Internal Audit Report Re The CMH Asset Weaknesses PDF

Diunggah oleh

mikekvolpeJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Internal Audit Report Re The CMH Asset Weaknesses PDF

Diunggah oleh

mikekvolpeHak Cipta:

Format Tersedia

EFIDB.

9191/303

~ FannieMae.

Internal Audit Report

Portfolio Pooling

December 19, 2008

EXHIBIT

I

Internal Audit R49 2007

#1

Confidential - Restricted

+7

EF 10 B, 9 192/303

Objectives

To assess the adequacy and effectiveness of controls over portfolio pooling

Scope

We reviewed controls over the following;

We excluded the following, as they are covered in

other audits:

o Governance and oversight

o Trade designations (FAS 65)

0

MBS disclosures

0

MBS Pool Production edits

o Pool simulation & execution

o Trade entry for newly formed pools

0

PPAs on issued pools

o Post-purchase adjustments (PPA)

0

Buy-Up/Buy-Down price calculation

o Accounting for portfolio loan securitization

o Applications and EUCs

Period covered was April 2008 - September 2008, beginning after the new pooling system was implemented

Conclusion

ICQntrol~ Require Improvement

The legacy pooling system was replaced in April 2008 by the Collateral Management and Hedging (CMH)

application. CMH resolved several prior limitations and provided greater flexibility to manage the whole loan

portfolio. While CMH provided functionality to designate new loans for pooling in a future period, there is still $137

billion of loans that were in inventory prior to implementation that cannot be pooled. In addition, CMH does not

currently have the functionality needed to pool approximately $171 billion of multifamily, adjustable rate, and

reverse mortgages. The aforementioned system limitations prevent Fannie Mae from fully leveraging whole loan

assets for liquidity, revenue, or to manage the size and composition of the portfolio.

System weaknesses were also noted with the three primary pooling applications including inadequate segregation

of duties, excessive user access, and a lack of monitoring.

Deficiencies with reconciliations and documentation were also identified. The following pages summarize control

weaknesses noted during our review.

Portfolio Pooling - 12/19/2008

Confidential - Restricted

EF 10 B. 9 193/303

Portfolio pooling securitizes loans from the

portfolio into Mortgage-Backed Securities.

Pooling volumes peaked in Q2 due to

increased functionality, favorable market

conditions, and lender anticipation of a

pricing adjustment. They leveled off in Q3,

with a notable increase in September

correlated to a large deal and efforts to

infuse the market with liquidity (see below).

Portfolio pooling is important because it is

used to manage the portfolio, provide

liquidity, and generate income while

continuing to fulfill the mission of providing

housing

finance

liquidity through

the

purchase of loans from lenders.

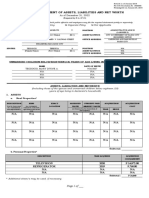

Whole Loan Inventory after Stock Project

(Millions as of 10/31/2008)

Reverse, $39,051, 11%l

Non-Fixed, $21,15:, 6"hl

.<'

SOP-03-3, $3,341, 1 '"~ ... \

Held Over Month End,

/.': .

$293, 0%

- , ."

Ineligible, $52,982, 15%

SF Poolable. 5137,471,

Portfolio Pooling Volumes

by Settlement Month

:;

~

;;:

::>

$5.0

$4.5

$4.0

$3.5

$3.0

$2.5

$2.0

$1.5

$1.0

$0.5

$-

37%

Source: Capilal Markets Business Initiatives

180

160

140

I!B:v"~+ 120

100

80

60

40

20

I .. I .. 1'1 - I - I '" I M 1 M 1 111 1 1M 'rM! 1 8 I ... ~

Ocl- Nov- Dec- Jan- Fell- Ivllr Apr- May- .l,m- .lJ1- Aug- Sep- Ocl07 07 07 08 08 08 08 08 08 08 08 08 08

IiiliiiiI Unpaid Principal Balance (UPB) - - Number of Pools I

~

:;;

;;

.0

:z

CMH, implemented in April 2008, provides better

information and greater flexibility to effectively

manage the mortgage loan collateral inventory

and to pool eligible loans for MBS securitization.

