anthonyIM 25

Diunggah oleh

ceojiJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

anthonyIM 25

Diunggah oleh

ceojiHak Cipta:

Format Tersedia

CHAPTER 25

REPORTING AND EVALUATION

Changes from the Eleventh Edition

All changes to Chapter 25 were minor.

Approach

Students should get a general idea of the difference between economic and managerial performance

measurement, the nature of control reports, the criteria for good reports, and a beginning of an

understanding of how to read such reports. A full understanding of the meaning of control reports requires

years of experience and it also requires a thorough knowledge of the specific environment to which the

reports pertain, so students should not be disturbed if they do not understand all the nuances of the sample

reports included in the chapter. Nevertheless, they should acquire some ability to distinguish between

what is significant and what is not significant, as well as an ability to spot fairly obvious red flags, that

is, items requiring further investigation.

Both of the last two sections can be somewhat controversial. Whereas some companies are significantly

reducing (or even eliminating) formerly intensive variance analysis processes, most still hew to this

approach. Also, the total amounts of many executives incentive awards have prompted considerable

criticism from certain quarters in recent years.

Cases

Olympic Car Wash requires students to isolate the effects of an uncontrollable factor (rain) on the results

of a car wash company. (Note: This case was included in Chapter 21 in the Eleventh Edition. It can still

be used there.)

Armco Inc.: Midwestern Steel Division illustrates a performance measurement system with measures

cascading from strategic priorities down to the lowest organization levels.

Formosa Plastics Group describes a company that has an elaborate planning and performance

measurement system but that uses mostly subjective evaluations of performance and highly smoothed

bonus payments.

Problems

Problem 25-1: Greene Enterprises

Performance Report

(A - B)

(C)

(B - C)

Budgeted

at Actual

Budget

Actual

Difference

Volume

Difference

Sales.....................................................................................................................................................................................

$56,000

$63,000

$7,000

$63,000

$

0

Cost of goods sold................................................................................................................................................................

39,200

37,800

1,400

(b) 44,100

6,300

Gross margin........................................................................................................................................................................

16,800

25,200

8,400

18,900

6,300

Direct operating expenses:

Variable................................................................................................................................................................................

(a) 6,720

8,000

(1,280)

(c) 7,560

(440)

Fixed....................................................................................................................................................................................

10,000

10,000

0

10,000

0

Contribution to indirect costs...............................................................................................................................................

$

80

$ 7,200

$7,120

$ 1,340

$5,860

(A)

(B)

Accounting: Text and Cases 12e Instructors Manual

(a)

Anthony/Hawkins/Merchant

Direct operating expenses........................................................................................................................................................

$16,720

Less: Fixed expense.................................................................................................................................................................

10,000

Variable expense......................................................................................................................................................................

$ 6,720

(b) Cost of sales $39,200/budgeted sales $56,000 = 70%

.70 x $63,000 = $44,100, the cost of goods sold budgeted for actual volume.

(c) Budgeted variable costs $6,720/budgeted sales $56,000 = 12%

.12 x $63,000 = $7,560, the direct operating expenses budgeted at actual volume.

Sales increased substantially and were $7,000 more than expected. The indirect costs were $440 more

than expected, but the cost of sales was only 60% of sales, rather than the budgeted 70%. These two

factors account for the $5,860 difference between actual contribution to indirect costs and that expected at

the actual sales volume. (The fairness of such an appraisal depends upon whether the predicted behavior

of costs was realistic and reasonable.)

Problem 25-2: Watson Company

a.

Performance Report

Division A

Current Year

Last Year

Net sales.................................................................................................................................................................................

$252,000

$216,000

Cost of goods sold:

Variable costs.....................................................................................................................................................................

$72,000

$72,000

Division fixed costs...........................................................................................................................................................

29,000

101,000

29,000

101,000

Gross margin..........................................................................................................................................................................

151,000

115,000

Selling and administrative expenses:

Variable expense................................................................................................................................................................

22,000

19,000

Division fixed expenses.....................................................................................................................................................

25,000

47,000

22,000

41,000

Contribution to allocated costs and expenses.........................................................................................................................

$104,000

$ 74,000

b. Division A performed better in the current year than in the last year when the ratios of contribution to

allocated costs to sales are made. ($104,000/$252,000 = 41% and $74,000/$216,000 = 34%.) Division

managers cannot control allocated costs, and their performance should not be judged on the basis of

net income/sales because the net income figure includes allocated costs. By comparing division

contributions to allocated costs, the amount which each Division Manager contributes toward the

overall company profits can be clearly seen. Bonuses based on division contributions would be in the

best interest of both the managers and the company.

Problem 25-3: Machine Shop

a. If the report is meant to be a control report, the only two items strictly within the direct control of the

machine shop supervisor are probably materials handling costs and supplies. Depreciation of machine

shop equipment is a departmental direct cost, but the supervisor may not have much control over the

amount. The costs for buildings and grounds, and general plant are allocated costs and cannot be

controlled by the supervisor. Maintenance is controllable to the extent of the number of hours of

maintenance time, but the supervisor cannot control the standard rate applied to these hours. Training

costs might be similar to maintenance costs in that the supervisor might be able to control the amount

of training time, but not the cost attributed to training.

