Corrected Financial Results For The Period Ended March 31, 2016 & June 30, 2016 (Result)

Diunggah oleh

Shyam SunderJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Corrected Financial Results For The Period Ended March 31, 2016 & June 30, 2016 (Result)

Diunggah oleh

Shyam SunderHak Cipta:

Format Tersedia

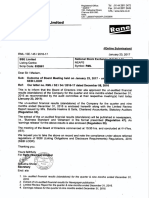

Krebs Biochemicals & Industries Limited

Cl

N : L24ttOAP1991 PLC1O39L2

l't November 2016

To,

The Manager,

Listing Department,

BSE Limited,

P J Towers, Dalal Street,

Fort, Mumbai-400001.

Dear Sir,/Madam,

Sub: Submission of conected financial results for the quarter ended 31$ March 2016 anil 306 June 201.6.

We refer to the above captioned subject, we herewith submit to you corrected results for the quarter ended

31$ March 2016 as we have identified clerical erors on our verification of financial results due to wtr-ich

the figures if quarter ending 3l't March 2016 needs to be corrected as explainedbelow:

a)

b)

c)

Cost of material consumed for the quarter ended 31.03.2016 should be rcad as Rs. 5.68 lakhs

instead of Rs. 24.73 lakhs. The difference is because the opening stock value of raw materials was

mistakenly considered.

Changes in inventories of work-in-progress and finished goods for the quarter ended 3l't March

2016, should be read as Rs. 62.85 lakhs instead of Rs. 65.29 lakhs. The difference is because the

opening stock value was mistakenly considered.

Other manufacnrring expenses tobe read as Rs. 205.71lakhs instead of Rs.92.47 lakhs. Other

manufacturing expenses head was regrouped during the audit and the same was not considered

during the prepantion of balancing figures for the 4n quarter i.e, 31't March 2016. Atso the

opening stock value of consumables was mistakenly considered and results in further difference of

Rs. 1.63 lakhs in other manufacnrring expenses.

d) Other expenses should be read as Rs. -9.67 lakhs instead of Rs. 105.20 lakhs. Other expenses head

was regrouped during the audit and the same was not considered during the prqaration of

balancingfigures for the quarter ending 31" March 2016.

e) The net effect of the above changes will result in decrease of loss for the quarter ended 31't March

2016to the extent of Rs. 23.11 lakhs, from Rs. 624.13 lakhs to Rs. 601.02lakhs.

We are herewith attaehing the corrected financial statements for the quarter ended 31" March 2016 and

30ft June 2016 (the figures of 31't March 2016 after complying with the Ind AS) that have been ratified by

the Audit Committee and will be put up to the Board's approval in the forthcoming Board Meeting.

We regret the error caused in the financial results and we ensure you that utmost care shall be taken in

future and avoid such kind of errors in declaring the financial results.

Kindly take the same into your records.

Thanking you,

Yours Faithfully,

For

Limited

(V), Kasim kota (M), Anakapalli, Visakhapatnam, Andhra Pradesh-531. 03 1

CorporateOffice: 8-2-57718, PlotNo.34,3rd Floor, Maas Heights, Road No.8, BanjaraHills, Hyderabad-5O0034

Tel :040-66808040 E-mail : marketing@krebsbiochem.com Website :www.krebsbiochem.com

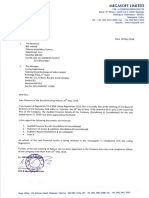

KREBS BIOCHEMICALS & INDUSTRIES LIMITED

CIN: L2411OAP19rPLC103912

Regd. OIIice: Kothapalli (Y), Kasimkota (M), Anakapalli, Vishakapatnam (DF 531031

Corp. Olfice: Plot No:38, &2-577i8, Maas Heights, Road No:8, Banjara Hills, Hyderabad -501X)34

