Disney HK

Diunggah oleh

Ashutosh KumarDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Disney HK

Diunggah oleh

Ashutosh KumarHak Cipta:

Format Tersedia

Project: Hong Kong Disneyland theme park and resort complex

Project to be started from 2000, Sponsors: Hong Kong Government and Walt

Disney

Cost of the project: HK$ 14 Billion, HK$ 3.3 Billion to be financed by syndicated

bank loan.

Hong Kong Disneyland invited 17 major banks to bid on the project financing

and Chase was chosen as the lead arranger with a commitment to underwrite

to full amount.

Sponsors:

Hong Kong Government:

Joined China in 1997, it has high degree of autonomy under the Peoples

Republic of China.

Free market economy, unrestricted capital movement, low tax rates

Stable Hong Kong Dollar ( HK$ 7.80= US$ 1.00 since 1983) and duty free port

Fell into recession following the Thai currency crisis in 1997, though some

recovery seen in mid 1999

The Walt Disney Company:

Established in 1923, it has become multinational, multimedia entertainment

giant.

Business segments: Theme parks and Resorts, Media Networks, Studio

Entertainment,

Consumer products, and Internet/Direct marketing

Annual revenues: $20 Billion, Operating cash flow: $5 Billion, A debt rating

Disneyland Paris theme park had experienced finance problem due to

aggressive capital structuring

with 75% of the project financed by debt.

To avoid bankruptcy, Disney agreed to forgo some of its management and

other fees.

Project features:

Strategy of Hong Kong Disneyland was to start small and then add capacity

over time as demand grows.

The project would have three phases. Phase I included a Disneyland style park

offering several themed lands featuring Disney rides and attractions

Phase II and III were less defined, but included options to develop adjoining

sites at some points in future.

Park to be constructed in coastline by reclamation of land from ocean side. H.

K. Government agreed to extend coastline

and construct roads and utilities at its expense.

Government supported the project because of the sizable public benefits it

would generate through employment.

Expected rate of return on investment is 17% to 25% per annum, with atleast

6% per annum under worst case scenario.

Land reclamation work would start at the end of 2000, resort construction

would start in 2002 and the park would be ready

for operation by late 2005.

Financing of the Project:

A new corporation, Hong Kong International Theme Parks Limited (HKTP) would

construct, own and operate the resort.

Of the total construction cost of HK$14 billion H. K .Government and Disney

would provide HK$ 3.25 billion and HK$ 2.45 billion of equity respectively. In

addition to that, H. K. Government would provide a long term loan of HK$ 6.1

billion with repayment starting from year 16th of operation till 25th year.

Thus HKTP was falling short of HK$ 2.3 billion. So, it decided to raise HK$ 2.3

billion 15 year, non recourse term loan for construction and a HK$ 1 billion,

nonrecourse revolving credit facility for working capital needs post

construction.

HKTP invited its relationship bankers and other bankers to raise HK$ 3.3 billion

non recourse loan package on fully underwritten basis and expected to select

up to 3 lead arrangers for the transaction.

Chase Manhattan Bank

One of Disneys top 10 relationship banks.

3rd largest bank in the US with more than US$400 bn assets and US$175 bn

loans.

Leader in the business of syndicated finance, with a 34% of total $ volume

loans. Next largest competitor had a 21% share.

Acquired nearly half of the US market (for loans > US$1bn), three times more

than its nearest competitor.

Received accolades from the financial press Best Loan House 1974-1999

(International Finance Review), Best at US Syndicated loans (Euromoney), Best

Project Finance Arranger in the US (Project Finance).

Formidable competitor in most markets across the world, including Asia 400

professionals in Global Syndicated Finance Group in NY, London, Hong Kong,

Tokyo and Sydney. Structuring and distribution teams at each office.

Largest syndicating platform in the Asia Pacific Region.

Bid-to-lose at first, bid-to-win later

The deal team at Chase Hong Kong office did not feel the project attractive at

the beginning.

The deal had a long tenor, there were problems at Disneyland Paris, sponsors

wanted to mandate 3 lead arrangers and competitors were likely to bid

aggressively.

Thus, Chase decided to bid-to-lose, but bid aggressively enough so that the

firms reputation would be preserved.

In the meeting with Disney Finance team, the Chase team emphasized on its

flexibility on key strategic terms, its credentials as a leading syndication bank

and its knowledge of relationship with the local market.

Indicated an underwriting fee between 100 to 150 bps and interest rate

spreads of 135 to 150 bp over HIBOR

However, Chase revised its objective towards winning the mandate due to

following

- Spreads on syndicated loans in local market were tightening as liquidity

improved

- Senior HK official re-assured governments commitment to the project

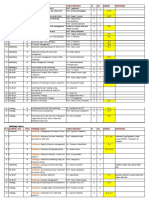

Sub-underwriting strategy for HK$3.3 billion financing

Invitation to 7 banks to make commitment of HK$600 mn

Benefit would be in form of lead arranger titles and sub-underwriting fees of

25 basis points.

