Isb 990 - 2000

Diunggah oleh

Americans for Peace and Tolerance0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

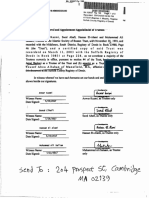

35 tayangan20 halamanIslamic Society of Boston's 2000 tax return showing Yusuf Qaradawi as one of the ISB's directors and Osama Kandil as its president.

Judul Asli

ISB 990 - 2000

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniIslamic Society of Boston's 2000 tax return showing Yusuf Qaradawi as one of the ISB's directors and Osama Kandil as its president.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

35 tayangan20 halamanIsb 990 - 2000

Diunggah oleh

Americans for Peace and ToleranceIslamic Society of Boston's 2000 tax return showing Yusuf Qaradawi as one of the ISB's directors and Osama Kandil as its president.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

Anda di halaman 1dari 20

JUL é 4 2001

Filaee

» 5m 990 -

Under section 501(c)of the internal Revenue Code (except black lung benefit trust

‘or private foundation). section S27, or section 4347(aX) nonexempt cl

Return of Organization Exempt from Income Tax

2000

able trast

agua ot wT ‘Open to Public

SimTRecaRtseece”| + The organization may have louse a copy af tis return to satsly stale eporung requirements. Tnspection

‘A For the 2000 calendar year. or tax year period beginning 2000, andending 2 =

Beet sera: [Ene st oariasen D Employer entetee Naber

rane of ess [Islamic Society of Bost 04-2767435

1204 Prospect Street

E teens sorter

(G17)_876-3546

Fel Town Gy Ta Se F creek > npg

vines Canbr idge HA 02139

INote:H anal are rot appicabie fo secon S27 ones

Goxganzason ype (neck any ong) K]_s014) 3+ coxeanay [] ser ee [Joven |H (a) st. uy ret rafts? yes KK) ne

* Section 501(¢X3) organizations and 4947(aX) nonexempt charitable

Trecarn mead leas, —[[aatuat —[otur Gpeang=

Weakness gations gon reais we poral net rore Fan

$2500) he ergranorore ol fe sre wih eR bul fs ogaenon

ee ee ee ere a ata

a

‘Some states require a complete return.

Pa] Revenue, Expenses. and Changes in Net Assets or Fund Balan:

| (0 a er ar! ata

IH(e) Area aruacos neues? — [ver fE]ne

(tee angen as See netutans)

(0) wees vrnen ten ey

Seman cdo earn ag? Jae

Erg eamgnn ro, NP

tomun sacangrumourmey

n

i

cee

(Ces (See instuchons)

[1 Gonioutons, gf ras and sito arouses 7

a Drei pubic sppert ta

|» inarect punie support 1

| covwrrnontconroctone (rants) Hel

ont oF ; rel

2 Prey sovce ovens haucng gover 05 and erat am Pat ln $9) 23,403, 488

3 Mertousyp aes a assessments

1 rest en soe end emperary cash vests

5 Dicer and iret tam seeries

6a Gross rents 6a) 107,751

| Less: rental expenses eo 25,032

€ Net ena came or ss) (eat tne 6 om ne 6a se 82.719

7 omer wesinent come (aserbe rf

Ba Gross amount trom sales of assels olher etree ceeee see

a | S* Sateen

$] ota: eater oer mans an eis espana

Bc cane (ncn ene)

8) nego or ost (comone tne 8, eters) and ad

8 Spec events an aces (atach sche)

2 Gross revenue rol wetting. §

ef conrstors repated on ie 1)

b tess ofect expenses oie han ndralsrg expenses

€ hencome o ext tom spec ever (ara tre 50 om ie 9) ¢ oe

We Gros soles of venary eases ane alonances toa

D Les: cat of gooce soe ios

© Ges pe Co to se ren (tc seu ag tm ne) tw

11 Omer revere (rom Pat Wine 103) Ba.

12_ Total revere odd ings 1, 2.5. 4,5, 6, 7.86.92, Cie Tea Bea

{1s Frogam sewces (rom ive a, counn fey 652.555

E14 management an generat (rom ine 24, cokana (Cy 3 53.660

£ [15 Fundraising (rom tne 44, colina ()) IS

B] te payers so ates attach sere 5

El ty tomenpenes tats nes teeta, oun ay) OGDEN, yo S| 306238

[18 Excess (ae forte yea (act w 17 fom be 12 2.7586

afl 19 Necosser or ting balances el begeing of year (em ine 3, clan) 1746-803

FE] 20 omer changes net assets or kr balances (tach explana) "20-716

3 Netossets und oaonees at en yer (en ines 18,19, an620) aise 817.

BAA For Paperwork Redicion Act Noli see separate insirucons. econ ieee Fear 90 Ca)

P 6

Foun 990 (2000) _[slamic Society of Boston 04-2767435 Page 2

~ Barf } Statement of Functional Expenses Al organiealons musi corpiee column (5, Columns @), (©, ane ©) ete

reqused or setion 5013) ane Cb ergoneations an sacton £7.) sonaverel Snontacl tums Gu atone or Shar.

