Glass Ceiling Converted Into Glass Transparency A Study On The Factors Making Women Executives Successful in The Indi-An Banking Sector

Diunggah oleh

Rakesh DwivediJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Glass Ceiling Converted Into Glass Transparency A Study On The Factors Making Women Executives Successful in The Indi-An Banking Sector

Diunggah oleh

Rakesh DwivediHak Cipta:

Format Tersedia

Journal of Business Management & Social Sciences Research (JBM&SSR)

Volume 3, No.4, April 2014

ISSN No: 2319-5614

---_________________________________________________________________________________

Glass Ceiling Converted Into Glass Transparency: A Study On

The Factors Making Women Executives Successful In The Indian Banking Sector

Dr Geeta Sachdeva, Assistant Professor, Department of Humanities & Social Sciences, National Institute of Technology,

Kurukshetra, Haryana, India

Abstract

Economic reforms in the Indian economy along with gradual opening up of a conservative society to a modern society preceded breaking the glass ceiling or conversion Glass ceiling into a Glass Transparency in the Indian Banking Sector. This

is backed by a recent study of 240 top Indian companies by EMA Partners, the global executive-search firm, which says

more than a half of India's women chief executives are accounted for by the banking and financial services industry.

This paper studies the impact of glass ceiling on the Indian banking Industry and increasing role of women leaders in

banking industry and also is an attempt to develop the factors which make women so successful in the Indian Banking Industry.

Purpose Of The Paper is to

a) To Study the impact of Glass Ceiling on the Indian banking Industry

b) To Study the why women in banking making it to the corner room than any other sector

c) To develop the factors making women executive successful in the Indian banking Sector

Design/Methodology/Approach

The theories about the factors that have been used to break through the glass ceiling and increase womens participation

have been discussed and coordinated with the statements of eminent personalities of Indian Banking Sector about factors

women bankers leverage in their career growth and classified into a set of six factor which are making women executive

successful in the Indian banking sector.

Findings

We conclude that Indias Banking sector seems to have gently shattered this Glass ceiling and has been a sort of opposition to the glass ceiling and the Indian banking industry has a better corner room diversity score

It is concluded that factors making women executive successful in the Indian Banking sector can be classified as a) Liberalization of Indian Economy b) Education c) Diversity Consciousness by Banks d) Nature of Banking Job e) Family Support f) Banking Comes Naturally to Women

Keywords: Glass Ceiling, Indian Banking, Women in Banking, Glass Transparency, Banking & Financial Services.

Introduction

Women Managers are conspicuous by their minority in

Indian Organizations. However studies show that Indian

Organizations are better off than their western counterparts as far as presence of women in the top management

is concerned. Around 11% of the top corporate organizations in India are headed by women against a corresponding figure of 3% for fortune 500 companies.

Trends in the Indian Banking sector are highly favorable

for women leaders; Managing Human Resources (Sie)

8E, By Cascio, Page 370).

Indian banking sector has witnessed explosive growth

and expansion ever since the economic reforms was

launched nearly two decades ago. This has created a new

window of opportunities for women to find employment

in the banking sector. In fact, the nationalization of the

Indian banking sector in 1969 served as the first major

step to reduce gender discrimination against women in

banking jobs. The general pattern of womens employment in this sector has shown that there has been a sort

www.borjournals.com

of opposition invisible glass ceiling against women acquiring the top management positions in banking.

Economic reforms in the Indian economy along with

gradual opening up of a conservative society to a modern

society preceded breaking the glass ceiling or conversion

Glass ceiling into a Glass Transparency in the Indian

Banking Sector. This is backed by a recent study of 240

top Indian companies by EMA Partners, the global executive-search firm, which says more than a half of India's

women chief executives are accounted for by the banking and financial services industry.

Glass Ceiling

Glass ceiling became a popular term after it was coined

in The Wall Street Journal by journalists Hymowitz and

Schellhardt in 1986. It is an everyday metaphor used to

describe the invisible barrier in front of women seeking

to move up organizational hierarchies (Powell, 2012).

This phenomenon is responsible for the scarcity of women holding leadership and senior management positions

Blue Ocean Research Journals

46

Journal of Business Management & Social Sciences Research (JBM&SSR)

Volume 3, No.4, April 2014

ISSN No: 2319-5614

----

in many areas, but particularly in business and politics

United Bank of India and Shubhalakshmi Panse, CMD

_________________________________________________________________________________

(Catalyst,

2011; Okimoto and Brescoll, 2010).

of Allahabad Bank.

The glass ceiling refers to an artificial barrier that prevents qualified individuals to advance within their organization and reach their full potential (Reinhold, 2005).

Even though society has come a long way in attaining

more opportunities for women, there is still a long way

to go in order to reach true equality (Goodman et al.,

2003). This inability to reach equality is what is termed

the glass ceiling (Veale and Gold, 1998). The term

glass ceiling is the apparent barriers that prevent women and minorities from reaching the top of the corporate

hierarchy (Pai and Vaidya, 2009, p.106).

In todays world female managers are business people

who are in relationships with family responsibilities and

it is important for women to realize that their dual roles

have to be managed (Veale and Gold, 1998, p.

