What Is Risk - A Common Definition

Diunggah oleh

imran jamil0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

107 tayangan2 halamanThe document compares different definitions of Risk, referred in internationally recognized Risk Management Standards

Judul Asli

What is Risk - A Common Definition

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThe document compares different definitions of Risk, referred in internationally recognized Risk Management Standards

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

107 tayangan2 halamanWhat Is Risk - A Common Definition

Diunggah oleh

imran jamilThe document compares different definitions of Risk, referred in internationally recognized Risk Management Standards

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

An article by Margaret Davis FIRM in the June/July 2001 issue of

InfoRM (pages 16-19), addressed the important question What is

Risk?, concluding that there does not appear to be a single

definitive answer, with the author describing six different ways

of using the word risk! The article ended by raising several

issues to be resolved by the risk management community,

including :

Risk management professionals must get the terminology right

We must clarify whether or not risk includes upsides

(opportunities) as well as downsides (threats)

The scope of the risk management process must be defined

The role of the risk manager should be better understood

Perhaps the first two of these issues are easier to deal with,

and certainly they need to be right before we can proceed to the

other two. So where do we stand on the question of terminology

and definitions?

As risk management practitioners and professionals, we

think we know what we mean when we talk about risk. And

when were talking to others, whether they are clients, colleagues

or friends, we assume that they share our understanding of the

term. After all its a common word, so surely it has a commonly

accepted meaning? But maybe the question isnt so simple after

all. Many different professional bodies and standards institutions

have attempted to create

a definition of risk

which will be widely

accepted. Of course

these perspectives differ,

but there seems to be

a trend towards a

common

view,

as

examination of some

key sources reveals.

There is no doubt

that common usage of

the word risk sees only the downside. Asking the man in the

street if he would like to have a risk happen to him will nearly

always result in a negative response - Risk is bad for you. This

is reflected in the traditional definitions of the word, both in

standard dictionaries and in some technical documents. But what

about the professional bodies, who may have a different view

from the layman?

The Institute of Risk Management (IRM) rather

surprisingly appears to have no official definition of risk,

although IRM documents use phrases such as chance of bad

consequences, or exposure to mischance. IRM seems to take the

unequivocal position that risk is wholly negative. Some other

national standard-setting bodies also use a negative definition of

risk, including the Norwegian Standard NS5814:1981, British

Standard BS8444-3:1996, and National Standard of Canada

CAN/CSA-Q850-97:1997.

What is risk?

Towards a common

definition

Dr David Hillson

Director of Consultancy

PM Professional Solutions Ltd

More recently other professional bodies have taken a

neutral view of risk, such as the UK Association for Project

Management (APM), whose Project Risk Analysis &

Management Guide (PRAM Guide, 1997) defines risk as an

uncertain event or set of circumstances which, should it occur,

will have an effect on achievement of objectives. The nature of

the effect is undefined, so implicitly this could include both

negative and positive effects. The British Standards Institute (BSI)

echoes this general view in BS6079-3:2000, which says that risk is

uncertainty that can affect the prospects of achieving

goals. The joint Australian/New Zealand risk management

standard AS/NZS 4360:1999 also has an open definition that

could implicitly encompass both opportunities and threats. And

project risk management guidelines in IEC62198:2001 also define

risk without specifying whether its consequences are positive or

negative.

Other recent guidelines explicitly introduce the concept of

including upside effects in the definition of risk. For example the

Risk Analysis & Management for Projects Guide (RAMP Guide,

1998) produced by the Institute of Civil Engineers (ICE) states

that risk is a threat (or opportunity) which could affect

adversely (or favourably) achievement of the objectives.

Similarly, the Guide to the Project Management Body of

Knowledge (PMBoK 2000) produced by the Project

Management Institute (PMI) defines risk as an uncertain event

or condition that, if it occurs, has a positive or negative effect on

a project objective. Most recently, the Draft ISO Guide Risk

Management Vocabulary Guidelines for use in standards ISO

DGUIDE73:2001 defines risk as combination of the probability

of an event and its consequence, noting

that consequences can range from

positive to negative, and recognising

that increasingly organisations utilise

risk management processes in order to

optimise the management of potential

opportunities.

There is no doubt that businesses,

like everything else in life, are subject to

uncertainty. It is also clear that some of

that uncertainty might be harmful if it

came to pass, whereas other

uncertainties might assist in achieving

our objectives. The issue is whether we

could or should include both types of

uncertainty in our definition of risk, and whether both could or

should be handled by a common risk management process.

