Taxation Trends in The European Union - 2012 44

Diunggah oleh

Dimitris Argyriou0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

6 tayangan1 halamanp44

Judul Asli

Taxation Trends in the European Union - 2012 44

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inip44

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

6 tayangan1 halamanTaxation Trends in The European Union - 2012 44

Diunggah oleh

Dimitris Argyrioup44

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

Part I

Overall tax revenue

Importance of fuel taxes varies across Member

States

O

v

e

r

a

l

l

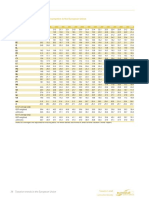

The share of fuel taxes differs a lot across the EU, from

above 90 % in Latvia, Lithuania, Bulgaria and

Luxembourg to only about 50 % in Denmark and

Sweden.

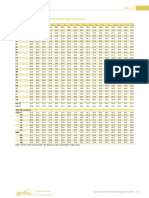

Map 1.6: Distribution of excise duty of gas oil, Jan 2012

t

a

x

r

e

v

e

n

u

e

The predominance of transport fuel taxes is striking in

the NMS-12 as most of them apply the minimum

excise duty, or at least rates close to the minimum, for

taxing energy products such as electricity, natural gas

and coal. The revenues collected from taxing these

products are therefore low compared with those

accruing from transport fuel. As for the EU-15 Member

States the picture is very different as there are

significant differences in the excise duty rates on

natural gas and electricity (some apply the EU required

minimum rate and others 200 times the minimum).

Taxation trends in the European Union

43

Anda mungkin juga menyukai

- Taxation Trends in The EU - 2016 PDFDokumen340 halamanTaxation Trends in The EU - 2016 PDFDiana IrimescuBelum ada peringkat

- Value Added TaxDokumen5 halamanValue Added TaxSabbir AwladBelum ada peringkat

- Taxation Trends in The European Union - 2012 28Dokumen1 halamanTaxation Trends in The European Union - 2012 28Dimitris ArgyriouBelum ada peringkat

- Energy Taxation in Europe, Japan and The United StatesDokumen16 halamanEnergy Taxation in Europe, Japan and The United StatesPham Minh CongBelum ada peringkat

- Taxation Trends in EU in 2010Dokumen42 halamanTaxation Trends in EU in 2010Tatiana TurcanBelum ada peringkat

- Cambridge Working Papers in Economics CWPE 0508: Why Tax Energy? Towards A More Rational Energy PolicyDokumen37 halamanCambridge Working Papers in Economics CWPE 0508: Why Tax Energy? Towards A More Rational Energy PolicyMatteo LeonardiBelum ada peringkat

- Taxation Trends in The European Union - 2012 41Dokumen1 halamanTaxation Trends in The European Union - 2012 41Dimitris ArgyriouBelum ada peringkat

- 2011 04 13 Fuel Tax Report Final MergedDokumen59 halaman2011 04 13 Fuel Tax Report Final MergedDiễm QuỳnhBelum ada peringkat

- Taxation Trends in The European Union - 2012 33Dokumen1 halamanTaxation Trends in The European Union - 2012 33Dimitris ArgyriouBelum ada peringkat

- Luxembourg: Inventory of Estimated Budgetary Support and Tax Expenditures For Fossil-FuelsDokumen3 halamanLuxembourg: Inventory of Estimated Budgetary Support and Tax Expenditures For Fossil-Fuelssagetarius92Belum ada peringkat

- Taxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsDokumen44 halamanTaxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsAnonymousBelum ada peringkat

- Taxation Trends in The European Union - 2012 31Dokumen1 halamanTaxation Trends in The European Union - 2012 31Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 25Dokumen1 halamanTaxation Trends in The European Union - 2012 25Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 82Dokumen1 halamanTaxation Trends in The European Union - 2012 82d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2012 67Dokumen1 halamanTaxation Trends in The European Union - 2012 67d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2012 20Dokumen1 halamanTaxation Trends in The European Union - 2012 20d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2012 48Dokumen1 halamanTaxation Trends in The European Union - 2012 48d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 29Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 38Dokumen1 halamanTaxation Trends in The European Union - 2012 38Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 21Dokumen1 halamanTaxation Trends in The European Union - 2012 21d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2012 59Dokumen1 halamanTaxation Trends in The European Union - 2012 59d05registerBelum ada peringkat

