Home Exercise No. 2

Diunggah oleh

Samir BagalkoteJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Home Exercise No. 2

Diunggah oleh

Samir BagalkoteHak Cipta:

Format Tersedia

Home Exercise No.

2

The following figures relate to questions 4-1

Below is information on local supply and demand of a particular product

(Let continuity and monotony of the fields);

Question 1

If the tax will be 12 unit

A. Government tax receipts will be 384.

B. Consumer prices will rise by 6.

C . The price the producer gets dropped on 12.

D. None of these answers is correct or is there more than one answer

Question 2

If the subsidy will be given a 20 unit

A. The cost of government subsidy will be in 1000.

B. Consumer prices fell by 10.

C . The price the producer receives) including a subsidy (exceeding 20.

D. None of these answers is correct or is there more than one answer

Now let the economy opened up foreign trade.

In overseas market to buy or sell any amount of price 10

(1 $ = 6 )Transportation costs are at the expense of exports of domestic

manufacturer, the amount of 4 = per kilo and transportation costs in imports

are at the expense of the domestic consumer, the amount 8 unit. Inland

transportation costs are negligible.

Question 3

If the local manufacturer will be given a subsidy by 12 per unit produced,

A. The amount offered will be 37 units

B. The amount offered will be 9 units

C . The imported amount will be 7 units

D. None of these answers is correct or is there more than one answer

Question 4

If the local manufacturer will be given a subsidy / premium 16 per unit

exported,

A. The amount offered will be 28 kg

B. The imported quantity would be 12 kg

C . The imported quantity would be 16 kg

D. There is no correct answer above.

The following figures relate to questions 7-5

Below is information on local supply and demand of a particular product (Let

continuity and monotony of fields)

Question 5

Place the subsidy given 8 unit. Now, it was decided to increase the subsidy to

20 unit.

Hence the

A. The increase in the subsidy cost the government a stronger increase in

revenue producers.

B. Manufacturers revenue growth weaker growth in consumer spending.

C . The cost of government subsidy will increase by more than 3

D. None of these answers is correct or is there more than one answer

Additional data questions 6-7: Back to the terms of the beginning and place, from

now on, because open economy with foreign trade

In overseas market to buy or sell any amount to $ 11 price envoy

(It is known that 1 $ = 6)

Transportation expenses are on account of exports of domestic manufacturer, the

sum of 3 unit, and transportation costs in imports

Both at the expense of domestic consumers, NIS 4 unit. Costs of transportation

in the country are negligible

Question 6:

If the local manufacturer will be given a subsidy by 23 per unit produced,

A. The imported amount will be reduced by 14 units

B. The amount offered will be 53 units

C . The imported quantity would be 70 units

D. There is no right answer or there is more than one correct answers above.

Question 7:

Ignoring the change in question 6, if the government imposes customs unit 8

imported and give

15 subsidy per unit exported

A. The manufacturer will provide more than two thirds of its products in the

domestic market and less than 1/3 of its products exported abroad.

B. General customs receipts higher than 80.

C . Will not export at all.

D. There is no correct answer to the above, or that more than one answer.

Anda mungkin juga menyukai

- Economics 1 Final ExaminationDokumen14 halamanEconomics 1 Final Examinationdum656Belum ada peringkat

- Chapter 4 Review QuestionsDokumen5 halamanChapter 4 Review QuestionsDiamante GomezBelum ada peringkat

- Foundations of Economics 7Th Edition Bade Test Bank Full Chapter PDFDokumen68 halamanFoundations of Economics 7Th Edition Bade Test Bank Full Chapter PDFhieuorlarofjq100% (11)

- Assignment 1 - KTEE203.1Dokumen11 halamanAssignment 1 - KTEE203.1Hà ChiếnBelum ada peringkat

- Chapter 23 QuizDokumen15 halamanChapter 23 QuizRhobie CuaresmaBelum ada peringkat

- Section 9Dokumen10 halamanSection 9nourhan rezkBelum ada peringkat

- Econ 203 S16 Final Exam Version 1Dokumen15 halamanEcon 203 S16 Final Exam Version 1givemeBelum ada peringkat

- Pre-Test Chapter 6 Ed17Dokumen8 halamanPre-Test Chapter 6 Ed17Vivek KumarBelum ada peringkat

- Practice Test 8: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDokumen20 halamanPractice Test 8: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionallybelleBelum ada peringkat