Sora are eat wore | Same” | Otegeee | mruneeors

tia ton a easy es

(sh S$ _ 121,300. | ee ae ae Se ae

ronscash > 22 121, 300, 121,300 Loe i eee

23 Syate sue oFonsto i) [28 Seat anaes ee

2 dee itor tment sa) aed ees

2 Omwusimtater renee 0 7 3

28 Otersalaen ond ngan a mas eas o:

2 Prneenplon conten Fa canna

28 Ow enaye derais 2 a

28 Payot nee 8 Tae H rae

2D Proeina reaiing lon 3

1 Aconnung tor Fl 530 3 5280 a

3 tel tos z i620 3 4620 3

3 Suopiee a

Beep %

3 Poste an shipsra s ila

36 Oncnoey 33

3 aspen etal sameitonanee «.. P

3 intend publesors [ae nai

3 amt $

© Caer, cet a ig 5 a 100-013

teers

{2 Duron ion a a)

a 30,586 ° 0

aan 118 a 5

a TH ees $

asel_—68.077 aa, 589 5

7 or 3

a [ocala agin

~ Speech. ay 306,234. 652,555. 52.660.| 100,019

pein oss oe lz rover ses ap es fon ono ae

ives! eter (D re eopemte omar ol ture fontcos 8 (smc abecedopratom ress

s

to tundeaising _$

(Parl | Statement of Program Service Accomplishments

Wala grits sigan ecm pupow?" meet. the. SB tual needs of Fuslibg

Scene ee re aes ene ace aoe, hs

SECS fatoennountn tao peice Sareea Osa,

viave five tines daily orayers throughout the year. fave a

very Sunday. _

) the amount allocaled to management and gener and Gv) tha amount allocated

Provan Sonica Expos

ee reste ant

652,555

ima = 2 ati a . =

« Shecpogan aces (Gions nésloeaions §

{ Toll et Program Service Exponeee (Govle earat eM. eatarn @), proyam seve) a 352,555

cry TeeAsio2 e800 Ferm 990 (2000)

Form 990 cou0) Islamic Society of Boston

04-2767435 Page

RAITT Balance Sheets (see istevere)

Note: Wiererequved,elached scrediles soa prounis min the dscrpton ®. ©

Column shouldbe for end-of year amounis only " Begining of oar End et year

“3 Cosh = noninterest Dearing 334,441 736,254

46 Savings and temporary cash vestments 324.685.[46 | 3.241.677

a

4a Accaunts recente be

‘Less: allowance lor doubt! accounts 51,16 | ae ae

48 Pledges receivaDie |

‘Less: allowance for doubt accounts Be

49. Grants reconaale 12

| 50. Recenabies tom otters, drectors, mustess, and key employees

graced eer 50

E] states notes &toans receiatie (alae sched) - | Stal 49,200 Ba]

3] Less: atowance for doubitul accounts sib Ste! 49.200

52 rventories forsale or use 52

53 Prepadi expenses and celerred charges 33

S54 Investmens — secuites (tla sehecse) >L cost) ro Ey

Ba ivestnens — land, buldngs, & equpment: basis | S82) 1, 057, 686 z

Less: accumulated depreciaon

(ataen steatey ss, stat so)

56 rvesnon ~ ober (atach schedule)

57a Lore, ulaings, and equpment: bass sr

bess: accuruated depreciaion

| "Gtaorscreautey 578]

| 58 Omer asses (aescrive y

58 Total assets (add lines 45 thvaugh 58) (wus equal ine 74)

4484 817

60 Accounls payable and accrued expenses

4] 61 Grants payable

62 Delerced revenue

63. Loans fom offeers, directors, uses, and key employees (aiach scheckHe)

Géa Texcexempt bond habuites (atlach schedule)

bbMorigages and other notes payable (ttach schedule)

