2016 L1 SS09

Diunggah oleh

shank16589Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

2016 L1 SS09

Diunggah oleh

shank16589Hak Cipta:

Format Tersedia

9

STUDY SESSION

Financial Reporting and Analysis

Inventories, Long-lived Assets, Income

Taxes, and Non-current Liabilities

The readings in this study session examine financial reporting for specific categories

of assets and liabilities. Analysts must understand the effects of alternative financial

reporting policies on financial statements and ratios and be able to execute appropriate adjustments to enhance comparability between companies. In addition, analysts

must be alert to differences between a companys reported financial statements and

economic reality.

The description and measurement of inventories require careful attention because

investment in inventories is frequently the largest current asset for merchandising and

manufacturing companies. For these companies, the measurement of inventory cost

(i.e., cost of sales) is a critical factor in determining gross profit and other measures

of profitability. Long-lived operating assets are often the largest category of assets

on a companys balance sheet. The analyst needs to scrutinize managements choices

with respect to recognizing expenses associated with these operating assets because

of the potentially large effect such choices can have on reported earnings and the

opportunities for financial statement manipulation.

A companys accounting policies (such as depreciation choices) can cause differences in taxes reported in financial statements and taxes reported on tax returns.

Issues relating to deferred taxes are discussed.

Non-current liabilities affect a companys liquidity and solvency and have consequences for its long-term growth and viability. The notes to the financial statements must be carefully reviewed to ensure that all potential liabilities (e.g., leasing

arrangements and other contractual commitments) are appropriately evaluated for

their conformity to economic reality. Adjustments to the financial statements may be

required to achieve comparability when evaluating several companies.

2016 Level I CFA Program Curriculum CFA Institute.

Note: New rulings and/or

pronouncements issued after

the publication of the readings

on financial reporting and

analysis may cause some of the

information in these readings

to become dated. Candidates

are expected to be familiar

with the overall analytical

framework contained in the

study session readings, as well

as the implications of alternative

accounting methods for

financial analysis and valuation,

as provided in the assigned

readings. Candidates are not

responsible for changes that

occur after the material was

written.

Study Session 9

READING ASSIGNMENTS

Reading 29

Inventories

by Michael Broihahn, CPA, CIA, CFA

Reading 30

Long-lived Assets

by Elaine Henry, PhD, CFA, and Elizabeth A. Gordon

Reading 31

Income Taxes

By Elbie Louw, CFA, CIPM, and Michael A. Broihahn,

CPA, CIA, CFA

Reading 32

Non-current (Long-term) Liabilities

by Elizabeth A. Gordon and Elaine Henry, PhD, CFA

LEARNING OUTCOMES

READING 29. INVENTORIES

The candidate should be able to:

a distinguish between costs included in inventories and costs recognised as

expenses in the period in which they are incurred;

b describe different inventory valuation methods (cost formulas);

c calculate and compare cost of sales, gross profit, and ending inventory using different inventory valuation methods and using perpetual and periodic inventory

systems;

d calculate and explain how inflation and deflation of inventory costs affect the

financial statements and ratios of companies that use different inventory valuation methods;

e explain LIFO reserve and LIFO liquidation and their effects on financial statements and ratios;

f convert a companys reported financial statements from LIFO to FIFO for purposes of comparison;

g describe the measurement of inventory at the lower of cost and net realisable

value;

h describe implications of valuing inventory at net realisable value for financial

statements and ratios;

i

describe the financial statement presentation of and disclosures relating to

inventories;

explain issues that analysts should consider when examining a companys inventory disclosures and other sources of information;

k calculate and compare ratios of companies, including companies that use different inventory methods;

l

analyze and compare the financial statements of companies, including companies that use different inventory methods.

READING 30. LONG-LIVED ASSETS

The candidate should be able to:

a distinguish between costs that are capitalised and costs that are expensed in the

period in which they are incurred;

2016 Level I CFA Program Curriculum CFA Institute.

Study Session 9

b compare the financial reporting of the following types of intangible assets: purchased, internally developed, acquired in a business combination;

c explain and evaluate how capitalising versus expensing costs in the period in

which they are incurred affects financial statements and ratios;

d describe the different depreciation methods for property, plant, and equipment

and calculate depreciation expense;

e describe how the choice of depreciation method and assumptions concerning

useful life and residual value affect depreciation expense, financial statements,

and ratios;

f describe the different amortisation methods for intangible assets with finite

lives and calculate amortisation expense;

g describe how the choice of amortisation method and assumptions concerning

useful life and residual value affect amortisation expense, financial statements,

and ratios;

h describe the revaluation model;

i

explain the impairment of property, plant, and equipment and intangible assets;

explain the derecognition of property, plant, and equipment and intangible

assets;

k explain and evaluate how impairment, revaluation, and derecognition of property, plant, and equipment and intangible assets affect financial statements and

ratios;

l

describe the financial statement presentation of and disclosures relating to

property, plant, and equipment and intangible assets;

m analyze and interpret financial statement disclosures regarding property, plant,

and equipment and intangible assets;

n compare the financial reporting of investment property with that of property,

plant, and equipment;

o explain and evaluate how leasing rather than purchasing assets affects financial

statements and ratios;

p explain and evaluate how finance leases and operating leases affect financial

statements and ratios from the perspective of both the lessor and the lessee.

