Solution Question in LMS

Diunggah oleh

VMROHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Solution Question in LMS

Diunggah oleh

VMROHak Cipta:

Format Tersedia

Preparation of consolidated financial statements using the worksheet

method

Solution

(a)

$

Book value of net assets of Entity B

350 000(1)

Add: Increase in equipment to fair value

40 000(2)

Less: Deferred tax liability

revaluation of equipment

(12 000)(3)

Fair value of net assets of Entity B

378 000

(1)

The book value of the net assets of Entity B is derived from the book value of its equity (issued

capital + retained earnings) at acquisition ($250 000 + $100 000)

(2)

The increase in the equipment to fair value is calculated as fair value less book value ($120 000 $80 000)

(3)

Calculated as 30 per cent of the increase in equipment to fair value ($40 000 * .30)

(b)

The goodwill on consolidation would be calculated as follows:

$

Consideration transferred

500 000

Less: Fair value of identifiable net assets (1)

378 000

Goodwill

122 000

(1)

Calculated in part (a) above.

Visit KnowledgEquity.com.au for practice questions,

videos, case studies and support for your CPA studies

KNOWLEDGEQUITY 2015

Preparation of consolidated financial statements using the worksheet

method

(c)

The consolidation worksheet entries for 30 June 2015 would be as follows:

(1) Revaluation of plant to fair value

Accumulated depreciation(1)

20 000

Equipment(2)

20 000

(1)

(2)

(3)

Business combinations reserve

28 000

Deferred tax liability(3)

12 000

Accumulated depreciation adjustment / consolidation entry is reversing the accumulated

depreciation previously recognised by Entity B.

The increase in equipment on revaluation is calculated as the net increase in the value of the

equipment ($40 000 [being $120 000 fair value less $80 000 book value] less $20 000

[reversal of accumulated depreciation] = $20 000).

Deferred tax liability is calculated as 30 per cent of the increase in value of the equipment

($40 000 * 30%).

(2) Depreciation entry and associated tax effect

Depreciation expense

8000

Accumulated depreciation

8000

(Calculated as difference in carrying value between Entity A and Entity B for the equipment divided

by 5 years [the useful life of the equipment] $40 000 / 5 = $8000).

Deferred tax liability

2400

Income tax expense

2400

(Calculated as 30 per cent of the depreciation expense adjustment above)

(3) Pre-acquisition elimination entry:

Issued capital

250 000

Retained earnings

100 000

Business combination reserve

28 000

Goodwill

122 000

Investment in Entity B

500 000

Visit KnowledgEquity.com.au for practice questions,

videos, case studies and support for your CPA studies

KNOWLEDGEQUITY 2015

Preparation of consolidated financial statements using the worksheet

method

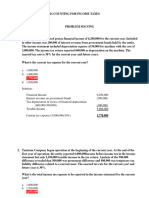

The following worksheet illustrates the pre-acquisition elimination entries required.

Account

Entity A Ltd

Entity B Ltd

Adjustments

DR

Statement of financial performance

Depreciation

expense

Income tax

expense

Statement of financial position

Issued capital 400 000

Retained

200 000

earnings

600 000

Equipment

Accumulated

depreciation

Other net

100 000

assets

Investment in 500 000

Entity B

Goodwill

Deferred tax

liability

Business

combinations

reserve

600 000

Consolidated

financial

statements

CR

8000

8000

2400

2400

250 000

100 000

250 000

100 000

400 000

200 000

350 000

100 000

(20 000)

20 000

20 000

600 000

120 000

(8000)

8000

270 000

350 000

370 000

500 000(3)

122 000

2400

12 000

122 000

(9600)

28 000

28 000

550 400

550 400

Visit KnowledgEquity.com.au for practice questions,

videos, case studies and support for your CPA studies

KNOWLEDGEQUITY 2015

Anda mungkin juga menyukai

- ACT150 Assignment DIMAAMPAODokumen4 halamanACT150 Assignment DIMAAMPAOJeromeBelum ada peringkat

- Exercises IAS 8 SolutionDokumen5 halamanExercises IAS 8 SolutionLê Xuân HồBelum ada peringkat

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDokumen13 halamanTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresBelum ada peringkat

