Project On Maaza Fresh

Diunggah oleh

Nilay KumarJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Project On Maaza Fresh

Diunggah oleh

Nilay KumarHak Cipta:

Format Tersedia

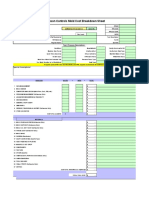

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

EXECUTIVE SUMMARY

Market penetration is one of the four growth strategies of the Product-Market

Growth Matrix defined by Ansoff. Market penetration occurs when a company

enters/penetrates a market with current products. The best way to achieve this is by

gaining competitors' customers (part of their market share). Other ways include attracting

non-users of your product or convincing current clients to use more of your

product/service (by advertising etc).

The project assigned to me is Market Penetration of Maaza Tetra Pak (Salugara

and Bagdogra market) and to make this project I have prepared a questionnaire to

conduct a survey on outlets present in these markets. Each of these markets i.e. Salugara

and Bagdogra are controlled by different MDs (Market Developer) who accompanied me

throughout the project. For the initial days, I was required to fetch orders for Maaza Tetra

Pak from the outlets which gave me valuable insights and understanding of the topic,

since it also involved interaction with the retailers.

The Siliguri market has three distributors for Hindustan Coca Cola Beverages Pvt

Ltd and they are Aqua Sales, Gupta Enterprise and Roys Sales Agency. The project

undertaken by me covers Salugara and Bagdogra markets and the distributors of these

markets are Gupta Enterprise and Roy Sales Agency respectively. Since Salugara and

Bagdogra are under the vicinity of different distributors, therefore, this project also

provides the comparative study of these distributors based on Market Penetration of

Maaza Tetra Pak.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

1

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

CHAPTER- I

INTRODUCTION

Bharati Vidyapeeth Institute of Management and Research, New Delhi

2

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

SOFT DRINK INDUSTRY: OVERVIEW

Three leading companies have prominent presence in the soft drink industry. The

leaders include the Coca-Cola Company, PepsiCo, and Cadbury Schweppes. According

to the Coca- Cola annul report; it has the most soft drink sales with $32 billion. The

Coca-Cola product line has several popular soft drinks including Coca-Cola, Diet Coke,

Fanta, Barqs, Sprite, Maaza etc selling over 400 drink brands in about 200 nations.

PepsiCo is the next top competitor with soft drink sales grossing $28 billion for the two

beverage subsidiaries, PepsiCo Beverages North America and PepsiCo International.

PepsiCos soft drink product line includes Pepsi, Mountain Dew, Miranda, Slice etc

which make up more than one quarter of its sales. Cadbury Schweppes, the third major

player had soft drink sales of $13 billion with a product line consisting of soft drinks such

as A&W Root Beer, Canada Dry, and Dr. Pepper.

These companies' products occupy large portions of any supermarket's shelf

space, often covering more territory than real food categories like dairy products, meat, or

produce. The prototype of all marketing and branding struggles, the "Cola Wars" keep

expanding. The Pepsi and Coca Cola keep rolling out the big guns: dueling pop stars, and

new branded products in the form of Vanilla Coke" and Pepsi Blue. They are fighting

on the TV, in the fast-food restaurants, and in the supermarkets; they are also dueling in

the schools. One of the biggest pushes of the last few years has been convincing school

districts, universities, and other institutions to go all-Coke or all-Pepsi, in return for a

(small) cut of the gross sales. Selling costly sugared water and building an increasing

demand for it, even in Third World countries, involves marketing in its purest form,

unsullied by any pre-existing need or local tradition. Markets in Eastern Europe, China,

India, and Mexico, among others, are expanding fast, and both Coke and Pepsi are

finding local partners (bottlers) in these countries to keep extending their reach. And

while the American market may be mature, there's still an opportunity worldwide to

Bharati Vidyapeeth Institute of Management and Research, New Delhi

3

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

replace hot beverages like coffee and tea that require some preparation with these cold,

iconic ready-to-drink brands.

KEY SUCCESS FACTORS

Key factors for competitive success within the soft drink industry branch from the

trends of the macro environment. Primarily, constant product innovation is imperative. A

company must be able to recognize consumer wants and needs, while maintaining the

ability to adjust with the changing market. They must keep up with the changing trends.

Another key factor is the size of the organization, especially in terms of market

share. Large distributors have the ability to negotiate with stadiums, universities and

school systems, making them the exclusive supplier for a specified period of time.

Additionally, they have the ability to commit to mass purchases that significantly lower

their costs. They must implement effective distribution channels to remain competitive.

Taste of the product is also a key factor for success.

Furthermore, established brand loyalty is a large aspect of the soft drink industry.

Many consumers of carbonated beverages are extremely dedicated to a particular product,

and rarely purchase other varieties. This stresses the importance of developing and

maintaining a superior brand image.

Price, however, is also a key factor because consumers without a strong brand

preference will select the product with the most competitive price. Finally, global

expansion is a vital factor in the success of a company within the soft drink industry. The

United States has reached relative market saturation, requiring movement into the global

industry to maintain growth.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

4

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

Variant Available

Soft drinks are available in glass bottles, aluminum cans and PET bottles for

home consumption. Fountains also dispense them in disposable containers. Nonalcoholic soft drinks beverage market can be divided into carbonated and non carbonated

drinks. Cola, Lemon and Oranges are carbonated drinks while mango drinks come under

non carbonated category. The market can also be segmented on the basis of types of

products in the cola products and non-cola products. Cola products accounts for nearly

61-62% of the total soft drinks market. The brands that fall in this category are Pepsi,

Coca-Cola, Thumps Up, Diet Coke, Diet Pepsi etc Non Cola segment which constitutes

36% can be divided into four categories based on the types of flavors available namely:

Orange, Cloudy Lime, Clear Lime and Mango. . Robust time ahead for soft drinks Soft

drinks are expected to see robust volume growth over the forecast period. This will occur

despite a total volume and constant value decline for carbonates. Growth will be led by

bottled water and, from a smaller base and with slower growth, fruit/vegetable juice.

Health and convenience are predicted to be the two most important factors affecting

buying behavior, as carbonates and concentrates play second fiddle to healthier bottled

water and fruit/vegetable juice.

Overall Carbonated Soft Drink

In fact, Coke and Pepsi have a third major rival on the bottled soft drink shelves,

namely

Cadbury-Schweppes. The big three carbonated beverage makers now exist in a

stable oligopoly those changes only by small increments and which controls over 90% of

the market. Over the years, Cadbury-Schweppes (the result of a merger between a British

candy company and a British beverage company) has improved its position by acquiring

key brands in the US, namely Dr. Pepper and Seven Up, along with A & W and Canada

Dry. In 2001, however, Cadbury acquired moribund RC Cola, giving it a cola drink to

battle against the big guys. This gave the company more shelf position and immediately

gave the RC Cola brand, long a distant also-ran with weak marketing muscles, more sales

and market presence. Pepsi gave itself a small boost because of the popularity of newly

Bharati Vidyapeeth Institute of Management and Research, New Delhi

5

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

introduced Mountain Dew Code Red, a hyper-caffeinated soda. Coke's numbers declined

slightly. It's pretty indicative of this mature market that the only major move in market

share comes through a takeover. Moreover, the takeover targets that are left are so small

that the biggest remaining brand doesn't make more than 1% difference in total volume.

