Taxation Trends in The European Union - 2012 37

Diunggah oleh

Dimitris ArgyriouJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Taxation Trends in The European Union - 2012 37

Diunggah oleh

Dimitris ArgyriouHak Cipta:

Format Tersedia

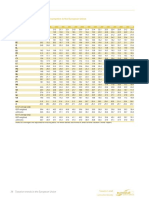

Part I

Overall tax revenue

Table 1.5: Adjusted top statutory tax rate on corporate income

1995-2012, in %

O

v

e

r

a

l

l

BE

BG

CZ

DK

DE

EE

IE

EL

ES

FR

IT

CY

LV

LT

LU

HU

MT

NL

AT

PL

PT

RO

SI

SK

FI

SE

UK

IS

NO

t

a

x

r

e

v

e

n

u

e

1995

40.2

40.0

41.0

34.0

56.8

26.0

40.0

40.0

35.0

36.7

52.2

25.0

25.0

29.0

40.9

19.6

35.0

35.0

34.0

40.0

39.6

38.0

25.0

40.0

25.0

28.0

33.0

33.0

28.0

1996

40.2

40.0

39.0

34.0

56.7

26.0

38.0

40.0

35.0

36.7

53.2

25.0

25.0

29.0

40.9

19.6

35.0

35.0

34.0

40.0

39.6

38.0

25.0

40.0

28.0

28.0

33.0

33.0

28.0

1997

40.2

40.2

39.0

34.0

56.7

26.0

36.0

40.0

35.0

41.7

53.2

25.0

25.0

29.0

39.3

19.6

35.0

35.0

34.0

38.0

39.6

38.0

25.0

40.0

28.0

28.0

31.0

33.0

28.0

1998

40.2

37.0

35.0

34.0

56.0

26.0

32.0

40.0

35.0

41.7

41.3

25.0

25.0

29.0

37.5

19.6

35.0

35.0

34.0

36.0

37.4

38.0

25.0

40.0

28.0

28.0

31.0

33.0

28.0

1999

40.2

34.3

35.0

32.0

51.6

26.0

28.0

40.0

35.0

40.0

41.3

25.0

25.0

29.0

37.5

19.6

35.0

35.0

34.0

34.0

37.4

38.0

25.0

40.0

28.0

28.0

30.0

30.0

28.0

2000

40.2

32.5

31.0

32.0

51.6

26.0

24.0

40.0

35.0

37.8

41.3

29.0

25.0

24.0

37.5

19.6

35.0

35.0

34.0

30.0

35.2

25.0

25.0

29.0

29.0

28.0

30.0

30.0

28.0

2001

40.2

28.0

31.0

30.0

38.3

26.0

20.0

37.5

35.0

36.4

40.3

28.0

25.0

24.0

37.5

19.6

35.0

35.0

34.0

28.0

35.2

25.0

25.0

29.0

29.0

28.0

30.0

30.0

28.0

2002

40.2

23.5

31.0

30.0

38.3

26.0

16.0

35.0

35.0

35.4

40.3

28.0

22.0

15.0

30.4

19.6

35.0

34.5

34.0

28.0

33.0

25.0

25.0

25.0

29.0

28.0

30.0

18.0

28.0

2003

34.0

23.5

31.0

30.0

39.6

26.0

12.5

35.0

35.0

35.4

38.3

15.0

19.0

15.0

30.4

19.6

35.0

34.5

34.0

27.0

33.0

25.0

25.0

25.0

29.0

28.0

30.0

18.0

28.0

2004

34.0

19.5

28.0

30.0

38.3

26.0

12.5

35.0

35.0

35.4

37.3

15.0

15.0

15.0

30.4

17.6

35.0

34.5

34.0

19.0

27.5

25.0

25.0

19.0

29.0

28.0

30.0

18.0

28.0

2005

34.0

15.0

26.0

28.0

38.7

24.0

12.5

32.0

35.0

35.0

37.3

10.0

15.0

15.0

30.4

17.5

35.0

31.5

25.0

19.0

27.5

16.0

25.0

19.0

26.0

28.0

30.0

18.0

28.0

2006

34.0

15.0

24.0

28.0

38.7

23.0

12.5

29.0

35.0

34.4

37.3

10.0

15.0

19.0

29.6

17.5

35.0

29.6

25.0

19.0

27.5

16.0

25.0

19.0

26.0

28.0

30.0

18.0

28.0

2007

34.0

10.0

24.0

25.0

38.7

22.0

12.5

25.0

32.5

34.4

37.3

10.0

15.0

18.0

29.6

21.3

35.0

25.5

25.0

19.0

26.5

16.0

23.0

19.0

26.0

28.0

30.0

18.0

28.0

2008 2009 2010

34.0 34.0 34.0

10.0 10.0 10.0

21.0 20.0 19.0

25.0 25.0 25.0

29.8 29.8 29.8

21.0 21.0 21.0

12.5 12.5 12.5

35.0 35.0 34.0

30.0 30.0 30.0

34.4 34.4 34.4

31.4 31.4 31.4

10.0 10.0 10.0

15.0 15.0 15.0

15.0 20.0 15.0

29.6 28.6 28.6