- Solutions: ECO 100Y Introduction To Economics Midterm Test # 1Dokumen12 halamanSolutions: ECO 100Y Introduction To Economics Midterm Test # 1examkillerBelum ada peringkat

- Microeconomics Australia in The Global Environment Australian 1St Edition Parkin Test Bank Full Chapter PDFDokumen68 halamanMicroeconomics Australia in The Global Environment Australian 1St Edition Parkin Test Bank Full Chapter PDFSherryElliottpgys100% (9)

- Microeconomics Australia in The Global Environment Australian 1st Edition Parkin Test BankDokumen62 halamanMicroeconomics Australia in The Global Environment Australian 1st Edition Parkin Test Bankelfledalayla5900x100% (32)

- Review Questions - AnswerDokumen8 halamanReview Questions - AnswerzitkonkuteBelum ada peringkat

- Chapter 8: The Instruments of Trade Policy Multiple Choice QuestionsDokumen13 halamanChapter 8: The Instruments of Trade Policy Multiple Choice QuestionsMian NomiBelum ada peringkat

- Tutorial - QuestionsDokumen4 halamanTutorial - Questions22UG2-0102 Stephan WijesingheBelum ada peringkat

- ECON 102 Midterm1 SampleDokumen5 halamanECON 102 Midterm1 SampleexamkillerBelum ada peringkat

- Assignment 5Dokumen4 halamanAssignment 5Syeda Umyma FaizBelum ada peringkat

- ECA5325 Assignment 1 S22324Dokumen1 halamanECA5325 Assignment 1 S22324keirazheng2001Belum ada peringkat

- 1917826Dokumen19 halaman1917826Khurram ShafiqueBelum ada peringkat

- Answer KeyDokumen4 halamanAnswer KeyParth BhatiaBelum ada peringkat

- ECN 221 With AnswersDokumen29 halamanECN 221 With Answersmuyi kunleBelum ada peringkat

- Macro Qch2Dokumen12 halamanMacro Qch2Yrence OliveBelum ada peringkat

- Econ 212 Final Exam PracticeDokumen9 halamanEcon 212 Final Exam PracticecodsocBelum ada peringkat

- Multiple Choice Questions: GRADE - 11Dokumen4 halamanMultiple Choice Questions: GRADE - 11Babu BalaramanBelum ada peringkat

- GDP: A Measure of Total Production and IncomeDokumen11 halamanGDP: A Measure of Total Production and IncomeSravan KumarBelum ada peringkat

- Econ 201 Past Midterm 3 (No Answer)Dokumen12 halamanEcon 201 Past Midterm 3 (No Answer)SooHan Moon100% (1)

- Public Finance - Final PracticeDokumen7 halamanPublic Finance - Final PracticeozdolBelum ada peringkat

- Economics, Markets and Organizations: Tutorial 11Dokumen35 halamanEconomics, Markets and Organizations: Tutorial 11LencyBelum ada peringkat

- Answers To Homework 3 Spring 2011Dokumen10 halamanAnswers To Homework 3 Spring 2011Anh Khoa NguyenBelum ada peringkat

- MT 2016Dokumen9 halamanMT 2016Ismail Zahid OzaslanBelum ada peringkat

- Chap 10 QuizDokumen29 halamanChap 10 QuizLeneth AngtiampoBelum ada peringkat

- Concepts & Meaning of National IncomeDokumen6 halamanConcepts & Meaning of National Incomemunawar sharifBelum ada peringkat

- HW 4 With SolutionsDokumen8 halamanHW 4 With SolutionsAnonymous hosn8JiBelum ada peringkat

- Tutorial 1 - AnswersDokumen5 halamanTutorial 1 - AnswersvanvunBelum ada peringkat

- Form 4 Economics Final Exam 2015-2016Dokumen13 halamanForm 4 Economics Final Exam 2015-2016yoyoBelum ada peringkat

- ECO372 Principles of MacroeconomicsDokumen74 halamanECO372 Principles of MacroeconomicsG JhaBelum ada peringkat

- Mgea02 TT1 2011F ADokumen9 halamanMgea02 TT1 2011F AexamkillerBelum ada peringkat

- MicroeconomicsDokumen10 halamanMicroeconomicsCarlos Funs0% (1)

- Internal Assessment #1Dokumen6 halamanInternal Assessment #1Rakesh PatelBelum ada peringkat