23).Presently, a large number of women have moved

rapidly into positions of management (Yukongdi and

Benson, 2005). Even though, to date, they occupy mostly

the middle and lower ranks in the managerial cadre

(Kottis, 1993). Quite a number of women have successfully broken the "glass ceiling" but the number gaining

access into senior management positions is still relatively small (Arfken et al., 2004 ). In most cases, female

managers carry out the same job description as men but

with lower titles (Albrecht et al., 2003). Furthermore,

practical evidence confirms that the few women that

have succeeded in getting to managerial positions earn

just a fraction of what their male counterparts earn on

salaries (Jamali et al., 2006). In spite of all the pressures

and legal changes from national and international organizations which have taken place, it is not in doubt that an

advancement in the positions held by women in large

organizations have been somewhat uneven and slow

(Cordano et al., 2002).

Glass Ceiling and Indian Banking Sector:

Indias Banking sector seems to have gently shattered

this Glass ceiling and has been a sort of opposition to the

glass ceiling.

As Arundhati Bhattacharya gets set to take charge as the

chairperson of the country's largest bank State Bank of

India (SBI) to become the first woman chairperson in the

history of 206 years of State bank of India, she looks

likely to join the steadily expanding club of women currently holding the top job in Indian banks. Bhattacharya

will be the latest entrant, joining the likes of Chanda

Kochhar, MD and CEO of ICICI Bank; Shikha Sharma,

MD and CEO, Axis Bank; Naina Lal Kidwai, country

head, HSBC; Kaku Nakhate, president and country head

(India), Bank of America Merrill Lynch, Vijayalakshmi

Iyer, CMD, Bank of India; Archana Bhargava, CMD,

www.borjournals.com

The government has reportedly zeroed in on Ms. Usha

Ananthasubramanian, ED, Punjab National Bank, to

head the countrys first all-women bankBhartiya Mahila Bankwhich has commenced operations from November.

This is unique both in the Indian and global contexts. In

India, only one in 10 companies across all sectors have a

woman at the helm, but more than half of these are from

the financial services sector, a study done by executive

search firm EMA Partners International a few years ago

discovered. That number has only grown in the past few

years, says K Sudarshan, managing partner - India

®ional VP - Asia.

Globally too, the Indian banking industry has a better

corner room diversity score than even the US. Only three

in the top 25 in American Banker Magazine's listing of

most powerful women in banking, released last month,

are at the very top of their companies. Two more had the

chief executive title, but only ran large subsidiaries.

Why Do More Women In Banking Make It

To The Corner Room Than Any Other Sector?

Women have this thing with numbers, finance and

money. The banking industry gave them equal opportunities and they have excelled Finance Secretary Sushma

Nath, who is herself the first woman to occupy the top

post in North Block, said.

Banking comes naturally to women, says Swati Piramal,

a non-executive director on the board of ICICI Bank and

vice-chairperson of Piramal Enterprises. "Women tend to

be more conservative, more structured, more careful

about money, good leaders and better team players," she

says. Arun Duggal, chairman of Shriram Capital and a

veteran international banker adds: "Banking requires

sound instinct and intellectual capability to analyse businesses. I feel women are better at it than men." says

Duggal, who is championing a mentoring programme to

get more women on corporate boards, says women have

the ability to judge a borrower situation instinctively and

are able to make very sound judgments.

At least two more factors have traditionally helped

women bankers leverage this natural advantage in their

career growth. First, banking does not present women

with the challenges and stereotypes other sectors such as

manufacturing pose. "Unlike in manufacturing, banking

in a way, did not have a shop-floor (and therefore no

problem of women having to do night shifts),"says K

Ramkumar, executive director, ICICI Bank. "Much of

Blue Ocean Research Journals

47

Journal of Business Management & Social Sciences Research (JBM&SSR)

Volume 3, No.4, April 2014

ISSN No: 2319-5614

----

the selling in the financial services industry, until retail

management levels, some women would tend to drop off

_________________________________________________________________________________

exploded

in the past 10 years, was done meeting people

because of various issues. This is changing a lot now."

in offices."

Banking requires a lot of reliance on external network

Second, banks started to intentionally build diversity

and research suggests women are very strong in external

much earlier than other sectors. "The number of senior

networking and more objective and performancewomen bankers that you see today is a testimony to

oriented in their roles within the organization, says Puthat,"says Madhavi Lall, head - group employee relaneet Singh, partner, financial services, and head-north

tions, Standard Chartered Bank. At ICICI Bank, for exIndia, Heidrick &Struggles. "This is one reason why

ample, this was happening since the 1980s, led by viwomen are successful at the top level in banks."

sionaries like SS Nadkarni and N Vaghul in the 80s,

Some of the operational challenges in terms of gender

points out Ramkumar. Kamath continued the tradition

aren't there in our banking and financial services industhat ensured women got an opportunity to prove themtry, said Aruna Sundararajan, who was till recently the

selves.

chief executive for digital inclusion at Infrastructure

"Women who are at the top now are largely those who

Leasing and Financial Services Ltd.

started their careers around 1980s and worked their way

'This industry also does not need the kind of networking

up,"says Shubhalakshmi Panse, chairman and managing

that is otherwise required in the corporate sector. It has

director of Allahabad Bank and the first woman to head

also provided equal, merit-based opportunities to womthe 148-year-old institution. "What works in their favour

en, 'Sundararajan, now a joint secretary in the urban deis that they are multi-taskers, team players, very flexible

velopment ministry, told IANS.

and able to handle all kinds of situations with equanimity."

Literature Review

Tarjani Vakil, former chairperson of the Exim Bank,

who rose to the top spot in 1996, was perhaps the first of

her kind. She was followed by Ranjana Kumar who became CMD of Indian Bank in 2000. She managed a significant turnaround at the bank, before taking over as

chairperson of Nabard (National Bank for Agriculture

and Rural Development) in 2003.