Product coverage

Asian speciality drinks; Bottled water; Carbonates; Concentrates; Fruit/vegetable

juice; Functional drinks; RTD coffee; RTD tea

Market trends and industry challenges

In order to survive in this environment, companies must consider the market

trends that will likely shape the industry over the next few years. This will help soft drink

companies to understand the challenges they will encounter and to turn them into

opportunities for process improvement, enhanced flexibility and, ultimately, greater

profitability.

Market trends for the soft drink industry can be summarized by six fundamental themes:

Changing consumer beverage preferences, featuring a shift toward health-oriented

wellness drinks.

Growing friction between bottlers and manufacturers in the distribution system.

Continually increasing retailer strength.

Fierce competition.

Complex distribution system composed of multiple sales channels.

Beverage safety concerns and more-stringent regulations.

Consumers turn to wellness and healthy drinks

Bharati Vidyapeeth Institute of Management and Research, New Delhi

6

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

In much of the developed world, a significant portion of the population is

overweight or obese. This includes two-thirds of Americans and an increasing number of

Europeans. Consequently, many people have started to actively manage their weight and

change their lifestyles, a shift that is reflected in their choices in the beverage aisles:

Demand has increased for beverages that are

Perceived to be healthy

Energy drink consumption has also climbed, due to

The increasingly active lifestyles of teenagers

This trend towards healthier drinks has created a number of new categories, and

changed the consumption trends of the beverage industry as a whole. While previously

dominated by carbonated soft drinks, the industry is now more evenly balanced between

carbonates, and product categories with a healthier image, such as bottled water, energy

drinks and juice: While carbonates are still the largest soft drink segment, bottled water is

catching up fast, with an average of 58 litters consumed annually per capita.

Among individual countries, Italy ranks number one in bottled water consumption, with

the average Italian drinking177 litters per year. Overall, bottled water represents the

fastest growing soft drink segment, expanding at 9percent annually. This growth is being

partially driven by increasing awareness of the health benefits of proper hydration. The

industry has responded to consumers desire for healthier beverages by creating new

categories, such as energy drinks, and by diversifying within existing ones. For example,

the leading carbonated soft drink companies have recently introduced products with

50%less sugar that fall mid-way between regular and diet classifications. Similarly, a

South African juice company has recently released a fruit-based drink that contains a

Full complement of vitamins and nutrients.

HISTORY: THE COCA- COLA COMPANY

The Early Days

Bharati Vidyapeeth Institute of Management and Research, New Delhi

7

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

Coca-Cola was created in 1886 by John Pemberton, a pharmacist in Atlanta,

Georgia, who sold the syrup mixed with fountain water as a potion for mental and

physical disorders. The formula changed hands three more times before Asa D. Candler

added carbonation and by 2003, Coca-Cola was the worlds largest manufacturer,

marketer, and distributor of nonalcoholic beverage concentrates and syrups, with more

than 400 widely recognized beverage brands in its portfolio.

With the bubbles making the difference, Coca-Cola was registered as a trademark

in 1887 and by 1895, was being sold in every state and territory in the United States. In

1899, it franchised its bottling operations in the U.S., growing quickly to reach 370

franchisees by 1910. Headquartered in Atlanta with divisions and local operations in over

200 countries worldwide, Coca-Cola generated more than 70% of its income outside the

United States by 2003

International expansion

Cokes first international bottling plants opened in 1906 in Canada, Cuba, and

Panama. By the end of the 1920s Coca-Cola was bottled in twenty-seven countries

throughout the world and available in fifty-one more. In spite of this reach, volume was

low, quality inconsistent, and effective advertising a challenge with language, culture, and

government regulation all serving as barriers. Former CEO Robert Woodruffs insistence

that Coca-Cola wouldnt suffer the stigma of being an intrusive American product, and

instead would use local bottles, caps, machinery, trucks, and personnel contributed to

Cokes challenges as well with a lack of standard processes and training degrading

quality. Coca-Cola continued working for over 80 years on Woodruffs goal: to make

Coke available wherever and whenever consumers wanted it, in arms reach of desire.

The Second World War proved to be the stimulus Coca-Cola needed to build effective

capabilities around the world and achieve dominant global market share. Woodruffs

patriotic commitment that every man in uniform gets a bottle of Coca-Cola for five

cents, wherever he is and at whatever cost to our company14 was more than just great

public relations. As a result of Cokes status as a military supplier, Coca-Cola was exempt

Bharati Vidyapeeth Institute of Management and Research, New Delhi

8

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

from sugar rationing and also received government subsidies to build bottling plants

around the world to serve WWII troops.

Turn of the Century Growth Imperative

The 1990s brought a slowdown in sales growth for the Carbonated Soft Drink

(CSD) industry in the United States, achieving only 0.2% growth by 2000 (just under 10

billion cases) in contrast to the 5-7% annual growth experienced during the 1980s. While

per capita consumption throughout the world was a fraction of the United States, major

beverage companies clearly had to look elsewhere for the growth their shareholders

demanded. The looming opportunity for twenty-first century was in the worlds

developing markets with their rapidly growing middle class populations.

The Worlds Most Powerful Brand

Interbrands Global Brand Scorecard for 2003 ranked Coca-Cola the #1 Brand in

the World and estimated its brand value at $70.45 billion. The rankings methodology

determined a brands valuation on the basis of how much it was likely to earn in the

future, distilling the percentage of revenues that could be credited to the brand, and

assessing the brands strength to determine the risk of future earnings forecasts.

Considerations included market leadership, stability, and global reach, incorporating its

ability to cross both geographical and cultural borders.

From the beginning, Coke understood the importance of branding and the creation

of a distinct personality. Its catchy, well-liked slogans (Its the real thing (1942, 1969),

Things go better with Coke (1963), Coke is it (1982), Cant beat the Feeling

(1987), and a 1992 return to Cant beat the real thing) linked that personality to the core

values of each generation and established Coke as the authentic, relevant, and trusted

refreshment of choice across the decades and around the globe.

THE COCA COLA SYSTEM

Bharati Vidyapeeth Institute of Management and Research, New Delhi

9

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

We are a global business that operates on a local scale in every community where

we do business. We create global reach with local focus because of the strength of the

Coca-Cola system, which comprises our Company and our bottling partnersmore

than300 worldwide. Our Company manufactures and sells concentrates, beverage bases

and syrups to bottling operations; owns the brands; and is responsible for consumer brand

marketing initiatives. Our bottling partners manufacture, package, merchandise and

distribute the finished branded beverages to our customers and vending partners, who

then sell our products to consumers.

All bottling partners work closely with customersgrocery stores, restaurants,

street vendors, convenience stores, movie theatres and amusement parks, among many

othersto execute localized strategies developed in partnership with our Company.

Customers then sell our products to consumers at a rate of 1.6 billion servings a day.

Our business operations are divided into the following geographies: Eurasia and

Africa, Europe, Latin America, North America and Pacific as well as our Bottling

Investments Group.

MISSION OF COCA-COLA

Create consumer products services and communications customers service and

bottling system strategy process and tools in order to create competitive advantage and

deliver superior value to-Consumers as a superior beverage experience.

Consumers as an opportunity to grow profit through the use of finished drinks.

Bottlers as an opportunity to make reasonable to grow profits and value added

Suppliers as an opportunity to make reasonable when creating real value added in

environment of system wide teamwork, flexible business system and continuous

improvement.

Indian society in form of contribution to economic and social development.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

10

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

VISION OF COCA-COLA

VISION FOR SUSTAINABLE GROWTH

PROFIT: Maximizing return to shareowners while being mindful of our

overall responsibilities.

PEOPLE: Being a great place to work where people are inspired to be the

best they can be.