2007 McGraw-Hill/Irwin

Chapter 25

b.

Performance Report

Machine Shop

Actual

over (under)

Budget

Actual

Direct costs

Materials handling.................................................................................................................................................

$ 8,000

$ 8,150

$150

Supplies.................................................................................................................................................................

5,200

5,000

(200)

Depreciation- equipment........................................................................................................................................

6,000

6,000

0

19,200

19,150

(50)

Indirect costs

Training.................................................................................................................................................................

4,500

5,300

Maintenance..........................................................................................................................................................

5,000

5,800

Building and grounds.............................................................................................................................................

3,700

3,700

General plant expense............................................................................................................................................

2,500

2,600

15,700

17,400

Total direct and indirect costs....................................................................................................................................

$34,900

$36,550

Problem 25-4: Hopedale Company

a.

Performance Report - Month of April

Variance

Favorable or

(Unfavorable)

Actual

Budget (a)

Controllable costs:

Salaries.................................................................................................................................................................

$12,300

$12,000

$(300)

Indirect labor........................................................................................................................................................

20,500

19,640 (b)

(860)

Indirect materials..................................................................................................................................................

2,550

2,640 (c)

90

Other costs............................................................................................................................................................

9,510

9,650 (d)

140

$44,860

$43,930

$(930)

(a) Budgeted costs at actual volume of 33,000 direct machine-hours consist of both fixed costs

and variable costs calculated for the actual volume.

Fixed costs:

Salaries.............................................................................................................................................

$12,000

Indirect labor....................................................................................................................................

17,000

Other costs........................................................................................................................................

8,000

(These are the same at any volume, because they are given as a fixed amount per month.)

(b) Variable indirect labor = $.08 x 33,000=$2,640

Total indirect labor costs budgeted = $17,000 + $2,640=$19,640

(c) Variable indirect materials = $.08 x 33,000=$2,640

(d) Variable other costs = $.05 x 33,000=$1,650

Total indirect other costs budgeted = $8,000 + $1,650=$9,650

b. Total actual costs for March were $930 higher than budgeted, with salaries and indirect

labor higher than budgeted. More labor was probably used than expected, due to the

greater volume than formerly budgeted.

The increase of $300 in salaries cost probably caused the increase in indirect labor cost

also, perhaps for such as increased janitorial costs or routine maintenance.

3

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

(The expected volume was 29,000 machine-hours and was later revised to 34,000

machine-hours.) Although the actual volume of activity at 33,000 machine-hours was less

than the revised budgeted 34,000 machine-hours, the favorable variances still resulted

because the original budget was apparently based on a total yearly volume which is

proving to be low. There seems to be good cost control over indirect material cost, as less

was spent than budgeted.

Cases

Case 25-1: Olympic Car Wash

Note: This case is unchanged from the Eleventh Edition, but it has been moved from Chapter 21 in the

Eleventh Edition to Chapter 25 in the Twelfth Edition.

Assignment question: How large should the bonus pool be for the Aalst location?

Solution

Flex the budget based on number of hours of good weather.

Flexible

Controllable

variance

(actual

flex budget)

Budget

Actual

budget

184,000

124,080

108,100

15,980

Variable expenses

(50% of revenue)

92,000

62,040

54,050

(7,990)

Fixed expenses

53,820

55,000

53,820

(1,180)

145,820

117,040

107,870

(9,170)

38,180

7,040

230

6,810

Revenue

Total expenses

Profit

Size of the bonus pool = 3,000 + 681 = 3,681

Case 25-2: Armco Inc.: Midwestern Steel Division*

Note: This case is unchanged from the Eleventh Edition.

Approach

The Armco case was designed to illustrate a performance measurement system with measures

cascading from strategic priorities down to the lowest organization levels. The system is not tightly

linked with incentive compensation, although that is being discussed. Still, the focus on measured results

promises to change managerial behaviors significantly.

The case is particularly interesting because it describes a major change from an old measurement system

*

This teaching note was prepared by Professor Kenneth A. Merchant. Copyright 1998 Kenneth A. Merchant.

2007 McGraw-Hill/Irwin

Chapter 25

which was primarily designed for standard financial reporting purposes and was not perceived, at least by

top management, to be effective for management control purposes. The new performance measurement

system eliminated most of the allocations of indirect costs and helped managers understand the critical

success factors in their areas.

In this case, then, students can understand two performance measurement systems and the companys

reasons for changing from one to the other. They can evaluate the new system and decide whether the

division managers have made optimal choices in designing their new system, and they can make a

judgment as to whether the system should be used to increase the proportion of total compensation linked

to performance.

Most of the students will conclude the new system is a substantive change for the better. But then they

will get a dose of reality as they see the problems Armco is having getting managers to adapt to the new

system.

