Year IRR: IRR (Cash Flows, (Guess) )

Diunggah oleh

Emilie June0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

11 tayangan1 halamanThis document contains 3 examples of financial calculations: 1) Calculating an internal rate of return (IRR) of 8% for a project with cash inflows of $100, $200, and $300 over 3 years. 2) Determining it will take 8.04 years to double an investment of $1,250 earning 9% annual interest. 3) Calculating a positive net present value of $80,015.02 for an investment of $500,000 with cash flows of $200,000, $300,000, and $200,000 over 3 years with a 10% discount rate.

Deskripsi Asli:

internal rate of return

Judul Asli

Irr

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThis document contains 3 examples of financial calculations: 1) Calculating an internal rate of return (IRR) of 8% for a project with cash inflows of $100, $200, and $300 over 3 years. 2) Determining it will take 8.04 years to double an investment of $1,250 earning 9% annual interest. 3) Calculating a positive net present value of $80,015.02 for an investment of $500,000 with cash flows of $200,000, $300,000, and $200,000 over 3 years with a 10% discount rate.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

11 tayangan1 halamanYear IRR: IRR (Cash Flows, (Guess) )

Diunggah oleh

Emilie JuneThis document contains 3 examples of financial calculations: 1) Calculating an internal rate of return (IRR) of 8% for a project with cash inflows of $100, $200, and $300 over 3 years. 2) Determining it will take 8.04 years to double an investment of $1,250 earning 9% annual interest. 3) Calculating a positive net present value of $80,015.02 for an investment of $500,000 with cash flows of $200,000, $300,000, and $200,000 over 3 years with a 10% discount rate.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

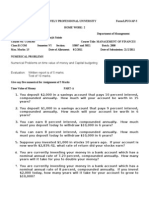

1 .Assume Company ABC wants to know whether it should buy a $500 piece of equipment.

It projects

that it will increase profits by $100 in Year 1, $200 in Year 2, and $300 in Year 3. Calculate the IRR of

the proposed project.

Period

0

1

2

3

IRR

Cash Inflow

$500

$100

$200

$300

8%

=IRR (cash flows, [guess])

2. Suppose that you have $1,250 today and

you would like to know how long it will take

you double your money to $2,500. Assume

that you can earn 9% per year on your investment.

Present Value

Future Value

Annual Rate

$1250

$2500

9%

Number of Periods

8.04

=NPer (rate, pmt, PV, FV, type)

3. Shoes for You's will expect to invest $500,000 for the development of their new product. The company

estimates that the first year cash flow will be $200,000; the second year cash flow will be $300,000, and

the third year cash flow to be $200,000. The expected return of 10% is used as the discount rate.

Annual Discount Rate

Initial Investment

1st Year Return

2nd Year Return

3rd Year Return

Net Present Value

10%

$500,000

$200,000

$300,000

$200,000

$80,015.02

=NPV (rate, value1, value2, value3,..)

Anda mungkin juga menyukai

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Dari EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Penilaian: 5 dari 5 bintang5/5 (1)

- Time Value of Money (Notes)Dokumen13 halamanTime Value of Money (Notes)Zubair ArshadBelum ada peringkat

- CIMA F3 Workbook Q PDFDokumen67 halamanCIMA F3 Workbook Q PDFjjBelum ada peringkat

- Module 2 Time Value of MoneyDokumen62 halamanModule 2 Time Value of MoneyNEERAJ N RCBSBelum ada peringkat

- Capital Budgeting Problems PDFDokumen23 halamanCapital Budgeting Problems PDFJitendra SharmaBelum ada peringkat

- Cash BudgetDokumen3 halamanCash Budgetmanoj kumarBelum ada peringkat

- General Principles of Flexible Pavement DesignDokumen67 halamanGeneral Principles of Flexible Pavement DesignEmilie JuneBelum ada peringkat

- Final Quiz EDokumen3 halamanFinal Quiz ETimothy JonesBelum ada peringkat

- Capital Budgeting ActivityDokumen1 halamanCapital Budgeting ActivityChristian ZuluetaBelum ada peringkat

- Problems For Practice - Portal Upload - 01 - Oct - 2019Dokumen1 halamanProblems For Practice - Portal Upload - 01 - Oct - 2019Yasir MalikBelum ada peringkat

- Homework PDFDokumen3 halamanHomework PDFSyed AliBelum ada peringkat

- Soal Soal Ekonomi Teknik KimiaDokumen2 halamanSoal Soal Ekonomi Teknik KimiapratitatriasalinBelum ada peringkat

