Advanced Accounting Problems Solutions

Diunggah oleh

qyb95Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Advanced Accounting Problems Solutions

Diunggah oleh

qyb95Hak Cipta:

Format Tersedia

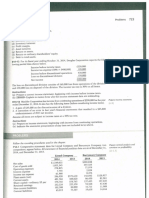

Fundamentals of Advanced Accounting

Sixth Edition

by

Hoyle/Schaefer/Doupnik

Key Figures in Selected Problems

(Check figures for multiple choice questions not provided.)

CHAPTER 4

P4-22:

(a)

(b)

2015 Consolidated net income = $342,000

Noncontrolling interest 12/31/15 = $83,400

P4-23

(a)

(c)

(d)

(e)

Technology processes = $950,000

Controlling interest in consolidated net income = $878,000

Noncontrolling interest in consolidated net income = $57,000

Noncontrolling interest 12/31/15 = $797,000

P4-24:

(a)

(d)

(e)

(f)

Sorianos total acquisition-date fair value = $3,100,000

Goodwill = $200,000

Consolidated net income = $1,615,000

Noncontrolling interest 12/31 = $667,000

P4-25:

(a)

(b)

Credit to Palkas APIC = $30,000

Investment in Sellinger 12/31/15 = $1,900,000

P4-26:

(a)

Goodwill = $14,000

Consolidated net income = $469,000

Controlling interest in consolidated net income = $418,300

Consolidated net income = $426,750

Controlling interest in consolidated net income = $388,725

(b)

P4-27:

Noncontrolling interest in consolidated net income = $9,400

End-of-year noncontrolling interest = $31,400

P4-28:

(a)

(c)

Goodwill to Parflex = $36,200, Goodwill to NCI = $1,800

Consolidated total assets = $1,950,000

Noncontrolling interest 12/31 = $52,100

P4-29:

(b)

(c)

(d)

Gain on revaluation to fair value = $13,250

Goodwill = $65,000

Noncontrolling interest at 12/31 = $40,750

P4-30:

(a)

(b)

Equity income from sold shares of Sabathia = $7,950

Book value of investment being sold = $159,950

P4-31:

(a)

(b)

(c)

(d)

Entry S debit to Bandmors 1/1/15 Retained earnings = $268,000

Entry *C credit to Telconnects 1/1/15 Retained earnings = $53,200

Entry *C debit to Telconnects 1/1/15 Retained earnings = $8,400

12/31/15 noncontrolling interest in Bandmor = $246,000

P4-32:

(a)

(b)

(d)

(e)

(f)

P4-33:

Excess acquisition-date fair-value depreciation = $4,000

Goodwill = $150,000

Equity method accrual = $52,800

Equity method balance = $826,400

Consolidated Buildings = $1,172,000

Consolidated net income = $245,000

Noncontrolling interest in Subsidiary Income = $9,000

Goodwill = $100,000

P4-34:

(b)

(c)

(d)

(e)

Acquisition-date excess fair value annual amortization total = $15,000

Equity method income = $45,000

Parents share of consolidated Retained earnings = $811,000

Controlling interest in consolidated net income = $235,000

P4-35:

(a)

Consolidated net income = $450,500

Consolidated net income to controlling interest = $437,000

Consolidated retained earnings = $2,712,000

Noncontrolling interest = $206,000

Consolidated total assets = $5,500,000

Noncontrolling interest = $183,500

Goodwill = $352,500

(b)

P4-36:

(a)

(b)

(c)

Consolidated net income = $243,500

Consolidated retained earnings, 12/31 = $958,000

Noncontrolling interest, 12/31 = $164,000

Controlling interest in consolidated net income = $228,800

Goodwill declines to $195,200

P4-37:

Consolidated Buildings and Equipment = $1,162,800

Noncontrolling interest in subsidiary = $231,960

Retained earnings, 12/31 = $1,487,000

P4-38:

(a)

(c)

Total annual excess fair value amortization expense = $15,000

Goodwill = $90,000

Noncontrolling interest in subsidiary, 12/31 = $75,000

Consolidated retained earnings = $1,658,000

Consolidated total assets = $3,321,000

P4-39:

(a)

Consolidated net income = $205,500

Noncontrolling interest in subsidiary income = $31,800

Consolidated equipment = $774,500

(b)

P4-40:

(a)

(b)

(d)

Goodwill = $70,000

Goodwill to noncontrolling interest = $8,000

Consolidated revenues = $870,000

Consolidated patent = $90,000

Noncontrolling interest, 12/31 = $293,000

P4-41:

(a)

