Impact of Internet Banking On Customer Satisfaction and Loyalty: A Conceptual Model

Diunggah oleh

Yusuf HusseinJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Impact of Internet Banking On Customer Satisfaction and Loyalty: A Conceptual Model

Diunggah oleh

Yusuf HusseinHak Cipta:

Format Tersedia

298

The Fourth International Conference on Electronic Business (ICEB2004) / Beijing

Impact of Internet Banking on Customer Satisfaction and Loyalty:

A Conceptual Model

Thanh Nguyen, Mohini Singh

School of Business Information Technology, RMIT University,

GPO Box 4576V, V Melbourne, Victoria, Australia

thanh.nguyen@rmit.edu.au, mohini.singh@rmit.edu.au

ABSTRACT

This is a research in progress paper discussing Internet banking issues both from the bank

s point of view and from the

customerspoints of view. Based on literature it includes several factors that impact Internet banking. It includes several

hypothesis derived from literature to be tested empirically. The research will be guided by the conceptual model

presented as figure 2 in this paper highlighting the relationship between Internet banking and customer satisfaction and

loyalty.

Keywords: Internet banking, customer satisfaction, customer loyalty

1. INTRODUCTION

Internet banking is one form of e-commerce that has

gained a wider acceptance than others. In Australia all

banks are now offering internet banking facilities to all

its customers. As suggested by Chang [10] the evolution

of information technology has significantly influenced

the banking industry. Particularly, the advent of the

Internet and the popularity of personal computers have

created both an opportunity and a challenge for this

industry. In only a decade Internet Banking has rapidly

grown [2]. In 2001, the Market Intelligence Strategy

Centre (MISC) reported that approximately 2.8 million

people have used Internet Banking in Australia [50].

These figures increase rapidly with each new survey.

A study from Taylor Nelson Sofre in 2002 revealed that

23% of Australians used Internet Banking and the

Internet Banking adoption rate in Australia is greater

than in the US and Britain [3]. In mid-2002, the MISC

reported that 5 million Australians had used Internet

Banking services [39]. Recent survey undertaken by the

MISC shows that the number of Australians using

Internet Bank had reached 7.7 million in September

2003, with an annual growth rate of 113% [33].

perceptions of Internet Banking between the literature

and practitioners. With reference to most Australian

bankswebsites, the term Internet bankinghas been

construed as the transactions relating to current and

credit card accounts such as viewing balances, paying

bills, and transferring funds. In contrast, in the literature,

Internet banking includes the services relating to

financing, insurance, investment, and new banking

services [14, 43]. The latter will be referenced in this

paper.

3. INTERNET BANKING TECHNOLOGY

According to Leong, Srikanthan & Hura [27] Internet

banking is a web application based on client/server

architecture in which Internet technology plays an

important role. A basic architecture is illustrated in

figure 1.

The rapid growth of Internet banking in recent years is a

clear indication of consumer acceptance of this media.

However, the impact of Internet Banking on customer

satisfaction and loyalty in Australia is yet to be

established as few studies have addressed this issue. In

this paper we present a review of literature on internet

banking and the factors that may impact internet

banking and customer satisfaction and loyalty.

2. DEFINITION OF INTERNET BANKING

Internet Banking is defined as the usage of Internet and

telecommunication networks to deliver banking services

to customers [12, 14, 43]. Customers can inquire

information and carry out most banking services such as

account balance inquiry, inter-account transfers, and

bill-payment via the Internet. There are different

Figure 1: Internet Banking application architecture - adopted

from Leong, Srikanthan & Hura (1998) and Turban et al.

(2000)

The Fourth International Conference on Electronic Business (ICEB2004) / Beijing

Similar to all Internet transmission of information, with

Internet banking security is an important concern for

banks and customers [43]. All banks offering Internet

Banking have taken special care to ensure security,

privacy and confidentiality of information to all its

customers. Basic security requirements to conduct

business over the Internet are discussed below.

Authentication involves the ability of an individual,

organisation, or computer to prove its identity. Security

systems accomplish authentication by verifying

information that the user provides against what the

system already knows about the user. Authorisation

involves the control of access to particular information

once identity has been verified. Authorisation is meant

to limit the actions or operations that authenticated

parties are able to perform in a networked environment.

Audits include information on access of particular

resources using particular privileges or performing

certain security actions. It identifies the person or

program that performed the actions. Confidentiality

involves the secrecy of data and/or information, and the

protection of such information from unauthorised access.

For e-businesses confidentiality is of utmost importance

in the protection of an organisation or company's

financial data, product development information,

organisation structures and various other types of

information. Time related information such as a price

list or confidential report can be crucial and need to be

kept confidential until a certain time. Policies regarding

the release of information must be included in

confidentiality, as well as authorisation services.

Confidentiality policy must ensure that information

cannot be read, copied, modified, or disclosed without

proper authorisation and that communication over

networks cannot be intercepted. Integrity is the

protection of data from modification either while in

transit or in storage. E-commerce and e-business

systems must have the capability of ensuring that data

transmissions over networks arrive at their destinations

in exactly the same form as they were sent. Integrity

services must protect data against modifications,

additions, deletions, and reordering parts of the data.

Information can be erased or become inaccessible,

resulting in loss of availability. This means that those

who are authorized to get information did not get what

they needed. Availability of information is an important

attribute in service-oriented businesses that depend on

information (e.g. airline schedules). When a user cannot

get access to the network or specific services provided

on the network, they experience a denial of service.

Nonrepudiation involves protection against a party

involved in a transaction or communication activity that

later falsely denies that the transaction or activity

occurred. Nonrepudiation services must be able to

demonstrate to a third party proof of origin, delivery,

submission and transport of the data in question [56].

