Mid Lease Solution

Diunggah oleh

Imtiaz RashidHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Mid Lease Solution

Diunggah oleh

Imtiaz RashidHak Cipta:

Format Tersedia

396

Part 6 Special Topics in Managerial Finance

P16-5. LG 2: Lease versus Purchase

Challenge

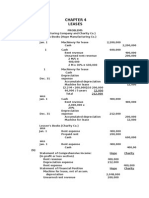

(a) Lease

After-tax cash outflows = $19,800 (1 0.40) = $11,880/year for 5 years plus $24,000

purchase option in year 5 (total $35,880).

Purchase

Year

Loan

Payment

(1)

Maintenance

(2)

Depreciation

(3)

1

2

3

4

5

$23,302

23,302

23,302

23,302

23,302

$2,000

2,000

2,000

2,000

2,000

$16,000

25,600

15,200

9,600

9,600

Total

Tax

After-tax

Cash Outflows

Interest Deductions Shields

at 14% (2 + 3 + 4) [(0.40) (5)] [(1 + 2) (6)]

(5)

(6)

(7)

(4)

$11,200

9,506

7,574

5,372

2,862

$29,200

37,106

24,774

16,972

14,462

$11,680

14,842

9,910

6,789

5,785

$13,622

10,460

15,392

18,513

19,517

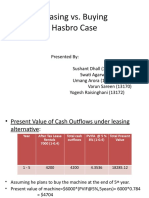

(b)

End

of Year

After-tax

Cash Outflows

PVIF9%,n

PV of Outflows

Calculator

Solution

Lease

1

2

3

4

5

$11,880

11,880

11,880

11,880

35,880

0.917

0.842

0.772

0.708

0.650

$10,894

10,003

9,171

8,411

23,322

$61,801

$61,807.41

$12,491

8,807

11,883

13,107

12,686

$58,974

$58,986.46

Purchase

1

2

3

4

5

(c)

$13,622

10,460

15,392

18,513

19,517

0.917

0.842

0.772

0.708

0.650

The present value of the cash outflows is less with the purchasing plan, so the firm should

purchase the machine. By doing so, it saves $2,827 in present value terms.

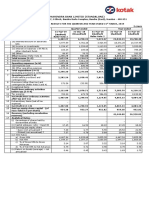

P16-6. LG 2: Capitalized Lease Values

Intermediate

Lease

A

B

C

D

E

Table Values

$40,000

120,000

9,000

16,000

47,000

6.814 =

4.968 =

6.467 =

2.531 =

7.963 =

$272,560

596,160

58,203

40,496

374,261

Calculator Solution

$272,547.67

596,116.77

58,206.78

40,500.72

374,276.42

Anda mungkin juga menyukai

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDari EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineBelum ada peringkat

- Question BankDokumen25 halamanQuestion BankAastha Bisht100% (1)

- Hybrid and Derivative Securities (Lembar Jawaban)Dokumen4 halamanHybrid and Derivative Securities (Lembar Jawaban)Radinne Fakhri Al WafaBelum ada peringkat

- ICICI Financial StatementsDokumen9 halamanICICI Financial StatementsNandini JhaBelum ada peringkat

- Solutions to Chapter 11 QuestionsDokumen3 halamanSolutions to Chapter 11 QuestionssajedulBelum ada peringkat

- Lease Accounting ProblemsDokumen27 halamanLease Accounting ProblemsElijah Lou ViloriaBelum ada peringkat

- Assignment 2Dokumen8 halamanAssignment 2Tawanda MakombeBelum ada peringkat

- Goodweek Tires, Inc - A tire producing companyDokumen20 halamanGoodweek Tires, Inc - A tire producing companyMai Trần100% (1)

- Standalone Financial Results, Auditors Report For December 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Auditors Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- AnswersDokumen8 halamanAnswersTareq ChowdhuryBelum ada peringkat

- CongoleumDokumen16 halamanCongoleumMilind Sarambale0% (1)

- UBS Capital BudgetingDokumen19 halamanUBS Capital BudgetingRajas MahajanBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Project Report PDFDokumen13 halamanProject Report PDFMan KumaBelum ada peringkat

- Hayleys Surpasses Rs 100 BN Turnover in 1HFY18/19Dokumen18 halamanHayleys Surpasses Rs 100 BN Turnover in 1HFY18/19Janitha DissanayakeBelum ada peringkat

- 2022 04 Q4-2022 PR2-New-roomDokumen10 halaman2022 04 Q4-2022 PR2-New-roomTejpal SainiBelum ada peringkat

