Winfield Case

Diunggah oleh

Abhinandan SinghDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Winfield Case

Diunggah oleh

Abhinandan SinghHak Cipta:

Format Tersedia

Winfield Refuse

management, Inc.

Raising Debt vs. Equity

Abhinandan Singh (MP15003)

Financial Management II

XLRI PGDM 2015-18 Batch

Winfield Refuse Management, Inc. : Raising Debt

vs. Equity

Executive Summary:

Winfield Reuse Management, a vertically integrated, non-hazardous waste

management company is going for a major acquisition and has to take a

decision whether to finance through Debt or Equity. The company started in

1972 as a two-truck operation in Creve Coeur, Missouri and by 2012; it had

acquired 22 landfills and 26 transfer stations and material recovery facilities,

which served 33 collection operations. Winfields board had adhered to a

consistent policy of avoiding long term debt. The business was done through

the steady cash flows and raising equity whenever required. Since early

1990s the firm had been making small acquisitions by acquiring companies

which would extend its geographical reach and creating economies of scale

with existing facilities. Most of the company operation was in the Midwest

and with other bigger companies indulging in consolidation strategy; it

required to maintain a competitive position on a regional basis which was

only possible through acquisition.

Acquiring a firm like MPIS (Mott-Pliese Integrated Solutions), a waste

management company serving parts of Ohio, Indiana, Tennessee, and

Pennsylvania will increase their footprint in Midwest and also provide an

entry into mid-Atlantic region. MPIS had a strong management team

producing 12-13% operating margins every year and the acquisition bid was

$125 million and was also ready to accept 25% of purchase price in Winfield

stock. At an earlier Board meeting most of the board members refused to

accept the proposal of financing this deal through long term debt and

suggested equity to be a better option to generate the revenue. As a chief

financial officer Mamie Sheene was of the opinion that debt financing would

be a better option and had to convince the Board members. In this case we

have to analyze which financing option would be better for a company in

terms of finance as well as strategy.

Important Facts and Figures

Waste Management industry was highly fragmented and most of the players

were private. All the companies in this sector aimed to achieve economies of

scale and acquisition spree was going on in the business. Winfield being a

regional player in Midwest region wanted to consolidate its position and also

enter into other region. Acquisition cost was estimated to be $125 million

1 | Page

Financial Management II

XLRI PGDM 2015-18 Batch

and was large enough which required external financing. Opting for Equity, it

was estimated that a common stock could be issued at $17.75 per share and

net proceeds to Winfield would be $16.67 per Share. 7.5 million shares would

be required for MPIS.

Companys performance had been steady and the company reliably paid

dividends but in last 2-3 years performance had been disappointing and

dividend had not increased.

If the firm goes for Bond, it could sell $125 million in bonds to a

Massachusetts Insurance company. Annual interest rate would be 6.5% and

would mature in 15 years. Annual principal repayments would be required,

leaving $37.5 million outstanding at majority.

When going for Equity it would dilute the EPS to $1.91, and debt would bump

the EPS to $2.51. The EBIT for the combined Winfield MPIS was expected to

be $66 million.

Problem Statement

What would be the appropriate financing structure for the investment

decision-Raising capital through Debt or Equity?

How the Debt or Equity decision would affect the shareholders and how

EPS (Earnings per share) would be affected in both the cases.

Should the firm goes for entire financing through debt or through

Equity or a combination of both.

Return on Equity before taking this decision

ROE = Net Income in 2011(26350) / Average Stockholders Equity (685380)

= 3.84%

Possible Solutions

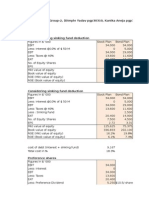

A. Financing entirely through Debt with Interest

payment and Final Principal Payment on Maturity

2 | Page

Financial Management II

XLRI PGDM 2015-18 Batch

Under this option the entire capital is to be financed through Debt with yearly

interest payments and principal payment is done only on maturity. The

yearly interest payment comes out to be $8.125 million with an interest rate

of 6.5% on a principal of $125 million. As tax benefit will be reaped by the

firm on interest payment so Net Interest Payment comes out to be 5.28 (65%

of 8.125). The Net present value comes out to be $98.26 million at a

discounting rate of 6.5%.

