Key Priorities of SMEs' Development in Uzbekistan

Diunggah oleh

ADBI EventsJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Key Priorities of SMEs' Development in Uzbekistan

Diunggah oleh

ADBI EventsHak Cipta:

Format Tersedia

KEY PRIORITIES of SMEs

DEVELOPMENT IN UZBEKISTAN

The views expressed in this presentation are the views of the author and do not necessarily reflect the views or policies of the Asian Development Bank

Institute (ADBI), the Asian Development Bank (ADB), its Board of Directors, or the governments they represent. ADBI does not guarantee the accuracy of

the data included in this paper and accepts no responsibility for any consequences of their use. Terminology used may not necessarily be consistent with

ADB official terms.

Dilshod Abduazizov

Head of Department, Ministry of Economy of the Republic of Uzbekistan

General information about Uzbekistan

Area: 447,400 sq kilometres;

Population: 31,9 mln.

Uzbekistan: 56th largest

country in the world by area and

the 42nd by population;

Uzbekistan is the 5th largest

country by area and the 3rd

largest by population in the CIS

region.

2

Overview about SMEs

Business type

Number of SMEs 226 thousand

Individual entrepreneurs

Micro firms

Small enterprises

Type of export products

Population employed in SMEs 77,9%

Electro-technical products

Automobile

Textile

Share of SMEs in export 26,9%

Chemicals

Construction materials

Agricultural products

3

Overview about SMEs

Dynamics of SMEs share in GDP (% )

52.5

56.5

38.2

31.0

0,1

1990

2000

2005

2010

2015

Main directions of Government support

in development of SMEs

creating the most favorable business environment, further improvement of

legislation, reduction of government administrative functions and licensing

procedures;

scale reduction of government intervention and regulatory authorities in financial

and economic activity of private sector;

creating maximum favorable conditions, tax exemptions and preferences,

improving reporting systems;

increase lending to small businesses and private entrepreneurship;

enlarging participation of small and private businesses in foreign trade;

development of information support system and advisory services to small

businesses, as well as in matters of training.

5

Reforms on improvement of business environment

and liberalization of entrepreneurship

Presidential Decree from May 15, 2015 No.4725

"On measures to ensure the protection of private

property, small business and private

entrepreneurship, the removal of obstacles for their

accelerated development

from January 1, 2015 upon conduct of public services

SMEs are not required documents by organizations that

are possessed in other government bodies;

carrying out all inspections of micro firms, small

enterprises and farms activities is performed in the

planned procedure not more than once in four years,

only according to the decision of Republican council;

terms of carrying out the scheduled inspections not related

to financial and economic activities, constitutes no more

than 10 calendar days;

strengthening the responsibility of officers of government,

law enforcement and controlling organs for unlawful

interference into the entrepreneurship activities.

Dynamics of tax burden

on SMEs in 1993-2015

(in % to GDP)

50%

45.0%

45%

37.1%

40%

30,2%

35%

30%

21.9%

25%

20%

15%

16.1%

1993

2000

2005

2011

2015

Reforms on improvement of business environment

and liberalization of entrepreneurship

Presidential Decree from April 7, 2014 No.4609

On additional measures for further enhancement

of investment climate and business environment in

the Republic of Uzbekistan

From July 1, 2014:

SMEs utmost annual average number of employees

in labor-intensive industries were increased

by 2 times against the current (or up to 200 people):

construction materials industry;

light industry including leather and footwear industry;

food processing industry.

it is prohibited to apply to businesses measure of

responsibility for the violation of legal and other acts

of bodies of state and economic management,

municipal authorities, regulating issues of relations

with business entities, not published on their official

websites.

The number of registered SMEs

per 1,000 employed population

Presidential Decree from October 5, 2016 No.4848

On additional measures to ensure accelerated development of entrepreneurial activity,

full protection of private property and effective improvement of business climate

According to the Decree providing greater freedom of small business and private entrepreneurship,

radical reduction of interference in their activities with a concentration of efforts on early warning,

prevention and improving the effectiveness of crime prevention is determined as a top priority and primary

task of government agencies.

