Enrollment at A Glance - Basic Guidelines

Diunggah oleh

mapykDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Enrollment at A Glance - Basic Guidelines

Diunggah oleh

mapykHak Cipta:

Format Tersedia

Enrollment at a glance

A guide to your plan basics

Kinross Gold USA, Inc.

Take advantage of insurance offered at your workplace.

Its convenient and affordable.

Life Insurance provides basic protection for your loved ones if something happens to you. While many U.S. households

have life insurance, the average amount of coverage is often inadequate to meet family needs or pay off debt. Taking

advantage of life insurance coverage offered by Kinross Gold USA, Inc. can be an important part of your financial security.

Kinross Gold USA, Inc. provides you with Basic Life Insurance coverage and Accidental Death and Dismemberment

Insurance in the amount of 2 times your annual salary or $500,000, whichever is less. Your employer also provides Basic

Dependent Life Insurance for your Spouse in the amount of $10,000 and Children in the amount of $5,000. Eligible

employees may apply for more coverage in the Supplemental Group Term Life Insurance program.

Your Life Insurance Benefit Includes

Convenient Payroll

Deductions

(Applicable for Supplemental Life Only) Since deductions are taken directly from your

paycheck, you never have to worry about late payments or lapse notices.

Take it With You

(Applicable for Supplemental Life Only) The portability option allows for continued coverage

that can help protect your family even when your current employment ends.

Waiver of Premium

If you become totally disabled, your life insurance premium may be waived if you satisfy

certain conditions as defined by the policy.

Accelerated Benefit

You may collect a portion of your death benefit (typically 50%) while you are living, if you are

diagnosed with a terminal condition with a limited life expectancy under six months (may

vary by state).

Refer to the information on the following pages to learn more about Supplemental Group Term Life Insurance options and

determine your coverage cost.

Supplemental Term Life Insurance Coverage Options

For You

For Your Spouse

For Your Child(ren)

Eligibility

All active benefits eligible

employees working 30+ hours

per week.

Coverage is available only if

Employee Supplemental Life

Insurance is elected.

Coverage is available only

if Employee Supplemental

Life Insurance is elected.

Coverage Options

$10,000 to $500,000 in

$10,000 increments.

$10,000 to $500,000 in $10,000

increments.

$5,000 or $10,000 on your

children from birth to age

26 years.

Guaranteed Issue

Offer*

New Hire You can elect up

to $200,000 of coverage

without providing proof of

good health during the initial

eligibility period.

New Hire You can elect up to

$30,000 of coverage without

providing proof of good health on

your spouse during the initial

eligibility period.

New Hire You can elect

coverage without providing

proof of good health on

your children during the

initial eligibility period.

Supplemental

Accidental Death &

Dismemberment

Insurance

You may elect coverage from

$10,000 to $500,000 in

$10,000 increments.

Spouse Only 50% of the

employees coverage.

Children Only 10% of the

employees coverage.

Spouse and Children Spouse

amount is 40% of the

employees coverage.

Spouse and Children

Children amount is 5% of

the employees coverage.

Age Reduction(s)

Benefit amount reduces to

65% of original coverage at

age 70, and to 50% of original

coverage at age 75.

Benefit amount reduces to 65%

of original coverage at

spouse age 70, and to 50% of

original coverage at spouse age

75.

Not applicable.

The term spouse as used in this summary includes a domestic partner or civil union partner as described in the

certificate(s) of insurance.

Contact your employer if you have questions about the definition of "child" for your plan.

Accidental Death & Dismemberment coverage has exclusions that are described in the certificate of coverage.

*Proof of good health is required if you elect Supplemental Life Insurance coverage in amounts in excess of the limits

described above, or you submit an application for coverage more than 31 days after the date you become eligible. Subject

to approval by the insurance company.

Supplemental Life Insurance for Married Couples/Domestic Partners who are both Kinross

employees

When both the employee and the Spouse are Kinross Gold employees, the Dependent Life coverage is only available

to the employee who elected medical coverage.

Each employee can elect the Supplemental Life Insurance in $10,000 increments up to a maximum of $500,000 on

his/herself.

If you are an employee, you cannot be covered as a Spouse.

