Company Fundamental Research Adhi, November 2012 - Indosurya

Diunggah oleh

Adi AbdulrohmanHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Company Fundamental Research Adhi, November 2012 - Indosurya

Diunggah oleh

Adi AbdulrohmanHak Cipta:

Format Tersedia

Company Fundamental Research, November 27,

2 2012

Company Information:

Price [November 26, 2012] :

IDR 1,700

Target Price

IDR 2,025

52wk Range

: 435.00 - 1,640.00

JCI

4,375

Beta

1.37

Market Cap [IDR mil.]

IDR 3,062,244

Shares outstanding [mil.]

1,801.32

Stock Code

ADHI

Sector

Construction

PT Adhi Karya Tbk

Company Performance: Outstanding performance

Summary

3Q11

2Q12

Revenue

1,184

1,790

51.16%

36.86%

80

79

158

100.08%

96.69%

EBT

47

51

108

111.31%

129.27%

150.89%

586.89%

150.89%

570.08%

Net Income

EPS

24

59

0.66%

2.00%

3.32%

4.92

13.14

32.98

61%

Public - Local

30%

Source: Company, Indosurya research

Public - Foreign

19%

40,000,000

35,000,000

1,800

10 per. Mov. Avg. (Series4)

20 per. Mov. Avg. (Series4)

1,600

1,400

30,000,000

1,200

25,000,000

1,000

20,000,000

800

15,000,000

600

10,000,000

400

5,000,000

200

M J S D M J S D M J S D M J S D M J S D M J S D M J S D M J S D M J S

Y-Y

1,308

45,000,000

Q-Q

Operating Income

Government

Share Performance:

3Q12

(In Billions of IDR)

Profit Margin

Share Holders Information:

(ADHI |BUY|TP: IDR2,025)

Revenue +36.86% y-y and +51.16% q-q, ADHIs

s revenue grew 36.86% compare to its

revenue in same period last year.

year

Profit Margin +3.32% 3Q12, ADHI could book profit margin more than what it achieved in

same period last year around 0.66%.

0.66%

EPS Growth +570.08% y-y and +150.89% q-q, ADHIs EPS grew

ew higher than last year.

Outlook

Outlook:

Seriousness of the government in prioritizing infrastructure development has a positive

impact on ADHI.

ADHI As a state-owned enterprise (SOE), ADHI has big opportunities to obtain the

projects. Government programs to expedite the project deployment process, MP3EI and PPP,

will remain as

a catalyst to accelerate project to be started. ADHIs

ADHI effort to achieve revenue

and contract targets will be reached following the pattern that always gets a lot more

m

in the

last quarter.

quarter We believe ADHI could achieve its IDR13.5

5 trillion contract target this year by

seeing its pattern in getting more project in last quarter especially government project.

ADHIs decision to create new line business, property and real estate,

estate in order to stabilize its

st

revenues is found as a right decision. Recurring income will reduce its lack of revenue in 1

nd

and 2 Quarter. ADHIs ace project, Monorail, is likely to have big chance to be selected by

the newly elected Jakarta governor

go

rather than MRT.

Valuation and Recommendation:

Recommendation BUY with potential 19% upside

rd

th

Outstanding

ding performance in 3 Quarter and its potential to create better performance in 4

Quarter make ADHI as one of the leading stock from construction sector. Government

seriousness in improving infrastructure quality implies large of potential in years ahead.

ahead Our

calculation through DCF method led us to the fair price

pr at IDR2,025

25 with potential 19% upside

In 2013.

Company Fundamental Research, November 27,

2 2012

FINANCIAL

Revenue Pattern: always fat in 4th quarter::

th

Most of ADHIs revenue comes from revenue in 4 quarter if we look at the

th

pattern from historical data. In 2011, ADHIs 4 quarter revenue is around

th

37% of ADHIs total revenue. While in 2010, ADHIs 4 quarter revenue is

st

around 46% from its total. Interesting thing is that ADHIs revenue in 1

nd

rd

and 2 quarter in 2012 is decreasing by 5% and 1%,

1% while revenue in 3

quarter jumps by 37%. If ADHI could achieve its 22% growth target until

th

end of this year, means that its 4 quarter revenue will jump for around

30%. Until September 2012, ADHI has achieved 44% from its 2012 revenue

target.

