The Effects of Political Connection On Corporate Social Responsibility Disclosure - Evidence From Listed Companies in Malaysia

Diunggah oleh

inventionjournalsJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

The Effects of Political Connection On Corporate Social Responsibility Disclosure - Evidence From Listed Companies in Malaysia

Diunggah oleh

inventionjournalsHak Cipta:

Format Tersedia

International Journal of Business and Management Invention

ISSN (Online): 2319 8028, ISSN (Print): 2319 801X

www.ijbmi.org || Volume 5 Issue 2 || February. 2016 || PP-16-21

The effects of political connection on corporate social

responsibility disclosure evidence from listed companies in

Malaysia

Intan Maiza Abd. Rahman1, Ku Nor Izah Ku Ismail2

1

(Faculty of Economics and Management, Universiti Kebangsaan Malaysia, Malaysia)

2

(College of Business, Universiti Utara Malaysia, Malaysia)

ABSTRACT : This paper examines the effects of political connection on CSR disclosure. The measurement of

political connection is separated into two which were government ownership and representation of politicians

on boards. From a sample of 300 non-financial companies listed in Bursa Malaysia for the year 2013, results

from the regression analysis show that government ownership positively influences CSR disclosure. However,

we are unable to find any significant effects of having politicians on boards on CSR disclosure. Findings from

this study add to the literature on the impact of political connection on CSR disclosure. They also broaden the

literature on the different effects of different political connection proxies on CSR disclosure from a developing

country that is now economically recognized by the global community.

KEYWORDS corporate social responsibility disclosure, emerging markets, government ownership,

political connection, politicians on boards

I.

INTRODUCTION

Nowadays, the business world is facing challenging situations in order to survive as companies need to

focus not only on financial aspects, but also on non-financial ones. For the financial aspects, companies need to

focus on the use of companies resources and profit generation that can benefit them and the shareholders. On

the other hand, for non-financial aspects, companies may need to focus on activities such as corporate social

responsibility (CSR) as implementing them may benefit the companies and the stakeholders at large. Prior

studies by [1] Amran and Siti-Nabiha (2009), [2] Mohamad Taha (2013), [3] Kahreh et al. (2014), [4] Cahan et

al. (2015) and [5] Usman and Amran (2015) show that the benefits can be seen in terms of improved financial

performance, enhanced board image and companys reputation, and improved value of the company.

With the benefits that could presumably be attained from performing CSR activities, prior studies by

[6] Bouten et al. (2011), [7] Othman et al. (2011), [8] Djajadikerta and Trireksani (2012), [9] Bowrin (2013),

[10] Ahmed Haji (2013), [11] Kansal et al. (2014) and [12] Fatima et al. (2015) found a low level of CSR

disclosure provided by the companies. As argued in [1] Amran and Siti-Nabiha (2009) and [8] Djajadikerta and

Trireksani (2012), companies (or management) do not take full advantage of disclosing CSR information even

though CSR disclosure could act as communication tools to potential investors and differentiate one company

from another. This situation may occur due to the lack of awareness by companies or the structure of companies

that does not support CSR disclosure. Further, the content of information that is to be disclosed depends on the

management as there is no mandatory accounting standard issued by the standard setting bodies for CSR

reporting. Thus, the level of disclosure may vary among companies.

Focusing on CSR disclosure in Malaysia, prior studies by [2] Mohamad Taha (2013) and [10] Ahmed

Haji (2013) provide evidence that corporate governance attributes such as audit committee, board size, and

independent directors could influence CSR disclosure. However, in a unique country like Malaysia that is richly

populated by multi-ethnic groups whose economic status is different, government intervention may come into

play. As a proxy for political connection, government intervention and existence of politicians on boards may

affect companies decision making and business trajectory. As for CSR disclosure, companies with political

connection may have different intention when disclosing their CSR information ([13] Gao (2011), [14] Gu et al.

(2013), [15] Snider et al. (2013) and [16] Lin et al. (in press)). It is shown that these companies disclose CSR

information in order to build relationships and safeguard their interest with influential politicians.

The objective of this paper is to examine the effects of political connection on CSR disclosure.