Functionality was expanded in 2008 to include

jumbo loans, balloon loans, and some high

balance loans.

Further enhancements are

scheduled for Q1

2009 that will provide

functionality to pool $137 billion of SF loans in

inventory ["Stock"). However, functionality has not

been implemented to pool approximately $171

billion of loans consisting primarily of MF whole

loans, reverse mortgages and adjustable-rate

mortgages (see above).

Source: Capitol M::Hkets lv'or1gage Asset Trading

Porttollo Pooling - 12/19/2008

Confidential - Restricted

EF ID B. 9 194/303

Issue

1.

Observation

Responsibility

Implementation

Timing

CMH only provides functionality to poolli.x~d-rote slngle-fqmlly loans, limiting management's abBity to pool other loan

products for liquidity or tor management at th~ size and composition of the whole loan portfolio.

While the implementation of CMH

corrected many lImitations, It does not

have the functionality to pool eligible

loans in inventory prior to

implementation ("stock" J nor to pool

non-single family fixed-rate products.

There were approximately $308 billion

of eligible assets in the portfolio as of

Oclober 31. 2008, that could not be

pooled. Without this funclionality, these

assets cannot be used for liquidity

purposes or to capitalize on favorable

market opportunities.

2.

Management Corrective Actions

Development efforts are currently underway,

management will complete implementatlon of

system functionality to pool eligible fixed-rate

stock loans.

Ramon

Decastro

March 31. 2009

Management will use the Strategic Initiative

Benefit Assessment (SIBA) template to submit a

business case to expand product eligibility for

multifamily, ARM, and reverse mortgages.

Ramon

Decastro

April 1, 2009

Excesslye functlongllty

Porttollo Pooling - 12/1 9/2008

HIGH

Plans to expand product eligibility to include

ARMS are already monitored as an FHFA open

deficiencv.

System controls are no! adequote to ensure se~regatlon of duties and appropriate user access.

There are no controls that prevent the

use of certain off-the-shelf CMH

functionality that should not be used.

Prohibited functions were not

deactivated through customizations,

rather management documented user

instructions that mandate restrictions on

these functions. One function. the reuse of temporary pool numbers, was

used and resulted in the omission of a

pool from the accounting system.

Without preventive or detective

controls there may be incomplete or

erroneous data in the pooling and

downstream applications.

Priority

Management reviewed all prohibited functions,

determined risk, and appropriately identified

mitigating controls for all but one prohibited

function, the re-use of temporary pool numbers.

The vendor, CMH, has provided a fix which is

currently being tested and will then be

implemented.

Confidential - Restricted

Don Palumbo

MEDIUM

January 9. 2009

EF 10 B. 9 195/303

Issue / Observation

2,

System controls are not adequate

Management Corrective Actions

tqensur~ segrel:lCJtlon

Excessive user access

.\..f,i~, .

'l!~>r~~,)'\'

. ;.ir~".l.;t,.

i

;' f

l, "~

.'., '.,:f

Assigned roles in CMH grant excessive

user access, One-third of users are

System Administrators, four have an

undocumented role, and two business

support personnel have Super Trader

access. Unauthorized changes could

occur if privileges are inconsistent with

business responsibilities,

19ck of secreaatlon of duties

Production support for CMH-LA (the

accounting application) is performed

by a single development team

member. This results in key person

dependency and a lack of segregation

between development and

production.

Uomonl!gred user gctlvlty

Activity in the FAS65 production

database is logged but not monitored

by the Central Monitoring team ICMT).

FAS 65 is a financial reporting

application that provides trade

designations. Unauthorized changes to

production data may not be detected

if activity is not monitored.

Unrevlewed user access

An access review for CMH-LA, a

financial reporting application, was not

conducted for 02 and 03 2008.

Unauthorized changes could occur if

users have Inappropriate access.

Portfolio Pooling - 12/19/2008

Responsibility

Implementation

TIming

MEDIUM

of duties and appropriate uSer access (continued).

All roles will be documented in the roles matrix

and user manual, business and suppori roles will

be segregated, and System Administrator access

will be limited based on business need.