65 Oiner babies describe * Hai] Deposits

6.377 [6

66 Total abies (ods ines 60 throug 65)

6.897

reaizations thatofow SFAS 117, check here >

Dough 68 ana ines 73 and 74

© Unresvcted

68. Temporary restricted

69. Permanenty resviced

Organizations tht dono! low SFAS 117, checkhere * [and compete ines

70 enough 74,

70. Capa stock, ts rnp, or cent une

71. Passio coil spl. 0 lend, Bling, and eaupmnent kane

72. Retaned earings, endowmenl accursed income, of oer nds

‘ad compete ines 67

73. Total net assets or fund balances (add lines 67 trough 69 or lines 70 woush

72! cokann (A) must equal ie 19 Sd column (3) must equal ne 21)

76 Tolat liabilities and net assets/und balances (odd ines 6 and 73)

1,746,903

1,712,136

2.758, 631

al

1,746 ,903.[73 4,470,767

1,753,800.) 74 4,484,817

Forrn 990s avaiable for public inspection and, fer some people, serves as the primary or sole source of information about a particular

‘organizaton, Mow te public percelves an organization in sucn cases may be Gatemaned by the miotmauun presented ons fel. Therefoce,

please make sure te felura fe complete and accurate and fully Gesctwes, Pall, he argarizaver’s programs and sccomplsrmiente

BAA

Form 990 2000) Islamic Society of Boston

ue per Audited

Financial Statements with Revenue

{TReconciliation of Rot

per Return (See instructions.)

04:

2767435 Page 4

Reconciliation of Expenses per Audited

per Return

inancial Statements with Expenses

‘8 Teolreun gas ané ober spat

Perit tases sabres

Arvounls included onjine a but

ioton te 38 Far

) Net ureatized

Reecunents

Donated ser:

© Revand tee

Soches

(8) Reco fae

ve pas

) Otner (speci):

eae e

7a means on ines cou) |_|

Aer

s. pe

Line a meus tine b |

Amounls included on ine 12,

Form 990 but ast om Ine a

(©) inves xersor

ralinlied opine

Boman.

@ Otter (specity:

“'s.

‘Add emurts on lines (1) anai@ —*|

© otal everue per tine 12, Form

990 ding eB tna d)

(ERRVE [List of Officers, Directors, Trustees, and Key Empl

»

Total expenses and losses per audiled

ments +|

insane 5

‘Amounts eludes online a bu not

one 7 Form 950

pene

ofteattes . §

© reps

eam.

tose repr

OR ene. §

(Omer (spect

‘dd arsunts om ines (1) Tough @)

Ling a minus ine b

“Amounts ined on tine 17

Form 990 Sut net on ine a:

(1) tnvesinen expenses

‘kee on Ine

Ferm 990

@ Other (pect:

i 5

‘Add amounis on lines (1) 96 @)

Total expenses per tine 17, Fon

280 (ine e plus tne @.

=

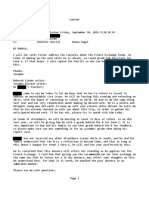

Toyoos (List eacn ane even if nol compensated: see navuclons)

(A) Nome and adores

(8) Tie and average nour

(compensation

Oeapereaion | Oegwmdons > | CO eperae

enero), | pionseraecteres |“ stowences

Kadil

Washington, D.C. “pees ident 4| 0. 9 0

1

Washington, D.C. Vice President 3! o 0 oO

‘Soud Haft |

lSecretary 3| oO 9 0

405 S. Devon Rd, Payne, PA 19087|Member 4 o. 0 0

Dr. Walid Firainy al

142|Menber, 4 0. 0 9.

~"|Menber, y o. o. 9

Member: y 0. 0. 9.

75 Diaary otteer,

from your casi

Felated organzations?

11s, attach schecule — see nsvuctions.

ectr,euslee, or key employee receive agregale compensation o mre, than $100,000

ion bid a rated Segonenbons, af whch mor han € 10,600 wen proved by ie

TeEnaIon cane

> Dyes ino

Form 890 (2000)

Form 990 (2000) Islamic Society of Boston. 04-2767435 Page 5

Bark Wi [Other Information Gee specie nsrucions

76 Dae cganaton engage any acy ot prewousy repre the RS? "Yen! aac a eles aesepton

77 were any changes made 1 the organizing or governing documents but not reported to He IRS?

W°Y95, attach a conformed copy of the changes.

