Understanding My Benefits: Pre - Auth@

Diunggah oleh

Jonelle Morris-DawkinsJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Understanding My Benefits: Pre - Auth@

Diunggah oleh

Jonelle Morris-DawkinsHak Cipta:

Format Tersedia

UNDERSTANDING MY BENEFITS

Who is eligible?

All government full-time employees in the central and

local govern-ment ministries, departments and agencies.

Contractual and tempo-rary employees (i..e. employees

must work a 5 day, 40 hours per week and have at least a

one year contract) may be allowed to enroll on the scheme

upon approval from their HR departments and receipt

of three (3) consecutive premium payments. Three (3)

months premiums must be paid before any claims can be

made by the member.

How can I enroll?

You can enroll by completing an enrollment and a salary

deduc-tion authorization forms and submitting a copy of your

birth certificate. These forms can be obtained through your

HR depart-ments or at our Business Centres island-wide.

Please note that all enrollment and salary deductions forms

must be submitted through your HR department. No

enrollment forms will be accepted directly from you at our

Business Cen-tres.

For individual enrolment, the employee is the only person

covered while family enrolment covers; you the employee,

your spouse (married or unmarried), your biological or legally

adopted or spouses child/children (step-children) under 19

years old. A birth certificate and/or marriage certificate is

required for your spouse and only a birth certificate is required

for your child/children. In the event, your child was adopted;

a copy of the Legal Adoption Certifi-cate will be required for

enrollment.

Can I change my spouse at any time?

NO. The Plan accommodates change of spouse between the

peri-ods July 1st to October 31st, of each year. Please note that

this was changed in keeping with your current anniversary

of August 1st. Please note, only (1) change of spouse will be

allowed during a plan year, except in the case of marriage.

What is the current Anniversary date of the GEASO health

plan?

YES. The Anniversary Date is August 1st

I just got married; can I add my spouse to my health

plan?

YES. If you are already on the Family plan, then your spouse

can be added immediately. The Subscriber Change Request

form, Spouses Birth Certificate and a copy of your Marriage

Certificate must be submitted. If you are on an Individual plan,

you will be required to upgrade to the family plan and submit

the documents above.

I am solely responsible for my grandchild/godchild/niece/

neph-ew/little brother/little sister. Can I put them on my

card?

They can be put on only if you have legally adopted these children i.e. you have adopted the child through the Court.

Can I put my mother and father on my health card?

NO. Parents, grandchildren and guardians are not considered

eligi-ble dependents by the plan.

FULL HOUSE BENEFITS

I have been told that I have Full-house benefits. What

does this mean?

The term Full-house describes the benefit that features one

limit that is shared by the combination of dental, optical and

prescrip-tion drug benefits. Please note that under the Family

plan, this benefit is a shared benefit. As such, one amount

is allotted for the use of all members of the family on the

scheme.

If I dont use all the money on my card, can the balance be

car-ried forward to the following year?

NO. There is no provision for carry forward of benefits.

Can my Major Medical be used for drugs when the money

on the swipe card is exhausted?

NO. Your full house benefit is replenished on an annual

basis (i.e. August 1 every year). Once the amount for the

full-house benefit is exhausted, no top-ups will be given

until the benefits are refreshed on August 1st. Please note

that your Major Medical does not cover prescription

drugs.

How often can my card be used for Lens/Frames or Dental

Ser-vices?

Lens every 12 months from the last service date.

Frames every 24 months from the last service date.

Dental Cleaning every 6 months from the last

service date.

When is the Full house benefit refreshed?

This amount will be refreshed on August 1st annually.

Does the Full house benefits go into major medical?

NO. Once this benefit is exhausted, the member or their

dependents cannot access the benefit until it is refreshed.

If there is a balance on my dependent card can I use it?

There are no balances on dependent Full- house. The

amount on the Full-house benefit is allocated for the use

of the entire family for the plan year.

Why are over the counter drugs excluded?

The scheme was not designed to facilitate the purchase of

drugs and/medication which is accessed over the counter,

but rather those which are dispensed from the prescription

area.

SURGICAL BENEFITS

As a new member, I am schedule to do a surgical procedure,

am I automatically eligible for coverage?

NO. You are required to serve the mandated six (6) months

waiting period for Surgery, Major Diagnostics (MRI, CAT scan)

and Hospitalization.

