Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Diunggah oleh

Shyam SunderDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Diunggah oleh

Shyam SunderHak Cipta:

Format Tersedia

Sambhaav Media Limited

"Sambhaav House", Opp. Judges ' Bungalows,

Premchandnagar Road, Satellite, Ahmedabad-380015

Tel : +91-79 26873914/15/16/17, Fax : +91-79 26873922

Email : info@sambhaav.com Website : www.sambhaavnews.com

CIN : L67120GJ1 990PLC014094

SAMBHAAV

GROUP

SML/CS/2016/194

Date: August 12, 2016

To,

The Department of Corporate Services

BSE Limited

Phiroze Jeejeebhoy Towers

Dalal Street Fort

MUMBAI - 400 001

To,

The Listing Department

National Stock Exchange oflndia Limited

Exchange Plaza, Plot no. C/1, G Block,

Bandra-Kurla Complex Sandra (E)

MUMBAI - 400 051

Scrip Code: 511630

Scrip Symbol: SAMBHAAV

Dear Sir,

Sub: Outcome of the Board Meeting dated August 12. 2016

Ref: Regulation 33 ofSEBI (Listing Obligation and Disclosure Requirements) Regulations.

2015

This is to submit that the meeting of the Board of Directors of Sambhaav Media Limited was

commenced at 11.30 a.m. and concluded at 12.15 p.m. on Friday, August 12, 2016 at the registered

office of the Company whereat the Board has considered and approved the following:

1. Unaudited Standalone Financial Results for the quarter ended on June 30, 2016;and

2. Issue of 45000000 (Four Crore Fifty Lac Only) Warrants convertible into equivalent number

of equity shares of Re. 1 /- each at an issue price of Rs. 5/- per share (including premium of

Rs. 4/-) to the Persons belonging to the Promoters and Non-promoters on private

placement basis.

A copy of the unaudited standalone financial results along with limited review report thereon is

enclosed herewith.

Kindly take the same on your record and acknowledge the receipt.

Thanking you,

Yours faithfully,

For, Sambhaav Media Limited

~'

PalakAsawa

Company Secretary

Encl: a/a

NEWS

WI Sc

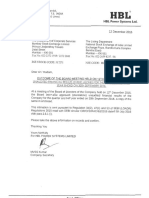

SAMBHAAV MEDIA LIMITED

CIN: L67120GJ1990PLC014094

Regd . Office: "Sambhaav House", Opp. Judges Bungalows,

Premchandnagar Road , Satellite, Ahmedab~d - 380 015

Tel: +91 79 2687 3914/15/16/17 Fax: +91 79 2687 3922

E-mail: secretarial@sambhaav.com Website: www.sambhaavnews.com

STATEMENT OF UNAUDITED FINANCIAL RESULTS FOR QUARTER ENDED ON 30TH JUNE 2016

(~in

Part-I

SN

1

PARTICULARS

Income from Operations

(a) Net Sales/ Income from Operations

(b) Other Operating Income

Total Income from Operations ( 1+2)

Expenses

(a) Cost of Material Consumed

(b) Broadcasting Expense/ Licence Fee

(c) Changes in inventories of finished

goods, work in progress and stock in trade

Quarter ended

31.03.2016

30.06.2016

30.06.2015

(Unaudited) (Unaudited)

(Audited)

Year Ended

31 .03.2016

(Audited)

616 .51

847.58

3020.17

775.57

616.51

847.58

3020.17

78.09

245.83

84.98

189.39

81 .30

484.65

(0.03)

321 .26

1047.29

(0.03)

775.57

(d) Employee benefit expense

(e) Depreciation & Amortisation Expense

(f ) Other Expenses

Total Expenses

Lacs)

61.40

67.17

70.83

54.07

71 .36

50.17

273.25

207.85

234.83

687.32

127.97

527.24

252.91

940.36

913.66

2763.28

Profit/ (Loss) from operations before

other Income. Finance cost and

exceptional items (1-2)

88.25

89.27

(92.78)

256.89

Other Income

65.13

15.59

188.83

654 .65

Profit/ (Loss) from ordinary activities before

finance costs & exceptional items (34)

Finance Costs

153.38

104.86

96.05

911 .54

49.02

55 .37

45.12

222.03

104.36

(3.52)

49.49

(1 .75)

50.93

689.51

6.76

100.84

47.74

50.93

696 .27

99 .81

(5.25)

238.00

1.92

(5.25)

461.60

6

7

8

9

10

11

12

13

14

15

16

17

17 i

17 ii

Profit/ (Loss) from ordinary activities

before exceptional items (5 6)

Exceptional Items

Profit/ (Loss) from oridinary activities before

tax ( 7 8)

Tax Expense

Current

Earlier Year Tax

Deferred tax

Profit/ (Loss) from oridinary activities after tax (

9 10)

Extra Ordinary Items( Net of tax expense)

Net Profit/ (Loss) forthe period (1112)

