Philippine Real Estate 2013 Midyear Report

Diunggah oleh

Justine AdorablėHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Philippine Real Estate 2013 Midyear Report

Diunggah oleh

Justine AdorablėHak Cipta:

Format Tersedia

KMC MAG GROUP Research

Metro Manila

Metro Manila Real Estate

Midyear Report | 1H 2013

kmcmaggroup.com/research

KMC MAG Group Research

Metro Manila | H1 2013

About KMC MAG Group, Inc.

KMC MAG Group, Inc. is an award-winning real estate services firm, headquartered in Bonifacio Global City, a prime

business district in Metro Manila. With over 100 employees involved directly in transactions for office, investments, retail,

industrial & hotel locaters, as well as residential properties, KMC is a full service real estate firm and is widely recognized

as best in class. With services ranging from tenant representation, investments to property management, KMC MAG

Group has successfully become the leading local firm in the Philippine real estate services industry.

Since early 2013, KMC MAG Group has been an International Associate of Savills, one of the largest real estate service

providers listed on the London Stock Exchange. This provides KMC and its clients access to a global network of over 500

offices with nearly 20,000 employees worldwide.

Contents

Letter from the Managing Director

Economic Overview

Real Estate Market Overview

Makati City

Bonifacio Global City

Ortigas

3

4-5

6

7-8

9 - 10

11 - 12

kmcmaggroup.com/research

KMC MAG Group Research

Metro Manila | H1 2013

A Year of Opportunities

In spite of the struggling global economy with Americas

sluggish growth, Europes ongoing crisis, and Chinas slowdown, the Philippines recent economic figures remain spectacular for investors. The countrys remarkable 7.6% GDP

expansion in the first half made it the fastest-growing economy in Asia, characterized by strong macroeconomic fundamentals that offers plenty of opportunities for investment.

This positive environment is expected to last for a few years

as growth forecasts remain positive, specifically the IMF

which has recently raised its Philippine outlook to 7.0 percent for 2013 and to 5.5 percent in 2014.

Bullish Office Markets

Backed by the Philippines recent credit rating achievements

and robust economic growth, the demand for office space

and lack of new supply has pushed up rents in the prime

districts, as well as other emerging submarkets such as Quezon City. Regionally in Asia, the relatively low real estate

costs, plus an attractive labor market have been driving

companies to outsource to the Philippines. The entire Metro

Manila continues to be the top choice for the Business Process Outsourcing and Offshoring (BPOs) industry which are

driving 80+% of new office take up.

Future Looks Cautiously Bright

The property market in the Philippines will sustain its current

performance. The second half of 2013 will be quite similar

to the first six months only with added supply. In total,

around 340,000 square meters of new office space will be

introduced this year, concentrated mainly in Bonifacio

Global City.

Short term residential investors may see pricing pressure

when developments are ready for handover due to the

amount of available stock plus slow leasing demand.

Roughly 30,000 residential units will come online in 2013

alone. On the other hand, nearly sold-out projects in the

Premium Residential sector (The Suites at One High Street by

Ayala and The Proscenium by Rockwell) signal high demand

for the premium residential property markets. In the long

run, the mid-range residential markets will continue to grow

supported by the increased purchasing power of the middle

class and nationwide housing needs.

For property investors, the Philippine real estate markets

current conditions in the office sector are seen as an attractive landlord's markets due to the high demand coupled with

limited supply. Were seeing good yields (8-10%) in Makati

which have been attracting international institutional investors. There remains a lot of potential that is untapped in the

market. The real estate sector should improve transparency

in terms of market information and corporate governance.