(c)

Goodwill = $50,000

Consolidated net income = $433,500

Consolidated customer contract = $300,000

Noncontrolling interest = $88,000

Consolidated total assets = $3,814,000

P4-42:

(a)

(c)

Debit to Investment in Keane = 301,500

Consolidated net income = $362,000

Consolidated retained earnings = $1,000,000

Consolidated copyrights = $590,000

Consolidated total assets = $2,225,000

Anda mungkin juga menyukai

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDari EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsBelum ada peringkat

- Chapter06 CheckFiguresDokumen2 halamanChapter06 CheckFiguresBD132Belum ada peringkat

- ContabilidadDokumen38 halamanContabilidadEshianneBelum ada peringkat

- Advanced Accounting Week 3Dokumen3 halamanAdvanced Accounting Week 3rahmaBelum ada peringkat

- Solutions CH 1 and 3Dokumen3 halamanSolutions CH 1 and 3payalkhndlwlBelum ada peringkat

- Solution Manual For Cost Management Accounting and Control 6th Edition by HansenDokumen6 halamanSolution Manual For Cost Management Accounting and Control 6th Edition by Hansenphilips monitorsBelum ada peringkat

- Assignment Part OneDokumen3 halamanAssignment Part Onetovi0821Belum ada peringkat

- ACC 401 Homework CH 4Dokumen4 halamanACC 401 Homework CH 4leelee03020% (1)

- Summary Multiple Steps Income Statements & ExercisesDokumen19 halamanSummary Multiple Steps Income Statements & ExercisesrayBelum ada peringkat

- Tugas 2 - AnsalDokumen5 halamanTugas 2 - AnsalDita Sari LutfianiBelum ada peringkat

- Tugas Financial ManagementDokumen5 halamanTugas Financial Managementesterelisabet7777Belum ada peringkat

- Acct 201 Exam Cover SheetDokumen4 halamanAcct 201 Exam Cover SheetMohammed AwadBelum ada peringkat

- Finance 2Dokumen7 halamanFinance 2Vũ Hải YếnBelum ada peringkat

- Chapter 4 SolutionsDokumen12 halamanChapter 4 SolutionsSoshiBelum ada peringkat

- Key Financial Figures ChecklistDokumen15 halamanKey Financial Figures Checklistkindergarten tutorialBelum ada peringkat

- F18Dokumen10 halamanF18Access MaterialsBelum ada peringkat

- Acc HWDokumen6 halamanAcc HWAneeq TahirBelum ada peringkat

- Key Merchandising FiguresDokumen4 halamanKey Merchandising FiguresalmamunduthmBelum ada peringkat

- Accounting Volume 1 Canadian 9th Edition Horngren Test BankDokumen99 halamanAccounting Volume 1 Canadian 9th Edition Horngren Test Bankbacksideanywheremrifn100% (25)

- CH 04Dokumen50 halamanCH 04Akbar LodhiBelum ada peringkat

- Advanced Accounting Chapter 1 Problems 5-7Dokumen2 halamanAdvanced Accounting Chapter 1 Problems 5-7Mitch Boehm0% (1)

- Financial Reporting & AnalysisDokumen9 halamanFinancial Reporting & AnalysisNuman Rox0% (1)

- Tranr New 3Dokumen1 halamanTranr New 3fayyasin99Belum ada peringkat

- AssignmentsDokumen3 halamanAssignmentsVikin JainBelum ada peringkat

- Chapter 9 Checklist Key FiguresDokumen2 halamanChapter 9 Checklist Key FiguresPocaGuriBelum ada peringkat

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsDokumen9 halamanFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMBelum ada peringkat

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDokumen22 halamanAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedBelum ada peringkat

- Analyzing Financial Ratios for Investment DecisionsDokumen50 halamanAnalyzing Financial Ratios for Investment DecisionsGaurav KarkiBelum ada peringkat

- FINA2207 Solutions To Practice QuestionsDokumen22 halamanFINA2207 Solutions To Practice Questionszdoug1Belum ada peringkat

- Solutions Chapter 23Dokumen11 halamanSolutions Chapter 23Avi SeligBelum ada peringkat

- Project's Estimated Residual Income and Required InvestmentDokumen7 halamanProject's Estimated Residual Income and Required InvestmentblueberryBelum ada peringkat

- Forecasting Nike's Financial Statements Using Accounting RelationsDokumen15 halamanForecasting Nike's Financial Statements Using Accounting RelationsM Umar KhanBelum ada peringkat

