Module Two Discussion Topic - FO

Diunggah oleh

Kevyn VzJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Module Two Discussion Topic - FO

Diunggah oleh

Kevyn VzHak Cipta:

Format Tersedia

Interpreting financial statements requires

knowledge

of

how

these

statements

are

prepared. Because the Balance Sheet, Income Statement, and Statement of Retained Earnings are

all influenced by management assumptions, it is critical to not take the figures on

these statements at face value and instead perform a thorough examination of these assumptions.

For this weeks discussion question, provide an example of a management assumption that could

have a significant impact on one of the aforementioned financial statements and explain how you

would scrutinize this assumption.

Example:

Your paternal grandfather bought a 1969 Camaro SS in the same year of its production for

$500.20 (like $3,333.34 nowadays) and in your fathers high school prom, your grandfather

gives away his 69 Camaro SS as a prom gift. Now, we are in 2016 and your dad also gave you

as a prom gift your grandfather 69 Camaro SS, but now that we are in 2016, someone gets close

to you to ask for the price of the car and if its on sale. Your 69 Camaro SS is the price listed in +

$45K with all the original accessories, engine, wheels, and without being involved in a car crash

and never restored. You now that there is an excellent deal in case you sell your grandfathers car

with an easy 15 times profit.

The previous example states the Cost Principle as a book value but also involves other

characteristics that raised this American Classic Car. Like the fact that it has gained the name of

Classic has a limited production, the supply, and demand of this car have been raising within the

last ten years. Also because its so difficult to find one in excellent conditions without being

restored, as we mentioned in the example, this car has never been restored once, and that its

what gives value to this type of car.

References

Bates, T., Kidwell, D., & Parrino, R. (p. 50-51, 2014). Fundamentals of Corporate Finance. (3 rd

ed.). Hoboken, New Jersey: Wiley.

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Reflection PaperDokumen3 halamanReflection PaperKevyn VzBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Copyright InfringementDokumen2 halamanCopyright InfringementKevyn VzBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Capm - AppleDokumen1 halamanCapm - AppleKevyn VzBelum ada peringkat

- Legal Issues in The Workplace: S T A MDokumen2 halamanLegal Issues in The Workplace: S T A MKevyn VzBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- InstaSummary Report of Mantra Softech (India) Private Limited - 30-06-2020Dokumen10 halamanInstaSummary Report of Mantra Softech (India) Private Limited - 30-06-2020RajiBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- DanielDokumen17 halamanDanielJerome MogaBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Fiscal Policy of EUROPEDokumen11 halamanFiscal Policy of EUROPEnickedia17Belum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- FirstStrike PlusDokumen5 halamanFirstStrike Plusartus14Belum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Audit of Property, Plant and Equipment: Auditing ProblemsDokumen5 halamanAudit of Property, Plant and Equipment: Auditing ProblemsLei PangilinanBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Sinking Fund and Amortization: OP PMT X IDokumen10 halamanSinking Fund and Amortization: OP PMT X IKhevin NetflixBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Rangkuman TaDokumen19 halamanRangkuman Tamutia rasyaBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Delhi To Rudrapur: Abhibus TicketDokumen2 halamanDelhi To Rudrapur: Abhibus TicketKrishan SharmaBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Dodd Frank CertificationDokumen1 halamanDodd Frank CertificationTara IsmineBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Appraisal ReportDokumen193 halamanAppraisal ReportDicky BhaktiBelum ada peringkat

- GloPAC Program 16 11 2023Dokumen10 halamanGloPAC Program 16 11 2023ElvisPresliiBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Bhavesh Jadav BB 1Dokumen7 halamanBhavesh Jadav BB 1bhaveshjadavBelum ada peringkat

- Recruitment Selection Process in HDFCDokumen102 halamanRecruitment Selection Process in HDFCaccord123100% (2)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- In The United States Bankruptcy Court For The District of Delaware in Re:) Chapter 11 Pacific Energy Resources LTD., Et Al.,') Case No. 09-10785 (KJC) ) (Jointly Administered) Debtor.)Dokumen67 halamanIn The United States Bankruptcy Court For The District of Delaware in Re:) Chapter 11 Pacific Energy Resources LTD., Et Al.,') Case No. 09-10785 (KJC) ) (Jointly Administered) Debtor.)Chapter 11 DocketsBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- (Springer Finance) Dr. Manuel Ammann (Auth.) - Credit Risk Valuation - Methods, Models, and Applications-Springer Berlin Heidelberg (2001)Dokumen258 halaman(Springer Finance) Dr. Manuel Ammann (Auth.) - Credit Risk Valuation - Methods, Models, and Applications-Springer Berlin Heidelberg (2001)Amel AmarBelum ada peringkat

- Soneri Bank Internship+ (Marketing)Dokumen66 halamanSoneri Bank Internship+ (Marketing)qaisranisahibBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

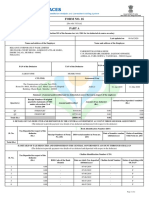

- Form No. 16: Part ADokumen8 halamanForm No. 16: Part AParikshit ModiBelum ada peringkat

- BBA Sem - II Syllabus - 13.112019Dokumen28 halamanBBA Sem - II Syllabus - 13.112019Gaurav BuchkulBelum ada peringkat

- Pmec ChallanDokumen1 halamanPmec ChallanSubhendu BarisalBelum ada peringkat

- Chapter 10 - Risk Response Audit Strategy Approach and Program - NotesDokumen9 halamanChapter 10 - Risk Response Audit Strategy Approach and Program - NotesSavy DhillonBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Geometric SequencesDokumen11 halamanGeometric SequencesDania Sonji0% (1)

- Financial Report (October 2017)Dokumen2 halamanFinancial Report (October 2017)Marija DukićBelum ada peringkat

- A Loan and Interest Problem: RepresentationsDokumen2 halamanA Loan and Interest Problem: RepresentationsMarjorie ChavezBelum ada peringkat

- Re InsuranceDokumen18 halamanRe InsuranceRahul MaratheBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Welcome To Momentum Trading SetupDokumen12 halamanWelcome To Momentum Trading SetupSunny Deshmukh0% (1)

- Introduction To Budgets and The Master BudgetDokumen33 halamanIntroduction To Budgets and The Master BudgetkunalBelum ada peringkat

- Fund Rankings Sovereign Wealth Fund InstituteDokumen3 halamanFund Rankings Sovereign Wealth Fund Institutelohenci_sammyBelum ada peringkat

- Accounting For Income TaxDokumen14 halamanAccounting For Income TaxJasmin Gubalane100% (1)

- 347Dokumen2 halaman347TarkimBelum ada peringkat

- A 2021MBA010 NiraliOswal Case Scenarios RBCDokumen3 halamanA 2021MBA010 NiraliOswal Case Scenarios RBCmohammedsuhaim abdul gafoorBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)