Quarter Report Q3.16

Diunggah oleh

DEButtDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Quarter Report Q3.16

Diunggah oleh

DEButtHak Cipta:

Format Tersedia

The Episcopal Church Foundation in West Texas

Investment Program

Q UARTERLY R EPORT

September 30, 2016

Market Report

After the worst start for a year ever, common stocks recovered and have continued to

gain ground in the third quarter. The most popular US market indices (Dow Jones, S&P500,

NASDAQ) all established new all-time highs in August. The Brexit vote in the UK triggered

some sell-off in September, but by quarter end domestic equities had gained nearly 4.5% for the

quarter and 8% for the year.

As the chart below shows, for Q3 small cap stocks performed substantially better than

large cap stocks and the growth style outperformed the value style in both large and small cap

categories. International stocks rebounded from Q2 with nice gains this quarter. Year-to-date,

international stocks trail the performance of the US market.

The performance of bonds was much more subdued, with short-term bonds flat and

intermediate-term bonds gaining only one-half percentage point. Year-to-date, fixed income

securities have achieved reasonable gainsabout 5.8% for intermediate-term bonds.

Market Returns for Quarter

1

9.2%

8.9%

6.3%

4.6%

3.5%

0.0%

Model Portfolio Review

Large Cap

Growth

Large Cap

Value

Small Cap

Growth

Small Cap

Value

International

Stocks

Short Term

Bonds

0.5%

Intermediate

Bonds

All four of the Foundations investment strategies (represented by model portfolios)

achieved reasonable gains for the quarter. Performance relative to peer groups was mixed, but

slightly unfavorable compared to passive indices for most models.

A manager change was made during the quarter to reduce by half the allocation to

Touchstone Sands, with a corresponding allocation to a Russell 1000 Growth Index fund

managed by Vanguard.

Details of the performance of the four models are shown below.

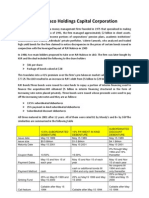

Asset Class Investment Results

The Foundations performance this quarter for the three assets classes in which it invests,

along with comparative benchmark returns, are shown in the following table.

Asset Class

Common Stocks

Fixed Income

Cash Equivalents

Return

4.9%

1.6%

0.0%

Benchmark

4.4%

0.5%

0.0%

Account Status

Foundation assets at quarter-end totaled $63 million, an increase of $2.5 million during

the quarter. Investment gains were $2 million or 3.4%. One new account was opened during the

quarter, with an initial deposit of $59 thousand.

At September 30th, the Foundation had a total of 208 accounts as follows:

Ownership

Churches/Schools

Diocese

Number of Accounts

152

56

Amount

34.7 million

28.3 million

Portfolio Performance as of September 30, 2016*

Growth

Portfolio Total Return

+/- Peer Group Composite

+/- Index Composite

3 Mo

1 Yr

3 Yr

5 Yr

3.08

(0.26)

(0.59)

7.88

(0.98)

(2.25)

4.53

(0.85)

(1.91)

9.36

(0.41)

(1.20)

3 Mo

1 Yr

3 Yr

5 Yr

2.93

(0.03)

(0.22)

7.60

(0.03)

(1.89)

4.53

(0.39)

(1.60)

8.04

0.03

(0.75)

3 Mo

1 Yr

3 Yr

5 Yr

2.61

0.06

(0.04)

7.19

0.42

(0.92)

4.19

(0.06)

(0.98)

6.56

0.25

(0.23)

3 Mo

1 Yr

3 Yr

5 Yr

0.70

0.08

0.19

1.59

0.25

0.25

1.13

0.15

0.16

0.99

0.08

0.22

Growth & Income

Portfolio Total Return

+/- Peer Group Composite

+/- Index Composite

Income

Portfolio Total Return

+/- Peer Group Composite

+/- Index Composite

Capital Maintenance

Portfolio Total Return

+/- Peer Group Composite

+/- Index Composite

* Returns for greater than one year are annualized. Past performance does not guarantee future

results.