Suggested Assignment Questions

1. What was wrong with the Midwestern Steel Divisions old system? (As part of your analysis, study

Exhibit 3 carefully and figure out what the columns tell you, individually and in total.)

2. If the old system was so bad, why did the operating managers seem to like it?

3. Evaluate the new system and the way in which it was being implemented. What changes would you

recommend, if any? Why?

4. What should Rob Cushman do about the two items described in the Remaining Issues section of the

case?

Case Analysis and Pedagogy

1. What factors most determine the success or failure of the Midwestern Steel Division? In particular,

how important is cost control?

Carbon wire rod is a commodity product, so cost control is critical for this line of business.

There is some product differentiation in grinding media. Customers can measure how long the steel

balls last, and they value long-lasting balls. Armco believes it has a superior manufacturing

technology that causes its balls to last longer. Further manufacturing technology innovations would

provide additional profits to the division.

Cost control is also important for grinding media, as Armco is the high cost producer in this market.

Plant throughput (productivity) is one key to cost control. Armco can sell all the product it makes.

(The plant has been operating at capacity for three years straight.)

Among the cost control challenges in the plant are the fact that the plant has old equipment, generally

poor preventative maintenance practices (40% of the 700 hourly workers in the plant were

maintenance workers), and less than optimum worker productivity.

The people left in the plan are the most senior. They would not be hurt that much by a shutdown.

They have pensions. Cost control is not that important to them. It would cost the company about $200

million to shut down the plant (environmental clean-up, pensions, etc.).

Students might ask why Armco does not put more people or more equipment in the melt shop so it

wouldnt be a bottleneck. The answer is that they would have to add a furnace, making an investment

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

of approximately $100 million. This would add capacity which is not needed in the industry.

2. How were managers controlling performance with the old system? What were the strengths and

weaknesses of the old system?

Strengths

1. Managers express need for detail so they can track

month-to-month trends.

2. Has value in identifying problem areas.

3. Measured performance was based on managers

ability to control cost above. System gave

managers information consistent with objective

they were given.

Weaknesses

1. Too much detail. Some numbers didnt change.

Some very small.

2. System designed for inventory costing purposes.

Have to allocate costs. For performance

measurement purposes, not sure if the allocations

mean anything.

3. Source of some of the data is unclear.

4. Reports were delivered 15 days after month-end.

This is too late.

5. System too focused on cost reductions, to the

exclusion of other critical success factors.

6. Managers performances judged on things over

which they had no control. Many costs were

caused by people who did not report to the

managers (e.g., capital spending, salaries,

maintenance). Easy to blame poor performance

on uncontrollables.

7. System not encouraging managers to work

together. Much local data. Contributes to

suboptimization.

8. Not graphic.

9. Accounting accruals distort the costs. Example

annual August maintenance shutdown accruals

start in January.

It is important to walk students through Exhibit 3. Pick some representative columns and have

students talk about what they mean or dont mean. Among the useful examples to discuss are

nonmetallics, salaries, electricity, lubricants, and loco cranes. Students should see the types of costs

that make up total cost above. Which are the big items? Which items are variable and which are

fixed? (The important ones are fixed. Costs per net ton are driven by tons produced.) Point out the

distorting effect of the August maintenance shutdown.

S-orders represent extraordinary maintenance. It is accrued for. It is fixed in the short-run (a month),

but it can vary over the year.

3. Why did the operating managers seem to like the old system?

Familiarity

Reports were related to budget

Managers cant be held accountable because they always had an excuse for poor performance.

(Nenni: The traditional way we ran our operating review meetings was that the managers would

find some items that didnt make sense. Then they would discredit the report and the accountants.

2007 McGraw-Hill/Irwin

Chapter 25

We never got to the items the managers can and should control.)

Gives managers a false sense that they can control costs. Gives a global picture. (The managers

would have liked to have the information every week.)

Gives managers a sense that they are responsible for a large number (e.g., melt shop manager

responsible for $50 million per year)

After the students have had their crack at the analysis, if it hasnt come up, the instructor might

usefully point their attention to Bob Nennis quote about the problem with non-value-added chores

under the new system and the difference between value-added and non-value-added work. (Nonvalue-added work includes everything customers are not willing to pay for.) One prominent example

of the non-value-added work associated with the old system (which is Bob Nennis focus) is the

administrative burden required to keep it going. The old system took five accountants to operate. The

new system required only three, even in start-up mode; most of the accountants time was spent

designing new reports. To what extent does Bob Nenni consider accounting to be value-added

work?

4. What were the key features of the new system and what improvements did it promise?

Hit the key design choices and discuss them; for example:

Strategic (not just financial) focus. 10 key measures.

Priorities must come from the general manager and his direct reports. Priorities must cascade

from above so that everybody is working on the right things.

Everybody agrees with the top four priorities

Safety is the #1 priority because managers do not want people to get hurt. It is not #1 because

it is the largest cost.

safety, productivity, quality, and up-time.

Elimination of cost above measure

New system does not do a trend analysis (e.g., performance vs. a year ago or vs. last rolling 12

months). What is key is whether manager did in January what he said he would do (vs. agreed-to

benchmark).