Earnings per Share - $2.51

B. Financing entirely through Debt with Fixed Principal

payment of $6.25 Million and Interest payment on

Present Principal Amount and Outstanding Principal

Payment on Maturity

3 | Page

Financial Management II

XLRI PGDM 2015-18 Batch

Under this option the entire capital is to be financed through Debt with yearly

interest payments and fixed principal payment of $6.5 million. The left over

principal payment of $37.5 million is done on maturity. The yearly interest

payment comes out to be $8.125 million for the first year and a decreasing

interest payments every year with decreasing Principal with an interest rate

of 6.5% every year. As tax benefit will be reaped by the firm on interest

payment so Net Interest Payment comes out to be 5.28 (65% of 8.125) for

the first year and similarly for other years. The Net present value comes out

to be $106.07 million at a discounting rate of 6.5%.

C. Financing Entirely through Equity

4 | Page

Financial Management II

XLRI PGDM 2015-18 Batch

Earnings per Share - $1.91

Under this option the entire capital is to be financed through equity with

yearly dividend payments of $7.5 million and maturity value will be given

after 15 years. The dividend per share has been assumed to be $1 per share

and with total 7.5 million shares; the dividend paid each year comes out to

be $7.5 million.

With price earnings ratio of other firms given and expected Earnings per

share given for Winfield, the expected market price comes out to be 20.17.

Calculating the terminal value gives a value of 151.25. Some assumptions

have also been taken.

Risk free rate assumed to be 4% (taken from US past year data). Stock price

return also assumed to be 13.4% on the basis of actual data from various

finance agencies. As the firm dependency on market performance is minimal

so a low beta has been used for the calculation. On calculating Cost of Equity

was foind out to be 6.82%. On discounting the payments for the 15 years at

a discounting arte of 6.82%, NPV came out to be $125.31.

Return on Equity = Net Income/Average Stockholders Equity

Net Income = 42,900 (Thousand of Dollars)

Average Stockholders Equity = 685380+75000 = 760580

So ROE = 42900/760580 = 5.64%

5 | Page

Financial Management II

XLRI PGDM 2015-18 Batch

D.Financing through Debt and Equity (Debt -75% and

Equity 25%)

Under this option the capital is to be financed through both equity and debt

with 25:75 Ratio. The yearly dividend payments come out to be $1.88 million

and maturity value will be given after 15 years. The dividend per share has

been assumed to be $1 per share and with total 1.88 million shares; the

dividend paid each year comes out to be $1.88 million.

On discounting the payments made towards Equity at a Cost of Equity of

6.82% the NPV comes out to be $31.33 million

75% of the capital is to be financed through Debt with only interest

payments every year and principal payment to be made after 15 years. The

NPV for the Debt payments at a discounting rate of 6.5% comes out to be

$73.70 million.

Thus Net NPV for this option comes out to be $105.03 million.

6 | Page

Financial Management II

XLRI PGDM 2015-18 Batch

Conclusion

Various

Financing

Options

Through Debt

with

Fixed

Principal

Payment

NPV

$98.26

million

EPS

ROE

Through

Debt

with

only

Interest

payment

$106.07

million

$2.51

5.48%

Through

Equity

Through Debt

Equity ratio

of 75:25

$125.31

million

$1.91

5.64%

$105.03

million

Considering all the above calculations into account we find that NPV is least

for the option Debt with interest payment and principal payment at end of

maturity. Also the EPS (earnings per share) for this option is the highest with

a value of $2.51. Even though return on Equity is not the highest in this case

but overall this option looks better.

Thus I would recommend going for the Debt option.

7 | Page

Anda mungkin juga menyukai

- Intrinsic Value Calculator Adam KhOODokumen3 halamanIntrinsic Value Calculator Adam KhOOShereeAnnTorres25% (8)

- Case Study - Hill Country Snack Foods Co.Dokumen2 halamanCase Study - Hill Country Snack Foods Co.Spencer123455678967% (3)

- Detect Payroll FraudDokumen7 halamanDetect Payroll FraudSheree SandersBelum ada peringkat

- Finance Simulation: Estimated Equity Value of Bel Vino CorporationDokumen4 halamanFinance Simulation: Estimated Equity Value of Bel Vino Corporationvardhan73% (11)

- Williams, 2002 SolutionDokumen16 halamanWilliams, 2002 Solutionimtehan_chowdhury0% (3)

- Winfield Refuse ManagementDokumen13 halamanWinfield Refuse ManagementAnshul Sehgal100% (3)

- Group 4 Williams SFMDokumen7 halamanGroup 4 Williams SFMthisissick100% (3)