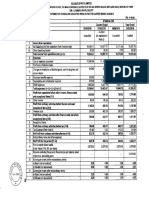

CORRXCTf,D STAND ALONE FINANCIAL RESULTS FOR THE QUARTER AND TWELVE MONTHS EIIDED 31ST MARCH 2016

31.12.201s

31.03.2016

Changes in inventories offinished goods,

/ (Loss) from ordinary activities before finance costs

& exceptional

Profrt / (Loss) from Ordinary Activities after Finance Cosls but before

re of

Profit/ (Lms)

of Assmiatq

Net Profit / (Loss) after Taxs, minoilty Interest

ofAssociotes (13 + 14+ I

&

Share of PrcfiU (Loss)

Sbare Caoital (Facc Value Rs. 10/-

Reene Excluding Revaluation

951 43

Reserues as per Balance Sheet of

Eaming Per Share (before extraordinarry

ltems)

previou

(1,417 .e7)

(ofRs.l0/- each)

Earning Per Share (after extraordinarry Items) (ofRs.l0/- each) (not

-,

2

3

,'

5

The above results have been reviewed by the Audit Comrnittee at its meeting held on 28th May, 2016 md approved by the

held on 28th May, 2016.

Bord ofDirectors ofthe Company

at its meting

The Company is operating in one sepent only hence no sepent results have been disclosed.

Figures have been regrouped,

remged

wherever necessary.

3lst March, 2015 are the balmcing figures between the audited figures in respect ofthe firll financial year and the

audited third quaner published year to date figures, which are subjmted to a Limited Review.

The figures for the quarter ended 31st March, 2016 md

NOTES FOR CORRECTIONS

The figures ofthe quarter ended 31.03.2016 have been corected for minor clerical enors md regrouping involving

i

ii

) Cost of Materials consmed to read as Rs. 5.68 lacs instead of Rs. 24.73lacs

) Changes in invealsries 6ffinished Goods, WIP and Stock in Trade to read as Rs. 62 85 lacs instead ofRs. 65.29 lacs

iii)OthermanufacturingexpensestoreadasRs.205.Tl

lacsinsteadofRs 92.47lacs

iv ) Other expenses to read as Rs (9 67) lacs instead ofRs. 105.20 lacs

v )Theconectionisprimfilyduetoclericalenorsinaccomtingtheopeningbalmceofstockvalueinquarterended3l.03.2016mdregroupingofsomeoftheexpenres.

This lead to change ofitems at Sl. No:3 ,

5,7,9,

ll,

13, 16, 19(i) and

l9(ii)

and no other changes are made

vi) The net effect ofthe above changes will result in decrease ifloss for the quarter ended 3 lst Milch 2016 to the extent ofRs. 23.1

vii)ConectionshavebeenratifiedbytheAuditCommitteeinitsmeetingdated3l

Place:Hyderabad

Date :31 10.2016

102016

lacs

/ It;

)|<!--VTNASHRA

ManagingD

DIN:01616152

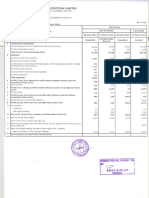

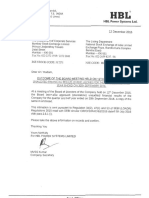

KREBS BIOCHEMICALS & INDUSTRIES LIMITED

CIN:L241 l0APl99l PLCI 0391 2

Registered Ollice: Kothapalli Village, Kasimkota Mandal, Ankapalli, Visakhapatnarn, Andhra Pradesh - 531 031

Corporate Ollicez 8-2-577lB,Plot No:34,3rd Floor, Maas Heights, Road No:8, Banjara Hills, Hyderabad - 500 034

CORRECTED STANDALONE FINANCIAL RESULTS FOR THE QUARTER / PERIOD ENDED 3OTH JT]NE 2016

(Rs- In lacs

For

30.06.2016

31.03.2016

30.06.201s

fllnaudited' flInauditedl fUnaudited)