21.3 21.3 20.6

35.0 35.0 35.0

25.5 25.5 25.5

25.0 25.0 25.0

19.0 19.0 19.0

26.5 26.5 29.0

16.0 16.0 16.0

22.0 21.0 20.0

19.0 19.0 19.0

26.0 26.0 26.0

28.0 26.3 26.3

30.0 28.0 28.0

15.0 15.0 18.0

28.0 28.0 28.0

EU-27 35.3 35.3 35.2 34.1 33.5 31.9 30.7 29.3 28.3 27.0 25.5 25.3 24.5 24.0

EA-17 36.8 37.0 37.0 35.8 35.2 34.4 33.0 31.8 30.4 29.6 28.1 27.7 26.8 26.3

Note:

23.7

26.2

Difference

2012 1995-2012 2000-2012

34.0

-6.2

-6.2

10.0

-30.0

-22.5

19.0

-22.0

-12.0

25.0

-9.0

-7.0

29.8

-27.0

-21.8

21.0

-5.0

-5.0

12.5

-27.5

-11.5

30.0

-10.0

-10.0

30.0

-5.0

-5.0

36.1

-0.6

-1.7

31.4

-20.8

-9.9

10.0

-15.0

-19.0

15.0

-10.0

-10.0

15.0

-14.0

-9.0

28.8

-12.1

-8.7

20.6

1.0

1.0

35.0

0.0

0.0

25.0

-10.0

-10.0

25.0

-9.0

-9.0

19.0

-21.0

-11.0

31.5

-8.1

-3.7

16.0

-22.0

-9.0

20.0

-5.0

-5.0

19.0

-21.0

-10.0

24.5

-0.5

-4.5

26.3

-1.7

-1.7

24.0

-9.0

-6.0

20.0

-13.0

-10.0

28.0

0.0

0.0

23.4

25.9

23.5

26.1

-11.9

-10.8

-8.4

-8.3

Only the basic (non-targeted) top rate is presented here. Existing surcharges and averages of local taxes are included. Some countries also apply small profits

rates or special rates, e.g., in case the investment is financed through issuing new equity, or alternative rates for different sectors. Such targeted tax rates can be

substantially lower than the effective top rate.

-Belgium: a) A 3 % crisis surcharge is applicable since 1993; b) since 1/1/2006 Belgium, applies a system of notional interest (ACE) which reduces the effective tax

rate by several percentage points, depending on the difference between the rate of return and the rate of the notional interest deduction.

-Cyprus: In 2003 and 2004 the rate includes the additional 5 % surcharge on companies with income exceeding 1.7 million.

-Estonia: As from 2000 the rate for Estonia refers only to the gross amount of distributed profits; the tax rate on retained earnings is zero.

-France: France applies a standard CIT rate of 33.3 %. Large companies (turnover over 7 630 000 and taxable profit over 2 289 000) are subject to an additional

surcharge of 3.3 % levied on the part of aggregate corporate tax which exceeds 763 000. For fiscal years 2012 and 2013, an additional 5% surcharge on gross

income exceeding EUR 250 million is levied. An annual minimum lump-sum tax (IFA) based on turnover is payable when turnover is more than 15 million.

-Germany: The rate includes the solidarity surcharge of 5.5 % and the average rate for the trade tax ('Gewerbesteuer'). From 1995 to 2000 the rates for Germany

refer only to retained profits. For distributed profits lower rates applied. Until 2007 the trade tax was an allowable expense for the purpose of calculating the income

on which corporation tax is payable. As from 2008 enterprises are subject to an overall tax burden of 29.8 % nominally. This is the result of the reduction of the

corporate tax rate from 25 % to 15 % and the reduction of the base measure for trade tax from 5 % to 3.5 %. The adjusted top statutory tax rate is calculated with an

average multiplier of 400 % for the trade tax.