Over the years, ICICI Bank and others have supported

women at various points in their career, enabling them to

balance their home and work life more effectively, especially at key decision points or the cross-roads. "Banking

as a career offers women the opportunity to better balance their family and professional careers, says Duggal.

Many banks have also proactively promoted women for

fear of losing them to competition. "Companies that have

managed to elevate internal candidates to the CEO position are better examples where this approach has worked

best,"says Kaku Nakhate, president and country head India, Bank of America Merrill Lynch.

Banks remain sharply focused on improving gender diversity, top search firms say. Other things remaining the

same, between two candidates from different sexes,

banks prefer women.

At least half-a-dozen clients across multinational banks

and insurance are making a more conscious effort to hire

women candidates, says Monica Agrawal, partner and

head of financial services at executive search firm

Korn/Ferry International. "Earlier, men and women

would start off at the same level but at the mid-

www.borjournals.com

According to McDonald (2004) attaining education has

been categorized as one of the most significant factors

that have been used to break through the glass ceiling

and increase womens participation in the labor force.

Kirchmeyer (2002 cited in Jamali et al. 2006) noted that

in the past, women have achieved high levels of education in different countries and consist of about 40 percent

of the workforce worldwide. Self development through

formal education and volunteering for leadership positions would help women acquire good skills for business

as well as gain high profile, knowledge and experience

(Still, 1992).

Diversity is an asset which can be transformed when

properly managed into a workplace where different employees can grow and utilize their full potential (Kundu,

2003). MacRae (2005) noted the increase in gender and

ethnic diversity in organizations as a vital strategy which

has helped in assuring women of equal opportunity in

attaining top management positions and getting involved

in making strategic business decisions thereby making it,

not only imperative for organizational success but also

for societal development. Morrison (1992) suggested

that top management should promote diversity and their

top executives should constantly advocate and nudge

their direct subordinates and other employees to foster

diversity within the organization. According to Jackson

(2001) organizations should effectively embrace diversity and put strategies in place to eliminate discrimination

and injustice to women.

Williams and Cooper, (2004) acknowledged that family

obligations affected working women while Clancy and

Blue Ocean Research Journals

48

Journal of Business Management & Social Sciences Research (JBM&SSR)

Volume 3, No.4, April 2014

ISSN No: 2319-5614

----

Tata (2005) argued that women would be successful in

c) Diversity Consciousness by Banks: Banks and Intheir_________________________________________________________________________________

career if they get the support of their husbands.

surance companies are making a more conscious effort

to hire women candidates.F The present scenario clearly

According to Cornelius and Skinner (2005) equal opporindicates that management in general has become much

tunities in promotion, pay and support for all women

more human-oriented, even in the face of some incrediirrespective of their age enable them to engage in any

ble advancement in technology. As a result, scholars and

career of their choice. Kottis (1993) also noted that,

professionals alike have recognized the need for people

women employees receive lower salaries and less prowith better 'Soft' skills that include communicating, netmotion and this made them less fulfilled than their male

working, empowering, delegating, and counseling

counterparts. Thus, equal opportunities in pay and proamong others.

motions should be encouraged as one of the strategies.

Promotions should be based on their performance and

d) Nature of Banking Job: The working hours of banks

not on gender (Fitsum and Luchien, 2007).

were suited to serve the woman's domestic schedules,

there was physical proximity to the place of work, the

According to Don (2006) excellent services are provided

job offered an element of respectability and the profesby managers who identify with others on an emotional

sion did not require physical labor. Banking does not

level. Evans (2010) supports this view by stating that

present women with the challenges and stereotypes other

female managers have superior people management

sectors such as manufacturing pose

skills, more democratic, visionary, focus on quality of

performance, possess distinctive virtues, skills and abile) Family Support: Most women bankers agree that one

ity to inspire and motivate employees, results driven at

of main advantages they had was the support system

work, proficient in organizational transformation using

from their family. Banking as a career offers women the

their personality, good interpersonal skills, ability to

opportunity to better balance their family and profesmulti-task and prioritize, possess effective soft skills

sional careers.

such as negotiating and communicating and their style of

f) Banking comes naturally to Women: Retail banking

leadership is transformational.

is more of a relationship thing and women excel at that.

In the Indian context, while women have started venturFindings:

ing out to work in the corporate world, they have been

Indias Banking sector seems to have gently shattered

handling relationships at home too, as a wife or a moththis Glass ceiling and has been a sort of opposition to the

er. Women have done well in banking because it is a

glass ceiling and the Indian banking industry has a better

business where you need to keep in mind what the cuscorner room diversity score.

tomer wants. Women have some amount of empathy

towards customers needs

It is concluded that factors making women executive

successful in the Indian Banking sector can be classified

The Challenge Ahead:

into six factors:

We welcome the appointment of Arundhati Bhattachara) Liberalization of Indian Economy

ya, the first woman to steer the countrys largest lender,

b) Education

the State Bank of India. She joins other women heading

c) Diversity Consciousness by Banks

public and private sector banks in India, all of whom

d) Nature of Banking Job

have been chosen on merit and performance, and not

e) Family Support

because of their gender. But in sectors other than bankf) Banking comes naturally to Women

ing, there is a dearth of women in the senior-most positions. This is strange and calls out to be remedied. We do

not need a quota on company board seats for women.

a) Liberalization of Indian Economy: The answer to

That would be patronizing. What corporate India needs

shattered glass ceiling in the Indian Banking Sector dates

is awareness that there is something called a glass ceiling

back to 50 years when then prime minister Indira Gandhi

for women, probably right there in its own house. Other

nationalized 14 top banks in the country, followed by

things being equal, gender should not come in the way of

seven more in 1980, and made them adopt a common

womens progress to leadership roles.

process of recruitment through competitive tests.