Specifically, it examines the effects of government ownership and representation of politicians on boards on

CSR disclosure. Using these two proxies that represent political connection may fill the gap left by prior studies

which normally examined the effects of political connection on financial reporting quality (for example [17] Md

Salleh (2009), [18] Chaney et al. (2011), [19] Abdul Wahab et al. (2011)).

www.ijbmi.org

16 | Page

The effects of political connection on corporate social

This paper may contribute to the body of knowledge, theory, and business practice in a number of

ways. First, this paper may add to the literature on the effects of political connection on CSR disclosure. Second,

as this paper uses a sample of Bursa Malaysia listed companies, findings of this paper may enrich the literature

on the impact of political connection on CSR disclosure from a perspective of an emerging economy and

developing country. Third, findings of this paper may help to explain the different impact that different political

connection proxies could have on CSR disclosure. As an agent to shareholders, the involvement of government

and politicians may have different effects on CSR disclosure. Lastly, this paper may be useful to business

practices as it helps to explain how political connection could affect business decisions and trajectories.

The remainder of this paper is organized as follows. The next section discusses theory and hypothesis

development, followed by the research method section. Findings and discussion will be discussed next. The

final section concludes the paper.

II.

THEORY AND HYPOTHESIS DEVELOPMENT

In examining the effects of political connection on CSR disclosure, this paper referred to an agency

theory originated by [20] Jensen and Meckling (1976). Agency relationships are basically established between

two parties the principal and the agent where shareholders are the principal and companies directors and

management teams are the agent. Directors and management teams are given the authority to make decisions on

behalf of shareholders in which both parties, in actuality, try to maximize their own interests. In this situation,

conflicts may occur at some point.

In politically connected companies, agency conflicts may occur as politically influential directors may

have their own interest in the companies. Their representation on the companies is supposedly to safeguard

shareholders wealth and companies resources. However, there may be situations where their representation

fulfils their own interest and agenda, bringing detrimental effects on shareholders wealth and companies

resources.

Further, according to the model of bargaining between politicians and managers as proposed by [21]

Shleifer and Vishny (1994), politicians can use subsidies to bribe managers when companies are controlled by

the managers. In other situations when companies are controlled by the politicians, managers would possibly

bribe them to safeguard their own interest and to avoid following the politicians political interest. In both

situations, political connection or politicians themselves could affect companies decisions on certain issues.

Prior studies by [18] Chaney et al. (2011) and [19] Abdul Wahab et al. (2011) provided evidence that

political connection could negatively affect financial reporting quality. [18] Chaney et al. (2011) used data of

4500 companies from 19 countries, while [19] Abdul Wahab et al. (2011) used data of 382 non-financial

companies listed in Bursa Malaysia in 2001 to 2003. The negative effects revealed in these prior studies indicate

that companies with political connection have poorer financial reporting quality than those that do not and have

high possibility to misstate their financial statements. Using the data of 256 companies listed in Bursa Malaysia

from 1999 to 2003 and interviews with 24 top managers from 24 companies, [17] Md Salleh (2009) found

mixed results in his study; companies with politicians on boards have a poor financial reporting quality, similar

to that found by [18] Chaney et al. (2011) and [19] Abdul Wahab et al. (2011). However, he also reported that

government ownership could positively influence financial reporting quality. These positive effects that

government ownership could have on CSR disclosure are as well pointed out by [22] Said et al. (2009). On the

other hand, prior studies by [13] Gao (2011), [14] Gu et al. (2013), [15] Snider et al. (2013), and [16] Lin et al.

(in press) found that companies with political connection have different orientation when implementing and

disclosing their CSR information. [13] Gao (2011) examined companies categorized as state-owned and nonstate-owned enterprises in China. [14] Gu et al. (2013) provided evidence from a survey conducted to 404 senior

Chinese hotel managers. Similarly, [15] Snider et al. (2013) utilized survey information that was obtained from

166 managers. Lastly, [16] Lin et al. (in press) used data from A-Shares companies listed in either Shenzhen or

Shanghai Stock Exchange in 2005 to 2009.

Having explained the theory and findings of past studies, this paper proposed that political connection

could influence companies CSR disclosure. Specifically, we developed the following hypotheses:

H1: Government ownership, as a proxy for political connection, impacts companies CSR disclosure.

H2: Politicians on boards, as a proxy for political connection, impact companies CSR disclosure.

