Tax Calculator - Residents - YA18

Diunggah oleh

Ben0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

14 tayangan1 halamanJudul Asli

Tax Calculator - Residents_YA18

Hak Cipta

© © All Rights Reserved

Format Tersedia

XLS, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai XLS, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

14 tayangan1 halamanTax Calculator - Residents - YA18

Diunggah oleh

BenHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai XLS, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

Income Tax Calculator for Tax Resident Individuals

YEAR OF ASSESSMENT 2018 (For the year ended 31 Dec 2017)

What to do: Enter amount in the gray boxes, where applicable.

Tips: For more information, move your mouse over the field or click on the field name.

INCOME

Employment income

S$

.00

S$

.00

S$

.00

S$

.00

Dividends

S$

.00

Interest

S$

Rent from Property

Royalty, Charge, Estate/Trust Income

S$

0

0

.00

.00

S$

.00

Gains or Profits of an Income Nature

S$

.00

S$

.00

S$

.00

.00

Less: Employment expenses

NET EMPLOYMENT INCOME

Trade, Business, Profession or Vocation

Add: OTHER INCOME

TOTAL INCOME

Less: Approved Donations

ASSESSABLE INCOME

Less: PERSONAL RELIEFS

Earned income relief

S$

.00

Spouse/handicapped spouse relief

S$

.00

Qualifying/handicapped child relief

S$

.00

Working mother's child relief

S$

.00

Parent/handicapped parent relief

Grandparent caregiver relief

S$

.00

S$

.00

Handicapped brother/sister relief

S$

.00

CPF/provident Fund relief

S$

S$

.00

S$

0

0

.00

.00

Foreign maid levy relief

CPF cash top-up relief (self, dependant and Medisave account)

S$

.00

S$

.00

Supplementary Retirement Scheme (SRS) relief

S$

.00

NSman(Self/wife/parent) relief

S$

S$

0

0

.00

S$

.00

Life Insurance relief

Course fees relief

Total Personal Reliefs (capped at $80,000)

CHARGEABLE INCOME

Tax Payable on Chargeable Income

Less:

Parenthood Tax Rebate

NET TAX PAYABLE

.00

S$

0.00

S$

0.00

S$

0.00

Anda mungkin juga menyukai

- Non Resident Tax CalculatorDokumen1 halamanNon Resident Tax Calculatorpramoth_cm1194Belum ada peringkat

- Non Resident Tax CalculatorDokumen1 halamanNon Resident Tax CalculatorMohit RaghavBelum ada peringkat

- 2013 AustralianTax Bracket CalculatorDokumen1 halaman2013 AustralianTax Bracket Calculatormsimbolon32Belum ada peringkat

- 2018 Year End Tax TipsDokumen4 halaman2018 Year End Tax TipsMichael CallahanBelum ada peringkat

- A Perfect LifeDokumen19 halamanA Perfect LifeAmal ChinthakaBelum ada peringkat

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesDari EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesBelum ada peringkat

- Tax Receipt TransactionsDokumen2 halamanTax Receipt TransactionsPoh Shi HuiBelum ada peringkat

- Income Tax Calculator - TaxScoutsDokumen1 halamanIncome Tax Calculator - TaxScoutsnadine.massabkiBelum ada peringkat

- Rmi Personal Budget Worksheet v05Dokumen10 halamanRmi Personal Budget Worksheet v05api-299736788Belum ada peringkat

- The Trump Tax Cut: Your Personal Guide to the New Tax LawDari EverandThe Trump Tax Cut: Your Personal Guide to the New Tax LawBelum ada peringkat

- ACC 330 Final Project Formal Letter To Client TemplateDokumen4 halamanACC 330 Final Project Formal Letter To Client TemplateBREANNA JOHNSONBelum ada peringkat

- Noa 2020Dokumen5 halamanNoa 2020xiaolong.siboBelum ada peringkat

- Come See The New Digs!: Meet Our Team !Dokumen4 halamanCome See The New Digs!: Meet Our Team !magicvalleytaxBelum ada peringkat