READING 31. INCOME TAXES

The candidate should be able to:

a describe the differences between accounting profit and taxable income and

define key terms, including deferred tax assets, deferred tax liabilities, valuation

allowance, taxes payable, and income tax expense;

b explain how deferred tax liabilities and assets are created and the factors that

determine how a companys deferred tax liabilities and assets should be treated

for the purposes of financial analysis;

c calculate the tax base of a companys assets and liabilities;

d calculate income tax expense, income taxes payable, deferred tax assets, and

deferred tax liabilities, and calculate and interpret the adjustment to the financial statements related to a change in the income tax rate;

e evaluate the impact of tax rate changes on a companys financial statements and

ratios;

2016 Level I CFA Program Curriculum CFA Institute.

Study Session 9

f distinguish between temporary and permanent differences in pre-tax accounting income and taxable income;

g describe the valuation allowance for deferred tax assetswhen it is required

and what impact it has on financial statements;

h explain recognition and measurement of current and deferred tax items;

i

analyze disclosures relating to deferred tax items and the effective tax rate reconciliation and explain how information included in these disclosures affects a

companys financial statements and financial ratios;

identify the key provisions of and differences between income tax accounting

under International Financial Reporting Standards (IFRS) and US generally

accepted accounting principles (GAAP).

READING 32. NON-CURRENT (LONG-TERM) LIABILITIES

The candidate should be able to

a determine the initial recognition, initial measurement and subsequent measurement of bonds;

b describe the effective interest method and calculate interest expense, amortisation of bond discounts/premiums, and interest payments;

c explain the derecognition of debt;

d describe the role of debt covenants in protecting creditors;

e describe the financial statement presentation of and disclosures relating to debt;

f explain motivations for leasing assets instead of purchasing them;

g distinguish between a finance lease and an operating lease from the perspectives of the lessor and the lessee;

h determine the initial recognition, initial measurement, and subsequent measurement of finance leases;

i

compare the disclosures relating to finance and operating leases;

compare the presentation and disclosure of defined contribution and defined

benefit pension plans;

k calculate and interpret leverage and coverage ratios.

2016 Level I CFA Program Curriculum CFA Institute.

Anda mungkin juga menyukai

- Banking and Capital MarketsDokumen1 halamanBanking and Capital Marketsshank16589Belum ada peringkat

- Control Diabetes Ebook by Guru MannDokumen8 halamanControl Diabetes Ebook by Guru MannGaurav Sharma100% (1)

- IT ServicesDokumen489 halamanIT Servicesshank16589Belum ada peringkat

- 2016 L1 SS10Dokumen2 halaman2016 L1 SS10shank16589Belum ada peringkat

- 2016 L1 SS12Dokumen3 halaman2016 L1 SS12shank16589Belum ada peringkat

- Prasthanam Movie ScreenplayDokumen191 halamanPrasthanam Movie ScreenplayAllTeluguFilms100% (2)

- 2016 L1 SS08Dokumen3 halaman2016 L1 SS08shank16589Belum ada peringkat

- 2016 L1 SS16Dokumen2 halaman2016 L1 SS16shank16589Belum ada peringkat

- 2016 L1 SS02 PDFDokumen4 halaman2016 L1 SS02 PDFXPloadTBelum ada peringkat

- 2016 L1 SS18Dokumen2 halaman2016 L1 SS18shank16589Belum ada peringkat

- 2016 L1 SS06Dokumen2 halaman2016 L1 SS06shank16589Belum ada peringkat

- CRISIL Research Ier Report Electrosteel 2014 Q3FY14fcDokumen10 halamanCRISIL Research Ier Report Electrosteel 2014 Q3FY14fcshank16589Belum ada peringkat

- Ethical and Professional Standards: Study SessionDokumen2 halamanEthical and Professional Standards: Study Sessionshank16589Belum ada peringkat

- Ethical and Professional Standards: Study SessionDokumen2 halamanEthical and Professional Standards: Study Sessionshank16589Belum ada peringkat

- M and ADokumen5 halamanM and Ashank16589Belum ada peringkat

- Adobe - Photoshop - Every - Tool.Explained PDFDokumen130 halamanAdobe - Photoshop - Every - Tool.Explained PDFsmachevaBelum ada peringkat

- Ambit Strategy Good & Clean 4.0 The Great 50Dokumen16 halamanAmbit Strategy Good & Clean 4.0 The Great 50Anoop RavindranBelum ada peringkat

- 2013 Annual ReportDokumen86 halaman2013 Annual Reportshank16589Belum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- 1GF S4hana1909 BPD en UsDokumen15 halaman1GF S4hana1909 BPD en UsBiji RoyBelum ada peringkat

- QUIZ - CHAPTER 1 - STATEMENT OF FINANCIAL POSITION With SolutionsDokumen9 halamanQUIZ - CHAPTER 1 - STATEMENT OF FINANCIAL POSITION With Solutionsfinn mertens100% (1)

