Business Registration

Diunggah oleh

Eric SanchezHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Business Registration

Diunggah oleh

Eric SanchezHak Cipta:

Format Tersedia

No.

01

Procedure

Verify and reserve the company name with the Securities

Time to Complete

1 day

Associated Costs

PHP 40

1 day

No cost

1 day

PHP 500

3 days

PHP

and Exchange Commission (SEC)

The company can verify the availability of the company name

online. Verification is free but reservation of the name, once

approved by the SEC, costs PHP 40 for the first 30 days. The

company name can be reserved for a maximum of 120 days for

a fee of PHP 120, which is renewable upon expiration of the

02

period.

Deposit paid-up capital in the Authorized Agent Bank (AAB)

and obtain bank certificate of deposit

The company is required by law to deposit paid-up capital

amounting to at least 6.25% of the authorized capital stock of

the corporation. This paid-up capital must not be less than PHP

5,000.

Some banks charge a fee for issuance of the certificate of

03

deposit.

Notarize articles of incorporation and treasurer's affidavit at

the notary

According to Sections 14 and 15 of the Corporation Code,

articles of incorporation should be notarized before filing with

04

the SEC.

Register the company with the SEC and receive preregistered Taxpayer Identification Number (TIN)

2,665

1,667.99

filing

(PHP

fee

equivalent to 1/5 of 1% of

The company can register online through SEC i-Register but

the

authorized

capital

must pay on site at the SEC. The following documents are

stock or the subscription

required for SEC registration:

price of the subscribed

capital stock, whichever is

a. Company name verification slip;

higher but not less than

b. Articles of incorporation (notarized) and by-laws;

PHP 1,000 + PHP 16.68

c. Treasurer's affidavit (notarized);

legal research fee (LRF)

d. Statement of assets and liabilities;

equivalent to 1% of filing

e. Bank certificate of deposit of the paid-in capital;

fee but not less than PHP

f. Authority to verify the bank account;

10 + PHP 500 By-laws +

g. Registration data sheet with particulars on directors, officers,

PHP 150 for registration

stockholders, and so forth;

of stock and transfer book

h.

Written

undertaking

to

comply

with

SEC

reporting

(STB) required for new

requirements (notarized); and

corporations + PHP 320

i. Written undertaking to change corporate name (notarized).

STB

registration

The SEC Head Office issues pre-registered TINs only if the

bulletin)

companys application for registration has been approved. The

company must still register with the Bureau of Internal Revenue

(BIR) in order to identify applicable tax types, pay an annual

registration fee, obtain and stamp sales invoices, receipts and

05

the books of accounts.

Obtain barangay clearance

1 day

PHP 500

1 day

PHP 500

1 day

PHP 50

This clearance is obtained from the barangay where the

business is located and is required to obtain the business permit

from the city or municipality. Barangay fees vary for each

barangay since they have the discretion to impose their own

fees and charges for as long as these fees are reasonable and

within the limits set by the Local Government Code and city

ordinances. Barangay fees may depend on:

a. the location and the area (size in square meters) of the place

of business; or

b. the companys paid-up capital and the area it occupies; or

06

c. whether they issue clearance plates or certificates.

After issuance of the SEC certificate of incorporation, pay

the annual community tax and obtain the community tax

certificate (CTC) from the City Treasurer's Office (CTO)

In Taguig, the community tax certificate is not a requirement for

obtaining the barangay clearance. The City has passed an

ordinance setting a ceiling for barangay clearance fees for all

07

barangays under its jurisdiction.

Notarize the business permit application form at the notary

PHP

for

10

SEC

Business permit application form is downloadable from the citys

08

website.

Obtain the business permit to operate from the Customer

2 days

PHP 6,426 (PHP 208.5

Service Counter of the Business Permits and Licensing

business tax (1/4 of 1/10

Office (BPLO)

of 1% of paid-up capital)

+ PHP 500 environmental

The company must file the following documents at the BPLO:

impact fee + PHP 2,500

a. SEC registration;

mayors permit + PHP

b. Duly notarized application form;

500 sanitary inspection

c. Barangay clearance;

fee

d. Corporate community tax (Cedula);

medical/health

e. Contract of lease;

PHP

f. Insurance (comprehensive general liability);

inspection fee + PHP 400

g. Location sketch; and

electrical inspection fee +

h. Photocopy of Certificate of Occupancy (obtained from the

PHP

owner of the building).

inspection fee + PHP 500

PHP

400

250

fees

10

+

building

plumbing

mechanical inspection fee

Once the documents are filled, the officer at the Customer

+ PHP 200 fire inspection

Service Counter forwards the forms to the following

fee + PHP 150 business

offices: (1) the BPLO for the assessment of fees and tax

plate/sticker + PHP 260

order of payment; and (2) the Health Department for

signboard + PHP 547

calculation of sanitary inspection fee.