PART -

,,

714

Expenses

l Cost ofMaterial Consumed

work-in-orosess and stock -in-trade

l Emolovee benefits exDense

I Deoreciation and Amortisation exnense

:.Other Manufacfuring Expenses

4

5

Other Exoenses

fotal Expenses

Profit / (Loss) from Operations before other incorne, frnance costs and exceptional

tems (1 - 2)

Other Income

Profit / (Loss) from ordinary activities before finance costs & exceptional items (3

+4)

Finance Costs

Prolit / (Loss) from Ordinary Activities after Finance Costs but before exceptional

Exceotional Itmes:

items (5

{Arrdited)

* lo

a) Debit balances written

r7.79

39.01

39.01

r7.79

123 17

17.79

140.96

011

s68

13 22

l'17.26

4.07

62 85

r23.93

104 09

7t 29

56 60

360.10

198 08

162 00

t38 53

566.52

95.54

448 62

20s'71

(s 65

I 15.04

628.67

424.65

1.E29.81

(3r3.97)

(s89.66)

(406.861

(1,688.8s

l13

31.46

075

102 94

(312.84)

(ss8.20)

39.00

46-14

: Changes in inventories offinished goods,

31.03.2016

lncome from Operations

l) Net Sales / Income from Operations

b) Other Operatins Income

fotal Income from onerations (net)

:-.

The

fear Endinl

Quarter Ended

Profit / (Loss) after Tax

(406.1r

(1,585.91

4872

0.19

73.88

(406.30)

(1,659.79'

(0.e3)

(0.93

(126.93

(8.37)

683

Net

(9 + 10)

13

350 97

(606.e2)

d) Profit on Sale of Food Division's Immovables

ll

449

65 07

50.67

c) Amounts Written Back

Profit / (Loss) from ordinarv activities before Tax (7 + 8)

Iax Expense

<162.69

(363.s1)

off

b) Depletion in Value oflnventory

9

10

Q.7s)

52 03

96 49

59 t2

59.12

(37r.EE)

(601.02t

(295.15)

(1.632.04'

(371.88)

(60r.021

(29s.rs)

(1,632.04'

(371.88)

(601.021

(295.15t

(1.632.04

(371.88)

(601.021

(29s.rsl

(1,632.04'

t2

Extra Ordinarv Items

13

NetProfit / (Loss) for the Deriod (11 + 12)

t4 Other Comorehensive Income

Iotal Comprehensive Income after Tax(13 + 14)

15

[Comprisins Profit (Loss) and other Comorehensive Income for the oeriod)

r6 Paid-uo Eouitv Share Caoital (Face Value Rs. 10/- each)

Reserve Excluding Revaluation Reserves as per Balance Sheet of previous

t7

Accountins Year

(ofRs.lO/- each) (not

Earning Per Share (before extraordinary Items)

(i)

l8

Annrrllised)

a) Basic

'b) Diluted

(iD

EarningPerShare(afterextraordinaryItems)(ofRs.10/-each)

I

2

-306.43

r.306.43

r.24r.43

(372 26

(2.7r

(4.87'

(2 38)

13 24

(2.79

G.62'

Q.38'

(L2.54

Q71

(4 87)

(4.62

()'t9'

(notAnnualised)

a) Basic

b) Diluted

Jee accomDanving notes to the

r_374 43

() 10\

(2 3E

13.24

02.54

Financial results

The above results have been reviewed by the Audit Committee at its meeting held on 14th September 2016, and approved by the Board

Directors of the Company at its meeting held on l4th September 2016.

of

Ihe Company is operating in one segrnent only hence no segment results have been disclosec

Figures have been regrouped, rearranged wherever necessary,

Transition to Ind-As

The Company has adopted Iad-As with effect from lst April 2016 with comparitives being restated. Accordingly the impact of transition has been

provided in the Opening reseryes as at lst April 2015 and all the periods presented have been restated accordingly.