Source: Company, Indosurya research

Revenue Stream and Cost Structure:

Real Estates

2%

Property

2%

EPC

10%

Construction

Services

86%

Source: Company, Indosurya research

Source: Company, Indosurya research

The biggest contributor in ADHIs revenue comes from its Construction Services business with 86% from its revenue in 3Q 2012,

2012

while ADHIs new business line, Property, contribute 2%. Compare to its revenue in 3Q 2011, ADHIs

ADHI revenue grow 36.9%,

Construction Services grow 30%, EPC grow 76% and Real Estates grow 21%.

21%

90%

80%

9%

ADHIs EBIT contributor composition is a bit different than its Revs. Property

contribute 9% with 43% margin while Real Estates only 1% with 8% margin.

Construction Services still the biggest contributor followed by EPC. ADHIs EBIT

grow by 56% with 11% margin from its Revs compare to same period last year.

year

Construction Services grow 34%, EPC grow 283% while Real Estates down

d

by 67%.

Property

Source: Company, Indosurya research

76%

70%

60%

50%

43%

40%

30%

20%

10%

10%

14%

16%

1%

0%

Construction

Services

EPC

EBIT

8%

Real Estates

Gross Margin

Company Fundamental Research, November 27,

2 2012

Billions

Cost Structure 3Q12

250

200

Depreciation

150

Selling

100

General

Salary and Allowances

50

2010

2011

3Q11 1Q12 2Q12 3Q12

Source: Company, Indosurya research

Source: Company, Indosurya research

rd

ADHIs operating cost grew by 6% compare to its cost in 3 quarter 2011. Slower growth in operating cost made ADHI could book

rd

more EBIT in 3 quarter. Salary & Allowances and Depreciation cost grew by 16% and 50% while General and Selling cost down by

12% and 1%.

Earnings Performance:

4-Year EPS CAGR

120

100

80

60

40

20

0

92.71

62.69

2007

108.23

103.97

2010

2011

46.89

2008

2009

Earnings per share (EPS)

Source: Company, Indosurya research

Source: Company, Indosurya research

ADHI shows strong earnings growth by 570% in 3Q 2012 compare to its earning in 3Q 2011. ADHIs strong 3rd

3 Quarter performance

also supported by its 4-year

year earnings CAGR at 13.48%. If ADHI could achieve its 2012 earnings target, then ADHI will have 5-year

5

earnings CAGR at 22.94%.

By Sector:

Market Capt. based on revenue in year 2011

ADHI booked the second biggest revenue by 27% below WIKA, compare to revenue of

all construction company in year 2011.

Source: Company, Indosurya research

Company Fundamental Research, November 27,

2 2012

3rd Quarter 2012 performance

EPS Growth

Gross Margin Operating Margin Profit Margin

4-Year CAGR

3Q yoy

13.48% 570.08%

11.29%

8.83%

3.32%

26.78%

NA

NA

NA

NA

88.51% 200.35%

37.03%

24.72%

21.39%

23.20% 138.18%

19.98%

11.51%

10.46%

28.45%

34.18%

9.85%

8.19%

4.75%

Market Cap.

ADHI

PTPP

SSIA

TOTL

WIKA

2,936,152

3,970,801

5,552,195

2,728,000

9,163,752

ROA

0.83%

NA

4.81%

2.61%

1.02%

ROE

5.65%

NA

11.75%

8.68%

4.67%

Source: Company, Indosurya research

rd

ADHI has the biggest growth in 3 Quarter yoy followed by SSIA and TOTL. Government plan in increasing infrastructure quality has

rd

given positive influence to government construction companies such as ADHI, PTPP and WIKA. PTPP has not released its 3 Quarter

report.