Security protection includes physical security devices

i.e. secure server rooms, unauthorised intrusion detector,

organisations security policies and related Internet

security technologies.

Authentication, digital

299

certificates, firewalls, Secure Socket Layer (SSL),

Secure HTTP (S-HTTP), Secure Electronic Transaction

(SET), Joint Electronic Payment Initiative (JEPI), and

Open Financial Exchange (OFX) are important

technologies supporting Internet Banking security [25].

SSL and S-HTTP are popular protocols for secure

communications over the Internet at network level

security and application level security respectively,

using public key cryptography and symmetric key

encryptions.

On the other hand, SET is a

standard/protocol for securing real-time credit card

transactions over the Internet. This protocol enables

E-Commerce applications to communicate between the

customers, SET-compliant merchants and authorised

third-party payment gateways.

JEPI and OFX are secure communication protocols.

JEPI is known to standardise payment negotiations by

assisting consumers and merchants in selecting an

appropriate payment mechanism of different payment

protocols for both parties. OFX is primarily designed

for electronic data exchange between financial

institutions and is a messaging protocol for online

financial services such as Electronic Bill Presentments

and Payments (EBPP) and investment services. OFX

has been adopted by many large financial institutions

[25]. In Australia, OFX has been implemented for

BPAY, an EBPP system developed by Australian banks

[9].

Internet Banking allows account aggregation. With

account aggregation, customers can manage several

banking accounts held at different banks via a unique

access point. This means that customers just log on to

the Internet Banking websites which support account

aggregation enable customers to access their account

held at other banks, including deposit account, credit

cards and award programs [28]. To use account

aggregation service, a customer has to give settings such

as the URL, user name and password of each external

account.

Once customer logs on to an account

aggregation website, this system automatically logs onto

other banksInternet Banking sites just as if a customer

is logged on to them directly. With account aggregation,

a customer is able to access al information from an

account held at another bank. This provides customers

with convenience and time saving. Although this has

many advantages to the customers, security, level of

information access and legal standards to protect the

banks and customers has led to a slow adoption [1, 28].

In Australia, account aggregation was offered by

WestPac, Commonwealth Bank, AMP and Macquarie

Bank [57]. However, recently, Macquarie Bank has

removed this feature due to the security concerns [47].

3. BENEFITS OF INTERNET BANKING

Internet Banking provides clear advantages to both the

financial institutions and the customers. From the

banksperspective, Internet Banking has very low cost

transactions, compared to human teller banking since it

300

The Fourth International Conference on Electronic Business (ICEB2004) / Beijing

reduces the following expenses [24, 52]: (1) Banks can

reduce customer service staff as customers use more

self-service functions; (2) There is less cheque

processing costs due to an increase in electronic

payments.; (3) Costs of paper and mail distribution are

reduced as bank statements and disclosures are

presented online; (4) There is less data entry as

applications are completed and processed online by

customers. On the other hand, according to KPMG

[24], banks revenue increases from Internet Banking

due to: (1) Increased account sales; (2) Wider market

reach; (3) New fee-based income; (4) New market

opportunities; (5) Improved customer satisfaction. For

consumers, Internet banking provides convenience,

lower service charges, more accessible information

about bank accounts, and an attractive option for busy

people since it saves time to go to the bank branches

and gives 24 hours access [26]. All the benefits of B2C

e-commerce such as 24*7 bank service, convenience,

access from anywhere, one stop shop and easy access to

information [57, 58 59] also apply to internet banking.

6. PRODUCTS AND SERVICES

OFFERED ONLINE

Internet Banking provides customers with many

services and several facilities to carry out online

banking transactions. The basic services include

opening a bank account, printing bank statement,

transferring funds between bank accounts, and paying

bills. Other Internet Banking services comprise of future,

dated and recurring bill payments and funds transfers,

loan

application,

e-trade,

fund

management,

customisation of account names, ability to export

banking transactions to popular financial management

software packages such as Microsoft Money or Intuit

Quicken [1]. In addition, account aggregation services

allow customers to manage multiple accounts from

different financial institutions with a single login.

There are many online financial services but they can be

divided into the following categories [18]: (1) Current

account; (2) Insurance-based; (3) Credit-based; (4)

Investment-based services.

influencing

Internet

Banking

customer

behaviour/attitude. The recent studies have examined

the determinants such as demographics [7, 23, 32, 49,

15, 23, 32, 49, consumer characteristics [15, 23, 32, 35,

44, 34, 37, 43, 30, 45, 51], consumer perceptions [15,

44], technology attributes [30, 45, 51], and social

context [15, 44] in association with the affects of these

variables

to

Internet

Banking

customer

behaviour/attitude.

Unfortunately, most studies concentrated on

investigating the impact of the above determinants on

Internet Banking adoption. Few studies [34, 40, 48, 54]

have examined customer satisfaction and loyalty in

relation to Internet Banking. Though Internet Banking

in Australia began in 1997 [43], literature and research

have only concentrated on Australian Internet Banking

adoption issues, focusing on either retail customer [43]

or small and medium business [52]. No empirical study

has been conducted to understand the impact of Internet

Banking on customer satisfaction and loyalty in

Australia.

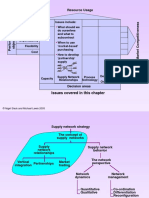

8. A CONCEPTUAL MODEL AND

HYPOTHESES

For the purpose of understanding the factors influencing

Internet Banking customer satisfaction and loyalty, this

paper proposes a conceptual model (figure 1). This

conceptual model is developed based on several

previous studies relating to Internet Banking and

human-computer interactions [55].

Most Australian banks provide interactive, extensive

and sophisticated Internet Banking services [6].

However, it appears that no empirical study has been

conducted to examine whether the Internet banking

services in Australia are satisfactory to customers.