78aia ne organzaton have urvelated buenas gts income of $1,000 of mare during ine year covered by tis eta? | 78al | xX

Biles, has eg 3 tx etn on Form 90-7 for bis year? 785]

79 Was mere s iqudston, dssluten, termaton, o° substan! contacton dug eyes? I"Ye," each

Sas Ey

80a 1s ne organzation related (ther tnan by association witha stalemde or natonwide organization) thraush common aes

mrantperdip, governng bose, usoes ices t,o ay aher teem © honest Spmisakon wal | x

Biisyan oe ts ene lis egueaian een ea deen -| ee

ease a ~Swaack mena tis Leen oe CInenaieret | | fe

‘B12 Enter the amount of political expenditures, direct or indirect, as described in the instructions | 81 fesse

ia me oxgenzaton ii Form 1120-POL tor Ps year? awl |x

{20g te orgaizatn cave donated seca or he Use of mata, easement, oF facites at no charge or a oe

Sub sanGely toe Bon ar rental wae?

bles: youmay mcete te valve ot eee tars nee, Do not rece bis amount ae

revive ln atl Groen expose Rath Gop seruclors tmmeim eset i). Laabl

£832 Date organization comely wih the pu mene requirements for retin and exemption aration? sax]

10s te ogerralin comply with the asciosixe requirements eating to qd pro avo contibulons? a36) x

{942 Date organza seit any contours or gts tat mere nt tx cedutbe? eal 1X

TES

B11 -¥e, aid he organization include with every soliton an express stlement Pal such conrbutons orgs were Taye

ot for decebie? a . e gaol |

8 50165, (5,0 (5)organzatons Were sostamaly all dues nanéecuctie by members? a

tbDed ne eganzaton make ony e-houselboying expenditures of $2.00 or les? 4b

Les! was areweced ete 850 oF 8S, do nat complete Be Yous Eh elow inece he organzaton recawed 3 ae

wae 1 pang tx oma far he oe yor ae!

Duet, atersment, ond star amounts rom members eee

| None; ab fe prereesorrt ae

BAA For Paperwork Redon Ac lice, ses ensure Tov Fo BU and Fo OE Seale A Form 590 OED) A0

Schedule A'(Form 900 a1 990-62) 2000 __Islamic Society of Boston. 04-2767435 Page?

FRRUEDE statements About Activities Yes] No

1 Ouing te year, nas he organaton atimpied {0 inluence national, sat, or oral legislation, eluding ry atempl

{ounfenee puble oprvon an a leglave mater or referendum?

I1"Yes, enter ne tolal expenses paid or inewred in connection wih the laboyeg actties .- * $,

‘Organizations tnat made an election under section 01(h) By ting Form S768 must complete Part VIA, Other

organzaons ceceng Yea, must complete Pot Viana ah osatoment gvng a eialed deserpion of te

Iobbpng actives.

Fears

ea

2 uring the year, has ne organzation, eine del or inarocy, engage in any oe lowing acts win any os

trustage, avectirs officers ereatore, key employees, of members of her famies, of wit any tarable argarizaticn 2

tin whch ary such person fs aflitaled ds an officer, drector, use, majonty onner, er prineipal Beneliaery be

‘Sate, exchange, of leasing of property? 2a

Lending of meney oF ther extension of cred? 2 | x

‘¢Furmishing of goes, services. or facies? 2el__| x

<4Payment of compensation (or payment or remmbursement of expenses it more thar $1,000)? 2d | x.

«# Tranctor of any pat ol te income or assets?

Tt answer to any question is "Yes, altzen 2 detailed statement explaring ine wansactons.

2 es agian mak gan si, ws a? a tx

‘4a D0 you nave @ section 403(0) annuity plan for your employees? | aa x

reer eee

So nate Ts SS at as a iy ne

[P&RIVEE] Reason for Non-Private Foundation Status (See instuctons.)

‘Te erganization we nota privale foundation Because ie please cheak only One appicabie box)

5 fk] A church, convention of churches, o association of churcnos, Secton 170(0)1}(A)()

A school, Section 170(@)(1)(A)in. (Also comolete Part V, page 5:)

‘A nospital 0” a cooperative hospital sevice organization. Section T7O(X NYA).

‘A rede, stave, oF local goverroent or goverrmental unt. Section 170(0)(T}A),

‘A macical research organization operated i conjunction with a hosptal, Seetin 170(b)1)(A)Gi). Enter the hospital's name, city,

and state»

10 [[] An orgarwaon operated for the benefit of a college ot university owned or operaied by a governmental unt Section 17O()C)AN).