III.

RESEARCH METHOD

In examining the effects of political connection on CSR disclosure, information from 300 companies

listed in Bursa Malaysia in 2013 was collected. The 300 companies were chosen using stratified random

sampling. The use of 300 sampled companies was deemed justifiably sufficient as referred to the table of sample

www.ijbmi.org

17 | Page

The effects of political connection on corporate social

and population provided by [23] Krejcie and Morgan (1970)1. Year 2013 was chosen because of data

availability when this study was conducted. The use of companies listed in Bursa Malaysia would be practical

and relevant as it would add another view to the literature that is contextualized in Malaysia; a developing

country and is considered as an emerging economy. Further, the authoritative bodies in Malaysia are concerned

about the business environment and continue to improve protection for investors. This is done through

improvements made to the Malaysian Code on Corporate Governance (MCCG). In addition, imbalances in

economic status among ethnic groups provide opportunities for politically influential figures to intervene in the

process. This allows for a scrutiny on their existence in companies decision making in general and CSR

disclosure in specific to take place. The use of one-year data was appropriate as prior studies by [10] Ahmed

Haji (2013) and [12] Fatima et al. (2015) found a low level of disclosure from 2005 to 2009. Furthermore, other

studies by [24] Embong (2014) found insignificant increase of disclosure for the year 2007 to 2009 and

unchanged level of voluntary disclosure for the year 2009 to 2010 for a sample of companies listed in Bursa

Malaysia. The use of companies annual reports in collecting data was aligned with prior studies that examined

CSR disclosure. Refer to the work by [10] Ahmed Haji (2013) and [12] Fatima et al. (2015).

CSR disclosure was measured using three-point Likert scale. The scale of zero was assigned for nondisclosure, one for information provided in general term, and two for information disclosed in detail including

the quantitative one. The information was collected based on CSR disclosure checklist developed in this study2.

The checklist was developed after reviewing the CSR disclosure checklists that were utilized in prior studies and

referring to Bursa Malaysia CSR framework. The score for the quality of CSR disclosure for each company was

divided by its possible total score.

Political connection was separated using two measurements. The first measurement was the percentage

of government ownership as per listed in the 30 largest shareholders in companies annual report. Government

ownership is proxied by five public institutional investors Permodalan Nasional Berhad (PNB), Lembaga

Tabung Angkatan Tentera (LTAT), Tabung Haji (TH), the Employee Provident Fund (EPF), and National Social

Security Organization of Malaysia (SOCSO). The second measurement for political connection was the

representation of politicians on boards. The score of one was given if at least one director held a position at a

state or federal level or was a committee member of a political party, while zero if otherwise.

This paper used six control variables, namely total assets which represented the size of the company,

profitability, leverage, independent directors, and industry type. These variables which were normally used as

control variables in prior research were imperative for the present study in examining corporate disclosure. We

constructed the following equation to test the hypotheses.

CSRD = 0 + 1PGOV + 2PPOL + 3SIZE + 4PROFIT + 5LEV + 6BIND + 7BSZE + INDMY +

it,

(1)

where:

CSRD

= Corporate social responsibility disclosure,

PGOV

= % of government ownership,

PPOL

= The existence of politicians on boards, scoring 1 if at least one director was

connected to a political party or a minister at a state or federal level, 0 otherwise,

SIZE

= Size of the companies, measured as the natural log of total assets,

PROFIT

= Profitability, measured as net income/total assets,

LEV

= Leverage, measured as total liability/total assets,

BIND

= Proportion of independent directors on boards,

BSZE

= Board size, being the number of board members, and

INDMY

= Dummy variables for industry type.

IV.

FINDINGS AND DISCUSSION

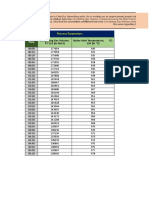

Referring to Table 1, the mean of CSR disclosure is .2427 with a minimum and maximum disclosure of

0 and .86. This indicates that there are companies that do not disclose their CSR information in the annual

reports. Some of these companies only provide pictures in reporting their CSR activities. The government

ownership ranges from 0 to 74.43% with a mean of 3.02%. The minimum and maximum number of politicians

on boards represents companies with and without politicians on boards. From the table, it can be seen that 23

companies have politicians on boards, while the remaining 277 companies have no politicians on their boards.