My doctor asked me to do an MRI and CT scan. Do I have

to pay the full cost?

NO. Your health plan will cover a part of the cost. Please

ask your Provider to submit an estimate of the charges and

also the doctors referral to the Pre-Authorization Unit.

Please note that the referral should state the reason why

this test is necessary.

I am a GEASO cardholder scheduled to do a surgery that

costs $800,000. How much of this expense will be covered

by my health plan?

Your surgeon will be required to submit an invoice

which should include an estimate of the charges, the

type of procedure and the diagnosis to Sagicors Preauthorization Unit. We will inform your surgeon of the

coverage amount within three (3) to five (5) working days.

The Pre-authorization Unit can be contacted at pre_auth@

sagicor.com. The maximum payable for surgical ex-penses

is $500,000 per disability.

LIFETIME MAXIMUM or MAJOR MEDICAL

What is a Lifetime Maximum?

The Lifetime Maximum, otherwise known as Major

Medical is a predetermined sum of money which

establishes a limit to the amount to be utilized during the

lifetime of a subscriber and/or dependent.

What is the current Lifetime Maximum?

As at August 1, 2012 it is $2,500,000. 00

I was told of a deductible to be satisfied before

reimbursement is done from the major medical. What is a

deductible? What is the GEASO deductible amount? What

benefits goes into Major Medical?

A deductible is an out-of the-pocket expense borne by

the insured before the major medical benefit is payable.

GEASO deductible per contract year is $2000.00. Benefits

such as Lab/X-Ray, ECG/EKG, Ultrasound goes into Major

Medical once you have utilized the allow-ance issued on

the swipe card. Surgical procedures are also cov-ered

under Major Medical.

If the lifetime maximum amount (Major Medical) is

exhausted what happens to the plan?

The plan will still be effective as basic benefits will remain

accessi-ble. However, procedures and/or treatment which

require Major Medical coverage will be denied.

MATERNITY BENEFITS

Who is eligible for the maternity benefit?

Members and spouses enrolled under the Family plan

and have served a waiting period of nine (9) months.

All maternity related expenses, including doctors visits,

prescription drugs, diagnostic tests (i.e. labs, x-rays and

ultrasounds) are paid from the maternity benefit. Please

note that you cannot receive the maternity bene-fit while

on an individual plan.

What is my Ante-natal benefit?

Please note that the plan pays approximately 50% to the

maximum of $25,0000 of your normal delivery maximum for

your antenatal care. This is done to ensure that monies are

available for the pay-ment of expenses associated with the

delivery.

Is my baby covered under my health plan immediately

after birth?

YES. The enrolment information (i.e. birth registration slip

and com-pleted Subscriber Change Request Form) should

be submitted with-in 90 days after the birth of your baby. In

this case, the effective date of enrolment on the plan will

be the childs birth date.

If your baby is not enrolled on the plan within 90 days after

its birth, then the childs enrolment will take effect on the

actual date of enrol-ment and not from the childs birth

date.

Why are dependent children excluded from the maternity

bene-fit?

The maternity benefit is intended for female members and

female dependent spouses ONLY.

What is the waiting period for the maternity benefit?

Nine (9) months on the Family benefit only. Individual

coverage does not include the maternity benefit.

CLAIMS

Why is my claim not covered when my premium is up to

date?

The service which was given is not a covered benefit under

your plan.

How long does it take for my claim to be processed?

We currently process claim payments within three to five

working days from receipt.

I wish to submit a claim form I received 6 months ago, will

it be processed?

NO. All claims must be submitted within ninety (90)

days of the ser-vice except in the case of Maternity where

you have the option to submit claims 90 days from your

delivery date. The Benefits are subject to exclusions.

My Benefit Card states that I am covered for $1,500.00 of

each office visit but my doctor charges $3,000.00 for each

visit. Can I submit a claim for the $1,500.00 I paid?

NO. The difference you pay is called your co-payment.

The bene-fit of $1,500 and your co-payment cannot be

covered under the same plan. However, if you are part of

a second health plan, you can coordinate your benefits by

also using your second plan to re-duce your co-payment.

Are my dependents covered for Overseas Emergency or

Non-Emergency?

No. This benefit is only applicable to members/employees

only.