PORTFOLIO: Bringing to the world a portfolio of beverage brands that

anticipate and satisfy peoples Desires and needs.

PARTNERS: Nurturing a winning network of partners and building mutual

loyalty.

PLANET: Being a responsible global citizen that makes a difference.

VISION 2020

The world is changing all around us. To ensure our business will continue to

thrive over the next 10 years and beyond, we are looking ahead to understand the trends

and forces that will shape our industry in the future. Our 2020 Vision creates a long-term

destination for our business. It provides us with business goals that outline what we need

to accomplish with our global bottling partners in order to continue winning in the

marketplace and achieving sustainable, quality growth. For each goal, we have a set of

guiding principles and strategies for winning throughout the entire Coca-Cola system.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

11

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

VALUE

Coca-Cola is guided by shared values that both the employees as individuals and

the Company will live by; the values being:

LEADERSHIP: The courage to shape a better future

PASSION: Committed in heart and mind

INTEGRITY: Be real

ACCOUNTABILITY: If it is to be, its up to me

COLLABORATION: Leverage collective genius

INNOVATION: Seek, imagine, create, delight

QUALITY: What we do, we do well

Bharati Vidyapeeth Institute of Management and Research, New Delhi

12

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

Public (NYSE: KO)

Dow Jones Industrial Average

Type

component

Industry

Beverage

Founded

1892

Headquarters

Atlanta, Georgia, United States

Area served

Worldwide

Key people

Muhtar Kent

(Chairman and CEO)

Products

Coca-Cola

Carbonated Soft Drinks

Water

Other Non-alcoholic beverages

Revenue

US$31.0 Billion (FY 2009)

Operating

income

US$8.23 Billion (FY 2009)

Net income

US$5.82 Billion (FY 2009)

Total assets

US$48.7 Billion (FY 2009)

Total equity

US$24.8 Billion (FY 2009)

Employees

92,400 (October 2009)

Website

KO.com or The Coca-Cola

Company Corporate Website

Source: www.wikipedia.com

HINDUSTAN COCA- COLA BEVERAGES PRIVATE

LIMITED (HCCBPL)

Bharati Vidyapeeth Institute of Management and Research, New Delhi

13

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

ABOUT THE COMPANY

India is home to one of the most ancient cultures in the world dating back over

5000 years. At the beginning of the twenty-first century, twenty-six different languages

were spoken across India, 30% of the population knew English, and greater than 40%

were illiterate. At this time, the nation was in the midst of great transition and the

dichotomy between the old India and the new was stark. Remnants of the caste system

existed alongside the worlds top engineering schools and growing metropolises as the

historically agricultural economy shifted into the services sector. In the process, India had

created the worlds largest middle class, second only to China.

A British colony since 1769 when the East India Company gained control of all

European trade in the nation, India gained its independence in 1947 under Mahatma

Gandhi and his principles of non-violence and self-reliance. In the decades that followed,

self-reliance was taken to the extreme as many Indians believed that economic

independence was necessary to be truly independent. As a result, the economy was

increasingly regulated and many sectors were restricted to the public sector. This

movement reached its peak in 1977 when the Bhartiya Janta Party government came to

power and Coca-Cola was thrown out of the country. In 1991, the first generation of

economic reforms was introduced and liberalization began.

COKE IN INDIA

Coca-Cola was the leading soft drink brand in India until 1977 when it left rather

than reveals its formula to the government and reduces its equity stake as required under

the Foreign Exchange Regulation Act (FERA) which governed the operations of foreign

companies in India. After a 16-year absence, Coca-Cola returned to India in 1993,

cementing its presence with a deal that gave Coca-Cola ownership of the nation's top

soft-drink brands and bottling network. Cokes acquisition of local popular Indian brands

including Thums Up (the most trusted brand in India), Limca, Maaza, Citra and Gold

Spot provided not only physical manufacturing, bottling, and distribution assets but also

strong consumer preference. This combination of local and global brands enabled CocaBharati Vidyapeeth Institute of Management and Research, New Delhi

14

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

Cola to exploit the benefits of global branding and global trends in tastes while also

tapping into traditional domestic markets.

Leading Indian brands joined the Company's international family of brands,

including Coca-Cola, diet Coke, Sprite and Fanta, plus the Schweppes product range. In

2000, the company launched the Kinley water brand and in 2001, Shock energy drink and

the powdered concentrate Sunfill hit the market.

From 1993 to 2003, Coca-Cola invested more than US$1 billion in India, making

it one of the countrys top international investors. By 2003, Coca-Cola India had won the

prestigious Woodruff Cup from among 22 divisions of the Company based on three broad

parameters of volume, profitability, and quality. Coca-Cola India achieved 39% volume

growth in 2002 while the industry grew 23% nationally and the Company reached

breakeven profitability in the region for the first time. Encouraged by its 2002

performance, Coca-Cola India announced plans to double its capacity at an investment of

$125 million (Rs. 750 crore) between September 2002 and March 2003.

Coca-Cola India produced its beverages with 7,000 local employees at its twentyseven wholly-owned bottling operations supplemented by seventeen franchisee-owned

bottling operations and a network of twenty-nine contract-packers to manufacture a range

of products for the company. The complete manufacturing process had a documented

quality control and assurance program including over 400 tests performed throughout the

process.

The complexity of the consumer soft drink market demanded a distribution

process to support 700,000 retail outlets serviced by a fleet that includes 10-ton trucks,

open-bay three wheelers, and trademarked tricycles and pushcarts that were used to

navigate the narrow alleyways of the cities. In addition to its own employees, Coke

indirectly created employment for another 125,000 Indians through its procurement,

supply, and distribution networks. Sanjiv Gupta, President and CEO of Coca-Cola India,

joined Coke in 1997 as Vice President, Marketing and was instrumental to the companys

Bharati Vidyapeeth Institute of Management and Research, New Delhi

15

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

success in developing a brand relevant to the Indian consumer and in tapping Indias vast

rural market potential. Following his marketing responsibilities, Gupta served as Head of

Operations for Company-owned bottling operations and then as Deputy President. Seen

as the driving force behind recent successful forays into packaged drinking water,

powdered drinks, and ready-to-serve tea and coffee, Gupta and his marketing prowess

were critical to the continued growth of the Company.

MARKETING COLA IN INDIA

The post-liberalization period in India saw the comeback of cola but Pepsi had

already beaten Coca-Cola to the punch, creatively entering the market in the 1980s in

advance of liberalization by way of a joint venture. As early as 1985, Pepsi tried to gain

entry into India and finally succeeded with the Pepsi Foods Limited Project in 1988, as a

JV of PepsiCo, Punjab government-owned Punjab Agro Industrial Corporation (PAIC),

and Voltas India Limited. Pepsi was marketed and sold as Lehar Pepsi until 1991 when

the use of foreign brands was allowed under the new economic policy and Pepsi

ultimately bought out its partners, becoming a fully-owned subsidiary and ending the JV

relationship in 1994.

While the joint venture was only marginally successful in its own right, it allowed

Pepsi to gain precious early experience with the Indian market and also served as an

introduction of the Pepsi brand to the Indian consumer such that it was well-poised to

reap the benefits when liberalization came. Though Coke benefited from Pepsi creating

demand and developing the market, Pepsis head-start gave Coke a disadvantage in the

mind of the consumer. Pepsis appeal focused on youth and when Coke entered India in

1993 and approached the market selling an American way of life, it failed to resonate as

expected.