OO ease eens Seti staan Baa 7 ee

11a [én rgerignton tt neva esis a sna pao apr 9 goverment ut or Yon oars pt

CO gecrar pais Ra Cae Settee Ree ee ci Be Ro?

tb [1A communty tust Secton 17000) (Ao complete re Supper Schedulein Part VA)

2

An orgrsation hat nna eevee (2) more than 3-13% of apport Rom conubutigns, members ees. and gross recepts

from Selves elias o ts choriabie, a, hnstons ~ subject fo cern exceptions, and @) ro more than 36-13% of ts support

{fam goss svestnent inorge and wralsied bennesswnauve core ese seston Bt ta) rom guemeneessequren by Me

Scjacbator ster lune 3 1573" See seeton SoH), tales coma he Suppor Schedule m Par WA)

ee

vo seme eet Be WSS air BSUS BW, We telah RAEI ae

rondo the folowng Wfomaton about he sipparied ciganizalons. Gee menclons)

(a) Name(s) of supported erganizabon(s) Line numer

(e)Name(s) of supported erganizabonis) © Line nny

14 [Lan organization arganzed and operates to ator publi soley, Secton SOSa)), ee inetuctons)

ae Peas Schedule A Form 980.0 Form 980 E2) 00

Schedute A (Forin $90 or 980.2) 2000 Islamic Society of Boston 04-2767435 Page 3

ParfiV2A71 Support Schedule Corpiete ory you cnecke a Box on tne 10, 11, 12) Use cash method of accounting NIA

Hote? You may use tte worksheet i the insituchons fo convering fam the acerval o ihe cash melhed oF accounting

| ® e & 1

‘Calendar year (or fiscal yeor

Beginning ny ei

15 Gils, 75, ang conuibutione

Fecelved (bb neg scuce,

(cial grants Sen te 25.)

16 Mambersip tees received

V7 Geos ess hem admissann

trechorde tld ares pete.

rms at aes i ap at

Malis nota business unvelale e

iguncaln char fable, eG gagase

TS Geese eore om nee, dient,

“arnt esr tam paren

Serres ars (Seebon SONS),

Fey eats, nd unesiee buses

(aa nae ss Seton Sts)

trom bunts Surety te gan

"an at ee 15

seating

ai Torrraes ets

See eee

ie rear

aaa

Grntiowe charge’ Bo not

ciara ease

seeeaer Nas

B oencenge fr

Sees Ae,

Sine wise

23 Toto! of ines 1§ Brough 22

24_Line 23 mans ine 17

25. Enter 1% of ine 23 eae Toes

‘26 Organizations described on lines 1O or 11: Eniet 2% of enount in cota (@), ne 28

bAnacn a ist (whieh Is not open fo public nspeclon) sxowng the name of and amount contrbuled by each sas

‘argon fot! Vion a govelnmental Unt cr publicly supported organization) nhose Tota gis for 1258 ough Hees

sed

1899 excousea the aroun shown inne 26a, EMer the cum of all ese excess amount i

«Total support fc Section 508(a)) lest: Enter ine 24, ctu (6)

‘dod! Amounts trom column (e) fr ines: 18 1”

2 2b

‘@ Pale support (ine 2¢ minus Ine 264 toa)

{ Public suppor percentage (line Ee (numerator) eivided byline 26¢ (denominator)

2 Organizations described on ine 12:

‘aFor amounts included in lnes 15, 16, and 17 that were received trom a “squaliied person,’ alta ist (yuch is not open to pubic

‘sspecton) fo show the name ol, and tela! amounts recewed #1 eath year om, tack ‘Ssqualieg person. Eales be Sumo! Suen amounts

toreacr year

(1999) _ (0988) tioamy eae cease casey saneeaneaesannetgui!

bbFor any amount inckided in ine 17 thal was received from a ndraisqualiied parson, atlach @ lis Ig show the hare ol, ahd aroun

received for each year thal was mare than the larger af (1) the aroun on he 25 forthe year or (2) $0,000. (inclage i the list

bigonzavons ceséripea in lines 5 wough 1]. a0 wel 8s indvieuals,) Arter computing tne itierence between the amount received

‘ithe larger amour Bescriond (1). af @} enter tne sum ol Ulese dlferences ihe excess armours) Tor each Year

pe

(1395) (98) 03) (96)

Aa: Aunts ar cou @) Tor mes: 1B eer

7 2 a >| zd i

Aa: ine 27a ttl Sad ne Ob otal old

{Pathe sunoort (ine 27¢ toa rus ine 274 Tia) old

1 Total suppor tor secton 509(0() test Enter amount on ine 23. okra (e)-- L274 | ae

‘9 Public support percentage (line Z7e (numerator eivided by in 271 denominator) =z x

invesment income percentage ine 18, column (numertor) vied by ine 27 (Genominator) ola %

"2B Unusual Grants: Foran organzation described in line 10. 1, or 12 that received any unusual grants during 1996 through 1959 atfch =

sistem rat open fo pube nsbecon [or oer yous ending fe are of te gornblo, the date and amount ote rai ara a

ret dasenption of te nature ot he gram, Do nol Meude these grants mine 15. (See newustions)