- EconomicsDokumen5 halamanEconomicsbrian mochez01Belum ada peringkat

- Final Exam Corporate Finance CFVG 2016-2017Dokumen8 halamanFinal Exam Corporate Finance CFVG 2016-2017Hạt TiêuBelum ada peringkat

- Unitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Dokumen4 halamanUnitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Bhuvan MalikBelum ada peringkat

- Financial Management (FM) Solution Pack: S. No ACCA Exam Paper Topics CoveredDokumen64 halamanFinancial Management (FM) Solution Pack: S. No ACCA Exam Paper Topics CoveredKoketso MogweBelum ada peringkat

- Rent-Way Rentavision Pro Forma Adjustments Pro FormaDokumen6 halamanRent-Way Rentavision Pro Forma Adjustments Pro FormaBassoonDude05Belum ada peringkat

- 7 Quiz Bonds Payable & Note Payable - Part 1: 1 1 PT 2 PTDokumen5 halaman7 Quiz Bonds Payable & Note Payable - Part 1: 1 1 PT 2 PTJessa Mae BanseBelum ada peringkat

- Unaudited Financial Results Q2 FY2022 23 Bandhan BankDokumen6 halamanUnaudited Financial Results Q2 FY2022 23 Bandhan BankPradyut RoyBelum ada peringkat

- SD17 Hybrid F9 Answers Clean ProofDokumen10 halamanSD17 Hybrid F9 Answers Clean ProofVinny Lu VLBelum ada peringkat

- Chapter 3 ProFormaDokumen15 halamanChapter 3 ProFormaNancy LuciaBelum ada peringkat

- (A) Nature of Business of Cepatwawasan Group BerhadDokumen16 halaman(A) Nature of Business of Cepatwawasan Group BerhadTan Rou YingBelum ada peringkat

- Asl Marine Holdings Ltd.Dokumen30 halamanAsl Marine Holdings Ltd.citybizlist11Belum ada peringkat

- RIL Financial Statement Analysis (CIA-1BDokumen10 halamanRIL Financial Statement Analysis (CIA-1Bprince chaudharyBelum ada peringkat

- Accounting/Series 4 2007 (Code3001)Dokumen17 halamanAccounting/Series 4 2007 (Code3001)Hein Linn Kyaw100% (2)

- Research Needed For Question 5Dokumen4 halamanResearch Needed For Question 5Ahmed MahmoudBelum ada peringkat

- 2021-22Dokumen3 halaman2021-2241 lavanya NairBelum ada peringkat

- Leasing vs. Buying Hasbro CaseDokumen14 halamanLeasing vs. Buying Hasbro CaseUmang AroraBelum ada peringkat

- FIN304 (End-Sem Model Answer 2021)Dokumen9 halamanFIN304 (End-Sem Model Answer 2021)sha ve3Belum ada peringkat

- Solution Far450 UITM - Jan 2013Dokumen8 halamanSolution Far450 UITM - Jan 2013Rosaidy SudinBelum ada peringkat

- Solution To QB QuestionsDokumen3 halamanSolution To QB QuestionsSurabhi Suman100% (1)

- Rs. in 000: Ans.6 (A) Hadi Limited Statement of Comprehensive Income For The Year Ended 31 December 2016Dokumen4 halamanRs. in 000: Ans.6 (A) Hadi Limited Statement of Comprehensive Income For The Year Ended 31 December 2016Sameen KhanBelum ada peringkat

- 7110 Principles of Acounts: MARK SCHEME For The October/November 2006 Question PaperDokumen6 halaman7110 Principles of Acounts: MARK SCHEME For The October/November 2006 Question Papermstudy123456Belum ada peringkat

- Cash Flows Statement - Two ExamplesDokumen4 halamanCash Flows Statement - Two Examplesakash srivastavaBelum ada peringkat

- Financial Application: Portfolio SelectionDokumen16 halamanFinancial Application: Portfolio SelectionTeree ZuBelum ada peringkat

- Chapter 5 Property, Plant and Equipment GuideDokumen14 halamanChapter 5 Property, Plant and Equipment GuideNaSheeng100% (1)

- 2000 5000 Corp Action 20220525Dokumen62 halaman2000 5000 Corp Action 20220525Contra Value BetsBelum ada peringkat

- GAR02 28 02 2024 FY2023 Results ReleaseDokumen29 halamanGAR02 28 02 2024 FY2023 Results Releasedesifatimah87Belum ada peringkat

- INDIGO Cash FlowsDokumen9 halamanINDIGO Cash FlowsAyush SarawagiBelum ada peringkat