Rightly, Twitter is now under attack, for lack of diversib) Education: The mid-80s saw a number of smart

ty, being the only tech powerhouse without a female

women graduating from the B-schools just when the

board member. And what drives home the difference is

Indian banking sector was starting to grow. ICICI,

the fact that there are more women than men using TwitHDFC, HSBC, Citibank, were all expanding and were

ter. Facebook came under similar attack ahead of its

hiring during the mid-80s and the early 90s.

IPO, but named a woman director shortly after the public

www.borjournals.com

Blue Ocean Research Journals

49

Journal of Business Management & Social Sciences Research (JBM&SSR)

Volume 3, No.4, April 2014

ISSN No: 2319-5614

----

offering. Google, Apple, Microsoft, LinkedIn, Amazon

[12] Fitsum, G., Luchien, K. (2007) Employee reactions

and _________________________________________________________________________________

eBay, all have at least one woman elected to their

to human resource management and performance in

boards. Surely, diversity improves the quality of decia developing country, Personnel Review, 36(5), pp.

sion-making.

722-738.

Research has shown that having women on boards provides genuine value addition to decision-making. We

have a distance to go, especially in the larger society,

whose attitudes determine how women are viewed and

valued, including in corporate life.

References

[1] Albrecht, J., Bjorklund, A. and Vroman, S. (2003)

Is there a glass ceiling in Sweden? , Journal of Labor Economics, 21(1), pp. 145-78

[2] Arfken, D.E., Bellar, S.L. and Helms, M.M. (2004)

The ultimate glass ceiling revisited: the presence of

women on corporate boards, Journal of Business

Ethics, Vol. 50, pp. 177-186

[13] Goodman, J.S., Fields, D.L. and Blum, T.C. (2003)

Cracks in the glass ceiling: in what kinds of organizations do women make it to the top?, Group &

Organization Management, 28(4), pp. 475-50

[14] http://www.ema-partners.com/articles/gender-split

study on 03.08.2011

[15] Jackson, J. (2001) Women middle managers perception of the glass ceiling, Women in Management

Review, 16(1), pp. 30-41.

[16] Jamali, D., Sidani, Y., Safieddine, A. (2006) Constraints facing working women in Lebanon: an insider view, Women in Management Review, 20(8),

pp. 581-594

[3] Brychan Thomas, Anthony Lewis, Isaiah Florence

Uchenna (2013) : Women in Management: Breaking

the Glass Ceiling in the Developing Countries- The

case of Nigeria

[17] Kirchmeyer, C. (2002) Gender differences in managerial careers: yesterday, today and tomorrow,

Journal of Business Ethics, Vol. 37, pp. 5-24.

[4] Cascio; Managing Human Resources (Sie) 8E, Page

370).

[18] Kottis A. P., (1993) Women in Management: The

"Glass Ceiling" And How To Break It, Women in

Management Review, 8(4), pp. 9-15.

[5] Catalyst (2011), 2011 Quick takes: Women in US

Management, Catalyst, New York, NY

[6] Clancy, M., Tata, J. (2005) A global perspective on

balancing work and family, International Journal

of Management, 2(2), pp.234-242.

[7] Cordano, M., Scherer, R. and Owen, C. (2002) Attitudes toward women as managers: sex versus culture, Women in Management Review, 17(2), pp.

51-60.

[8] Cornelius, N and Skinner, D. (2005) An alternative

view through the glass ceiling: Using capabilities

theory to reflect on the career journey of senior

women, Women in Management Review, 20 (8), pp.

595-609.

[9] Don, C. (2006) Considerations of emotional intelligence in dealing with change decision management, Management decision, 44(5), pp.644-657.

[10] Editorial, The Economic Times report dated

09.10.2013.

[11] Evans, D., (2010). Aspiring to leadership: a womans world? An example of developments in France.

Cross cultural management: An international journal, 17(4), p.347-367.

www.borjournals.com

[19] Kundu, S. (2003) Workforce diversity status: a

study of employees reactions, Industrial Management & Data Systems, 103(4), pp. 215-226.

[20] MacRae, N. (2005) Women and work: a ten year

retrospective, Work, 24(4), pp. 331-339.

[21] McDonald, I. (2004) Women in management: a

historical perspective, Employee Relations, 26(3),

pp. 307-319.

[22] Morrison, A.M. (1992) New Solutions to the Same

Old Glass Ceiling, Women in Management Review.

7(4), pp. 15-19.

[23] Neha Chahal (2013) Women Entrepreneurship:

Banking IndustryInternational Journal of Marketing, Financial Services & Management Research

Vol 2 No. 3 pp. 190-197

[24] Okimoto, T.G. and Brescoll, V.L. (2010), The price

of power: power seeking and backlash against female politicians, Personality and Social Psychology

Bulletin, Vol. 36, pp. 923-936

[25] Pai, K., & Vaidya, S. (2009) Glass ceiling: role of

women in the corporate world, Competitiveness re-

Blue Ocean Research Journals

50

Journal of Business Management & Social Sciences Research (JBM&SSR)

Volume 3, No.4, April 2014

ISSN No: 2319-5614

---view: An international business journal, 19(2),

_________________________________________________________________________________

pp.106-113

[26] Powell, G.N. (2012), Six ways of seeing the elephant: the intersection of sex, gender, and leadership, Gender in Management: An International

Journal, Vol. 27, pp. 119-14

[27] Reinhold, B. (2005) Smashing glass ceilings: why

women still find it tough to advance to the executive

suite, Journal of Organizational Excellence, 24(3),

pp. 43-55

[28] Smith Paul, Caputi Peter & Crittenden Nadia(2012)

A maze of metaphors around glass ceiling Research Online, University of Wollongong

[29] Sreeradha D Basu & Rica Bhattacharyya, The Economics Times 04.10.2013

[30] Still, V., (1992) Breaking the glass ceiling: another

perspective. Women in management review, 7(5),

p.3-8.