- ExDokumen5 halamanExMagdy KamelBelum ada peringkat

- Calculate Owners Equity from Balance SheetDokumen4 halamanCalculate Owners Equity from Balance SheetHoang MinhBelum ada peringkat

- FSA - Class 15 - 13 October 2023 - RevSess2 - ExDokumen15 halamanFSA - Class 15 - 13 October 2023 - RevSess2 - Exmhmdgholami0939Belum ada peringkat

- MBA641 Managerial Accounting Case Study #3Dokumen3 halamanMBA641 Managerial Accounting Case Study #3risvana rahimBelum ada peringkat

- Solution Manual For Contemporary Financial Management 13th Edition Moyer, McGuigan, RaoDokumen5 halamanSolution Manual For Contemporary Financial Management 13th Edition Moyer, McGuigan, Raoa289899847Belum ada peringkat

- ACCT311 Chapter 4 SolutionsDokumen10 halamanACCT311 Chapter 4 SolutionsSThomas070884Belum ada peringkat

- CH4 Seminar SolutionsDokumen3 halamanCH4 Seminar SolutionsrisitsavaniBelum ada peringkat

- More Sample Exam Questions-Midterm2Dokumen6 halamanMore Sample Exam Questions-Midterm2mehdiBelum ada peringkat

- ACC1002 Team 8Dokumen11 halamanACC1002 Team 8Yvonne Ng Ming HuiBelum ada peringkat

- Use This Template To Complete The Problem 4-32 Based Upon The 3 Step Approach BelowDokumen7 halamanUse This Template To Complete The Problem 4-32 Based Upon The 3 Step Approach BelowJoshua LenardsonBelum ada peringkat

- Financial Statement Analysis: Practice Exercises PE 15Dokumen29 halamanFinancial Statement Analysis: Practice Exercises PE 15Samuel EtanaBelum ada peringkat

- Johnson - Cassandra - AC556 Assignment Unit 4Dokumen9 halamanJohnson - Cassandra - AC556 Assignment Unit 4ctp4950_552446766Belum ada peringkat

- Tugas Akl 2Dokumen7 halamanTugas Akl 2Kukuh HariyadiBelum ada peringkat

- Answers (مبادئ مالية) Ch.2and3Dokumen11 halamanAnswers (مبادئ مالية) Ch.2and3moon lightBelum ada peringkat

- ABC Company comparative balance sheet and income statement analysisDokumen6 halamanABC Company comparative balance sheet and income statement analysisruruBelum ada peringkat

- Solution Ch8inclassexerciseDokumen5 halamanSolution Ch8inclassexerciseAdam100% (1)

- F19Dokumen10 halamanF19Access MaterialsBelum ada peringkat

- Check Figures PLL3e FinalDokumen23 halamanCheck Figures PLL3e FinalTrần Tuấn AnhBelum ada peringkat

- ACCT550 Homework Week 2Dokumen5 halamanACCT550 Homework Week 2Natasha Declan100% (2)

- Finance CH 2Dokumen32 halamanFinance CH 2ValeriaRios67% (3)

- Ch04 Consolidation TechniquesDokumen54 halamanCh04 Consolidation TechniquesRizqita Putri Ramadhani0% (1)

- Mid Semester Assignment: Course Code: FIN - 254 Section: 08Dokumen8 halamanMid Semester Assignment: Course Code: FIN - 254 Section: 08Fahim Faisal 1620560630Belum ada peringkat

- Managerial Finance (503) EMBA Summer-2020 Jahangirnagar UniversityDokumen4 halamanManagerial Finance (503) EMBA Summer-2020 Jahangirnagar UniversityIsmail EmonBelum ada peringkat

- Checklist of Key Figures: Reporting Financial PerformanceDokumen3 halamanChecklist of Key Figures: Reporting Financial Performanceeagle1965Belum ada peringkat

- Chapter+2 3Dokumen14 halamanChapter+2 3kanasanBelum ada peringkat

- Homework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Dokumen3 halamanHomework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Caroline OktavianiBelum ada peringkat

- Preparing a Cash Flow StatementDokumen7 halamanPreparing a Cash Flow StatementMiconBelum ada peringkat

- Branch Banking CompleteDokumen195 halamanBranch Banking Completesohail merchantBelum ada peringkat

- Mrunal Economy Handouts PCB8 2023-24Dokumen901 halamanMrunal Economy Handouts PCB8 2023-24Adharsh Surendhiran100% (3)

- Abaya vs. EbdaneDokumen30 halamanAbaya vs. Ebdanealexandra recimoBelum ada peringkat

