Taxation Trends in The European Union - 2012 26

Diunggah oleh

Dimitris Argyriou0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

7 tayangan1 halamanp26

Judul Asli

Taxation Trends in the European Union - 2012 26

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inip26

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

7 tayangan1 halamanTaxation Trends in The European Union - 2012 26

Diunggah oleh

Dimitris Argyrioup26

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

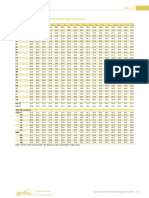

Part I

Overall tax revenue

Graph 1.5: Structure of tax revenues by major type of taxes

2010, % of total tax burden

O

v

e

r

a

l

l

Share of indirect taxes

60 55.4

50

45.5 45.2 44.7

43.8 43.5 43.1 42.2

41.8 41.7 41.4

40

39.7 39.7 38.5

37.2 36.9

35.5 35.4 35.0 34.0

33.5 33.0 32.2 32.0 32.0

38.6

40.8

36.5

30.3 29.8

28.3

30

20

10

0

BG HU RO LT

CY

PL

PT

LV MT EE

IE

SE

EL

SI

SK UK FR DK AT

CZ

IT

ES

NL

FI

LU

BE DE

EU- EA27 17

IS

t

a

x

NO

Share of direct taxes

70

62.7

r

e

v

e

n

u

e

60

50

44.4

47.4 49.2

42.2

40

40.1 38.8

38.2 37.9 37.2

34.9

30

31.5 31.1 30.9 30.3

29.4 28.4

27.1 25.8 25.2

20

30.4 30.6

22.6 22.6 21.9 21.8 20.8

19.9 19.1 18.8

17.4

10

0

DK UK SE MT LU

FI

IE

BE

IT

NL CY ES

AT DE PT

LV

FR

EL HU RO PL

SI

CZ EE SK BG

LT

EU- EA27 17

IS

NO

Share of social security contributions

50

45.2

40

43.7

40.8 40.1

39.3 38.6 38.5 38.3

36.3 35.1

34.9 34.9

32.4 32.2 31.9 31.7

30.7 29.8

29.2 28.5

30

31.1

33.1

25.8 25.1

20.7

20

22.5

18.7 18.1 18.1

11.8

10

2.1

0

CZ SK DE

SI

FR ES EE

LT

NL

EL

PL

AT

BE RO HU

IT

LV

FI

LU

PT BG CY

IE

UK MT SE DK

EU- EA27 17

IS

NO

Source: Commission services

This is due to the fact that harmonisation usually does

not translate into the setting of actual tax rates (e.g.

equalizing them), but that legal form and some

minimum requirements are imposed (e.g. minimum

excise duties on mineral oils). Typically NMS-12

countries show a high share of consumption taxes.

Apart from the fact that generally final domestic

consumption amounts to a large share of GDP in the

NMS-12 purely statistically, the comparatively lower

taxation of labour in these countries symmetrically

tends to boost the share of consumption taxation. Also,

the energy intensity of the economy in these Member

States is generally higher (as an important element of

consumption taxes is represented by mineral oil excise

duties).

Even greater variation is visible in revenues from

capital and business income, while some smaller

revenue sources, such as taxation of stocks of

capital/wealth and taxation of non-employed labour

Taxation trends in the European Union

25

Anda mungkin juga menyukai

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsDari EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsBelum ada peringkat

- Taxe Și Impozite (% PIB)Dokumen6 halamanTaxe Și Impozite (% PIB)dlavinutzzaBelum ada peringkat

- The Overall tax-to-GDP Ratio in The EU27 Up To 38.8% of GDP in 2011Dokumen4 halamanThe Overall tax-to-GDP Ratio in The EU27 Up To 38.8% of GDP in 2011pissiqtzaBelum ada peringkat

- Taxation Trends in The European Union - 2012 35Dokumen1 halamanTaxation Trends in The European Union - 2012 35Dimitris ArgyriouBelum ada peringkat

- EU27 tax-to-GDP ratio up to 38.8% in 2011Dokumen5 halamanEU27 tax-to-GDP ratio up to 38.8% in 2011WISDOM your outside perspective pillarBelum ada peringkat

- Taxation Trends in The European Union - 2012 30Dokumen1 halamanTaxation Trends in The European Union - 2012 30Dimitris ArgyriouBelum ada peringkat

- Top Personal Income Tax Rates 1995-2012Dokumen1 halamanTop Personal Income Tax Rates 1995-2012Dimitris ArgyriouBelum ada peringkat

- Izveštaj Sa Laboratorijske Vežbe Trofazni Ispravljač: SadržajDokumen49 halamanIzveštaj Sa Laboratorijske Vežbe Trofazni Ispravljač: Sadržajbojan 2Belum ada peringkat

- Case 6-2 Lewis CorpDokumen9 halamanCase 6-2 Lewis CorpSourav MookerjeeBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 31Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 31Dimitris ArgyriouBelum ada peringkat

- Total Tax Revenue in GDPDokumen1 halamanTotal Tax Revenue in GDPmyrthanaBelum ada peringkat