The countrys restrictions on land ownership also limits opportunities and discourages some investors from fully entering the market, resulting in lower transaction volume and

lack of liquidity. The majority of transactions are carried out

with equity, offering opportunities to improve yields using

debt financing, since interest rates have come down significantly.

kmcmaggroup.com/research

KMC MAG Group Research

Metro Manila | H1 2013

Economic Overview

8%

6%

4%

2%

2013H1

2012

2011

2010

2009

2008

2007

2006

2005

2004

0%

Source: National Statistical Coordination Board, NSCB

Peso per US Dollar

45

44

43

42

41

13-Aug

13-Jul

13-Jun

13-May

13-Apr

13-Mar

13-Feb

13-Jan

12-Dec

12-Nov

12-Oct

12-Aug

12-Jul

40

Source: BSP

Philippines Stock Exchange Index

8,000

7,000

6,000

5,000

13-Aug

13-Jul

13-Jun

13-May

13-Apr

13-Mar

13-Feb

13-Jan

12-Dec

12-Nov

12-Oct

12-Aug

4,000

12-Jul

Recent credit rating achievements and determined actions

of the government through PPP (Private Public Partnership) have boosted investments within the country in the

first half of the year. However, some concerns arose after

the Federal Reserves announcement of possible reduction in quantitative easing. According to the Philippine

Central Bank (Bangko Sentral ng Pilipinas), the announcement accelerated the outflow of foreign portfolio

investments from $2.4 billion to $2.6 billion in May and

$2.8 billion in June, as foreign fund managers are preparing to take actions outside the emerging markets and

return to developed markets that are showing recovery.

Additionally, the announcement caused the Philippine

Peso to weaken against US Dollar and led to a period of

high volatility in the local stock markets. Stock index declined almost 22.0% from an all-time high of 7,403.65

basis points. However, this is considered as a temporary

setback as markets are expected to show some signs of

recovery in the second half of the year.

10%

12-Jul

The second quarter GDP increase of 7.5% is also the

fourth consecutive GDP growth of more than 7.0% under

the current administration of President Aquino. It was

backed up by the peaceful and successful May 2013

elections that support Aquinos platform and program,

signaling the countrys political stability.

GDP Growth

12-Jul

The Philippine economy continued its rapid growth in the

first half of 2013. Strong macroeconomic fundamentals

such as the continuously expanding BPO sector, growing

private consumption, and increasing government investments and tourism drove the GDP to 7.6% in H1, making

the Philippines the fastest-growing Asian country according to National Accounts of the Philippines. With a rising

economy, the Philippines is on its way to a continued

property boom. The best performing industry last quarter

was Construction, which ensures high level of activities on

property markets in the future. The industry recovered

from its drawbacks in 2010, accounting to a 17.4%increase year over year with an annual average of

15.7%.

Source: BSP, Philippine Stock Exchange (PSE)

kmcmaggroup.com/research

KMC MAG Group Research

Metro Manila | H1 2013

Bank Average Lending Rates

14.0%

12.0%

10.0%

8.0%

6.0%

4.0%

2.0%

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

0.0%

2000

Meanwhile, BSP reports that net inflow of foreign portfolio

investments still accounted for $1.6 billion in the first half

of the year, which increased by 73.4% compared to

2012s year-to-date inflow. Net inflows of foreign direct

investments (FDI) that directly contribute to the countrys

economy equaled to $1.5 billion during the first four

months of the year, with an 2.8% YoY decline. Overseas

Filipino Workers (OFW) remittances, another form of

capital inflow and a crucial part of the Philippine economy accounting for almost 10% of the GDP, increased

6.2% YoY during the first half of the year reaching $11.8

billion. In addition, a moderate inflation rate of 2.9% is

slightly behind the BSP target of 3-5%, suggesting that its

monetary policy rates remain unchanged. The key interest

rates remain at a low level of 3.5% for Reverse Repo Rate

(overnight borrowing), 5.5% for Repo Rate (overnight

lending), and 2.0% for Special Deposit Account (SDA).

The relatively low interest rates offer good debt financing

opportunities that have also accelerated the transaction

volume in the real estate sector. Real estate-related loans

totaled to 676.9 billion PHP at the end of last year; 39.1%

is allocated for residential loans and 60.90 % for commercial loans, significantly increasing by 20.7% compared to previous quarters 560.8 billion PHP according

to BSP.