Outlook:

Contract target 2012

Contract target 2012 Break

eak down

In IDR (tn)

EPC, 2.7

Real Estate, 0.1

Property, 0.3

Construction,

10.4

Source: Company

ADHIs contract target in year 2012 is IDR13.5 trillion. Until October 2012, ADHI has achieved around 68% from its target

or around IDR9.2 trillion. The project dominated by Building, EPC and Road/ Toll Road project.

Most of ADHIs project came from government based project. As a statestate

owned enterprise (SOE), ADHI has the advantage in obtaining project from

the government and other SOE. Only 13% contract comes from private

sector.

Source: Company

Company Fundamental Research, November 27,

2 2012

ADHIs next projects (Recurring Income)

ADHIs revenues were coming from contractual based project. To stabilize the revenue stream, ADHI has created new

business line in Property and Real Estate in 2011 which will provide recurring income. In 2013, ADHI will deploy 4 (four)

Property

roperty and Real Estate projects which are Taman Dhika Cinere, Taman Dhika Cibubur, Hotel The GrandDhika and

Mixed Use Area ADHI Kalimas.

Real Estate

Taman Dhika Cinere

Source: Company

Taman Dhika Cibubur

Source: Company

Company Fundamental Research, November 27,

2 2012

Property

Mixed Use Area ADHI Kalimas

Hotel The GrandDhika

Source: Company

Source: Company

Monorail

ADHIs abandoned Monorail project has been pushed back since the newly governor of Jakarta, Joko Widodo whos also

known as Jokowi elected. Jokowi is known as someone who pro for public transportation development rather than

adding new road. New plan had been presenting to the newly governor and appears to be getting good impression. The

advantage of Monorail compared to MRT is that with lower budget,

budget, more lines could be covered. While Monorail seems

one step ahead of MRT, if ADHI could win this project which rumored to be announced in January, 2013, then this

project will boost ADHIs performance.

Sector Outlook

ADHIs contract target in 2012 shows that about 87% of the contract source is coming from government project. In 2013,

government plan to increase its budget for Infrastructure project. Around IDR204

IDR20 trillion will be prepared by

government for infrastructure only which increase 16.6%

16

compare to its budget this year around IDR174.9

IDR174. trillion.

Indonesia government

overnment estimates total funds that will be issued by government and private sector for infrastructure

development in 2013 is around IDR458

458 trillion. Government program, MP3EI and PPP, which created

cre

to expedite

infrastructure development and government spending, shows the seriousness and clarity of government to improve the

quality of Indonesian infrastructure within measured timeline.

Toward election in year 2014, will led year 2013 to be the golden year for ADHI. Incumbent government will strive to

make landmark to create positive impression for its assets prior to election.

election One of the impressions that are usually used

is successful in improving the quality of infrastructure to support economic development,

development, since lack of infrastructure

quality has been main concern to improve the Indonesian economy.

economy Thus, there

here is no doubt that ADHI will play big role

in any government and SOE project in 2013.

2013

Company Fundamental Research, November 27,

2 2012

ABOUT COMPANY

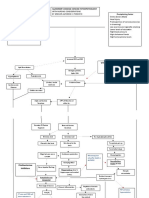

ADHIs Business Model:

Key Partnership

Key Activities

- Other related company (Joint

Operation)

- Bank

- Supplier

- Construction

- Operation & Maintenance

- Business development

- Humar resources development

- Marketing

Key Resources

- Brand "ADHI"

- SOE

- Human Resources

Value Preposition

Customer Relationship

- Experienced construction

company

- Integrated construction

company (Constructio, EPC, Real

Estates & Property)

- SOE

- Central & Regional

Government

- Private

Channel

- Advertising

- Marketing office

- Infrastructure & Property event

Cost Stream

Revenue Stream

- Salary and Allowances

- General

- Selling

- Depreciation

- Construction Services

- EPC

- Real Estates

- Property

Source: Indosurya research

Customer Segment

Company Fundamental Research, November 27,

2 2012

Projection Summary

Income Statement

2009

2010

2011

2012E

2013E

(In Billions of IDR)