From January 1, 2017:

all kinds of unscheduled inspections of business entities are canceled, other than inspections related

to liquidation of the legal entity, as well as carried out only by a decision of the National Council on the

basis of appeals of individuals and legal entities on the facts of violations of the law;

all kinds of counter inspections of business entities are canceled, including criminal matters;

in respect of businesses does not apply a criminal penalty of deprivation of the right to carry out

business activities.

8

Presidential Decree from October 5, 2016 No.4848

Program providing implementation of 42 concrete measures in five priority areas of most

accelerated development of business, protection of private property and the effective

improvement of the business climate was approved by the Decree

I. Legal regulation of business.

II. Reduction of businesses inspections and prevent undue interference in their activities.

III. Liberalization of responsibility of businesses.

IV. Improvement of financial, taxation and customs system.

V. Strengthening legal protection of entrepreneurs, improving business environment and

increasing Uzbekistans international rating.

Central geographical location

to the largest markets

Free Trade Agreement with 11 CIS countries including Georgia

Moscow

Minsk

Berlin

Kiev

Astana

Brussels

London

Paris

Washington

Bishkek

Ashgabad

Ankara

Jerusalem Tehran

Amman

Cairo Riyadh

Most Favourable Nation Treatment: with

51 countries, including US, EU countries,

Japan, China, India, Republic of Korea and

others

Tokyo

Beijing

Seoul

Shanghai

Bangkok

Singapore

Manila

Jakarta

10

Free Economic Zones of Uzbekistan

11

Free Economic Zones: Tax preferences

FEZ residents are exempted from all types of taxes:

Period of privileges and incentives:

If amount of FDI is:

0,3 to 3 million USD 3 years;

3 to 5 million USD 5 years;

5 to 10 million USD 7 years;

more than 10 million USD 10 years

12

Free Economic Zones: Current projects

59 operating projects

Started production of such goods as:

Automobile components and wires

LED lams, High-voltage cables

ADSL modems, Heating boilers

Mobile phones, Set-up boxes (TV tuners)

Construction materials, Cosmetic products

Polyethylene pipes and etc.

These projects have been realized in cooperation with Italy,

UAE, India, Korea, China, Singapore, Bulgaria and so on.

13

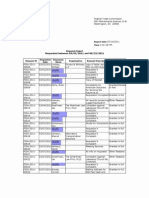

Rank of Uzbekistan in Doing Business

Indicators

DB-2012

DB-2017

+/-

Protecting minority investors

136

70

66

Enforcing contracts

60

38

22

Starting a business

96

25

71

Resolving insolvency

117

77

40

Getting credit

158

44

114

Getting electricity

172

83

89

Overall ranking

166

87

79

Uzbekistan is in Top-10 economies showing the most notable improvement in

performance on the Doing Business indicators in 2014/15.

14

Thank you !

Anda mungkin juga menyukai

- Ways To Develop A Competitive Environment in The Field of EntrepreneurshipDokumen5 halamanWays To Develop A Competitive Environment in The Field of EntrepreneurshipIJRASETPublicationsBelum ada peringkat

- Trade Opportunity ZonesDokumen26 halamanTrade Opportunity ZonesmajoBelum ada peringkat

- SEZ Notes - February 18th, 2009: DegreeDokumen5 halamanSEZ Notes - February 18th, 2009: DegreeZofail HassanBelum ada peringkat

- SEZ Notes - ManagementParadise - Com - Your MBA Online Degree Program and Management Students Forum For MBA, BMS, MMS, BMM, BBA, Students & AspirantsDokumen5 halamanSEZ Notes - ManagementParadise - Com - Your MBA Online Degree Program and Management Students Forum For MBA, BMS, MMS, BMM, BBA, Students & AspirantsVinod WaghelaBelum ada peringkat

- AF - Guia Resumido INGDokumen23 halamanAF - Guia Resumido INGMaria Moniz de BettencourtBelum ada peringkat