Focuses attention on important categories and provides more detail on those

Focuses on controllables. For example, melt shop manager controls KWH/T, not electricity

dollars/T. Purchasing negotiates the price.

Focuses more on productivity than costs.

Standardardizes everything. Everything is not driven by tons.

Apparent reduction in the manufacturing managers financial responsibility. (The new system

reported only what the employees reporting to each manager spent. Those are the dollars that can

be controlled.)

5. What are the weaknesses of the new system?

Its not a cost system. Company still needs a cost system. The company still does not have a

handle on what costs are controllable, what are fixed and variable, etc.

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

Should show consumption, not purchases. (There is still a problem with the source of the data.)

The performance standards are not benchmarked with the best in the industry. (Firms in the steel

industry do not share much operating performance information.)

Seasonal factors are ignored.

Uncontrollables still not handled well. For example, what happens if the plant shuts down for a

few hours? Should this be segregated from the managers performance reports?

The system is not complete. Three measures

inspection are not yet implemented.

Should the system focus on exception reporting, rather than provide all the detail?

maintenance, on-time delivery, and

6. The implementation process.

Division managers decided to discontinue the old system immediately? What are the advantages

and disadvantages of that decision?

Managers would never adapt to new system if old system was still running. After the switch to

the new system, they were frequently in Rob Cushmans office begging for their old reports.

(Actually the old system is still being run, for inventory valuation and product costing purposes.

But the operating managers have not been told that the old system is still running.)

The risk of the immediate switch-over is that uninformed decisions will be made: Managers dont

have their old information, and they dont yet understand the new information. But the new

system seemed to work. The periods after the switch-over to the new system were the best in the

history of the plant.

Department managers had no input into the design of the new system? Was that wise?

Ideally it should be the operating managers, not the accountants, who identify what is critical to

their areas. But the operating managers were consulted, and they said only, We want the old

system. Only three managers in the division wanted the new system the general manager, the

director of finance, and the manager of cost accounting. The other 997 people in the plant were

indifferent to overtly combative.

What can be done to get operating managers to take the lead? Training? Hiring? Should

accountants have a role in measuring quality, on-time delivery, etc.?

Why did Bob Nenni devote so much energy to the performance measurement system instead of

working on, for example, an activity-based costing system, which Armco does not yet have?

He thought the performance measurement system, with its link to strategic priorities, was much

more important than an accurate costing system.

7. Remaining issues:

When should something be considered uncontrollable?

Under the new system at Armco, the handling of uncontrollables is at the discretion of the

individual superior. The lines between controllables and uncontrollables are tough to define. The

company has a culture of making excuses.

Should larger bonuses be linked to the new system measures?

2007 McGraw-Hill/Irwin

Chapter 25

The answer to this question is complex. Among other things, it depends on the trust people have

in the measures and the companys compensation strategy (e.g., compensation competitiveness,

amount of risk they want managers to bear).

8. What has happened since the case was written?

Many things have happened since the case was written. There was significant management turnover.

First, the manufacturing cost manager (Scott Molaro) resigned. He got frustrated by the operating

managers resistance to change. Then there was significant turnover among the operating managers.

The works manager (Charlie Bradshaw) was asked to retire. The maintenance manager (Ed Graves)

was fired. The rolling/finishing manager (Paul Phillips) retired.

In April 1992, Armco Inc. acquired Cyclops Industries, Inc., another specialty steel manufacturer. The

combined company needed capital, so they spun off the Midwestern Steel Division. It is now a

privately held, freestanding business.

As of March 1993, the new performance measurement system was still operating. The three missing

measures were still not implemented. Rob Cushman was not sure the on-time delivery measures

would be worth the cost of developing them. Managers were not sure how best to develop the

maintenance measures. And they had not gotten around to developing the inspection measures.

Case 25-3: Formosa Plastics Group*

Approach

The Formosa Plastics Group (FPG) case describes the reporting and evaluation system used by the largest

private corporation in Taiwan. The case describes the companys organization and responsibility centers,

budgeting processes and, particularly, methods of evaluating the performances of profit center managers

when profit is to a large extent uncontrollable. The system is somewhat unusual in that the planning and

reporting processes are quite detailed and costly, yet performance evaluations are highly subjective, and

bonuses do not vary much from period to period.

Suggested Assignment Questions

1. Identify the major elements of Formosa Plastics Groups control system.

2. Is the Polyolefin division a profit center?

3. Managers at Formosa Plastics Group use subjectivity to eliminate some of the effects of

uncontrollable factors from performance evaluations. Evaluate this choice. Did they have any

alternatives?

4. Evaluate FPGs incentive compensation system. What are the advantages and disadvantages of

smoothing incentive compensation?

Case Analysis and Possible Discussion Questions

1. Describe the Formosa Plastics Group (FPG).

FPG is a Taiwan-based conglomerate consisting of more than 10 different companies located in

Taiwan, China, and the United States. It includes several chemical, plastics, electronic, and textile

*

This teaching note was prepared by Professor Kenneth A. Merchant. Assistance from Professors Thomas W. Lin and Dan

Elnathan is gratefully acknowledged. Copyright 1998 Kenneth A. Merchant.