- Winfield ManagementDokumen5 halamanWinfield Managementmadhav1111Belum ada peringkat

- Dividend Decision at Linear TechnologyDokumen8 halamanDividend Decision at Linear TechnologyNikhilaBelum ada peringkat

- Loewen Group CaseDokumen2 halamanLoewen Group CaseSu_NeilBelum ada peringkat

- OM Scott Case AnalysisDokumen20 halamanOM Scott Case AnalysissushilkhannaBelum ada peringkat

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Dokumen3 halamanSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajBelum ada peringkat

- Analyzing Mercury Athletic Footwear AcquisitionDokumen5 halamanAnalyzing Mercury Athletic Footwear AcquisitionCuong NguyenBelum ada peringkat

- Case Study: Hill Country Snack Foods " HCSF " (With Soluion )Dokumen12 halamanCase Study: Hill Country Snack Foods " HCSF " (With Soluion )Kamran Shabbir50% (2)

- 454K Loan for Cartwright Lumber CoDokumen5 halaman454K Loan for Cartwright Lumber CoRushil Surapaneni50% (2)

- 13 Earned Value ManagementDokumen9 halaman13 Earned Value ManagementAbhinandan Singh100% (1)

- Teuer Furniture (A)Dokumen14 halamanTeuer Furniture (A)Abhinandan SinghBelum ada peringkat

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDokumen5 halamanCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashBelum ada peringkat

- Hill CountryDokumen8 halamanHill CountryAtif Raza AkbarBelum ada peringkat

- Winfield Refuse ManagementDokumen13 halamanWinfield Refuse Managementnishant JaiswalBelum ada peringkat

- Strides Arcolab's $650-700M dividend payout decisionDokumen15 halamanStrides Arcolab's $650-700M dividend payout decisionNAMI100% (1)

- JetBlue 2012 Fuel Hedging StrategyDokumen3 halamanJetBlue 2012 Fuel Hedging StrategyPritam Karmakar0% (1)

- Hill Country Snack Foods CoDokumen9 halamanHill Country Snack Foods CoZjiajiajiajiaPBelum ada peringkat

- Hill Country Snack Foods Co - UDokumen4 halamanHill Country Snack Foods Co - Unipun9143Belum ada peringkat

- Hill Country Snack Foods CoDokumen1 halamanHill Country Snack Foods CoKriti AhujaBelum ada peringkat

- Williams CEO evaluates $900M financing offer and long-term strategyDokumen1 halamanWilliams CEO evaluates $900M financing offer and long-term strategyYun Clare Yang0% (1)

- Updated Stone Container PaperDokumen6 halamanUpdated Stone Container Paperonetime699100% (1)

- Finance Case - Blaine Kitchenware - GRP - 11Dokumen4 halamanFinance Case - Blaine Kitchenware - GRP - 11Shona Baroi100% (3)

- New Heritage Doll Company Report: Design Your Own Doll Project Best ChoiceDokumen5 halamanNew Heritage Doll Company Report: Design Your Own Doll Project Best ChoiceRahul LalwaniBelum ada peringkat

- Case Summary Financial Management-II: "The Loewen Group, Inc. (Abridged) "Dokumen4 halamanCase Summary Financial Management-II: "The Loewen Group, Inc. (Abridged) "Rishabh Kothari100% (1)

- Hill Country Snack Foods Co - UDokumen4 halamanHill Country Snack Foods Co - Unipun9143Belum ada peringkat

- WilliamsDokumen20 halamanWilliamsUmesh GuptaBelum ada peringkat

- FIN 370 Final Exam 30 Questions With AnswersDokumen11 halamanFIN 370 Final Exam 30 Questions With Answersassignmentsehelp0% (1)

- Use More SoapsDokumen9 halamanUse More SoapsAbhinandan SinghBelum ada peringkat

- Valuation of 5000 stock options using Black Scholes model over 5 yearsDokumen4 halamanValuation of 5000 stock options using Black Scholes model over 5 yearsAbhinandan Singh0% (2)

- Job Satisfaction and Employee Engagement Case StudyDokumen11 halamanJob Satisfaction and Employee Engagement Case StudyMuneeb Ur-Rehman0% (1)

- Mccaw Cellular Communications - The At& Amp T - Mccaw Merger Negotiation - Free EssaysDokumen7 halamanMccaw Cellular Communications - The At& Amp T - Mccaw Merger Negotiation - Free EssaysGrey StephensonBelum ada peringkat