Insurance Rate Information and Premium Calculator

The cost is calculated based on the age of the employee or spouse at the start of the plans current policy year.

The rates shown are guaranteed until 12/31/15.

Employee and Spouse

Supplemental Life Insurance Rates

Age

Supplemental Accidental Death and

Dismemberment (AD&D) Insurance Rates

Monthly Cost per $1,000 of Coverage

Non-Tobacco User

Tobacco User

Under 30

$0.082

$0.115

30-34

$0.097

$0.148

35-39

$0.128

$0.206

40-44

$0.198

$0.330

45-49

$0.322

$0.549

50-54

$0.528

$0.888

55-59

$0.938

$1.521

60-64

$1.401

$2.140

65-69

$2.140

$3.074

70-74

$4.265

$5.701

75 +

$7.299

$9.757

Coverage type

Monthly Cost per

$1,000 of

Coverage

Employee Supplemental

AD&D

$0.05

Employee and Family

Supplemental AD&D

$0.07

Dependent Children Life Insurance Rates

Coverage Levels

Monthly Cost

$5,000

$0.50

$10,000

$1.00

Follow the steps below to calculate the premium based on the amount of insurance you plan to elect.

Supplemental Life Insurance

For Your

Spouse

For You

Step 1: Select the amount of insurance you want

Step 2: Divide this number by $1,000

Step 3: Enter the rate from the table(s) above

Step 4: Multiply Step #2 by Step #3

Step 5: Add (A), (B), and (C) for the Total Monthly

Premium

(A)

$

$

N/A

(C)

$

(B)

For Your

Children

N/A

Supplemental AD&D Insurance

For You or For You and Your Family

Step 6: Select the amount of insurance you want

Step 7: Divide this number by $1,000

Step 8: Enter the rate from the table(s) above

Step 9: Multiply Step #7 by Step #8

Total Monthly Premium - Add Step 5 and Step 9

This is a summary of benefits only. A complete description of benefits, limitations, exclusions and termination of

coverage will be provided in the certificate of coverage. All coverage is subject to the terms and conditions of the group

policy. To keep coverage in force, premiums are payable up to the date of coverage termination. Insurance products

TM

and services are provided by ReliaStar Life Insurance Company, a member of the Voya family of companies. Policy

form LP00GP (may vary by state).

(v. 04/15/2014) Group # 631353, 09/12/2014

Anda mungkin juga menyukai

- 2014-15 Ag-Pro Final New Hire Benefit BookletDokumen20 halaman2014-15 Ag-Pro Final New Hire Benefit BookletkellifitzgeraldBelum ada peringkat

- Life Insurance For Above 50Dokumen7 halamanLife Insurance For Above 50NisaBelum ada peringkat

- Horizon Presale Kit 2014off OnexchangeDokumen18 halamanHorizon Presale Kit 2014off OnexchangewygneshBelum ada peringkat

- Life Insurance Plans 2013 - 2014 FINALDokumen3 halamanLife Insurance Plans 2013 - 2014 FINALMattress Firm BenefitsBelum ada peringkat

- Your Group Life and Accidental Death and Dismemberment BenefitsDokumen38 halamanYour Group Life and Accidental Death and Dismemberment BenefitsEnvironmental Working GroupBelum ada peringkat

- The Formula for Happy Retirement : Ways to Enjoy and Make the Most of Your Retirement YearsDari EverandThe Formula for Happy Retirement : Ways to Enjoy and Make the Most of Your Retirement YearsBelum ada peringkat

- Medical Education Bariatric Fellowship BenefitsDokumen6 halamanMedical Education Bariatric Fellowship BenefitsOmer FarooqBelum ada peringkat

- 2014 Benefits Summary FINALDokumen5 halaman2014 Benefits Summary FINALoljayseeBelum ada peringkat

- School Employees Benefits Board (SEBB) Program Plan Overview and Cost of CoverageDokumen4 halamanSchool Employees Benefits Board (SEBB) Program Plan Overview and Cost of CoverageRaisul ShakilBelum ada peringkat

- VOYA Term Life Certificate 11.20 PDFDokumen20 halamanVOYA Term Life Certificate 11.20 PDFDarrick WeatherlyBelum ada peringkat