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

companies, as well as a modern hospital, a nursing school, a technical college, and a medical college.

More facts about the company can be pulled from the case. Here is some more recent information:

a. In 1994, FPG completed a $2.1 billion petrochemical and plastics-making plant in Point Comfort,

Texas. This was the largest investment by a privately held corporation in Texass history.

b. Taiwanese law does not include a holding company-type organization. FPG actually has a

complex ownership structure. The dominant shareholders are a family of two brothers, Y.C. Wang

(chairman, 80 years old in 1997) and Y.T. Wang (president, about 73 years old). The two brothers

own at least 20% of all companies in FPG.

c. The case does not make it obvious, but the actual running of FPG is in the hands of the Chairman,

not the President. Staff in the Presidents Office take orders both from the Chairman and the

President directly. The Chairman has a dictatorial management style. He was raised by a poor

village family and had to quit school after the sixth grade. But he taught himself how to master a

complex company. His young brother (the FPG President) is more of a human relations-oriented

person. Most people in Taiwan believe the two brothers make an excellent management team.

d. As an indication of the centrality of FPG in the Taiwanese economy and of the significance of the

Chairman, in particular, it is interesting to note that the Taiwanese stock index fell 5% in one day

in early 1994 when a rumor circulated that Chairman Y.C. Wang had died.

2. What are the major types of financial responsibility centers in FPG?

a. Companies and Divisions: investment centers (ROI measure)

b. Plants and Product Groups: profit centers

c. Production Processes and Group of Machines: cost centers

d. Non-production-oriented units, such as sales, technology, management: revenue or discretionary

expense centers

3. What are the major problems facing FPG management in the early 1990s?

Labor shortages and rising wages. At FPG, labor costs are significant, but less than 20% of total

production cost. They are actually much smaller in some divisions (e.g., polyethylene). Labor costs in

the United States are approximately 50% higher than in Taiwan. Taiwanese wages are higher than in

other producing countries (e.g., Indonesia, Mexico), but Taiwan has higher productivity than most

developing countries.

Many FPG divisions compete on price, but they cannot raise prices because their products are

commodities. At the same time, most raw material prices (e.g., petrochemicals) are volatile and not

controllable. Thus, profits go up and down. The goal of many of the divisions is simply to produce at

full capacity.

A growing problem which is not directly relevant to this case is the radicalization of the

environmental movement in Taiwan.

At the Polyolefin division, specific problems include uncertainty in the raw material markets with

respect both to prices and availability and uncertainty in the markets for its own products.

4. Describe and evaluate the major elements of FPGs control system.

a. Each company and division has a target ROI. ROI is defined as profit before taxes but after

allocation of corporate expenses divided by divisional investment only.

10

2007 McGraw-Hill/Irwin

Chapter 25

b. FPG uses a target costing (with benchmarking from Japanese companies) approach to the budget

planning. Standard costs are revised promptly when conditions so warrant. These changing target

costs are used to motivate continuous improvement.

c. An extensive set of monthly performance reports (Exhibit 3).

d. Chairman and Presidents monthly detailed performance review meetings with 30 senior

managers.

e. Bonus plans. These plans have some unique features:

i.

FPG bonus pools are determined at the time of budgeting, not after actual profit has been

measured.

ii. The bonus potentials vary by organization level and role. Workers below section chief level

receive a performance bonus program about 20-26% of their base salaries. Management has a

special performance-based bonus fund. Technical people such as R&D have incentive

rewards for good ideas.

iii. Total FPG bonus amounts paid per year did not vary much over time due to the Reserve

Bank system. By creating reserves for bonuses, the company is smoothing the employees

bonus stream.

iv. Every employee automatically gets 3-5 months of base salary as a so-called bonus each year.

This is cultural. It is traditional in Taiwanese for every employee (even government

employees and university professors) to get a minimum of two months pay as a year-end

bonus. (Many Japanese firms give their employees at least four months pay as a year-end

bonus.) These payments are not performance-dependent.

f.

The Presidents Office

The Presidents Office (or Red Guard) is composed of 15 teams (340 employees) of specialists

whose role is to collect information and to help division management. The Presidents Office

has three levels. The top level staff usually have experience serving as division managers. The

second level staff usually have experience serving as plants or product group managers. The third

level staff usually have experience serving as department heads or section chiefs. The Presidents

Office staff and some line managers will rotate every few years.

This Office is a very costly system feature, but it serves three purposes: (1) helping the Chairman

and the President to control and evaluate line managers, (2) helping different divisions, plants,

and product groups to continuously improve their performance, and (3) serving as the training

ground for these staff persons for future higher line positions. Many Japanese companies also

rotate people through different functions in their career, so that by the time a Japanese manager

gets into a top level position, he knows almost all the companys functions/processes/products.