As for the control variables, the geometric mean of natural log of total assets is MYR 452 million (e19.93) and it

1

The total number of companies listed in Bursa Malaysia in 2013 was 815 companies. According to [23]

Krejcie and Morgan (1970), this population requires a sample size of 256. Thus, the use of 300 companies was

above the required sample size and sufficient for the population.

2

The CSR disclosure checklist is available from the authors upon request.

www.ijbmi.org

18 | Page

The effects of political connection on corporate social

ranges from MYR 24 million (e17.02) to MYR 99 billion (e25.32). The ranges for profitability and leverage are .408 to .832 and .0029 to .98 respectively. The mean for the board independence is .483, indicating that a

majority of the companies fulfill the requirement to have 30% independent directors. Lastly, the average board

size is 7, with a minimum and maximum of 4 and 17, respectively.

Table 1: Descriptive statistics

Construct

Operation measure

Mean / (SD)

Max.

Min.

1. CSR Disclosure

Three-point Likert scale

.2427 / (.1637)

.86

.00

2. Government Ownership

% of government ownership

3.0163 / (9.5200)

74.43

.00

3. Politicians on boards

0/1

1 / (23)

0 / (277)

4. Company size

Natural log of total assets

19.9328 / (1.5525)

25.32

17.02

5. Profitability

Net income/total assets

.0396 / (.1073)

.832

-.408

6. Leverage

Total liability/total assets

.3811 / (.2044)

.98

.0029

7. Board Independence

% of independent directors

.483 / (.134)

1.00

.25

8. Board size

Number of directors on boards

7.29 / (1.839)

17

4

The correlation analysis reported in Table 2 shows that government ownership, company size,

profitability, leverage, and board size have a significant and positive association with CSR disclosure. This

indicates that these elements are able to improve companies CSR disclosure. Looking at the value of correlation

coefficient, company size has a moderate strength to affect CSR disclosure, while the other variables have a

mild strength to influence CSR disclosure, given that the coefficient value is below 0.3. The correlation

coefficient among independent and control variables provide an indication that these variables are free from

multicollinearity issue, given that the values of correlation coefficients are below 0.7.

Table 2: Correlation analysis

Construct

1

2

3

4

5

6

7

1. CSR Disclosure

2. Government Ownership

.274**

3. Politicians on boards

.090

.172**

4. Company size

.559**

.326**

.117*

5. Profitability

.131*

.032

.025

.203**

6. Leverage

.127*

.175**

.006

.261**

.-2.62**

7. Board Independence

-.050

-.014

.045

-.052

-.152**

-.016

8. Board size

.232**

.151**

-.011

.340**

.094

.132*

-.368**

**p < .01, *p < .05 (two-tailed)

Notes: N= 300. Descriptive statistics and correlation coefficients for industry are available from the authors

upon request.

Next, this paper reports the results from multiple regression analysis and they are as illustrated in Table

3. From the table, only one measurement for political connection that is government ownership is positive and

significant in influencing CSR disclosure. With p < .10, H1 is supported and it substantiates the assumption that

government ownership is able to improve the quality of CSR disclosure. This positive effect is similar to that

found by [17] Md Salleh (2009) and [22] Said et al. (2009). The positive effect that might be interpreted as one

percent increase in government ownership would increase companies CSR disclosure by .002. The positive

effect might also suggest that companies with government ownership provide better quality of CSR disclosure in

order to show that they are responsible and trying to maintain the good relationship with the government.

Further, the positive effect might indicate that the government, through its proxies, induces companies to

implement and disclose more information about their CSR activities that they have performed to show to the

stakeholders that both parties (the government and the companies) are responsible. However, this study was

unable to find any significant effects of politicians on boards on CSR disclosure, thus H2 is not supported. This

insignificant finding could be due to a small percentage of companies that have politicians on boards. With a

significant result for H1 and insignificant one for H2, this paper provides some evidence that political connection

could affect CSR disclosure. For control variables, only one variable, the company size, significantly influences

companies CSR disclosure. This positive and significant effect signifies that companies with large amount of

resources are able to implement and provide better quality of CSR information to the stakeholders. Results from

the regression analysis were checked for robustness and they fulfilled the statistical assumptions such as

normality, multicollinearity and heteroscedasticity.