7. INTERNET BANKING AND CUSTOMER

BEHAVIOUR IN THE LITERATURE

In the literature, scholars have focused on examining the

characteristics of Internet Banking and the factors

In figure 1, three groups of variables that are likely to

have an impact on customer satisfaction are grouped

together. These are Internet Banking system quality,

customer characteristics, and customers system

constraints. However, for the purpose of assisting

practitioners in building a more effective Internet

Figure 2: Conceptual model of the relationships

between Internet banking system and customer

satisfaction and loyalty

banking application and the impact of the technological

characteristics of Internet Banking are specially

considered.

Internet Banking system quality: this consists of

several independent variables such as transaction speed,

ease of use, convenience, accessibility, cost/benefit,

The Fourth International Conference on Electronic Business (ICEB2004) / Beijing

user empowerment, security and privacy [30, 34, 43, 46,

54].

Customer characteristics: Characteristics of Internet

banking customers identified from literature are

younger, high income earners [17, 41, 46, 17, 41], and

the better-educated [17, 41]. To date no significant

relationship between e-Banking and gender or

occupation has been identified [17, 41]. Zhang & Li [51]

suggest that health condition (disability, emotion i.e.

stress) also impact customer perceived usage of

technologies. Based on the above, age, income,

education, experience, disability and emotion are

included as customer characteristics in the conceptual

model.

Customers system constraints: System constraints

(hardware, software and Internet bandwidth) are likely

to affect the accessibility of Internet banking by

customers [51]. Customers with these constraints will

be deprived of Internet banking opportunities therefore

these technology issues are considered as contingent

variables.

Customer satisfaction is defined based on the

confirmation/disconfirmation

theory

that

states

satisfaction results from a process of comparison

where consumers judge product satisfaction against

their expectations about product performance[17].

Customer loyalty, in the behavioural approach, has

often been construed as repeat purchase frequency [22],

probability of future purchase [36] and intentions of

switching brand [19]. Cunningham [11] assesses

customer loyalty based on the proportion of money that

a customer spends with purchases from a single supplier.

In the attitudinal approach, a loyal customer must have

strong "attitudinal commitment" to a brand [16, 20].

Bank attributes: Customer loyalty/retention may result

from a banks reputation (brand name, well-known,

popularity), costs (interest rate, fees), convenience (i.e.

location and distance) and quality of banking service

[13]. Therefore, these factors have been taken into

account to identify the relationship between customer

satisfaction and customer loyalty.

From the literature review and the conceptual model,

the following hypotheses are thus stated:

H1. Better Internet banking system quality such as the

transaction speed, ease of use, convenience,

accessibility, cost/benefit, user empowerment, security,

and privacy is likely to have a positive impact on

customer satisfaction [30, 34, 46, 54].

H2. The difficulties of using technology due to

customer characteristics such as age, education, income,

disability and emotion are likely to moderate the

relationship between Internet Banking system quality

and customer satisfaction [17, 41, 46, and 55].

301

H3. The limitations of accessibility to technology due to

customer system constraints such as availability of

software, users system processing speed and Internet

bandwidth are likely to moderate the relationship

between Internet banking quality and customer

satisfaction [55].

H4. Customer satisfaction resulting from the usage of

Internet banking is likely to have a positive impact on

customer loyalty [13, 34].

6. CONCLUSION

This is a research in progress paper, providing an

overview of Internet banking, addressing a number of

issues identified from literature. Literature review

discussed above address Internet banking as well as

online banking customer issues. The hypothesis

presented above will be empirically tested to identify

customer satisfaction and loyalty in internet banking.

Research will be guided by the conceptual model

presented above as figure 2.

REFERENCES

1. Adams, L. S. & Martz, D. J. 2002, 'Developments

in cyberbanking', Business Lawyer, vol. 57, no. 3, pp.

1257-364.

2.

Ashford, W. 2004, 'Internet Banking Booms',

in Africa News Service.

3.

Australasian Business Intelligence 2002a,

'Internet banking: Australia enthusiastic but wary',

Australasian Business Intelligence.

4.

---- 2002b, 'Macquarie gives up on account

aggregation', Australasian Business Intelligence.

5.

---- 2002c, 'Wrapping up aggregation

accounts', Australasian Business Intelligence, March

31, 2002.

6.

Australian Bankers' Association 1999,

Banking on the Internet - a guide to personal Internet

banking

services,

http://www.bankers.asn.au/ABA/pdf/ibpart1.pdf,

(Accessed 3 June 2004)

7.

Barczak, G., Ellen, P. S. & Pilling, B. K. 1997,

'Developing typologies of consumer motives for use

technologically based banking services', Journal of

Business Research, vol. 38, no. 2, pp. 131-40.

8.

Black, N. J., Lockett, A., Winklhofer, H. &

Ennew, C. 2001, 'The adoption of Internet financial

services: a qualitative study', International Journal of

Retail & Distribution Management, vol. 29, no. 8, pp.

390-8.

9.

BPAY 2002, BPAY Certifies New OFX Server

Product from TPG, News Section 23 August 2002,

[Web],

http://www.bpay.com.au/about/news_detail.asp?id=7,

(Accessed 8 July 2004)

10.

Chang, Y. T. 2003, Dynamics of Banking

Technology Adoption: An Application to Internet

Banking, paper presented to Royal Economic Society

Annual Conference 2003 41 / Royal Economic Society

302

The Fourth International Conference on Electronic Business (ICEB2004) / Beijing

(RePEc:ecj:ac2003:41).

11.

Cunningham, R. M. 1956, 'Brand loyalty What, Where, How much?' Harvard Business Review,

vol. 34, no. 1, pp. 116-28.

12.