Don Palumbo

February 27, 2009

The developer wiU train and fully transition

production support to the Structured Transaction

Technology production support team.

Monte Shapiro

January 31, 2009

Management will establish monitoring

requirements and enable monitoring by the

CMT.

Monte Shapiro

The business application owner wiU perform

quarterly user access reviews.

Don Palumbo

The technology application owner will perform

quarterly user access reviews.

Monte Shapiro

Confidential - Restricted

Priority

SOX

ILOW)

January 31,2009

SOX

(LOW)

January 31, 2009

SOX

(LOW)

January 31, 2009

EF 10 B. 9 196/303

Issue / Observation

3.

Management Corrective Actions

Responsibility

Implementation

Timing

Pooling reconciliations are not executed timely or documented consistently, Increasing the risk that Intended actions are not

qccurately capt!JJeq III dqwnstream systems.

Inconsistent documentation

The reconciliation between the pooling

application and the trader's record of

pooled loans is not executed and

documented consistently. There were

multiple versions of one reconciliation

and uninvestigated discrepancies. If

discrepancies are not resolved prior to

the intended pooling date, the pool

may not be formed resulting in lost

revenue. Loans will however, remain

eligible for pooling at a sUbsequent

date. Reconciliations were also saved

on local hard drives increasing the risk

of data loss if files are not backed up.

UntimelY reconciliation

The reconciliation between the trader's

intended designation enlered in CMH

and the finallrode designation in the

FAS65 system occurs 22 days after

monlh-end. While the accounting

treatment will accurately reflect lhe

designalion in lhe system of record

(FAS65), it may not refleel the trader's

intent to retain loans based on a review

of lhe underlying economics.

Portfolio Pooling - 12/1 't /2008

Management will maintain evidence of the

reconciliations and discrepancy resolution on a

centralized SherePoint site.

Laura Simmons

April 1, 2009

An automated e-mail message will be sent with

high priority to Technology Production Support to

address re-designotion interface failures

Don Palumbo

March 31. 2009

Confidential - Restricted

Priority

lOW

EFIDB.9197/303

Issue / Observation

4.

Prlc:ln~

c:lotq Is not looded timely, potentlqlly

There is no control to ensure that the

most current buy up/buy down pricing

grid is loaded into the pooling

application. The appropriate grid was

not in the system archive for two of the

three months reviewed. Best execution

will not be achieved if pricing grids are

not loaded timely and there is a

material move in the markeL It is likely

however, that material anomalies

would be identified by the trader.

5.

Management Corrective Actions

Impoctln~

Responsibility

Implementation

Timing

LOW

PQoHn'! decisions.

Management will independently verify the

manual upload of the monthly pricing grid.

Steve Shen

January 12,2009

Certqllll?9rtlQI19 P9()III'l~q()~Umlilnt9tJ0I1IS,JIl5\-1mElen!, r~~~ltJl'lg In thl!! pqtentlql !qr Inconsl~ent cqntrol ~rfon"qnce.

IDcom plet\:! procedures

Complete trade reposition and update PFP

Middle Office procedures in compliance with

the corporate framework.

Laura Simmons

April 1, 2009

Complete monitoring unpooled, unpaid

principal balance and update PFP Pool

Simulation & Closed Pool Submission procedures

in compliance with the corporate framework

and to reftect the ability to hold over month end.

Steve Shen

April 1, 2009

Also, three procedures are not fully

compliant with the corporate

framework.

Complete the Single Family Operations PFP CMH

LA JE Reconciliation procedure in compliance

with the coroorate procedure framework.

Terri Messina

April 1, 2009

Incompl\:!te doclJm\:!ntgtion trail

Management will enhance procedures and

comply with new evidence and retention

reqUirements outlined.

Don Palumbo

April 1,2009

Procedures are not documented for:

0

Trode repositions,

Monitoring unpooled, unpaid

principal balances, and

The ability to hold held-for-sale

loans over month end.

There is unclear and inconsistent

documentation retained to support the

linkage between Post Purchase

Adjustment (PPA) identification,

analysis, and resolution. Erroneous

pooling decisions could occur if a

relevont PPA is nof resolved in CMH.