If I am unconscious and not able to make the call within 48

hours of the emergency overseas, what happens?

You should be sure to carry your travel card with you so that

the Providers will know that you have emergency overseas

coverage. It is also very important to let your family/

friend etc. with whom you are staying know that you have

this coverage. In this situation, your host, companion or

Health Care Provider should make the call on your behalf

within the specified time (i.e. within 48 hours of the occurrence).

Why is GCT not covered?

GCT is a government tax for which each insured is

responsible to pay by law.

Can I coordinate my health card with another insurance

plan?

YES. If you are covered under another health insurance

policy, benefits may be coordinated to further reduce your

co-payments. If you have health insurance with another

insurance company, kindly submit your completed claims

forms and original receipts to your primary insurance

provide. Please attach a copy of the explanation of benefits

from the primary provider, to your secondary provider,

upon submission of your claims.

Explain what is meant by per disability?

This means that the associated benefit recognizes more than

one illness being covered on your health plan.

Explain what is meant by Executive Profile?

This refers to a set of chosen diagnostic, laboratory tests

ordered by the medical doctor to affirm wellness or confirm

a disease process as well as for the provision of treatment

(i.e. medical or surgical).

OVER-AGED DEPENDENTS

My daughter is now nineteen and is presently in sixth

form; can she remain on my health plan?

YES. A dependent child is terminated from the plan on his/

her 19th birthday; if the child is in sixth form, coverage

can be extended up to age 20, once a status letter from an

approved secondary institution is submitted. Thereafter,

coverage can continue until their twenty-third (23rd) birthday

if: There is no academic break between high school and

tertiary/vocational studies, up to age 23. A status letter from

an approved tertiary institution is submitted annually.

My son is now 20 years old and attending University; but

he took a year off to rest and gain some work experience,

can he be reinstated on my health plan?

NO. The plan can only accommodate dependents who are

full-time students with no academic break between high

school and their entry into a tertiary institution.

How often must the school status letter be submitted to

Sagi-cor?

The school status letter must be submitted on an annual

basis at the beginning of each new academic year.

If I have a child that is challenged, can the child remain

on my health plan over the age of nineteen (19) years?

YES. You and your General Physician will be required to

complete the Declaration of Dependent Disability Form

and submit to Sagicor for consideration by our GEASO

Monitoring Committee.

What should the school status letter include?

The school status letter should include: Full name of the

student, Year of study (i.e. 2013/2014), Course of study

(i.e. CAPE or CSEC/ Degree), Field of study (i.e. English,

Business, Medicine). The mem-bers policy number

should be affixed to the letter. It should be noted that only

full-time students may remain on their parents health

plan.

ELECTRONIC FUND TRANSFER (EFT)

What is Electronic Fund Transfer (EFT)?

Electronic Funds Transfer (EFT) is a system of transferring

money from one financial institution account directly to

another without any paper money or cheques changing

hands.

Will Sagicor charge me to have money sent directly to my

ac-count?

NO. Sagicor will not charge you to send funds to your

account and most banks will not charge you for receiving

payments by EFT. You can confirm with your particular

bank to determine if there are any charges.

How do I authorize that my claim payments are sent

directly to my account instead via cheque?

You can visit any of our branch offices island wide

and complete the EFT request form. Upon receipt,

your account information will be added to your

policy immediately. Due to the confidentiality of your

information, your account information is only accessible

by author-ized personnel internally.

If you can deposit money into my account, what is to stop

you from taking money out?

We do not have access to remove cash from your

account. The arrangement that we have with the financial

institutions is for depos-its only. We send the institution

an electronic file with your account number, name and

payment amount. The institution will in turn de-posit the

funds to your account.

How will I know when my claim reimbursements are

deposited to my account?

You will receive an alert via email or SMS text message.

This mes-sage will include the amount and date of the

deposit.

How long does it takes for my reimbursement to be

deposited in my account?

Deposits are usually made within 1-3 business days after

the claim has been processed.

CHANGE OF PAY SITE

I recently changed pay sites from the Ministry of Tourism

to the Ministry of National Security, how can I ensure that

health plan is not terminated?

Changing from one pay station or from one Ministry/

Department/Agency to another without notifying Sagicor,

will likely disrupt your payment record. Sagicor must

receive written notifications from the old and new pay-sites

along with the effective date of transfer.