FSIC

(10%

of

regulatory charges))

The city collects initial business tax for the quarter covering the

period of business registration. In the succeeding quarter(s), the

tax is based on the gross sales for the preceding quarter.

Inspection from the BPLO takes place after issuance of the

09

business permit.

Buy special books of account at bookstore

Special books of accounts are required for registering with the

BIR. The books of accounts are sold at bookstores nationwide.

One set of journals consisting of four books (cash receipts

account, disbursements account, ledger, general journal) costs

1 day

PHP 400

all

about PHP 400.

If the company has a computerized accounting system (CAS), it

may opt to register its CAS under the procedures laid out in BIR

Revenue Memorandum Order Nos. 21-2000 and 29-2002. The

BIR Computerized System Evaluation Team is required to

inspect and evaluate the companys CAS within 30 days from

receipt of the application form (BIR Form No. 1900) and

10

complete documentary requirements.

Apply for Certificate of Registration (COR) and TIN at the

2 days

Bureau of Internal Revenue (BIR)

PHP

115

(PHP

100

certification fee + PHP 15

documentary stamp tax)

The company must register each type of internal revenue tax for

which it is obligated by filing BIR Form No. 0605 and paying the

annual registration fee of PHP 500. Upon registration, the BIR

will issue to the company the certificate of registrationBIR

Form No. 2303.

To obtain the TIN, the company has to file:

a. Barangay clearance;

b. Mayor's permit; and

c. Copy of its SEC registration.

For company registrations filed with the SEC Head Office in

Metro Manila, the BIR confirms the pre-registered TIN issued by

the SEC.

11

New taxpayers are required to attend a seminar.

Pay the registration fee and documentary stamp taxes

(DST) at the AAB

1 day

PHP 4,670 (PHP 500

registration fee + PHP

4,169.97 DST on original

The company must pay DST on the original issuance of shares

issuance of shares of

of stock. The rate is PHP 1 on each PHP 200 or a fractional part

stock. DST on the lease

thereof, of the par value of such shares of stock. This payment

contract is not included in

with the BIR should be made on the 5th of the month following

the computation of the

registration with the SEC.

cost)

The COR will be released only after all the DSTs are paid.

The company must also pay DST on its lease contract at the

rate of PHP 3 for the first PHP 2,000 or fractional part thereof,

and an additional PHP 1 for every PHP 1,000 or fractional part

thereof in excess of the first PHP 2,000 for each year of the

12

lease as stated in the contract.

Obtain the authority to print receipts and invoices from the

1 day

No cost

7 days

PHP 3,500 (between PHP

BIR

The authority to print receipts and invoices must be secured

before the sales receipts and invoices may be printed. The

company can ask any authorized printing company to print its

official forms, or it can print its own forms (i.e., it uses its

computers to print loose-leaf invoice forms) after obtaining a

permit from BIR for this purpose. To obtain the authority to print

receipts and invoices from the BIR, the company must submit

the following documents to the Revenue District Office (RDO):

a. Duly completed application for authority to print receipts and

invoices (BIR Form No. 1906);

b. Job order;

c. Final and clear sample of receipts and invoices (machineprinted);

d. Application for registration (BIR Form No. 1903); and

e. Proof of payment of annual registration fee (BIR Form No.

13

0605).

Print receipts and invoices at the print shops

2,500 - PHP 3,500)

The cost is based on the following specifications of the official

receipt: 1/2 bond paper (8 x 5 cm) in duplicate, black print,

14

carbonless for 10 booklets.

