Policies and Guidelines On Cash Advances

Diunggah oleh

Pau Line EscosioJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Policies and Guidelines On Cash Advances

Diunggah oleh

Pau Line EscosioHak Cipta:

Format Tersedia

POLICIES AND GUIDELINES ON CASH ADVANCES

WHEREAS, it is necessary to promulgate policies and guidelines regarding cash advances as part of the

internal control measures of the corporation;

Title: POLICIES AND GUIDELINES ON CASH ADVANCES

I.

PURPOSES OF CASH ADVANCES Cash Advances may be allowed only for official/operational

purposes. to wit:

1)

2)

3)

4)

5)

II.

LIMITS ON AMOUNT OF CASH ADVANCE

1)

2)

3)

4)

III.

Purchases of office supplies, fixed assets, merchandise inventory and other supplies when direct

payment to the vendor/supplier is not possible under the circumstances of the transaction, or

when payment by check is not possible

Expenses for repairs, maintenance, and other services

Seminars, conferences, conventions, meetings and training attended by officers and staff

Other expenditures necessary for the continued operation of the cooperatives business, such as

motor vehicle rental, traveling expenses, and other necessary services

Cash advances for salaries, wages or allowances of office employees and staff shall be allowed

provided, that these are only for, and do not exceed, the total amount due in the current pay

period, and are fully deducted automatically on the nearest payday after the cash advance has

been made.

Only officers and staff of the cooperative shall be allowed to make cash advances which shall not

exceed Twenty Thousand Pesos (P20,000), Only Bonded Officer shall allowed to make cash

advances amounting to more than Twenty Thousand Pesos (P20,000).

The amount of cash advance shall be limited to the price of the item/s to be purchased, repairs to

be undertaken and services to be rendered by Companies/Dealers/Suppliers who do not accept

checks as payment.

For cash advances re; purchases, repairs and services, such shall be canvassed first to have an

idea how much cash advance is to be taken. For this purpose, Request slip, purchase order or

job order should be prepared first by the end user, duly approved by the approving authority.

For cash advances regarding travels for two days or more, to attend conventions, seminars and

trainings, this shall be limited to seminar fees, if any; per diems/traveling allowances, lodging fees

and transportation expenses.

APPROVAL OF CASH ADVANCES the approval of cash advances is hereby assigned based on the

amounts as follows:

1. Manager Up to 20,000

2. The Chairman Over 20,000 to P100, 000

3. Majority of the Board of Directors Over 100,000 to P500, 000

4. General Assembly Over P500, 000

IV. LIQUIDATION OF CASH ADVANCES

1)

2)

3)

All cash advances shall be liquidated within seven days after the transaction has been

consummated for which cash advance was taken.

Statement of liquidation expenses should be prepared by the employee who took the cash

advance. Such liquidation statement should be properly supported and documented. As such, the

bookkeeper shall ensure the accuracy, authenticity and correctness of data in the documents

prior to booking of liquidation.

No succeeding cash advances shall be granted unless the previous cash advance has been

properly liquidated in full.

4)

5)

IV.

Cash advances not liquidated within the period specific shall be booked as accounts receivable

from the officer or management staff concerned who made such cash advances and will bear an

interest rate of one percent (1%) per month, automatically deducted from the salaries for a

maximum period of twelve (12) months until settled in full. Provided however, when the unliquidated amount is less than P1, 200 the deduction period is a maximum of 6 months.

All cash advances are subject to post audit by the Audit and Inventory Committee, while cash

advances amounting to more than P20,000 are subject to both pre and post audit by the Audit

and Inventory Committee as part of the cooperatives internal control measures.

CASH ADVANCE FORMS

1)

The Treasurer or Cashier shall not make any disbursement for cash advance unless supported by

a duly approved Cash Advance Form. The following forms shall be printed and used in requesting

and liquidating cash advances:

(a) CASH ADVANCE REQUEST and RECEIPT FORM

DATE ___________________

(State the date here)

Requesting cash advance in the amount of ______________________________ to defray

(Amount in words and figures)

expenses for the following purpose/s:

Description and date needed

Amount

1.

2.

3.

4.