- Surprise Quiz IDokumen5 halamanSurprise Quiz I23pgp011Belum ada peringkat

- 期末考试题Dokumen5 halaman期末考试题dhndzwxjBelum ada peringkat

- Economics 1A OSA Preparation PDFDokumen26 halamanEconomics 1A OSA Preparation PDFTman LetswaloBelum ada peringkat

- Revision On CH 14Dokumen8 halamanRevision On CH 14Mohamed FoulyBelum ada peringkat

- Chapter 7 Efficiency and Exchange: Answers To Review QuestionsDokumen7 halamanChapter 7 Efficiency and Exchange: Answers To Review QuestionsmaustroBelum ada peringkat

- Solutions: ECO 100Y Introduction To Economics Midterm Test # 2Dokumen12 halamanSolutions: ECO 100Y Introduction To Economics Midterm Test # 2examkillerBelum ada peringkat

- MACROECONOMICS Test (Finals)Dokumen76 halamanMACROECONOMICS Test (Finals)Merry Juannie U. PatosaBelum ada peringkat

- Measuring National IncomeDokumen45 halamanMeasuring National IncomeArush saxenaBelum ada peringkat

- ECON 1050 Midterm 2 2013WDokumen20 halamanECON 1050 Midterm 2 2013WexamkillerBelum ada peringkat

- Assignment 1Dokumen11 halamanAssignment 1Anh LanBelum ada peringkat

- Multiple Choice Questions-MacroDokumen21 halamanMultiple Choice Questions-MacroSravan Kumar100% (1)

- Tutorial 8 For Discussion On The Week of 8 June 2020: Importing CountryDokumen21 halamanTutorial 8 For Discussion On The Week of 8 June 2020: Importing CountryShiouqian ChongBelum ada peringkat

- Macroeconomics Study GuideDokumen60 halamanMacroeconomics Study Guidewilder_hart100% (1)

- Answers To Second Midterm Summer 2011Dokumen11 halamanAnswers To Second Midterm Summer 2011ds3057Belum ada peringkat

- Economics AssignmentDokumen6 halamanEconomics AssignmentNsh JshBelum ada peringkat

- Econ2015 Paper1 EDokumen14 halamanEcon2015 Paper1 EOdd CatBelum ada peringkat

- Eco100 Pesando Tt1 2010fDokumen7 halamanEco100 Pesando Tt1 2010fexamkillerBelum ada peringkat

- Sample QuestionsDokumen3 halamanSample Questions23pgp011Belum ada peringkat

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Dari EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Penilaian: 5 dari 5 bintang5/5 (1)

- DRDO TOT PostImpactdelayfuze16062023Dokumen1 halamanDRDO TOT PostImpactdelayfuze16062023Samir BagalkoteBelum ada peringkat

- Drdo Tot WohhtiDokumen1 halamanDrdo Tot WohhtiSamir BagalkoteBelum ada peringkat

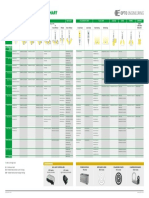

- LED Illuminators Selection ChartDokumen1 halamanLED Illuminators Selection ChartSamir BagalkoteBelum ada peringkat

- Fs ft t t δ t t: , 0 1. 1 , unit impulse at 2. 1, unit step 3. ! 4. 5. 6. 1 7. 8. 9Dokumen1 halamanFs ft t t δ t t: , 0 1. 1 , unit impulse at 2. 1, unit step 3. ! 4. 5. 6. 1 7. 8. 9Samir BagalkoteBelum ada peringkat

- Company Registration OptionsDokumen6 halamanCompany Registration OptionsSamir BagalkoteBelum ada peringkat

- Women'S Clinic: Diet Chart For Pregnant WomenDokumen1 halamanWomen'S Clinic: Diet Chart For Pregnant WomenSamir BagalkoteBelum ada peringkat

- WVTR Study of Different Films and BlistersDokumen18 halamanWVTR Study of Different Films and BlistersSamir BagalkoteBelum ada peringkat

- Anarchist's EconomicsDokumen11 halamanAnarchist's EconomicsJoseph Winslow100% (4)

- Chapter 5 Notes On SalesDokumen5 halamanChapter 5 Notes On SalesNikki Estores GonzalesBelum ada peringkat