- Dog Walk Sponsor Form 1Dokumen3 halamanDog Walk Sponsor Form 1api-320061157Belum ada peringkat

- My High-Yield Savings Account: Year in Review 2022: Financial Freedom, #101Dari EverandMy High-Yield Savings Account: Year in Review 2022: Financial Freedom, #101Belum ada peringkat

- 6K TfsaDokumen3 halaman6K TfsaMichael CallahanBelum ada peringkat

- Tax Planning 2020 - 1Dokumen51 halamanTax Planning 2020 - 1VISHAL PATILBelum ada peringkat

- Know The Gift Tax Rules: Rules-1.Aspx#Ixzz3Eki0TeebDokumen1 halamanKnow The Gift Tax Rules: Rules-1.Aspx#Ixzz3Eki0TeebalisagasaBelum ada peringkat

- Budget Calculator: Stop Managing Your Household Budget On Paper!Dokumen16 halamanBudget Calculator: Stop Managing Your Household Budget On Paper!mitkamojsovska1Belum ada peringkat

- RMI Personal Budget Worksheet v05Dokumen7 halamanRMI Personal Budget Worksheet v05chanayireBelum ada peringkat

- Word Sponsorship Form Feb 16 PDFDokumen1 halamanWord Sponsorship Form Feb 16 PDFMiriam AdamsBelum ada peringkat

- Business Financial PlanDokumen6 halamanBusiness Financial PlanAryana AbdullahBelum ada peringkat

- Tax-Free Savings Account: Investment SolutionsDokumen3 halamanTax-Free Savings Account: Investment Solutionsapi-97071804Belum ada peringkat

- The Results!: How To Use This Budget PlannerDokumen48 halamanThe Results!: How To Use This Budget PlannerRatikant PandaBelum ada peringkat

- Individual Income Tax RatesDokumen6 halamanIndividual Income Tax RatesLydia Mohammad SarkawiBelum ada peringkat

- 7 Big Mistakes Small Business Owners Make at Tax Time: UPDATED 2019Dokumen25 halaman7 Big Mistakes Small Business Owners Make at Tax Time: UPDATED 2019nnauthooBelum ada peringkat

- Individuals: Tax Return ForDokumen12 halamanIndividuals: Tax Return FormoocowchickenBelum ada peringkat

- CLIC Sargent Sponsor Form - 1Dokumen2 halamanCLIC Sargent Sponsor Form - 1Andi JohnsonBelum ada peringkat

- Ena KaDokumen12 halamanEna KaBobot MazzeBelum ada peringkat

- A Guide To Filling Income Taxes As A NewcomerDokumen9 halamanA Guide To Filling Income Taxes As A NewcomerpsicologothBelum ada peringkat

- Advance I Ch-IDokumen63 halamanAdvance I Ch-IUtban Ashab100% (1)

- Formula Sheet: Income Tax Rates 2012/13Dokumen6 halamanFormula Sheet: Income Tax Rates 2012/13scribbyscribBelum ada peringkat

- Benefits in The Netherlands: How Do Benefits Work?Dokumen10 halamanBenefits in The Netherlands: How Do Benefits Work?Ananto Yusuf WBelum ada peringkat

- 7 Reasons to Become an Income Investor: Financial Freedom, #214Dari Everand7 Reasons to Become an Income Investor: Financial Freedom, #214Belum ada peringkat

- Tax On Individuals Tax Rate:: Premium Payments On Health And/or Hospitalization Insurance Not To Exceed 2,400Dokumen1 halamanTax On Individuals Tax Rate:: Premium Payments On Health And/or Hospitalization Insurance Not To Exceed 2,400arloBelum ada peringkat

- Freelance Guide Americas SBDCDokumen42 halamanFreelance Guide Americas SBDCPrince TognizinBelum ada peringkat

- Annual Gross IncomeDokumen4 halamanAnnual Gross IncomeMarilyn Perez OlañoBelum ada peringkat