Sagicor will accept a faxed copy of the notification letter

to fax num-ber 929-4730 to the attention of your Group

Insurance Administrator or an email from the pay station

to geaso-enquiries@sagicor.com.

APPROVED LEAVE OF ABSENCE

I am presently on no-pay leave completing my Masters

degree; can I remain on the health plan while studying?

YES. Sagicor must receive written notification from your

employer advising the reason for non-payment and the

period of the leave of absence. Once this information

is received by our Customer Care Department, you may

pay the outstanding premium via cash or cheque, at

the cashier located at Sagicors office. Please note that

you will be required to pay 100% of premiums (i.e. the

Govern-ment -80% and Subscriber-20%)

Based on the response above, I am now returning to

work after seven months no-pay leave, can I be reinstated

without paying the outstanding amount?

NO. Reinstatements are only allowed within three (3)

months of your effective leave of absence date. You must

now re-enrol to access the GEASO benefits. You will be

required to serve the wait-ing periods prior to access to the

following benefits:

Maternity (family plan only) 9 months

Surgical 6 months

NON-PAYMENTS OF PREMIUMS

The Accounts department in error did not deduct my

health premiums for a particular month, will my plan be

terminated? Can I make the payments over the counter?

How do I correct this error?

YES. Your health plan is automatically terminated once

payments of premiums cease. NO. We cannot accept

payments over the counter, as this is only allowed if you

are on an approved no-pay leave.

This can be corrected by submission of a Commitment

Letter from the HR Director or Accountant This

commitment must be sent to the Group Insurance

Administrator at Sagicor prior to the next premium

payment. Once the information sent is considered

satisfactory, the policy will be reinstated immediately.

My salary was received late for June and no deductions

were made for my health plan. I resumed duties in July

and only July deductions were made. Will there be any

disruption in my ser-vices?

YES. Your policy will be automatically terminated for

non-payment of premiums. A commitment letter from

your pay site will be required stating the reason for nonpayment and the stipulated period the

outstanding funds will be recovered. Once the

information received is considered satisfactory, the policy

will reinstated immediately.

GENERAL INFORMATION

Can I maintain coverage after termination of

employment?

NO. Coverage is only applicable to persons employed on

a full-time basis to the Government of Jamaica.

My company recently had a Wellness Day and my card

was not accepted by a health provider, why is this?

Wellness Day services are considered as Mass Screening.

Mass Screening service is not a covered benefit under your

health plan.

Is there a cost for the replacement of health cards?

YES. The cost is $300.00 for each. (i.e. Benefit and Swipe

Card).

Frequently Asked

Questions

GEASO

Is a new swipe card issued annually?

NO. While a new benefit card is issued on renewal at the

beginning of a contract period, the swipe card does not

have an expiry date and should be retained.

What is the eligibility period?

There is a standard waiting period of three (3) months.

Please check with your HR department on the fourth (4)

month for collection of your health cards.

For information on the GEASO Health Plan contact any of

the following offices:

Sagicor Winchester Business Centre

Shop #24, Winchester Business Centre

15 Hope Road

Kingston 10

Tel.: (876) 656-8764-9

Sagicor Life Jamaica Limited

R. Danny Williams Building

28-48 Barbados Avenue

Kingston 5

Tel.: (876) 929-8920-9 Option 3

Government Employees

Administrative Services Only

Anda mungkin juga menyukai

- Benefit Guide Template 3Dokumen18 halamanBenefit Guide Template 3TheChipper1979Belum ada peringkat

- The Way of The Samurai, Shadowrun BookDokumen19 halamanThe Way of The Samurai, Shadowrun BookBraedon Montgomery100% (8)

- Smarajit Ghosh - Control Systems - Theory and Applications-Pearson (2006) PDFDokumen629 halamanSmarajit Ghosh - Control Systems - Theory and Applications-Pearson (2006) PDFaggarwalakanksha100% (2)

- Benefits Enrollment Guide 2013-2014 FINALDokumen39 halamanBenefits Enrollment Guide 2013-2014 FINALMattress Firm BenefitsBelum ada peringkat

- 2011-0021 37 Enterpreneurship PDFDokumen27 halaman2011-0021 37 Enterpreneurship PDFJonelle Morris-DawkinsBelum ada peringkat

