WKW Roof Rail Systems Tax Abatement Information

Diunggah oleh

Dillon DavisJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

WKW Roof Rail Systems Tax Abatement Information

Diunggah oleh

Dillon DavisHak Cipta:

Format Tersedia

Coversheet

Page 1 of 3

Resolution

NO. 78

A Resolution approving an Industrial Facilities Exemption Certificate on behalf of WKW Roof Rail Systems LLC for real and tangible personal

property located at 215 N. Hill Brady Road in Industrial District No. 2, and having an estimated cost of $54,491,210.

BATTLE CREEK, MICHIGAN - 2/3/2015

Resolved by the Commission of the City of Battle Creek:

On December 30, 2014, an application was submitted on behalf of WKW Roof Rail Systems LLC for an Industrial Facilities Tax Exemption

Certificate under Act 198 of the Public Acts of 1974, as amended, with respect to certain industrial property set forth in the application located

within the boundaries of Industrial Development District No. 2 established by Resolution December 2, 1975; and

After notice was given as required by law, the City Commission of the City of Battle Creek held a public hearing on the 3rd of February at 7:00

PM and the opportunity to be heard was offered to the Assessor and representatives of all taxing units affected by the application referred to

above, as well as to all other interested parties; and

It appears to this Commission that the application filed on behalf of WKW Roof Rail Systems LLC for an Industrial Facilities Tax Exemption

Certificate with respect to the property described in it complies in all respects with the requirements of the Act; and the WKW Roof Rail

Systems LLC complies with the Citys Equal Employment Opportunity Policy; and now

1. The Commission determines that the granting of this Industrial Facilities Tax Exemption Certificate required by the application of WKW

Roof Rail Systems LLC is in keeping with the Commissions policy in granting these certificates, effective on June 10, 1986.

2. The Commission determines that the granting of this Industrial Facilities Tax Exemption Certificate requested by WKW Roof Rail Systems

LLC together with all other Industrial Facilities Exemption Certificates presently in effect, will not have the effect of substantially impeding the

operation of the City of Battle Creek and will not impair the financial soundness of any taxing unit which levies ad valorem property taxes in the

City of Battle Creek.

3. The application of WKW Roof Rail Systems LLC for an Industrial Facilities Tax Exemption Certificate with respect to the property described

in it has an estimated cost of $54,491,210 for real and tangible personal property and is approved for twelve (12) years after completion.

4. The Commission determines that the facilities, which are subject to the previously mentioned application, were not installed more than six

months prior to filing of the application and will be completed in not more than two years.

5. The aggregate SEV of real and personal property exempt from ad valorem taxes within the City of Battle Creek after granting this certificate

will exceed 5% of an amount equal to the sum of the SEV of the unit, plus the SEV of personal and real property thus exempted.

6. The application of WKW Roof Rail Systems LLC together with all other pertinent documents as required by the Act, including proper

evidence of this Commissions approval of the application shall be forwarded to the Michigan State Tax Commission by the City Clerk in

accordance with the requirements of this Act.

I, Victoria Houser, City Clerk of the City of Battle Creek, hereby certify the above and foregoing is a true and correct copy of a Resolution

adopted by the Battle Creek City Commission at a Regular meeting held on February 3, 2015.

Victoria Houser

Battle Creek City Commission

2/3/2015

Action Summary

Staff Member:

Steven M. Hudson

Department:

Assessing

SUMMARY

http://battlecreek.novusagenda.com/agendapublic/CoverSheet.aspx?ItemID=675&Meetin... 11/16/2016

Coversheet

Page 2 of 3

A Resolution approving an Industrial Facilities Exemption Certificate on behalf of WKW Roof Rail Systems LLC for real and tangible

personal property located at 215 N. Hill Brady Road in Industrial District No. 2, and having an estimated cost of $54,491,210.

BUDGETARY CONSIDERATIONS

CITY OF BATTLE CREEK

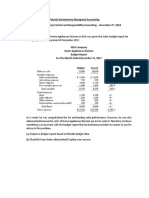

Assessor's Application Review & Tax Analysis for Industrial Facilities Tax Exemption Request

Applicant:

WKW ROOF RAIL SYSTEMS, LLC

Location of Facility:

215 N. Hill Brady Road

Application Filed:

12/30/2014

Industrial Development District:

IDD No. 2

Special District(s) Containing Facility:

TIFA

Type of Facility:

Description of Facility:

NEW

Real property improvements include converting an existing building used as warehouse to an industrial automotive

supply components facility. Equipment purchases will enable production and assembly of manufactured parts.