- Compounding and Discounting TablesDokumen3 halamanCompounding and Discounting Tablespoyinho100% (1)

- EU Labour Implicit Tax Rates 1995-2009Dokumen1 halamanEU Labour Implicit Tax Rates 1995-2009Dimitris ArgyriouBelum ada peringkat

- 2014 2015 2016 2017 2018 Revenues Op Expenses Ebidta Other Income Int. Exp Prelim. Exp. Dep. PBT Tax Pat Capex WC Delta WC Ebit Ebit (1-T) FCFF TV Discounting Factor PV Pvoftv ValueDokumen2 halaman2014 2015 2016 2017 2018 Revenues Op Expenses Ebidta Other Income Int. Exp Prelim. Exp. Dep. PBT Tax Pat Capex WC Delta WC Ebit Ebit (1-T) FCFF TV Discounting Factor PV Pvoftv ValueVivekSinghBelum ada peringkat

- Study Spreadsheet 2Dokumen7 halamanStudy Spreadsheet 2Vainess S ZuluBelum ada peringkat

- V C I W: Seismic Load CalculationDokumen8 halamanV C I W: Seismic Load CalculationbonnicoBelum ada peringkat

- Study Spreadsheet ErrorsDokumen7 halamanStudy Spreadsheet ErrorsVainess S ZuluBelum ada peringkat

- Comparative Study of Indian and Chinese International TradeDokumen9 halamanComparative Study of Indian and Chinese International TradeAmit JaiswalBelum ada peringkat

- Gs Base Without Locality 2011Dokumen1 halamanGs Base Without Locality 2011Darrell AugustaBelum ada peringkat

- Quarterly Top 50 3Q 2011Dokumen5 halamanQuarterly Top 50 3Q 2011Jun GomezBelum ada peringkat

- Annual income statement & balance sheet analysisDokumen12 halamanAnnual income statement & balance sheet analysisRadhe Mohan SinghBelum ada peringkat

- Tabela de Juros Compostos I I Periodos P - S S - P R - P P - R Periodos P - S S - P R - P P - RDokumen4 halamanTabela de Juros Compostos I I Periodos P - S S - P R - P P - R Periodos P - S S - P R - P P - RocattiniBelum ada peringkat

- Composition of NPAs of Public Sector Banks from 2002 to 2011Dokumen1 halamanComposition of NPAs of Public Sector Banks from 2002 to 2011srikumarasBelum ada peringkat

- Big PaperDokumen2 halamanBig PaperNanthene SivalingamBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 34Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 34Dimitris ArgyriouBelum ada peringkat

- 1st Half Report - June 30, 2010Dokumen75 halaman1st Half Report - June 30, 2010PiaggiogroupBelum ada peringkat

- 1Q15 Presentation of ResultsDokumen20 halaman1Q15 Presentation of ResultsMillsRIBelum ada peringkat

- Koefisien Discounting (DF), Compounding (CF) Dan Anuity Factor (Af)Dokumen30 halamanKoefisien Discounting (DF), Compounding (CF) Dan Anuity Factor (Af)Weedya NastitiBelum ada peringkat

- Base Case: Cash FlowDokumen29 halamanBase Case: Cash FlowKumar Abhishek100% (3)

- Electotecniaaa 1Dokumen3 halamanElectotecniaaa 1LUISITO99_11Belum ada peringkat

- Transaction Statistics for Pulau Pinang Q3 2011Dokumen14 halamanTransaction Statistics for Pulau Pinang Q3 2011Noelle LeeBelum ada peringkat

- Taxation Trends in The European Union - 2012 27Dokumen1 halamanTaxation Trends in The European Union - 2012 27Dimitris ArgyriouBelum ada peringkat

- Klabin Webcast 20101 Q10Dokumen10 halamanKlabin Webcast 20101 Q10Klabin_RIBelum ada peringkat

- 01 IMF - Taxing Immovable Property - 2013 21Dokumen1 halaman01 IMF - Taxing Immovable Property - 2013 21Dimitris ArgyriouBelum ada peringkat

- P Data Extract From World Development IndicatorsDokumen15 halamanP Data Extract From World Development IndicatorsLuiz Fernando MocelinBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 33Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 33Dimitris ArgyriouBelum ada peringkat

- MGU Ra PrincipalDokumen2 halamanMGU Ra PrincipalajbioinfoBelum ada peringkat

- Analysis of AirThread Connection Acquisition Cash Flows and ProjectionsDokumen66 halamanAnalysis of AirThread Connection Acquisition Cash Flows and Projectionsbachandas75% (4)

- Taxation Trends in The European Union - 2012 42Dokumen1 halamanTaxation Trends in The European Union - 2012 42Dimitris ArgyriouBelum ada peringkat

- Pinkerton (A)Dokumen14 halamanPinkerton (A)Namita Dey33% (3)

- CAFA Pro Forma - Nusharif (10MBA1046)Dokumen2 halamanCAFA Pro Forma - Nusharif (10MBA1046)Sheel VictoriaBelum ada peringkat

- OECD Factbook 2011-2012: Economic, Environmental and Social StatisticsDokumen4 halamanOECD Factbook 2011-2012: Economic, Environmental and Social StatisticsSuHyun ParkBelum ada peringkat