- FINANCE MANAGEMENT FIN420 CHP 6Dokumen52 halamanFINANCE MANAGEMENT FIN420 CHP 6Yanty IbrahimBelum ada peringkat

- Winfieldpresentationfinal 130212133845 Phpapp02Dokumen26 halamanWinfieldpresentationfinal 130212133845 Phpapp02Sukanta JanaBelum ada peringkat

- Hospital Corporation Of America Maintains A RatingDokumen16 halamanHospital Corporation Of America Maintains A RatingDhruv Kalia50% (2)

- Winfield PPT 27 FEB 13Dokumen13 halamanWinfield PPT 27 FEB 13prem_kumar83g100% (4)

- Continental Carriers Debt vs EquityDokumen10 halamanContinental Carriers Debt vs Equitynipun9143Belum ada peringkat

- Hill Country SnackDokumen8 halamanHill Country Snackkiller dramaBelum ada peringkat

- ClarksonDokumen22 halamanClarksonfrankstandaert8714Belum ada peringkat

- Winfield Refuse. - Case QuestionsDokumen1 halamanWinfield Refuse. - Case QuestionsthoroftedalBelum ada peringkat

- Case Background: Kaustav Dey B18088Dokumen9 halamanCase Background: Kaustav Dey B18088Kaustav DeyBelum ada peringkat

- Hill Country Snack Food Co. Optimal Capital StructureDokumen7 halamanHill Country Snack Food Co. Optimal Capital StructureAnish NarulaBelum ada peringkat

- Winfield Refuse Management Inc. Raising Debt vs. EquityDokumen13 halamanWinfield Refuse Management Inc. Raising Debt vs. EquitynmenalopezBelum ada peringkat

- Case StudyDokumen10 halamanCase StudyEvelyn VillafrancaBelum ada peringkat

- Lex Service PLC - Cost of Capital1Dokumen4 halamanLex Service PLC - Cost of Capital1Ravi VatsaBelum ada peringkat

- Williams Seeks $900M Financing to Address Liquidity CrisisDokumen4 halamanWilliams Seeks $900M Financing to Address Liquidity CrisisAnirudh SurendranBelum ada peringkat

- This Study Resource Was: 1 Hill Country Snack Foods CoDokumen9 halamanThis Study Resource Was: 1 Hill Country Snack Foods CoPavithra TamilBelum ada peringkat

- LinearDokumen6 halamanLinearjackedup211Belum ada peringkat

- MEG CV 2 CaseDokumen10 halamanMEG CV 2 Casegabal_m50% (2)

- Corporate Finance - Hill Country Snack FoodDokumen11 halamanCorporate Finance - Hill Country Snack FoodNell MizunoBelum ada peringkat

- Marriott Cost of Capital Analysis for Lodging DivisionDokumen3 halamanMarriott Cost of Capital Analysis for Lodging DivisionPabloCaicedoArellanoBelum ada peringkat

- Ethical Dilemma of Conflict On Trading FloorDokumen10 halamanEthical Dilemma of Conflict On Trading FloorManpreet0711Belum ada peringkat

- HAMPTON MACHINE TOOL Case - PresentationDokumen7 halamanHAMPTON MACHINE TOOL Case - PresentationChaitanya90% (10)

- Hill Country Snack Foods CompanyDokumen14 halamanHill Country Snack Foods CompanyVeni GuptaBelum ada peringkat

- Continental CarriersDokumen6 halamanContinental CarriersVishwas Nandan100% (1)

- Linear Technology Dividend Policy and Shareholder ValueDokumen4 halamanLinear Technology Dividend Policy and Shareholder ValueAmrinder SinghBelum ada peringkat

- Maximizing Shareholder Value Through Optimal Dividend and Buyback PolicyDokumen2 halamanMaximizing Shareholder Value Through Optimal Dividend and Buyback PolicyRichBrook7Belum ada peringkat

- case-UST IncDokumen10 halamancase-UST Incnipun9143Belum ada peringkat

- Strategy Consulting: Session 4 Declining Industries Buffet'S Bid For Media General'S NewspapersDokumen13 halamanStrategy Consulting: Session 4 Declining Industries Buffet'S Bid For Media General'S NewspapersPrashant JhakarwarBelum ada peringkat

- Calculate WACC and Cost of Common EquityDokumen24 halamanCalculate WACC and Cost of Common EquityAdirtnBelum ada peringkat