Source: BSP

Key Figures - Philippine Economy, %

2007

2008

2009

2010

2011

2012

2013 Q2

GDP

6.6

4.2

1.1

7.6

3.9

6.6

7.5

Private Consumption

4.6

3.7

2.3

3.4

5.7

6.6

5.2

Export

6.7

-2.7

-7.8

21.0

-2.8

8.9

-6.5

Import

1.7

1.6

-8.1

22.5

-1.0

5.3

-3.0

Average Inflation rate

2.9

8.3

4.2

3.8

4.6

3.2

2.9*

Unemployment rate

7.3

7.4

7.5

7.3

7.0

7.0

7.1

T-bill 91-days rates

3.4

5.4

4.2

3.7

1.5

1.6

0.3*

T-Bond 10-year rates

8.6

7.7

7.9

7.2

6.3

5.2

4.0

Sources: NSCB, BSP, Bureau of The Treasury

*First Semester Average

kmcmaggroup.com/research

KMC MAG Group Research

Metro Manila | H1 2013

Real Estate Market Overview

The local real estate markets have not shown changes that

are as drastic as in the Philippine stock markets. Investors

remain optimistic towards the real estate sector, and new

developments are being carried out in wide range.

This optimism has encouraged the major local players as

well. The most recent action came from Megaworld Corporation, one of the major developers in the country.

Megaworld consolidated its real estate units to ensure better fund availability, thus capitalizing on real estate opportunities in the coming years. Previously, SM Prime Holdings, Inc. also merged its real estate units to increase its

market position, making it the largest property firm in

Southeast Asia. On the other hand, Ayala Land Inc., the

second largest developer, issues new bonds worth 21 billion PHP ($500 million) to raise additional capital for financing corporate expenses that include new projects

worth 129 billion PHP.

The office market retains a positive atmosphere as it is

boosted by the BPO sector and the solid performance of

the countrys economy. The low vacancy rates demonstrate

the strong demand for office space within the central business districts. There seems to be no shortage of tenants

ready to pay prime rent for high-quality small and medium offices in the CBDs. This can also be observed from

the rapid growth of prime rental rates that continue rising

at an average of approximately 6.6% p.a. On the supply

side, developers are looking to benefit from the current

market conditions by adding around 340,000 square meters of new office supply this year within CBDs, mainly

concentrated in Bonifacio Global City.

Furthermore, the same factors the countrys continued

economic growth, expanding BPO sector, and low interest rates are driving the strong performance of the residential market. The countrys growth is encouraging

more investors and expatriates to establish BPOs and

move to the Philippines, increasing the demand for spacious and high-end apartments in premium residential

condos located near the CBDs. At the same time, the expanding BPO sector also drives the purchasing power of

the middle-class, allowing them to buy their own homes,

thereby increasing demand for subdivisions, townhouses,

and condominiums. This phenomenon allows more people

to enter the residential market, further boosting its performance in the long run. Lastly, the relatively low interest rates

guarantee mortgage financing, encouraging buyers and

investors to remain active.

The retail sector is also benefiting from strong consumer

spending. Private consumption that makes up almost 60% of

the GDP grew 5.2% YoY, encourages retail developers to

take advantage of the increased consumption and to expand territory. The recently opened SM Aura in Fort Bonifacio (187,000 sqm), current expansion of SM Megamall in

Ortigas (101,000 sqm) and development of Century City

Mall in Makati (49,000 sqm) increases the gross floor area

of retail space in CBDs by 337,000 sqm this year.

kmcmaggroup.com/research

KMC MAG Group Research

Metro Manila | H1 2013

Makati City

Offices

Makati City is the prime central business district in Metro

Manila, having the highest concentration of the countrys

commercial establishments. It is home to some of the

largest companies in the Philippines, covering the ITBPO sector. As a major cultural and entertainment hub

in Metro Manila, Makati is also known for its highly cosmopolitan culture.