BAR EEA 121000 Schedule A Form 390 or SHULD 00

Schedule A (Form 990 or S90E7 2000_ Islamic Society of Boston 04-2767435 Page 4

Bad'V- 7 Private School Questionnaire Gee rsiuctors

Eiabe Somstieg O2y by sehons tat cece ite boy online in Part 1)

w

Ya

ee ee eee eee re ne

sb amt nae aoa reper oly oye set ty > =

oot ee ee eee ee

Suez temnzsin nce a imo ay nce poy og ues nat |

Sees 2”

See ee a ;

Seo romain as ora ceca ee eae rea mage :

ESE seeks eS oerat coset peg a

Tees nes wero a pose cs aa eoes vices ea ie} 5

eae eee zs

eee,

Sataeuyyagt ee y zal

oe eee

Cope ale anbees. poorers omnstnen te doses Be

Eyes o onal Hatgacomee si ns ctor 24

{you answered No! to any of the above, please expan (Il you need more space, allacn a separaie statement.) oe

Tae

138 _Does tne organization discriminate by race in any way with respect to: " S

Pacparan

ee .

ec Erelamen testy samisatv sa? ae

eee eee nd

ee nd

Anite pean? :

It you ensweres "Yes' to any of ne above, please explain. (II you need more space, attach a separate stalement.) be

i

a

fae

SnGls open ety eae seemed eg eaiee aaa

Se ee eee

teers ee ene ge pase ares aes ewes

Se ee ee ere ere

Sree crest ey a hes cle i splen oeentl aers 01 og

x

TEEADIOR Ian rede A Form 950 er OSOEZ) BIOS

Scnedule A (Form 990 oF 990-7) 2000_Islamic Society of Boston 04-2767435 Pages

Par WEA. TLobbyi nditures by Electing Public Charities (sso mnsvuctons

Coe LOREAE Day by or earns ab hares Ses : N/A

Gheckhee > 7H "9 Erganization belongs to an affisted gio

Cheskhere you checked above and ‘ned core? provslons app a i ia

Limits on Lobbying Expenditures anvatdgon | tore Proates

ee i ‘caneciee

{5 Totar asia expendires io nfvence pute opm (rasro's odoin) x

37 Toa odoyng expentures lo nies a lepelalve boy (eat bby) 2

38. Toil lobbyeng expenses (sda nes 36 and 37) 3

38. Ofer exempt purpoce expences 2

40 Total exempt pote expences (cd ines 38 ard 29) a

41 Lovbyng nonarbie noun. Enter the aout rom Be fawn ‘ole — Eran EaET

ithe amount on ine fe = Toalonoyig none amoantis (ee

Not over $500,000 20% of te amount on ine 40... Fes |

Ove $10.00 bt oe 1.02009 $0000 ps Sol ess on NOW | EMT ES

Ove $}M0 ba atv 31.000 S150 pur Wha! eaceso sone + [ar | soe eee

‘ver $190.00 but at ever $17,000,000 {522500 pus 5% f the excess ovr $1,50.000 ie ae eee

(Over $17,000,000 ‘$1,000,000 J BED ee

42. Gresootsnenacsle amount (enter 25% ot ie 4) 2 acest

48. Snract ine 42 fom tne 9, Enter il Ine 42s mere han tne 36 et

44 Suotadt ine 4 tom tne 38, Enter 0 ine 4! more fan ine 38

Caulon i teres amount on ene ne 43. ine you mst le Fin A720 PETE De LTS

4 -Year Averaging Period Under Section 501(h)

(ome organizations that mace 2 secon SOM) election do not have to camplete all ofthe fve columns below

‘See the mnevuetions for ines 45 tough 80).

Lobbying Expenditures During 4-Year Averaging Period

Calendar year ” ©, © © ©

eee | 2000 1999 1998, 1997 Toa

45. Lobbying nontaxable

‘moun

ene

7 [ae

eee

46 ay cong et eee

SON Be ee

Total lobbyn

penanures |

a7

48. Gracsr00%s 000

(aaabie mount

49 Guseotscoing mam | ne

(iste BA

5 yao epoyry

BREVEBCT Lobbying Activity by Nonelecting Public Charities

Corrcbentg ony by dancers et be 98 tonics Hat VLA) Bee instructions

ee

SSE ors Car oe

Ae

Pe

ae ee

terete ithosnee Donic opeian ova ieicsbve Hater orrolecaSun, Frou Rewas el ey | Yes | No Amount

2 Vouuriaers eS

Pia cit or management (nciude compensation in expenses reported on bes Lough re

Meda adverierenis x

<4Maange to members, lla, ore pute x

‘= Puoteatone, or bubiened or eroacast statements x

1 Grans to ober organizations for lobying purposes x

‘9Orecteoract min lepsltrs ter sia, goverment fii, oa legate bay x

IRalies, demonsvators, seminars, crwerion, speeches, echres, ary ome means x

1 To obying expats (add nese rough h) si

Iie to any of the above, also attach a statement ging 2 detailed descnpiion of the Wooyiny acwvbes.