TOTAL

Requested by: _____________________________________________________

(Signature of requestor over printed name), (Position), (Company)

APPROVED FOR: ____________________________________________ SUBJECT TO

(Approved amount in words and figures)

LIQUIDATION WITHIN SEVEN DAYS, and other pertinent coop policies on cash advances.

Approved by: ____________________________________________________

(Signature of approving authority over printed name), (Position)

RECEIPT:

I hereby acknowledge receipt of the above-stated amount on ____________________ and

(date of receipt)

I hereby bind myself to the company policies on cash advances.

__________________________________

(Signature over printed name or requestor)

Copy Furnished: Accounting Department

(b) CASH ADVANCE LIQUIDATION FORM

Name of Employee: ________________________ Liquidation Date: ______

Position: _______________________ Cash Advance Date: _______

AMOUNT OF C. A. _____ (In words and figures) __________ C. A. Voucher No. __

Particulars: (Expense Item/s) Supporting Document/s: Amount:

1.____________ _____________________ P_______________

2.____________ _____________________ P_______________

3____________ _____________________ P_______________

4.____________ _____________________ P_______________

5.____________ _____________________ P_______________

TOTAL LIQUIDATED: P_______________

Amount to be refunded to the Company / reimbursed by the Company P ______________

Prepared by: Checked by: Approved by:

_______________________

Officer/Staff who made

a cash advance

_____________________

Accountant

Copy Furnished: Accounting Department

_____________________

Approving Authority

Anda mungkin juga menyukai

- Gve Policies and Guidelines On Cash AdvancesDokumen3 halamanGve Policies and Guidelines On Cash Advancesmarvinceledio100% (3)

- Proposed Policy & Guidelines For Cash Advance Requisition LiquidationDokumen3 halamanProposed Policy & Guidelines For Cash Advance Requisition LiquidationEmmanuelCuaresma100% (1)

- Cta - Cash Advance Policy 1Dokumen3 halamanCta - Cash Advance Policy 1Leizza Ni Gui DulaBelum ada peringkat

- Granting, Utilization and Liquidation of Cash AdvancesDokumen8 halamanGranting, Utilization and Liquidation of Cash Advancesduskwitch100% (1)

- Petty Cash Policies and ProceduresDokumen7 halamanPetty Cash Policies and ProceduresyonportesBelum ada peringkat

- Cash Advance Liquidation - FinalDokumen2 halamanCash Advance Liquidation - FinalRosana PlancoBelum ada peringkat

- SOP Petty CashDokumen5 halamanSOP Petty Cashkumanqatar100% (2)

- Guidelines On Cash AdvanceDokumen2 halamanGuidelines On Cash AdvanceAlyssa Molina100% (5)

- Cash AdvanceDokumen2 halamanCash AdvanceMatths Apoche100% (2)

- Requirements (Cash Advance)Dokumen60 halamanRequirements (Cash Advance)Rosemarie Guinayen Perez-MalagueñaBelum ada peringkat

- Policy On Revolving Fund and Petty Cash FundDokumen6 halamanPolicy On Revolving Fund and Petty Cash Fundmarvinceledio100% (3)

- Company Loan PolicyDokumen2 halamanCompany Loan PolicyKaleem60% (5)

- HR Policy - Absence & LeaveDokumen0 halamanHR Policy - Absence & LeaveRashmin MuhammadBelum ada peringkat

- MemoDokumen2 halamanMemoa luBelum ada peringkat

- Form Cash AdvanceDokumen1 halamanForm Cash Advanceaansewu67% (3)

- 02 Policies On Petty Cash Fund and LiquidationDokumen4 halaman02 Policies On Petty Cash Fund and LiquidationMichael GarciaBelum ada peringkat

- Memo On Release of Final PayDokumen2 halamanMemo On Release of Final PayZendy Pastoral67% (3)

- MEMODokumen2 halamanMEMOAllyza Magtibay0% (1)

- Policy On Emergency LoanDokumen3 halamanPolicy On Emergency LoanLancemachang EugenioBelum ada peringkat

- Waiver For Non-Deductible FormDokumen2 halamanWaiver For Non-Deductible FormQueenileen Arindaeng67% (3)

- Company Phone Accountability FormDokumen1 halamanCompany Phone Accountability FormCarmina Edradan100% (6)