Porttollo Pooling - 12/1 9/2008

Confidential - Restricted

Priority

LOW

EF 10 B. 9 198/303

Addressees

Ramon Decastro, Senior Vice President, Capital Markets Mortgage Trading

Audit Director

Leah Malcolm Skrine

li,!

\1\tJ(~~

~i,,;

~ r'.,,'.iJ

''''~~I~

~; "~,:

r, ()'.; 'C;.;" ,

It ';"""' ..

,: (if 't.~ ,tj

Distribution

Herb Allison

David Benson

Gary Friend

David M. Johnson

Linda Knight

Curtis Lu

Theresa Messina

Don Palumbo

Bill Senhauser

Monte Shapiro

Michael Shaw

Steve Shen

Laura Simmons

Jacquie Wagner

Mike Williams

Deloitte & Touche

FHFA

Internal Audit Team

Anandhi Ananthanarayanan

Aliso Davis

David Fourney

Mary Ann Gebhard

Mike Li

Peter stoyas

Mythili Vandara

Nicole Wade

Portfolio Pooling - 12/19/2008

Confidential - Restricted

Anda mungkin juga menyukai

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementDari EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementBelum ada peringkat

- United States General Accounting Office Washington, DC 20548Dokumen28 halamanUnited States General Accounting Office Washington, DC 20548Hawera SolomonBelum ada peringkat

- Earnings Management and Earnings QualityDokumen23 halamanEarnings Management and Earnings QualityZa HanfiBelum ada peringkat

- #$%& &'# (M $") # M) 'M) ", $#&$M &-$M $ M '.$ $' : M M M MMM !!Dokumen12 halaman#$%& &'# (M $") # M) 'M) ", $#&$M &-$M $ M '.$ $' : M M M MMM !!Mehmood Zubair WarraichBelum ada peringkat

- Audit Videos by Blair Cook. Here Is The Link: Doc /archives/edgar/data/34088/000003408821000012/xom-20201231.htmDokumen5 halamanAudit Videos by Blair Cook. Here Is The Link: Doc /archives/edgar/data/34088/000003408821000012/xom-20201231.htmJackson TooBelum ada peringkat

- Earnings Management and Earnings Quality (2010)Dokumen56 halamanEarnings Management and Earnings Quality (2010)Spread LoveBelum ada peringkat

- Auditing and Assurance Services Understanding The Integrated Audit 1St Edition Hooks Solutions Manual Full Chapter PDFDokumen34 halamanAuditing and Assurance Services Understanding The Integrated Audit 1St Edition Hooks Solutions Manual Full Chapter PDFindicterpointingzbqg2100% (12)

- Chapter 11 - Equity Analysis and Valuation: Adjusting Financial Statements and Earnings PersistenceDokumen3 halamanChapter 11 - Equity Analysis and Valuation: Adjusting Financial Statements and Earnings PersistenceEchiBelum ada peringkat

- Chapter 11 - Equity Analysis and ValuationDokumen3 halamanChapter 11 - Equity Analysis and ValuationEchiBelum ada peringkat

- Chapter 1 Management Control SystemDokumen27 halamanChapter 1 Management Control SystemAndi IswoyoBelum ada peringkat

- Latihan Soal Audit Internal Bab 8 PDFDokumen3 halamanLatihan Soal Audit Internal Bab 8 PDFari100% (1)

- Chapter 1Dokumen14 halamanChapter 1syed ehsan aliBelum ada peringkat

- Top 10 Tips for Impairment TestingDokumen13 halamanTop 10 Tips for Impairment TestingTindo MoyoBelum ada peringkat

- Advanced Accounting Hoyle 12th Edition Solutions ManualDokumen33 halamanAdvanced Accounting Hoyle 12th Edition Solutions ManualBrentBrowncgwzm100% (89)

- 6f GLA LedgerDokumen16 halaman6f GLA LedgerRheann Marie BugtongBelum ada peringkat

- FA Unit 2 MaterialDokumen58 halamanFA Unit 2 MaterialKeerthanaBelum ada peringkat