Brand Localization Strategy: The Two India

India A: Life ho to aisi

Bharati Vidyapeeth Institute of Management and Research, New Delhi

16

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

India A, the designation Coca-Cola gave to the market segment including

metropolitan areas and large towns, represented 4% of the countrys population. This

segment sought social bonding as a need and responded to inspirational messages,

celebrating the benefits of their increasing social and economic freedoms. Life ho to

aisi, (life as it should be) was the successful and relevant tagline found in Coca-Colas

advertising to this audience.

India B: Thanda Matlab Coca-Cola

Coca-Cola India believed that the first brand to offer communication targeted to

the smaller towns would own the rural market and went after that objective with a

comprehensive strategy. India B included small towns and rural areas, comprising the

other 96% of the nations population. This segments primary need was out-of-home

thirst-quenching and the soft drink category was undifferentiated in the minds of rural

consumers. Additionally, with an average Coke costing Rs. 10 and an average days

wages around Rs. 100, Coke was perceived as a luxury that few could afford.

In an effort to make the price point of Coke within reach of this high-potential

market, Coca-Cola launched the Accessibility Campaign, introducing a new 200ml bottle,

smaller than the traditional 300ml bottle found in urban markets, and concurrently cutting

the price in half, to Rs. 5. This pricing strategy closed the gap between Coke and basic

refreshments like lemonade and tea, making soft drinks truly accessible for the first time.

At the same time, Coke invested in distribution infrastructure to effectively serve a

disbursed population and doubled the number of retail outlets in rural areas from 80,000

in 2001 to 160,000 in 2003, increasing market penetration from 13 to 25%. Cokes

advertising and promotion strategy pulled the marketing plan together using local

language and idiomatic expressions. Thanda, meaning cool/cold is also generic for cold

beverages and gave Thanda Matlab Coca-Cola delicious multiple meanings. Literally

translated to Coke means refreshment, the phrase directly addressed both the primary

need of this segment for cold refreshment while at the same time positioning Coke as a

Thanda or generic cold beverage just like tea, lassi, or lemonade. As a result of the

Bharati Vidyapeeth Institute of Management and Research, New Delhi

17

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

Thanda campaign, Coca-Cola won Advertiser of the Year and Campaign of the Year in

2003.

RURAL SUCCESS

Comprising 74% of the country's population, 41% of its middle class, and 58% of

its disposable income, the rural market was an attractive target and it delivered results.

Coke experienced 37% growth in 2003 in this segment versus the 24% growth seen in

urban areas.

Driven by the launch of the new Rs. 5 product, per capita consumption doubled

between 2001-2003. This market accounted for 80% of Indias new Coke drinkers, 30%

of 2002 volume, and was expected to account for 50% of the companys sales in 2003.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

18

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

HINDUSTAN COCA- COLA BEVERAGES PRIVATE

LIMITED (HCCBPL) STRUCTURE

Coca-cola is a world class company in "low margin, high volume" business

which means sales of high volume for the product in order to be profitable and

complete in the global market.

Company Owned Bottling Operation (COBO)

Franchisee Owned Bottling Operation (FOBO)

COBO :

COBO stand for company owned bottling operations; COBO has been of Coke

Company's biggest strategy, which has proved to be winner. A bottling operation is a

capital intensive business, particularly so the returnable bottle market like in India and

the investment is the forth level.

Apart from the capital cost of plant and equipment the bottles has to invest in bottles

and crates, truck and cooling structure (Visi Coolers and ice boxes) at the retail point

industry estimates @ Rs. Crate which is equivalent to the price at which the crate

enters the distribution system Bottlers operates on margins around 10% with the bulk

of the killing (between Rs. 24 and Rs. 30 per crate or about 20%) being made by the

retailer. Excise and other taxes amounting Rs. 40 per crate. The going for a COBO is

the risk of coke Company and it is also implied a big attitude change from a totally

marketing orientation to an operation mindset.

COBO'S IN INDIA

COBOs are present across the nation, the locations are given below:

Mumbai, Bangalore, Ahemadabad, Chennai, Calcutta & Jalpaiguri unit also

Bharati Vidyapeeth Institute of Management and Research, New Delhi

19

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

FOBO

FOBO stand for franchise owned bottling operation, in India Pepsi has

franchise. In the case the company supplies its soft drink concentrate to its franchises

(bottle syrup). Coca-cola has taken a more capital - intensive route of the owning and

running its own plants along side those of its franchises.

Coca-cola pumped in money to upgrade plants of franchises, which were

weaker did not have financial worth were given massive support in form of interest

free loans to upgrade their operations.

Getting into FOBO has helped Coke Company on several fronts. First, it has

enabled Pepsi to focus on marketing operations as much as it has on operation fronts.

Another gain of going FOBO is that since the franchises have to invest in plants and

machines glass bottles, trucks, and infrastructure, the cost burden has been reduced.

FOBO IN INDIA:

FOBO are located at the following places:

Part of Delhi, Punjab, Part of Andhra Pradesh, Calcutta and South Bengal

Bharati Vidyapeeth Institute of Management and Research, New Delhi

20

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

ORGANISATIONAL CHART

Bharati Vidyapeeth Institute of Management and Research, New Delhi

21

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

ORGANISATIONAL STRUCTURE

Bharati Vidyapeeth Institute of Management and Research, New Delhi

22

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

SALES DEPARTMENT STRUCTURE

Bharati Vidyapeeth Institute of Management and Research, New Delhi

23

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

CHALLENGES FOR COCA COLA

The Coca-Cola Company and its products have been criticized by various sources

for various reasons including negative health effects resulting from consumption of its

products, exploitative labor practices, high levels of pesticides in its products, building

plants in Nazi Germany which employed slave labor, environmental destruction,

monopolistic business practices, hiring paramilitary units to murder trade union leaders,

and marketing unhealthy products to children.

Health effects

Acidity and tooth decay

Numerous court cases have been filed against the Coca-Cola Company since the

1940s alleging that the acidity of the drink is dangerous and it causes tooth decay.

High fructose corn syrup

High fructose corn syrup was rapidly introduced in many processed foods and

soda drinks in the US over the period of about 19751985. Since 1985 in the U.S., Coke

has been made with high fructose corn syrup instead of sucrose to reduce costs. One of

the reasons this has come under criticism is because the corn used to produce corn syrup

often comes from genetically altered plants. Some nutritionists also caution against

consumption of high fructose corn syrup because of possible links to obesity and

diabetes. High fructose corn syrup has been shown to be metabolized differently than

sugar by the human body.

India secret formula ban

Coca-Cola was India's leading soft drink until 1977 when it left India after a new

government ordered the company to turn over its secret formula for Coca-Cola and dilute

its stake in its Indian unit as required by the Foreign Exchange Regulation Act (FERA).In

1993, the company (along with PepsiCo) returned in pursuance of India's Liberalization

policy.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

24

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

Environmental issues

In India, there exists widespread concern over how Coca-Cola is produced. In

particular, it is feared that the water used to produce Coke may contain unhealthy levels

of pesticides and other harmful chemicals. It has also been alleged that due to the amount

of water required to produce Coca-Cola, aquifers are drying up and forcing farmers to

relocate.

Pesticide use

In 2003, the Centre for Science and Environment (CSE), a non-governmental

organization in New Delhi, said aerated waters produced by soft drinks manufacturers in

India, including multinational giants Pepsico and Coca-Cola, contained toxins including

lindane, DDT, malathion and chlorpyrifos pesticides that can contribute to cancer and

a breakdown of the immune system. Tested products included Coke, Pepsi, and several

other soft drinks (7Up, Mirinda, Fanta, Thums Up, Limca, Sprite), many produced by

The Coca-Cola Company.