[31] Veale, C. and Gold, J. (1998) Smashing into the

glass ceiling for women managers, Journal of

Management Development, 17(1), pp. 17-26.

[32] Williams, J.C. and Cooper, H.C. (2004) The public

of motherhood, Journal of Social Issues, 60(4), pp.

849-865.

[33] Yukongdi, V. and Benson, J. (2005) Women in

Asian management: cracking the glass ceiling?

Asia Pacific Business Review, 11(2), pp. 139-148

www.borjournals.com

Blue Ocean Research Journals

51

Anda mungkin juga menyukai

- BB&T Bank Statement Word TemplateDokumen6 halamanBB&T Bank Statement Word TemplateKyalo Martins90% (10)

- Study GuideDokumen282 halamanStudy GuideInga Cimbalistė75% (4)

- Easterling (2003) SubtractionDokumen58 halamanEasterling (2003) SubtractionAthina100% (1)

- Cold Sinus Sore Throat Tonsillitis Fever and Flu PDFDokumen4 halamanCold Sinus Sore Throat Tonsillitis Fever and Flu PDFAnna GalánBelum ada peringkat

- Fitness VisionDokumen6 halamanFitness Visionsubodhmp100% (3)

- Bank of America Online Statement 1Dokumen1 halamanBank of America Online Statement 1Wells Wally100% (1)

- Housing Societies Faqs - EnglishDokumen132 halamanHousing Societies Faqs - EnglishJnanam100% (3)

- SapmDokumen87 halamanSapmpriya031Belum ada peringkat

- Treatment of Toilets Using MahaVastu Techniques - 2Dokumen3 halamanTreatment of Toilets Using MahaVastu Techniques - 2Rakesh Dwivedi60% (10)

- Teacher Induction Program - Module 2 V1.0 PDFDokumen60 halamanTeacher Induction Program - Module 2 V1.0 PDFBrillantes Mae SheeraBelum ada peringkat

- Women at Work Balancing Career and Personal GoalsDokumen18 halamanWomen at Work Balancing Career and Personal Goalsstellacrasto12Belum ada peringkat

- PNB v. Sapphire Shipping, 259 SCRA 174 (1996)Dokumen2 halamanPNB v. Sapphire Shipping, 259 SCRA 174 (1996)Rebuild Bohol100% (2)

- A Study On Role of Women in Banking and Financial SectorDokumen58 halamanA Study On Role of Women in Banking and Financial Sectorsv netBelum ada peringkat

- Women Participation in Indian Banking Sector: Issues and ChallengesDokumen4 halamanWomen Participation in Indian Banking Sector: Issues and ChallengesSiddhai ManeBelum ada peringkat

- Breaking The Glass Ceiling - Women of Indian BankingDokumen4 halamanBreaking The Glass Ceiling - Women of Indian BankingbusinessviewsreviewsBelum ada peringkat

- GLASS CEILING SCALEDokumen23 halamanGLASS CEILING SCALEcem hocaBelum ada peringkat

- Women Entrepreneurship Literature ReviewDokumen9 halamanWomen Entrepreneurship Literature Review娜奎Belum ada peringkat

- Synopsis of LeadershipDokumen19 halamanSynopsis of LeadershipReema AgrawalBelum ada peringkat

- Does The Ceiling Still Exist?Dokumen11 halamanDoes The Ceiling Still Exist?Swarupa RaniBelum ada peringkat

- Women Entrepreneurship: Banking Industry: Neha ChahalDokumen8 halamanWomen Entrepreneurship: Banking Industry: Neha ChahalrakessBelum ada peringkat

- Investigating The Impact of Motivations in Entrepreneurial Intention Among Women Entrepreneurs in TamilnaduDokumen8 halamanInvestigating The Impact of Motivations in Entrepreneurial Intention Among Women Entrepreneurs in TamilnaduIAEME PublicationBelum ada peringkat

- Success Stories of Women Entrepreneur: March 2012Dokumen13 halamanSuccess Stories of Women Entrepreneur: March 2012Sachin KumarBelum ada peringkat

- Challenges Faced by Women Entrepreneurs in The Era of GlobalizationDokumen28 halamanChallenges Faced by Women Entrepreneurs in The Era of GlobalizationInternational Journal of Innovative Research and Studies0% (1)

- Women & Corporate Goverance: Gender Diversity in Corporate Board - GIBS Bangalore - Top Business School in BangaloreDokumen10 halamanWomen & Corporate Goverance: Gender Diversity in Corporate Board - GIBS Bangalore - Top Business School in BangalorePradeep KhadariaBelum ada peringkat

- Women on Bank Boards Impact in IndiaDokumen39 halamanWomen on Bank Boards Impact in IndiaAbu HanifBelum ada peringkat