BAA TEEaeuns an ‘Senedse A Form 990 oF 95EZ 2000

Schadule A'(Form 990 90-£2) 2000_Islamic Society of Boston

[art VifTInformation Regarding Transfers To and Transactions and Relationships With Noncharitable

Exempt Orgar

tions (See instructors)

‘51 Oa me reporung orgarvzation dyectly o maivecly angage aay ofthe folowing with ay

Bi te Cod (oher Hon section £01) ergerizaons) or im setien Se, raloneg to pol

1 Transtors trom the reporting organization lo a nonchantable exempt egenzation of

‘@cesn

Gorner assets

botner traneactone!

(Sales oF excnanges of assets witn a nonenaritaole exempi organization

i)Purchases of asses from a noncharitaple exempt organization

)Rental of faaiies. equipment, or olner assets

(v)Reimbursement airangements

(@)Loans or lean guarantees

(wi) Pertormance of serwces or membershp o Luncrasing solotations

‘eShaning of aciives, equpment, mailing Isis, otter assels, a paid employees

“tha gens goer odes ar'ervces gveh Sy he repoting afgaRissvans if We segartenon

Wesntachen cr chaning arrangement ara im coun (Se value of the

i] ©

|__Amountnwowven

©.

©

Lathe Name of nenehantathe exempt organization

04-2767435 Page 6

yo" ogarizavon described mn section S01)

3 orgatzations?

Yes

> lg

bo

bai

bai

baw)

bw

bow]

‘show ine tar mata value of

FeSt Ban fat rare wales n

> fx xe acl]

il alway

i oer assela, oy selves receiven

@

Destin of Wastes, uansSens and shag aagerets

52

jose bedin Section S01(2) of Me Code (olner man Gechon SOT(C3) erin section S27?

bit'Yes" complete te folowing seneduie

Nami

@

Type of Seanizaton

®

Ergarzation

Is he organezation aisetly or mdzeclyatilsled wih, of relled to, one or more tax-exempt organizations

> Ove

Desexpion Sretatonsp

Scneaile A (Form 950 or OED 2000

; re

Schedule Boy oop thle of Contributors

a ory satan bare 0 2000

a pen

Talore Society of Boston bearers

Orpen econ) Secs VOL) []. histor patot te goup, cack he oor.» Band aac ot wi ie names and EIN ofa members

the extension wl

TTrequest an auiomave 3monih (Emon, for 890-7 corporation) extension oftime unt Aug 15,20 02

torte she exempt organzaven retum far the arganizauon names: ove, The extension 1s for the oxganizaion's

» [x] cxiender year 20.00 or

> Ctar year bearing 2 ___ and encing 20

2. tis tax years for less than TZ mantis, Sec easan:—[] tarot L] Fina vein [] Cnange m accounting pen

Balt mis apptication Is for Form 990-BL, 990-PF, 990-7, 4720, or 66D, enter He tentative tax, less any

nonefuneabie ceais. See msvuctens

I this appkcaton is for Form 990 PF or 990-7. enter any refundable credits and estimated tax payments made

‘nckuce any prior year overpayment allowed as 2 credit 5

Rp sae ee sar eo a tees al es een

SESE oy ee ne ae 22 per wh ea rae s

Signature and Verification

noo ry | cs anv cama em nig cent he nd an

sown Wesh Dol wvar— ae * Attorney/ Accountant oom * 05/08/01

BAA For Paperwork Reduction Act Notice, see insiruclions Form 8868 (12.2000)

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Dechter v. City of Newton School Committee ComplaintDokumen495 halamanDechter v. City of Newton School Committee ComplaintAmericans for Peace and ToleranceBelum ada peringkat

- Email From ISBCC Imam Suhaib Webb To Gay Jewish LeadersDokumen1 halamanEmail From ISBCC Imam Suhaib Webb To Gay Jewish LeadersAmericans for Peace and ToleranceBelum ada peringkat