Minority Interest

Net Profit/ (Loss) after Minority Interest

rthe

period (13 14)

Paid-Up Equity Share Capital (Face Value of

Share~ 1/-)

Reserves Excluding Revaluation Reserves as per

Balance sheet of previous accounting year

Earning per share (before extra ordinary items)

(of~ 1/- each (not annualised))

(a) Basic

(b) Diluted

Earning per share (after extra ordinary items)

(of~ 1/- each (not annualised))

(a) Basic

(b) Diluted

39.25

13.65

61 .59

34.09

(43.63)

61.59

34.09

(43.63)

461.60

61.59

34.09

(43.63)

461 .60

1461.11

1461 .11

1461.11

1461 .11

3241 .23

0.04

0.04

0.02

0.02

(0.03)

(0.03)

0.32

0.32

0.04

0.04

0.02

0.02

(0.03)

(0.03)

0.32

0.32

Notes:1

The above results were reviewed by the Audit Committee & approved by the Board of Directors of the

Company at its meeting held on August 12, 2016.The statutory auditors have carried out a limited review of

the result for the quarter ended 30th June,2016.

2

Figures of last quarter are the balancing figures between audited figures in respect of full financial year and

the published year to date figures up to the third quarter of the relevant financial year.

The figures of previous period are regrouped/ reclassified wherever necessary to correspond to the figures of

the current reporting period.

By Order of Board of Directors

Kiran lfVcidodarf'a

Place : Ahmedabad

Chairman and Managing Director

Date : August 12, 2016

DIN: 00092067

CHARTERED ACCOUNTANTS

4th Floor, Aditya Bu il d ing,

Near Sardar Patel Seva Samaj,

Mithakhali Six Roads, Ellisbridge,

Ahmedabad 380006.

Auditor's Report on Quarterly Financial Results of the Company Pursuant to the

Regulation 33 of the SEBI (listing Obligations and Disclosure Requirements)

Regulations, 2015

To Board of Directors of

Sambhaav Media limited

We have audited the quarterly financial results of Sambhaav Media Limited for the

quarter ended June 30, 2016 attached herewith, being submitted by the company

pursuant to the requirement of Regulation 33 of the SEBI (Listing Obligations and

Disclosure Requirements) Regulations, 2015. These quarterly financial results have been

prepared on the basis of the interim financial statements, which are the responsibility of

the company's management. Our responsibility is to express an opinion on these

financial results based on our audit of such interim financial statements, which have

been prepared in accordance with the recognition and measurement principles laid

down in Accounting Standard for Interim Financial Reporting (AS 25 I Ind AS 34),

prescribed, under Section 133 of the Companies Act, 2013 read with relevant rules

issued thereunder; or by the Institute of Chartered Accountants of India, as applicable

and other accounting principles generally accepted in India.

We conducted our audit in accordance with the auditing standards generally accepted in

India. Those standards require that we plan and perform the audit to obtain reasonable

assurance about whether the financial results are free of material misstatement(s). An

audit includes examining, on a test basis, evidence supporting the amounts disclosed as

financial results. An audit also includes assessing the accounting principles used and

significant estimates made by management. We believe that our audit provides a

reasonable basis for our opinion.

In our opinion and to the best of our information and according to the explanations

given to us these quarterly financial results :

(i)

Phone : (079) 2640 3325/26 I Website : www.dbsgroup.in

1st Floor Coma Chambers,

23 Nagindas Master Road,

Mumbai : 400023

Doshi Corporate Park

Near Utkarsh School, Akshar Marg End

Rajkot 360001

204 Sakar

Opp Abs Tower, Old Padro Road

Vadodara: 390015

(ii)

give a true and fair view of the net profit and other financial information for the

quarter ended June 30, 2016 .

For, DHIRUBHAI SHAH & DOSHI

CHARTERED ACCOUNTANTS

~ ~ ~~

HAklSH

B~PATEL

cr.f

PARTNER

Membership No. 014427

Place: Ahmedabad

Date: August 12, 2016

Anda mungkin juga menyukai

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen7 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen10 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen11 halamanStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen7 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Updates On Financial Results For June 30, 2016 (Result)Dokumen3 halamanUpdates On Financial Results For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Revised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanRevised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen7 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen3 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Revised Financial Results For June 30, 2016 (Result)Dokumen4 halamanRevised Financial Results For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Performance For The Half Year Ended September 30, 2016 (Company Update)Dokumen5 halamanPerformance For The Half Year Ended September 30, 2016 (Company Update)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen3 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Dmart-Q3 Fy18Dokumen7 halamanDmart-Q3 Fy18jigarchhatrolaBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen6 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Dokumen3 halamanAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen7 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Dokumen7 halamanAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen9 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen8 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen9 halamanStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen7 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen9 halamanStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Dokumen17 halamanStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionDari EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionBelum ada peringkat