Property Type

Real

Estimated

Construction

Construction

# of Years

Investment

Begins

Ends

Eligible

$4,634,497

7/18/2014

12/30/201612

$49,856,713

Total:

$54,491,210NOTE: Abatement ends 12 years after project completion.

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

TOTALS

12/30/201612

12/30/2027

Personal*

Tax Year

7/18/2014

Abatement Ends

12/30/2027

ESTIMATED PROPERTY TAXES OVER LIFE OF CERTIFICATE

Taxable

Taxes Without Taxes With

Taxes

Abatement Years

Value

Abatement

Abatement

Abated

$1,287,284

$45,422

$24,834

$20,5881st Year Abatement

$2,317,249

$163,811

$89,629

$74,1822nd Year Abatement

$2,317,249

$163,811

$89,629

$74,1823rd Year Abatement

$2,317,249

$163,811

$89,629

$74,1824th Year Abatement

$2,317,249

$163,811

$89,629

$74,1825th Year Abatement

$2,317,249

$163,811

$89,629

$74,1826th Year Abatement

$2,317,249

$163,811

$89,629

$74,1827th Year Abatement

$2,317,249

$163,811

$89,629

$74,1828th Year Abatement

$2,317,249

$163,811

$89,629

$74,1829th Year Abatement

$2,317,249

$163,811

$89,629

$74,18210th Year Abatement

$2,317,249

$163,811

$89,629

$74,18211th Year Abatement

$2,317,249

$163,811

$89,629

$74,18212th Year Abatement

$2,317,249

$163,811

$89,629

$74,18213th Year Abatement

$2,011,154

$1,100,381

$910,772

Expected # of jobs to be created within 2 years of completion:

186

Expected # of jobs to be retained as a result of this project:

19

City's Current Abatement Ratio (including this application):

Proposed TOTAL Taxes to be Abated over Life of Certificate:

Real

Personal

Full

63.6266

39.6266Submitted by:

Millage**

IFT

34.8132

19.8132

Millage**

*New personal property becomes exempt in 2016

**Does not include 1% administrative fee

21.22%

$910,772

Steven Hudson, MMAO 4

City Assessor

ANALYSIS IS FOR ILLUSTRATIVE PURPOSES ONLY

ACTUAL AMOUNT AND DURATION OF INCENTIVE SUBJECT TO CITY COMMISSION APPROVAL

HISTORY, BACKGROUND and DISCUSSION

This resolution approves a new Industrial Facilities Tax Exemption for WKW Roof Rail Systems LLC.

DISCUSSION OF THE ISSUE

http://battlecreek.novusagenda.com/agendapublic/CoverSheet.aspx?ItemID=675&Meetin... 11/16/2016

Coversheet

Page 3 of 3

POSITIONS

ATTACHMENTS:

File Name

Description

WKW_IFT_Application_12-30-14.pdf

WKW Roof Rail System LLC IFT Application

Resolution_64_Setting_Public_Hearing_for_WKW_Roof_Rail_Systems_LLC.pdf

Resolution 64 Setting Public Hearing For WKW IFT Application

http://battlecreek.novusagenda.com/agendapublic/CoverSheet.aspx?ItemID=675&Meetin... 11/16/2016

Anda mungkin juga menyukai

- Report: Valhalla High Supervisor Used 'Inappropriate' Restraint in Breaking Up Fight, Should Be ReassignedDokumen36 halamanReport: Valhalla High Supervisor Used 'Inappropriate' Restraint in Breaking Up Fight, Should Be ReassignedDillon DavisBelum ada peringkat

- Community Development Loan AgreementDokumen10 halamanCommunity Development Loan AgreementDillon DavisBelum ada peringkat

- Barrio Logan Community Plan, October 2021 DraftDokumen142 halamanBarrio Logan Community Plan, October 2021 DraftDillon DavisBelum ada peringkat

- NTSB Crash Preliminary Report On Oct. 11 Santee Neighborhood CrashDokumen3 halamanNTSB Crash Preliminary Report On Oct. 11 Santee Neighborhood CrashDillon DavisBelum ada peringkat

- Asheville City Staff Report Re: Create 72 BroadwayDokumen3 halamanAsheville City Staff Report Re: Create 72 BroadwayDillon DavisBelum ada peringkat

- TMIP Phase 1 Full Report-Final, October 2019Dokumen164 halamanTMIP Phase 1 Full Report-Final, October 2019Dillon DavisBelum ada peringkat