- FINAL EXAM Winter 2014Dokumen8 halamanFINAL EXAM Winter 2014denisemriceBelum ada peringkat

- Fin 370 All My Finance LabDokumen12 halamanFin 370 All My Finance Labjupiteruk0% (1)

- Accounting Chapter 10Dokumen11 halamanAccounting Chapter 10Andrew ChouBelum ada peringkat

- Chapter-14: Multinational Capital BudgetingDokumen14 halamanChapter-14: Multinational Capital BudgetingAminul Islam AmuBelum ada peringkat

- Engineering Economics Tutorial Questions UnitDokumen3 halamanEngineering Economics Tutorial Questions UnitcleousBelum ada peringkat

- Summer 2020 1Dokumen1 halamanSummer 2020 1Hossain AhmedBelum ada peringkat

- Assignment#2Dokumen3 halamanAssignment#2Wuhao KoBelum ada peringkat

- Break Even Point ExampleDokumen10 halamanBreak Even Point Examplerakesh varmaBelum ada peringkat

- Practice Exercise For EconomicsDokumen2 halamanPractice Exercise For EconomicsclaireBelum ada peringkat

- Topic 2 Practice QuestionsDokumen3 halamanTopic 2 Practice Questionstijopaulose00Belum ada peringkat

- QNS & AnsDokumen10 halamanQNS & AnsJoseph SilayoBelum ada peringkat

- CB Lecture 1Dokumen20 halamanCB Lecture 1Tshepang MatebesiBelum ada peringkat

- Chapter-14: Multinational Capital BudgetingDokumen41 halamanChapter-14: Multinational Capital BudgetingShakib Ahammed ChowdhuryBelum ada peringkat

- CH 7 IntermediateDokumen21 halamanCH 7 IntermediateArely ChapaBelum ada peringkat

- Analysis of Accounts.: Grade 11Dokumen16 halamanAnalysis of Accounts.: Grade 11Mary TanuiBelum ada peringkat

- CH 08Dokumen12 halamanCH 08AlJabir KpBelum ada peringkat

- Tutorial Sheet For Engineering EconomicsDokumen12 halamanTutorial Sheet For Engineering EconomicsTinashe ChikariBelum ada peringkat

- Unit 1 FPP DoneDokumen3 halamanUnit 1 FPP DoneJayBelum ada peringkat

- Engineering Economics Practice Problems 2Dokumen1 halamanEngineering Economics Practice Problems 2Joshua PerezBelum ada peringkat

- Problem Set 04 - More Problems Using Financial FunctionsDokumen2 halamanProblem Set 04 - More Problems Using Financial FunctionsShashwatBelum ada peringkat

- FIN515 W3 Problem SetDokumen3 halamanFIN515 W3 Problem Sethy_saingheng_7602609Belum ada peringkat

- Answer The Following Questions Very CarefullyDokumen2 halamanAnswer The Following Questions Very CarefullyMaham ImtiazBelum ada peringkat

- Finance Practice ProblemsDokumen54 halamanFinance Practice ProblemsMariaBelum ada peringkat

- Capital Budgeting Exercise 1Dokumen2 halamanCapital Budgeting Exercise 1Mohamed ZaitoonBelum ada peringkat

- HW 2Dokumen3 halamanHW 2Love MittalBelum ada peringkat

- Exam 2 Practice ProblemsDokumen12 halamanExam 2 Practice ProblemsumerubabBelum ada peringkat

- Chapter - 7 - Pay Back PeriodDokumen15 halamanChapter - 7 - Pay Back PeriodAhmed freshekBelum ada peringkat

- Sample Final SolvedDokumen9 halamanSample Final SolvedateiskaBelum ada peringkat

- Producto Académico #02:: Ingeniería EconómicaDokumen4 halamanProducto Académico #02:: Ingeniería EconómicaBarrio Sarita ColoniaBelum ada peringkat

- Sinclair Company Group Case StudyDokumen20 halamanSinclair Company Group Case StudyNida Amri50% (4)

- FIN 341 - Exercise#6 - PAYBACKDokumen3 halamanFIN 341 - Exercise#6 - PAYBACKAbhishek SuranaBelum ada peringkat