Resultforthequarterended30thJune2016areincompliancewithlndian

AccountingStandards(Ind-As)notifiedbytheMinistryofCorporate

Affairs, Consequently, result for the quarter ended 3lst march 2016, 30th June 2015 and previous year ended 31st March 2016 have been restated

to complv with Ind-As to make them comoarable

Notes for Corrections:

for incorporation ofcorrected figures for the quarter ended 31.03.2016 that have been made in the

financial results for the ouarter ended 3 1st march 2016 dt.3 1.10.2016 and these have been restated to comply with Ind-As

b Column heading ofquarter ended 3l 03 2016 to read as "Unaudited" instead ofAudited.

c.Corrections have been ratified by the Audit Committe in its meeting dt 31.10.2016.

a.These corrections are

Jlace

Hvderabad

Date

1.10.2016

AVIFASH

Managing

Dii

DIN:016161

KREBS BIOCHEMICA|5

& INDUSTRIES LIMITED

CORRECTED RECONCITATION OF PROFIT AND RESERVE BETWEEN INDAS AND PREVIOUS INDIAN GAAP FOR EARLIER

PERIOD AND AS AT MARCH

3L,2016

Rs.in lakhs

Reserve

Profit reconciliation

Quarter

Quarter

ended 31st ended

Note March

l0th June

2015

ref. 20t6

sl # Nature of adiustments

Net Profit

'econciliation

fear ended

llst March

As

2016

March 2015

at 31st

Reserves as per Previous lndian

(501.02)

GAAP

Fair valuation as deemed cost

(2ss.16)

(1,532.04)

1L,477.971

for Property, Plant

and Eouioment

Fair valuation

4,743.25

(37s.28l,

of Intansible Assets

Fair Valuation of for Financial Assets

(3,r.26.95)

Defered Tax

(131.30)

Sub Total

1,105.71

Net profit/ Reserves as per Ind As

1501.021

(29s.161

(372.261

(1,632.041

Notes:

1 Fair valution as deemed cost for Properw, Plant and Equipment

Considered fair value for property, viz land admeasuring 1L0.7 acres, situated in Andhra Pradesh

in

India, with

impact of Rs.4743.25 lakhs in accordance with stipulations of Ind AS 101 (see Ind As 16) with the resultant

impact being accounted for in the reserves.

Fair Valuation of Intangible Assets

Considered fair value of Intangible Assets based on expected future economic benefits using reasonable and

supportable assumptions in accordance with stipulations of Ind As 38 with the resultant impact being accounted

for in the reseryes.

Fair valuation

for Financial Assets

The Company has valued financial assets at fair value. lmpact of fair value changes as on the date of transition,

is recognised in opening reserves and changes thereafter are recongnised in Profit and Loss Account or Other

Comprehensive Income, as the case may be.

Defered Tax

The lmpact of transition adjustments together with Ind As mandate of using balance sheet approch (against

profit and loss approch in the previous GMP) for computation of deferred taxes has resulted in charge to the

Reserves, on the date oftransition, with consequential impact to the Profit and Loss account for the subsequent

periods.

5 The Audit Committee has reviewed the above results and the Board of Directors has approved the above results

and its release at their resepective meetings held on 14th September 2016. The Statutory Auditors of the

Company have carried out a Limited Review of the results for the current quarter.

6 Notes for Corrections:

a)These corrections are for incorporation of corrected figures for the quarter ended 31.03.2016 that

have been made in the corrected stand alone financial results for the quarter ended 3lst march 2016

d1.31.10.2016.

b.Correction

(624.r3).

in Net

Profit/Reserves as per previous Indian GAAP

to read as (601.02) instead of

c) Correction in Net Proht/Reserys as per Ind As to read as (601.02) instead of (624.1 3).