- WinfieldDokumen4 halamanWinfieldMOHIT SINGHBelum ada peringkat

- FIN222 Autumn2016 Tutorials Tutorial 8Dokumen8 halamanFIN222 Autumn2016 Tutorials Tutorial 8HELENABelum ada peringkat

- FIN 370 Final Exam - AssignmentDokumen11 halamanFIN 370 Final Exam - AssignmentstudentehelpBelum ada peringkat

- Name: Meenakshi MBA-II Semester MB0029 Financial ManagementDokumen10 halamanName: Meenakshi MBA-II Semester MB0029 Financial Managementbaku85Belum ada peringkat

- Merchandise Presentation in Retail Store - Intro, Demo, Floor Layout and SignageDokumen26 halamanMerchandise Presentation in Retail Store - Intro, Demo, Floor Layout and SignageAbhinandan SinghBelum ada peringkat

- Starbucks Deliveringcustomerservice 160222181028Dokumen11 halamanStarbucks Deliveringcustomerservice 160222181028Abhinandan SinghBelum ada peringkat

- World CSR Congress: Integrating Sustainability Into A Global OrganizationDokumen12 halamanWorld CSR Congress: Integrating Sustainability Into A Global OrganizationAbhinandan SinghBelum ada peringkat

- Merve BEKTAŞ Didem ŞAHİN Sara OsmanoğluDokumen22 halamanMerve BEKTAŞ Didem ŞAHİN Sara OsmanoğluAbhinandan SinghBelum ada peringkat

- Mortein Vaporizer Marketing StrategyDokumen26 halamanMortein Vaporizer Marketing Strategymukesh chavanBelum ada peringkat

- Positioning Book ReviewDokumen35 halamanPositioning Book ReviewSmat JacerBelum ada peringkat

- G GeniusDokumen26 halamanG GeniusAbhinandan SinghBelum ada peringkat

- Category Management 2Dokumen9 halamanCategory Management 2Abhinandan SinghBelum ada peringkat

- Stratergic Management Case Study On StarbucksDokumen30 halamanStratergic Management Case Study On StarbucksRahul Sttud50% (2)

- Visualmerchandising 121126111353 Phpapp02Dokumen145 halamanVisualmerchandising 121126111353 Phpapp02Abhinandan SinghBelum ada peringkat

- 5 Fastest Frontend Web Dev Frameworks - Fonbell SolutionDokumen13 halaman5 Fastest Frontend Web Dev Frameworks - Fonbell SolutionAbhinandan SinghBelum ada peringkat

- Starbucks: Delivering Customer ServiceDokumen23 halamanStarbucks: Delivering Customer ServiceVishakha Rl RanaBelum ada peringkat

- Leading Supply Chain Without Suits and TiesDokumen11 halamanLeading Supply Chain Without Suits and TiesAnoop AgrawalBelum ada peringkat

- Batiste 2in1 Dry Shampoo & Conditioner: Refreshes Roots and Targets Dryness For Gorgeously Soft, Conditioned HairDokumen11 halamanBatiste 2in1 Dry Shampoo & Conditioner: Refreshes Roots and Targets Dryness For Gorgeously Soft, Conditioned HairAbhinandan SinghBelum ada peringkat

- The Wonder of Mumbai Dabbawallas Inspiration of ManagementDokumen23 halamanThe Wonder of Mumbai Dabbawallas Inspiration of ManagementSeema Mehta SharmaBelum ada peringkat

- Product Palaning Refe1Dokumen58 halamanProduct Palaning Refe1rafiq5002Belum ada peringkat

- FINAL - New Product Development and Feasibility PDFDokumen7 halamanFINAL - New Product Development and Feasibility PDFRenz PamintuanBelum ada peringkat

- General Motors and Its SuppliersDokumen8 halamanGeneral Motors and Its SuppliersAbhinandan SinghBelum ada peringkat

- Six Sigma - IDokumen133 halamanSix Sigma - INitin PatelBelum ada peringkat

- XLRI Strategic Management of Apple Inc. in 2015Dokumen6 halamanXLRI Strategic Management of Apple Inc. in 2015Abhinandan SinghBelum ada peringkat

- Freelancing ListDokumen29 halamanFreelancing ListAbhinandan SinghBelum ada peringkat

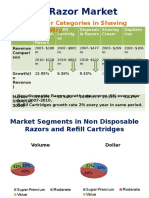

- US Razor Market ParamountDokumen17 halamanUS Razor Market ParamountAbhinandan SinghBelum ada peringkat