- Kotak Mahindra Bank Q4 FY19 standalone resultsDokumen9 halamanKotak Mahindra Bank Q4 FY19 standalone resultsSumit SharmaBelum ada peringkat

- L2 HW SET4.SolutionsDokumen5 halamanL2 HW SET4.SolutionsJack Wei QiBelum ada peringkat

- Biblio & AnnexureDokumen4 halamanBiblio & AnnexureJoy CharlesBelum ada peringkat

- Adelphia Bankruptcy Spreadsheets XLS664-XLS-ENGDokumen23 halamanAdelphia Bankruptcy Spreadsheets XLS664-XLS-ENGShubham KumarBelum ada peringkat

- CH 10 FMDokumen30 halamanCH 10 FMshubakarBelum ada peringkat

- Chapter - 14-Working Capital and Current Assets ManagementDokumen8 halamanChapter - 14-Working Capital and Current Assets ManagementShota TsakashviliBelum ada peringkat

- Lease or Buy DecesionDokumen7 halamanLease or Buy DecesionRashid HussainBelum ada peringkat

- Statements of Comprehensive IncomeDokumen7 halamanStatements of Comprehensive IncomewawanBelum ada peringkat

- Exhibit 2a Summarized Income StatementsDokumen15 halamanExhibit 2a Summarized Income StatementsPooja TyagiBelum ada peringkat

- Financial Statement Analysis of Maruti SuzukiDokumen6 halamanFinancial Statement Analysis of Maruti SuzukiAshish AimaBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Ramesh Kumar SoniDokumen13 halamanRamesh Kumar SoniShreeRang ConsultancyBelum ada peringkat

- Corporate Actions: A Guide to Securities Event ManagementDari EverandCorporate Actions: A Guide to Securities Event ManagementBelum ada peringkat

- The NEC4 Engineering and Construction Contract: A CommentaryDari EverandThe NEC4 Engineering and Construction Contract: A CommentaryBelum ada peringkat

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionDari EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionBelum ada peringkat

- Stockholder's Equity Part 1Dokumen14 halamanStockholder's Equity Part 1Imtiaz RashidBelum ada peringkat

- The Reason Why LIFO Has Been DeniedDokumen2 halamanThe Reason Why LIFO Has Been DeniedImtiaz RashidBelum ada peringkat

- Chap005 PDFDokumen63 halamanChap005 PDFTrần Gia LinhBelum ada peringkat

- ERDDokumen1 halamanERDtbenguaBelum ada peringkat

- ABC Blocher SolutionsDokumen73 halamanABC Blocher Solutionsmayankgrover8658% (12)

- Sources of FundsDokumen22 halamanSources of FundsImtiaz RashidBelum ada peringkat

- ABC Blocher SolutionsDokumen73 halamanABC Blocher Solutionsmayankgrover8658% (12)

- Journals in DetailsDokumen3 halamanJournals in DetailsImtiaz RashidBelum ada peringkat

- SELECT Employee - Employee - Name, Employee - City FROM Employee, Works Works - Employee - Name Employee - Employee - NameDokumen1 halamanSELECT Employee - Employee - Name, Employee - City FROM Employee, Works Works - Employee - Name Employee - Employee - NameImtiaz RashidBelum ada peringkat

- Sources of FundsDokumen22 halamanSources of FundsImtiaz RashidBelum ada peringkat

- Marico Bangladesh LimitedDokumen12 halamanMarico Bangladesh LimitedImtiaz RashidBelum ada peringkat

- Remedies Conclusion, ReferrencesDokumen4 halamanRemedies Conclusion, ReferrencesImtiaz RashidBelum ada peringkat

- Executive SummeryDokumen18 halamanExecutive SummeryImtiaz RashidBelum ada peringkat

- Apex Footwear LimitedDokumen11 halamanApex Footwear LimitedImtiaz RashidBelum ada peringkat

- IFRS 7 Original PDFDokumen39 halamanIFRS 7 Original PDFImtiaz Rashid50% (2)

- Steps in Developing Effective Marketing CommunicationDokumen1 halamanSteps in Developing Effective Marketing CommunicationImtiaz RashidBelum ada peringkat

- Financial Accounting PDFDokumen684 halamanFinancial Accounting PDFImtiaz Rashid91% (11)

- Finance Assignment On Mid 2Dokumen10 halamanFinance Assignment On Mid 2Imtiaz RashidBelum ada peringkat

- Aggregate DemandDokumen9 halamanAggregate DemandImtiaz RashidBelum ada peringkat

- Chapter 16Dokumen11 halamanChapter 16Aarti J50% (2)

- Chapter 05Dokumen20 halamanChapter 05Imtiaz RashidBelum ada peringkat