Daniel, E. 1999, Provision of Electronic

Banking in the UK and the Republic of Ireland, paper

presented to International Journal of Bank Marketing,

vol. 17, pp. 72-82.

13.

Ford, W. S. Z. 1998, Communicating with

Customers, Hampton Press. Inc., Cresskill, New Jersey.

14.

Furst, K., Lang, W. W. & Nolle, D. E. 2000,

Internet banking: Developments and Prospects,

http://www.occ.treas.gov/ftp/workpaper/wp2000-9.pdf,

(Accessed 2 May 2004)

15.

Gerrard, P. & Cunningham, J. B. 2003, 'The

diffusion of Internet banking among Singapore

consumers', International Journal of Bank Marketing,

vol. 21, no. 1, pp. 16-28.

16.

Guest, L. 1944, 'A study of brand loyalty',

Journal of Applied Psychology, vol. 28, pp. 16-27.

17.

Ho, S. C., Chan, C. F. & Hsu, D. I. 1990,

'New Banking Technology in Hong Kong',

International Journal of Bank Marketing, vol. 8, no. 6,

pp. 9-15.

18.

Howcroft, J. F., Hamilton, R. & Hewer, P.

2002, 'Consumer attitude and the usage and adoption of

home-banking in the United Kingdom', International

Journal of Bank Marketing, vol. 20, no. 3, pp. 111-21.

19.

Jacoby, J. & Kyner, D. 1973, 'Brand loyalty vs.

repeat purchasing behavior', Journal of Marketing

Research, vol. 10, no. 1, pp. 1-9.

20.

Jain, A. K., Pinson, C. & Malhotra, N. K.

1987, 'Customer loyalty as a construct in marketing of

banking services', International Journal of Bank

Marketing, vol. 5, pp. 49-72.

21.

Joseph, M. & Stone, G. 2003, 'An empirical

evaluation of US bank customer perceptions of the

impact of technology on service delivery in the

banking sector', International Journal of Retail &

Distribution Management, vol. 31, no. 4, pp. 190-202.

22.

Kahn, B. E., Kalwani, M. U. & Morrison, D.

G. 1986, 'Measuring variety seeking and reinforcement

behaviors using panel data', Journal of Marketing

Research, vol. 23, pp. 89-100.

23.

Karjaluoto, H., Mattila, M. & Pento, T. 2002,

'Factors underlying attitude formation towards online

banking in Finland', International Journal of Bank

Marketing, vol. 20, no. 6, pp. 261-72.

24.

KPMG 1998, Internet Banking Development,

Operations and Maintenance, KPMG Consulting

Group, An Industry White Page.

25.

Lee, D. 1999, Internet Banking and

E-Commerce, www.authnet.com, (Accessed 4 May

2004)

26.

Lee, E. J. & Lee, J. 2001, 'Consumer Adoption

of Internet Banking: Need Based And/Or Skill Based',

Marketing Management Journal, no. Spring 2001.

27.

Leong, S. K., Srikanthan, T. & Hura, G. S.

1998, 'An Internet application for on-line banking',

Computer Communications, vol. 20, pp. 1534-40.

28.

Li, F. 2001, 'The internet and the

deconstruction of the integrated banking model',

British Journal of Management, vol. 12, no. 4, pp.

307-9.

29.

Liao, S., Shao, Y. P., Wang, H. & Chen, A.

1999, 'The Adoption of Virtual Banking: an Empirical

Study', International Journal of Information

Management, vol. 19, no. 1, pp. 63-74.

30.

Liao, Z. & Cheung, M. T. 2002,

'Internet-based e-banking and customer attitudes: an

empirical study', Information & Management, vol. 39,

pp. 283-95.

31.

Mattila, M. 2003, 'Factors Affecting The

Adoption Of Mobile Banking Services', Journal of

Internet Banking and Commerce, vol. 8, no. 1.

32.

Mattila, M., Karjaluoto, H. & Pento, T. 2003,

'A review of brand-loyalty measures in marketing',

Tijdschrift voor Economie en Management, vol. 41, no.

4, p. 507(33).

33.

Moullakis, J. 2004, 'Internet banking triples in

three years.' Australasian Business Intelligence, Jan 26,

2004.

34.

Moutinho, L. & Smith, A. 2000, 'Modelling

bank customers' satisfaction through mediation of

attitudes towards human and automated banking',

International Journal of Bank Marketing, vol. 21, no. 1,

pp. 5-15.

35.

Mukherjee, A. & Nath, P. 2003, 'A model of

trust in online relationship banking', International

Journal of Bank Marketing, vol. 21, no. 1, pp. 5-15.

36.

Ostroki, P. L., O'Brien, T. V. & Gordon, G. L.

1993, 'Service quality and customer loyalty in the

commercial airline industry', Journal of Travel

Research, vol. 33, no. 2, pp. 16-24.

37.

Patricio, L., Fisk, R. P. & Cunha, J. F. 2003,

'Improving satisfaction with bank service offerings:

measuring the contribution of each delivery channel',

Managing Service Quality, vol. 13, no. 6, p. 471(82).

38.

Pessemier, E. 1959, 'A new way to determine

buying decision', Journal of Marketing, vol. 24, no. 2,

pp. 41-6.

39.

Plaskitt, S. 2002, 'Online banking numbers

surge', Australasian Business Intelligence, July 24,

2002.

40.

Polatoglu, V. N. & Ekin, S. 2001, 'An

empirical investigation of the Turkish consumers'

acceptance of Internet banking services', International

Journal of Bank Marketing, vol. 19, no. 4, pp. 156-65.

41.

Prendergast, G. P. 1993, 'Self Service

Technologies in Retail Banking: Current and Expected

Adoption Patterns', International Journal of Bank

Marketing, vol. 11, no. 7, pp. 29-35.

42.