www.ijbmi.org

19 | Page

The effects of political connection on corporate social

Table 3: Regression analysis

Coefficients

-.956

.002

-.008

.060

.019

-.025

.001

-.008

.035

.037

.010

.006

-.063

-.008

.323

11.966***

299

Constant

Government ownership

Politicians on boards

Natural log of total assets

Profitability (ROA)

Leverage

Board size

Proportion of independent directors

Construction

Consumers

Industrial products

Plantation

Properties

Trade and services

Adjusted R2

F Statistics (for model summary)

N

*p < .10, **p <.05, ***p<.01

V.

t-stat

-7.651

1.957

0.276

9.236

.234

-.555

.236

-.127

.743

.970

.283

.117

-1.545

-.231

P value

.000***

.051*

.782

.000***

.815

.580

.813

.899

.458

.333

.777

.907

.123

.818

CONCLUSION

This paper examines the effects of political connection on CSR disclosure. From a sample of 300 nonfinancial companies listed in Bursa Malaysia for the year 2013, this paper find that one proxy for political

connection, that is government ownership, could positively and significantly influence CSR disclosure. Results

for another proxy that is politicians on boards are found to be insignificant. While the findings of this paper

benefit the body of knowledge on the different proxies for political connection that could affect CSR disclosure,

this paper is subject to some limitations. First, this paper only uses two proxies that represented political

connections. Second, the scoring for CSR disclosure was only accounted for quantitative and qualitative

information. Future studies may use other proxies for political connection such as golden share and political

connectedness. Further, the scoring for CSR disclosure may consider to account for picture as one of the scoring

scale, as a picture is able to provide some information about companies CSR activities.

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

[15]

[16]

A. Amran, and A. K. Siti-Nabiha, Corporate social reporting in Malaysia: a case of mimicking the West or succumbing to local

pressure, Social Responsibility Journal, 5, 2009, 358-375.

M. H. Mohamad Taha, The relationship between corporate social responsibility disclosure and corporate governance

characteristics in Malaysian public listed companies, http://ssrn.com/abstract=2276763, 2013, retrieved on 26 February 2013.

M. S. Kahreh, A. Babania, M. Tive, and S. M. Mirmehdi, An examination to effects of gender differences on the corporate social

responsibility (CSR), Procedia - Social and Behavioral Sciences, 109, 2014, 664668.

S. F. Cahan, C. Chen, L. Chen, and N. H. Nguyen, Corporate social responsibility and media coverage, Journal of Banking and

Finance, 2015, doi: http://dx.doi.org/10.1016/j.jbankfin.2015.07.004.

A. B. Usman, and N. A. Amran, Corporate social responsibility practice and corporate financial performance: evidence from

Nigeria companies, Social Responsibility Journal, 11, 2015, 749-763.

L. Bouten, P. Everaert, L. V. Liederkerke, L. D. Moor, and J. Christiaens, Corporate social responsibility reporting: A

comprehensive picture?, Accounting Forum, 35, 2011, 187-204.

R. Othman, I. F. Ishak, S. M. Mohd Arif, and N. Abdul Aris, Influence of audit committee characteristics on voluntary ethics

disclosure, Procedia - Social and Behavioral Sciences, 145, 2011, 330342.

H. G. Djajadikerta, and T. Trireksani, Corporate social and environmental disclosure by Indonesian listed companies on their

corporate web sites, Journal of Applied Accounting Research, 13, 2012, 2136.

A. R. Bowrin, Corporate social and environmental reporting in the Caribbean, Social Responsibility Journal, 9, 2013, 259280.

A. Ahmed Haji, Corporate social responsibility disclosure over time: Evidence from Malaysia, Managerial Auditing Journal, 28,

2013, 647-676.

M. Kansal, M. Joshi, and G. S. Batra, Determinants of corporate social responsibility disclosures: Evidence from India, Advances

in Accounting, 30, 2014, 217229.

A. H. Fatima, N. Abdullah, and M. Sulaiman, Environmental disclosure quality: examining the impact of the stock exchange of

Malaysias listing requirements, Social Responsibility Journal, 11, 2015, 904-922.