- Template - Loan PolicyDokumen2 halamanTemplate - Loan Policynipunda86% (7)

- Leave & Leave Types: Weekly Holiday Public HolidaysDokumen3 halamanLeave & Leave Types: Weekly Holiday Public HolidaysPrajay Nepal100% (1)

- 2.notice of Personnel ActionDokumen1 halaman2.notice of Personnel ActionemeletBelum ada peringkat

- Template For Accounting ManualDokumen4 halamanTemplate For Accounting ManualKent TacsagonBelum ada peringkat

- Policy On Cash ShortagesDokumen2 halamanPolicy On Cash Shortagesmarvinceledio67% (3)

- Official Business Form TemplateDokumen1 halamanOfficial Business Form TemplateBENBelum ada peringkat

- Inventory MemoDokumen3 halamanInventory MemoBryan Ramos57% (7)

- Attendance and Leave PolicyDokumen4 halamanAttendance and Leave Policyapi-1729404192% (37)

- HMO Dependents Enrolment Form and Salary Deduction Authorization Form 20...Dokumen1 halamanHMO Dependents Enrolment Form and Salary Deduction Authorization Form 20...GemarieRoblesDelosReyesBelum ada peringkat

- Application For Certificate of Tax ExemptionDokumen2 halamanApplication For Certificate of Tax Exemptionalfx21671% (17)

- SCRIBD - Memo On Observation of Inventories and Fixed Assets Count For Batch PlantDokumen4 halamanSCRIBD - Memo On Observation of Inventories and Fixed Assets Count For Batch Plantalejandroctay100% (1)

- Cash Advance FormDokumen7 halamanCash Advance FormChe CambalizaBelum ada peringkat

- Job Responsibilities: Pre-Regularization Self-Assessment FormDokumen1 halamanJob Responsibilities: Pre-Regularization Self-Assessment Formsetsunai_12Belum ada peringkat

- Template BIR EFPS Letter of Intentions Individual Tax PayerDokumen1 halamanTemplate BIR EFPS Letter of Intentions Individual Tax PayerJimmy Yau80% (15)

- Clearance From SSSDokumen2 halamanClearance From SSSnathalie velasquez86% (7)

- Employee Exit Clearance FormDokumen2 halamanEmployee Exit Clearance FormAubrey Sindian100% (5)

- Sworn Declaration Annex A - RMC 68-2015Dokumen1 halamanSworn Declaration Annex A - RMC 68-2015Eunice Espiritu50% (2)

- Sworn Statement For Loose Leaf PTUDokumen1 halamanSworn Statement For Loose Leaf PTUKeith Pagurayan100% (1)

- Sample Request For Reinvestigation Bir - Google SearchDokumen2 halamanSample Request For Reinvestigation Bir - Google Searchbatusay5750% (2)

- General Guidelines On Leave ApplicationsDokumen2 halamanGeneral Guidelines On Leave ApplicationsJanking Madriaga I100% (7)

- Cash Advance Liquidation FormDokumen1 halamanCash Advance Liquidation FormStan LeyBelum ada peringkat

- Finance Policies and Procedures Manual - TEMPLATEDokumen60 halamanFinance Policies and Procedures Manual - TEMPLATEHassan Liquat100% (2)

- C0006 Regularization Contract With Salary IncreaseDokumen1 halamanC0006 Regularization Contract With Salary IncreaseJune Bermudez100% (1)

- Request For DiscountDokumen1 halamanRequest For DiscountJenz PaulBelum ada peringkat

- Memo On Cash ShortagesDokumen1 halamanMemo On Cash ShortagesLynette Grace Ordiz Valdez100% (5)

- Accounts Receivable PolicyDokumen3 halamanAccounts Receivable PolicyRaza AhmadBelum ada peringkat

- Fund Coordinator HDMFDokumen2 halamanFund Coordinator HDMFRalph Esteban33% (3)

- Critical Workdays MemoDokumen6 halamanCritical Workdays Memo송아리 (The Sapiosexual)Belum ada peringkat

- Loose LeafDokumen1 halamanLoose LeafMaricel Valerio Canlas67% (6)

- AR Blank Confirmation LetterDokumen1 halamanAR Blank Confirmation LetterDominique VasalloBelum ada peringkat