Rotchanakitumnuai, S. & Speece, M. 2003,

'Barriers to Internet banking adoption: a qualitative

study among corporate customers in Thailand',

International Journal of Bank Marketing, vol. 21, no.

6/7, pp. 312-23.

43.

Sathye, M. 1999, 'Adoption of Internet

Banking by Australian Consumers: An Empirical

Investigation', International Journal of Bank Marketing,

The Fourth International Conference on Electronic Business (ICEB2004) / Beijing

vol. 17, no. 7, pp. 324-34.

44.

Sohail, M. S. & Shanmungham, B. 2003,

'E-Banking and Customer Preferences in Malaysia: An

Empirical Investigation', Information Sciences, vol.

150, no. 3-4, pp. 207-17.

45.

Suganthi, Balachandher & Balachandran 2001,

'Internet

Banking

Patronage:

An

Empirical

Investigation of Malaysia', Journal of Internet Banking

and Commerce, vol. 6, no. 1.

46.

Tan, A., Beaumont, N. & Freeman, S. 1999,

Demographics and Perceptions as Determinants of

Consumers' Use of Electronic Banking, Working Paper

Series, Department of Management, Monash

University.

47.

Turban, E., Lee, J., King, D. & Chung, H. M.

2000, Electronic Commerce: A Managerial Perspective,

Prentice Hall, Upper Saddle River, New York.

48.

Vatanasombut, B. 2001, Factors Affecting

Retention of Customers Who Are Users of

Computerized Application on the Internet: the Case of

Online Banking, PhD thesis, Claremont University.

49.

Vrechopoulos, A., G., S. & Doukidis, G. 2000,

'The Adoption of Internet Shopping by Electronic

Retail Consumers in Greece: Some Preliminary

Findings', Journal of Internet Banking and Commerce,

vol. 5, no. 2.

50.

Wall, S. 2001, 'Internet banking explosion',

Australian Banking & Finance, vol. 10, no. 12, p. 1.

51.

Wang, Y., Wang, Y., Lin, H. & Tang, T. 2003,

'Determinants of user acceptance of Internet banking:

an empirical study', International Journal of Service

Industry Management, vol. 14, no. 5, pp. 501-19.

303

52.

Wright, A. & Ralston, D. 2002, 'The lagging

development of Small Business Internet Banking in

Australia', Journal of Small Business Management, vol.

40, no. 1, pp. 51-8.

53.

Wu, C. H., Cheng, F. & Lin, H. 2004, 'Web

site Usability Evaluation of Internet Banking in

Taiwan', Journal of Internet Banking and Commerce,

vol. 9, no. 1.

54.

Yen, H. J. R. & Gwinner, K. P. 2003, 'Internet

retail customer loyalty: the mediating role of relational

benefits', International Journal of Service Industry

Management, vol. 14, no. 5, pp. 483-500.

55.

Zhang, P. & Li, N. 2004, 'An Assessment of

Human-Computer Interaction Research in Management

Information Systems: Topics And Methods', Computers

in Human Behavior, vol. 20, no. 2, p. 125.

56.

Singh, M., 2003, Managing a Secure

E-Business Environment, The 2003 International

Business Information Management Conference,

December 16 18, Cairo, Egypt, CD ROM.

57.

Singh, M. (2000), Electronic Commerce in

Australia: Opportunities and Factors Critical for

Success, proceedings of the 1st World Congress on the

Management of Electronic Commerce (CD ROM),

January 19 21, Hamilton, Ontario, Canada.

58.

Chaffey, D., 2004, E-Business and

E-Commerce Management Second Edition, Prentice

Hall, UK.

59.

Turban, E., King, D., Lee, J. and Viehland, D.,

2004, Electronic Commerce A managerial Perspective,

Prentice Hall, New Jersey

Anda mungkin juga menyukai

- FMDokumen14 halamanFMJorge Gonzalez LopezBelum ada peringkat

- Qualitative Research Digital BankingDokumen24 halamanQualitative Research Digital BankingMuhammad MohsinBelum ada peringkat

- 45 Vibrating ScreensDokumen12 halaman45 Vibrating ScreensSandi ApriandiBelum ada peringkat

- Getting Started With SOLIDWORKS PlasticsDokumen4 halamanGetting Started With SOLIDWORKS PlasticscititorulturmentatBelum ada peringkat

- Security Testing Handbook for Banking ApplicationsDari EverandSecurity Testing Handbook for Banking ApplicationsPenilaian: 5 dari 5 bintang5/5 (1)

- Accounting for Islamic Banks: Mudharabah FinancingDokumen32 halamanAccounting for Islamic Banks: Mudharabah FinancingYusuf Hussein40% (5)

- Recent Developments in The Chemistry of Halogen-Free Flame Retardant PolymersDokumen52 halamanRecent Developments in The Chemistry of Halogen-Free Flame Retardant PolymersThinh DangBelum ada peringkat

- E-Banking and Its Support ServicesDokumen25 halamanE-Banking and Its Support ServicesbhuvaneshkmrsBelum ada peringkat

- List of Steel Producer and Related AssociationsDokumen2 halamanList of Steel Producer and Related Associationsbindu pathakBelum ada peringkat

- E-Commerce Privacy and Security IssuesDokumen7 halamanE-Commerce Privacy and Security IssuesStephany Coderias0% (1)

- CASR Part 43 Amdt. 1 - Maintenance, Preventive Maintenance, Rebuilding and Alteration PDFDokumen21 halamanCASR Part 43 Amdt. 1 - Maintenance, Preventive Maintenance, Rebuilding and Alteration PDFHarry Nuryanto100% (2)

- PMDG 737NGX Introduction PDFDokumen135 halamanPMDG 737NGX Introduction PDFAdee FramadhaniBelum ada peringkat