- EWG Life Sumary of BenefitsDokumen4 halamanEWG Life Sumary of BenefitsEnvironmental Working GroupBelum ada peringkat

- Prudential - Benefit SummaryDokumen11 halamanPrudential - Benefit SummaryShawonna JohnsonBelum ada peringkat

- InsuranceGuide IndustryDokumen36 halamanInsuranceGuide Industryjim STAMBelum ada peringkat

- HDFC Click 2 Protect Plus: What Are The Key Features of This PlanDokumen5 halamanHDFC Click 2 Protect Plus: What Are The Key Features of This PlanAniket DesaiBelum ada peringkat

- Social Security: The New Rules, Essentials & Maximizing Your Social Security, Retirement, Medicare, Pensions & Benefits Explained In One PlaceDari EverandSocial Security: The New Rules, Essentials & Maximizing Your Social Security, Retirement, Medicare, Pensions & Benefits Explained In One PlaceBelum ada peringkat

- What Is Life Insurance?Dokumen11 halamanWhat Is Life Insurance?Ratul BanerjeeBelum ada peringkat

- The Lincoln Term Life and AD&D Insurance Plan:: Benefits At-A-GlanceDokumen4 halamanThe Lincoln Term Life and AD&D Insurance Plan:: Benefits At-A-GlanceAngel MansillaBelum ada peringkat

- The Basics of Life Insurance: The Answer to What Life Insurance is and How It Works: Personal Finance, #1Dari EverandThe Basics of Life Insurance: The Answer to What Life Insurance is and How It Works: Personal Finance, #1Belum ada peringkat

- Invest & Protect Your FutureDokumen44 halamanInvest & Protect Your FutureCharish DanaoBelum ada peringkat

- Health InsuranceDokumen1 halamanHealth Insuranceapi-473034142Belum ada peringkat

- Benefits DescriptionDokumen16 halamanBenefits DescriptionKenneth Del RioBelum ada peringkat

- Complete Care for Health with ReligareDokumen5 halamanComplete Care for Health with Religaret0ysoldierBelum ada peringkat

- 2011 BCBS PlansGlance PDFDokumen2 halaman2011 BCBS PlansGlance PDFsakethram_gBelum ada peringkat

- AST Benefits SummaryDokumen4 halamanAST Benefits SummarySam GobBelum ada peringkat

- Introduction & Classification of Group InsuranceDokumen17 halamanIntroduction & Classification of Group InsuranceMajharul Islam BillalBelum ada peringkat

- IDBI Federal Lifesurance Savings Insurance PlanDokumen16 halamanIDBI Federal Lifesurance Savings Insurance PlanKumarniksBelum ada peringkat

- ICICI Pru IProtect Smart LeafletDokumen8 halamanICICI Pru IProtect Smart LeafletSurendra KushwahaBelum ada peringkat

- Relationship: Start A Life LongDokumen10 halamanRelationship: Start A Life LongRajesh Kumar RamaswamyBelum ada peringkat

- Heartbeat Silver BrochureDokumen10 halamanHeartbeat Silver Brochuresubs007Belum ada peringkat

- SBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness TooDokumen2 halamanSBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness ToobpshuBelum ada peringkat

- Life InsuranceDokumen16 halamanLife InsuranceKanika LalBelum ada peringkat

- The New Health Insurance Solution: How to Get Cheaper, Better Coverage Without a Traditional Employer PlanDari EverandThe New Health Insurance Solution: How to Get Cheaper, Better Coverage Without a Traditional Employer PlanPenilaian: 4 dari 5 bintang4/5 (1)

- Voya Compass Hospital Confinement Indemnity InsuranceDokumen4 halamanVoya Compass Hospital Confinement Indemnity InsuranceDavid BriggsBelum ada peringkat

- Life InsuranceDokumen26 halamanLife Insurancevivek kant100% (1)

- Background of D TipicDokumen3 halamanBackground of D TipicSandeep GuptaBelum ada peringkat

- 2011-12 Benefits BrochureDokumen4 halaman2011-12 Benefits BrochureKevin MarshallBelum ada peringkat