- Answer Key: Entry TestDokumen4 halamanAnswer Key: Entry TestMaciej BialyBelum ada peringkat

- Checklist Code ReviewDokumen2 halamanChecklist Code ReviewTrang Đỗ Thu100% (1)

- Windows Server 2016 Technical Preview NIC and Switch Embedded Teaming User GuideDokumen61 halamanWindows Server 2016 Technical Preview NIC and Switch Embedded Teaming User GuidenetvistaBelum ada peringkat

- New Era Hospital IncomeDokumen2 halamanNew Era Hospital IncomeHihiBelum ada peringkat

- ESC H BAND FAQsDokumen8 halamanESC H BAND FAQsRamesh DeshpandeBelum ada peringkat

- 2014-15 Ag-Pro Final New Hire Benefit BookletDokumen20 halaman2014-15 Ag-Pro Final New Hire Benefit BookletkellifitzgeraldBelum ada peringkat

- Claim FormDokumen3 halamanClaim FormInvestor ProtegeBelum ada peringkat

- Flexi Medical Plan BrochureDokumen28 halamanFlexi Medical Plan BrochurewoodksdBelum ada peringkat

- SPD Ra Spd2011Dokumen51 halamanSPD Ra Spd2011Judy RomatelliBelum ada peringkat

- Morningstar India Private Limited: Hospitalization Benefit PlanDokumen10 halamanMorningstar India Private Limited: Hospitalization Benefit PlandevanyaBelum ada peringkat

- TCS India FAQsDokumen8 halamanTCS India FAQsRaj kishan ShawBelum ada peringkat

- Upcoming HR Program Changes - Part Time Employees - EN PDFDokumen4 halamanUpcoming HR Program Changes - Part Time Employees - EN PDFjsource2007Belum ada peringkat

- Chrysler Retirees - FAQDokumen7 halamanChrysler Retirees - FAQAlex RobertsBelum ada peringkat

- Contractor Benefit Guide 2012-2013Dokumen42 halamanContractor Benefit Guide 2012-2013roseguy7Belum ada peringkat

- Ameritas Dental BrochureDokumen4 halamanAmeritas Dental BrochureSocialmobile TrafficBelum ada peringkat

- Aetna Student Health Plan Design and Benefits Summary Notre Dame 2018 19-7-24 18Dokumen38 halamanAetna Student Health Plan Design and Benefits Summary Notre Dame 2018 19-7-24 18MESSI SURYA 10Belum ada peringkat

- 8Z9N0K0001V0Dokumen3 halaman8Z9N0K0001V0Vanessa Graves FosterBelum ada peringkat

- FAQ One Medical (Eng)Dokumen5 halamanFAQ One Medical (Eng)Razman ZaidiBelum ada peringkat

- Flexible Spending Account (FSA) Frequently Asked Questions: WWW - Irs.govDokumen2 halamanFlexible Spending Account (FSA) Frequently Asked Questions: WWW - Irs.govRobinhoodBelum ada peringkat

- Health Insurance FAQ From IntrawestDokumen9 halamanHealth Insurance FAQ From IntrawestScott FranzBelum ada peringkat

- Election Form and Compensation Reduction Agreement: Sagitec Solutions LLCDokumen2 halamanElection Form and Compensation Reduction Agreement: Sagitec Solutions LLCFinding FannyBelum ada peringkat

- Optional Term Life Optional Universal Life: Group Insurance ProgramDokumen32 halamanOptional Term Life Optional Universal Life: Group Insurance ProgramGaurav PultamkarBelum ada peringkat

- Access Health Enrollment FormsDokumen5 halamanAccess Health Enrollment FormsadeleaBelum ada peringkat

- 2023 - Oe - Notice - 2008 - FinalDokumen5 halaman2023 - Oe - Notice - 2008 - FinalabroughearBelum ada peringkat

- Benefits DescriptionDokumen16 halamanBenefits DescriptionKenneth Del RioBelum ada peringkat

- 2020 Benefits Information Guide: Understanding Your Options Staffing EmployeesDokumen28 halaman2020 Benefits Information Guide: Understanding Your Options Staffing Employeeseric.risnerBelum ada peringkat

- Health Care 2013 - 2014 FINALDokumen2 halamanHealth Care 2013 - 2014 FINALMattress Firm BenefitsBelum ada peringkat