- SolutionDokumen6 halamanSolutionaskdgasBelum ada peringkat

- NPV PDFDokumen2 halamanNPV PDFMOHD AnasBelum ada peringkat

- Finance HWMDokumen5 halamanFinance HWMmobinil1Belum ada peringkat

- Worksheet 3. Sequence and Series ApplicationDokumen3 halamanWorksheet 3. Sequence and Series ApplicationvalerieBelum ada peringkat

- Non-Discounted Capital Budgeting TechniquesDokumen4 halamanNon-Discounted Capital Budgeting TechniquesLloyd ReglosBelum ada peringkat

- Tutorial Sheet - 1 (UNIT-1)Dokumen5 halamanTutorial Sheet - 1 (UNIT-1)Frederick DugayBelum ada peringkat

- Payback Period QuestionsDokumen2 halamanPayback Period Questionspareekrishika34Belum ada peringkat

- Problem-Set-Math-Day-13 - EDITEDDokumen12 halamanProblem-Set-Math-Day-13 - EDITED2018-103863Belum ada peringkat

- Solved Answers For Payback PeriodDokumen9 halamanSolved Answers For Payback Periodwihanga100% (2)

- Assignment 01Dokumen1 halamanAssignment 01Rehan DhamiBelum ada peringkat

- PIA 8DI - Multinational Capital Budgeting FinalDokumen22 halamanPIA 8DI - Multinational Capital Budgeting FinalTania Davila TamezBelum ada peringkat

- Net Profit:: Sales Operating Expenses Taxes Stock Dividends Revenue RevenueDokumen3 halamanNet Profit:: Sales Operating Expenses Taxes Stock Dividends Revenue RevenueAhsan PrinceBelum ada peringkat

- 2102 Practice Exam 1 Fall07Dokumen9 halaman2102 Practice Exam 1 Fall07John ShinBelum ada peringkat

- Amara Prabasari 119211078 (Final Exam - Financial Statement)Dokumen3 halamanAmara Prabasari 119211078 (Final Exam - Financial Statement)Amara PrabasariBelum ada peringkat

- Net Present Value and Other Investment Criteria: Solutions To Questions and ProblemsDokumen4 halamanNet Present Value and Other Investment Criteria: Solutions To Questions and Problemsabraha gebruBelum ada peringkat

- Earn Profits: "Goodwill Is Nothing More Than The Probability That The Old Customer Will Resort To The Old Place."Dokumen4 halamanEarn Profits: "Goodwill Is Nothing More Than The Probability That The Old Customer Will Resort To The Old Place."MayurRawoolBelum ada peringkat

- Your Income Should Increase Every Year 2: Financial Freedom, #151Dari EverandYour Income Should Increase Every Year 2: Financial Freedom, #151Belum ada peringkat

- Canacona Building Collapse: A Case Study A Requirement in Steel DesignDokumen2 halamanCanacona Building Collapse: A Case Study A Requirement in Steel DesignEmilie JuneBelum ada peringkat

- Steel EmilieDokumen3 halamanSteel EmilieEmilie JuneBelum ada peringkat

- 0 20 40 60 80 100 120 50 38 40 45 25 30 45 30 25 3 2 7 1 2 20 13 37 43 18 29 43 Days Remaining Days Completed Days To Complete TaskDokumen4 halaman0 20 40 60 80 100 120 50 38 40 45 25 30 45 30 25 3 2 7 1 2 20 13 37 43 18 29 43 Days Remaining Days Completed Days To Complete TaskEmilie JuneBelum ada peringkat

- Emilie Payroll and ChequeDokumen5 halamanEmilie Payroll and ChequeEmilie JuneBelum ada peringkat

- Start: Assume B & D Assume B & DDokumen1 halamanStart: Assume B & D Assume B & DEmilie JuneBelum ada peringkat

- Structural Failure: A Case StudyDokumen3 halamanStructural Failure: A Case StudyEmilie JuneBelum ada peringkat

- Name: Francis Timothy J. Denaga Assignment #2 Course/Year/Section: AMT I B747 Date: 06/27/2016 Instructor: Engr. Arjay D. Ansag, MPA ScoreDokumen1 halamanName: Francis Timothy J. Denaga Assignment #2 Course/Year/Section: AMT I B747 Date: 06/27/2016 Instructor: Engr. Arjay D. Ansag, MPA ScoreEmilie JuneBelum ada peringkat

- Hiram Na SalitaDokumen2 halamanHiram Na SalitaEmilie June100% (3)

- Chapter 6 CommunicatingDokumen6 halamanChapter 6 CommunicatingEmilie JuneBelum ada peringkat