- Quarterly Report On EU Gas MarketsDokumen33 halamanQuarterly Report On EU Gas MarketsgiovanniBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 28Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 28Dimitris ArgyriouBelum ada peringkat

- Tax System of EstoniaDokumen19 halamanTax System of EstoniaEmil SalmanliBelum ada peringkat

- Taxation Trends in The European Union - 2012 107Dokumen1 halamanTaxation Trends in The European Union - 2012 107d05registerBelum ada peringkat

- Environmental Tax in European Union: Oecd (Dokumen2 halamanEnvironmental Tax in European Union: Oecd (Kris AssBelum ada peringkat

- Taxation Trends in The European Union - 2012 151Dokumen1 halamanTaxation Trends in The European Union - 2012 151d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2012 164Dokumen1 halamanTaxation Trends in The European Union - 2012 164d05registerBelum ada peringkat

- RW Energy Taxation ENDokumen46 halamanRW Energy Taxation ENPruthvi Mundalamane JagadishchandraBelum ada peringkat

- Date Date Eventevent: Cape and TargetDokumen3 halamanDate Date Eventevent: Cape and TargetsfgusdBelum ada peringkat

- Transfer - European Review of Labour and Research-2010-Pitti-37-54Dokumen18 halamanTransfer - European Review of Labour and Research-2010-Pitti-37-54Yudha Alief AprilianBelum ada peringkat

- Taxation Trends in The European Union - 2012 52Dokumen1 halamanTaxation Trends in The European Union - 2012 52d05registerBelum ada peringkat

- Taxation Trends in The European Union - 2012 40Dokumen1 halamanTaxation Trends in The European Union - 2012 40Dimitris ArgyriouBelum ada peringkat

- 2050 EU Energy Strategy ReportDokumen7 halaman2050 EU Energy Strategy ReportHector Parra MolinaBelum ada peringkat

- The EU EmissionDokumen3 halamanThe EU EmissionhdvdfhiaBelum ada peringkat

- Taxation Trends in The European Union - 2012 159Dokumen1 halamanTaxation Trends in The European Union - 2012 159d05registerBelum ada peringkat

- MJ0121372ENN enDokumen114 halamanMJ0121372ENN enAlexandru FloricicaBelum ada peringkat

- Comparative View Energy Taxation in The Republic of Croatia and The Countries of The European UnionDokumen17 halamanComparative View Energy Taxation in The Republic of Croatia and The Countries of The European UnionDr. George M. JonesBelum ada peringkat

- Taxation Trends in The European Union - 2012 70Dokumen1 halamanTaxation Trends in The European Union - 2012 70d05registerBelum ada peringkat

- Ireland: Developments in The Member StatesDokumen4 halamanIreland: Developments in The Member StatesBogdan PetreBelum ada peringkat

- Factsheet Ets enDokumen6 halamanFactsheet Ets enHjkkkkBelum ada peringkat

- Pajak Yang Ditambah Nilai Dan Efisiensinya Eu - 28 Dan TurkiDokumen12 halamanPajak Yang Ditambah Nilai Dan Efisiensinya Eu - 28 Dan TurkiTati AprianiBelum ada peringkat

- Norway Case Study May2015Dokumen11 halamanNorway Case Study May2015abrahamBelum ada peringkat

- Quarterly Report On European Gas Markets: Market Observatory For EnergyDokumen32 halamanQuarterly Report On European Gas Markets: Market Observatory For EnergyLeo ToivonenBelum ada peringkat

- Hourly Labour Costs Ranged From 3.8 To 40.3 Across The EU Member States in 2014Dokumen4 halamanHourly Labour Costs Ranged From 3.8 To 40.3 Across The EU Member States in 2014Turcan Ciprian SebastianBelum ada peringkat

- HEPI Press Release July 2010Dokumen8 halamanHEPI Press Release July 2010Philip LewisBelum ada peringkat