-Greece: The rate includes a special contribution introduced in 2009 (2008 income) on companies with net income above 5 million. The contribution is levied at

progressive rates, with the marginal rate reaching 10 %. In 2010 (2009 income) the contribution applies to income above 100 000, top rate being 10 % (income

above 5 million).

-Hungary: An Innovation tax of 0.3 % is due on the same base as the local business tax while micro and small enterprises are exempted from paying. In 2010 the

corporate income tax in Hungary consists of two components: the standard CIT rate of 19 %, a local tax of maximum 2 % that applies on the gross operating profit

(turnover minus costs). Starting from a gross operating profit of 100, companies would pay the local tax of 2. The CIT base is calculated as the profit before tax of

98. A CIT rate of 19 % gives a tax of 18.62. In total the tax paid is 18.62 + 2 = 20.62.

-Italy: As from 1998 the rates for Italy include IRAP (rate 3.90 %), a local tax levied on a tax base broader than corporate income. The rate may vary up to 1

percentage point depending on location. "Robin tax" on financial institutions is not included. From 2012, an ACE allowance is in force, reducing the effective tax rate

(see also previous note on Belgium).

-Ireland: 25 % for non-trading income, gains and profits from mining petroleum and land dealing activities. Until 2003, Ireland applied a 10 % CIT rate to qualifying

manufacturing and services companies.

-Lithuania: A 'social tax' (applied as a surcharge) has been introduced in 2006 and 2007 (at 4 % and 3 % respectively). As from 2010, companies with up to ten

employees and taxable income not exceeding LTL 500 000 (approx. EUR 144 810), benefit from a reduced tax rate of 5 % .

-Malta: The rate shown does not take into account the corporate tax refund system.

-Luxembourg: Basic local tax (municipal business tax) is 3 % to be multiplied by a municipal factor ranging from 2 to 3.5. The rate in the table is for Luxembourg

City.

-Portugal: As from 2007 the rate for Portugal includes the maximum 1.5 % rate of a municipal surcharge. As from 1.1.2012 the State tax is 3 % on taxable profits

between EUR 1.5 and 10 million and 5 % on profits exceeding EUR 10 million.

-United Kingdom: As of the 1st January 2012 the rate was still 26%. From 1st April the rate has been reduced to 24% as a result of a Budget change (in stead of the

foreseen 25%).

Source: Commission services

36

23.9

26.2

2011

34.0

10.0

19.0

25.0

29.8

21.0

12.5

30.0

30.0

34.4

31.4

10.0

15.0

15.0

28.8

20.6

35.0

25.0

25.0

19.0

29.0

16.0

20.0

19.0

26.0

26.3

26.0

20.0

28.0

Taxation trends in the European Union

Anda mungkin juga menyukai

- How to Handle Goods and Service Tax (GST)Dari EverandHow to Handle Goods and Service Tax (GST)Penilaian: 4.5 dari 5 bintang4.5/5 (4)

- Global Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItDari EverandGlobal Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItBelum ada peringkat

- Landlord Tax Planning StrategiesDari EverandLandlord Tax Planning StrategiesBelum ada peringkat

- Deloitte Refund Guide 2011Dokumen186 halamanDeloitte Refund Guide 2011Andrea OrsiBelum ada peringkat

- Value Added TaxDokumen5 halamanValue Added TaxSabbir AwladBelum ada peringkat

- France Tax LawDokumen22 halamanFrance Tax LawGary SinghBelum ada peringkat

- Taxation Trends in The European Union - 2012 156Dokumen1 halamanTaxation Trends in The European Union - 2012 156d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2012 59Dokumen1 halamanTaxation Trends in The European Union - 2012 59d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2012 107Dokumen1 halamanTaxation Trends in The European Union - 2012 107d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2012 91Dokumen1 halamanTaxation Trends in The European Union - 2012 91d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2012 64Dokumen1 halamanTaxation Trends in The European Union - 2012 64d05registerBelum ada peringkat

- GE 3 May 2012 - Andrea ManzittiDokumen23 halamanGE 3 May 2012 - Andrea ManzittiMeadsieBelum ada peringkat

- Taxation Trends in The European Union - 2012 155Dokumen1 halamanTaxation Trends in The European Union - 2012 155d05registerBelum ada peringkat