- FAQ Group Life InsuranceDokumen5 halamanFAQ Group Life InsuranceMuhammad Yousuf FazalBelum ada peringkat

- FinanceDokumen25 halamanFinanceShaun D'souzaBelum ada peringkat

- Reliance Life Care For You Plan: We Protect, We CareDokumen25 halamanReliance Life Care For You Plan: We Protect, We CareBabujee K.NBelum ada peringkat

- A Beginner's Guide to Disability Insurance Claims in Canada: How to Apply for and Win Payment of Disability Insurance Benefits, Even After a Denial or Unsuccessful AppealDari EverandA Beginner's Guide to Disability Insurance Claims in Canada: How to Apply for and Win Payment of Disability Insurance Benefits, Even After a Denial or Unsuccessful AppealBelum ada peringkat

- Protection Planning 2013Dokumen28 halamanProtection Planning 2013JessBelum ada peringkat

- Life Insurance-Shaiful ALICODokumen6 halamanLife Insurance-Shaiful ALICOMahamudul Hassan RumiBelum ada peringkat

- FULLY COVERED LIFEDokumen4 halamanFULLY COVERED LIFESelva NBelum ada peringkat

- Apollo Munich Optima Restore BrochureDokumen2 halamanApollo Munich Optima Restore BrochureAmit SawantBelum ada peringkat

- Eric Tyson's three laws of insurance and top PH insurersDokumen3 halamanEric Tyson's three laws of insurance and top PH insurersRhia shin PasuquinBelum ada peringkat

- The Hidden Value in Your Life Insurance: Funds for Your RetirementDari EverandThe Hidden Value in Your Life Insurance: Funds for Your RetirementBelum ada peringkat

- Wilo BenefitsDokumen25 halamanWilo BenefitsscottjsterlingBelum ada peringkat

- Prubsn ProtectDokumen19 halamanPrubsn ProtectYusof PrubsnBelum ada peringkat

- Benefits Enrollment Guide 2013-2014 FINALDokumen39 halamanBenefits Enrollment Guide 2013-2014 FINALMattress Firm BenefitsBelum ada peringkat

- KEY Features SBI E-Shield HDFC Click To ProtectDokumen6 halamanKEY Features SBI E-Shield HDFC Click To ProtectAditi MehtaBelum ada peringkat

- Insurance BasicsDokumen25 halamanInsurance BasicsGautam SandeepBelum ada peringkat

- Unit 2 Health Insurance ProductsDokumen25 halamanUnit 2 Health Insurance ProductsShivam YadavBelum ada peringkat

- Family Income Benefit Key FactsDokumen8 halamanFamily Income Benefit Key FactsPatrick BoydBelum ada peringkat

- Elements of Good Life Insurance PolicyDokumen4 halamanElements of Good Life Insurance PolicySaumya JaiswalBelum ada peringkat

- Overall 866.47 286850.53 273945.06: Month Redrill Hours Actual Meters Overal Metrs (Redrill+ Drill Meters)Dokumen2 halamanOverall 866.47 286850.53 273945.06: Month Redrill Hours Actual Meters Overal Metrs (Redrill+ Drill Meters)mapykBelum ada peringkat

- Kibali Gold Mine Drilling and Blasting: Blast Name Bench Height Sub DrillDokumen1 halamanKibali Gold Mine Drilling and Blasting: Blast Name Bench Height Sub DrillmapykBelum ada peringkat

- KUZ-RAM FRAGMENTATION ANALYSISDokumen1 halamanKUZ-RAM FRAGMENTATION ANALYSISJorge Crisologo VilchezBelum ada peringkat

- AcomprehensiveQA-QCmethodology Dec2010Dokumen13 halamanAcomprehensiveQA-QCmethodology Dec2010mapykBelum ada peringkat

- Ghana FDA Standard For Soymilk - 0Dokumen7 halamanGhana FDA Standard For Soymilk - 0mapykBelum ada peringkat

- Rt-005 Kom AnalysisDokumen3 halamanRt-005 Kom AnalysismapykBelum ada peringkat

- Drill and Blast Engineer Achieves Production TargetsDokumen1 halamanDrill and Blast Engineer Achieves Production TargetsmapykBelum ada peringkat