Water use

Environmental degradation in the form of depletion of the local ground water

table due to the utilization of natural water resources by the company poses a serious

threat to many communities.

Coca-Cola's operations in India have come under intense scrutiny as many

communities are experiencing severe water shortages as well as contaminated

groundwater and soil that some assert are a result of Coca-Cola's bottling operations. A

massive movement has emerged across India to hold the Coca-Cola Company

accountable for its actions. The state of Kerala imposed a ban of colas from the state only

to be quashed by Coca Cola; the matter is pending in the Supreme Court. The Plachimada

plant in Kerala state, one of Coca-Cola's largest bottling facilities in India, has remained

shut for 17 months now because the village council has refused to renew its license,

blaming the company for causing water shortages and pollution.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

25

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

In Sivaganga District of Tamil Nadu state there were several protests and rallies

opposing the proposed Coca Cola bottling plant in fear of water depletion and

contamination. The president of the Gangaikondan panchayat, Mr. V. Kamson died under

mysterious circumstances two days after going back and forth in his resentment against

the upcoming Coca-cola bottling plant in the village. When asked about the conflicting

statements, he said: "I am under immense pressure from the public, police and other

quarters. So I have issued this statement." Five other Indian states have announced partial

bans on the drinks in schools, colleges and hospitals.

Packaging

Packaging used in Coca-Cola's products has a significant environmental impact

but the company strongly opposes attempts to introduce mechanisms such as container

deposit legislation.

Economic business practices

Monopolistic

In 2000, a United States federal judge dismissed an antitrust lawsuit filed by

PepsiCo Inc. accusing Coca-Cola Co. of monopolizing the market for fountain-dispensed

soft drinks in the United States.

In June 2005, Coca-Cola in Europe formally agreed to end deals with shops and

bars to stock its drinks exclusively after a European Union investigation found its

business methods stifled competition.

In November 2005, Coca-Cola's Mexican unit - Coca-Cola Export Corporation and a number of its distributors and bottlers were fined $68 million for unfair commercial

practices. Coca-Cola is appealing the case.

Marketing

In 1993, US investigative journalist Mark Pendergrast published For God Country

and Coca Cola (ISBN 0465054684), an in-depth study of the marketing phenomenon

which had made Coca-Cola synonymous with US culture.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

26

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

In 2004, the British government launched a wide-ranging review into food

promotion and childhood obesity. One survey found that Coca-Cola broadcasted a high

proportion of their advertisements during children's television. The company removed its

branding from vending machines in Scottish schools in December 2003, replacing it with

a graphic of an urban scene.

"Channel stuffing" settlement

Coca-Cola Co, on July 7, 2008 compromised to pay $137.5 million (69.4 million

pounds) to settle an October 2000 shareholder lawsuit. Coca-Cola was charged in a U.S.

District Court for the Northern District of Georgia, with "forcing some bottlers to

purchase hundreds of millions of dollars of unnecessary beverage concentrate to make its

sales seem higher." Institutional investors, led by Carpenters Health & Welfare Fund of

Philadelphia & Vicinity, accused Coca-cola of "channel stuffing," or artificial inflation of

Coca-Cola's results which gave investors a false picture of the company's health. The

settlement applies to Coca-Cola common stock owners from Oct 21, 1999 to March 6,

2000.

Employee issues

Racial discrimination

In November 2000, Coca-Cola agreed to pay $192.5 million to settle a class

action racial discrimination lawsuit and promised to change the way it manages,

promotes and treats minority employees in the US. In 2003, protesters at Coca-Cola's

annual meeting claimed that black people remained underrepresented in top management

at the company, were paid less than white employees and fired more often. In 2004, Luke

Visconti, a co-founder of Diversity Inc., which rates companies on their diversity efforts,

said: "Because of the settlement decree, Coca-Cola was forced to put in management

practices that have put the company in the top 10 for diversity."

Bharati Vidyapeeth Institute of Management and Research, New Delhi

27

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

Shareholder resolution attempt (2002)

In 2002, Christian Brothers Investment Services, Inc. submitted, along with other

co-filers, a shareholder resolution that called for Coca-Cola to adopt a code of conduct on

bottling practices and employee relations. Problems in Colombia were cited, but the

proposal called for "clear standards for its suppliers, vendors and bottlers." The resolution

received support from Coca-Cola unions in Colombia, Guatemala, Zimbabwe, the

Philippines, and the United States.

However, Coca Cola's board of directors recommended rejecting the proposal,

noting in the proxy: "We believe that the Company's existing policies address

substantially all of the concerns raised in this proposal and that the proposal is therefore

unnecessary... For example, both our policy and the Principles specifically provide that

we (i) will not condone the exploitation of children, physical punishment or involuntary

servitude; and (ii) will pay wages that enable our employees to meet their basic needs.

Ultimately, shareholders rejected the resolution.

2010 Polish election campaign

During Polish presidential election campaign 2010 two DJs of Radio "Eska

Rock", Wojewodzki and Figurski, recorded a hip-hop song parodying the political usage

of funerals of victims of 2010 Polish Air Force Tu-154 crash. The song's most attacked

verse referred to burying the dead president among Polish kings at the Wawel castle hill.

The authors also parodied the "I love Poland"-style of nationalistic politicians. Refrain

criticized the dog-eat-dog approach of political usage of mourning and country-wide

grief. The song quickly spread over social networks, by-passing mainstream media

controlled by nationalist politicians that use censorship against their opponents CocaCola responded to the appeals of Polish nationalist activists and announced that its logo

will be removed from "Eska Rock" Internet appearance.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

28

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

CLASSIFICATION OF OUTLETS AND BRAND

ORDER SYSTEM

Classification of outlets on the basis of volume

There are four types of outlets according to the volume of sales of the

outlet-Diamond

800>C/s & above per year

Gold

500-799C/s per year

Silver

200-499C/s per year

Bronze

<200C/s per year

CHANNEL CLUSTER

(A) GROCERY STORE

Grocery (customer profile): Store stocking a variety of regular uses household items. The

channels provide an opportunity for penetration as it propels home consumption. It

includes all kirana stores, juice, departmental stores, supermarkets, provision stores etc.

Necessary Availability - 1.5 liter and 300ml

(B) EATING & DRINKING CHANNEL- 1

Eating and Drinking Channel: Outlets which are having less than five tables come under

channel one. Outlets range from the high-end restaurants to the smaller dhabas. These

outlets offer multiple opportunities to effect sales as people usually order something to

drink along with food. It includes

- Restaurants

- Bars and Pubs

- Dhabas

- Cafes

Bharati Vidyapeeth Institute of Management and Research, New Delhi

29

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

(C) EATING & DRINKING CHANNEL 2

It includes bakery, sweet shops, tea shops, soft drink shops and juice centre which have

more than five tables.

(D) CONVENIENCE CHANNEL

Pan/bidi shops (customer profile): This segment includes PAN BIDDI outlets that stock

cigarettes, mint, and confectionary. It covers STD/ISD phone booths, travel channel etc.

Small outlets that mainly sell 200ml or 300ml bottles. They may also sell 600ml.

BRAND ORDER SYSTEM OF COCA COLA

COLOJ-K

COLA

LEMON

ORANGE

JUICE

KINLEY

COKE

KINLEY

FANTA

THUMS UP

SPRITE

Bharati Vidyapeeth Institute of Management and Research, New Delhi

30

MAAZA

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

MMPO/MMNF

LIMCA

PRODUCT PORTFOLIO

Bharati Vidyapeeth Institute of Management and Research, New Delhi

31

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

COMPETITORS

The competitors to the products of the company mainly lie in the nonalcoholic

beverage industry consisting of juices and soft drinks.