- Video of San Diego County Sheriff's Deputy Collapsing After Fentanyl Exposure Raises QuestionsDokumen48 halamanVideo of San Diego County Sheriff's Deputy Collapsing After Fentanyl Exposure Raises QuestionsDillon DavisBelum ada peringkat

- San Diego Unified COVID-19 Vaccination RoadmapDokumen17 halamanSan Diego Unified COVID-19 Vaccination RoadmapDillon DavisBelum ada peringkat

- Santa Barbara Father Indicted For Killing 2 Young Children in MexicoDokumen4 halamanSanta Barbara Father Indicted For Killing 2 Young Children in MexicoDillon DavisBelum ada peringkat

- TMIP Phase 1 Report Without Appendix, October 2019Dokumen105 halamanTMIP Phase 1 Report Without Appendix, October 2019Dillon DavisBelum ada peringkat

- Haywood Page Visioning Report, City of AshevilleDokumen21 halamanHaywood Page Visioning Report, City of AshevilleDillon DavisBelum ada peringkat

- NTSB Crash Preliminary Report of Buncombe County Plane CrashDokumen4 halamanNTSB Crash Preliminary Report of Buncombe County Plane CrashDillon DavisBelum ada peringkat

- 3 North County Districts Ask State To Allow Vaccinated Staff, Students To Have Mask ChoiceDokumen2 halaman3 North County Districts Ask State To Allow Vaccinated Staff, Students To Have Mask ChoiceDillon DavisBelum ada peringkat

- Buncombe County Resident Survey Report FinalDokumen42 halamanBuncombe County Resident Survey Report FinalDillon DavisBelum ada peringkat

- City of Asheville: Create 72 Broadway Mixed-Use Hotel Staff ReportDokumen31 halamanCity of Asheville: Create 72 Broadway Mixed-Use Hotel Staff ReportDillon DavisBelum ada peringkat

- City of Asheville: Policy On Affordable Housing On City LandDokumen13 halamanCity of Asheville: Policy On Affordable Housing On City LandDillon DavisBelum ada peringkat

- New Americans in Asheville, A Report by New American EconomyDokumen2 halamanNew Americans in Asheville, A Report by New American EconomyDillon DavisBelum ada peringkat

- Buncombe County Board of Commissioners, Economic Development Update, Aug. 20, 2019Dokumen32 halamanBuncombe County Board of Commissioners, Economic Development Update, Aug. 20, 2019Dillon DavisBelum ada peringkat

- Asheville Flatiron Building Proposal, April 2019Dokumen45 halamanAsheville Flatiron Building Proposal, April 2019Dillon DavisBelum ada peringkat

- Duke Energy Hot Springs Microgrid State FilingDokumen18 halamanDuke Energy Hot Springs Microgrid State FilingDillon DavisBelum ada peringkat

- RAB Builders v. Buncombe County Lawsuit, 2019Dokumen122 halamanRAB Builders v. Buncombe County Lawsuit, 2019Dillon DavisBelum ada peringkat

- Memo in SPT of MTD RAB v. County WDNC 19-182 (6!7!2019)Dokumen26 halamanMemo in SPT of MTD RAB v. County WDNC 19-182 (6!7!2019)Dillon DavisBelum ada peringkat

- City of Asheville Staff PowerPoint For Civic Center Naming RightsDokumen16 halamanCity of Asheville Staff PowerPoint For Civic Center Naming RightsDillon DavisBelum ada peringkat

- Dogwood Health Trust CEO Leadership Profile, March 2019Dokumen13 halamanDogwood Health Trust CEO Leadership Profile, March 2019Dillon DavisBelum ada peringkat

- City of Asheville: Homestays & STVRs Update, Feb. 2019Dokumen2 halamanCity of Asheville: Homestays & STVRs Update, Feb. 2019Dillon DavisBelum ada peringkat

- Buncombe County Community Health Improvement Process, March 2019Dokumen11 halamanBuncombe County Community Health Improvement Process, March 2019Dillon DavisBelum ada peringkat

- Bennjin Lao For STR, Inc. Presentation On Buncombe County Lodging, February 2019Dokumen51 halamanBennjin Lao For STR, Inc. Presentation On Buncombe County Lodging, February 2019Dillon DavisBelum ada peringkat

- Asheville Downtown Commission: Flatiron Building Renderings, Feb. 2019Dokumen29 halamanAsheville Downtown Commission: Flatiron Building Renderings, Feb. 2019Dillon Davis100% (1)

- Asheville City Council, Down Payment Assistance PolicyDokumen11 halamanAsheville City Council, Down Payment Assistance PolicyDillon DavisBelum ada peringkat