- Classifications of Rock PropertiesDokumen5 halamanClassifications of Rock PropertiesAlwin AntonyBelum ada peringkat

- Recent Ad Avn Cement in DB Full 2Dokumen6 halamanRecent Ad Avn Cement in DB Full 2mapykBelum ada peringkat

- Cat and Mouse in PartnershipDokumen2 halamanCat and Mouse in Partnershipranjit.martisBelum ada peringkat

- Blast Volume AnalysisDokumen3 halamanBlast Volume AnalysismapykBelum ada peringkat

- The Willow Wren and The BearDokumen1 halamanThe Willow Wren and The BearmapykBelum ada peringkat

- The Frog PrinceDokumen2 halamanThe Frog PrinceScOrPiQBelum ada peringkat

- RapenzelDokumen4 halamanRapenzelPriyaBelum ada peringkat

- Hans in Luck: 'No Care and No Sorrow, A Fig For The Morrow! We'll Laugh and Be Merry, Sing Neigh Down Derry!'Dokumen3 halamanHans in Luck: 'No Care and No Sorrow, A Fig For The Morrow! We'll Laugh and Be Merry, Sing Neigh Down Derry!'mapykBelum ada peringkat

- Jorinda and JorindelDokumen2 halamanJorinda and JorindelmapykBelum ada peringkat

- 10 1 1 836 4513Dokumen165 halaman10 1 1 836 4513mapykBelum ada peringkat

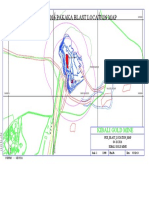

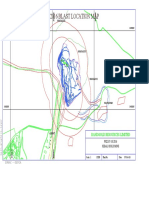

- 04-10-2016 Pakaka - Blast Location MapDokumen1 halaman04-10-2016 Pakaka - Blast Location MapmapykBelum ada peringkat

- Blast Check ListDokumen1 halamanBlast Check ListmapykBelum ada peringkat

- Shotplus 5 PlanDokumen1 halamanShotplus 5 PlanmapykBelum ada peringkat

- Shotplus 5 PlanDokumen1 halamanShotplus 5 PlanmapykBelum ada peringkat

- Star BurnDokumen1 halamanStar BurnmapykBelum ada peringkat

- Block Size Selection and Its Impact On Open-Pit Design and Mine PlanningDokumen7 halamanBlock Size Selection and Its Impact On Open-Pit Design and Mine PlanningmapykBelum ada peringkat

- 03 - SAFETY ALERT 3 - Fatal Accident Inquiry Report 2017Dokumen15 halaman03 - SAFETY ALERT 3 - Fatal Accident Inquiry Report 2017mapykBelum ada peringkat

- 1.revised Blast Management Plan FinalDokumen25 halaman1.revised Blast Management Plan FinalmapykBelum ada peringkat

- PKK-07-10-2016 Blast Location Map 500m RadiusDokumen1 halamanPKK-07-10-2016 Blast Location Map 500m RadiusmapykBelum ada peringkat

- Pakaka - Blast Location MapDokumen1 halamanPakaka - Blast Location MapmapykBelum ada peringkat

- Tutorial Excel IRRDokumen1 halamanTutorial Excel IRRUok RitchieBelum ada peringkat

- MFL67731023 140225Dokumen116 halamanMFL67731023 140225mapykBelum ada peringkat

- Fatigue COSSDokumen35 halamanFatigue COSSzubair195Belum ada peringkat

- 004 General Consent English (Front)Dokumen2 halaman004 General Consent English (Front)عبدالله الرعويBelum ada peringkat

- Occurrence and Health Risk Assessment of Pharmaceutical and Personal Care Products (PPCPS) in Tap Water of ShanghaiDokumen8 halamanOccurrence and Health Risk Assessment of Pharmaceutical and Personal Care Products (PPCPS) in Tap Water of ShanghaiTiago TorresBelum ada peringkat

- Water, Sanitation and Hygiene in SchoolsDokumen6 halamanWater, Sanitation and Hygiene in SchoolsDux Mercado100% (1)

- Nutraceutical Products in India Market ReportDokumen7 halamanNutraceutical Products in India Market ReportMadan Mohan Sharan SinghBelum ada peringkat