6 banks agreed to participate in the deal at HK$600 mn, forcing Chase to

reduce the exposure to HK$ 471 mn ( 0.471*7= 3.3 bn)

General Syndication

Invitation to 67 banks with 3 level of participation

Arranger for HK$250 mn commitments with a upfront fees of 70 bp

Co-arranger tier for HK$150 mn commitments with a upfront fees of 60 bp

Lead Manager tier for HK$ 75 mn HK$ 100 mn commitments with a upfront

fees of 50 bp

All commitments to be pro rata basis for KH$2.3 bn and revolving credit

facility of HK$ 1 bn.

General syndication was a success with commitment of HK$5.3 bn from

25 banks. Credit commitments totalled HK$9.5 bn, with over

subscription of three times.

Basis for dealing with over subscription. Criteria selected

Fairness- Giving banks as close to what they committed

Consistency- Scale back is consistent for all banks within a given tier

Client Consideration Giving appropriate weight to clients preference.

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Loan Agreements Hauser Chris ExampleDokumen3 halamanLoan Agreements Hauser Chris ExampleJusta100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Adeyinka Oluwafunsho (134) $693.5 Thu Sep 03 11 48 00 EDT 2020 PDFDokumen1 halamanAdeyinka Oluwafunsho (134) $693.5 Thu Sep 03 11 48 00 EDT 2020 PDFGrace AdeyinkaBelum ada peringkat

- Collins Apple PDFDokumen1 halamanCollins Apple PDFGh UnlockersBelum ada peringkat

- Wintel Simulation Ashutosh KumarDokumen9 halamanWintel Simulation Ashutosh KumarAshutosh Kumar100% (1)

- Taisys Case StudyDokumen10 halamanTaisys Case StudyAshutosh Kumar100% (1)

- All in One Income Tax Return Preparation For W.B. Govt - Employees Fy 10-11Dokumen24 halamanAll in One Income Tax Return Preparation For W.B. Govt - Employees Fy 10-11Pranab BanerjeeBelum ada peringkat

- MERS Southeast Legal Seminar (11.10.04) FinalDokumen26 halamanMERS Southeast Legal Seminar (11.10.04) FinalgregmanuelBelum ada peringkat

- ATT Receipt George PDFDokumen1 halamanATT Receipt George PDFBrennan BargerBelum ada peringkat

- Audit Programme For Accounts ReceivableDokumen5 halamanAudit Programme For Accounts ReceivableDaniela BulardaBelum ada peringkat

- Rex B. Banggawan, CPA, MBA: Business & Trasfer Tax Solutions Manual True or False: Part 1Dokumen5 halamanRex B. Banggawan, CPA, MBA: Business & Trasfer Tax Solutions Manual True or False: Part 1ela alan100% (2)

- Working Capital Management Maruti SuzukiDokumen76 halamanWorking Capital Management Maruti SuzukiAbhay Gupta81% (32)

- Chemical Calculations Book-3Dokumen25 halamanChemical Calculations Book-3Ashutosh KumarBelum ada peringkat

- Post Graduate Programme in Management 2016-17 Term: Vi Title of The Course: Growth and Inflation in Developing EconomiesDokumen4 halamanPost Graduate Programme in Management 2016-17 Term: Vi Title of The Course: Growth and Inflation in Developing EconomiesAshutosh KumarBelum ada peringkat

- Chemical Calculations Book-4Dokumen14 halamanChemical Calculations Book-4Ashutosh KumarBelum ada peringkat

- Chemical Calculations Book-2Dokumen20 halamanChemical Calculations Book-2Ashutosh KumarBelum ada peringkat

- Birm VF Vi 2016-17Dokumen7 halamanBirm VF Vi 2016-17Ashutosh KumarBelum ada peringkat

- Ib Vi 2016-17 PDFDokumen3 halamanIb Vi 2016-17 PDFAshutosh KumarBelum ada peringkat

- Cap Vi 2016-17 PDFDokumen6 halamanCap Vi 2016-17 PDFAshutosh KumarBelum ada peringkat

- BF VF Vi 2016-17Dokumen7 halamanBF VF Vi 2016-17Ashutosh KumarBelum ada peringkat

- List of CoursesDokumen2 halamanList of CoursesAshutosh KumarBelum ada peringkat

- Demon Et IzationDokumen8 halamanDemon Et IzationAshutosh KumarBelum ada peringkat

- Ac Vi 2016-17Dokumen3 halamanAc Vi 2016-17Ashutosh KumarBelum ada peringkat

- Entrepreneurial Orientation B-Plan Submission - Mahendra Singh Taragi - 2015PGP192Dokumen5 halamanEntrepreneurial Orientation B-Plan Submission - Mahendra Singh Taragi - 2015PGP192Ashutosh KumarBelum ada peringkat