Place: Hyderabad

Date: 31.10.2016

Managing

DIN: 015161

Anda mungkin juga menyukai

- Tools to Beat Budget - A Proven Program for Club PerformanceDari EverandTools to Beat Budget - A Proven Program for Club PerformanceBelum ada peringkat

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen11 halamanStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen15 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen8 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report, Earning Release For December 31, 2016 (Result)Dokumen7 halamanStandalone Financial Results, Limited Review Report, Earning Release For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Revised Financial Results For March 31, 2016 (Result)Dokumen10 halamanRevised Financial Results For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen8 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Dokumen8 halamanStandalone & Consolidated Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Dokumen7 halamanAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokumen5 halamanFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen7 halamanStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Updates On Financial Results For March 31, 2015 (Result)Dokumen3 halamanUpdates On Financial Results For March 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Statement of Assets & Liabilites As On March 31, 2016 (Result)Dokumen6 halamanStatement of Assets & Liabilites As On March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen11 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen7 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For March 31, 2016 (Result)Dokumen3 halamanStandalone Financial Results For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen10 halamanStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Revised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanRevised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Revised Financial Results For June 30, 2016 (Result)Dokumen4 halamanRevised Financial Results For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen7 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen6 halamanStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Inter Alia,: VikrantDokumen18 halamanInter Alia,: VikrantShyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen8 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Announces Q1 (Standalone) Results, Limited Review Report (Standalone) & Results Press Release For The Quarter Ended June 30, 2016 (Result)Dokumen4 halamanAnnounces Q1 (Standalone) Results, Limited Review Report (Standalone) & Results Press Release For The Quarter Ended June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Mutual Fund Holdings in DHFLDokumen7 halamanMutual Fund Holdings in DHFLShyam SunderBelum ada peringkat

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDokumen5 halamanExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderBelum ada peringkat

- JUSTDIAL Mutual Fund HoldingsDokumen2 halamanJUSTDIAL Mutual Fund HoldingsShyam SunderBelum ada peringkat

- HINDUNILVR: Hindustan Unilever LimitedDokumen1 halamanHINDUNILVR: Hindustan Unilever LimitedShyam SunderBelum ada peringkat

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDokumen2 halamanSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderBelum ada peringkat

- Settlement Order in Respect of R.R. Corporate Securities LimitedDokumen2 halamanSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderBelum ada peringkat

- Order of Hon'ble Supreme Court in The Matter of The SaharasDokumen6 halamanOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderBelum ada peringkat

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Dokumen1 halamanPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokumen3 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen4 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results For Mar 31, 2014 (Result)Dokumen2 halamanFinancial Results For Mar 31, 2014 (Result)Shyam SunderBelum ada peringkat

- Financial Results For June 30, 2014 (Audited) (Result)Dokumen3 halamanFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For September 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For June 30, 2016 (Result)Dokumen2 halamanStandalone Financial Results For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results For June 30, 2013 (Audited) (Result)Dokumen2 halamanFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderBelum ada peringkat

- Financial Results For Dec 31, 2013 (Result)Dokumen4 halamanFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Dokumen2 halamanFinancial Results For September 30, 2013 (Result)Shyam SunderBelum ada peringkat

- PDF Processed With Cutepdf Evaluation EditionDokumen3 halamanPDF Processed With Cutepdf Evaluation EditionShyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For March 31, 2016 (Result)Dokumen11 halamanStandalone Financial Results For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Transcript of The Investors / Analysts Con Call (Company Update)Dokumen15 halamanTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Investor Presentation For December 31, 2016 (Company Update)Dokumen27 halamanInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Refrigerador de Vacunas Vesfrost MKF 074Dokumen5 halamanRefrigerador de Vacunas Vesfrost MKF 074Brevas CuchoBelum ada peringkat

- Technology in Society: SciencedirectDokumen10 halamanTechnology in Society: SciencedirectVARGAS MEDINA ALEJANDRABelum ada peringkat

- A List of 142 Adjectives To Learn For Success in The TOEFLDokumen4 halamanA List of 142 Adjectives To Learn For Success in The TOEFLchintyaBelum ada peringkat