- Company Your Policy ExplainedDokumen34 halamanCompany Your Policy ExplaineddeonptBelum ada peringkat

- Relationship: Start A Life LongDokumen10 halamanRelationship: Start A Life LongRajesh Kumar RamaswamyBelum ada peringkat

- Heartbeat Silver BrochureDokumen10 halamanHeartbeat Silver Brochuresubs007Belum ada peringkat

- CA81457 Quick Net BrochureDokumen34 halamanCA81457 Quick Net BrochureBradley GreenwoodBelum ada peringkat

- Health Benefits Coverage: PractitionersDokumen2 halamanHealth Benefits Coverage: PractitionersNijhdsfjhBelum ada peringkat

- 24 Policy Wording EnglishDokumen4 halaman24 Policy Wording EnglishIsrael DoteBelum ada peringkat

- Group Mediclaim Policy Coverages For Employees of Century PlyDokumen2 halamanGroup Mediclaim Policy Coverages For Employees of Century PlyUDAYBelum ada peringkat

- Sisc Q ADokumen7 halamanSisc Q Aapi-204910805Belum ada peringkat

- Sss Benefits I. Sickness Benefits: For Unemployed, Self-Employed and Voluntary MembersDokumen23 halamanSss Benefits I. Sickness Benefits: For Unemployed, Self-Employed and Voluntary MembersdenelizaBelum ada peringkat

- Entitlements and Obligations Applicable To GGGI Personnel Under Individu...Dokumen9 halamanEntitlements and Obligations Applicable To GGGI Personnel Under Individu...white saberBelum ada peringkat

- B I New Employee PresentationDokumen41 halamanB I New Employee Presentationzulmohd1Belum ada peringkat

- Aetna Open Access Managed Choice: Answers Important Questions Why This MattersDokumen8 halamanAetna Open Access Managed Choice: Answers Important Questions Why This MattersChris BohoBelum ada peringkat

- Cornell University Division of Human Resources - Short Term Disability Faq - 2018-04-18Dokumen2 halamanCornell University Division of Human Resources - Short Term Disability Faq - 2018-04-18Daniel CasasolaBelum ada peringkat

- 6 Provident Fund SecrectsDokumen6 halaman6 Provident Fund SecrectssrikarchanduBelum ada peringkat

- Agropreneur Sick Leave PolicyDokumen2 halamanAgropreneur Sick Leave Policybrian mangeniBelum ada peringkat

- Flexible Spending Account FINALDokumen2 halamanFlexible Spending Account FINALMattress Firm BenefitsBelum ada peringkat

- Your Policy ExplainedDokumen29 halamanYour Policy ExplaineddeonptBelum ada peringkat

- Financial AgreementDokumen1 halamanFinancial AgreementdanielcidBelum ada peringkat

- Pparx ApplicationsDokumen8 halamanPparx ApplicationsJames MullinsBelum ada peringkat

- Reg 2-Primary Care Claim Form-31 Oct 2008Dokumen2 halamanReg 2-Primary Care Claim Form-31 Oct 2008Pradeep KhubchandaniBelum ada peringkat

- Ast Medical History PDFDokumen2 halamanAst Medical History PDFUzma TahirBelum ada peringkat

- Application For Membership Form: Application No.: Effectivity Date: Contract No.Dokumen2 halamanApplication For Membership Form: Application No.: Effectivity Date: Contract No.Lizeth QuerubinBelum ada peringkat

- GL3655EDokumen0 halamanGL3655EandyhrBelum ada peringkat

- NoticesDokumen2 halamanNoticesapi-252555369Belum ada peringkat

- 2016 Benefit Changes (Non-Barganing Unit)Dokumen18 halaman2016 Benefit Changes (Non-Barganing Unit)Blaine RiceBelum ada peringkat

- TCS India FAQs - Health Insurance SchemeDokumen7 halamanTCS India FAQs - Health Insurance SchemeVipul KulshreshthaBelum ada peringkat

- Prospectus New India Mediclaim PolicyDokumen15 halamanProspectus New India Mediclaim PolicyKamlesh KumarBelum ada peringkat

- Usfts SPDDokumen355 halamanUsfts SPDford7451Belum ada peringkat

- Kpit BenefitsDokumen12 halamanKpit BenefitsRAHUL DAM100% (1)