The key competitors in the industry are as follows:

Bharati Vidyapeeth Institute of Management and Research, New Delhi

32

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

PepsiCo: The PepsiCo challenge, to keep up with arch rival, the Coca-Cola

Company never ends for the World's # 2, carbonated soft drink maker. The company's

soft drinks include Pepsi, Mountain Dew, Mirinda and Slice. Cola is not the company's

only beverage; PepsiCo sells Tropicana orange juice brands, Gatorade sports drink, and

Aquafina water. PepsiCo also sells Dole juices and Lipton ready-to-drink tea. PepsiCo

and Coca-Cola hold together, a market share of 95% out of which 60.8% is held by CocaCola and the rest belongs to Pepsi.

Nestl: Nestle does not give that tough a competition to Coca-Cola as it mainly deals

with milk products, Baby foods and Chocolates. But the iced tea that is Nestea which has

been introduced into the market by Nestle provides a considerable amount of competition

to the products of the Company. Iced tea is one of the closest substitutes to the Colas as it

is a thirst quencher and it is healthier when compared to fizz drinks. The flavored milk

products also have become substitutes to the products of the company due to growing

health awareness among people.

Dabur: Dabur in India, is one of the most trusted brands as it has been operating ever

since times and people have laid all their trust in the Company and the products of the

Company. Apart from food products, Dabur has introduced into the market Real Juice

which is packaged fresh fruit juice. These products give a strong competition to Maaza

and the latest product Minute Maid Pulpy Orange.

Parle Agro: Parle Agro is a household name in the beverages industry and has

leading brands like Frooti, consistent winner of India's fruit beverage brand, Appy, Appy

Fizz and packaged drinking water, Bailley.

A pioneer in the Indian industry, Parle Agro is associated with many firsts. They were the

first to introduce fruit drinks in tetra packaging, first to introduce apple nectar and the

first to introduce fruit drinks in PET bottles

SWOT ANALYSIS

STRENGTHS

Bharati Vidyapeeth Institute of Management and Research, New Delhi

33

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

DISTRIBUTION NETWORK: The Company has a strong and reliable distribution

network. The network is formed on the basis of the time of consumption and the amount

of sales yielded by a particular customer in one transaction. It has a distribution network

consisting of a number of efficient salesmen, 700,000 retail outlets and 8000 distributors.

The distribution fleet includes different modes of distribution, from 10-tonne trucks to

open-bay three wheelers that can navigate through narrow alleyways of Indian cities and

trademarked tricycles and pushcarts.

STRONG BRANDS: The products produced and marketed by the Company have a

strong brand image. People all around the world recognize the brands marketed by the

Company. Strong brand names like Sprite, Fanta, Limca, Thums Up and Maaza add up to

the brand name of the Coca-Cola Company as a whole. The red and white Coca- Cola is

one of the very few things that are recognized by people all over the world. Coca-Cola

has been named the world's top brand for a fourth consecutive year in a survey by

consultancy Interbrand. It was estimated that the Coca-Cola brand was worth

$70.45billion.

Source: (http://news.bbc.co.uk/1/hi/business/4706275.stm)

LOW COST OF OPERATIONS: The production, marketing and distribution

systems are very efficient due to forward planning and maintenance of consistency of

operations which minimizes wastage of both time and resources leads to lowering of

costs.

WEAKNESSES

SMALL SCALE SECTOR RESERVATIONS LIMIT ABILITY TO

INVEST AND ACHIEVE ECONOMIES OF SCALE: The Companys operations are

carried out on a small scale and due to Government restrictions and red-tapism, the

Company finds it very difficult to invest in technological advancements and achieve

economies of scale.

OPPORTUNITIES

LARGE DOMESTIC MARKETS: The domestic market for the products of the

Company is very high as compared to any other soft drink manufacturer. Coca-Cola India

Bharati Vidyapeeth Institute of Management and Research, New Delhi

34

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

claims a 58 per cent share of the soft drinks market; this includes a 42 per cent share of

the cola market. Other products account for 16 per cent market share, chiefly led by

Limca. The company appointed 50,000 new outlets in the first two months of this year, as

part of its plans to cover one lakh outlets for the coming summer season and this also

covered 3,500 new villages. In Bangalore, Coca-Cola amounts for 74% of the beverage

market.

EXPORT POTENTIAL: The Company can come up with new products which are not

manufactured abroad, like Maaza etc and export them to foreign nations. It can come up

with strategies to eliminate apprehension from the minds of the people towards the Coke

products produced in India so that there will be a considerable amount of exports and it is

yet another opportunity to broaden future prospects and cater to the global markets rather

than just domestic market.

HIGHER INCOME AMONG PEOPLE: Development of India as a whole has lead

to an increase in the per capita income thereby causing an increase in disposable income.

Unlike olden times, people now have the power of buying goods of their choice without

having to worry much about the flow of their income. The beverage industry can take

advantage of such a situation and enhance their sales.

THREATS

IMPORTS: As India is developing at a fast pace, the per capita income has increased

over the years and a majority of the people is educated, the export levels have gone high.

People understand trade to a large extent and the demand for foreign goods has increased

over the years. If consumers shift onto imported beverages rather than have beverages

manufactured within the country, it could pose a threat to the Indian beverage industry as

a whole in turn affecting the sales of the Company.

TAX AND REGULATORY SECTOR: The tax system in India is accompanied by a

variety of regulations at each stage on the consequence from production to consumption.

When a license is issued, the production capacity is mentioned on the license and every

time the production capacity needs to be increased, the license poses a problem.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

35

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

Renewing or updating a license every now and then is difficult. Therefore, this can limit

the growth of the Company and pose problems.

SLOWDOWN IN RURAL DEMAND: The rural market may be alluring but it is not

without its problems: Low per capita disposable incomes that is half the urban disposable

income; large number of daily wage earners, acute dependence on the vagaries of the

monsoon; seasonal consumption linked to harvests and festivals and special occasions;

poor roads; power problems; and inaccessibility to conventional advertising media. All

these problems might lead to a slowdown in the demand for the companys products.

PEST ANALYSIS

The PEST analysis examines changes in a marketplace caused by Political, Economical,

Social and Technological factors.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

36

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

POLITICAL ANALYSIS

Non-alcoholic beverages fall within the food category under the FDA. The

government plays a role within the operation of manufacturing these products in terms of

regulations. There are potential fines set by the government on companies if they do not

meet a standard of laws.

The following are some of the factors that could cause Coca-Cola company's

actual results to differ materially from the expected results described in their underlying

company's forward statement:Changes in laws and regulations, including changes in accounting standards,

taxation requirements, (including tax rate changes, new tax laws and revised tax law

interpretations) and environmental laws in domestic or foreign jurisdictions.

Changes in the non-alcoholic business environment. These include, without

limitation, competitive product and pricing pressures and their ability to gain or maintain

share of sales in the global market as a result of action by competitors.

Political conditions, especially in international markets, including civil unrest,

government changes and restrictions on the ability to transfer capital across borders.

Their ability to penetrate developing and emerging markets, which also depends on

economic and political conditions, and how well they are able to acquire or form strategic

business alliances with local bottlers and make necessary infrastructure enhancements to

production facilities, distribution networks, sales equipment and technology.