There appear to be two options :

1. Risk is an umbrella term, with two varieties:

opportunity which is a risk with positive effects

threat which is a risk with negative effects

2. Uncertainty is the overarching term, with two varieties :

risk referring exclusively to a threat, i.e. an uncertainty

with negative effects

opportunity which is an uncertainty with positive effects

The evolution of risk definitions in the various standards

and guidelines suggests that the risk community is moving

towards the first option, with the single term risk covering two

subsets called opportunity and threat.

Does this matter, since as Shakespeare said that which we

call a rose, by any other name would smell as sweet? It matters

because encompassing both opportunities and threats within a

single definition of risk is a clear statement of intent, recognising

that both are equally important influences over business and

project success, and both need managing proactively.

Opportunities and threats are not qualitatively different in

nature, since both involve uncertainty which has the potential to

affect objectives. As a result, both can be handled by the same

process, although some modifications may be required to the

standard risk management approach in order to deal effectively

with opportunities.

There are definite advantages in including both types of

uncertainty together under a single heading of risk covering all

uncertainties that can affect objectives. The only difference is in

the nature of the effect. One category has potential effects which

are negative, unwelcome, harmful, adverse - these can be called

threats. The other group have positive, welcome, beneficial

effects - these are opportunities. Defining a risk as any

uncertainty which can affect achievement of objectives either

positively or negatively allows both opportunities and threats to

be encompassed in a single definition.

The objection that common current

usage of the word risk is exclusively

negative can be met by two arguments.

Firstly, words change their common-use

meanings over time; and secondly it is

quite acceptable for a profession to adopt

a technical usage which differs from the

layman's

definition. And

both

opportunities and threats can be handled

by a common risk management

process, with clear advantages.

Extending the existing threat-based

process to cover opportunities will mean

that there is no need to introduce a new

process, with all the resistance that is

likely to be encountered when another overhead is added. There

is clear synergy in extending the same process to cover both types

of uncertainty - if the management team are already setting aside

time and effort to deal with threats, why not use the same time to

identify and proactively manage opportunities as well?

It is clear that the risk management process as commonly

implemented does not include a structured framework for

proactively addressing opportunities, since it focuses almost

entirely on threats. If a broadened definition of risk is used which

includes both opportunities and threats, and if an extended

approach is implemented to address both together, the

organisation will be able to take full advantage of those

uncertainties with potential upside impact. The alternative is a

failure to implement proactive opportunity management

strategies, which will guarantee that only half of the benefits of

risk management can be achieved.

There seems to be increasing momentum towards a

broadened definition of risk which includes both upside

opportunities as well as downside threats. This remains an issue

of current debate among risk management professionals, but the

trend appears to be towards an inclusive view of risk. If this

becomes widely accepted in the risk management community

and beyond, then other issues concerning the scope of the risk

process and the role of the risk manager will also become clear.

Dr David Hillson MIRM FAPM PMP is Director of Consultancy with Project

Management Professional Solutions Limited in Buckinghamshire UK. He has a

particular interest in risk management consultancy and training, with clients

across UK, Europe and US. Davids speciality is risk technology transfer, assisting

organisations to develop and improve in-house risk processes, and he is a

regular conference speaker on risk.

Before developing an interest in risk management, David was a project manager

in a major UK engineering company, responsible for the successful delivery of

a number of large real-time software-intensive projects.

David can be contacted at dhillson@PMProfessional.com.

Reprinted with the kind permission of the Editor from the April 2002 issue of InfoRM Magazine

InfoRM is the official journal of the Institute of Risk Management - www.theIRM.org

Anda mungkin juga menyukai

- Threat And Risk Assessment A Complete Guide - 2020 EditionDari EverandThreat And Risk Assessment A Complete Guide - 2020 EditionBelum ada peringkat

- Risk Factors ExplainedDokumen7 halamanRisk Factors Explainednehateotia2011Belum ada peringkat

- The Role of The Insurance Industry Association: Brad Smith and Diana KeeganDokumen30 halamanThe Role of The Insurance Industry Association: Brad Smith and Diana Keeganrajesh_natarajan_4Belum ada peringkat

- The Risk of Using Risk Matrices PDFDokumen12 halamanThe Risk of Using Risk Matrices PDFJack SparoBelum ada peringkat

- Sa6 Pu 14 PDFDokumen118 halamanSa6 Pu 14 PDFPolelarBelum ada peringkat

- Managerial Policy Course Outline-Spring 2014 PDFDokumen5 halamanManagerial Policy Course Outline-Spring 2014 PDFMuhammad IbadBelum ada peringkat