Y. Gao, CSR in an emerging country: a content analysis of CSR reports of listed companies, Baltic Journal of Management, 6,

2011, 263-291.

H. Gu, C. Ryan, L. Bin, and G. Wei, Political connections, guanxi and adoption of CSR policies in the Chinese hotel industry: Is

there a link?, Tourism Management, 34, 2013, 231-235.

K. F. Snider, B. H. Halpern, R. G. Rendo, and M. V. Kidalov, Corporate social responsibility and public procurement: How

supplying government affects managerial orientation, Journal of Purchasing and Supply Management, 19, 2013, 63-72.

K. J. Lin, J. Tan, L. Zhao, and K. Karim, In the name of charity - Political connection and strategic corporate social responsibility

in a transition economy, Journal of Corporate Finance, in press.

www.ijbmi.org

20 | Page

The effects of political connection on corporate social

[17]

[18]

[19]

[20]

[21]

[22]

[23]

[24]

M. F. Md Salleh, Political influence, corporate governance and financial reporting quality: evidence from companies in

Malaysia, Ph.D. dissertation. Massey University, Wellington, New Zealand, 2009.

P. K. Chaney, P, M. Faccio, and D. Parsley, The quality of accounting information in politically connected firms, Journal of

Accounting and Economics, 51, 2011, 58-76.

E. A. Abdul Wahab, M. Mat Zain, and K. James, Political connections, corporate governance and audit fees in Malaysia,

Managerial Auditing Journal, 26, 2011, 393-418.

M. C. Jensen, and W. H. Meckling, Theory of the firm: Managerial behavior, agency costs and ownership structure, Journal of

Financial Economics, 3, 1976, 305-360.

A. Shleifer, and R. W. Vishny, Politicians and Firms, The Quarterly Journal of Economics, 109, 1994, 995-1025.

R. Said, Y, Hj Zainuddin, and H. Haron, The relationship between corporate social responsibility disclosure and corporate

governance characteristics in Malaysian public listed companies, Social Responsibility Journal, 5, 2009, 212-226.

R. V. Krejcie, and D. W. Morgan, Determining sample size for research activities, Educational and Psychological Measurement,

30, 1970, 607-610.

Z. Embong, Understanding voluntary disclosure: Malaysian perspective, Asian Journal of Accounting and Governance, 5, 2014,

15-35.

www.ijbmi.org

21 | Page

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Midterm: (15 Points) : Indian Institute of Management Bangalore Decision Science II Old ExamsDokumen72 halamanMidterm: (15 Points) : Indian Institute of Management Bangalore Decision Science II Old ExamsNitishBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Educational Measurement, Assessment and EvaluationDokumen53 halamanEducational Measurement, Assessment and EvaluationBoyet Aluan100% (13)

- Islamic Insurance in The Global EconomyDokumen3 halamanIslamic Insurance in The Global EconomyinventionjournalsBelum ada peringkat

- Effects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - NigeriaDokumen12 halamanEffects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeriainventionjournals100% (1)

- The Effect of Transformational Leadership, Organizational Commitment and Empowerment On Managerial Performance Through Organizational Citizenship Behavior at PT. Cobra Direct Sale IndonesiaDokumen9 halamanThe Effect of Transformational Leadership, Organizational Commitment and Empowerment On Managerial Performance Through Organizational Citizenship Behavior at PT. Cobra Direct Sale Indonesiainventionjournals100% (1)

- Effects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeria.Dokumen12 halamanEffects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeria.inventionjournalsBelum ada peringkat

- A Discourse On Modern Civilization: The Cinema of Hayao Miyazaki and GandhiDokumen6 halamanA Discourse On Modern Civilization: The Cinema of Hayao Miyazaki and GandhiinventionjournalsBelum ada peringkat

- Negotiated Masculinities in Contemporary American FictionDokumen5 halamanNegotiated Masculinities in Contemporary American FictioninventionjournalsBelum ada peringkat

- The Network Governance in Kasongan Industrial ClusterDokumen7 halamanThe Network Governance in Kasongan Industrial ClusterinventionjournalsBelum ada peringkat

- Muslims On The Margin: A Study of Muslims OBCs in West BengalDokumen6 halamanMuslims On The Margin: A Study of Muslims OBCs in West BengalinventionjournalsBelum ada peringkat