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionDari EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionBelum ada peringkat

- PDF Processed With Cutepdf Evaluation EditionDokumen3 halamanPDF Processed With Cutepdf Evaluation EditionShyam SunderBelum ada peringkat

- Standalone Financial Results For September 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For March 31, 2016 (Result)Dokumen11 halamanStandalone Financial Results For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Transcript of The Investors / Analysts Con Call (Company Update)Dokumen15 halamanTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderBelum ada peringkat

- Investor Presentation For December 31, 2016 (Company Update)Dokumen27 halamanInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- The Champion Legal Ads 04-01-21Dokumen45 halamanThe Champion Legal Ads 04-01-21Donna S. SeayBelum ada peringkat

- Orwell's 1984 & Hegemony in RealityDokumen3 halamanOrwell's 1984 & Hegemony in RealityAlex JosephBelum ada peringkat

- Climate Resilience FrameworkDokumen1 halamanClimate Resilience FrameworkJezzica BalmesBelum ada peringkat

- Purpose of Schooling - FinalDokumen8 halamanPurpose of Schooling - Finalapi-257586514Belum ada peringkat

- The MinoansDokumen4 halamanThe MinoansAfif HidayatullohBelum ada peringkat

- Hudaa Catalog Jan 07webverDokumen28 halamanHudaa Catalog Jan 07webverISLAMIC LIBRARYBelum ada peringkat

- Q2 - Week 7 8Dokumen4 halamanQ2 - Week 7 8Winston MurphyBelum ada peringkat

- Preposition Exercises: SIUC Writing Center Write - Siuc.eduDokumen4 halamanPreposition Exercises: SIUC Writing Center Write - Siuc.eduveni100% (1)

- Creating A Carwash Business PlanDokumen7 halamanCreating A Carwash Business PlanChai Yeng LerBelum ada peringkat

- Career Oriented ProfileDokumen3 halamanCareer Oriented ProfileSami Ullah NisarBelum ada peringkat

- Kansai Survival Manual CH 15Dokumen2 halamanKansai Survival Manual CH 15Marcela SuárezBelum ada peringkat

- Reading 53 Pricing and Valuation of Futures ContractsDokumen3 halamanReading 53 Pricing and Valuation of Futures ContractsNeerajBelum ada peringkat

- Egyptian Gods and GoddessesDokumen5 halamanEgyptian Gods and GoddessesJessie May BonillaBelum ada peringkat

- Boone Pickens' Leadership PlanDokumen2 halamanBoone Pickens' Leadership PlanElvie PradoBelum ada peringkat

- Qualified Written RequestDokumen9 halamanQualified Written Requestteachezi100% (3)

- HB 76 SummaryDokumen4 halamanHB 76 SummaryJordan SchraderBelum ada peringkat

- 35 Childrens BooksDokumen4 halaman35 Childrens Booksapi-710628938Belum ada peringkat

- Udom Selection 2013Dokumen145 halamanUdom Selection 2013Kellen Hayden100% (1)

- Jimenez Vizconde Lozcano V VeranoDokumen2 halamanJimenez Vizconde Lozcano V VeranoEscanorBelum ada peringkat

- Ooad Lab Question SetDokumen3 halamanOoad Lab Question SetMUKESH RAJA P IT Student100% (1)

- G.R. No. L-6393 January 31, 1955 A. MAGSAYSAY INC., Plaintiff-Appellee, ANASTACIO AGAN, Defendant-AppellantDokumen64 halamanG.R. No. L-6393 January 31, 1955 A. MAGSAYSAY INC., Plaintiff-Appellee, ANASTACIO AGAN, Defendant-AppellantAerylle GuraBelum ada peringkat

- Social Inequality and ExclusionDokumen3 halamanSocial Inequality and ExclusionAnurag Agrawal0% (1)

- Catalogue of CCP Publications 2021Dokumen75 halamanCatalogue of CCP Publications 2021marcheinBelum ada peringkat

- Blue Umbrella: VALUABLE CODE FOR HUMAN GOODNESS AND KINDNESSDokumen6 halamanBlue Umbrella: VALUABLE CODE FOR HUMAN GOODNESS AND KINDNESSAvinash Kumar100% (1)

- Hospitals' EmailsDokumen8 halamanHospitals' EmailsAkil eswarBelum ada peringkat

- Determinate and GenericDokumen5 halamanDeterminate and GenericKlara Alcaraz100% (5)

- Guilatco Vs City of Dagupan Case DigestDokumen1 halamanGuilatco Vs City of Dagupan Case DigestYrna Caña100% (1)

- Attendance 2.0 Present 2.1 Absent With ApologyDokumen3 halamanAttendance 2.0 Present 2.1 Absent With ApologyPaul NumbeBelum ada peringkat

- Petersen S 4 Wheel Off Road December 2015Dokumen248 halamanPetersen S 4 Wheel Off Road December 20154lexx100% (1)