It is interesting to note that the Chairman and the President also have many relatives working in

different parts of FPG. Through regular family gatherings, relatives also provide some inside

information on particular divisions or departments.

5. Describe FPGs annual planning process. Is it more a top-down or bottom-up process?

a. Four-month planning process, begins in September and ends in December.

b. It starts with a bottom-up planning. Division level managers submitted their sales plan and

production plan. Then the top management made suggested revisions. The revision process

iterates two or three rounds.

c. Top management uses the targeting pricing/costing approach. Continuous improvement is

11

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

stressed. Each division is expected to use improvement projects to reduce costs each year. Funds

are available for these projects.

d. Top management is prone to reject the initial budget proposals, to ask for more profit. This

procedure adds a top-down dimension to the process, and it creates some gaming behavior. The

lower-level managers expect their initial plan to come back for revision, so they produce a

conservative plan which leaves some room for improvements in future round(s).

6. Describe FPGs performance evaluation process.

a. Primarily subjective, but objective numbers form a basis for the subjective evaluations.

b. The budget is used as the basis for evaluation. The probability of achieving targets is around 8090%. Performance targets are sometimes revised due to environmental changes.

c. Managers are evaluated by considering controllable factors, both financial and nonfinancial

measures, such as quantity of product sold, production efficiency, production schedules,

consumption of materials, cost control, inventory control, leadership, and product quality.

d. Changes in results due to activities that were approved by top management after the budget was

approved (e.g., improvement projects) are adjusted for in the evaluations.

e. Those making evaluations and assigning bonuses also take into consideration the persons ability

and potential for the future, years in the company, teamwork, cooperation, and the situation the

person faced. It is very subjective. FPG employees must trust their evaluators.

7. Is the Polyolefin division a profit center?

Yes and no. Profit of the entity is measured, but the manager, Mr. Hsaio, is not held accountable for

profit. FPG managers have concluded that he does not control significant elements in the profit

calculation. In particular, ethylene accounts for 60-65% of the divisions total product cost; there is

only one local ethylene supplier owned by the government; ethylene prices are set by the government;

ethylene prices fluctuate significantly; and prices of the divisions output (polyethylene) do not

fluctuate with the input (ethylene) prices.

8. So what is Mr. Hsaio held accountable for?

He is responsible for all aspects of his divisions performance except material price variances. In most

of FPGs chemical businesses, particularly those which sell in commodity markets, material price

variances are factored out as being largely uncontrollable.

Managers of other FPGs divisions are held substantially accountable for profits. Where the managers

have substantial control over profits, profits are used as a major component of the performance

evaluation. In such cases, the evaluations will be more transparent even though they are still

subjective.

9. Is FPGs choice to allow high subjectivity in performance evaluations a good one?

It seems to work at FPG. The managers are comfortable with the system, and the company has been

quite successful for a long period of time.

10. Are any of FPG managers control choices affected by national or cultural factors? If so, which

choices were affected and which factors affected them?

FPGs control system differs in several significant ways from most Western companies:

a. It is a large company which is substantially owned and dominated by one family. The large

12

2007 McGraw-Hill/Irwin

Chapter 25

Presidents Office and the detailed monthly performance reviews are two of the methods the top

managers use. While seemingly everyone in FPG was satisfied that the current management

control systems were effective, some managers wondered whether the system would continue to

serve the company well in the future. Most important, they were concerned about a shift in

management style if the current top-level managers retired. And many managers expected that

research and new product development would become more important to FPG in the future, and

this change could force the company to have a longer-term focus because the typical research and

development cycle in the chemical industry was 4 to 5 years.

b. The heavy use of subjectivity in performance evaluations is more common in Asian companies

than in Western companies. Most American managers and employees, for example, prefer a more

objective evaluation system. They are less comfortable with giving their superior that much

evaluation discretion and power (the power distance concept discussed in Chapter 19). They

worry that a high degree of subjectivity in evaluations will cause unfairness and bias.

c. FPGs system, with its detailed monthly performance reviews and no long-term incentive

program, appears very short-term oriented. Myopia danger is minimized, however, because most

of the employees spend their whole career with the company. Thus, they are not able to avoid the

harmful effects of their short-term actions. Further, FPG likes to have its bonus payments be

relatively constant over time. A total bonus figure is put in the budget and is not varied by the

actual amount of profit earned. As one manager explained, If this year is no good and next year

is no good, maybe we will consider a lower bonus in the third year. But it is difficult to

distinguish good and bad performance in the short-run, and we like to make the situation more

steady. This philosophy contrasts with the tendency in most Western companies to make bonus

payments ever more variable with short-term performance.

d. The use of year-end employee bonuses is traditional in Taiwan (and other Asian countries).

(Employees also receive month salary on each of two national holidays.) These bonuses are not

motivational, however, because they are not performance-dependent. Thus, they are not part of

the companys control system.

11. What happens when the chairman and president retire?

This is a major concern for FPG employees. Here is a representative comment from one manager:

As long as chairman Wang stays, fundamentally there will be no change. He is the founder, and

he knows everything very well. Our system is good, and our goals will be the same. I dont even

know how many of us have contemplated change because Chinese people believe their leaders

will be long-lived. But when our chairman changes, things will be different. One mans

leadership can have a significant effect.