Have books of accounts and Printers Certificate of

Delivery (PCD) stamped by the BIR

After the printing of receipts and invoices, the printer issues a

1 day

No cost

Printers Certificate of Delivery of Receipts and Invoices (PCD)

to the company, which must submit this to the appropriate BIR

RDO (i.e., the RDO which has jurisdiction over the companys

principal place of business) for registration and stamping within

thirty (30) days from issuance. The company must also submit

the following documents:

a. All required books of accounts;

b. VAT registration certificate;

c. SEC registration;

d. BIR Form W-5;

e. Certified photocopy of the ATP; and

f. Notarized taxpayer-users sworn statement enumerating the

responsibilities and commitments of the taxpayer-user.

The company must also submit a copy of the PCD to the BIR

RDO having jurisdiction over the printers principal place of

15

business.

Register with the Social Security System (SSS)

3 days

No cost

1 day

No cost

To register with the SSS, the company must submit the

following documents:

a. Employer registration form (Form R-1);

b. Employment report (Form R-1A);

c. List of employees, specifying their birth dates, positions,

monthly salary and date of employment; and

d. Articles of incorporation, by-laws and SEC registration.

Upon submission of the required documents, the SSS employer

and employee numbers will be released. The employees may

attend an SSS training seminar after registration. SSS prefers

that all members go through such training so that each member

16

is aware of their rights and obligations.

Register with the Philippine Health Insurance Company

(PhilHealth)

To register with PhilHealth, the company must submit the

following documents:

a. Employer data record (Form ER1);

b. Report of employee-members (Form ER2);

c. SEC registration;

d. BIR registration; and

e. Copy of business permit.

Upon submission of the required documents, the company shall

get the receiving copy of all the forms as proof of membership

until PhilHealth releases the employer and employee numbers

within three months.

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- PWC Clarifying The RulesDokumen196 halamanPWC Clarifying The RulesCA Sagar WaghBelum ada peringkat

- Aswath Damodaran - Valuation of SynergyDokumen60 halamanAswath Damodaran - Valuation of SynergyIvaBelum ada peringkat

- Memo To Client Regarding Choice of Business EntityDokumen6 halamanMemo To Client Regarding Choice of Business EntityAaron Burr100% (2)

- Cash Flow StatementDokumen53 halamanCash Flow StatementRadha ChoudhariBelum ada peringkat

- FI - Financial Accounting - Asset ManagementDokumen37 halamanFI - Financial Accounting - Asset Managementdjango111100% (4)

- AGPM Business PlanDokumen10 halamanAGPM Business PlanOlome EmenikeBelum ada peringkat

- HRA NotesDokumen19 halamanHRA NotesatulbhasinBelum ada peringkat

- Merger and AcquisitionDokumen11 halamanMerger and AcquisitionPriyanka AgarwalBelum ada peringkat

- The 6 Phrases That Should Be Banned From Legal WritingDokumen3 halamanThe 6 Phrases That Should Be Banned From Legal WritingEric SanchezBelum ada peringkat

- Villanueva v. Chiong, GR 159889 PDFDokumen8 halamanVillanueva v. Chiong, GR 159889 PDFEric SanchezBelum ada peringkat

- Questionnaire on Avon's ANEW Facial Skin CareDokumen10 halamanQuestionnaire on Avon's ANEW Facial Skin CareEric SanchezBelum ada peringkat

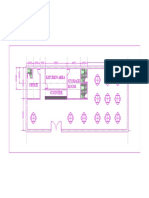

- Quantity of MaterialsDokumen5 halamanQuantity of MaterialsEric SanchezBelum ada peringkat

- Ayala Investment and Development Corp. v. CA, GR 118305 PDFDokumen11 halamanAyala Investment and Development Corp. v. CA, GR 118305 PDFEric SanchezBelum ada peringkat

- Business RegistrationDokumen7 halamanBusiness RegistrationEric SanchezBelum ada peringkat

- Alcazar v. Alcazar, GR 174451Dokumen11 halamanAlcazar v. Alcazar, GR 174451diazadieBelum ada peringkat

- QUESTIONNAIREDokumen2 halamanQUESTIONNAIREEric SanchezBelum ada peringkat

- 4 PDFDokumen1 halaman4 PDFEric SanchezBelum ada peringkat

- Equipments IIDokumen15 halamanEquipments IIEric SanchezBelum ada peringkat

- Project TimetableDokumen5 halamanProject TimetableEric Sanchez100% (1)