- A B C D of E-BankingDokumen75 halamanA B C D of E-Bankinglove tannaBelum ada peringkat

- HSE Head ProtectionDokumen5 halamanHSE Head ProtectionPudding2007100% (1)

- AirbusSafetyLib - FLT - OPS - SOP - SEQ02 - Optimum Use of AutomationDokumen14 halamanAirbusSafetyLib - FLT - OPS - SOP - SEQ02 - Optimum Use of AutomationHarry NuryantoBelum ada peringkat

- Lec 1 - Introduction To Wireless CommunicationDokumen60 halamanLec 1 - Introduction To Wireless CommunicationYusuf HusseinBelum ada peringkat

- Implementation of EbankingDokumen11 halamanImplementation of EbankingVictory M. DankardBelum ada peringkat

- Information System For ManagersDokumen11 halamanInformation System For ManagersRupesh SinghBelum ada peringkat

- INTRODUCTION TO E-BANKING CUSTOMER PERCEPTIONSDokumen4 halamanINTRODUCTION TO E-BANKING CUSTOMER PERCEPTIONSk_prabinBelum ada peringkat

- K FinishDokumen63 halamanK FinishPrakash ChauhanBelum ada peringkat

- The Analysis of Confidence and SecurityDokumen8 halamanThe Analysis of Confidence and SecurityGeorgianaBelum ada peringkat

- FFIEC ITBooklet E-BankingDokumen84 halamanFFIEC ITBooklet E-BankingChico Setyo AsmoroBelum ada peringkat

- FFIEC's guide to managing risks in electronic bankingDokumen78 halamanFFIEC's guide to managing risks in electronic bankingahong100Belum ada peringkat

- EBSCO-FullText-2024-03-30Dokumen28 halamanEBSCO-FullText-2024-03-30AbrarHossainAsifBelum ada peringkat

- Theoretical SampleDokumen9 halamanTheoretical SampleJulie EscalanteBelum ada peringkat

- Security Challenges and Various Methods For Increasing Security in E-Commerce ApplicationsDokumen8 halamanSecurity Challenges and Various Methods For Increasing Security in E-Commerce ApplicationsIJRASETPublicationsBelum ada peringkat

- E Banking PMDokumen48 halamanE Banking PMArun Koshy ThomasBelum ada peringkat

- Online BankingDokumen28 halamanOnline BankingMuneeb SohailBelum ada peringkat

- VULNERABILITIES IN E-BANKINGDokumen14 halamanVULNERABILITIES IN E-BANKINGQuaqu Ophori AsieduBelum ada peringkat

- Online Banking Security Issues & ChallengesDokumen10 halamanOnline Banking Security Issues & ChallengesAyunni Azalin0% (1)

- Ustomer Perceptions On Nternet Banking Information ProtectionDokumen6 halamanUstomer Perceptions On Nternet Banking Information ProtectionDaniel BassawBelum ada peringkat

- ACCEPTABILITY With STATISTICSDokumen24 halamanACCEPTABILITY With STATISTICSJezza G. PlangBelum ada peringkat

- SECURITY ISSUES IN E-BANKINGDokumen16 halamanSECURITY ISSUES IN E-BANKINGmansiBelum ada peringkat

- Security Issues in E-Banking An ExplDokumen19 halamanSecurity Issues in E-Banking An ExplVijayendra GuptaBelum ada peringkat

- Impact of Online Banking Services: A Study: Associate Professor, Department of Commerce, Alagappa University, KaraikudiDokumen10 halamanImpact of Online Banking Services: A Study: Associate Professor, Department of Commerce, Alagappa University, KaraikudiALL OVER EMPIREBelum ada peringkat

- Trust & Security Issues in Mobile Banking and Its Effect On CustomersDokumen5 halamanTrust & Security Issues in Mobile Banking and Its Effect On CustomersvauwnullBelum ada peringkat

- Ijcsn 2012 1 6 41Dokumen9 halamanIjcsn 2012 1 6 41ijcsnBelum ada peringkat

- A Review of IoT in Banking Industry Manasvi RizviDokumen5 halamanA Review of IoT in Banking Industry Manasvi RizvigualabaBelum ada peringkat

- Study On Impact of Internet Banking in Present ScenarioDokumen57 halamanStudy On Impact of Internet Banking in Present ScenarioGarima MandirattaBelum ada peringkat

- EBM ASSESMENT 2Dokumen21 halamanEBM ASSESMENT 2neymarvikeshBelum ada peringkat

- Full Report Ppta 18.5Dokumen58 halamanFull Report Ppta 18.5kstools. veenaaBelum ada peringkat

- INTRODUCTION of ProjectDokumen16 halamanINTRODUCTION of ProjectSiddhi mahadikBelum ada peringkat

- The Three Pillars of TrustDokumen12 halamanThe Three Pillars of Trustsamir47Belum ada peringkat

- Safety in Business-To-Business Online TransactionsDokumen6 halamanSafety in Business-To-Business Online TransactionsIJRASETPublicationsBelum ada peringkat

- Group 1 ProjectDokumen47 halamanGroup 1 ProjectKurmi MainaBelum ada peringkat

- V2 N2 Paper 2Dokumen7 halamanV2 N2 Paper 2sami teferiBelum ada peringkat

- Definition of E-BankingDokumen10 halamanDefinition of E-BankingMaximiliano CentenoBelum ada peringkat

- REGULATORY AND SUPERVISORY CONCERNS IN INTERNET BANKINGDokumen24 halamanREGULATORY AND SUPERVISORY CONCERNS IN INTERNET BANKINGAbhi TiwariBelum ada peringkat

- A Comparative Study of Customer Perception Toward E-Banking Services Provided by Selected Private & Public Sector Bank in IndiaDokumen5 halamanA Comparative Study of Customer Perception Toward E-Banking Services Provided by Selected Private & Public Sector Bank in IndiaPooja AdhikariBelum ada peringkat