- Advanced Accounting 9th Edition Hoyle Solutions ManualDokumen33 halamanAdvanced Accounting 9th Edition Hoyle Solutions Manualcemeteryliana.9afku100% (22)

- All Year RTP AuditDokumen564 halamanAll Year RTP AuditShivam ChaudharyBelum ada peringkat

- Auditing & Assurance Services II-UBAF2144/UKAF 2124 Audit Risk and MaterialityDokumen10 halamanAuditing & Assurance Services II-UBAF2144/UKAF 2124 Audit Risk and Materialitycynthiama7777Belum ada peringkat

- Advanced Accounting 13th Edition Hoyle Solutions ManualDokumen32 halamanAdvanced Accounting 13th Edition Hoyle Solutions ManualKatieElliswcze100% (35)

- Solution Manual Contemporary Issues in Accounting 1st Edition by Michaela Rankin slw1027 PDF FreeDokumen46 halamanSolution Manual Contemporary Issues in Accounting 1st Edition by Michaela Rankin slw1027 PDF Free--bolabola100% (1)

- Bellamy Corp Audit Report AnalysisDokumen7 halamanBellamy Corp Audit Report AnalysisRafaelius Ary Surya SaputraBelum ada peringkat

- Capítulo 13 de Auditoría para TraducirDokumen7 halamanCapítulo 13 de Auditoría para TraducirKatherine_Alde_2297Belum ada peringkat

- Global Trends in Investment Operations OutsourcingDokumen9 halamanGlobal Trends in Investment Operations OutsourcingCognizantBelum ada peringkat

- Warehouse AuditDokumen2 halamanWarehouse AuditBob ForeverBelum ada peringkat

- Debt Restructuring & Rehabilitation Policy for SMEsDokumen36 halamanDebt Restructuring & Rehabilitation Policy for SMEsSagar WelekarBelum ada peringkat

- CH 3 - The Statement of Financial Position and Financial DisclosuresDokumen37 halamanCH 3 - The Statement of Financial Position and Financial DisclosuresZulqarnain KhokharBelum ada peringkat

- Solution Manual Auditing and Assurance Services 13e by Arens Chapter 19 PDFDokumen20 halamanSolution Manual Auditing and Assurance Services 13e by Arens Chapter 19 PDFFlo 00yjBelum ada peringkat

- Solution Manual Auditing and Assurance Services 13e by Arens Chapter 19Dokumen20 halamanSolution Manual Auditing and Assurance Services 13e by Arens Chapter 19Bams Widodo100% (3)

- Internal control and accounting systemsDokumen29 halamanInternal control and accounting systemsdiegopoBelum ada peringkat

- GAM PresentationDokumen40 halamanGAM Presentationemdi19100% (1)

- New Questions in Study MaterialDokumen17 halamanNew Questions in Study MaterialVikram KumarBelum ada peringkat

- Project Initiation and Scope: Listing The Bank'S Pain PointsDokumen14 halamanProject Initiation and Scope: Listing The Bank'S Pain PointsEhsan AliBelum ada peringkat

- Advanced Accounting 10th Edition Hoyle Solutions ManualDokumen29 halamanAdvanced Accounting 10th Edition Hoyle Solutions Manualcliniqueafraidgfk1o100% (20)

- (Objective 1-1) : Ayu Safitri (1902113029) Auditing 1 Review Question CH 1, Page 18Dokumen3 halaman(Objective 1-1) : Ayu Safitri (1902113029) Auditing 1 Review Question CH 1, Page 18Ayu SafitriBelum ada peringkat

- AUE2602 E0LS05Topic8Dokumen7 halamanAUE2602 E0LS05Topic8Maapule MiganBelum ada peringkat

- 1A An Overview of Financial StatementsDokumen6 halaman1A An Overview of Financial StatementsKevin ChengBelum ada peringkat

- Analysis of Business CombinationsDokumen58 halamanAnalysis of Business Combinationstehsin123Belum ada peringkat

- Chapter 2 OutlineDokumen11 halamanChapter 2 OutlineMah NoorBelum ada peringkat

- Sarboox ScooterDokumen6 halamanSarboox ScooterNisa SuriantoBelum ada peringkat

- Project Finance Smart Task 3Dokumen13 halamanProject Finance Smart Task 3Abhishek KumarBelum ada peringkat