- Risk Analysis & Risk ManagementDokumen19 halamanRisk Analysis & Risk ManagementAnonymous wPr4C6yeBelum ada peringkat

- The Making of An Investment Banker: Stock Market Shocks, Career Choice, and Lifetime IncomeDokumen28 halamanThe Making of An Investment Banker: Stock Market Shocks, Career Choice, and Lifetime IncomeKarthikSridharBelum ada peringkat

- 2021 09 Private Equity Venture Capital (6QQMN562) - Assessment Overview and Marking CriteriaDokumen5 halaman2021 09 Private Equity Venture Capital (6QQMN562) - Assessment Overview and Marking CriteriaEshaan SharmaBelum ada peringkat

- 2017 Exam With SolutionsDokumen4 halaman2017 Exam With SolutionsMathew YipBelum ada peringkat

- Advanced Financial ReportingDokumen6 halamanAdvanced Financial ReportingJacques OwokelBelum ada peringkat

- Casualty Actuarial SocietyDokumen43 halamanCasualty Actuarial SocietyChinmay P KalelkarBelum ada peringkat

- ECN209 - International FinanceDokumen4 halamanECN209 - International FinancehamBelum ada peringkat

- Risk Management Is The Identification, Evaluation, and Prioritization ofDokumen8 halamanRisk Management Is The Identification, Evaluation, and Prioritization ofkubs arainBelum ada peringkat

- Module OutlineDokumen3 halamanModule OutlineMichael EbiyeBelum ada peringkat

- Risk Management PDFDokumen16 halamanRisk Management PDFGokul SridharBelum ada peringkat

- Principle-Based vs. Rule-Based AccountingDokumen2 halamanPrinciple-Based vs. Rule-Based AccountingPeter MastersBelum ada peringkat

- What Is A Gantt ChartDokumen2 halamanWhat Is A Gantt ChartRaaf RifandiBelum ada peringkat

- USS Global Equity Fund FactsheetDokumen1 halamanUSS Global Equity Fund Factsheetsteven burnsBelum ada peringkat

- IC 14 Regulations PDFDokumen320 halamanIC 14 Regulations PDFanjana CrBelum ada peringkat

- Olson DL Wu D Enterprise Risk Management in FinanceDokumen277 halamanOlson DL Wu D Enterprise Risk Management in FinanceAnna ZubovaBelum ada peringkat

- Ca3 Pu 15 PDFDokumen10 halamanCa3 Pu 15 PDFPolelarBelum ada peringkat

- Determinants of Credit RatingDokumen23 halamanDeterminants of Credit RatingFerlyan Huang 正莲Belum ada peringkat

- The Actuary - Let Actuaries HelpDokumen28 halamanThe Actuary - Let Actuaries HelpRitukotnalaBelum ada peringkat

- Loan Valuation Using Present Value Analysis - FDICDokumen25 halamanLoan Valuation Using Present Value Analysis - FDICAnonymous A0jSvP1100% (1)

- 1 PDFDokumen3 halaman1 PDFGokul KrishnanBelum ada peringkat

- Infrastructure-Financing-India PWCDokumen138 halamanInfrastructure-Financing-India PWCGosia PłotnickaBelum ada peringkat

- CASH Report 10 - 2012 FINAL PDF Nettiin1Dokumen118 halamanCASH Report 10 - 2012 FINAL PDF Nettiin1sabahaizatBelum ada peringkat

- Student Guide Actuarial Online ExamsDokumen21 halamanStudent Guide Actuarial Online ExamsVishesh MalikBelum ada peringkat

- Construction ManagementDokumen4 halamanConstruction ManagementJournalNX - a Multidisciplinary Peer Reviewed JournalBelum ada peringkat

- European Re InsuranceDokumen95 halamanEuropean Re InsuranceKapil MehtaBelum ada peringkat

- A Literature Survey of Cost of Quality ModelsDokumen10 halamanA Literature Survey of Cost of Quality Modelsimran_chaudhryBelum ada peringkat

- Recent Research Trends in Business AdministrationDokumen147 halamanRecent Research Trends in Business AdministrationPrem KnowlesBelum ada peringkat

- Artikel EMADokumen11 halamanArtikel EMAZaraBelum ada peringkat

- A Simple FTP Model For A Commercial BankDokumen80 halamanA Simple FTP Model For A Commercial BankMaratAyaibergenovBelum ada peringkat