- F1040es 2018Dokumen18 halamanF1040es 2018diversified1Belum ada peringkat

- 101 Ways to Save Money on Your Tax - Legally! 2017-2018Dari Everand101 Ways to Save Money on Your Tax - Legally! 2017-2018Belum ada peringkat

- Tax Minimization PlanDokumen87 halamanTax Minimization Plan918JJonesBelum ada peringkat

- Your RRSP Contribution LimitDokumen15 halamanYour RRSP Contribution LimitMadia AbdelrahmanBelum ada peringkat

- Year-Round Tax Saving Tips: Vow To Be More EfficientDokumen4 halamanYear-Round Tax Saving Tips: Vow To Be More EfficientSrinivas ThoutaBelum ada peringkat

- Advance I Ch-IDokumen61 halamanAdvance I Ch-IBamlak WenduBelum ada peringkat

- Tax Data Card 30 June 2014Dokumen9 halamanTax Data Card 30 June 2014api-300877373Belum ada peringkat

- Business Financial Plan1Dokumen6 halamanBusiness Financial Plan1Daivick BhaskarBelum ada peringkat

- TestiDokumen1 halamanTestiTjun HuongBelum ada peringkat

- Istilah Cukai Sering KaliDokumen14 halamanIstilah Cukai Sering KaliLydia Mohammad SarkawiBelum ada peringkat

- Financial PlanDokumen4 halamanFinancial Planapi-338264607Belum ada peringkat

- Types of SelfDokumen8 halamanTypes of SelfcoolmdBelum ada peringkat

- Companies - Business Databases by Category - LibGuides at MIT LibrariesDokumen7 halamanCompanies - Business Databases by Category - LibGuides at MIT LibrariesBenBelum ada peringkat

- Articles - Business Databases by Category - LibGuides at MIT LibrariesDokumen3 halamanArticles - Business Databases by Category - LibGuides at MIT LibrariesBenBelum ada peringkat

- Test PDFDokumen1 halamanTest PDFBenBelum ada peringkat

- Analyst Reports - Business Databases by Category - LibGuides at MIT LibrariesDokumen3 halamanAnalyst Reports - Business Databases by Category - LibGuides at MIT LibrariesBenBelum ada peringkat

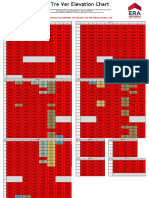

- The Tre Ver EChart-Updated 24th Feb 2020 PDFDokumen1 halamanThe Tre Ver EChart-Updated 24th Feb 2020 PDFBenBelum ada peringkat

- Stay Current - Business Resources - LibGuides at MIT LibrariesDokumen7 halamanStay Current - Business Resources - LibGuides at MIT LibrariesBenBelum ada peringkat

- The Tre Ver EChart-Updated 24th Feb 2020Dokumen1 halamanThe Tre Ver EChart-Updated 24th Feb 2020BenBelum ada peringkat

- One-Page Paper (Buffett)Dokumen2 halamanOne-Page Paper (Buffett)BenBelum ada peringkat

- WSJ Earnings Wizardry ArticleDokumen1 halamanWSJ Earnings Wizardry ArticleBenBelum ada peringkat

- NYU Dividend Growth ModelDokumen20 halamanNYU Dividend Growth ModelBenBelum ada peringkat

- IB235 2013 OutlineDokumen13 halamanIB235 2013 OutlineBenBelum ada peringkat

- NYU Dividend Growth ModelDokumen20 halamanNYU Dividend Growth ModelBenBelum ada peringkat

- Student's T Distribution: Statistical Tables QAM 2013-14Dokumen3 halamanStudent's T Distribution: Statistical Tables QAM 2013-14BenBelum ada peringkat

- American Chemical Corporation: Financial Analysis: June 2010Dokumen9 halamanAmerican Chemical Corporation: Financial Analysis: June 2010BenBelum ada peringkat

- NPV and Payback Capital Appraisal MethodsDokumen1 halamanNPV and Payback Capital Appraisal MethodsBenBelum ada peringkat