Currently, ongoing office developments in Makati are

few, and developers are mainly looking to open projects

in Fort Bonifacio. At the moment, Makati CBD facilitates

around 1,100,000 square meters of premium and

grade A office space that will increase by an additional

70,000 sqms by the end of the year. This consists of Alphaland Tower and V Tower.

The average asking rental rates for premium space in

the Makati CBD reached up to 1,027 PHP per sqm, and

maximum rate is at 1,200 PHP. Grade A rates accounted for an average of 733 PHP per sqm, with a

maximum rate of 950 PHP, while Grade B equaled to

543 PHP per sqm, reaching up to 750 PHP. The rates

are backed up by strong demand since vacancy rates in

the prime buildings continued at a level of 3.9%. However, this rate is forecasted to increase to 7.2% once the

new supply is delivered, according to KMC MAG

Groups database.

Makati New Premium and Grade A Office Supply (sqm)

200,000

150,000

100,000

50,000

0

2009

2010

2011

2012

2013

2014F

2015F

Source: KMC MAG Group database

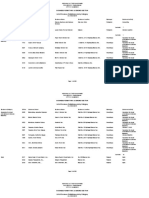

Key Figures - Premium and Grade A Office

Current Stock (GLA)

Vacancy Rate

Prime Yield

1,100,000

3.9%

7.5% - 11.0%

Average Rental

Rate

Upper Rental

Level

Commercial Lease Rates

Makati CBD

Premium Office

1,027.00

1,200.00

Grade A Office

733.00

950.00

1,750.00

2,200.00

17,500.00*

20,000.00*

Retail Lease

Serviced Offices

PHP/Square Meter/Month; *PHP/Seat/Month

Source: KMC MAG Group database

kmcmaggroup.com/research

KMC MAG Group Research

Metro Manila | H1 2013

Residential

Rental rates in Makati condos vary largely depending on

the grade and size of the condo building. The average

rental rate across condos in the Makati CBD is 646 PHP

per sqm, while small high-end premium condo units located within the district have higher rental rates, reaching

up to 1,300 PHP per sqm.

For capital rates, small one- to two-bedroom condo units

account for 121,182 PHP per sqm. However, similar to

the rental rates, the capital rate also varies within the district. Condo units in expensive premium-grade buildings

can be worth twice as much as below-average condo

buildings.

Makati Rental Levels

1,400

1,200

1,000

800

600

Average

400

200

0

Premium Office

Grade A Office

Source: KMC MAG Group database

Residential Lease

Rates in PHP

Makati remains to be the location of choice for luxurious

residential spaces. One of the biggest developments is

Discovery Primea located along Ayala Avenue. It is a 68storey luxury residential building with more than 50,000

sqms of floor area that is estimated to be handed over this

year.

Another major development is from Ayala Land; the Garden Towers that is a multi-billion peso project offering

340 luxurious condo units with a total floor area of approximately 55,000 sqms.

Makati CBD

Price per Square meter

Average Rental Rate

(per Month)

Upper Rental Level

(per Month)

Average

Capital Rate

646.00

1,300.00

121,183.00

60,000.00 - 95,000.00

140,000.00 - 160,000.00

14,112,873.00

Prime Yield

5.5%-7.0%

2 Bedroom

Rates in PHP

Source: KMC MAG Group Database

kmcmaggroup.com/research

KMC MAG Group Research

Metro Manila | H1 2013

Bonifacio Global City

Offices

Bonifacio Global City (BGC) is a rapidly growing business

district and cyber park located in Taguig City, Metro Manila. It is becoming the most active business district, generating almost 50% of the growth in the property market.

Currently, there is 140,000 sqms of development in the

pipeline by the end of year, including buildings such as

Ecotower (33,000 sqm), W Fifth Avenue (33,000 sqm),

RCBC Savings Bank Corporate Center (38,000 sqm) and

SM Aura, which will open a 38,000 sqm office tower by

the turn of the year in addition to its recently opened

187,000 sqm retail complex. Annual increase in supply of

prime buildings for 2012 was recorded at 90,000 sqms

increasing the total stock of BGC to 650,000 sqms.