Revenue

7,715

5,675

6,695

8,163

8,693

Cost

7,229

5,220

6,251

7,621

8,117

Operating Income

485

455

444

541

577

Earnings before taxes

332

321

326

447

499

Taxes

169

131

144

112

125

Net Profit

163

190

183

335

375

Balance Sheet

2009

2010

2011

2012E

2013E

307

242

552

673

717

94

3,498

3,132

4,002

4,879

5,196

Inventories

814

681

822

1,002

1,067

Fixed assets

1,011

871

735

896

955

Total assets

5,629

4,928

6,113

7,453

8,028

2,850

2,214

3,133

3,819

4,067

988

771

973

1,186

1,263

Depreciation

Infrastructure development will

support ADHI in achieving its

revenue targets

(In Billions of IDR)

Assets

Cash

ST Investments

Accounts receivable

Liabilities and equity

Accounts payable

Accruals

Notes payable

Total current liabilities

Long-term bonds

Total liabilities

Total common equity

Liabilities and equity

Ratios

Earnings per share (EPS)

494

416

770

812

812

4,331

3,401

4,875

5,817

6,143

567

666

254

268

268

4,898

4,067

5,129

6,085

6,410

731

861

984

1,367

1,618

5,629

4,928

6,113

7,453

8,028

2012E

2013E

2009

2010

2011

92.71

108.23

103.97

176.50

197.20

Book value per share (BVPS)

416.11

490.04

559.73

719.98

851.83

Debt Ratio

87.01%

82.52%

83.91%

81.65%

79.85%

Return on Assets

2.89%

3.86%

2.99%

4.50%

4.67%

Return on Equity

22.28%

22.09%

18.57%

24.51%

23.15%

4.75

8.22

7.69

9.10

10.50

2.11%

3.35%

2.73%

4.11%

4.31%

Price-to Earnings Ratio

Profit Margin

Source: Company, Indosuryaresearch

Big source of financing needed for

big scale of project

From the last 4-yr, ADHIs EPS CAGR

is 13..48% and we estimate its 5-yr

EPS CAGR is around 23%

Will managed

m

to maintain Profit

Margin around 4%

Company Fundamental Research, November 27,

2 2012

Equity Research Team

www.indosuryaresearch.com

Branch Office:

Jakarta:

Surabaya:

GrhaKencana Lt 2

Indosurya Tower Lt 2

Jl. Perjuangan No 88

Jl. BasukiRahmat 75

KebonJeruk,

Surabaya

Jakarta

Telp: +6231 - 535 3333

Telp: +6221 - 5365 0385

Medan:

West Plaza Lt 5

Jl. Diponegoro No 16

Medan 20152

Telp: +6261 - 455 8545

Fax: +6261 - 457 5548

Palembang:

Komplek PTC Mall

Blok 1 No 8

Jl. R. Sukamto, Palembang

Telp:+62711 - 382627

Solo;

JlSlametRiyadi No 401

Surakarta

Telp: +62271 - 711958

Disclaimers:

PT. AsjayaIndosurya Securities does not give any warranty in relation to the accuracy, completeness and reliability of this report

report as it only expresses his/her personal

views. This report is prepared for internal use and clients of PT. AsjayaIndosurya Securities only. PT. AsjayaIndosurya Securities

Secur

does not responsible for any

transactions with regard to any recommendation mentioned in this report. The final

final decision is in your hands. Please learn of risk and return first before making an

investment

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5782)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Growth and Development (INFANT)Dokumen27 halamanGrowth and Development (INFANT)KasnhaBelum ada peringkat

- HR CONCLAVE DraftDokumen7 halamanHR CONCLAVE DraftKushal SainBelum ada peringkat

- Stylistics: The Routledge Handbook of Stylistics Edited by Michael BurkeDokumen56 halamanStylistics: The Routledge Handbook of Stylistics Edited by Michael BurkeAmmara FarhanBelum ada peringkat

- Skripsi Tanpa Bab Pembahasan PDFDokumen117 halamanSkripsi Tanpa Bab Pembahasan PDFArdi Dwi PutraBelum ada peringkat