- International Comparisons Energy EfficiencyDokumen8 halamanInternational Comparisons Energy EfficiencyMoldoveanu BogdanBelum ada peringkat

- Taxation Trends in The European Union - 2012 66Dokumen1 halamanTaxation Trends in The European Union - 2012 66d05registerBelum ada peringkat

- European Environmental Regulations in The Automotive IndustryDokumen7 halamanEuropean Environmental Regulations in The Automotive IndustrySwati SinghBelum ada peringkat

- BasebaseDokumen50 halamanBasebaseNour ElhoudaBelum ada peringkat

- Energy Markets Jdelgado 0408Dokumen7 halamanEnergy Markets Jdelgado 0408BruegelBelum ada peringkat

- Allowance Allocation in The European Emissions TraDokumen10 halamanAllowance Allocation in The European Emissions TraJulie Ann MalonzoBelum ada peringkat

- Taxation Trends in The European Union - 2012 74Dokumen1 halamanTaxation Trends in The European Union - 2012 74d05registerBelum ada peringkat

- Inceu Adrian & Zai Paul & Mara Ramona - Indirect Taxes in European UnionDokumen9 halamanInceu Adrian & Zai Paul & Mara Ramona - Indirect Taxes in European UnionAlex MariusBelum ada peringkat

- Excise Duties-Part I Alcohol enDokumen33 halamanExcise Duties-Part I Alcohol enscribd01Belum ada peringkat

- X Dialnet-TaxPolicyConvergenceInEU-2942147Dokumen28 halamanX Dialnet-TaxPolicyConvergenceInEU-2942147NikolinaBelum ada peringkat

- European Salary Survey: 3rd EditionDokumen68 halamanEuropean Salary Survey: 3rd EditionshohanBelum ada peringkat

- The European Green Deal and The Risk of Widening The East-West GapDokumen16 halamanThe European Green Deal and The Risk of Widening The East-West GapSkittlessmannBelum ada peringkat

- Assessing The Impact of A Carbon Tax in Ukraine: Miriam FreyDokumen24 halamanAssessing The Impact of A Carbon Tax in Ukraine: Miriam FreyPutri AyuBelum ada peringkat

- Taxation Trends in The European Union - 2012 39Dokumen1 halamanTaxation Trends in The European Union - 2012 39Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 34Dokumen1 halamanTaxation Trends in The European Union - 2012 34Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 42Dokumen1 halamanTaxation Trends in The European Union - 2012 42Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 38Dokumen1 halamanTaxation Trends in The European Union - 2012 38Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 40Dokumen1 halamanTaxation Trends in The European Union - 2012 40Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 35Dokumen1 halamanTaxation Trends in The European Union - 2012 35Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 33Dokumen1 halamanTaxation Trends in The European Union - 2012 33Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 37Dokumen1 halamanTaxation Trends in The European Union - 2012 37Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 30Dokumen1 halamanTaxation Trends in The European Union - 2012 30Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 29Dokumen1 halamanTaxation Trends in The European Union - 2012 29Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 26Dokumen1 halamanTaxation Trends in The European Union - 2012 26Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 25Dokumen1 halamanTaxation Trends in The European Union - 2012 25Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 31Dokumen1 halamanTaxation Trends in The European Union - 2012 31Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 27Dokumen1 halamanTaxation Trends in The European Union - 2012 27Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 10Dokumen1 halamanTaxation Trends in The European Union - 2012 10Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 24Dokumen1 halamanTaxation Trends in The European Union - 2012 24Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 3Dokumen1 halamanTaxation Trends in The European Union - 2012 3Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 5Dokumen1 halamanTaxation Trends in The European Union - 2012 5Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2012 8Dokumen1 halamanTaxation Trends in The European Union - 2012 8Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 36Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 36Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 37Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 37Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 34Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 34Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 35Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 35Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 29Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 33Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 33Dimitris ArgyriouBelum ada peringkat

- Taxation Trends in The European Union - 2011 - Booklet 31Dokumen1 halamanTaxation Trends in The European Union - 2011 - Booklet 31Dimitris ArgyriouBelum ada peringkat