The average asking rental rates for Grade A buildings

amounted to 708 PHP per sqm, with a maximum of

1,000 PHP per sqm. Due to the numerous developments

and annual increase of supply within the area, the vacancy rate rose up to 9.7% and will remain high by the

end of the year.

Bonifacio Global City New Grade A Office Supply (sqm)

200,000

150,000

100,000

50,000

0

2009

2010

2011

2012

2013

2014F

2015F

Source: KMC MAG Group database

Key Figures - Grade A Office

Current Stock (GLA)

Vacancy Rate

Prime Yield

650,000

9.7%

6.5%-8.5%

Average Rental Rate

Upper Rental Level

Commercial Lease Rates

Bonifacio Global City

Grade A

Retail Lease

Serviced Offices

708.00

1,000.00

1,800.00

2,500.00

18,500.00*

20,000.00*

PHP/Square Meter/Month; *PHP/Seat/Month

Source: KMC MAG Group database

kmcmaggroup.com/research

KMC MAG Group Research

Metro Manila | H1 2013

Residential

The rapidly rising residential sector remains popular even

in the second quarter of the year. Almost all of the developments are sold out, signaling the high demand for

space in the area.

Fluctuation in BGC rental rates is not as strong as the

other CBDs, mainly because most of the stock is composed of new buildings. Average rental rate for BGC

condos are at 835 PHP per sqm, reaching up to 1,300

PHP per sqm for high-end units. The capital rates are

slightly higher than Makati levels, with an average value

of 125,438 PHP per sqm that transmits to a spread of

7,500,000 15,000,000 PHP for a 2-bedroom condo.

Bonifacio Global City Rental Levels

1,400

1,200

1,000

800

600

Average

400

200

0

Grade A Office

Source: KMC MAG Group database

Residential Lease

Rates in PHP

Several projects are currently ongoing in BGC. Among

the biggest developments is Grand Hyatt Residences,

with 220 luxury units and a total floor area of approximately 56,000 sqms to be turned over in 2015. This

development is a two-tower mixed-use project that also

features a new Grand Hyatt Manila hotel. Another highend development is Arya Residences at the Fort by ArthaLand. The first building of the two-tower condominium

development is almost sold out. Its expected turnover

date is on the first quarter of 2014.

Bonifacio Global City

Price per Square meter

2 Bedroom

Average Rental Rate

(per Month)

Upper Rental Level

(per Month)

Average

Capital Rate

835.00

1,300.00

125,438.00

75,000.00 - 100,000.00

120,000.00 - 140,000.00

13,648,947.00

Prime Yield

6.0%-8.0%

PHP/Square Meter/Month; *PHP/Seat/Month

Source: KMC MAG Group database

10

kmcmaggroup.com/research

KMC MAG Group Research

Metro Manila | H1 2013

Ortigas CBD

Offices

Located in the middle of Pasig City, Mandaluyong City,

and Quezon City, Ortigas Center is the third most important business district in the Philippines, and the second largest next to Makati. It is home to many condos

and subdivisions, though the buildings are a lot older

compared to most of the developments in Fort Bonifacio

and Makati.

Grade A office space supply in Ortigas totaled to around

450,000 sqms in mid-2013 and is estimated to increase

by 100,000 sqms by the end of the year after Robinsons

Cyberscape Alpha and Beta are completed. The average

rental rate for office spaces in Grade A buildings is at

518 PHP per sqm with a maximum rate of 750 PHP per

sqm. Meanwhile, office space rental in Grade B buildings are at an average of 497 PHP per sqm with highest

rate of 700 PHP per sqm.

Vacancy rate remains low at 3.6% but is expected to increase given the new supply of office spaces to be completed in the current year.