- Challenges of Quality Worklife and Job Satisfaction for Food Delivery EmployeesDokumen15 halamanChallenges of Quality Worklife and Job Satisfaction for Food Delivery EmployeesStephani shethaBelum ada peringkat

- Semester 1 FinalDokumen29 halamanSemester 1 FinalBudi NugrohoBelum ada peringkat

- v4 Nycocard Reader Lab Sell Sheet APACDokumen2 halamanv4 Nycocard Reader Lab Sell Sheet APACholysaatanBelum ada peringkat

- Legion of Mary - Some Handbook ReflectionsDokumen48 halamanLegion of Mary - Some Handbook Reflectionsivanmarcellinus100% (4)

- Back Order ProcessDokumen11 halamanBack Order ProcessManiJyotiBelum ada peringkat

- Solar CompendiumDokumen19 halamanSolar CompendiumCasey Prohn100% (4)

- Jsi Eng Paper 1Dokumen4 halamanJsi Eng Paper 1Sharifah Jannatul AjilahBelum ada peringkat

- Ajzen - Constructing A Theory of Planned Behavior QuestionnaireDokumen7 halamanAjzen - Constructing A Theory of Planned Behavior QuestionnaireEstudanteSax100% (1)

- Assignment Histogram and Frequency DistributionDokumen6 halamanAssignment Histogram and Frequency DistributionFitria Rakhmawati RakhmawatiBelum ada peringkat

- Virl 1655 Sandbox July v1Dokumen16 halamanVirl 1655 Sandbox July v1PrasannaBelum ada peringkat

- Pathophysiology of Alzheimer's Disease With Nursing ConsiderationsDokumen10 halamanPathophysiology of Alzheimer's Disease With Nursing ConsiderationsTiger Knee100% (1)

- Control System Question BankDokumen3 halamanControl System Question Bankmanish_iitrBelum ada peringkat

- Wicked Arrangement WickednessDokumen8 halamanWicked Arrangement WickednessbenchafulBelum ada peringkat

- Final InternshipDokumen64 halamanFinal Internshippradeep100% (2)

- Poster: Cloud API Testing: Junyi Wang, Xiaoying Bai, Haoran Ma, Linyi Li, Zhicheng JiDokumen2 halamanPoster: Cloud API Testing: Junyi Wang, Xiaoying Bai, Haoran Ma, Linyi Li, Zhicheng JiHa NhBelum ada peringkat

- Futura.: Design by Zoey RugelDokumen2 halamanFutura.: Design by Zoey RugelZoey RugelBelum ada peringkat

- Conceptual analysis of developing Europe strategy and external border securityDokumen2 halamanConceptual analysis of developing Europe strategy and external border securityДанаBelum ada peringkat

- Emcee RubricDokumen1 halamanEmcee RubricAdi Ruzaini Di EddyBelum ada peringkat

- Old English Vs Modern GermanDokumen12 halamanOld English Vs Modern GermanfonsecapeBelum ada peringkat

- 5e Lesson Plan Technical WritingDokumen3 halaman5e Lesson Plan Technical Writingapi-608904180Belum ada peringkat

- ETH305V Multicultural Education TutorialDokumen31 halamanETH305V Multicultural Education TutorialNkosazanaBelum ada peringkat

- Business Process Re-Engineering: Angelito C. Descalzo, CpaDokumen28 halamanBusiness Process Re-Engineering: Angelito C. Descalzo, CpaJason Ronald B. GrabilloBelum ada peringkat

- Design, Fabrication and Performance Evaluation of A Coffee Bean (RoasterDokumen7 halamanDesign, Fabrication and Performance Evaluation of A Coffee Bean (RoasterAbas S. AcmadBelum ada peringkat

- Application For Enrolment Electoral Roll 20132Dokumen1 halamanApplication For Enrolment Electoral Roll 20132danielBelum ada peringkat

- Operating Manual SIMARIS Therm V2 1 enDokumen30 halamanOperating Manual SIMARIS Therm V2 1 enTân Ngọc TyBelum ada peringkat

- Advanced Research Methodology in EducationDokumen18 halamanAdvanced Research Methodology in EducationReggie CruzBelum ada peringkat