- H0606016570 PDFDokumen6 halamanH0606016570 PDFinventionjournalsBelum ada peringkat

- An Appraisal of The Current State of Affairs in Nigerian Party PoliticsDokumen7 halamanAn Appraisal of The Current State of Affairs in Nigerian Party PoliticsinventionjournalsBelum ada peringkat

- The Social Composition of Megaliths in Telangana and Andhra: An Artefactual AnalysisDokumen7 halamanThe Social Composition of Megaliths in Telangana and Andhra: An Artefactual AnalysisinventionjournalsBelum ada peringkat

- The Impact of Leadership On Creativity and InnovationDokumen8 halamanThe Impact of Leadership On Creativity and InnovationinventionjournalsBelum ada peringkat

- Inter-Caste or Inter-Religious Marriages and Honour Related Violence in IndiaDokumen5 halamanInter-Caste or Inter-Religious Marriages and Honour Related Violence in IndiainventionjournalsBelum ada peringkat

- The Usage and Understanding of Information and Communication Technology On Housewife in Family Welfare Empowerment Organization in Manado CityDokumen10 halamanThe Usage and Understanding of Information and Communication Technology On Housewife in Family Welfare Empowerment Organization in Manado CityinventionjournalsBelum ada peringkat

- Student Engagement: A Comparative Analysis of Traditional and Nontradional Students Attending Historically Black Colleges and UniversitiesDokumen12 halamanStudent Engagement: A Comparative Analysis of Traditional and Nontradional Students Attending Historically Black Colleges and Universitiesinventionjournals100% (1)

- A Critical Survey of The MahabhartaDokumen2 halamanA Critical Survey of The MahabhartainventionjournalsBelum ada peringkat

- Literary Conviviality and Aesthetic Appreciation of Qasa'id Ashriyyah (Decaodes)Dokumen5 halamanLiterary Conviviality and Aesthetic Appreciation of Qasa'id Ashriyyah (Decaodes)inventionjournalsBelum ada peringkat

- Effect of P-Delta Due To Different Eccentricities in Tall StructuresDokumen8 halamanEffect of P-Delta Due To Different Eccentricities in Tall StructuresinventionjournalsBelum ada peringkat

- E0606012850 PDFDokumen23 halamanE0606012850 PDFinventionjournalsBelum ada peringkat

- D0606012027 PDFDokumen8 halamanD0606012027 PDFinventionjournalsBelum ada peringkat

- F0606015153 PDFDokumen3 halamanF0606015153 PDFinventionjournalsBelum ada peringkat

- Non-Linear Analysis of Steel Frames Subjected To Seismic ForceDokumen12 halamanNon-Linear Analysis of Steel Frames Subjected To Seismic ForceinventionjournalsBelum ada peringkat

- C0606011419 PDFDokumen6 halamanC0606011419 PDFinventionjournalsBelum ada peringkat

- C0606011419 PDFDokumen6 halamanC0606011419 PDFinventionjournalsBelum ada peringkat

- D0606012027 PDFDokumen8 halamanD0606012027 PDFinventionjournalsBelum ada peringkat

- Non-Linear Analysis of Steel Frames Subjected To Seismic ForceDokumen12 halamanNon-Linear Analysis of Steel Frames Subjected To Seismic ForceinventionjournalsBelum ada peringkat

- E0606012850 PDFDokumen23 halamanE0606012850 PDFinventionjournalsBelum ada peringkat

- H0606016570 PDFDokumen6 halamanH0606016570 PDFinventionjournalsBelum ada peringkat

- F0606015153 PDFDokumen3 halamanF0606015153 PDFinventionjournalsBelum ada peringkat

- Development of Nighttime Visibility Assessment System For Road Using A Low Light CameraDokumen5 halamanDevelopment of Nighttime Visibility Assessment System For Road Using A Low Light CamerainventionjournalsBelum ada peringkat

- Variance PDFDokumen11 halamanVariance PDFnorman camarenaBelum ada peringkat

- National Council of Teachers of MathematicsDokumen13 halamanNational Council of Teachers of Mathematicsrodrigoxs123Belum ada peringkat

- J1+ Practice SetDokumen15 halamanJ1+ Practice Setpavan h ghogareBelum ada peringkat