Residential

Although a lot of activities are in Makati and Fort Bonifacio, there are still several ongoing major developments

in Ortigas. One of them is Robinsons Lands flagship

luxury condo project, Sonata Private Residences. Its first

tower is ready for occupancy while its second tower is

expected to be turned over by early 2014. Each of the

towers has 30 storeys with over 400 units. On the other

hand, the Grove by Rockwell Land is the fastest emerging 5.4-hectare residential community in Ortigas and

one of the biggest ongoing mixed-use developments in

Ortigas New Grade A Office Supply (sqm)

200,000

150,000

100,000

50,000

0

2009

2010

2011

2012

2013

2014F

2015F

Source: KMC MAG Group database

Key Figures - Grade A Office

Current Stock (GLA)

Vacancy Rate

Prime Yield

450,000

3.6%

5.0%-9.0%

Lease Rates

Ortigas CBD

Average Rental

Rate

Upper Rental

Level

518.00

750.00

1,334.00

1,650.00

12,000.00*

18,000.00*

436.00

700.00

45,000.00-60,000.00

70,000.00-90,000.00

Commercial

Grade A Office

Retail Lease

Serviced Offices

Residential

Residential Lease

2 Bedroom

PHP/Square Meter/Month; *PHP/Seat/Month

Source: KMC MAG Group database

11

kmcmaggroup.com/research

KMC MAG Group Research

Metro Manila | H1 2013

Metro Manila. It features 6 residential towers 2 of which

have already been completed while the remaining towers

are still under construction. Another luxurious development

on the rise is One Shangri-La Place by Shang Properties,

which features two 64-storey towers with a gross floor area

of 190,000 sqms to be turned over in 2015.

Ortigas has significantly lower residential lease rates compared to other districts. The average rate in Ortigas is at

436 PHP per sqm, reaching up to 700 PHP per sqm.

Ortigas Rental levels

1,000

800

600

400

Average

200

0

Grade A Office

Residential Lease

Source: KMC MAG Group database

Rates in PHP

Antton Nordberg

Yves Luethi

Research Associate

Vice President

antton.nordberg@kmcmaggroup.com

yves.luethi@kmcmaggroup.com

Copyright 2013 KMC MAG Group, Inc.

Please contact us for further information:

KMC MAG Group, Inc.

8th Floor Sun Life Centre, 5th Avenue,

Bonifacio Global City, Metro Manila,

Philippines

(+632) 403-55 19

research@kmcmaggroup.com

kmcmaggroup.com

12

This document was prepared by KMC MAG Group, Inc. for information

only. Whilst reasonable care has been exercised in preparing this document, it is subject to change and these particulars do not constitute part of

an offer or contract. Interested parties should not only rely on the statements or representations of fact but must satisfy themselves by inspection or

otherwise as to the accuracy. No person in the employment of KMC MAG

Group, Inc. has any authority to make any representations or warranties

whatsoever in relation to these particulars and KMC MAG Group, Inc. cannot be held responsible for any liability whatsoever or for any loss howsoever arising from or in reliance upon the whole or any part of the contents

of this document. This publication may not be reproduced in any form or in

any manner, in part or as a whole without written permission of the publisher, KMC MAG Group, Inc.

kmcmaggroup.com/research

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Comm Oj SitesDokumen53 halamanComm Oj Sitesapi-306485332Belum ada peringkat

- RVA Sales Progress Report August 2019Dokumen5 halamanRVA Sales Progress Report August 2019Angel Lee IbabaoBelum ada peringkat

- TyphoonDokumen9 halamanTyphoonRonald TanBelum ada peringkat

- 00420989420080241Dokumen19 halaman00420989420080241Ging AbelladaBelum ada peringkat

- POP - Pque 2ndDokumen39 halamanPOP - Pque 2ndLiam Dale and Lianne Denisse Sonsona100% (1)

- Awarded Solar 2022-09-30Dokumen17 halamanAwarded Solar 2022-09-30steventanco1977Belum ada peringkat