- Low Floor Bus DesignDokumen10 halamanLow Floor Bus DesignavinitsharanBelum ada peringkat

- Low Cost CarriersDokumen24 halamanLow Cost CarriersMuhsin Azhar ShahBelum ada peringkat

- Gauteng Department of Education Provincial Examination: MARKS: 150 TIME: 2 HoursDokumen12 halamanGauteng Department of Education Provincial Examination: MARKS: 150 TIME: 2 HoursKillBelum ada peringkat

- SSS Required Online RegistrationDokumen2 halamanSSS Required Online RegistrationTin AvenidaBelum ada peringkat

- Angel - Credit Transactions PDFDokumen10 halamanAngel - Credit Transactions PDFAdine DyBelum ada peringkat

- Patria Light Vessel HD 785-7Dokumen9 halamanPatria Light Vessel HD 785-7bayu enasoraBelum ada peringkat

- Ae (C)Dokumen1 halamanAe (C)Akesh LimBelum ada peringkat

- Afiq Razlan Bin Abdul Razad: Trucking/Operation JR - ExecutiveDokumen2 halamanAfiq Razlan Bin Abdul Razad: Trucking/Operation JR - ExecutiveDaniel Fauzi AhmadBelum ada peringkat

- Against Historical MaterialismDokumen31 halamanAgainst Historical MaterialismDimitris Mcmxix100% (1)

- Cyber US Port SecurityDokumen50 halamanCyber US Port SecurityLaurent de HasardBelum ada peringkat

- Cima c04 2013 Class Chapter 8 Competition, Market Failure and Gov - T InterventionDokumen18 halamanCima c04 2013 Class Chapter 8 Competition, Market Failure and Gov - T InterventionMir Fida NadeemBelum ada peringkat

- When KD Is Less Than Coupon Intrest RateDokumen3 halamanWhen KD Is Less Than Coupon Intrest RateAmit Kr GodaraBelum ada peringkat

- Why Blue-Collar Workers Quit Their JobDokumen4 halamanWhy Blue-Collar Workers Quit Their Jobsiva csBelum ada peringkat

- Etis ToolkitDokumen36 halamanEtis ToolkitPatricia Dominguez SilvaBelum ada peringkat

- VJEPADokumen6 halamanVJEPATrang ThuBelum ada peringkat

- Cognos LearningDokumen12 halamanCognos LearningsygladiatorBelum ada peringkat

- 0Dokumen5 halaman0Nicco Ortiz50% (2)

- Chapter 2 Activity 2 1Dokumen3 halamanChapter 2 Activity 2 1Wild RiftBelum ada peringkat

- Countamax NickingDokumen1 halamanCountamax NickingrasfgtsBelum ada peringkat

- Economic Development Democratization and Environmental ProtectiDokumen33 halamanEconomic Development Democratization and Environmental Protectihaimi708Belum ada peringkat

- Leaflet Lokotrack - st4.8 Product - Spread 4524 12 21 en Agg HiresDokumen2 halamanLeaflet Lokotrack - st4.8 Product - Spread 4524 12 21 en Agg Hiresjadan tupuaBelum ada peringkat

- Strategic Options For Building CompetitivenessDokumen53 halamanStrategic Options For Building Competitivenessjeet_singh_deepBelum ada peringkat

- Credit Assessment On Agricultural LoansDokumen84 halamanCredit Assessment On Agricultural LoansArun SavukarBelum ada peringkat

- Anna University Question PaperDokumen5 halamanAnna University Question PaperSukesh R100% (1)

- Fundamental Equity Analysis & Recommandations - The Hang Seng Mainland 100 - 100 Largest Companies Which Derive The Majority of Their Sales Revenue From Mainland ChinaDokumen205 halamanFundamental Equity Analysis & Recommandations - The Hang Seng Mainland 100 - 100 Largest Companies Which Derive The Majority of Their Sales Revenue From Mainland ChinaQ.M.S Advisors LLCBelum ada peringkat

- Turismo Médico en Tijuana, B.C. EvimedDokumen2 halamanTurismo Médico en Tijuana, B.C. EvimedElizabethBelum ada peringkat

- Indian Association of Soil and Water ConservationistsDokumen521 halamanIndian Association of Soil and Water Conservationistsshyam143225Belum ada peringkat

- Endless BountyDokumen14 halamanEndless BountyAnonymous C0q7LDwSBelum ada peringkat