- Commissioning Federal Facilities Chiller (PQ)Dokumen19 halamanCommissioning Federal Facilities Chiller (PQ)Yu-Chih PuBelum ada peringkat

- Hydrogen Sulphide Safety Around RigDokumen14 halamanHydrogen Sulphide Safety Around RigmohammedBelum ada peringkat

- Workshop Statistical Methods in Biomedical Research - Nioh - NimsDokumen3 halamanWorkshop Statistical Methods in Biomedical Research - Nioh - NimsSudheerChauhanBelum ada peringkat

- "Classic" Technique Guide: Niti Rotary Instrumentation SystemDokumen12 halaman"Classic" Technique Guide: Niti Rotary Instrumentation SystemdrnikhilbobadeBelum ada peringkat

- Gene TherapyDokumen15 halamanGene TherapyRose Mary GeorgeBelum ada peringkat

- The ABO Blood Groups: Phenotypes GenotypesDokumen2 halamanThe ABO Blood Groups: Phenotypes GenotypesSheila Mae CabahugBelum ada peringkat

- Sport Science and Sports Medicine Framework 2017 v1Dokumen31 halamanSport Science and Sports Medicine Framework 2017 v1api-443327549Belum ada peringkat

- Annual Report 2013-14Dokumen198 halamanAnnual Report 2013-14shahabBelum ada peringkat

- Report - AYESHA KHATOON (230750060006)Dokumen3 halamanReport - AYESHA KHATOON (230750060006)ahmedkhandba1Belum ada peringkat

- Lab Diagnosis of Diarrheal DiseasesDokumen37 halamanLab Diagnosis of Diarrheal DiseasesGIST (Gujarat Institute of Science & Technology)Belum ada peringkat

- Evidence Based Practices For Young Children With AutismDokumen11 halamanEvidence Based Practices For Young Children With Autismkonyicska_kingaBelum ada peringkat

- Principles of Health AdminDokumen42 halamanPrinciples of Health AdminAnne BattulayanBelum ada peringkat

- Grade 7 (TLE) Week 1Dokumen12 halamanGrade 7 (TLE) Week 1RoswlleBelum ada peringkat

- KCC Mall 69kV Substation DesignDokumen18 halamanKCC Mall 69kV Substation DesignRomie ArazaBelum ada peringkat

- The Ultimate Guide To Anxiety DisordersDokumen66 halamanThe Ultimate Guide To Anxiety Disordersnajaxx100% (2)

- Ar-Afff 3 MSDS LCFDokumen5 halamanAr-Afff 3 MSDS LCFMark YeBelum ada peringkat

- Speech Disorders - ChildrenDokumen2 halamanSpeech Disorders - ChildrenAmanda Kenshi NurfitriBelum ada peringkat

- All India Aakash Test Series (AIATS) 12th Class Test Schedule for NEET/AIIMS 2019Dokumen2 halamanAll India Aakash Test Series (AIATS) 12th Class Test Schedule for NEET/AIIMS 2019Chirasree Laha100% (1)

- Nogales v. Capitol Medical Center DigestDokumen4 halamanNogales v. Capitol Medical Center DigestWilliam AzucenaBelum ada peringkat

- Daftar PustakaDokumen3 halamanDaftar PustakaErliTa TyarLieBelum ada peringkat

- 296402-Official ESTA Application Website U.S. Customs and Border Protection PDFDokumen5 halaman296402-Official ESTA Application Website U.S. Customs and Border Protection PDFLouise Ann TunstallBelum ada peringkat

- Changes in Demand and Supply of Face Masks Under CovidDokumen3 halamanChanges in Demand and Supply of Face Masks Under CovidHanh HoangBelum ada peringkat

- History Patient - Co.ukDokumen14 halamanHistory Patient - Co.ukiuytrerBelum ada peringkat

- Safe Food Handlers Course NotesDokumen13 halamanSafe Food Handlers Course NotesJinky PradoBelum ada peringkat

- Respiratory MechanicsDokumen27 halamanRespiratory MechanicsKarla Hernandez100% (1)

- Labor and Delivery QuizDokumen7 halamanLabor and Delivery QuizAmy50% (2)