If Chairman Wang retires, who will be the new leader? Would we change our strategic

direction away from commodity chemicals in favor of creation of higher value added

products? If that happened, would the system have to change? I guess it depends on the

needs of the company and the philosophy of the new managers. It is clear that the second

generation of managers will be different. They have been educated in Western Europe and

the United States and have been less influenced by the Japanese.

12. Does anything else threaten FPGs system?

Some managers were also concerned that FPGs success might be threatened, ironically, by the

advancing Taiwanese standard of living. They noted that the cost of labor was increasing, and it was

becoming harder to motivate employees. One manager said, The younger generation likes leisure,

and the older generation is getting lazy. They have more money and more time to spend it.

13

Anda mungkin juga menyukai

- Why Stocks Are Safer Than Cash - Harris AssociatesDokumen4 halamanWhy Stocks Are Safer Than Cash - Harris AssociatesceojiBelum ada peringkat

- Rationality Amidst Uncertainty - Harris AssociatesDokumen6 halamanRationality Amidst Uncertainty - Harris AssociatesceojiBelum ada peringkat

- Elder - How To Study & LearnDokumen52 halamanElder - How To Study & LearnceojiBelum ada peringkat

- Unitary MethodDokumen18 halamanUnitary MethodanilBelum ada peringkat

- Elder - Critical Thinking Learn The Tools The Best Thinkers UseDokumen368 halamanElder - Critical Thinking Learn The Tools The Best Thinkers UseceojiBelum ada peringkat

- Positioning Portfolios For The Long Term - Harris AssociatesDokumen6 halamanPositioning Portfolios For The Long Term - Harris AssociatesceojiBelum ada peringkat

- Responding To A Crisis - Harris AssociatesDokumen4 halamanResponding To A Crisis - Harris AssociatesceojiBelum ada peringkat

- People: Driven To Lead: 2006 Annual ReportDokumen24 halamanPeople: Driven To Lead: 2006 Annual ReportceojiBelum ada peringkat

- 2004ARDokumen7 halaman2004ARceojiBelum ada peringkat

- 2007ARDokumen24 halaman2007ARceojiBelum ada peringkat

- Keeping The Drive: AliveDokumen24 halamanKeeping The Drive: AliveceojiBelum ada peringkat

- Efficiency: in The WorkplaceDokumen16 halamanEfficiency: in The WorkplaceceojiBelum ada peringkat

- The Drive To LeadDokumen9 halamanThe Drive To LeadceojiBelum ada peringkat

- VF 2Q2012 Manager LetterDokumen4 halamanVF 2Q2012 Manager LetterceojiBelum ada peringkat

- Barc RfiDokumen4 halamanBarc RficeojiBelum ada peringkat

- VF 3Q2012 Manager LetterDokumen5 halamanVF 3Q2012 Manager LetterceojiBelum ada peringkat

- Asset Valuation Allocation Models-Deutsche Bank (2001)Dokumen28 halamanAsset Valuation Allocation Models-Deutsche Bank (2001)ceojiBelum ada peringkat

- ISC214 Fundamentals of E-Business PDFDokumen5 halamanISC214 Fundamentals of E-Business PDFceojiBelum ada peringkat

- Syllabus - Services Management - Development and Design of Service CompaniesDokumen1 halamanSyllabus - Services Management - Development and Design of Service CompaniesceojiBelum ada peringkat

- VF 4Q2012 Manager LetterDokumen5 halamanVF 4Q2012 Manager LetterceojiBelum ada peringkat

- RMD, PCDokumen5 halamanRMD, PCceojiBelum ada peringkat

- Fms 2009 Section 4Dokumen3 halamanFms 2009 Section 4MbatutesBelum ada peringkat

- Fms 2009 Section 4Dokumen3 halamanFms 2009 Section 4MbatutesBelum ada peringkat

- MKTG Dec Lehmann Syllabus2006Dokumen13 halamanMKTG Dec Lehmann Syllabus2006ceojiBelum ada peringkat

- Syllabus - Services Management - Development and Design of Service CompaniesDokumen1 halamanSyllabus - Services Management - Development and Design of Service CompaniesceojiBelum ada peringkat

- How To Read A Scientific Paper: Mihai PopDokumen18 halamanHow To Read A Scientific Paper: Mihai PopceojiBelum ada peringkat

- Fall 2012 Fin 380 Course SyllabusDokumen5 halamanFall 2012 Fin 380 Course SyllabusceojiBelum ada peringkat

- A Fresh Look PDFDokumen8 halamanA Fresh Look PDFceojiBelum ada peringkat

- What in The World Is Competitive Advantage?Dokumen5 halamanWhat in The World Is Competitive Advantage?Sibichakravarthi MeganathanBelum ada peringkat

- Article Review FormDokumen1 halamanArticle Review FormceojiBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Syllabus AML Gasal 21 22Dokumen6 halamanSyllabus AML Gasal 21 22Lia AmeliaBelum ada peringkat