- Ans: Industrial Enterprise Act 1992:: Name: Sandisha Shrestha Section: B Roll No: 157110 Section: BDokumen5 halamanAns: Industrial Enterprise Act 1992:: Name: Sandisha Shrestha Section: B Roll No: 157110 Section: BMilisha ShresthaBelum ada peringkat

- Economic Policy 1991Dokumen20 halamanEconomic Policy 1991Anusha Palakurthy100% (1)

- Indian Sez ModelsDokumen24 halamanIndian Sez ModelsAnuja BakareBelum ada peringkat

- Business Integrity Digest: Compliance in The Agricultural SectorDokumen27 halamanBusiness Integrity Digest: Compliance in The Agricultural SectorHaval A.MamarBelum ada peringkat

- Pol and Legal Env of IndiaDokumen101 halamanPol and Legal Env of Indiarajat_singlaBelum ada peringkat

- Attracting Investments To Small Industry ZonesDokumen6 halamanAttracting Investments To Small Industry ZonesAcademic JournalBelum ada peringkat

- MSME Book Full NotesDokumen46 halamanMSME Book Full NotesKoushikBelum ada peringkat

- Special Economic ZonesDokumen10 halamanSpecial Economic ZonesPranay Manikanta JainiBelum ada peringkat

- Manage-Free Economic-Burieva Nigora HasanovnaDokumen4 halamanManage-Free Economic-Burieva Nigora HasanovnaImpact JournalsBelum ada peringkat

- Moot Court CompetitionDokumen7 halamanMoot Court CompetitionAya AhmedBelum ada peringkat

- Financial Market of Mongolia: Current State and PossibilitiesDokumen15 halamanFinancial Market of Mongolia: Current State and PossibilitiesUrtaBaasanjargalBelum ada peringkat

- DR - Ram Manohar Lohiya National Law University: SociologyDokumen7 halamanDR - Ram Manohar Lohiya National Law University: SociologySaroj adityaBelum ada peringkat

- Fc-Sem 2-Unit 1 - Globalisation of Indian SocietyDokumen14 halamanFc-Sem 2-Unit 1 - Globalisation of Indian SocietyFahaad AzamBelum ada peringkat

- Seminars On General Topics: Sez and Its Effect On The EconomyDokumen21 halamanSeminars On General Topics: Sez and Its Effect On The EconomyLubna ShaikhBelum ada peringkat

- Status and Prospects of Effective Use of Financial Resources by Small Business Entities in Our CountryDokumen5 halamanStatus and Prospects of Effective Use of Financial Resources by Small Business Entities in Our CountryIJRASETPublicationsBelum ada peringkat

- SMEDA Assessment of IncomeDokumen160 halamanSMEDA Assessment of IncomeAdnan AzharBelum ada peringkat

- PESTLE Analysis of China's E-Commerce SectorDokumen8 halamanPESTLE Analysis of China's E-Commerce Sectorcl YEUNGBelum ada peringkat

- Chapter - 22 LiberalisationDokumen14 halamanChapter - 22 LiberalisationrjvmafiaBelum ada peringkat

- Geographic and Demographic Conditions and Financial Environment of ChinaDokumen3 halamanGeographic and Demographic Conditions and Financial Environment of ChinaLiru YanBelum ada peringkat

- Improving The Economic Mechanisms of State Regulation and Support of Trade ServicesDokumen5 halamanImproving The Economic Mechanisms of State Regulation and Support of Trade ServicesResearch ParkBelum ada peringkat

- Doing Business in China OverviewDokumen36 halamanDoing Business in China OverviewĐào Phương OanhBelum ada peringkat

- Economics Part From Slides Political From BookDokumen39 halamanEconomics Part From Slides Political From BookMirza Huraira BaigBelum ada peringkat

- Resolution35 SupportEnterprisesDokumen11 halamanResolution35 SupportEnterpriseskangBelum ada peringkat

- Indonesia Regulatory ReformDokumen2 halamanIndonesia Regulatory ReformdeeBelum ada peringkat

- RP Compliance With Labor LawsDokumen23 halamanRP Compliance With Labor LawsAdfarhanBelum ada peringkat

- Doing Business in ChinaDokumen26 halamanDoing Business in ChinaShariq KhanBelum ada peringkat