ECONOMIC ANALYSIS

Last year the U.S. economy was strong and nearly every part of it was growing

and doing well. However, things changed. Most economists loosely define a recession as

two consecutive quarters of contraction, or negative GDP growth. On Monday 26, the

government officially declared that the U.S. has been in recession since March. (CBS

Bharati Vidyapeeth Institute of Management and Research, New Delhi

37

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

Market Watch. U.S. Officially in a recession." Rex Nutting. [Nov 26, 2001].

www.cbsmarketwatch.com)

However, because of aggressive action by the Federal Reserve and Congress it will be

short and mild. The economy will return to sustained, positive growth in the first half of

2002.

SOCIAL ANALYSIS

Many U.S. citizens are practicing healthier lifestyles. This has affected the nonalcoholic beverage industry in that many are switching to bottled water and diet colas

instead of beer and other alcoholic beverages. Also, time management has increased and

is at approximately 43% of all households. (http://www.cdf-mn.org). The need for bottled

water and other more convenient and healthy products are in important in the average

day-to-day life.

Consumers from the ages of 37 to 55 are also increasingly concerned with

nutrition. There is a large population of the age range known as the baby boomers. Since

many are reaching an older age in life they are becoming more concerned with increasing

their longevity. This will continue to affect the non-alcoholic beverage industry by

increasing the demand overall and in the healthier beverages.

TECHNOLOGICAL ANALYSIS

Some factors that cause company's actual results to differ materially from the

expected results are as follows:

Bharati Vidyapeeth Institute of Management and Research, New Delhi

38

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

The effectiveness of company's advertising, marketing and promotional programs.

The new technology of internet and television which use special effects for advertising

through media. They make some products look attractive. This helps in selling of the

products. This advertising makes the product attractive. This technology is being used in

media to sell their products.

Introduction of cans and plastic bottles have increased sales for Coca-Cola as

these are easier to carry and you can bin them once they are used.

As the technology is getting advanced there has been introduction of new

machineries all the time. Due to introduction of this machineries the production of the

Coca-Cola Company has increased tremendously then it was few years ago CCE has six

factories in Britain which use the most stat-of the-art drinks technology to ensure top

product quality and speedy delivery. Europe's largest soft drinks factory was opened by

CCE in Wakefield, Yorkshire in 1990. The Wakefield factory has the technology to

produce cans of Coca-Cola faster than bullets from a machine gun.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

39

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

CHAPTER- II

RESEARCH

METHODOLOGY

RESEARCH METHODOLOGY

RESEARCH DESIGN FOLLOWED

Bharati Vidyapeeth Institute of Management and Research, New Delhi

40

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

Descriptive Research is the research method used because descriptive studies

embrace a large proportion of market research. The purpose is to provide an accurate

snapshot of some aspect of the market environment. Descriptive research is more rigid

than exploratory research and seeks to describe users of a product, determine the

proportion of the population that uses a product, or predict future demand for a product.

As opposed to exploratory research, descriptive research should define questions, people

surveyed, and the method of analysis prior to beginning data collection. In other words,

who, what, where, when, why, and how aspects of the research should be defined.

SAMPLING:SAMPLING TECHNIQUE USED

In this project the technique of sampling used was Judgment sampling. Judgment

sampling involves the choice of subjects who are most advantageously placed or in the

best position to provide the information required.

SAMPLE UNIT

In this project sample were the retailers in Salugara and Bagdogra region & the

aim was to know the penetration level of Maaza Tetra Pak and the competitors present

in the market.

SAMPLE SIZE: 200 Retailers.

Salugara- 83 retailers and Badogra- 117 retailers

DATA COLLECTION TECHNIQUES

SOURCES OF DATA

PRIMARY DATA

To collect primary data from Retailers Questionnaires were used. Questionnaire

was prepared very carefully so that it may prove to be effective in collecting the right

information.

SECONDARY DATA

Secondary data collected from different website. This secondary data formed the

conceptual background for the project. This secondary data was compared with the

primary data collected in area.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

41

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

RESEARCH INSTRUMENT

The research instrument used in the project was Questionnaire to collect primary

information, it provided flexibility by using more close ended and few open ended

questions.

METHOD OF DATA COLLECTION

Information was collected by personally contacting retailers through interviews.

ANALYSIS AND STATISTICAL TECHNIQUE USED

Types of data analysis techniques used in the project:

- Tabular analysis.

- Graphical analysis.

- Percentage analysis.

OBJECTIVES OF THE RESEARCH

PRIMARY OBJECTIVE

To study the presence of Maaza Tetra Pak in Salugara and Bagdogra Market

Bharati Vidyapeeth Institute of Management and Research, New Delhi

42

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

To analyse the potential market for Maaza Tetra Pak

To collect information about the competitors

SECONDARY OBJECTIVE

To analyze the factors influencing perception and buying decision

of consumers.

SCOPE OF THE RESEARCH

The study is carried out in Salugara and Bagdogra markets hence its scope is mainly

limited to Salugara and Bagdogra.

It gives information about the size of the retail network.

It gives information about the services given by distributor to their retailers.

It gives information about the competitors products.

It will serve consumer in better manner.

It provides suggestions to the company to improve their products sales.

It gives information about the sales promotion activities to improve the sale.

LIMITATIONS OF THE RESEARCH

Some of the retailers were too busy to participate for the survey.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

43

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

The monsoon hindered the survey and the collection of data.

The survey was limited only for two markets ( Salugara and Bagdogra)

Time period of the project was only 50 days which made it difficult to understand

the market completely.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

44

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

CHAPTER- III

CONCEPTUAL

DISSCUSION

LITERATURE REVIEW

The Ansoff Product-Market Growth Matrix is a marketing tool created by Igor

Ansoff and first published in his article "Strategies for Diversification" in the Harvard

Bharati Vidyapeeth Institute of Management and Research, New Delhi

45

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

Business Review (1957). The matrix allows marketers to consider ways to grow the

business via existing and/or new products, in existing and/or new markets there are four

possible product/market combinations. This matrix helps companies decide what course

of action should be taken given current performance. The matrix consists of four

strategies:

Market penetration (existing markets, existing products): Market penetration

occurs when a company enters/penetrates a market with current products. The

best way to achieve this is by gaining competitors' customers (part of their market

share). Other ways include attracting non-users of your product or convincing

current clients to use more of your product/service, with advertising or other

promotions. Market penetration is the least risky way for a company to grow.

Product development (existing markets, new products): A firm with a market for

its current products might embark on a strategy of developing other products

catering to the same market (although these new products need not be new to the

market; the point is that the product is new to the company). For example,

McDonald's is always within the fast-food industry, but frequently markets new

burgers. Frequently, when a firm creates new products, it can gain new customers

for these products. Hence, new product development can be a crucial business

development strategy for firms to stay competitive.

Market development (new markets, existing products): An established product in

the marketplace can be tweaked or targeted to a different customer segment, as a

strategy to earn more revenue for the firm. For example, Lucozade was first

marketed for sick children and then rebranded to target athletes. This is a good

example of developing a new market for an existing product. Again, the market

need not be new in itself; the point is that the market is new to the company.

Diversification (new markets, new products): Virgin Cola, Virgin Megastores,

Virgin Airlines, Virgin Telecommunications are examples of new products created

by the Virgin Group of UK, to leverage the Virgin brand. This resulted in the

company entering new markets where it had no presence before.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

46

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

The matrix illustrates, in particular, that the element of risk increases the further

the strategy moves away from known quantities - the existing product and the existing

market. Thus, product development (requiring, in effect, a new product) and market

extension (a new market) typically involve a greater risk than `penetration' (existing

product and existing market); and diversification (new product and new market)

generally carries the greatest risk of all. In his original work, which did not use the matrix

form, Igor Ansoff stressed that the diversification strategy stood apart from the other

three.