- 2009 A-2 Class NotesDokumen5 halaman2009 A-2 Class Notescome2sayBelum ada peringkat

- Dmp3e Ch02 Solutions 04.13.10 FinalDokumen56 halamanDmp3e Ch02 Solutions 04.13.10 Finalmichaelkwok1Belum ada peringkat

- Waste Management: A Focus On General Computing ControlsDokumen3 halamanWaste Management: A Focus On General Computing ControlsCryptic LollBelum ada peringkat

- ch02 SM RankinDokumen46 halamanch02 SM RankinDamien SmithBelum ada peringkat

- World Bank Project Financial Management GuidelinesDokumen156 halamanWorld Bank Project Financial Management GuidelinesInnocent Aryan60% (10)

- Fa4e SM Ch02Dokumen53 halamanFa4e SM Ch02michaelkwok1Belum ada peringkat

- Amendments in Ind AS Based On MCA Circular - Summary Notes - Bhavik ChokshiDokumen21 halamanAmendments in Ind AS Based On MCA Circular - Summary Notes - Bhavik Chokshitax SollutionsBelum ada peringkat

- Module 09Dokumen53 halamanModule 09samaanBelum ada peringkat

- Audit of InsuranceDokumen26 halamanAudit of Insuranceashokkeeli100% (1)

- Governance Chapter 15Dokumen5 halamanGovernance Chapter 15Niña Mae DiazBelum ada peringkat

- IASB Frawwork - NotesDokumen7 halamanIASB Frawwork - NotesAbdul MuneemBelum ada peringkat

- SM-08-new QQQQDokumen41 halamanSM-08-new QQQQpsbacloud100% (1)

- The Basic Activities in Glars:: U Ëc Invlvc Pingc C C Jrnalc Nric RMC A C IcDokumen6 halamanThe Basic Activities in Glars:: U Ëc Invlvc Pingc C C Jrnalc Nric RMC A C IcgatchanessBelum ada peringkat

- Sox Internal Controls ChecklistDokumen22 halamanSox Internal Controls Checklisttkannab100% (4)

- BJSS Case Study - Regulatory Compliance v1.0 (US)Dokumen8 halamanBJSS Case Study - Regulatory Compliance v1.0 (US)tabbforumBelum ada peringkat

- Case 5Dokumen5 halamanCase 5Pavan HegdeBelum ada peringkat

- Audit & Assurance: Suggested AnswersDokumen9 halamanAudit & Assurance: Suggested AnswersMuhammad HussainBelum ada peringkat

- Audit Fee Premium and Auditor Change - The Effect of Sarbanes-Oxley Act (Review)Dokumen3 halamanAudit Fee Premium and Auditor Change - The Effect of Sarbanes-Oxley Act (Review)Kharisma BaptiswanBelum ada peringkat

- Diegel V Arizona Department of Child Safety Azdce-21-02126 0001.0Dokumen7 halamanDiegel V Arizona Department of Child Safety Azdce-21-02126 0001.0mikekvolpe100% (2)

- Notice of AppealDokumen6 halamanNotice of AppealmikekvolpeBelum ada peringkat

- 3807 001Dokumen17 halaman3807 001mikekvolpeBelum ada peringkat

- Hpscan 20220215223900455 2022 02 15 224319742Dokumen17 halamanHpscan 20220215223900455 2022 02 15 224319742mikekvolpeBelum ada peringkat

- Marty's Supplemental Motion For RehearingDokumen13 halamanMarty's Supplemental Motion For RehearingmikekvolpeBelum ada peringkat

- Less C. Supplemental Mot To Dis Strike 120321Dokumen14 halamanLess C. Supplemental Mot To Dis Strike 120321mikekvolpeBelum ada peringkat

- Family Law Public Web - Print Register of ActionDokumen27 halamanFamily Law Public Web - Print Register of ActionmikekvolpeBelum ada peringkat

- Michael and Jennifer Brabson Preliminary ReportDokumen10 halamanMichael and Jennifer Brabson Preliminary ReportmikekvolpeBelum ada peringkat