- Presentation ON Industrial Policy, 1991: Master of Social Works-Ii YRDokumen11 halamanPresentation ON Industrial Policy, 1991: Master of Social Works-Ii YRpriya_ammuBelum ada peringkat

- EOPDokumen16 halamanEOPDrManiprakash AravelliBelum ada peringkat

- Improving Government Business Support Measures at The Regional LevelDokumen11 halamanImproving Government Business Support Measures at The Regional LevelCentral Asian StudiesBelum ada peringkat

- Role & Significance of Corporate Sector in Pakistan Economy: Development of Pakistan. Yes, The Operating and RegulatoryDokumen6 halamanRole & Significance of Corporate Sector in Pakistan Economy: Development of Pakistan. Yes, The Operating and RegulatoryAli AgralBelum ada peringkat

- Pest Analysis of ChinaDokumen7 halamanPest Analysis of ChinaSarada Nag100% (1)

- Liberalisation Policy: Vivekananda Institute of Professional Studies VsllsDokumen11 halamanLiberalisation Policy: Vivekananda Institute of Professional Studies VsllsHardik SharmaBelum ada peringkat

- Economic Reforms in India (1990-2008)Dokumen30 halamanEconomic Reforms in India (1990-2008)tarun_asrani9599Belum ada peringkat

- Will Anti-Tax-Avoidance Provisions Reduce The InveDokumen24 halamanWill Anti-Tax-Avoidance Provisions Reduce The InveKiruthigaah KanadasanBelum ada peringkat

- Unit 3 BDokumen22 halamanUnit 3 BWenlang SwerBelum ada peringkat

- Q: 1 The Business Environment of Pakistan. Give A Comprehensive Theoretical Background of The Topic and Then Analyze Its Practical Application in Any Private Organization of PakistanDokumen6 halamanQ: 1 The Business Environment of Pakistan. Give A Comprehensive Theoretical Background of The Topic and Then Analyze Its Practical Application in Any Private Organization of PakistanAli AhsanBelum ada peringkat

- Deloitte: Doing Business in China-Final-July 2012Dokumen94 halamanDeloitte: Doing Business in China-Final-July 2012jwatt17Belum ada peringkat

- PESTEL Analysis On China and FinlandDokumen26 halamanPESTEL Analysis On China and Finlandttom123Belum ada peringkat

- Jia Chen - Development of Chinese Small and Medium-Sized EnterprisesDokumen8 halamanJia Chen - Development of Chinese Small and Medium-Sized EnterprisesAzwinBelum ada peringkat

- SMEDA Compliance With Labor LawsDokumen23 halamanSMEDA Compliance With Labor Lawsfarooq61Belum ada peringkat

- Duties of A Business OwnerDokumen7 halamanDuties of A Business OwnerUche GinikaBelum ada peringkat

- Investment and Incentives LawDokumen219 halamanInvestment and Incentives LawBechay PallasigueBelum ada peringkat

- Small and Medium EnterprisesDokumen6 halamanSmall and Medium EnterprisesSarva ShivaBelum ada peringkat

- National Study On Digital Trade Integration of Pakistan 1Dokumen68 halamanNational Study On Digital Trade Integration of Pakistan 1Rabia TariqBelum ada peringkat

- Impact of Globalization On Developing Countries (With Special Reference To India)Dokumen7 halamanImpact of Globalization On Developing Countries (With Special Reference To India)manojbhatia1220Belum ada peringkat

- SBIE Knowledge Session on Indian Economy and PolicyDokumen17 halamanSBIE Knowledge Session on Indian Economy and PolicyMEHUL PALBelum ada peringkat

- Small Business Development Program in HNC 2011-2015Dokumen34 halamanSmall Business Development Program in HNC 2011-2015cajgerBelum ada peringkat

- India's Economic and Commerce Wing Newsletter Highlights OpportunitiesDokumen5 halamanIndia's Economic and Commerce Wing Newsletter Highlights OpportunitiesDigvijay Sanjay PatilBelum ada peringkat