- How to Enroll in Medicare Health Insurance: Choose a Medicare Part D Drug Plan and a Medicare Supplement PlanDari EverandHow to Enroll in Medicare Health Insurance: Choose a Medicare Part D Drug Plan and a Medicare Supplement PlanBelum ada peringkat

- A Guide for Medical Case Managers: Stop Loss Insurance for Medical ProfessionalsDari EverandA Guide for Medical Case Managers: Stop Loss Insurance for Medical ProfessionalsBelum ada peringkat

- The New Health Insurance Solution: How to Get Cheaper, Better Coverage Without a Traditional Employer PlanDari EverandThe New Health Insurance Solution: How to Get Cheaper, Better Coverage Without a Traditional Employer PlanPenilaian: 4 dari 5 bintang4/5 (1)

- Two Basic Rules of ProbabilityDokumen17 halamanTwo Basic Rules of ProbabilityJonelle Morris-DawkinsBelum ada peringkat

- Formula SheetDokumen5 halamanFormula SheetJonelle Morris-DawkinsBelum ada peringkat

- Idea Generation Sample AssignmentDokumen7 halamanIdea Generation Sample AssignmentJonelle Morris-DawkinsBelum ada peringkat

- Fall 2017 EOME ScheduleDokumen12 halamanFall 2017 EOME ScheduleJonelle Morris-DawkinsBelum ada peringkat

- Financial ManagementDokumen29 halamanFinancial ManagementJonelle Morris-DawkinsBelum ada peringkat

- Business Plan Final-2013Dokumen42 halamanBusiness Plan Final-2013Jonelle Morris-DawkinsBelum ada peringkat

- On RegressionDokumen57 halamanOn Regressionprashantgargindia_93Belum ada peringkat

- MTH400 - QM AssignmentsDokumen2 halamanMTH400 - QM AssignmentsJonelle Morris-DawkinsBelum ada peringkat

- Assignment Ch3Dokumen2 halamanAssignment Ch3Andy LeungBelum ada peringkat

- Idea Generation Sample AssignmentDokumen7 halamanIdea Generation Sample AssignmentJonelle Morris-DawkinsBelum ada peringkat

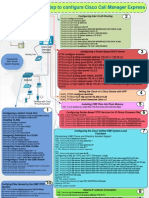

- 10 Step To Configure Cisco Call Manager ExpressDokumen1 halaman10 Step To Configure Cisco Call Manager ExpressSudhir Vats100% (2)

- On RegressionDokumen57 halamanOn Regressionprashantgargindia_93Belum ada peringkat

- Business Plan Final-2013Dokumen42 halamanBusiness Plan Final-2013Jonelle Morris-DawkinsBelum ada peringkat

- PPT4 - ConcurrencyDokumen54 halamanPPT4 - ConcurrencyJonelle Morris-DawkinsBelum ada peringkat

- Competitive AnalysisDokumen8 halamanCompetitive AnalysisJonelle Morris-DawkinsBelum ada peringkat

- Banas EcoDokumen22 halamanBanas EcoVipul RanjanBelum ada peringkat

- Discuss The Practicality of The Chinese Room and The Turing TestDokumen5 halamanDiscuss The Practicality of The Chinese Room and The Turing TestJonelle Morris-DawkinsBelum ada peringkat

- Expected Value, Variance and STD DeviationDokumen2 halamanExpected Value, Variance and STD DeviationJonelle Morris-DawkinsBelum ada peringkat

- Expected Value, Variance and STD DeviationDokumen2 halamanExpected Value, Variance and STD DeviationJonelle Morris-DawkinsBelum ada peringkat

- PotatoDokumen10 halamanPotatoAsad MalikBelum ada peringkat

- Group Enrollment Form PDFDokumen2 halamanGroup Enrollment Form PDFJonelle Morris-Dawkins0% (1)

- Alcohol & Advertising: IAS FactsheetDokumen19 halamanAlcohol & Advertising: IAS FactsheetJonelle Morris-DawkinsBelum ada peringkat

- Introduction To Sociology-V2.0Dokumen301 halamanIntroduction To Sociology-V2.0vanithamohanakumarBelum ada peringkat