- Parcor Chapter 1Dokumen6 halamanParcor Chapter 1Taylor SwiftBelum ada peringkat

- Kieso 14e PowerPoint Ch24Dokumen59 halamanKieso 14e PowerPoint Ch24James LeeBelum ada peringkat

- 2022 Special Olympics Missouri Annual ReportDokumen6 halaman2022 Special Olympics Missouri Annual ReportSpecial Olympics MissouriBelum ada peringkat

- Horizontal&Vertical Analysis Sample ProblemDokumen3 halamanHorizontal&Vertical Analysis Sample ProblemGenner RazBelum ada peringkat

- SOP Finance DepartmentDokumen21 halamanSOP Finance DepartmentAjay Kumar100% (1)

- Glen 2001097 KPNK4CDokumen3 halamanGlen 2001097 KPNK4CGlen ParadiseBelum ada peringkat

- Coso 2013 Internal Control Over External Financial Reporting - Integrate 1 PDFDokumen172 halamanCoso 2013 Internal Control Over External Financial Reporting - Integrate 1 PDFDora RodriguezBelum ada peringkat

- ACCA F3 Quiz 2 - RJDokumen2 halamanACCA F3 Quiz 2 - RJRahimBelum ada peringkat

- Business Com. Prelim ExamDokumen7 halamanBusiness Com. Prelim ExamJeane Mae BooBelum ada peringkat

- Chapter 5 Osama Mehmood Ali1 Erp Modules Alexis LeonDokumen44 halamanChapter 5 Osama Mehmood Ali1 Erp Modules Alexis LeonNikhil PrasannaBelum ada peringkat

- Unit 2: Financial Analysis 2.0 Aims and ObjectivesDokumen13 halamanUnit 2: Financial Analysis 2.0 Aims and ObjectiveshabtamuBelum ada peringkat

- RGU SyllabusDokumen3 halamanRGU SyllabusAnuran BordoloiBelum ada peringkat

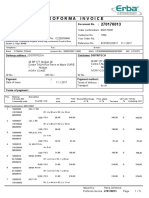

- FACTURE PRO FORMA ERBA PI 270170013 DistritechDokumen5 halamanFACTURE PRO FORMA ERBA PI 270170013 DistritechLuc YaoBelum ada peringkat

- Jawaban Intermediate Accounting Zaki Baridwan CertDokumen1 halamanJawaban Intermediate Accounting Zaki Baridwan Certnaomi devaBelum ada peringkat

- Audit Manual Part1Dokumen250 halamanAudit Manual Part1Romer Lesondato100% (2)

- DYBSAAgn313 - Accounting For Government & Non-Profit Organizations (MIDTERM MODULE) PDFDokumen11 halamanDYBSAAgn313 - Accounting For Government & Non-Profit Organizations (MIDTERM MODULE) PDFJonnafe Almendralejo IntanoBelum ada peringkat

- Financial Accounting Config S4HANADokumen64 halamanFinancial Accounting Config S4HANAalegpontonBelum ada peringkat

- Ficobbpfinalone10022011 120815114154 Phpapp02Dokumen146 halamanFicobbpfinalone10022011 120815114154 Phpapp02prashantaiwaleBelum ada peringkat

- CH 03 SolDokumen4 halamanCH 03 Solbhavin_tannaBelum ada peringkat

- Basic Accounting Reviewer Corpo PDFDokumen30 halamanBasic Accounting Reviewer Corpo PDFanthony lañaBelum ada peringkat

- Memo 097.9 082321 Internal Quality Audit IQA CY 2021 Advisory No.2Dokumen4 halamanMemo 097.9 082321 Internal Quality Audit IQA CY 2021 Advisory No.2David CastilloBelum ada peringkat

- ACCA Competency Framework How and When To Use 2020Dokumen6 halamanACCA Competency Framework How and When To Use 2020thanhloan1902Belum ada peringkat

- Full Download Ethics in Accounting A Decision Making Approach 1st Edition Solutions Klein PDF Full ChapterDokumen36 halamanFull Download Ethics in Accounting A Decision Making Approach 1st Edition Solutions Klein PDF Full Chapterapolloniccondylemoieax100% (13)

- Acctg 102 - Prelim Exams - 3048Dokumen3 halamanAcctg 102 - Prelim Exams - 3048AYAME MALINAO BSA19Belum ada peringkat

- Session 5 - QAR Audit Methodology Manual Presentation - Detailed ProcedureDokumen18 halamanSession 5 - QAR Audit Methodology Manual Presentation - Detailed ProcedureRheneir MoraBelum ada peringkat

- General Journal Entry - FABMDokumen10 halamanGeneral Journal Entry - FABMHannah SophiaBelum ada peringkat

- 7 IFRS 7 Financial Instruments - DisclosuresDokumen72 halaman7 IFRS 7 Financial Instruments - DisclosuresMihaelaBelum ada peringkat

- Users of Accounting Information-INTERNAL & EXTERNALDokumen3 halamanUsers of Accounting Information-INTERNAL & EXTERNALKayelle BelinoBelum ada peringkat