- Sel027 PDFDokumen9 halamanSel027 PDFSmart BiomedicalBelum ada peringkat

- Design and Analysis of DC-DC Boost Converter: September 2016Dokumen5 halamanDesign and Analysis of DC-DC Boost Converter: September 2016Anonymous Vfp0ztBelum ada peringkat

- JLPT Application Form Method-December 2023Dokumen3 halamanJLPT Application Form Method-December 2023Sajiri KamatBelum ada peringkat

- Boeing SWOT AnalysisDokumen3 halamanBoeing SWOT AnalysisAlexandra ApostolBelum ada peringkat

- Invenio Flyer enDokumen2 halamanInvenio Flyer enErcx Hijo de AlgoBelum ada peringkat

- Top Survival Tips - Kevin Reeve - OnPoint Tactical PDFDokumen8 halamanTop Survival Tips - Kevin Reeve - OnPoint Tactical PDFBillLudley5100% (1)

- Reflection - Reading and Writing 3Dokumen3 halamanReflection - Reading and Writing 3Quỳnh HồBelum ada peringkat

- Lenovo S340-15iwl Compal LA-H101P SchematicDokumen53 halamanLenovo S340-15iwl Compal LA-H101P SchematicYetawa Guaviare100% (4)

- Class 12 Unit-2 2022Dokumen4 halamanClass 12 Unit-2 2022Shreya mauryaBelum ada peringkat

- CFodrey CVDokumen12 halamanCFodrey CVCrystal N FodreyBelum ada peringkat

- Dr. Babasaheb Ambedkar Technological UniversityDokumen3 halamanDr. Babasaheb Ambedkar Technological UniversityalfajBelum ada peringkat

- Data SheetDokumen14 halamanData SheetAnonymous R8ZXABkBelum ada peringkat

- Description About Moon: Earth SatelliteDokumen6 halamanDescription About Moon: Earth SatellitePurva KhatriBelum ada peringkat

- Libel Arraignment Pre Trial TranscriptDokumen13 halamanLibel Arraignment Pre Trial TranscriptAnne Laraga LuansingBelum ada peringkat

- The Story of An Hour QuestionpoolDokumen5 halamanThe Story of An Hour QuestionpoolAKM pro player 2019Belum ada peringkat

- ARHAM FINTRADE LLP - Company, Directors and Contact Details Zauba CorpDokumen1 halamanARHAM FINTRADE LLP - Company, Directors and Contact Details Zauba CorpArun SonejiBelum ada peringkat

- New Client QuestionnaireDokumen13 halamanNew Client QuestionnairesundharBelum ada peringkat

- IRJ November 2021Dokumen44 halamanIRJ November 2021sigma gaya100% (1)

- Math - Snowflake With ProtractorsDokumen4 halamanMath - Snowflake With Protractorsapi-347625375Belum ada peringkat

- Determination of Hydroxymethylfurfural (HMF) in Honey Using The LAMBDA SpectrophotometerDokumen3 halamanDetermination of Hydroxymethylfurfural (HMF) in Honey Using The LAMBDA SpectrophotometerVeronica DrgBelum ada peringkat

- Exam Ref 70 483 Programming in C by Wouter de Kort PDFDokumen2 halamanExam Ref 70 483 Programming in C by Wouter de Kort PDFPhilBelum ada peringkat

- Comparison of Multi-Coil and Diaphragm Spring ClutchesDokumen3 halamanComparison of Multi-Coil and Diaphragm Spring Clutchesmasb_994077Belum ada peringkat

- Solitax SCDokumen8 halamanSolitax SCprannoyBelum ada peringkat

- Alan Freeman - Ernest - Mandels - Contribution - To - Economic PDFDokumen34 halamanAlan Freeman - Ernest - Mandels - Contribution - To - Economic PDFhajimenozakiBelum ada peringkat