- Brabson OrderDokumen3 halamanBrabson OrdermikekvolpeBelum ada peringkat

- Patsy AlcantarDokumen46 halamanPatsy AlcantarmikekvolpeBelum ada peringkat

- Case MPD-1600320Dokumen1 halamanCase MPD-1600320mikekvolpeBelum ada peringkat

- 21cvd709 Domestic BogerDokumen14 halaman21cvd709 Domestic BogermikekvolpeBelum ada peringkat

- Case Details For Court Case DAVIE 13CR050863: Defendant: Campbell, Timothy, Clayton Case InformationDokumen5 halamanCase Details For Court Case DAVIE 13CR050863: Defendant: Campbell, Timothy, Clayton Case InformationmikekvolpeBelum ada peringkat

- Additional Special Conditions ExistDokumen1 halamanAdditional Special Conditions ExistmikekvolpeBelum ada peringkat

- Foster-Morales Sockel-Stone, LLCDokumen23 halamanFoster-Morales Sockel-Stone, LLCmikekvolpeBelum ada peringkat

- Patsy AlcantarDokumen21 halamanPatsy AlcantarmikekvolpeBelum ada peringkat

- ForgeryDokumen3 halamanForgerymikekvolpeBelum ada peringkat

- Patsy AlcantarDokumen26 halamanPatsy AlcantarmikekvolpeBelum ada peringkat

- Laura Thomason - Petition For DamagesDokumen6 halamanLaura Thomason - Petition For DamagesmikekvolpeBelum ada peringkat

- HamiltonlawsuitDokumen23 halamanHamiltonlawsuitmikekvolpeBelum ada peringkat

- RondayDokumen22 halamanRondaymikekvolpeBelum ada peringkat

- 21-29107 Schulz - Millsap AwardDokumen20 halaman21-29107 Schulz - Millsap AwardmikekvolpeBelum ada peringkat

- Nov 04 2020 Kennedys Court Order 11-11-2020 13.19Dokumen3 halamanNov 04 2020 Kennedys Court Order 11-11-2020 13.19mikekvolpeBelum ada peringkat

- Quit Am StrattonDokumen20 halamanQuit Am StrattonmikekvolpeBelum ada peringkat

- Foster-Morales Sockel-Stone, LLCDokumen23 halamanFoster-Morales Sockel-Stone, LLCmikekvolpeBelum ada peringkat

- Rachel AlintoffDokumen2 halamanRachel AlintoffmikekvolpeBelum ada peringkat

- DeclarationofKathyStevenssigned12 30 14Dokumen5 halamanDeclarationofKathyStevenssigned12 30 14mikekvolpeBelum ada peringkat

- 21-29107 Schulz - Millsap AwardDokumen20 halaman21-29107 Schulz - Millsap AwardmikekvolpeBelum ada peringkat

- Patsy AlcantarDokumen26 halamanPatsy AlcantarmikekvolpeBelum ada peringkat

- NEW Melissa Diegel Rule 11 Oct 25 2021 Court MinutesDokumen4 halamanNEW Melissa Diegel Rule 11 Oct 25 2021 Court MinutesmikekvolpeBelum ada peringkat

- A Basic Guide To CE Marking Process Under CPRDokumen3 halamanA Basic Guide To CE Marking Process Under CPRALOKE GANGULYBelum ada peringkat

- 2015 Saln FormDokumen2 halaman2015 Saln FormAvyanna Rose De LeonBelum ada peringkat

- Obrasci Uverenja o Kretanju Tekst Izjave Na FakturiDokumen14 halamanObrasci Uverenja o Kretanju Tekst Izjave Na FakturiVladimir StojanovicBelum ada peringkat

- Prelim Examination 2018 With Answers PDFDokumen6 halamanPrelim Examination 2018 With Answers PDFjudel ArielBelum ada peringkat

- Midt - Chap.8 LEVERAGE & Capial StructureDokumen33 halamanMidt - Chap.8 LEVERAGE & Capial StructureJeanette FormenteraBelum ada peringkat

- Packing Services FacilitatorDokumen9 halamanPacking Services FacilitatorAkashHaiderBelum ada peringkat