- Ema Ge Berk CF 2GE SG 23Dokumen12 halamanEma Ge Berk CF 2GE SG 23Sascha SaschaBelum ada peringkat

- YPD Guide Executive Summary PDFDokumen2 halamanYPD Guide Executive Summary PDFAlex FarrowBelum ada peringkat

- Risk Management in The Insurance Industry and Solvency IIDokumen40 halamanRisk Management in The Insurance Industry and Solvency IIvibhas100% (1)

- Risk ManagementDokumen27 halamanRisk ManagementAnujPradeepKhandelwalBelum ada peringkat

- 2015 Purchase Price Allocation Study HLDokumen49 halaman2015 Purchase Price Allocation Study HLAnonymous 6tuR1hzBelum ada peringkat

- PSA-610 Using The Work of Internal AuditorsDokumen13 halamanPSA-610 Using The Work of Internal AuditorscolleenyuBelum ada peringkat

- EV and VNB MethodologyDokumen2 halamanEV and VNB MethodologySaravanan BalakrishnanBelum ada peringkat

- AsiaPacificAntitrustCompetitionGuidebook PDFDokumen119 halamanAsiaPacificAntitrustCompetitionGuidebook PDFjcfrancorpBelum ada peringkat

- Risk Management in Construction Industry: Dr. Nadeem Ehsan Mehmood AlamDokumen6 halamanRisk Management in Construction Industry: Dr. Nadeem Ehsan Mehmood AlamfritswelBelum ada peringkat

- Corporate Debt Value, Bond Covenants, and Optimal Capital Structure ModelDokumen36 halamanCorporate Debt Value, Bond Covenants, and Optimal Capital Structure Modelpedda60100% (1)

- Predicting Bankruptcy Through Financial Statement AnalysisDokumen21 halamanPredicting Bankruptcy Through Financial Statement AnalysisRashed TariqueBelum ada peringkat

- Corporate Social Responsibility and Corporate Governance: Role of Context in International SettingsDokumen25 halamanCorporate Social Responsibility and Corporate Governance: Role of Context in International SettingswajimmyBelum ada peringkat

- Chronicle of World Financial Crisis 2007-2008Dokumen4 halamanChronicle of World Financial Crisis 2007-2008Md. Azim Ferdous100% (1)

- The Exchange Rate Volatility and The Effects of Exchange Rate On The Price Level and International Trade of Bangladesh A ReviewDokumen5 halamanThe Exchange Rate Volatility and The Effects of Exchange Rate On The Price Level and International Trade of Bangladesh A ReviewInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Effective Strategies For Exploiting OpportunitiesDokumen9 halamanEffective Strategies For Exploiting OpportunitiesMy proteinBelum ada peringkat

- Managing Both Risks and Opportunities in ProjectsDokumen6 halamanManaging Both Risks and Opportunities in ProjectsSahil Azher RashidBelum ada peringkat

- Effective Strategies For Exploiting OpportunitiesDokumen13 halamanEffective Strategies For Exploiting OpportunitiesTuệ LýBelum ada peringkat

- Enterprise Risk ManagementDokumen25 halamanEnterprise Risk Managementmorrisonkaniu8283Belum ada peringkat

- Risk Management M-2. Approaches To Defining RisksDokumen4 halamanRisk Management M-2. Approaches To Defining RisksEngelie Mae ColloBelum ada peringkat

- F1lyon 0322Dokumen6 halamanF1lyon 0322Muhammad SulaimanBelum ada peringkat

- 641-Article Text-1573-1-10-20200713Dokumen11 halaman641-Article Text-1573-1-10-20200713Dinesh KanesanBelum ada peringkat

- 21 - Rsik Management1Dokumen93 halaman21 - Rsik Management1rajesh bathulaBelum ada peringkat

- Nama: Dian Yustika Tanda Kawi NIM: 1821101880Dokumen4 halamanNama: Dian Yustika Tanda Kawi NIM: 1821101880Dian TandakawiBelum ada peringkat

- TOP Risk - Enterprise Risk Management Handbook (Complete)Dokumen37 halamanTOP Risk - Enterprise Risk Management Handbook (Complete)LandryBelum ada peringkat

- Module 1 - Introduction To Risk Management 2023Dokumen22 halamanModule 1 - Introduction To Risk Management 2023mjibranali18Belum ada peringkat

- Intl Journal of Business Performance MGMT Vol 14 Issue 2 2013 Arena, Marika - Risk and Budget in An Uncertain WorldDokumen15 halamanIntl Journal of Business Performance MGMT Vol 14 Issue 2 2013 Arena, Marika - Risk and Budget in An Uncertain Worldimran jamilBelum ada peringkat