Anda mungkin juga menyukai

- The UK Stock Market Almanac 2016: Seasonality analysis and studies of market anomalies to give you an edge in the year aheadDari EverandThe UK Stock Market Almanac 2016: Seasonality analysis and studies of market anomalies to give you an edge in the year aheadBelum ada peringkat

- Quarter Report Q4.16Dokumen3 halamanQuarter Report Q4.16DEButtBelum ada peringkat

- Quarter Report Q4.14Dokumen3 halamanQuarter Report Q4.14DEButtBelum ada peringkat

- Quarter Report Q2.16Dokumen3 halamanQuarter Report Q2.16DEButtBelum ada peringkat

- Quarter Report Q1.16Dokumen3 halamanQuarter Report Q1.16DEButtBelum ada peringkat

- Quarter Report Q3.15Dokumen3 halamanQuarter Report Q3.15DEButtBelum ada peringkat

- Quarter Report Q1.15Dokumen3 halamanQuarter Report Q1.15DEButtBelum ada peringkat

- Quarter Report Q2.15Dokumen3 halamanQuarter Report Q2.15DEButtBelum ada peringkat

- Quarter ReportDokumen3 halamanQuarter ReportDEButtBelum ada peringkat

- Quarter Report Q1.14Dokumen3 halamanQuarter Report Q1.14DEButtBelum ada peringkat

- Quarter Report Q2.13Dokumen3 halamanQuarter Report Q2.13DEButtBelum ada peringkat

- Quarter Report Q1.13Dokumen3 halamanQuarter Report Q1.13DEButtBelum ada peringkat

- Quarter Report Q3.14 PDFDokumen3 halamanQuarter Report Q3.14 PDFDEButtBelum ada peringkat

- Cusip Rfo 5221392Dokumen12 halamanCusip Rfo 5221392Chemtrails Equals Treason100% (2)

- GSAM 2010: Year in ReviewDokumen6 halamanGSAM 2010: Year in Reviewed_nycBelum ada peringkat

- PIMCO TRF PropsectusDokumen23 halamanPIMCO TRF PropsectusZerohedgeBelum ada peringkat

- Government Pension Fund Global: Quarterly ReportDokumen40 halamanGovernment Pension Fund Global: Quarterly ReportZerohedgeBelum ada peringkat

- Selector March 2010 Quarterly NewsletterDokumen31 halamanSelector March 2010 Quarterly Newsletterapi-237451731Belum ada peringkat

- Market Commentary 12-03-12Dokumen3 halamanMarket Commentary 12-03-12CLORIS4Belum ada peringkat

- Weeklymarket: UpdateDokumen2 halamanWeeklymarket: Updateapi-94222682Belum ada peringkat

- Market SummariesDokumen11 halamanMarket SummariesO'Connor AssociateBelum ada peringkat

- Putnam Research Fund Q&A Q3 2012Dokumen4 halamanPutnam Research Fund Q&A Q3 2012Putnam InvestmentsBelum ada peringkat

- Alliance Portfoliopractice-Dividend-Stocks Jan 2011Dokumen16 halamanAlliance Portfoliopractice-Dividend-Stocks Jan 2011Connie SinBelum ada peringkat

- Second Quarter Market ReviewDokumen15 halamanSecond Quarter Market ReviewsamanthaBelum ada peringkat

- Investment Strategy: 'Tis The Season?Dokumen5 halamanInvestment Strategy: 'Tis The Season?marketfolly.comBelum ada peringkat

- Quarterly Market Review: Second Quarter 2016Dokumen15 halamanQuarterly Market Review: Second Quarter 2016Anonymous Ht0MIJBelum ada peringkat

- Fall 2016 Investor LetterDokumen4 halamanFall 2016 Investor LetterAnonymous Ht0MIJBelum ada peringkat