- Women Participation in Top Business Roles in BahawalpurDokumen17 halamanWomen Participation in Top Business Roles in Bahawalpurhasnain shahBelum ada peringkat

- Women Empowerment in Banking Sector IndiaDokumen17 halamanWomen Empowerment in Banking Sector IndiaAjBelum ada peringkat

- Women Entrepreneuers A Growing and Promising Face in Indian BusinessesDokumen6 halamanWomen Entrepreneuers A Growing and Promising Face in Indian BusinessesSriram VpBelum ada peringkat

- Women of Vision: Nine Business Leaders in Conversation with Alam SrinivasDari EverandWomen of Vision: Nine Business Leaders in Conversation with Alam SrinivasBelum ada peringkat

- A Study On Women Entrepreneurship in India: June 2020Dokumen12 halamanA Study On Women Entrepreneurship in India: June 2020Ankapali MukherjeeBelum ada peringkat

- Challenges and Prospects for Women Entrepreneurs in IndiaDokumen9 halamanChallenges and Prospects for Women Entrepreneurs in IndiaPurushothaman ABelum ada peringkat

- Applied Resesrch MethodsDokumen12 halamanApplied Resesrch MethodsmariamcgladeBelum ada peringkat

- Presentation On Women Empowerment in Banking SectorDokumen18 halamanPresentation On Women Empowerment in Banking SectorAj100% (1)

- Factors Affecting The Women Entrepreneurship Development in BangladeshDokumen7 halamanFactors Affecting The Women Entrepreneurship Development in BangladeshMonirul IslamBelum ada peringkat

- BIO Project - Group 2Dokumen11 halamanBIO Project - Group 2Parnika JainBelum ada peringkat

- Women Empowerment in 21st Century Conference PaperDokumen7 halamanWomen Empowerment in 21st Century Conference PaperashkhanBelum ada peringkat

- Women Entrepreneurship in India: Growth, Challenges and SupportDokumen26 halamanWomen Entrepreneurship in India: Growth, Challenges and SupportAshik ReddyBelum ada peringkat

- A Study On The Financial Awareness Among Women Entrepreneurs in Kottayam DistrictDokumen6 halamanA Study On The Financial Awareness Among Women Entrepreneurs in Kottayam Districtprashanthi EBelum ada peringkat

- P.N. Tiwari - SachinDokumen14 halamanP.N. Tiwari - SachinPeter MichaleBelum ada peringkat

- Women Entrepreneurs in Modern EraDokumen30 halamanWomen Entrepreneurs in Modern EravbasilhansBelum ada peringkat

- Fin Irjmets1675884458Dokumen14 halamanFin Irjmets1675884458ekmanikandan540Belum ada peringkat

- Gender Equality EssayDokumen9 halamanGender Equality EssayAmulya ShettyBelum ada peringkat

- Analysis of Barriers To Women Entrepreneurship: The DEMATEL ApproachDokumen20 halamanAnalysis of Barriers To Women Entrepreneurship: The DEMATEL ApproachPrathyaksh LewisBelum ada peringkat

- Women Entrepreneurship in India An AnalysisDokumen7 halamanWomen Entrepreneurship in India An AnalysisIJRASETPublicationsBelum ada peringkat

- Financial Problems of Women Entrepreneurs in IndiaDokumen19 halamanFinancial Problems of Women Entrepreneurs in IndiaSujit HegdeBelum ada peringkat

- Final DraftDokumen52 halamanFinal Draftmropgaming2003Belum ada peringkat

- Journal of Xi'an University of Architecture & Technology Women Empowerment ArticleDokumen6 halamanJournal of Xi'an University of Architecture & Technology Women Empowerment ArticleVanshika KapoorBelum ada peringkat

- Ranjana Kumar, Former CEO Indian Bank Ranjana Kumar Was The First Woman CEO ofDokumen5 halamanRanjana Kumar, Former CEO Indian Bank Ranjana Kumar Was The First Woman CEO ofAkansha RathoreBelum ada peringkat

- AlvarezlitreviewfinalDokumen10 halamanAlvarezlitreviewfinalapi-271755976Belum ada peringkat

- Women Entrepreneurship - A Literature ReviewDokumen8 halamanWomen Entrepreneurship - A Literature ReviewInternational Organization of Scientific Research (IOSR)Belum ada peringkat

- Women Entrepreneurs in India Face Challenges Despite Government SupportDokumen6 halamanWomen Entrepreneurs in India Face Challenges Despite Government SupportAdhiraj singhBelum ada peringkat

- Factors Effecting Performance of Female Employees in Financial Institutes A Case Study of Meezan Bank Limited PakistanDokumen15 halamanFactors Effecting Performance of Female Employees in Financial Institutes A Case Study of Meezan Bank Limited PakistanLoottera PCBelum ada peringkat

- Role of Micro-Financing in Women Empowerment: An Empirical Study of Urban PunjabDokumen16 halamanRole of Micro-Financing in Women Empowerment: An Empirical Study of Urban PunjabAnum ZubairBelum ada peringkat

- Project Report 2Dokumen75 halamanProject Report 2Ronit PanditBelum ada peringkat

- The Role of Women On Corporate Boards and Its Impact On GovernanceDokumen3 halamanThe Role of Women On Corporate Boards and Its Impact On GovernanceShubham VirulkarBelum ada peringkat

- Role of Micro Finances in Women Entreprenurship: Dr.V.S. MangnaleDokumen5 halamanRole of Micro Finances in Women Entreprenurship: Dr.V.S. MangnaleCharu ModiBelum ada peringkat