- U.S.-Bangladesh Trade Barriers LectureDokumen19 halamanU.S.-Bangladesh Trade Barriers LectureTanvir AhmedBelum ada peringkat

- Retail Market Entry Guide VietnamDokumen59 halamanRetail Market Entry Guide VietnamStanley NengBelum ada peringkat

- A Community Connect Report On Small Medium Enterprise (Sme) : YEAR-2019 Isha Lohani 2018016014 MBA (B&F)Dokumen41 halamanA Community Connect Report On Small Medium Enterprise (Sme) : YEAR-2019 Isha Lohani 2018016014 MBA (B&F)Isha lohaniBelum ada peringkat

- Model Answer Key Economics-IiDokumen17 halamanModel Answer Key Economics-Iisheetal rajputBelum ada peringkat

- Social Economic ZoneDokumen3 halamanSocial Economic ZoneRakesh Raj SinghaniayaBelum ada peringkat

- Provincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionDari EverandProvincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionBelum ada peringkat

- Somaliland: Private Sector-Led Growth and Transformation StrategyDari EverandSomaliland: Private Sector-Led Growth and Transformation StrategyBelum ada peringkat

- Session 5.1: Trade Facilitation and Regulatory Management in ASEAN: Insights From ERIA Studies by Rashesh ShresthaDokumen20 halamanSession 5.1: Trade Facilitation and Regulatory Management in ASEAN: Insights From ERIA Studies by Rashesh ShresthaADBI EventsBelum ada peringkat

- Session 4.1: Leveraging On The New Economy For Inclusive Growth: Factory Asia, Shopper Asia by Lam San LingDokumen43 halamanSession 4.1: Leveraging On The New Economy For Inclusive Growth: Factory Asia, Shopper Asia by Lam San LingADBI EventsBelum ada peringkat

- Session 5.2: Non-Tariff Measures and Regional Integration in ASEAN by Doan Thi HanhDokumen15 halamanSession 5.2: Non-Tariff Measures and Regional Integration in ASEAN by Doan Thi HanhADBI EventsBelum ada peringkat

- Session 2.2: Comments On Firm Size and Participation in The International Economy: Evidence From Bangladesh by Ayako ObashiDokumen6 halamanSession 2.2: Comments On Firm Size and Participation in The International Economy: Evidence From Bangladesh by Ayako ObashiADBI EventsBelum ada peringkat

- Session 3.3: Comments On "What Drives Innovation in Asia?" by Banri ItoDokumen12 halamanSession 3.3: Comments On "What Drives Innovation in Asia?" by Banri ItoADBI EventsBelum ada peringkat

- Session 1.4: Bubble, Bust and Policy Consequences by Masyita CrystallinDokumen7 halamanSession 1.4: Bubble, Bust and Policy Consequences by Masyita CrystallinADBI EventsBelum ada peringkat

- Session 1.2: Global Financial Market Updates by Cyn-Young ParkDokumen11 halamanSession 1.2: Global Financial Market Updates by Cyn-Young ParkADBI EventsBelum ada peringkat

- Session 4.2: ASEAN in The Global Value Chains by Aladdin RilloDokumen16 halamanSession 4.2: ASEAN in The Global Value Chains by Aladdin RilloADBI EventsBelum ada peringkat

- Session 1.1: Asset Price Bubbles and Indicators by Naoyuki YoshinoDokumen25 halamanSession 1.1: Asset Price Bubbles and Indicators by Naoyuki YoshinoADBI EventsBelum ada peringkat

- Session 1.3: The Housing Unaffordability Crisis in Asia & Pacific by Matthias HelbleDokumen24 halamanSession 1.3: The Housing Unaffordability Crisis in Asia & Pacific by Matthias HelbleADBI EventsBelum ada peringkat

- Session 3.2: What Drives Innovation in Asia? by Bihong HuangDokumen8 halamanSession 3.2: What Drives Innovation in Asia? by Bihong HuangADBI EventsBelum ada peringkat