- Q3 2012 Quarterly Market ReviewDokumen14 halamanQ3 2012 Quarterly Market Reviewlivmoore94Belum ada peringkat

- Investment Management: The Wisco TeamDokumen4 halamanInvestment Management: The Wisco TeamGreg SchroederBelum ada peringkat

- Weekly Trends Nov 21Dokumen5 halamanWeekly Trends Nov 21dpbasicBelum ada peringkat

- Wisco Team: Third QuarterDokumen4 halamanWisco Team: Third QuarterGreg SchroederBelum ada peringkat

- Franchis Chou SeAR 09Dokumen64 halamanFranchis Chou SeAR 09Sww WisdomBelum ada peringkat

- Market OverviewDokumen3 halamanMarket OverviewJohn MathiasBelum ada peringkat

- Perspective: Economic and MarketDokumen10 halamanPerspective: Economic and MarketdpbasicBelum ada peringkat

- Strategy 0518Dokumen30 halamanStrategy 0518derek_2010Belum ada peringkat

- Quarterly Market Review Q2 2013Dokumen14 halamanQuarterly Market Review Q2 2013livmoore94Belum ada peringkat

- Perspective: Economic and MarketDokumen6 halamanPerspective: Economic and MarketdpbasicBelum ada peringkat

- Weekly Market Recap-Week of May 6th-MSFDokumen2 halamanWeekly Market Recap-Week of May 6th-MSFasmith2499Belum ada peringkat

- Q3 - 2015 Commentary: 5.1% and 10.3%, RespectivelyDokumen5 halamanQ3 - 2015 Commentary: 5.1% and 10.3%, RespectivelyJohn MathiasBelum ada peringkat

- Weekly Trends October 2, 2015Dokumen4 halamanWeekly Trends October 2, 2015dpbasicBelum ada peringkat

- Q3 2012 Quarterly Market ReviewDokumen14 halamanQ3 2012 Quarterly Market Reviewlivmoore94Belum ada peringkat

- GF Letter 09-30-16 FinalDokumen4 halamanGF Letter 09-30-16 FinalAnonymous Feglbx5Belum ada peringkat

- Lane Asset Management Stock Market Commentary May 2012Dokumen6 halamanLane Asset Management Stock Market Commentary May 2012Edward C LaneBelum ada peringkat

- IVA Worldwide QR 2Q13Dokumen2 halamanIVA Worldwide QR 2Q13BaikaniBelum ada peringkat

- Standard Correction or Bull Trap?: ST THDokumen7 halamanStandard Correction or Bull Trap?: ST THClay Ulman, CFP®100% (1)

- Weekly Market Recap, May 13-Main Street FinancialDokumen2 halamanWeekly Market Recap, May 13-Main Street Financialasmith2499Belum ada peringkat

- New Paradigm or Same Old Hype in Equity Investing?: Louis K.C. Chan, Jason Karceski, and Josef LakonishokDokumen14 halamanNew Paradigm or Same Old Hype in Equity Investing?: Louis K.C. Chan, Jason Karceski, and Josef LakonishokfilipandBelum ada peringkat

- Spring 2014 HCA Letter FinalDokumen4 halamanSpring 2014 HCA Letter FinalDivGrowthBelum ada peringkat

- Weekly Commentary 12-3-12Dokumen4 halamanWeekly Commentary 12-3-12Stephen GierlBelum ada peringkat

- Equity Funds Q3 Return Remains PositiveDokumen7 halamanEquity Funds Q3 Return Remains PositiveAnonymous Ht0MIJBelum ada peringkat

- SPIVA Scorecard Year End 2010Dokumen31 halamanSPIVA Scorecard Year End 2010pkfinancialBelum ada peringkat

- TCU EIF 2016 Annual ReportDokumen29 halamanTCU EIF 2016 Annual ReportKat MatthewsBelum ada peringkat