- Ireland: Developments in The Member StatesDokumen4 halamanIreland: Developments in The Member StatesBogdan PetreBelum ada peringkat

- EY Tax Memento Corporate 2014Dokumen8 halamanEY Tax Memento Corporate 2014Justine991Belum ada peringkat

- Finland Highlight TaxDokumen9 halamanFinland Highlight TaxDogeBelum ada peringkat

- Do Smes Face A Higher Tax Burden? Evidence From Belgian Tax Return DataDokumen19 halamanDo Smes Face A Higher Tax Burden? Evidence From Belgian Tax Return DataPilar RiveraBelum ada peringkat

- Taxation Trends in The European Union - 2012 39Dokumen1 halamanTaxation Trends in The European Union - 2012 39Dimitris ArgyriouBelum ada peringkat

- Taxation BrigiDokumen3 halamanTaxation BrigiMari SzanyiBelum ada peringkat

- F6rom Jun 2011 QuDokumen13 halamanF6rom Jun 2011 Qusorin8488Belum ada peringkat

- Cyprus Tax Legislation Amendments August 2011Dokumen4 halamanCyprus Tax Legislation Amendments August 2011Dinos MarcouBelum ada peringkat

- Taxation Trends in The European Union - 2012 151Dokumen1 halamanTaxation Trends in The European Union - 2012 151d05registerBelum ada peringkat

- New EU Rules To Eliminate The Main Loopholes Used in Corporate Tax Avoidance Come Into Force On 1 JanuaryDokumen1 halamanNew EU Rules To Eliminate The Main Loopholes Used in Corporate Tax Avoidance Come Into Force On 1 JanuaryblezquerBelum ada peringkat

- Taxation Trends in The European Union - 2012 72Dokumen1 halamanTaxation Trends in The European Union - 2012 72d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2012 159Dokumen1 halamanTaxation Trends in The European Union - 2012 159d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2012 100Dokumen1 halamanTaxation Trends in The European Union - 2012 100d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2012 68Dokumen1 halamanTaxation Trends in The European Union - 2012 68d05registerBelum ada peringkat

- 01 S&D - Closing The European Tax Gap 2Dokumen1 halaman01 S&D - Closing The European Tax Gap 2Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 70Dokumen1 halamanTaxation Trends in The European Union - 2012 70d05registerBelum ada peringkat

- Taxation (United Kingdom) : Monday 6 June 2011Dokumen14 halamanTaxation (United Kingdom) : Monday 6 June 2011tayabkhalidBelum ada peringkat

- Taxation Trends in The European Union - 2012 41Dokumen1 halamanTaxation Trends in The European Union - 2012 41Dimitris ArgyriouBelum ada peringkat

- Info NoteDokumen2 halamanInfo NotePolitics.ieBelum ada peringkat

- Taxation Trends in EU in 2010Dokumen42 halamanTaxation Trends in EU in 2010Tatiana TurcanBelum ada peringkat

- Commission BEFITDokumen2 halamanCommission BEFITNikita ShumovichBelum ada peringkat

- Sa Mar11 F6UK Vatpart2Dokumen7 halamanSa Mar11 F6UK Vatpart2jeshyBelum ada peringkat

- Tax and British Business Making The Case PDFDokumen24 halamanTax and British Business Making The Case PDFNawsher21Belum ada peringkat

- Tax Nhóm 8Dokumen17 halamanTax Nhóm 8tranglq.ytgBelum ada peringkat

- Taxation Trends in The European Union - 2012 28Dokumen1 halamanTaxation Trends in The European Union - 2012 28Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 67Dokumen1 halamanTaxation Trends in The European Union - 2012 67d05registerBelum ada peringkat

- Contribution of Corporate Tax On Gross Domestic ProductDokumen28 halamanContribution of Corporate Tax On Gross Domestic ProductkushsuranaBelum ada peringkat

- EPS1 Lecture 16Dokumen15 halamanEPS1 Lecture 16dpsmafiaBelum ada peringkat

- Germany Tax StructureDokumen14 halamanGermany Tax StructurechadnuttasophonBelum ada peringkat

- Commission Decides Selective Tax Advantages For Fiat in Luxembourg and Starbucks in The Netherlands Are Illegal Under EU State Aid RulesDokumen4 halamanCommission Decides Selective Tax Advantages For Fiat in Luxembourg and Starbucks in The Netherlands Are Illegal Under EU State Aid RulesDevi PurnamasariBelum ada peringkat