- FIN Investorfactsheet PDF 20161008Dokumen24 halamanFIN Investorfactsheet PDF 20161008Ashutosh KumarBelum ada peringkat

- Basel IiDokumen4 halamanBasel IiAshutosh KumarBelum ada peringkat

- EquateDokumen6 halamanEquateAshutosh KumarBelum ada peringkat

- Polans MotorwaysDokumen3 halamanPolans MotorwaysAshutosh KumarBelum ada peringkat

- IridiumDokumen3 halamanIridiumAshutosh KumarBelum ada peringkat

- Club Mahindra Caselet PDFDokumen3 halamanClub Mahindra Caselet PDFVivekananda ReddyBelum ada peringkat

- Fixed Income Security AnalysisDokumen4 halamanFixed Income Security AnalysisAshutosh KumarBelum ada peringkat

- Green SignalsDokumen1 halamanGreen SignalsAshutosh KumarBelum ada peringkat

- Financial Markets & InstrumentsDokumen72 halamanFinancial Markets & InstrumentsK Arun NarayanaBelum ada peringkat

- Asset Allocation and Mutual Funds-ClassDokumen9 halamanAsset Allocation and Mutual Funds-ClassAshutosh KumarBelum ada peringkat

- AY: 2015-16 Term: IV A Indian Institute of Management IndoreDokumen4 halamanAY: 2015-16 Term: IV A Indian Institute of Management IndoreAshutosh KumarBelum ada peringkat

- Portfolio ConstructionDokumen9 halamanPortfolio ConstructionAshutosh KumarBelum ada peringkat

- Active Portfolio Management StrategiesDokumen5 halamanActive Portfolio Management StrategiesAshutosh KumarBelum ada peringkat

- Passive Portfolio Management StrategiesDokumen6 halamanPassive Portfolio Management StrategiesAshutosh KumarBelum ada peringkat

- Journal of Business Economics and ManagementDokumen21 halamanJournal of Business Economics and Managementsajid bhattiBelum ada peringkat

- p.21 Case 1-1 Ribbons An' Bows, IncDokumen3 halamanp.21 Case 1-1 Ribbons An' Bows, Incrajo_onglao50% (2)

- Financial Accounting Chapter 9: Accounts Receivable: Classification of ReceivablesDokumen2 halamanFinancial Accounting Chapter 9: Accounts Receivable: Classification of ReceivablesMay Grethel Joy PeranteBelum ada peringkat

- PDFDokumen19 halamanPDFRam SriBelum ada peringkat

- Assignment On MoneybhaiDokumen7 halamanAssignment On MoneybhaiKritibandhu SwainBelum ada peringkat

- MyGlamm Invoice 1671638258-96Dokumen1 halamanMyGlamm Invoice 1671638258-96ShruBelum ada peringkat

- Partnership & ClubsDokumen8 halamanPartnership & ClubsGary ChingBelum ada peringkat

- Problem 1Dokumen4 halamanProblem 1Live LoveBelum ada peringkat

- CH 6Dokumen32 halamanCH 6Zead MahmoodBelum ada peringkat

- Model Asset and Liability Affidavit D. VDokumen12 halamanModel Asset and Liability Affidavit D. VsavagecommentorBelum ada peringkat

- A Guide To UK Oil and Gas TaxationDokumen172 halamanA Guide To UK Oil and Gas Taxationkalite123Belum ada peringkat

- Daily Report MonitoringDokumen9 halamanDaily Report MonitoringMaasin BranchBelum ada peringkat

- Risk Capital Management 31 Dec 2011Dokumen181 halamanRisk Capital Management 31 Dec 2011G117Belum ada peringkat

- Round Tripping - Indian Dilemma and International PerspectiveDokumen8 halamanRound Tripping - Indian Dilemma and International PerspectiveINSTITUTE OF LEGAL EDUCATIONBelum ada peringkat

- Financial Performance of Retail Sector Companies in India-An AnalysisDokumen7 halamanFinancial Performance of Retail Sector Companies in India-An Analysisaniket jadhavBelum ada peringkat

- Step 1 Step 2: Notice of AssessmentDokumen1 halamanStep 1 Step 2: Notice of Assessmentabinash manandharBelum ada peringkat

- Satyam ScamDokumen17 halamanSatyam ScamRakib HasanBelum ada peringkat

- BS Delhi English 27-12-2023Dokumen20 halamanBS Delhi English 27-12-2023rajkumaryogi6172Belum ada peringkat

- Advanced AccountingDokumen4 halamanAdvanced Accountinggisela gilbertaBelum ada peringkat

- Report in BM 222Dokumen5 halamanReport in BM 222Neil Dela Cruz AmmenBelum ada peringkat

- International Trade and Finance (Derivatives)Dokumen52 halamanInternational Trade and Finance (Derivatives)NikhilChainani100% (1)