- Applied Research ProjectDokumen31 halamanApplied Research ProjectJonelle Morris-DawkinsBelum ada peringkat

- The Adventures of Sherlock HDokumen325 halamanThe Adventures of Sherlock HJonelle Morris-DawkinsBelum ada peringkat

- Nestle-Om FinalDokumen18 halamanNestle-Om FinalJonelle Morris-DawkinsBelum ada peringkat

- Repro Indo China Conf PDFDokumen16 halamanRepro Indo China Conf PDFPavit KaurBelum ada peringkat

- BCSS Sec Unit 1 Listening and Speaking SkillsDokumen16 halamanBCSS Sec Unit 1 Listening and Speaking Skillsjiny benBelum ada peringkat

- Teacher Resource Disc: Betty Schrampfer Azar Stacy A. HagenDokumen10 halamanTeacher Resource Disc: Betty Schrampfer Azar Stacy A. HagenRaveli pieceBelum ada peringkat

- English Literature Coursework Aqa GcseDokumen6 halamanEnglish Literature Coursework Aqa Gcsef5d17e05100% (2)

- Student's T DistributionDokumen6 halamanStudent's T DistributionNur AliaBelum ada peringkat

- English Examination 1-Bdsi-XiDokumen1 halamanEnglish Examination 1-Bdsi-XiHarsuni Winarti100% (1)

- 20131022-Additive Manufacturing & Allied Technologies, PuneDokumen56 halaman20131022-Additive Manufacturing & Allied Technologies, Puneprakush_prakushBelum ada peringkat

- Put Them Into A Big Bowl. Serve The Salad in Small Bowls. Squeeze Some Lemon Juice. Cut The Fruits Into Small Pieces. Wash The Fruits. Mix The FruitsDokumen2 halamanPut Them Into A Big Bowl. Serve The Salad in Small Bowls. Squeeze Some Lemon Juice. Cut The Fruits Into Small Pieces. Wash The Fruits. Mix The FruitsNithya SweetieBelum ada peringkat

- Chemistry For PhotographersDokumen184 halamanChemistry For PhotographersBahar ShoghiBelum ada peringkat

- Statistics 2Dokumen121 halamanStatistics 2Ravi KBelum ada peringkat

- MC0085 MQPDokumen20 halamanMC0085 MQPUtpal KantBelum ada peringkat

- Control Flow, Arrays - DocDokumen34 halamanControl Flow, Arrays - DocHARIBABU N SEC 2020Belum ada peringkat

- Jose André Morales, PH.D.: Ingeniería SocialDokumen56 halamanJose André Morales, PH.D.: Ingeniería SocialJYMYBelum ada peringkat

- Cpar Final Written Exam 1Dokumen3 halamanCpar Final Written Exam 1Jeden RubiaBelum ada peringkat

- Bajaj Allianz General Insurance CompanyDokumen4 halamanBajaj Allianz General Insurance Companysarath potnuriBelum ada peringkat

- Antibiotic I and II HWDokumen4 halamanAntibiotic I and II HWAsma AhmedBelum ada peringkat

- Problem SetsDokumen69 halamanProblem SetsAnnagrazia ArgentieriBelum ada peringkat

- VERITAS NetBackup 4 (1) .5 On UnixDokumen136 halamanVERITAS NetBackup 4 (1) .5 On UnixamsreekuBelum ada peringkat

- Skin Care Creams, Lotions and Gels For Cosmetic Use - SpecificationDokumen33 halamanSkin Care Creams, Lotions and Gels For Cosmetic Use - SpecificationJona Phie Montero NdtcnursingBelum ada peringkat

- Hormone Replacement Therapy Real Concerns and FalsDokumen13 halamanHormone Replacement Therapy Real Concerns and FalsDxng 1Belum ada peringkat

- Amazon Tax Information InterviewDokumen2 halamanAmazon Tax Information Interviewasad nBelum ada peringkat

- Industrial Training ReportDokumen19 halamanIndustrial Training ReportKapil Prajapati33% (3)

- E10.unit 3 - Getting StartedDokumen2 halamanE10.unit 3 - Getting Started27. Nguyễn Phương LinhBelum ada peringkat

- Topic 3 - Analyzing The Marketing EnvironmentDokumen28 halamanTopic 3 - Analyzing The Marketing Environmentmelissa chlBelum ada peringkat