- Materials & EquipmentDokumen4 halamanMaterials & EquipmentEric SanchezBelum ada peringkat

- M Articles of Partnership For General PartnershipsDokumen3 halamanM Articles of Partnership For General PartnershipsEric SanchezBelum ada peringkat

- UNCLOSDokumen2 halamanUNCLOSEric SanchezBelum ada peringkat

- UNCLOSDokumen2 halamanUNCLOSEric SanchezBelum ada peringkat

- Statistical TermsDokumen13 halamanStatistical TermsEric SanchezBelum ada peringkat

- A Study On The Effect of Working Capital On The Firm'S Profitability of InfosysDokumen11 halamanA Study On The Effect of Working Capital On The Firm'S Profitability of InfosysDr Abhijit ChakrabortyBelum ada peringkat

- Busn 11th Edition Kelly Test BankDokumen19 halamanBusn 11th Edition Kelly Test BankAnthonyJacksonekdpb100% (16)

- Param Mitra Coal Resources Secures US$7.5M Investment From Tembusu PartnersDokumen3 halamanParam Mitra Coal Resources Secures US$7.5M Investment From Tembusu PartnersWeR1 Consultants Pte LtdBelum ada peringkat

- WK 3 Tutorial 4 Is LM Model (Solution)Dokumen3 halamanWK 3 Tutorial 4 Is LM Model (Solution)Ivan TenBelum ada peringkat

- Building The is-LM ModelDokumen46 halamanBuilding The is-LM ModelMicky BozaBelum ada peringkat

- ACC2007 - Seminar 9 - Complex Group StructuresDokumen47 halamanACC2007 - Seminar 9 - Complex Group StructuresCeline LowBelum ada peringkat

- Fulltext01 PDFDokumen85 halamanFulltext01 PDFMarinda KardionoBelum ada peringkat

- Increasing The Competitiveness of Indian Steel Industry?: MFSA ProjectDokumen11 halamanIncreasing The Competitiveness of Indian Steel Industry?: MFSA ProjectJaimin JadavBelum ada peringkat

- The Woody Case StudyDokumen5 halamanThe Woody Case StudyniaaBelum ada peringkat

- Extraordinary Shareholders' Meeting of 05.08.2008 - Minutes (Merger of BOVESPA Holding S.A. Shares)Dokumen51 halamanExtraordinary Shareholders' Meeting of 05.08.2008 - Minutes (Merger of BOVESPA Holding S.A. Shares)BVMF_RIBelum ada peringkat

- ConclusionDokumen3 halamanConclusionAsadvirkBelum ada peringkat

- TB 06Dokumen7 halamanTB 06peter kongBelum ada peringkat

- Prudent Private Wealth Company ProfileDokumen5 halamanPrudent Private Wealth Company ProfilepratikBelum ada peringkat

- IAS 19 Employee BenefitsDokumen48 halamanIAS 19 Employee BenefitsHuzaifa AhmedBelum ada peringkat

- Break Even New2Dokumen39 halamanBreak Even New2thomasBelum ada peringkat

- SA LII 45 111117 Indira Chakravarthi With Annexure 1-6 PDFDokumen11 halamanSA LII 45 111117 Indira Chakravarthi With Annexure 1-6 PDFDebashish BhattacharyaBelum ada peringkat

- Observation Commercial Banks PDFDokumen52 halamanObservation Commercial Banks PDFyash_dalal123Belum ada peringkat

- Considerations For Investing in non-U.S. Equities: Executive SummaryDokumen15 halamanConsiderations For Investing in non-U.S. Equities: Executive Summarys97thliBelum ada peringkat

- How To Get A Philippine Special Investor Resident VisaDokumen3 halamanHow To Get A Philippine Special Investor Resident VisaPeter Eltanal EnfestanBelum ada peringkat

- Stock Market IndexDokumen27 halamanStock Market Indexjubaida khanamBelum ada peringkat

- PeSukuk - PHS - 3 IN 1Dokumen17 halamanPeSukuk - PHS - 3 IN 1hairyna37Belum ada peringkat

- Test Booklet: General Studies Paper-IDokumen11 halamanTest Booklet: General Studies Paper-IMukesh KumarBelum ada peringkat