- P4 Taxation New Suggested CA Inter May 18Dokumen27 halamanP4 Taxation New Suggested CA Inter May 18Durgadevi BaskaranBelum ada peringkat

- Debit Note PDFDokumen3 halamanDebit Note PDFMani ShuklaBelum ada peringkat

- Termination of Sub-Broker AgreementDokumen3 halamanTermination of Sub-Broker AgreementJnanesh S DevrajBelum ada peringkat

- 95085951Dokumen50 halaman95085951ANKITA LUTHRA EPGDIB 2018-20Belum ada peringkat

- BASO Presentation PDFDokumen25 halamanBASO Presentation PDFGEOEXPLOREMINPERU MINERÍA Y GEOLOGIABelum ada peringkat

- Private Employers Are Required To Allow The Inspection of Its Premises Including Its Books and Other Pertinent Records" and Philhealth CircularDokumen2 halamanPrivate Employers Are Required To Allow The Inspection of Its Premises Including Its Books and Other Pertinent Records" and Philhealth CircularApostol RogerBelum ada peringkat

- No. 13 EMHDokumen33 halamanNo. 13 EMHayazBelum ada peringkat

- How To Write A Good Letter of Intent When Buying A Company?Dokumen4 halamanHow To Write A Good Letter of Intent When Buying A Company?Jose Antonio BarrosoBelum ada peringkat

- Office Stationery Manufacturing in The US Industry ReportDokumen40 halamanOffice Stationery Manufacturing in The US Industry Reportdr_digital100% (1)

- Cost of CapitalDokumen68 halamanCost of CapitalJohn Ervin TalagaBelum ada peringkat

- Modifying Restrictive CovenantsDokumen45 halamanModifying Restrictive CovenantsLonaBrochenBelum ada peringkat

- Fria MCQDokumen13 halamanFria MCQJemima LalaweBelum ada peringkat

- CRC-ACE REVIEW SCHOOL PA1 SECOND PRE-BOARD EXAMSDokumen6 halamanCRC-ACE REVIEW SCHOOL PA1 SECOND PRE-BOARD EXAMSRovern Keith Oro CuencaBelum ada peringkat

- Cantabil Retail India Limited Private Equity ReportDokumen15 halamanCantabil Retail India Limited Private Equity ReportMayank GugnaniBelum ada peringkat

- Hindusthan Microfinance provides loans to Mumbai's poorDokumen25 halamanHindusthan Microfinance provides loans to Mumbai's poorsunnyBelum ada peringkat

- Strategic Plan of Indian Tobacco Company (ItcDokumen27 halamanStrategic Plan of Indian Tobacco Company (ItcJennifer Smith100% (1)

- Role of Derivatives in Economic Growth and DevelopmentDokumen22 halamanRole of Derivatives in Economic Growth and DevelopmentKanika AnejaBelum ada peringkat

- HTTPSWWW Sec GovArchivesedgardata1057791000105779114000008ex991 PDFDokumen99 halamanHTTPSWWW Sec GovArchivesedgardata1057791000105779114000008ex991 PDFДмитрий ЮхановBelum ada peringkat

- Technopreneurship in Small Medium EnterprisegrouptwoDokumen50 halamanTechnopreneurship in Small Medium EnterprisegrouptwoKurt Martine LacraBelum ada peringkat

- Joint Venture in Insurance Company in IndiaDokumen37 halamanJoint Venture in Insurance Company in IndiaSEMBelum ada peringkat

- Itc Balance SheetDokumen2 halamanItc Balance SheetRGNNishant BhatiXIIEBelum ada peringkat

- Rural Marketing Assignment PDFDokumen6 halamanRural Marketing Assignment PDFSriram RajasekaranBelum ada peringkat

- Pro Forma Invoice: Proline TechnologiesDokumen1 halamanPro Forma Invoice: Proline TechnologiesKanth KodaliBelum ada peringkat

- Jacob Investigates Bretton FraudDokumen2 halamanJacob Investigates Bretton FraudMilcah De GuzmanBelum ada peringkat

- Kirsty Nathoo - Startup Finance Pitfalls and How To Avoid ThemDokumen33 halamanKirsty Nathoo - Startup Finance Pitfalls and How To Avoid ThemMurali MohanBelum ada peringkat

- Research Proposal On Challenges of Local GovernmentDokumen26 halamanResearch Proposal On Challenges of Local GovernmentNegash LelisaBelum ada peringkat

- Taurian Curriculum Framework Grade 11 BSTDokumen6 halamanTaurian Curriculum Framework Grade 11 BSTDeepak SharmaBelum ada peringkat