- EAccreg and ESales Enrollment FormDokumen1 halamanEAccreg and ESales Enrollment FormFrancis Chris100% (2)

- eAccReg Sworn Statement - TaxpayerDokumen1 halamaneAccReg Sworn Statement - TaxpayerJayson Flaviano Panganiban100% (2)

- Secretary's Certificate - LTFRB New CPCDokumen1 halamanSecretary's Certificate - LTFRB New CPCSunshineSunshineBelum ada peringkat

- RE: Request For Manual PaymentDokumen1 halamanRE: Request For Manual PaymentJemrey Goles100% (5)

- Attendance PolicyDokumen9 halamanAttendance PolicySecret SecretBelum ada peringkat

- Reimbursement of Expenses PresentationDokumen26 halamanReimbursement of Expenses PresentationAlex Ochinang Jr.Belum ada peringkat

- Modes of Disbursements (ATA)Dokumen44 halamanModes of Disbursements (ATA)Maria Julieta Stephanie Tacogue100% (2)

- Atty. Roline M. Ginez-Jabalde: Presented byDokumen76 halamanAtty. Roline M. Ginez-Jabalde: Presented bylilaquitaineBelum ada peringkat

- Instruction On Petty Cash and Cash Advance HandlingDokumen4 halamanInstruction On Petty Cash and Cash Advance HandlingSuranga Fernando100% (1)

- Leases (Pas 17) PDFDokumen4 halamanLeases (Pas 17) PDFRon GumapacBelum ada peringkat

- IFRS Contract Analysis EnablerDokumen7 halamanIFRS Contract Analysis EnablerPau Line EscosioBelum ada peringkat

- GFFS 2018 Certification TemplateDokumen1 halamanGFFS 2018 Certification TemplatePau Line Escosio100% (2)

- Leases (Pas 17) PDFDokumen4 halamanLeases (Pas 17) PDFRon GumapacBelum ada peringkat

- IFRS Contract Analysis EnablerDokumen7 halamanIFRS Contract Analysis EnablerPau Line EscosioBelum ada peringkat

- Illustrative Notes For New Pronouncements Issued and Effective For December 31, 2018 Year-EndDokumen5 halamanIllustrative Notes For New Pronouncements Issued and Effective For December 31, 2018 Year-EndPau Line EscosioBelum ada peringkat

- Purchases FormatDokumen7 halamanPurchases FormatPau Line EscosioBelum ada peringkat

- Receivables Confirmation TemplateDokumen1 halamanReceivables Confirmation TemplatePau Line EscosioBelum ada peringkat

- Bir Form 1600 - Schedule Ii Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of April, 2019Dokumen5 halamanBir Form 1600 - Schedule Ii Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of April, 2019Pau Line EscosioBelum ada peringkat

- Qap FormatDokumen8 halamanQap FormatPau Line EscosioBelum ada peringkat

- BIR Ruling NoDokumen1 halamanBIR Ruling NoPau Line EscosioBelum ada peringkat

- 2431rr03 02 AnxbDokumen1 halaman2431rr03 02 AnxbPau Line EscosioBelum ada peringkat

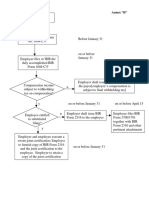

- Disbursment ProcessDokumen1 halamanDisbursment ProcessPau Line EscosioBelum ada peringkat

- National and Local Taxes SyllabusDokumen10 halamanNational and Local Taxes SyllabusPau Line EscosioBelum ada peringkat

- 2016 SSS Guidebook DeathDokumen13 halaman2016 SSS Guidebook DeathPau Line Escosio100% (1)

- UP Sales Reviewer 2007Dokumen54 halamanUP Sales Reviewer 2007Pau Line EscosioBelum ada peringkat

- Marketing Bake ParlorDokumen14 halamanMarketing Bake Parlorwaseem_almas0% (1)

- Top Qualities of A Successful BusinessmanDokumen40 halamanTop Qualities of A Successful Businessmansufyanbutt007Belum ada peringkat

- Referral MAR019-1 Assignment 2 EXPERIENTIAL MARKETING 2Dokumen4 halamanReferral MAR019-1 Assignment 2 EXPERIENTIAL MARKETING 2Palak ShahBelum ada peringkat