- Session 3.2: Comments On Small Vs Medium Vs Large Firms in Nepal: Internationalization and Participation in Global Value Chains by Ayako ObashiDokumen8 halamanSession 3.2: Comments On Small Vs Medium Vs Large Firms in Nepal: Internationalization and Participation in Global Value Chains by Ayako ObashiADBI EventsBelum ada peringkat

- Session 5.2: Comments On Financial Constraints and Global Value Chain Participation: Evidence From Indian Manufacturing by Cassey LeeDokumen5 halamanSession 5.2: Comments On Financial Constraints and Global Value Chain Participation: Evidence From Indian Manufacturing by Cassey LeeADBI EventsBelum ada peringkat

- Session 2.4: Comments On Trade, Global Value Chains and Small and Medium-Sized Enterprises in Thailand: A Firm-Level Panel Analysis by Doan Thi Thanh HaDokumen7 halamanSession 2.4: Comments On Trade, Global Value Chains and Small and Medium-Sized Enterprises in Thailand: A Firm-Level Panel Analysis by Doan Thi Thanh HaADBI EventsBelum ada peringkat

- Session 6.1: Entry, Survival and Exit of Firms in Global Value Chains The Case of Small and Medium-Sized Manufacturers From The Philippines by Adrian R. MendozaDokumen40 halamanSession 6.1: Entry, Survival and Exit of Firms in Global Value Chains The Case of Small and Medium-Sized Manufacturers From The Philippines by Adrian R. MendozaADBI Events100% (1)

- Session 6.3: Impact of Global Value Chains On Small and Medium Enterprises Development in Sri Lanka: Evidence From Uva and Central Provinces of Sri Lanka by N.P. Ravindra DeyshappriyaDokumen29 halamanSession 6.3: Impact of Global Value Chains On Small and Medium Enterprises Development in Sri Lanka: Evidence From Uva and Central Provinces of Sri Lanka by N.P. Ravindra DeyshappriyaADBI EventsBelum ada peringkat

- Session 5.3: Leveraging The Participation of Small and Medium Enterprises in Global Value Chains of Automotive Industry: Insights From Maruti Suzuki India Limited by Falendra Kumar SudanDokumen27 halamanSession 5.3: Leveraging The Participation of Small and Medium Enterprises in Global Value Chains of Automotive Industry: Insights From Maruti Suzuki India Limited by Falendra Kumar SudanADBI EventsBelum ada peringkat

- Session 3.3: Determinants of SME Upgrading From Local To International Market: Evidence From Kyrgyz Republic by Kamalbek KarymshakovDokumen25 halamanSession 3.3: Determinants of SME Upgrading From Local To International Market: Evidence From Kyrgyz Republic by Kamalbek KarymshakovADBI EventsBelum ada peringkat

- Session 6.2: Comments On Entry, Survival and Exit of Firms in Global Value Chains The Case of Small and Medium-Sized Manufacturers From The Philippines by Sothea OumDokumen9 halamanSession 6.2: Comments On Entry, Survival and Exit of Firms in Global Value Chains The Case of Small and Medium-Sized Manufacturers From The Philippines by Sothea OumADBI EventsBelum ada peringkat

- Session 3.1: Small Vs Medium Vs Large Firms in Nepal: Internationalization and Participation in Global Value Chains by Paras KharelDokumen17 halamanSession 3.1: Small Vs Medium Vs Large Firms in Nepal: Internationalization and Participation in Global Value Chains by Paras KharelADBI EventsBelum ada peringkat

- Session 4.4: Comments On Global Value Chains and Firms' Innovation: Evidence From Small and Medium-Sized Enterprises in Vietnam by Doan Thi Thanh HaDokumen10 halamanSession 4.4: Comments On Global Value Chains and Firms' Innovation: Evidence From Small and Medium-Sized Enterprises in Vietnam by Doan Thi Thanh HaADBI EventsBelum ada peringkat

- Agricultural Income Tax Exemption GuideDokumen6 halamanAgricultural Income Tax Exemption GuideAbhijeet TalwarBelum ada peringkat

- Definition of Business PolicyDokumen5 halamanDefinition of Business PolicyJessica LaguatanBelum ada peringkat