While the latter are usually followed with the same technical, financial, and

merchandising resources which are used for the original product line, diversification

usually requires new skills, new techniques, and new facilities. As a result it almost

invariably leads to physical and organizational changes in the structure of the business

which represent a distinct break with past business experience.

For this reason, most marketing activity revolves around penetration.

ABOUT THE PRODUCT

Maaza

Bharati Vidyapeeth Institute of Management and Research, New Delhi

47

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

Yaari Dosti Taaza Maaza

Maaza

is a Coca-Cola fruit drink brand marketed in India and Bangladesh,

the most popular drink being the mango variety so much that over the years, the Maaza

brand has become synonymous with Mango. Initially Coca-Cola had also launched

Maaza in orange and pineapple variants, but these variants were subsequently dropped.

Coca-Cola has recently re-launched these variants again in the Indian market.

Mango drinks currently account for 90% of the fruit juice market in India. Maaza

currently dominates the fruit drink category and competes with Pepsi's Slice brand of

mango drink and Frooti, manufactured by Parle Agro.

While Frooti was sold in small cartons, Maaza and Slice were initially sold in

returnable bottles. However, all brands are also now available in small cartons and large

PET bottles. Of late, the Indian market is witnessing the entry of a large number of small

manufacturers producing only mango fruit drink.

Maaza has a distinct pulpy taste as compared to Frooti and tastes slightly sweeter

than Slice. Maaza claims to contain mango pulp of the Alphonso which is known as

King of Mangoes in India and Totapuri variety.

HISTORY

Maaza was launched in 1976 in India. The Union Beverages Factory, based in the

United Arab Emirates, began selling Maaza as a franchisee in the Middle East and Africa

in 1976. By 1995, it had acquired rights to the Maaza brand in these countries through

Bharati Vidyapeeth Institute of Management and Research, New Delhi

48

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

Maaza International Co LLC Dubai. In India, Maaza was acquired by Coca-Cola India in

1993 from Parle-Bisleri along with other brands such as Limca, Citra, Thums Up and

Gold Spot. As for North America, Maaza was acquired by House of Spices in 2005.

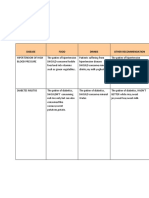

SWOT ANALYSIS OF MAAZA TETRA PAK

STRENGTHS

Most demanded mango juice in TP.

Maaza has good Brand Equity.

Maaza TP can be preserved for longer

duration.

Efficient distribution network readily

available.

WEAKNESSESS

Maaza TP doesnt run

advertisements.

Retailers are unaware of the margin

earned by selling Maaza TP.

Retailers dont find the price to be

reasonable.

Promotional offers are weak or

negligible in comparison to its

competitors.

Maaza comes only in one variant.

OPPORTUNITIES

45% of the markets are untapped.

2) The markets surveyed witnesses a

lot of travelers hence stocking Pocket

Maaza adequately in these markets

can boost sales.

THREATS

Supply of competitors Tetra Pak is

strong in remote locations which are

eating up the market share of Maaza

TP.

Maaza is not produced in Raninagar

Plant.

There are many competitors of Maaza

TP.

Bharati Vidyapeeth Institute of Management and Research, New Delhi

49

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

CHAPTER- IV

DATA ANALYSIS

QUESTION 1

SALUGARA

BAGDOGRA

Bharati Vidyapeeth Institute of Management and Research, New Delhi

50

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

SALUGARA AND BAGDOGRA COMBINED

INFERENCE:

There is huge market which is untapped for reasons ranging from competition,

irregular supply, high price etc. Maaza Tetra Pak is losing its market share to local

players and other companies due to availability of substitute products.

QUESTION 3

SALUGARA

BAGDOGRA

Bharati Vidyapeeth Institute of Management and Research, New Delhi

51

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

SALUGARA AND BAGDOGRA COMBINED

INFERENCE:

The consumers were found to be aware of availability of Maaza in Tetra Pak.

QUESTION 4

SALUGARA

Bharati Vidyapeeth Institute of Management and Research, New Delhi

52

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

BAGDOGRA

SALUGARA AND BAGDOGRA COMBINED

INFERENCE:

From the charts we can figure out that most of the retailers in both the markets sell

1-10 cases of Maaza TP in a month and only a minuscule number of retailers go

beyond 10 cases.

QUESTION 5

SALUGARA

Bharati Vidyapeeth Institute of Management and Research, New Delhi

53

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

BAGDOGRA

SALUGARA AND BAGDOGRA COMBINED

INFERENCE:

Out of all the retailers who stock Maaza be it Salugara, Bagdogra or the

combination of both the markets it is seen that Maaza TP dominates the sale, as

Coca Cola is found to be a dominant player in these markets.

QUESTION 7

SALUGARA

BAGDOGRA

Bharati Vidyapeeth Institute of Management and Research, New Delhi

54

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

SALUGARA AND BAGDOGRA COMBINED

INFERENCE:

On an average 72% of the retailers who stock Maaza TP in both the markets are

happy with their distributors. And the 28% of the remaining few are unhappy with

the distributor and the reasons range from irregular supply, absence of credit

facility with coke to issues with the coolers.

QUESTION 9

Bharati Vidyapeeth Institute of Management and Research, New Delhi

55

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

SALUGARA

BAGDOGRA

SALUGARA AND BAGDOGRA COMBINED

INFERENCE:

From the following results it is evident that consumers and retailers are unaware of

the benefits of Tetra Pak. Some of the benefits are; it takes less shelf space, juice can

be preserved for longer duration, it is easy to carry, the Tetra Pak is environment

friendly as it can be recycled etc. When the benefits were told to the retailers they

gave a positive gesture, hence, little education by the MDs (Market Developers) can

help Maaza TP to tap the potential market.

QUESTION 10

Bharati Vidyapeeth Institute of Management and Research, New Delhi

56

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

SALUGARA

BAGDOGRA

SALUGARA AND BAGDOGRA COMBINED

INFERENCE:

One of the major issues which restrain retailers to stock Maaza Tetra Pak is its

price. Maaza Tetra Pak comes with a price tag of Rs 12, which make the retailers as

well as the consumers to struggle in fending off the change. The retailers want

Maaza to come either in Rs 10 or Rs 15 packages.

QUESTION 11

Bharati Vidyapeeth Institute of Management and Research, New Delhi

57

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

SALUGARA

BAGDOGRA

SALUGARA AND BAGDOGRA COMBINED

INFERENCE:

Maaza Tetra Pak is a hit among the consumers up to the age of 40. Maaza Tetra Pak

is marketed as pocket Maaza therefore consumers are found to be up to the age of

40 who travel and move a lot.

QUESTION 12

Bharati Vidyapeeth Institute of Management and Research, New Delhi

58

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

SALUGARA

BAGDOGRA

SALUGARA AND BAGDOGRA COMBINED

INFERENCE:

It was difficult to find the gender which consumed Maaza Tetra Pak the most, many

retailers said that both the genders consumed Maaza Tetra Pak equally.

QUESTION 15

Bharati Vidyapeeth Institute of Management and Research, New Delhi

59

Market Penetration of Maaza Tetra Pak (Salugara and Bagdogra)

SALUGARA

BAGDOGRA

SALUGARA AND BAGDOGRA COMBINED

INFERENCE:

The retailers were found to be unhappy as the schemes are not reaching them. The