- Financial Management and Women Entrepreneurship in Malaysia-112Dokumen7 halamanFinancial Management and Women Entrepreneurship in Malaysia-112Aymen KareemBelum ada peringkat

- Barriers Faced by Women in Pursuit of Career Advancement in PakistanDokumen25 halamanBarriers Faced by Women in Pursuit of Career Advancement in Pakistankhan2345Belum ada peringkat

- Problems & Prospects of Women Entrepreneurship-A Critical Study-1Dokumen12 halamanProblems & Prospects of Women Entrepreneurship-A Critical Study-1komalBelum ada peringkat

- A Study On The Challenges Faces by Women Entrepreneurs in CoimbatoreDokumen4 halamanA Study On The Challenges Faces by Women Entrepreneurs in CoimbatoreEditor IJTSRDBelum ada peringkat

- Chanda Kochhar: CEO and MD of ICICI BankDokumen10 halamanChanda Kochhar: CEO and MD of ICICI BankVikas DeniaBelum ada peringkat

- An Investigation of The Leadership Challenges Amongst Women EntrepreneursDokumen7 halamanAn Investigation of The Leadership Challenges Amongst Women EntrepreneursIJRASETPublicationsBelum ada peringkat

- Challenges Faced by Women Entrepreneurs A Case Study of Mashonaland Central ProvinceDokumen15 halamanChallenges Faced by Women Entrepreneurs A Case Study of Mashonaland Central Provincezulikah89Belum ada peringkat

- Problems and Prospects of Women Entrepreneurship in India: B. Parimala DeviDokumen4 halamanProblems and Prospects of Women Entrepreneurship in India: B. Parimala DeviParimala DeviBelum ada peringkat

- JETIR1908C56Dokumen6 halamanJETIR1908C56AswinBelum ada peringkat

- Opportunities and Challenges Faced by Women Entrepreneurs in IndiaDokumen5 halamanOpportunities and Challenges Faced by Women Entrepreneurs in IndiaIOSRjournalBelum ada peringkat

- Women's Experiences of Micro-Enterprise: Contexts and MeaningsDokumen6 halamanWomen's Experiences of Micro-Enterprise: Contexts and MeaningsSimina ElenaBelum ada peringkat

- Women Entrepreneurship Problems and StrategiesDokumen8 halamanWomen Entrepreneurship Problems and Strategiesmevitsn6Belum ada peringkat

- Women Entrepreneur - FullDokumen8 halamanWomen Entrepreneur - FullTJPRC PublicationsBelum ada peringkat

- Problems and Challenges Faced by Women Entrepreneur in IndiaDokumen8 halamanProblems and Challenges Faced by Women Entrepreneur in IndiacpmrBelum ada peringkat

- The Future of Tech Is Female: How to Achieve Gender DiversityDari EverandThe Future of Tech Is Female: How to Achieve Gender DiversityBelum ada peringkat

- Matrix of Mind RealityDokumen27 halamanMatrix of Mind RealityTeshome YehualashetBelum ada peringkat

- InterviewquestionsDokumen7 halamanInterviewquestionsOmkar ChinnaBelum ada peringkat

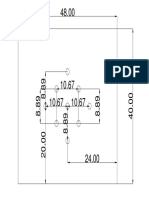

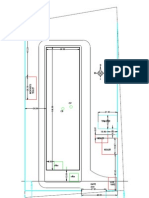

- North PLOT L Residence-ModelDokumen1 halamanNorth PLOT L Residence-ModelRakesh DwivediBelum ada peringkat

- Linux TutorialDokumen33 halamanLinux TutorialJulian HillmanBelum ada peringkat

- Alibaba Write-UpDokumen8 halamanAlibaba Write-UpRakesh DwivediBelum ada peringkat

- Marma 48x40Dokumen1 halamanMarma 48x40Rakesh DwivediBelum ada peringkat

- Hora Chart HindiDokumen1 halamanHora Chart HindiRakesh DwivediBelum ada peringkat

- Fast-Moving Consumer Goods Industry: Consumer Durables Revenues Have Been Growing at A Healthy PaceDokumen2 halamanFast-Moving Consumer Goods Industry: Consumer Durables Revenues Have Been Growing at A Healthy PaceRakesh DwivediBelum ada peringkat

- A Proposal Framework For Investigating The Impact of Customer Relationship Management On Customer Retention in E-CommerceDokumen6 halamanA Proposal Framework For Investigating The Impact of Customer Relationship Management On Customer Retention in E-CommerceRakesh DwivediBelum ada peringkat

- Yantrika Co-Operative Housing Society Ltd. Copy of Co-Operative Housing Societies Manual - Transfer of Property and Transfer FeeDokumen1 halamanYantrika Co-Operative Housing Society Ltd. Copy of Co-Operative Housing Societies Manual - Transfer of Property and Transfer FeeRakesh DwivediBelum ada peringkat

- Alibaba Write-Up PDFDokumen8 halamanAlibaba Write-Up PDFRakesh DwivediBelum ada peringkat

- Managing Rubber Plantations For Advancing Climate Change Mitigation Strategy.Dokumen6 halamanManaging Rubber Plantations For Advancing Climate Change Mitigation Strategy.Rakesh DwivediBelum ada peringkat

- Content ServerDokumen26 halamanContent ServerRakesh DwivediBelum ada peringkat

- Delimitations of Level 1 Vaastu ConsultantDokumen1 halamanDelimitations of Level 1 Vaastu ConsultantRakesh DwivediBelum ada peringkat