- EXAMPLE 12.1 (Current Tax Liability)Dokumen8 halamanEXAMPLE 12.1 (Current Tax Liability)KaiWenNgBelum ada peringkat

- AnswersDokumen8 halamanAnswersTareq ChowdhuryBelum ada peringkat

- HI5020 Tutorial Question Assignment T3 2020 FinalDokumen7 halamanHI5020 Tutorial Question Assignment T3 2020 FinalAamirBelum ada peringkat

- T01 - Income Tax QuestionsDokumen7 halamanT01 - Income Tax QuestionsLijing CheBelum ada peringkat

- Answers To Week 1 HomeworkDokumen6 halamanAnswers To Week 1 Homeworkmzvette234Belum ada peringkat

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDokumen4 halamanSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- ACC108 - Tutorial 13-14Dokumen40 halamanACC108 - Tutorial 13-14Shivati Singh KahlonBelum ada peringkat

- Seminar 12.2 Outline - Auditing of Group Financial Statements IIDokumen6 halamanSeminar 12.2 Outline - Auditing of Group Financial Statements IIJasmine TayBelum ada peringkat

- 01 Audit of Income Tax Exercise SetDokumen2 halaman01 Audit of Income Tax Exercise SetBecky GonzagaBelum ada peringkat

- Financial Statements PreparationDokumen6 halamanFinancial Statements Preparationana lopezBelum ada peringkat

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Dokumen14 halamanLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyBelum ada peringkat

- Quiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3Dokumen3 halamanQuiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3kanroji1923Belum ada peringkat

- Solutions Chapter 23Dokumen11 halamanSolutions Chapter 23Avi SeligBelum ada peringkat

- Problems Accouting For Deferred Taxes Webinar ReoDokumen7 halamanProblems Accouting For Deferred Taxes Webinar ReocrookshanksBelum ada peringkat

- 06 Taxation - Deferred s20 Final-1Dokumen44 halaman06 Taxation - Deferred s20 Final-150902849Belum ada peringkat

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDokumen5 halamanSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotBelum ada peringkat

- Financial Accounting ProjectDokumen9 halamanFinancial Accounting ProjectL.a. LadoresBelum ada peringkat

- Income Statement: Format: Single Step: List All Revenues and SubtotalDokumen2 halamanIncome Statement: Format: Single Step: List All Revenues and SubtotalRabia RabiaBelum ada peringkat

- Mpu3123 Titas c2Dokumen36 halamanMpu3123 Titas c2Beatrice Tan100% (2)

- Answers Quiz Chapter 4Dokumen4 halamanAnswers Quiz Chapter 4Anthony MartinezBelum ada peringkat

- Activity 1 Calculations Using The Tax-Payable MethodDokumen10 halamanActivity 1 Calculations Using The Tax-Payable MethodJohn TomBelum ada peringkat

- CFS Company Has The Following Details For Two-Year Period, 2019 and 2018Dokumen7 halamanCFS Company Has The Following Details For Two-Year Period, 2019 and 2018MiconBelum ada peringkat

- Faisal WorksheetDokumen5 halamanFaisal WorksheetAbdul MateenBelum ada peringkat

- Accounting CycleDokumen5 halamanAccounting Cycleruth san jose100% (1)

- Chapter #1 Tutorial Class: Faculty of Economics and Administration Accounting Department ACCT 117Dokumen47 halamanChapter #1 Tutorial Class: Faculty of Economics and Administration Accounting Department ACCT 117hazem 00Belum ada peringkat

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDokumen10 halamanFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaBelum ada peringkat

- Exercises cms-3: 1. ABC Corporation Has Developed The Following Standards For One of Its ProductsDokumen2 halamanExercises cms-3: 1. ABC Corporation Has Developed The Following Standards For One of Its ProductsThaa Manitha DinataBelum ada peringkat

- Practice QuestionsDokumen19 halamanPractice QuestionsAbdul Qayyum Qayyum0% (2)

- Sample Financial Management ProblemsDokumen8 halamanSample Financial Management ProblemsJasper Andrew AdjaraniBelum ada peringkat

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDokumen7 halamanAccounting For Managers (Assignment One (E-Finance) ) Question OnehananBelum ada peringkat