- Data Extract From World Development IndicatorsDokumen5 halamanData Extract From World Development IndicatorsmmmmmmmBelum ada peringkat

- Japan Gross Capital Formation as Percentage of GDP 1970-2015Dokumen2 halamanJapan Gross Capital Formation as Percentage of GDP 1970-2015Ji YuBelum ada peringkat

- Solution of Tata Motors Case StudyDokumen19 halamanSolution of Tata Motors Case StudyVishakha PawarBelum ada peringkat

- Chapter - 5 Growth of Income Tax RevenueDokumen28 halamanChapter - 5 Growth of Income Tax RevenueNiraj tiwariBelum ada peringkat

- Session 2 Income Statement FC Exercise - QuestionDokumen2 halamanSession 2 Income Statement FC Exercise - Questionnhutminh2706Belum ada peringkat

- DuPont Analysis of Cracker Barrel Old Country Store, Inc. (CBRL) FinancialsDokumen2 halamanDuPont Analysis of Cracker Barrel Old Country Store, Inc. (CBRL) FinancialsxandercageBelum ada peringkat

- Lab 3-1 Adaptive Solutions Online Eight-Year Financial Projection CTDokumen6 halamanLab 3-1 Adaptive Solutions Online Eight-Year Financial Projection CTNhim TruongBelum ada peringkat

- Ireland: Developments in The Member StatesDokumen4 halamanIreland: Developments in The Member StatesBogdan PetreBelum ada peringkat

- Taxation Trends in The European Union - 2012 182Dokumen1 halamanTaxation Trends in The European Union - 2012 182d05registerBelum ada peringkat

- Case 001Dokumen9 halamanCase 001MMBelum ada peringkat

- Top 50 Global Financial Transnational CorporationsDokumen1 halamanTop 50 Global Financial Transnational CorporationsFukyiro PinionBelum ada peringkat

- Buget Moldova 2015Dokumen7 halamanBuget Moldova 2015Otilia GordiencoBelum ada peringkat

- Hunting Cyber Criminals: A Hacker's Guide to Online Intelligence Gathering Tools and TechniquesDari EverandHunting Cyber Criminals: A Hacker's Guide to Online Intelligence Gathering Tools and TechniquesPenilaian: 5 dari 5 bintang5/5 (1)

- Basics of Dental Technology: A Step by Step ApproachDari EverandBasics of Dental Technology: A Step by Step ApproachPenilaian: 5 dari 5 bintang5/5 (1)

- United States Census Figures Back to 1630Dari EverandUnited States Census Figures Back to 1630Belum ada peringkat

- Grid Integration of Wind Energy: Onshore and Offshore Conversion SystemsDari EverandGrid Integration of Wind Energy: Onshore and Offshore Conversion SystemsBelum ada peringkat

- Taxation Trends in The European Union - 2012 42Dokumen1 halamanTaxation Trends in The European Union - 2012 42Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 31Dokumen1 halamanTaxation Trends in The European Union - 2012 31Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 45Dokumen1 halamanTaxation Trends in The European Union - 2012 45Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 44Dokumen1 halamanTaxation Trends in The European Union - 2012 44Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 29Dokumen1 halamanTaxation Trends in The European Union - 2012 29Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 37Dokumen1 halamanTaxation Trends in The European Union - 2012 37Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 40Dokumen1 halamanTaxation Trends in The European Union - 2012 40Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 41Dokumen1 halamanTaxation Trends in The European Union - 2012 41Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 40Dokumen1 halamanTaxation Trends in The European Union - 2012 40Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 38Dokumen1 halamanTaxation Trends in The European Union - 2012 38Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 28Dokumen1 halamanTaxation Trends in The European Union - 2012 28Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 39Dokumen1 halamanTaxation Trends in The European Union - 2012 39Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 37Dokumen1 halamanTaxation Trends in The European Union - 2012 37Dimitris ArgyriouBelum ada peringkat

- Top Personal Income Tax Rates 1995-2012Dokumen1 halamanTop Personal Income Tax Rates 1995-2012Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 33Dokumen1 halamanTaxation Trends in The European Union - 2012 33Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 23Dokumen1 halamanTaxation Trends in The European Union - 2012 23Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 27Dokumen1 halamanTaxation Trends in The European Union - 2012 27Dimitris ArgyriouBelum ada peringkat

- Revenue Structure by Level of GovernmentDokumen1 halamanRevenue Structure by Level of GovernmentDimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 10Dokumen1 halamanTaxation Trends in The European Union - 2012 10Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 25Dokumen1 halamanTaxation Trends in The European Union - 2012 25Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 8Dokumen1 halamanTaxation Trends in The European Union - 2012 8Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 7Dokumen1 halamanTaxation Trends in The European Union - 2012 7Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 6Dokumen1 halamanTaxation Trends in The European Union - 2012 6Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 5Dokumen1 halamanTaxation Trends in The European Union - 2012 5Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 3Dokumen1 halamanTaxation Trends in The European Union - 2012 3Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 4Dokumen1 halamanTaxation Trends in The European Union - 2012 4Dimitris ArgyriouBelum ada peringkat