- Sanjeevini Combination For Auspicious Efforts in ExaminationsDokumen4 halamanSanjeevini Combination For Auspicious Efforts in ExaminationsRakesh DwivediBelum ada peringkat

- Circular Shopping Complex With AyadiDokumen1 halamanCircular Shopping Complex With AyadiRakesh DwivediBelum ada peringkat

- Anita Agrawal CA HouseDokumen1 halamanAnita Agrawal CA HouseRakesh DwivediBelum ada peringkat

- InterviewquestionsDokumen7 halamanInterviewquestionsOmkar ChinnaBelum ada peringkat

- Circular Shopping Complex With AyadiDokumen1 halamanCircular Shopping Complex With AyadiRakesh DwivediBelum ada peringkat

- FOL Large HeadachDokumen1 halamanFOL Large HeadachRakesh DwivediBelum ada peringkat

- Sample Paper / Model Test Paper CBSE SA - 2 (II) 2012 Subject - Mathematics Section-ADokumen4 halamanSample Paper / Model Test Paper CBSE SA - 2 (II) 2012 Subject - Mathematics Section-ARakesh DwivediBelum ada peringkat

- Sample Paper / Model Test Paper CBSE SA - 2 (II) 2012 Subject - Mathematics Section-ADokumen4 halamanSample Paper / Model Test Paper CBSE SA - 2 (II) 2012 Subject - Mathematics Section-ARakesh DwivediBelum ada peringkat

- Automotive EnggDokumen15 halamanAutomotive EnggRakesh DwivediBelum ada peringkat

- Approved Clubs 2012-13Dokumen2 halamanApproved Clubs 2012-13Rakesh DwivediBelum ada peringkat

- Ishwar DBDokumen1 halamanIshwar DBRakesh DwivediBelum ada peringkat

- Approved Clubs 2012-13Dokumen2 halamanApproved Clubs 2012-13Rakesh DwivediBelum ada peringkat

- WCM MATERIALDokumen31 halamanWCM MATERIALNiña Rhocel YangcoBelum ada peringkat

- Business Plan: Bookshop & StationeryDokumen33 halamanBusiness Plan: Bookshop & StationeryMILDON CHERUIYOTBelum ada peringkat

- Unit Computation Sheet: Payment SchemesDokumen4 halamanUnit Computation Sheet: Payment SchemesGEN888 IGBelum ada peringkat

- Article Review Individual AssignmentDokumen6 halamanArticle Review Individual AssignmentTong0% (1)

- Afzal, 2013Dokumen7 halamanAfzal, 2013Abdul SamiBelum ada peringkat

- Learning Management System (LMS) : User ManualDokumen25 halamanLearning Management System (LMS) : User ManualRprBelum ada peringkat

- Sarfaesi ActDokumen7 halamanSarfaesi ActBhakti Bhushan MishraBelum ada peringkat

- Bank Strategic Positioning and Some Determinants of Bank SelectionDokumen11 halamanBank Strategic Positioning and Some Determinants of Bank SelectionDian AnantaBelum ada peringkat

- Bolt Mar 20201588157751190Dokumen83 halamanBolt Mar 20201588157751190Leo ClintonBelum ada peringkat

- Cox and KingsDokumen237 halamanCox and KingsSagar SonawaneBelum ada peringkat

- Participant Material 8.2.4.2A: Cash Receipts Controls Form SE CR Control 4Dokumen8 halamanParticipant Material 8.2.4.2A: Cash Receipts Controls Form SE CR Control 4Haley TranBelum ada peringkat

- GK Power Capsule For IBPS Clerk Mains 2018 Free Download-HereDokumen153 halamanGK Power Capsule For IBPS Clerk Mains 2018 Free Download-HerePrasprit ZualteaBelum ada peringkat

- Internship Report On Generel Banking Activities of Exim BankDokumen57 halamanInternship Report On Generel Banking Activities of Exim BankMorshedul HasanBelum ada peringkat

- SWOT Analysis of Mauritius' Financial Services IndustryDokumen9 halamanSWOT Analysis of Mauritius' Financial Services Industrymrsundeeps100% (1)

- Retail Banking Retail Banking Accounts: Syed Fazal AzizDokumen29 halamanRetail Banking Retail Banking Accounts: Syed Fazal AzizIbad Bin RashidBelum ada peringkat

- Engg7t2 Ems Accounting Concepts PDFDokumen2 halamanEngg7t2 Ems Accounting Concepts PDFStacey NefdtBelum ada peringkat

- 1955-2008: History of ICICI Bank from Development Financial Institution to International Banking OperationsDokumen24 halaman1955-2008: History of ICICI Bank from Development Financial Institution to International Banking OperationsDevan KumaranBelum ada peringkat

- Ife Efe CPMDokumen8 halamanIfe Efe CPMejazrdBelum ada peringkat

- Introduction To International Marketing & Trade Black Book PDFDokumen54 halamanIntroduction To International Marketing & Trade Black Book PDFarvind chauhanBelum ada peringkat

- Abad v.CADokumen3 halamanAbad v.CAaniciamarquez2222Belum ada peringkat

- Financial Law Assignment. Bachelor of Commerce in Law Year 2.student Number 12134061Dokumen18 halamanFinancial Law Assignment. Bachelor of Commerce in Law Year 2.student Number 12134061Calista NaidooBelum ada peringkat

- Fund Based Financial Services PresentationDokumen28 halamanFund Based Financial Services PresentationUjjawal Raj -57Belum ada peringkat