- Interim Financial Reporting and Operating Segment Discussion Problems and Answer KeyDokumen4 halamanInterim Financial Reporting and Operating Segment Discussion Problems and Answer Keyprincess QBelum ada peringkat

- Income TaxesDokumen3 halamanIncome TaxesCENTENO, JOAN R.Belum ada peringkat

- F7 - IPRO - Mock 1 - AnswersDokumen14 halamanF7 - IPRO - Mock 1 - AnswerspavishneBelum ada peringkat

- Solutions Ch07Dokumen15 halamanSolutions Ch07KyleBelum ada peringkat

- Interim Financial ReportingDokumen4 halamanInterim Financial Reportingbelle crisBelum ada peringkat

- Section 9-4 QADokumen3 halamanSection 9-4 QAZeinab MohamadBelum ada peringkat

- Handsout 06 Chap 03 Part 02Dokumen4 halamanHandsout 06 Chap 03 Part 02Shane VeiraBelum ada peringkat

- p1 Quiz With TheoryDokumen16 halamanp1 Quiz With TheoryRica RegorisBelum ada peringkat

- Solution - Accounting For Income TaxesDokumen12 halamanSolution - Accounting For Income TaxesKlarissemay MontallanaBelum ada peringkat

- Soal Acc Income TaxDokumen2 halamanSoal Acc Income TaxVidya IntaniBelum ada peringkat

- Chapter 18 Govt GrantsDokumen6 halamanChapter 18 Govt Grantsrobinady dollaga100% (2)

- Assignment 6Dokumen8 halamanAssignment 6Muhammad AdilBelum ada peringkat

- Unit 1 - Essay QuestionsDokumen7 halamanUnit 1 - Essay QuestionsJaijuBelum ada peringkat

- Activity 3 CAMINGAWAN BSMA 2B PDFDokumen7 halamanActivity 3 CAMINGAWAN BSMA 2B PDFMiconBelum ada peringkat

- SolutionQuestionnaireUNIT 3 - 2020Dokumen5 halamanSolutionQuestionnaireUNIT 3 - 2020LiBelum ada peringkat

- Additional (Accelerated) Depreciation: Illustration PageDokumen4 halamanAdditional (Accelerated) Depreciation: Illustration PageAmer Wagdy GergesBelum ada peringkat

- Review Problems AnswersDokumen4 halamanReview Problems AnswersFranchette Yvonne JulianBelum ada peringkat

- IAS 12: Practice Questions AnswersDokumen8 halamanIAS 12: Practice Questions AnswersTaffy Isheanesu BgoniBelum ada peringkat

- 1) Answer Any Five Question From The Following .Each Question Carries Two MarksDokumen14 halaman1) Answer Any Five Question From The Following .Each Question Carries Two Marksmanasa k pBelum ada peringkat

- Thor Semiconductor Is An Exporter of Transistors To The United StatesDokumen6 halamanThor Semiconductor Is An Exporter of Transistors To The United StatesSophia KeratinBelum ada peringkat

- Chapter 18 CompilationDokumen21 halamanChapter 18 CompilationMaria Licuanan0% (1)

- Acct6005 Company Accounting: Assessment 2 Case StudyDokumen8 halamanAcct6005 Company Accounting: Assessment 2 Case StudyRuhan SinghBelum ada peringkat

- Chapter 11 Advacc 1 DayagDokumen17 halamanChapter 11 Advacc 1 Dayagchangevela67% (6)

- Final Exam Review QuestionsDokumen16 halamanFinal Exam Review QuestionsAj201819Belum ada peringkat

- Sol. Man. Chapter 4 Partnership Liquidation 2020 EditionDokumen30 halamanSol. Man. Chapter 4 Partnership Liquidation 2020 EditionJennifer RelosoBelum ada peringkat

- IFRS Week 6Dokumen4 halamanIFRS Week 6AleksandraBelum ada peringkat

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDari EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsBelum ada peringkat

- Skene Albanians 1850Dokumen24 halamanSkene Albanians 1850VMROBelum ada peringkat

- 2006 018 389.01.02 People To People Actions JSPFDokumen16 halaman2006 018 389.01.02 People To People Actions JSPFVMROBelum ada peringkat