- How To Calculate Your Hourly RateDokumen3 halamanHow To Calculate Your Hourly RateERIC GARCHITORENABelum ada peringkat

- MACR-05 - SEBI Takeover CodeDokumen29 halamanMACR-05 - SEBI Takeover CodeVivek KuchhalBelum ada peringkat

- Welcome To Oyo Rooms: Founder and CEO:-Ritesh AgarwalDokumen10 halamanWelcome To Oyo Rooms: Founder and CEO:-Ritesh AgarwalNitin MishraBelum ada peringkat

- Profitability AnalysisDokumen43 halamanProfitability AnalysisAvinash Iyer100% (1)

- Exercises OnDokumen5 halamanExercises OnPrasanth GummaBelum ada peringkat

- 1.5-Case StudyDokumen11 halaman1.5-Case StudyPradeep Raj100% (1)

- Term:2008-2009 B.Tech Iv/Cse Iind Semester Unit-V PPT Slides Text Books: 1. Frontiers of Electronic Commerce - Kalakata, Whinston, Pearson. 2. E-Commerce, S.Jaiswal - GalgotiaDokumen50 halamanTerm:2008-2009 B.Tech Iv/Cse Iind Semester Unit-V PPT Slides Text Books: 1. Frontiers of Electronic Commerce - Kalakata, Whinston, Pearson. 2. E-Commerce, S.Jaiswal - GalgotiaMohit SainiBelum ada peringkat

- Food and Beverages - AlliedDokumen5 halamanFood and Beverages - AlliedAyman KhalidBelum ada peringkat

- Construction Project Management: Unit 2: Project Planning and SchedulingDokumen25 halamanConstruction Project Management: Unit 2: Project Planning and SchedulingGirman ranaBelum ada peringkat

- GMI Currenex ManualDokumen30 halamanGMI Currenex ManualsarakalineBelum ada peringkat

- VINAYAK KONDAL AI & Finance Report CBRDokumen7 halamanVINAYAK KONDAL AI & Finance Report CBRvinayakBelum ada peringkat

- CH12Dokumen4 halamanCH12Kurt Del RosarioBelum ada peringkat

- ProjectreportonexploringexpresscargoDokumen43 halamanProjectreportonexploringexpresscargosanzitBelum ada peringkat

- SCM2Dokumen31 halamanSCM2hasib_ahsanBelum ada peringkat

- Cash Flows and Accrual Accounting in Predicting Future Cash FlowsDokumen210 halamanCash Flows and Accrual Accounting in Predicting Future Cash FlowsNicolai AquinoBelum ada peringkat

- Pan African Resources: Exceeding Expectations (As Usual)Dokumen11 halamanPan African Resources: Exceeding Expectations (As Usual)Owm Close CorporationBelum ada peringkat

- Cfas Pas 34 & 10 and Pfrs 1Dokumen11 halamanCfas Pas 34 & 10 and Pfrs 1Tunas CareyBelum ada peringkat

- Insurance Finals TranscriptDokumen25 halamanInsurance Finals TranscriptMichael Francis HubahibBelum ada peringkat

- NullDokumen261 halamanNullRabia jamalBelum ada peringkat

- MOA Disaster ReliefDokumen2 halamanMOA Disaster ReliefErnan Baldomero91% (11)

- NEW LOAN-APPLICATION-FORM November 2021 v2 PDFDokumen4 halamanNEW LOAN-APPLICATION-FORM November 2021 v2 PDFjohnson mwauraBelum ada peringkat

- CE On Cash CDokumen3 halamanCE On Cash CChesterTVBelum ada peringkat

- E CommerceDokumen10 halamanE CommerceShruti SinghBelum ada peringkat

- Mark LK TW Iii 2019Dokumen60 halamanMark LK TW Iii 2019RafliSitepuBelum ada peringkat

- FranchiseDokumen4 halamanFranchiseJane DizonBelum ada peringkat

- Entrep Quiz 2Dokumen20 halamanEntrep Quiz 2encarBelum ada peringkat

- Esdc Lab1058Dokumen2 halamanEsdc Lab1058Kavinda BandaraBelum ada peringkat