- PAC SetupDokumen16 halamanPAC SetupMohamed Fathy HassanBelum ada peringkat

- Bu3111-3280 Lecture 2003Dokumen91 halamanBu3111-3280 Lecture 2003Sowah-Laryea FelixBelum ada peringkat

- Castillo Cost2Dokumen2 halamanCastillo Cost2Angel John CastilloBelum ada peringkat

- Scope and Meaning of Accounting 1: Accounting and Its Relationship To Shareholder Value and Business StructureDokumen4 halamanScope and Meaning of Accounting 1: Accounting and Its Relationship To Shareholder Value and Business StructurepebinscribdBelum ada peringkat

- 1stF 2nd Yr Cost Accounting and Control VerifiedDokumen34 halaman1stF 2nd Yr Cost Accounting and Control VerifiedMika MolinaBelum ada peringkat

- Pinto Pm3 Ch08Dokumen25 halamanPinto Pm3 Ch08AlbertoBelum ada peringkat

- Ac410 13Dokumen64 halamanAc410 13Daniel WuBelum ada peringkat

- Accounting Information System-Chapter 5 ProductionDokumen49 halamanAccounting Information System-Chapter 5 ProductionMelisa May Ocampo AmpiloquioBelum ada peringkat

- SAP Controlling - Presentation PDFDokumen21 halamanSAP Controlling - Presentation PDFAnil TakalikarBelum ada peringkat

- GRC Cost Concepts ModuleDokumen23 halamanGRC Cost Concepts ModuleJoneric RamosBelum ada peringkat

- 6.2 Standard Costing & Variance Anlysis: Cost Accounting 341Dokumen25 halaman6.2 Standard Costing & Variance Anlysis: Cost Accounting 341sadhaya rajanBelum ada peringkat

- Contact Centers: Rest of Us!Dokumen76 halamanContact Centers: Rest of Us!hamzadarbar100% (1)

- Skip To Main Contentaccessibility Hel3Dokumen3 halamanSkip To Main Contentaccessibility Hel3Yassi CurtisBelum ada peringkat

- Fixed Asset Accounting - AccountingToolsDokumen3 halamanFixed Asset Accounting - AccountingToolsPankaj Gautam0% (2)

- Acc 419Dokumen14 halamanAcc 419KamauWafulaWanyamaBelum ada peringkat

- Study Guide For Students in Cost AccountingDokumen41 halamanStudy Guide For Students in Cost Accountingjanine moldinBelum ada peringkat

- Product Cost by Sales Order: Scenario: PrerequisitesDokumen5 halamanProduct Cost by Sales Order: Scenario: PrerequisitesGK SKBelum ada peringkat

- Manager Inventory Purchasing Procurement in Philadelphia PA Resume Teresa BattagliaDokumen2 halamanManager Inventory Purchasing Procurement in Philadelphia PA Resume Teresa BattagliaTeresaBattagliaBelum ada peringkat

- How Managerial Accounting Adds Value To OrganizationDokumen12 halamanHow Managerial Accounting Adds Value To Organizationcallmeayu89% (9)

- Project Report On Cost Reduction and ControlDokumen12 halamanProject Report On Cost Reduction and ControlAnonymous QjMFZIK5f67% (6)

- Business Studies 2016 HSC PaperDokumen7 halamanBusiness Studies 2016 HSC PapernoBelum ada peringkat

- Tech Paper - Should Cost Analysis PDFDokumen113 halamanTech Paper - Should Cost Analysis PDFAndrew Arul Rose AmalrajBelum ada peringkat

- Paper8 Syl22 Dec23 Set2 SolDokumen13 halamanPaper8 Syl22 Dec23 Set2 Solwaranbhuvanesh81Belum ada peringkat

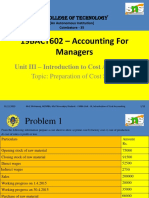

- 19BACT602 - Accounting For Managers: Unit III - Introduction To Cost AccountingDokumen12 halaman19BACT602 - Accounting For Managers: Unit III - Introduction To Cost AccountingReetaBelum ada peringkat

- Simulated Midterm Exam - Cost Accounting PDFDokumen13 halamanSimulated Midterm Exam - Cost Accounting PDFMarcus MonocayBelum ada peringkat

- Chapter09 - Decision Making & Relevant InvformationDokumen41 halamanChapter09 - Decision Making & Relevant InvformationDwiChenBelum ada peringkat

- (Always Learning) - Controlling Foodservice Costs.-Pearson Education (2013)Dokumen323 halaman(Always Learning) - Controlling Foodservice Costs.-Pearson Education (2013)Kim Arggie75% (4)

- Cost Management: Hansen & MowenDokumen27 halamanCost Management: Hansen & Mowensnobar1282Belum ada peringkat

- Solution Manual For Accounting Information Systems 10th EditionDokumen37 halamanSolution Manual For Accounting Information Systems 10th EditionPamelaSmithcxdoe100% (74)