- ABS Journal RankingDokumen54 halamanABS Journal RankingEmad RashidBelum ada peringkat

- WQM 2015 ROI of Quality Fact Sheet FDokumen1 halamanWQM 2015 ROI of Quality Fact Sheet Fimran jamilBelum ada peringkat

- Beyond CapaDokumen6 halamanBeyond CapaJorge Humberto HerreraBelum ada peringkat

- 13 - ABC of Risk Culture - Hillson PaperDokumen9 halaman13 - ABC of Risk Culture - Hillson Paperimran jamilBelum ada peringkat

- Sr. No. Title of Training Dates Year - 2008Dokumen2 halamanSr. No. Title of Training Dates Year - 2008imran jamilBelum ada peringkat

- Transition ISO 9001:2008 to ISO 9001:2015Dokumen2 halamanTransition ISO 9001:2008 to ISO 9001:2015imran jamilBelum ada peringkat

- Lisa K. Meulbroek - A Senior Manage's Guide To Integrated Risk Management PDFDokumen17 halamanLisa K. Meulbroek - A Senior Manage's Guide To Integrated Risk Management PDFimran jamilBelum ada peringkat

- COQ - An Overview (Rev 01)Dokumen25 halamanCOQ - An Overview (Rev 01)imran jamilBelum ada peringkat

- WQM 2015 ProclamationDokumen1 halamanWQM 2015 Proclamationimran jamilBelum ada peringkat

- CQI NCR Training PresentationDokumen34 halamanCQI NCR Training Presentationimran jamilBelum ada peringkat

- Katalog Weldotherm 10 2013 GB EmailDokumen40 halamanKatalog Weldotherm 10 2013 GB Emailimran jamilBelum ada peringkat

- Production and Operation Management PPT at BEC DOMS BAGALKOTDokumen238 halamanProduction and Operation Management PPT at BEC DOMS BAGALKOTBabasab Patil (Karrisatte)67% (3)

- Imperfections in Welds - PorosityDokumen3 halamanImperfections in Welds - Porosityimran jamilBelum ada peringkat

- Pressure Points - HSB Newsletter - April 2014Dokumen4 halamanPressure Points - HSB Newsletter - April 2014imran jamilBelum ada peringkat

- 2 Main Categories of NCRsDokumen4 halaman2 Main Categories of NCRsimran jamilBelum ada peringkat

- PMI Project Risk ManagementDokumen21 halamanPMI Project Risk Managementimran jamilBelum ada peringkat

- Inspection and Test Plan..Construction ProjectsDokumen5 halamanInspection and Test Plan..Construction Projectsimran jamilBelum ada peringkat

- Integrated Management System (IMS) QMS/EMS/OHSDokumen17 halamanIntegrated Management System (IMS) QMS/EMS/OHSamitbanerjee51Belum ada peringkat

- Torn DiagDokumen4 halamanTorn Diagimran jamilBelum ada peringkat

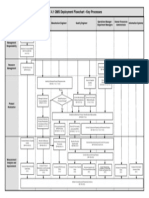

- QMS Deployment FlowchartDokumen1 halamanQMS Deployment Flowchartimran jamilBelum ada peringkat

- Iso 9001 - AsqDokumen7 halamanIso 9001 - Asqimran jamilBelum ada peringkat

- Project Quality Management - PMI PMBOKDokumen92 halamanProject Quality Management - PMI PMBOKimran jamil50% (2)

- Risk Management (RMP) PMI Sample QuestionsDokumen7 halamanRisk Management (RMP) PMI Sample Questionsimran jamil100% (1)

- Leadership Development OverviewDokumen11 halamanLeadership Development Overviewimran jamilBelum ada peringkat

- Importance of Quality in ProjectsDokumen16 halamanImportance of Quality in Projectsimran jamilBelum ada peringkat

- Project System Audit Checklist Planning and Scheduling GroupDokumen6 halamanProject System Audit Checklist Planning and Scheduling Groupimran jamil100% (1)

- ASQ GSQ Discoveries 2013Dokumen40 halamanASQ GSQ Discoveries 2013mseymour91Belum ada peringkat

- Importance of Welding: QA/QC DepartmentDokumen55 halamanImportance of Welding: QA/QC Departmentimran jamil0% (1)

- Teaching English For Young Learners: Mid AssignmentDokumen4 halamanTeaching English For Young Learners: Mid AssignmentAbdurrahman NurdinBelum ada peringkat