- E-BANKING IN INDIA: An InsightDokumen12 halamanE-BANKING IN INDIA: An InsightSandyBelum ada peringkat

- Electronic Business: May ContainDokumen11 halamanElectronic Business: May ContainHarshit MathurBelum ada peringkat

- Trust Agus 2021Dokumen10 halamanTrust Agus 2021mochamad sirodjudinBelum ada peringkat

- Sanket AssignmentDokumen8 halamanSanket AssignmentAniket KolapateBelum ada peringkat

- Security of E-Banking in Bangladesh: January 2016Dokumen9 halamanSecurity of E-Banking in Bangladesh: January 2016Sadia RipaBelum ada peringkat

- Lecture 1 - Intro To EbankingDokumen18 halamanLecture 1 - Intro To Ebankingtagashii100% (3)

- An Empirical Investigation of The Level of Users' Acceptance of E-Banking in NigeriaDokumen13 halamanAn Empirical Investigation of The Level of Users' Acceptance of E-Banking in NigeriajgkjykiykjhBelum ada peringkat

- Big Data Concern With Web Applications: The Growth Enhancement For Free Venture ProposalDokumen2 halamanBig Data Concern With Web Applications: The Growth Enhancement For Free Venture ProposalasBelum ada peringkat

- E-business overview and security measuresDokumen10 halamanE-business overview and security measuressandeepkumarkalvaBelum ada peringkat

- 1 Information Systems For ManagersDokumen9 halaman1 Information Systems For Managersasaurav566Belum ada peringkat

- Computer Security Issues in Online BankingDokumen12 halamanComputer Security Issues in Online BankingGanesh RaoBelum ada peringkat

- ECOMMERCEDokumen5 halamanECOMMERCECourier systemBelum ada peringkat

- History of BankingDokumen14 halamanHistory of Bankingrajeshpathak9Belum ada peringkat

- 72pada CSITEdDokumen16 halaman72pada CSITEdHamid ihsanBelum ada peringkat

- Alternate Channel BankingDokumen51 halamanAlternate Channel BankingfruitnutsBelum ada peringkat

- Prromise ResearchDokumen16 halamanPrromise ResearchNicholas LorenredBelum ada peringkat

- Technology in Society: Feng Li, Hui Lu, Meiqian Hou, Kangle Cui, Mehdi DarbandiDokumen11 halamanTechnology in Society: Feng Li, Hui Lu, Meiqian Hou, Kangle Cui, Mehdi Darbandibuat meetingBelum ada peringkat

- A Study On Recent Trends and Development in The Indian Banking IndustryDokumen6 halamanA Study On Recent Trends and Development in The Indian Banking IndustryIJRASETPublicationsBelum ada peringkat

- Internet BankingDokumen11 halamanInternet Bankinglakshmijey123Belum ada peringkat

- Kirti Um8803 Akshita Um8103 Nisha Um8109 Shivani Um8808Dokumen47 halamanKirti Um8803 Akshita Um8103 Nisha Um8109 Shivani Um8808Siddhant SingalBelum ada peringkat

- Implementation of a Central Electronic Mail & Filing StructureDari EverandImplementation of a Central Electronic Mail & Filing StructureBelum ada peringkat

- Resource Usage: Issues Covered in This ChapterDokumen21 halamanResource Usage: Issues Covered in This ChapterYusuf HusseinBelum ada peringkat

- Statistics and Research MethodsDokumen5 halamanStatistics and Research MethodsYusuf HusseinBelum ada peringkat

- Ch02 LeadershipDokumen60 halamanCh02 LeadershipYusuf HusseinBelum ada peringkat

- Acc 255 Final Exam Review Packet (New Material)Dokumen6 halamanAcc 255 Final Exam Review Packet (New Material)Tajalli FatimaBelum ada peringkat

- Final Exam Research Methods ANTH 410/510Dokumen7 halamanFinal Exam Research Methods ANTH 410/510Yusuf HusseinBelum ada peringkat

- Linear Regression Is An Important Concept in Finance and Practically All Forms of ResearchDokumen10 halamanLinear Regression Is An Important Concept in Finance and Practically All Forms of ResearchYusuf HusseinBelum ada peringkat

- Format of The ResearchDokumen2 halamanFormat of The ResearchYusuf HusseinBelum ada peringkat

- Yaaqshiid: 1 Xaafadaha, Laamaha Iyo Waax-AhaDokumen4 halamanYaaqshiid: 1 Xaafadaha, Laamaha Iyo Waax-AhaYusuf HusseinBelum ada peringkat

- BankingDokumen20 halamanBankingYusuf HusseinBelum ada peringkat

- Except The: Income Sharing RatioDokumen1 halamanExcept The: Income Sharing RatioYusuf HusseinBelum ada peringkat

- RSH - Qam11 - Excel and Excel QM Explsm2010Dokumen153 halamanRSH - Qam11 - Excel and Excel QM Explsm2010Yusuf HusseinBelum ada peringkat

- Abdc Journal Quality List 2013Dokumen32 halamanAbdc Journal Quality List 2013PratikJainBelum ada peringkat

- Lesson ThreeDokumen14 halamanLesson ThreeYusuf HusseinBelum ada peringkat

- QuizzDokumen1 halamanQuizzYusuf HusseinBelum ada peringkat

- Chapter EightDokumen11 halamanChapter EightYusuf HusseinBelum ada peringkat

- Exam 2 Sample SolutionDokumen6 halamanExam 2 Sample SolutionYusuf HusseinBelum ada peringkat

- Data and Process Modeling: Husein OsmanDokumen17 halamanData and Process Modeling: Husein OsmanYusuf HusseinBelum ada peringkat

