ada peringkat

- Midterm Exam Essay Questions-5Dokumen2 halamanMidterm Exam Essay Questions-5Thu Hiền KhươngBelum ada peringkat

- IndiabullsDokumen338 halamanIndiabullsPrasoon SurendranBelum ada peringkat

- Redemption of Debentures (Inter CA) PDFDokumen4 halamanRedemption of Debentures (Inter CA) PDFvenkata srikanth topalliBelum ada peringkat

- Assignment FS AnalysisDokumen2 halamanAssignment FS AnalysisLorraine Anne TawataoBelum ada peringkat