- RICS Red Book-Uploaded On Open InternetDokumen33 halamanRICS Red Book-Uploaded On Open InternetVishwas NagiBelum ada peringkat

- IIFL NCD 29jul2011Dokumen302 halamanIIFL NCD 29jul2011Mohan SharmaBelum ada peringkat

- CH 05Dokumen92 halamanCH 05Indah LestariBelum ada peringkat

- Introduction to Securities Law and Key Regulatory AreasDokumen119 halamanIntroduction to Securities Law and Key Regulatory Areasscottshear1Belum ada peringkat

- F2-17 Capital Budgeting and Discounted Cash Flows PDFDokumen28 halamanF2-17 Capital Budgeting and Discounted Cash Flows PDFJaved ImranBelum ada peringkat

- Silk RouteDokumen22 halamanSilk RouteIzma NadeemBelum ada peringkat

- Foreign Currency Transactions: Solutions Manual, Chapter 10Dokumen54 halamanForeign Currency Transactions: Solutions Manual, Chapter 10Gillian Snelling100% (2)

- AEGON Religare Life Insurance CompanyDokumen4 halamanAEGON Religare Life Insurance CompanycooldudeforyewBelum ada peringkat

- Financial Accounting Theory: William R. ScottDokumen14 halamanFinancial Accounting Theory: William R. ScottDiny Fariha ZakhirBelum ada peringkat

- Book 1Dokumen57 halamanBook 1Alex Richard CarlosBelum ada peringkat

- How Do Family Offices Invest Through Hong KongDokumen3 halamanHow Do Family Offices Invest Through Hong KongScarlett TaiBelum ada peringkat

- Fin 4486 Chap 3 AnswersDokumen10 halamanFin 4486 Chap 3 Answerskingme157Belum ada peringkat

- E-Commerce Term Paper: TopicDokumen11 halamanE-Commerce Term Paper: Topicsimar001Belum ada peringkat

- Commercial Studies: Notes Class 10 (Icse) : Topic 1Dokumen5 halamanCommercial Studies: Notes Class 10 (Icse) : Topic 1Amir100% (5)

- Global Derivatives 2010Dokumen14 halamanGlobal Derivatives 2010bezi1985Belum ada peringkat

- Creating New Cities for the NationDokumen256 halamanCreating New Cities for the NationArissa WulandariBelum ada peringkat

- CH 11 Hull OFOD9 TH EditionDokumen20 halamanCH 11 Hull OFOD9 TH Editionseanwu95Belum ada peringkat

- Primary Cost and Secondary Cost PlanningDokumen4 halamanPrimary Cost and Secondary Cost PlanningsampathBelum ada peringkat

- Autochartist Intro GuideDokumen42 halamanAutochartist Intro GuidemartianabcBelum ada peringkat

- ThreeHorizons 1Dokumen2 halamanThreeHorizons 1sreen2rBelum ada peringkat

- BSPDokumen159 halamanBSPHoneyleth TinamisanBelum ada peringkat

- TaxationDokumen742 halamanTaxationSrinivasa Rao Bandlamudi83% (6)

- Financial Analysis of Everest BankDokumen25 halamanFinancial Analysis of Everest BankBarishtLalKaparBelum ada peringkat

- Money, interest rates, inflation, and exchange ratesDokumen3 halamanMoney, interest rates, inflation, and exchange ratesMeghana1205Belum ada peringkat

- Responsive Document - CREW: FTC: Regarding Efforts by Wall Street Investors To Influence Agency Regulations: 7/20/2011 - Foia Log Cont.Dokumen21 halamanResponsive Document - CREW: FTC: Regarding Efforts by Wall Street Investors To Influence Agency Regulations: 7/20/2011 - Foia Log Cont.CREWBelum ada peringkat

- Choice Securities Final ProjectDokumen72 halamanChoice Securities Final Projectdevendra reddy GBelum ada peringkat

- UK Money Creation GuideDokumen2 halamanUK Money Creation Guidematts292003574Belum ada peringkat

- FMA Agencies ListDokumen11 halamanFMA Agencies ListmofibhaiBelum ada peringkat