- SOLVING THE STEADY STATE SOLVER AND UNSTEADY or TRANSIENT SOLVER 2D HEAT CONDUCTION PROBLEM BY USINGDokumen3 halamanSOLVING THE STEADY STATE SOLVER AND UNSTEADY or TRANSIENT SOLVER 2D HEAT CONDUCTION PROBLEM BY USINGGodwin LarryBelum ada peringkat

- BQ - Structural Works - CompressedDokumen163 halamanBQ - Structural Works - CompressedLee YuxuanBelum ada peringkat

- Aits 2122 PT I Jeea 2022 TD Paper 2 SolDokumen14 halamanAits 2122 PT I Jeea 2022 TD Paper 2 SolSoumodeep NayakBelum ada peringkat

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeDari EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimePenilaian: 4.5 dari 5 bintang4.5/5 (89)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldDari Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldPenilaian: 5 dari 5 bintang5/5 (20)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurDari Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurPenilaian: 4 dari 5 bintang4/5 (2)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureDari EverandSummary of Zero to One: Notes on Startups, or How to Build the FuturePenilaian: 4.5 dari 5 bintang4.5/5 (100)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveDari EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveBelum ada peringkat

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthDari EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthPenilaian: 4.5 dari 5 bintang4.5/5 (1026)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryDari EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryPenilaian: 4 dari 5 bintang4/5 (26)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeDari EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimePenilaian: 4.5 dari 5 bintang4.5/5 (58)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizDari EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizPenilaian: 4.5 dari 5 bintang4.5/5 (112)

- The Master Key System: 28 Parts, Questions and AnswersDari EverandThe Master Key System: 28 Parts, Questions and AnswersPenilaian: 5 dari 5 bintang5/5 (62)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyDari EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyPenilaian: 5 dari 5 bintang5/5 (22)

- Every Tool's a Hammer: Life Is What You Make ItDari EverandEvery Tool's a Hammer: Life Is What You Make ItPenilaian: 4.5 dari 5 bintang4.5/5 (249)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsDari EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsPenilaian: 5 dari 5 bintang5/5 (48)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisDari EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- Your Next Five Moves: Master the Art of Business StrategyDari EverandYour Next Five Moves: Master the Art of Business StrategyPenilaian: 5 dari 5 bintang5/5 (801)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursDari EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursPenilaian: 5 dari 5 bintang5/5 (24)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessDari EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessPenilaian: 4.5 dari 5 bintang4.5/5 (407)

- Transformed: Moving to the Product Operating ModelDari EverandTransformed: Moving to the Product Operating ModelPenilaian: 4 dari 5 bintang4/5 (1)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelDari EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelPenilaian: 5 dari 5 bintang5/5 (51)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedDari EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedPenilaian: 4.5 dari 5 bintang4.5/5 (38)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleDari EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistiblePenilaian: 4.5 dari 5 bintang4.5/5 (48)

- 7 Secrets to Investing Like Warren BuffettDari Everand7 Secrets to Investing Like Warren BuffettPenilaian: 4.5 dari 5 bintang4.5/5 (121)

- Cryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyDari EverandCryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyPenilaian: 4.5 dari 5 bintang4.5/5 (300)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andDari EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andPenilaian: 4.5 dari 5 bintang4.5/5 (709)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Dari EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Penilaian: 5 dari 5 bintang5/5 (2)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeDari EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifePenilaian: 5 dari 5 bintang5/5 (22)

- 100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziDari Everand100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziBelum ada peringkat

- Startup: How To Create A Successful, Scalable, High-Growth Business From ScratchDari EverandStartup: How To Create A Successful, Scalable, High-Growth Business From ScratchPenilaian: 4 dari 5 bintang4/5 (114)

- Invention: A Life of Learning Through FailureDari EverandInvention: A Life of Learning Through FailurePenilaian: 4.5 dari 5 bintang4.5/5 (28)