- Annual Report: March 31, 2011Dokumen23 halamanAnnual Report: March 31, 2011VALUEWALK LLCBelum ada peringkat

- Qis - Insights - Qis Insights Style InvestingDokumen21 halamanQis - Insights - Qis Insights Style Investingpderby1Belum ada peringkat

- Blog - Looking Back at Equity Factors in Q1 With WisdomTree-2Dokumen7 halamanBlog - Looking Back at Equity Factors in Q1 With WisdomTree-2Owm Close CorporationBelum ada peringkat

- BBH Partner Fund International Equity Quarterly Update q2 2019 DataDokumen5 halamanBBH Partner Fund International Equity Quarterly Update q2 2019 DataPland SpringBelum ada peringkat

- Monthly Strategy Report Q3 2013Dokumen7 halamanMonthly Strategy Report Q3 2013dpbasicBelum ada peringkat

- Wisdom of Wealth: If The U.S. Government Was An Average American FamilyDokumen10 halamanWisdom of Wealth: If The U.S. Government Was An Average American FamilyTriangleFinancialBelum ada peringkat

- The Monarch Report 9-26-11Dokumen4 halamanThe Monarch Report 9-26-11monarchadvisorygroupBelum ada peringkat

- Quarter Report Q1.23Dokumen3 halamanQuarter Report Q1.23DEButtBelum ada peringkat

- Quarter Report Q3.20Dokumen3 halamanQuarter Report Q3.20DEButtBelum ada peringkat

- Quarter Report Q4.22Dokumen3 halamanQuarter Report Q4.22DEButtBelum ada peringkat

- Quarter Report Q1.24Dokumen2 halamanQuarter Report Q1.24DEButtBelum ada peringkat

- Quarter Report Q4.20Dokumen3 halamanQuarter Report Q4.20DEButtBelum ada peringkat

- Quarter Report Q3.19Dokumen3 halamanQuarter Report Q3.19DEButtBelum ada peringkat

- Quarter Report Q1.20Dokumen3 halamanQuarter Report Q1.20DEButtBelum ada peringkat

- Quarter Report Q2.17Dokumen3 halamanQuarter Report Q2.17DEButtBelum ada peringkat

- Quarter Report Q2.20Dokumen3 halamanQuarter Report Q2.20DEButtBelum ada peringkat

- Quarter Report Q2.19Dokumen3 halamanQuarter Report Q2.19DEButtBelum ada peringkat

- Quarter Report Q4.18Dokumen3 halamanQuarter Report Q4.18DEButtBelum ada peringkat

- Quarter Report Q3.18Dokumen3 halamanQuarter Report Q3.18DEButtBelum ada peringkat

- Quarter Report Q2.18Dokumen3 halamanQuarter Report Q2.18DEButtBelum ada peringkat

- Quarter Report Q1.18Dokumen3 halamanQuarter Report Q1.18DEButtBelum ada peringkat

- Quarter Report Q3.17Dokumen3 halamanQuarter Report Q3.17DEButtBelum ada peringkat

- Quarter Report Q1.17Dokumen3 halamanQuarter Report Q1.17DEButtBelum ada peringkat

- Quarter Report Q2.15Dokumen3 halamanQuarter Report Q2.15DEButtBelum ada peringkat

- Quarter Report Q3.14 PDFDokumen3 halamanQuarter Report Q3.14 PDFDEButtBelum ada peringkat

- Quarter Report Q2.14Dokumen3 halamanQuarter Report Q2.14DEButtBelum ada peringkat

- Quarter Report Q1.15Dokumen3 halamanQuarter Report Q1.15DEButtBelum ada peringkat

- Module 17-Bonds-PayableDokumen12 halamanModule 17-Bonds-PayableJehPoyBelum ada peringkat

- Lampiran I Entitas Ilegal NovemberDokumen5 halamanLampiran I Entitas Ilegal NovemberCoba KillBelum ada peringkat