- 2014 1st Place in Teaching History March 2015 0Dokumen6 halaman2014 1st Place in Teaching History March 2015 0VMROBelum ada peringkat

- New Balkan Politics The Balkan Muslim Di PDFDokumen12 halamanNew Balkan Politics The Balkan Muslim Di PDFVMROBelum ada peringkat

- Whose Language? Exploring The Attitudes of Bulgaria's Media Elite Toward Macedonia's Linguistic Self-IdentificationDokumen22 halamanWhose Language? Exploring The Attitudes of Bulgaria's Media Elite Toward Macedonia's Linguistic Self-IdentificationVMROBelum ada peringkat

- Jane SandanskiDokumen1 halamanJane SandanskiVMROBelum ada peringkat

- A Return To SocratesDokumen3 halamanA Return To SocratesVMROBelum ada peringkat

- MacedoniaPoliticsofEthnicityandConflict PDFDokumen21 halamanMacedoniaPoliticsofEthnicityandConflict PDFVMROBelum ada peringkat

- Declassified DocumentsDokumen340 halamanDeclassified DocumentsVMROBelum ada peringkat

- TermsDokumen7 halamanTermsVMROBelum ada peringkat

- NooseaDokumen166 halamanNooseaVMROBelum ada peringkat

- MinorityDokumen13 halamanMinorityVMROBelum ada peringkat

- SorosDokumen59 halamanSorosVMROBelum ada peringkat

- Xero AnnualDokumen66 halamanXero AnnualVMROBelum ada peringkat

- 01 GrigorievaDokumen9 halaman01 GrigorievaVMROBelum ada peringkat

- This Is The Published VersionDokumen12 halamanThis Is The Published VersionVMROBelum ada peringkat

- Albanian Grammar: Studies On Albanian and Other Balkan Language by Victor A. Friedman Peja: Dukagjini. 2004Dokumen17 halamanAlbanian Grammar: Studies On Albanian and Other Balkan Language by Victor A. Friedman Peja: Dukagjini. 2004RaulySilvaBelum ada peringkat

- Macedonia, The Lung of Greece Fighting An Uphill Battle BlackDokumen29 halamanMacedonia, The Lung of Greece Fighting An Uphill Battle BlackVMROBelum ada peringkat

- Lecture Text May 18, 2008Dokumen11 halamanLecture Text May 18, 2008VMROBelum ada peringkat

- Panslavism PDFDokumen109 halamanPanslavism PDFVMROBelum ada peringkat

- Generalsketchofp 00 InneuoftDokumen440 halamanGeneralsketchofp 00 InneuoftVMROBelum ada peringkat

- Warranty Card For Australia - EnglishDokumen3 halamanWarranty Card For Australia - EnglishVMROBelum ada peringkat

- The Tsars Loyal Greeks The Russian Diplo PDFDokumen15 halamanThe Tsars Loyal Greeks The Russian Diplo PDFVMROBelum ada peringkat

- MACEDONIADokumen4 halamanMACEDONIAVMROBelum ada peringkat

- Eastern EuropeDokumen1 halamanEastern EuropeVMROBelum ada peringkat

- Haemus 1 - 2012Dokumen240 halamanHaemus 1 - 2012Siniša KrznarBelum ada peringkat

- Make DonDokumen1 halamanMake DonVMROBelum ada peringkat

- MyLocker User Manual v1.0 (Mode 8)Dokumen18 halamanMyLocker User Manual v1.0 (Mode 8)gika12345Belum ada peringkat

- Macedonian MushroomsDokumen3 halamanMacedonian MushroomsVMROBelum ada peringkat

- Possession Demand LetterDokumen4 halamanPossession Demand LetterVileshBelum ada peringkat

- PdataDokumen6 halamanPdataRazor11111Belum ada peringkat

- Corporate Tax PlanningDokumen8 halamanCorporate Tax PlanningTumie Lets0% (1)

- Drucker Vs CommissionerDokumen1 halamanDrucker Vs CommissionerAthena SantosBelum ada peringkat

- Invoice: Sustaincert SaDokumen1 halamanInvoice: Sustaincert SaNorato XerindaBelum ada peringkat