- Newton, MA History Teacher David Bedar Assignment - Topics To Research Israeli PalestineDokumen12 halamanNewton, MA History Teacher David Bedar Assignment - Topics To Research Israeli PalestineAmericans for Peace and ToleranceBelum ada peringkat

- Islamic Society of Boston Board of Trustees Annual Meeting Minutes July 2002Dokumen5 halamanIslamic Society of Boston Board of Trustees Annual Meeting Minutes July 2002Americans for Peace and ToleranceBelum ada peringkat

- NEA 2022 Annual Convention NBIsDokumen33 halamanNEA 2022 Annual Convention NBIsAmericans for Peace and ToleranceBelum ada peringkat

- March 2020 Removal of MAS Leaders From ISB TrustDokumen8 halamanMarch 2020 Removal of MAS Leaders From ISB TrustAmericans for Peace and ToleranceBelum ada peringkat

- Memo To BPD Civil Rights Unit DetectivesDokumen75 halamanMemo To BPD Civil Rights Unit DetectivesAmericans for Peace and ToleranceBelum ada peringkat

- Islamic Society of Boston Articles of OrganizationDokumen4 halamanIslamic Society of Boston Articles of OrganizationAmericans for Peace and ToleranceBelum ada peringkat

- Accommodating Israel Absence at Newton SouthDokumen2 halamanAccommodating Israel Absence at Newton SouthAmericans for Peace and ToleranceBelum ada peringkat

- ISB Cambridge DeedDokumen2 halamanISB Cambridge DeedAmericans for Peace and ToleranceBelum ada peringkat

- Burton Show DocumentsDokumen3 halamanBurton Show DocumentsAmericans for Peace and ToleranceBelum ada peringkat

- Burton Next Steps For Action NewtonDokumen1 halamanBurton Next Steps For Action NewtonAmericans for Peace and ToleranceBelum ada peringkat

- ADL, CJP Newton Reaction Raises Questions of IntegrityDokumen2 halamanADL, CJP Newton Reaction Raises Questions of IntegrityAmericans for Peace and ToleranceBelum ada peringkat

- Newton North History Dept. Chair Jon Bassett: Don't Change A Thing About Your Biased Anti-Israel TeachingDokumen2 halamanNewton North History Dept. Chair Jon Bassett: Don't Change A Thing About Your Biased Anti-Israel TeachingAmericans for Peace and ToleranceBelum ada peringkat

- Newton North History Dept. Chair Jon Bassett: Don't Change A Thing About Your Biased Anti-Israel TeachingDokumen2 halamanNewton North History Dept. Chair Jon Bassett: Don't Change A Thing About Your Biased Anti-Israel TeachingAmericans for Peace and ToleranceBelum ada peringkat

- Newton South History Dept. Chair Jen Morrill: We Will Continue To Use Biased Israeli-Palestinian Conflict History MaterialsDokumen2 halamanNewton South History Dept. Chair Jen Morrill: We Will Continue To Use Biased Israeli-Palestinian Conflict History MaterialsAmericans for Peace and ToleranceBelum ada peringkat

- Newton, MA History Teacher David Bedar PowerPoint Slides On Israeli Palestinian ConflictDokumen125 halamanNewton, MA History Teacher David Bedar PowerPoint Slides On Israeli Palestinian ConflictAmericans for Peace and ToleranceBelum ada peringkat

- October 23, 2017 Anti-Defamation League Letter To Newton, MA School Superintendent David FleishmanDokumen2 halamanOctober 23, 2017 Anti-Defamation League Letter To Newton, MA School Superintendent David FleishmanAmericans for Peace and ToleranceBelum ada peringkat

- Newton, MA History Teacher David Bedar Assignment - Israeli Vs Palestinian PerspectiveDokumen56 halamanNewton, MA History Teacher David Bedar Assignment - Israeli Vs Palestinian PerspectiveAmericans for Peace and ToleranceBelum ada peringkat

- Bassett-Bedar-Codd-Ibokette Correspondence Re Guidelines Document 02-07-17Dokumen9 halamanBassett-Bedar-Codd-Ibokette Correspondence Re Guidelines Document 02-07-17Americans for Peace and Tolerance100% (1)

- Hassan Shibly's Facebook NotesDokumen22 halamanHassan Shibly's Facebook NotesAmericans for Peace and ToleranceBelum ada peringkat

- NewtonDokumen10 halamanNewtonAmericans for Peace and ToleranceBelum ada peringkat

- David Bedar "The Dynamics of The Middle East" Course Registration From Primary SourceDokumen2 halamanDavid Bedar "The Dynamics of The Middle East" Course Registration From Primary SourceAmericans for Peace and ToleranceBelum ada peringkat