- Key Concepts: Week 5 Lesson 3: Economic Order Quantity (EOQ) ExtensionsDokumen5 halamanKey Concepts: Week 5 Lesson 3: Economic Order Quantity (EOQ) ExtensionsYusuf HusseinBelum ada peringkat

- Test OneDokumen8 halamanTest OneYusuf HusseinBelum ada peringkat

- Example DVDDokumen17 halamanExample DVDYusuf HusseinBelum ada peringkat

- 6 - 2 - Lectures NotesDokumen103 halaman6 - 2 - Lectures NotesYusuf HusseinBelum ada peringkat

- Chapter 1Dokumen29 halamanChapter 1Yusuf Hussein100% (2)

- Chapter Four: Entering Beginning BalancesDokumen4 halamanChapter Four: Entering Beginning BalancesYusuf HusseinBelum ada peringkat

- Ackoff's Management Misinformation SystemsDokumen5 halamanAckoff's Management Misinformation SystemsAnna KarousiotiBelum ada peringkat

- Capital BudgetDokumen124 halamanCapital BudgetYusuf HusseinBelum ada peringkat

- Islamic Banking Ideal N RealityDokumen19 halamanIslamic Banking Ideal N RealityIbnu TaimiyyahBelum ada peringkat

- Simplex Method Solves Linear Programming ProblemsDokumen34 halamanSimplex Method Solves Linear Programming ProblemsYusuf HusseinBelum ada peringkat

- Mcom Ac Paper IIDokumen282 halamanMcom Ac Paper IIAmar Kant Pandey100% (1)

- BLP Pipeline Resellers CatalogDokumen12 halamanBLP Pipeline Resellers CatalogalefleavBelum ada peringkat

- Rapid Investment Casting: Direct and Indirect Approaches Via Fused Deposition ModellingDokumen9 halamanRapid Investment Casting: Direct and Indirect Approaches Via Fused Deposition ModellingNitin GroverBelum ada peringkat

- Using Workforce Compensation PDFDokumen203 halamanUsing Workforce Compensation PDFChary MadarapuBelum ada peringkat

- Mehak Industries: Quality Assurance Plan For Logitudinal/Circumferential Welded M.S. PipeDokumen1 halamanMehak Industries: Quality Assurance Plan For Logitudinal/Circumferential Welded M.S. PipeSadiq ShakilBelum ada peringkat

- As ISO 140.6-2006 Acoustics - Measurement of Sound Insulation in Buildings and of Building Elements LaboratorDokumen6 halamanAs ISO 140.6-2006 Acoustics - Measurement of Sound Insulation in Buildings and of Building Elements LaboratorSAI Global - APACBelum ada peringkat

- Ebm-Papst 6318 - 19HPU Server - Round Fan 6318 - 19HPU - PCHubDokumen2 halamanEbm-Papst 6318 - 19HPU Server - Round Fan 6318 - 19HPU - PCHubBruno NascimentoBelum ada peringkat

- MIS Project Example 2Dokumen59 halamanMIS Project Example 2bossman89100% (1)

- Time Table of GDR (German Democratic Republic) Interchangeable Lenses For 35 MM Cameras ©Dokumen3 halamanTime Table of GDR (German Democratic Republic) Interchangeable Lenses For 35 MM Cameras ©sgalaxys5660Belum ada peringkat

- Indian Standard: Code of Practice For Training and Testing of Metal Arc WeldersDokumen56 halamanIndian Standard: Code of Practice For Training and Testing of Metal Arc WeldersramramramramramrabBelum ada peringkat

- Data Warehousing Interview Questions and AnswersDokumen5 halamanData Warehousing Interview Questions and Answerssiva_mmBelum ada peringkat

- Problems On Operating CostingDokumen2 halamanProblems On Operating Costingcoolstuf4uBelum ada peringkat

- Li Ukkonen 2014Dokumen21 halamanLi Ukkonen 2014Lavanya SothiBelum ada peringkat

- Production Planning ManagerDokumen2 halamanProduction Planning ManagerNitin Verma100% (1)

- Management Information System of Event Organizer: I Made Gede Yudiyana, Andrew Sumichan, Ni Wayan Sri AriyaniDokumen7 halamanManagement Information System of Event Organizer: I Made Gede Yudiyana, Andrew Sumichan, Ni Wayan Sri AriyaniGame GMBelum ada peringkat

- Nuvoco launches designer concrete collection with Gauri KhanDokumen2 halamanNuvoco launches designer concrete collection with Gauri Khankashyappathak01Belum ada peringkat

- Step by Step Legacy System Migration Workbench - LSMWDokumen3 halamanStep by Step Legacy System Migration Workbench - LSMWK Veera Kishore KumarBelum ada peringkat

- Adf Code GuidelinesDokumen42 halamanAdf Code Guidelineskien tran dongBelum ada peringkat

- CatalogmagneticcouplerDokumen12 halamanCatalogmagneticcouplerNian S KoBelum ada peringkat

- Esd.70J / 1.145J Engineering Economy Module: Mit OpencoursewareDokumen14 halamanEsd.70J / 1.145J Engineering Economy Module: Mit OpencoursewarePanagiotis StamatisBelum ada peringkat

- Powerware 9170 Tower User Guide UPSDokumen126 halamanPowerware 9170 Tower User Guide UPSgladdyloweBelum ada peringkat

- Product Lifecycle Management: Dr. Michael Grieves Co-Director U of M PLM Development Consortium WWW - Plmdc.engin - Umich.eduDokumen24 halamanProduct Lifecycle Management: Dr. Michael Grieves Co-Director U of M PLM Development Consortium WWW - Plmdc.engin - Umich.eduiwc2008007100% (1)