- GST Invoice: Shubham Engineering Works - (2019-20)Dokumen3 halamanGST Invoice: Shubham Engineering Works - (2019-20)vinodBelum ada peringkat

- GET - Indicative Compensation Details - B.TechsDokumen1 halamanGET - Indicative Compensation Details - B.Techskush 9031Belum ada peringkat

- Refund of IGST On Export of Goods PDFDokumen7 halamanRefund of IGST On Export of Goods PDFCA Rahul ModiBelum ada peringkat

- Sitel Philippines Corporation V CIR G.R. No 201326 - February 8, 2017 FactsDokumen2 halamanSitel Philippines Corporation V CIR G.R. No 201326 - February 8, 2017 FactsTicia Co So100% (3)

- Cir V. Pilipinas Shell Petroleum Facts:: Exemption Provided in Sec. 135 Attaches To The PetroleumDokumen5 halamanCir V. Pilipinas Shell Petroleum Facts:: Exemption Provided in Sec. 135 Attaches To The PetroleumDennis Aran Tupaz AbrilBelum ada peringkat

- 961028.CD FTH Brosura Pages 1 425Dokumen5 halaman961028.CD FTH Brosura Pages 1 425Luka VukicBelum ada peringkat

- Quiz #3Dokumen4 halamanQuiz #3Jenny BernardinoBelum ada peringkat

- Payslip 2022 2023 9 Inf0047318 ISSINDIADokumen1 halamanPayslip 2022 2023 9 Inf0047318 ISSINDIAManohar NMBelum ada peringkat

- Reen LawnsDokumen8 halamanReen LawnsAshish BhallaBelum ada peringkat

- 8 Sison Vs AnchetaDokumen1 halaman8 Sison Vs AnchetarjBelum ada peringkat

- AK Personal 1Dokumen13 halamanAK Personal 1erniBelum ada peringkat

- Service Description: Internet Access ServiceDokumen1 halamanService Description: Internet Access ServiceYatnaBelum ada peringkat

- Paseo Realty Vs Court of AppealsDokumen9 halamanPaseo Realty Vs Court of AppealsChristelle Ayn BaldosBelum ada peringkat

- Chapter 11Dokumen5 halamanChapter 11张心怡Belum ada peringkat

- Adyen Invoice BR202111001041.Company - Frubana BRDokumen2 halamanAdyen Invoice BR202111001041.Company - Frubana BRBruno Tescaro RomaBelum ada peringkat

- PPSC Lecturer Recruitment 2015 Math Mcqs For Lecturer Test 2015Dokumen7 halamanPPSC Lecturer Recruitment 2015 Math Mcqs For Lecturer Test 2015ALI ASGHERBelum ada peringkat

- Blinkit-Offer Letter-Yashas Nag. U!-SignedDokumen2 halamanBlinkit-Offer Letter-Yashas Nag. U!-Signedvijaybhaskar damireddy100% (1)

- Tax Invoice: Page 1 of 2Dokumen2 halamanTax Invoice: Page 1 of 2nirooBelum ada peringkat

- Topic 1 - Budget ConstraintsDokumen76 halamanTopic 1 - Budget ConstraintsAhmad MahmoodBelum ada peringkat

- Paystub TjmaxxDokumen1 halamanPaystub Tjmaxxyishii258000Belum ada peringkat

- Lladoc vs. CIR (G.R. No. L-19201 June 16, 1965) - H DIGESTDokumen1 halamanLladoc vs. CIR (G.R. No. L-19201 June 16, 1965) - H DIGESTHarleneBelum ada peringkat

- InvoiceDokumen1 halamanInvoiceLIBU GEORGE B 16PHD0594Belum ada peringkat

- Business Tax Laws in The PhilippinesDokumen12 halamanBusiness Tax Laws in The PhilippinesEthel Joi Manalac MendozaBelum ada peringkat

- Astha Nirman SewaDokumen3 halamanAstha Nirman SewaDibas BaniyaBelum ada peringkat

- eFPS Home - Efiling and Payment System AprilDokumen2 halamaneFPS Home - Efiling and Payment System AprilRenalynBelum ada peringkat