- Metrobank Card Agent CertificationDokumen3 halamanMetrobank Card Agent CertificationJr AdiaoBelum ada peringkat

- Resume of Mr. Armando U. GutierrezDokumen6 halamanResume of Mr. Armando U. GutierrezJonaliza GutierrezBelum ada peringkat

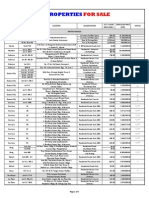

- Ucpb Acquired Assets For Sale - Dec 2013Dokumen5 halamanUcpb Acquired Assets For Sale - Dec 2013api-239883469Belum ada peringkat

- Stock Articles of Incorporation 1556070054 PDFDokumen6 halamanStock Articles of Incorporation 1556070054 PDFDuumypot TuserBelum ada peringkat

- 2021 School Based Inset Proposal-JrcmDokumen6 halaman2021 School Based Inset Proposal-JrcmJOE RALPH MABBORANG100% (1)

- Registered Electrical Engineer: Work Experience SkillsDokumen1 halamanRegistered Electrical Engineer: Work Experience SkillsDaryll SanjoseBelum ada peringkat

- Denr Dao 97-34Dokumen8 halamanDenr Dao 97-34ML BanzonBelum ada peringkat

- Awarded Solar Projects (As of 2014 07-31)Dokumen7 halamanAwarded Solar Projects (As of 2014 07-31)midas33Belum ada peringkat

- Maynilad Water Services V Secretary of Denr GR 202897 206823 207969 August 6 2019Dokumen6 halamanMaynilad Water Services V Secretary of Denr GR 202897 206823 207969 August 6 2019Ryw100% (1)

- Philippine Canadian Inquirer #473Dokumen32 halamanPhilippine Canadian Inquirer #473canadianinquirerBelum ada peringkat

- A Broader-Based Economy - Inquirer OpinionDokumen6 halamanA Broader-Based Economy - Inquirer OpinionRamon T. Conducto IIBelum ada peringkat

- BusinessDokumen230 halamanBusinessRobert SonguitanBelum ada peringkat

- Assessment of Jeepney Components PDFDokumen15 halamanAssessment of Jeepney Components PDFAJBelum ada peringkat

- SGDokumen18 halamanSGRenzo SantosBelum ada peringkat

- 5c947f5491808 BFB Branches To Open On April 6 (Saturday) PDFDokumen1 halaman5c947f5491808 BFB Branches To Open On April 6 (Saturday) PDFbacolodBelum ada peringkat

- Colliers Manila Q3 2022 Residential v2Dokumen4 halamanColliers Manila Q3 2022 Residential v2bhandari_raviBelum ada peringkat

- NCR NegoSale Batch 15148 011623-1 PDFDokumen38 halamanNCR NegoSale Batch 15148 011623-1 PDFSlow DownBelum ada peringkat

- Metro Manila's Notable Personalities and ArchitectureDokumen20 halamanMetro Manila's Notable Personalities and ArchitectureKciroj ArellanoBelum ada peringkat

- Pre-Authorized Centers Feb 2021Dokumen2 halamanPre-Authorized Centers Feb 2021Amabel JameroBelum ada peringkat

- Nike StoresDokumen4 halamanNike StoresMary LouiseBelum ada peringkat

- Philippine Association For Teachers and Educators: National Capital RegionDokumen1 halamanPhilippine Association For Teachers and Educators: National Capital RegionStephen Jay CoBelum ada peringkat

- Updated List of Dental Network As of September 2021Dokumen3 halamanUpdated List of Dental Network As of September 2021Xer Jr GnacagBelum ada peringkat

- Ns8122018profregwpwds PDFDokumen1.241 halamanNs8122018profregwpwds PDFPhilBoardResults50% (4)

- Feeder ID's As of Mar, 2021Dokumen35 halamanFeeder ID's As of Mar, 2021Carlo GaffudBelum ada peringkat