- TR EB Data Breach ResponseDokumen5 halamanTR EB Data Breach ResponseAbhinandan SinghBelum ada peringkat

- Saatchi&SaatchiDokumen5 halamanSaatchi&SaatchiAbhinandan SinghBelum ada peringkat

- Atlantic Computer - A Bundling of Pricing OptionsDokumen15 halamanAtlantic Computer - A Bundling of Pricing OptionsAbhinandan SinghBelum ada peringkat

- Slides2 StudentsDokumen41 halamanSlides2 StudentsSkirata75Belum ada peringkat

- Chapter 3 Bond Valuation Edited (Student)Dokumen14 halamanChapter 3 Bond Valuation Edited (Student)Nguyễn Thái Minh ThưBelum ada peringkat

- Sources & Cost of CapitalDokumen123 halamanSources & Cost of Capitaliamjith133680% (5)

- Financial Statement Analysis - Concept Questions and Solutions - Chapter 1Dokumen13 halamanFinancial Statement Analysis - Concept Questions and Solutions - Chapter 1ObydulRanaBelum ada peringkat

- IFRS13 Fair Value MeasurementDokumen79 halamanIFRS13 Fair Value MeasurementAnep ZainuldinBelum ada peringkat

- Master Input Sheet: InputsDokumen37 halamanMaster Input Sheet: Inputsminhthuc203Belum ada peringkat

- Mckinsey Appraisal - AppraisalDokumen8 halamanMckinsey Appraisal - Appraisalalex.nogueira396Belum ada peringkat

- IBPS RRB Office Assistant Mains 2018Dokumen23 halamanIBPS RRB Office Assistant Mains 2018Debadutta SethiBelum ada peringkat

- Fixed Rate Mortgage Homework ProblemsDokumen2 halamanFixed Rate Mortgage Homework ProblemscjBelum ada peringkat

- The error is in the second part of the sentence. The correct part is:The Prime Minister will announce the scheme if the Cabinet approves itDokumen50 halamanThe error is in the second part of the sentence. The correct part is:The Prime Minister will announce the scheme if the Cabinet approves itPawan Patankar100% (1)

- Promissory Notes, Simple Discount Notes, and The Discount ProcessDokumen18 halamanPromissory Notes, Simple Discount Notes, and The Discount ProcessAnnie VBelum ada peringkat

- Equity Valuation BookDokumen3 halamanEquity Valuation BookooppaaBelum ada peringkat

- Financial Management Lecture 2Dokumen27 halamanFinancial Management Lecture 2Tesfaye ejetaBelum ada peringkat

- Understanding Treasury BillsDokumen2 halamanUnderstanding Treasury BillsAnav AggarwalBelum ada peringkat

- Bonds Payable Accounting & ReportingDokumen12 halamanBonds Payable Accounting & ReportingJehPoyBelum ada peringkat

- Chapter 2Dokumen22 halamanChapter 2Tiến ĐứcBelum ada peringkat

- AEC 210 FinalRequirementDokumen9 halamanAEC 210 FinalRequirementALMA MORENABelum ada peringkat

- OCC Interest Rate RiskDokumen74 halamanOCC Interest Rate RiskSara HumayunBelum ada peringkat

- Investments: Chapter Learning ObjectivesDokumen44 halamanInvestments: Chapter Learning ObjectivesRahma NadhifaBelum ada peringkat

- Outlook Profit On L&T-1Dokumen10 halamanOutlook Profit On L&T-1Tentu VenkataramanaBelum ada peringkat

- CH 17 InvestmentsDokumen117 halamanCH 17 InvestmentsSamiHadadBelum ada peringkat

- Sampa Video G3 - SecBDokumen3 halamanSampa Video G3 - SecBEina GuptaBelum ada peringkat

- Current Liabilities - ProvisionsDokumen9 halamanCurrent Liabilities - ProvisionsJerome_JadeBelum ada peringkat

- A Comparative Study of Public and Private Sector Banks in IndiaDokumen10 halamanA Comparative Study of Public and Private Sector Banks in IndiaEditor IJRITCC100% (1)

- Final Exam Cfas WoDokumen11 halamanFinal Exam Cfas WoAndrei GoBelum ada peringkat

- Mock Exam September 2020 Attempt AFM - AnswerDokumen6 halamanMock Exam September 2020 Attempt AFM - AnswerKubBelum ada peringkat