- Corporate TaxesDokumen7 halamanCorporate TaxesFeras AliBelum ada peringkat

- Taxation Trends in The European Union - 2012 40Dokumen1 halamanTaxation Trends in The European Union - 2012 40Dimitris ArgyriouBelum ada peringkat

- Implementation of GST in France: A Case StudyDokumen9 halamanImplementation of GST in France: A Case StudyKrishnanBelum ada peringkat

- VAT Romania 1aprilDokumen2 halamanVAT Romania 1aprilMaria Gabriela PopaBelum ada peringkat

- The Overall tax-to-GDP Ratio in The EU27 Up To 38.8% of GDP in 2011Dokumen4 halamanThe Overall tax-to-GDP Ratio in The EU27 Up To 38.8% of GDP in 2011pissiqtzaBelum ada peringkat

- Taxes and CorporationsDokumen6 halamanTaxes and CorporationsMarta Garcia LópezBelum ada peringkat

- F6uk 2011 Dec QDokumen12 halamanF6uk 2011 Dec Qmosherif2011Belum ada peringkat

- To Know More About The Law and The Tax of Real Estate Civil Companies in FranceDokumen5 halamanTo Know More About The Law and The Tax of Real Estate Civil Companies in FranceMaître Hanane TifaqBelum ada peringkat

- Tax IndicatorsDokumen14 halamanTax IndicatorsSyed Muhammad Ali SadiqBelum ada peringkat

- Budget 2010 SummaryDokumen2 halamanBudget 2010 SummaryGopal Singh BhardwajBelum ada peringkat

- Taxation Trends in The European Union - 2012 86Dokumen1 halamanTaxation Trends in The European Union - 2012 86d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2012 30Dokumen1 halamanTaxation Trends in The European Union - 2012 30Dimitris ArgyriouBelum ada peringkat

- Tax Reforms: Salient Features of This New Tax SystemDokumen50 halamanTax Reforms: Salient Features of This New Tax SystemVARMABelum ada peringkat

- Inceu Adrian & Zai Paul & Mara Ramona - Indirect Taxes in European UnionDokumen9 halamanInceu Adrian & Zai Paul & Mara Ramona - Indirect Taxes in European UnionAlex MariusBelum ada peringkat

- Taxation Trends in The European Union - 2012 82Dokumen1 halamanTaxation Trends in The European Union - 2012 82d05registerBelum ada peringkat

- EIB Investment Survey 2023 - European Union overviewDari EverandEIB Investment Survey 2023 - European Union overviewBelum ada peringkat

- Taxation Trends in The European Union - 2012 41Dokumen1 halamanTaxation Trends in The European Union - 2012 41Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 39Dokumen1 halamanTaxation Trends in The European Union - 2012 39Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 42Dokumen1 halamanTaxation Trends in The European Union - 2012 42Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 44Dokumen1 halamanTaxation Trends in The European Union - 2012 44Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 40Dokumen1 halamanTaxation Trends in The European Union - 2012 40Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 34Dokumen1 halamanTaxation Trends in The European Union - 2012 34Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 35Dokumen1 halamanTaxation Trends in The European Union - 2012 35Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 25Dokumen1 halamanTaxation Trends in The European Union - 2012 25Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 38Dokumen1 halamanTaxation Trends in The European Union - 2012 38Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 33Dokumen1 halamanTaxation Trends in The European Union - 2012 33Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 31Dokumen1 halamanTaxation Trends in The European Union - 2012 31Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 30Dokumen1 halamanTaxation Trends in The European Union - 2012 30Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 29Dokumen1 halamanTaxation Trends in The European Union - 2012 29Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 27Dokumen1 halamanTaxation Trends in The European Union - 2012 27Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 28Dokumen1 halamanTaxation Trends in The European Union - 2012 28Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 24Dokumen1 halamanTaxation Trends in The European Union - 2012 24Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 26Dokumen1 halamanTaxation Trends in The European Union - 2012 26Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 3Dokumen1 halamanTaxation Trends in The European Union - 2012 3Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 10Dokumen1 halamanTaxation Trends in The European Union - 2012 10Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 34Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 34Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 31Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 31Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 37Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 37Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 8Dokumen1 halamanTaxation Trends in The European Union - 2012 8Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 5Dokumen1 halamanTaxation Trends in The European Union - 2012 5Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 33Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 33Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 35Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 35Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 29Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 36Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 36Dimitris ArgyriouBelum ada peringkat