- ICQ For Desk OfficeDokumen1 halamanICQ For Desk Officeprincess ciprianoBelum ada peringkat

- Intermediate Accounting 1 Quiz 1Dokumen4 halamanIntermediate Accounting 1 Quiz 1Manuel MagadatuBelum ada peringkat

- Annisa Pranadita (20221290) - 2EB09 - Tugas Akuntansi Keu. Menengah 1A - 1B (TM#3)Dokumen8 halamanAnnisa Pranadita (20221290) - 2EB09 - Tugas Akuntansi Keu. Menengah 1A - 1B (TM#3)rully movizarBelum ada peringkat

- Resume E-Commerce Supply ChainDokumen3 halamanResume E-Commerce Supply ChainMuhammad Asrorur Rifa'Belum ada peringkat

- 01 - Handout - 1 (16) ENTREPDokumen6 halaman01 - Handout - 1 (16) ENTREPAlbert UmaliBelum ada peringkat

- Pidilite Industries LimitedDokumen2 halamanPidilite Industries Limitedkavya guptaBelum ada peringkat

- Zobeir - 170061018 - Zobaeir - Ahamed - Zobaeir Ahamed, 170061018Dokumen55 halamanZobeir - 170061018 - Zobaeir - Ahamed - Zobaeir Ahamed, 170061018Mahir Rahman Khan NiloyBelum ada peringkat

- Martial law and the Philippine economyDokumen40 halamanMartial law and the Philippine economyMa. Andrea RamosBelum ada peringkat

- Akzonobel: Submitted To Dr. Syed JalilDokumen26 halamanAkzonobel: Submitted To Dr. Syed JalilSHARON TESS JoseBelum ada peringkat

- Exploratory Study of Consumer Issues in Online Peer-To-Peer Platform MarketsDokumen141 halamanExploratory Study of Consumer Issues in Online Peer-To-Peer Platform MarketsChioma MuonanuBelum ada peringkat

- Solved Refer To The Facts in The Preceding Problem Three YearsDokumen1 halamanSolved Refer To The Facts in The Preceding Problem Three YearsAnbu jaromiaBelum ada peringkat

- BIR RR 14-00 and 13-99Dokumen22 halamanBIR RR 14-00 and 13-99Sophia Martinez100% (1)

- List of Insurance Companies in Bangladesh - WikipediaDokumen12 halamanList of Insurance Companies in Bangladesh - Wikipediaak.kader.proBelum ada peringkat

- The Philosophy of Value InvestingDokumen23 halamanThe Philosophy of Value Investingsayuj83Belum ada peringkat

- IY2593 Managerial Economics: Assignment 1Dokumen5 halamanIY2593 Managerial Economics: Assignment 1Thejas JayBelum ada peringkat

- Uber Case StudyDokumen2 halamanUber Case Studyapi-501556428100% (1)

- Consignment HoseDokumen30 halamanConsignment Hose097Simanjntak Evelina 5DBelum ada peringkat

- Retirement of A PartnerDokumen33 halamanRetirement of A PartnerKriti Shah100% (2)

- PMSJ Pricelist - HDMF 4Dokumen1 halamanPMSJ Pricelist - HDMF 4Ren Irene MacatangayBelum ada peringkat

- Security Analysis (Book)Dokumen3 halamanSecurity Analysis (Book)LinaBelum ada peringkat

- PCGG, BIR Letters Re Marcos Estate TaxDokumen3 halamanPCGG, BIR Letters Re Marcos Estate TaxNami Buan100% (2)

- Public vs Private Sector Bank ComparisonDokumen15 halamanPublic vs Private Sector Bank ComparisonSomnathBelum ada peringkat

- Foreign Contractor Tax (FCT) : Section A - Multiple Choice QuestionsDokumen16 halamanForeign Contractor Tax (FCT) : Section A - Multiple Choice QuestionsWanda NguyenBelum ada peringkat

- Credit Card Reconciliation - Brianna Daguio 1Dokumen9 halamanCredit Card Reconciliation - Brianna Daguio 1api-507868036Belum ada peringkat