- Mission Health-HCA Healthcare, Amended and Restated APA - Main Text (Public)Dokumen160 halamanMission Health-HCA Healthcare, Amended and Restated APA - Main Text (Public)Dillon Davis67% (3)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Planned Value (Dokumen7 halamanPlanned Value (Randy DonatoBelum ada peringkat

- Jam and JellyDokumen28 halamanJam and Jellybig johnBelum ada peringkat

- Katia Sachoute Ead 510 School Budgetary Needs Assessment SurveyDokumen4 halamanKatia Sachoute Ead 510 School Budgetary Needs Assessment Surveyapi-639561119Belum ada peringkat

- Presentation On Planning Commission REVISEDDokumen55 halamanPresentation On Planning Commission REVISEDsyedamiriqbalBelum ada peringkat

- Constitutional challenges to the Philippines' Anti-Violence Against Women ActDokumen84 halamanConstitutional challenges to the Philippines' Anti-Violence Against Women ActNah ReeBelum ada peringkat

- Pool of Questions of Economix Quizbee 2013Dokumen17 halamanPool of Questions of Economix Quizbee 2013John Vincent Pardilla100% (1)

- Financial Planning, Tools EtcDokumen31 halamanFinancial Planning, Tools EtcEowyn DianaBelum ada peringkat

- NLC functions and operationsDokumen10 halamanNLC functions and operationsPujaMishraBelum ada peringkat

- Cost Accounting 1-3 FinalDokumen21 halamanCost Accounting 1-3 FinalChristian Blanza LlevaBelum ada peringkat

- Relationship Between Funding and The RankingsDokumen2 halamanRelationship Between Funding and The Rankingssaiki kBelum ada peringkat

- FY2021-22 Six-Month Activity ReportDokumen30 halamanFY2021-22 Six-Month Activity ReportBernewsAdminBelum ada peringkat

- Downloaded From WWW - Dbm.gov - PH WebsiteDokumen16 halamanDownloaded From WWW - Dbm.gov - PH WebsiteJean Monique Oabel-TolentinoBelum ada peringkat

- BAB 2024 CH09 - Budgetary PlanningDokumen79 halamanBAB 2024 CH09 - Budgetary Planningmini3110100% (1)

- The Fiscal Cliff ExplainedDokumen14 halamanThe Fiscal Cliff ExplainedasfawmBelum ada peringkat

- Flexible Budget Examples Chapter 18Dokumen9 halamanFlexible Budget Examples Chapter 18Surbhi JainBelum ada peringkat

- List of SAP T-CodesDokumen18 halamanList of SAP T-CodesastinetBelum ada peringkat

- 1 Intro To Financial MGMT (Slides)Dokumen22 halaman1 Intro To Financial MGMT (Slides)Ju RaizahBelum ada peringkat

- Budget Case StudyDokumen13 halamanBudget Case StudyChris Jackson'sBelum ada peringkat

- Economic Policy STDokumen7 halamanEconomic Policy STmyBelum ada peringkat

- Managerial Accounting ExerciseDokumen2 halamanManagerial Accounting Exerciseivan_ferdian_1Belum ada peringkat

- BLGF ESRE Harmonization Guidelines March 2012Dokumen54 halamanBLGF ESRE Harmonization Guidelines March 2012LalaLanibaBelum ada peringkat

- City of Columbus 2021 Proposed BudgetDokumen426 halamanCity of Columbus 2021 Proposed BudgetABC6/FOX28Belum ada peringkat

- Estimating ManualDokumen270 halamanEstimating ManualIon Logofătu Albert100% (7)

- Formulas For Calculating FinanceDokumen61 halamanFormulas For Calculating FinanceRukshar KhanBelum ada peringkat

- Advantages and Disadvantages of Single Currency 07Dokumen3 halamanAdvantages and Disadvantages of Single Currency 07vcs89Belum ada peringkat

- Cindy and Jack Have Always Practiced Good Financial Habits inDokumen1 halamanCindy and Jack Have Always Practiced Good Financial Habits inAmit PandeyBelum ada peringkat

- 2012 Barangay Annual Report of Sta. Cruz NorteDokumen30 halaman2012 Barangay Annual Report of Sta. Cruz NorteObed Andalis95% (21)

- QBDokumen34 halamanQBAadeel NooraniBelum ada peringkat

- Chapter 8: Assessing New Venture's Financial StrengthDokumen22 halamanChapter 8: Assessing New Venture's Financial StrengthHossain RajuBelum ada peringkat

- Program Budgetary Needs AssessmentDokumen3 halamanProgram Budgetary Needs Assessmentapi-578727511100% (1)