- Kumbh Alka RetalDokumen9 halamanKumbh Alka RetalAmarJadhaoBelum ada peringkat

- Institute of Actuaries of India: Subject CT3 - Probability and Mathematical StatisticsDokumen7 halamanInstitute of Actuaries of India: Subject CT3 - Probability and Mathematical Statisticssatishreddy71Belum ada peringkat

- Beaver 1968Dokumen27 halamanBeaver 1968aimran_amirBelum ada peringkat

- D 08 06Dokumen126 halamanD 08 06FG SummerBelum ada peringkat

- A Meta-Analytic Review of Empirical Research On Online Information Privacy Concerns: Antecedents, Outcomes, and ModeratorsDokumen13 halamanA Meta-Analytic Review of Empirical Research On Online Information Privacy Concerns: Antecedents, Outcomes, and ModeratorssaxycbBelum ada peringkat

- FRM Quant Question BankDokumen111 halamanFRM Quant Question Bankrajnish007100% (3)

- #Foodporn: Obesity Patterns in Culinary InteractionsDokumen8 halaman#Foodporn: Obesity Patterns in Culinary InteractionshattyuuBelum ada peringkat

- Impact of Training On Employee RetentionDokumen15 halamanImpact of Training On Employee RetentionNagib Farhad SpainBelum ada peringkat

- Level II of CFA Program Mock Exam 1 - Solutions (PM)Dokumen54 halamanLevel II of CFA Program Mock Exam 1 - Solutions (PM)Faizan UllahBelum ada peringkat

- 15.ijhss - The Reationnship of Some FitnesDokumen5 halaman15.ijhss - The Reationnship of Some Fitnesiaset123Belum ada peringkat

- The New Trauma Score (NTS) : A Modification of The Revised Trauma Score For Better Trauma Mortality PredictionDokumen9 halamanThe New Trauma Score (NTS) : A Modification of The Revised Trauma Score For Better Trauma Mortality PredictionstellaBelum ada peringkat

- Unit 4 Research Methods For Sport and Exercise SciencesDokumen11 halamanUnit 4 Research Methods For Sport and Exercise Sciencesseanc939100% (1)

- Proceedings 02 01395 v3Dokumen7 halamanProceedings 02 01395 v3Marilyn RonquilloBelum ada peringkat

- Pipelines Risk AssessmentDokumen48 halamanPipelines Risk AssessmentEssam Abdelsalam El-AbdBelum ada peringkat

- Multiple Regression Analysis: EstimationDokumen50 halamanMultiple Regression Analysis: Estimationsanbin007Belum ada peringkat

- Feeley-Predicting Employee Turnover From Friendship NetworksDokumen19 halamanFeeley-Predicting Employee Turnover From Friendship NetworksKenneth WhitfieldBelum ada peringkat

- B.SC MATHS 2013Dokumen43 halamanB.SC MATHS 2013kankirajeshBelum ada peringkat

- Research On RosesDokumen6 halamanResearch On RoseskirilkatzBelum ada peringkat

- An Investigation of Factors Influencing Design Team Attributes in Green BuildingsDokumen12 halamanAn Investigation of Factors Influencing Design Team Attributes in Green BuildingsRus Farah Ilyliya Binti RuslanBelum ada peringkat

- Bag-Ao Research Paper FinalDokumen76 halamanBag-Ao Research Paper FinalJoannalou TalaugonBelum ada peringkat

- Jurnal 9Dokumen5 halamanJurnal 9Een CandraBelum ada peringkat

- Econometrics Sep 2018 Thanh Binh Crime Rate PDFDokumen16 halamanEconometrics Sep 2018 Thanh Binh Crime Rate PDFHiếu LươngBelum ada peringkat

- Part 7: Model Assessment With TempyDokumen3 halamanPart 7: Model Assessment With TempyAndrés Trujillo MateusBelum ada peringkat

- SAMS 2000 User's Manual PDFDokumen96 halamanSAMS 2000 User's Manual PDFdanilo_vergara_11Belum ada peringkat

- The Realtionship Between Earnings Yield, Market Value and Return For Nyse Common Stocks - BasuDokumen28 halamanThe Realtionship Between Earnings Yield, Market Value and Return For Nyse Common Stocks - BasuflaszaBelum ada peringkat