- CFA一级培训项目 - 绝密攻坚计划 Corporate finance & DerivativesDokumen43 halamanCFA一级培训项目 - 绝密攻坚计划 Corporate finance & DerivativesBethuel KamauBelum ada peringkat

- V1 - 20140410 FRM-2 - Questions PDFDokumen30 halamanV1 - 20140410 FRM-2 - Questions PDFIon VasileBelum ada peringkat

- General Mathematics - Stocks and BondsDokumen32 halamanGeneral Mathematics - Stocks and BondsLourence Clark ElumbaBelum ada peringkat

- Chapter 1 - IntroductionDokumen41 halamanChapter 1 - IntroductionMuhd Rizzwan0% (1)

- Shares and Share CapitalDokumen50 halamanShares and Share CapitalSteve Nteful100% (1)

- Morgan Stanley Europe UpdateDokumen25 halamanMorgan Stanley Europe UpdateTeresa CarterBelum ada peringkat

- HA 222 Finance Practice Prob Chap 7Dokumen7 halamanHA 222 Finance Practice Prob Chap 7anishpra73Belum ada peringkat

- BA7021-Security Analysis and Portfolio PDFDokumen6 halamanBA7021-Security Analysis and Portfolio PDFLavanya GunalanBelum ada peringkat

- Presentation On Mutual FundDokumen19 halamanPresentation On Mutual FundmanoranjanpatraBelum ada peringkat

- CBOE S&P 500 2% OTM BuyWrite Index (BXY) Micro SiteDokumen4 halamanCBOE S&P 500 2% OTM BuyWrite Index (BXY) Micro SiteALBelum ada peringkat

- Questionnaire MotilalDokumen6 halamanQuestionnaire MotilalManish Jodhwani0% (1)

- Rep. Planters Bank V Agana SR Mar. 3, 1997 Hermosisima, J. Recit-Ready VersionDokumen3 halamanRep. Planters Bank V Agana SR Mar. 3, 1997 Hermosisima, J. Recit-Ready VersionGabe Ruaro100% (1)

- Far15 Long Term Liability 1Dokumen9 halamanFar15 Long Term Liability 1Joana TatacBelum ada peringkat

- Week 2 - Lecture NoteDokumen33 halamanWeek 2 - Lecture NoteChip choiBelum ada peringkat

- GARP FRM Practice Exam 2011 Level2Dokumen63 halamanGARP FRM Practice Exam 2011 Level2Kelvin TanBelum ada peringkat

- RJR Nabisco Holdings Capital CorporationDokumen3 halamanRJR Nabisco Holdings Capital CorporationManogana RasaBelum ada peringkat

- Ovme Userguide: 15 July 2010Dokumen21 halamanOvme Userguide: 15 July 2010Raphaël FromEverBelum ada peringkat

- Notes - Option PayoffsDokumen49 halamanNotes - Option PayoffsBilal AhmedBelum ada peringkat

- JPM - Abs-Cdo 2009-09-25Dokumen95 halamanJPM - Abs-Cdo 2009-09-25Ryan JinBelum ada peringkat

- Groww Stock Account Opening FormDokumen21 halamanGroww Stock Account Opening FormRohit ShawBelum ada peringkat

- Basis Points (BPS)Dokumen10 halamanBasis Points (BPS)Francis BellidoBelum ada peringkat

- Cva HedgingDokumen16 halamanCva HedgingjeanturqBelum ada peringkat

- CircularlistDokumen3 halamanCircularlistbrijeshBelum ada peringkat

- Wacc 4Dokumen10 halamanWacc 4Rita NyairoBelum ada peringkat

- Warren Buffet CaseDokumen4 halamanWarren Buffet Casetania shaheenBelum ada peringkat

- Equity ValuationDokumen13 halamanEquity ValuationSaraf Kushal100% (2)

- Acc Ch-5 Lecture NoteDokumen14 halamanAcc Ch-5 Lecture NoteBlen tesfayeBelum ada peringkat