- Reflexiones sobre la vida y la libertad desde Tokio Blues y otras obrasDokumen5 halamanReflexiones sobre la vida y la libertad desde Tokio Blues y otras obrasRigoletto ResendezBelum ada peringkat

- Surveyv DataDokumen4 halamanSurveyv DataEmmaBelum ada peringkat

- Iskolar-Bos TM (Final) 2011Dokumen184 halamanIskolar-Bos TM (Final) 2011gpn1006Belum ada peringkat

- Implementing Change: Change Management, Contingency, & Processual ApproachesDokumen10 halamanImplementing Change: Change Management, Contingency, & Processual ApproachesSyed Umair Anwer100% (1)

- Holding Police AccountableDokumen38 halamanHolding Police AccountableMelindaBelum ada peringkat

- Grade 9 Science LP Week 4Dokumen13 halamanGrade 9 Science LP Week 4venicer balaodBelum ada peringkat

- A Child 3Dokumen50 halamanA Child 3winona mae marzoccoBelum ada peringkat

- WillisTodorov (2006) Cognitive BiasDokumen7 halamanWillisTodorov (2006) Cognitive BiasrogertitleBelum ada peringkat

- Leadership CH 3-5 SlideDokumen20 halamanLeadership CH 3-5 SlideMndaBelum ada peringkat

- Narrative ReportDokumen4 halamanNarrative Reportfrancis vale NavitaBelum ada peringkat

- Quotes Tagged As "Love"Dokumen9 halamanQuotes Tagged As "Love"Stephany NagreBelum ada peringkat

- Portfolio Management: Culling ProjectsDokumen10 halamanPortfolio Management: Culling ProjectsLMWorsleyBelum ada peringkat

- Bridges FOR Communication AND Information: Reyjen C. PresnoDokumen27 halamanBridges FOR Communication AND Information: Reyjen C. PresnoReyjen PresnoBelum ada peringkat

- The Ancient Mystery Initiations (AMORC)Dokumen10 halamanThe Ancient Mystery Initiations (AMORC)Sauron386100% (1)

- Qualitative Data AnalysisDokumen4 halamanQualitative Data AnalysisShambhav Lama100% (1)

- Wisc V Interpretive Sample ReportDokumen21 halamanWisc V Interpretive Sample ReportSUNIL NAYAKBelum ada peringkat

- Lesson 9 - The Spiritual SelfDokumen1 halamanLesson 9 - The Spiritual SelfmichelleBelum ada peringkat

- OmetryDokumen386 halamanOmetryRohit Gupta100% (2)

- Group 2 ReportDokumen77 halamanGroup 2 ReportZhelParedesBelum ada peringkat

- Pakistan Guide To Making Entries June 2020 v2Dokumen58 halamanPakistan Guide To Making Entries June 2020 v2shaziaBelum ada peringkat

- Budgeting: Advantages & LimitationsDokumen8 halamanBudgeting: Advantages & LimitationsSrinivas R. KhodeBelum ada peringkat

- Level of Learning Motivation of The Grade 12 Senior High School in Labayug National High SchoolDokumen10 halamanLevel of Learning Motivation of The Grade 12 Senior High School in Labayug National High SchoolMc Gregor TorioBelum ada peringkat

- Group Synergy in Problem SolvingDokumen29 halamanGroup Synergy in Problem SolvingKenny Ann Grace BatiancilaBelum ada peringkat

- CSR Communication in the Age of New MediaDokumen15 halamanCSR Communication in the Age of New MediaAziz MuhammadBelum ada peringkat

- Culture Shock: DefinitionDokumen10 halamanCulture Shock: DefinitionPrecious Ivy FernandezBelum ada peringkat

- Jurnal Ilmu Kedokteran Dan Kesehatan, Volume 8, Nomor 3, September 2021 255Dokumen8 halamanJurnal Ilmu Kedokteran Dan Kesehatan, Volume 8, Nomor 3, September 2021 255Elsa NurhalisaBelum ada peringkat

- 9 Myths About EntrepreneursDokumen4 halaman9 Myths About EntrepreneursJayanta TulinBelum ada peringkat

- Hospital Mission Vision Values ExamplesDokumen4 halamanHospital Mission Vision Values ExamplesNesyraAngelaMedalladaVenesa100% (1)

- A Study of Spatial Relationships & Human ResponseDokumen30 halamanA Study of Spatial Relationships & Human ResponseJuan Pedro Restrepo HerreraBelum ada peringkat